Professional Documents

Culture Documents

Problems Cash Book II 1 4

Uploaded by

Racquel ReyesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Problems Cash Book II 1 4

Uploaded by

Racquel ReyesCopyright:

Available Formats

13

Problems Accounting

PROBLEMS CASH BOOK II (1-5)

Problem # 13.1: On April 1, 2017, Hassan Sajjad Store Cash Book showed debit balances of Cash Rs. 1,550 and Bank

Rs. 13,575. During the month of April following business was transacted. You are required to prepare Cash Book?

2017

April 02 Purchased Office Type-Writer for Cash Rs. 750; Cash Sales Rs. 1,315

07 Deposited Cash Rs. 500 to bank.

10 Received from A. Hussain a check for Rs. 2,550 in part payment of his account (not deposited).

16 Paid by check for merchandise purchased worth Rs. 1,005.

20 Deposited into Bank the check received from A. Hussain.

22 Received from customer a check for Rs. 775 in full settlement of his accounts (not deposited).

24 Sold merchandise to sweet Bros. for Rs 1,500 who paid by check which was deposited into bank.

26 Paid creditor a Salman Rs. 915 by check.

28 Deposited into Bank the check of customer of worth Rs. 775 was dated 22 nd April.

29 Paid wages by cash Rs. 500 and salary Rs. 1,000 by bank.

30 Drew from Bank for Office use Rs. 250 and Personal use Rs. 150

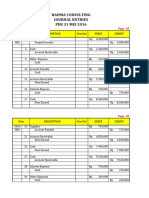

Hassan Sajjad Store

Cash Book (Double Column)

For the month ended April,2017

Receipts Payments

Date Description Ref Cash Bank Date Description Ref Cash Bank

2017 2017

April 1 Balance b/d 1,550 13,575 April

2

7

10

20

22

24

28

30

Balance c/d 1,365 15,580

Total 6,440 18,900 Total 6,440 18,900

May 1 Balance b/d 1,365 15,580

www.accountancyKnowledge.com 1 Cash Book II

13

Problems Accounting

Problem # 13.2: From the following particulars make cash book of Ghulam Fatima Trading Co. for the month of

November, 2016

2016

Nov 1 Cash balance (Cr) Rs. 2,000; Bank balance Rs. 40,000

4 Cash sales Rs. 3,700; Credit sales Rs. 1,800 would be received at near future

6 Paid Ahmed & Bros. by cash Rs. 500; Received cash by debtors Rs. 1,800

12 Paid to vendor by means of check worth Rs. 2,700

13 Paid Utility bills in cash Rs. 250; Bought goods by check Rs. 750

19 Drew from Bank for office use Rs. 160; Personal withdrawal of cash Rs. 1,000

20 Received a check from Hamid Rs. 2,700 and deposited into the bank

21 Received by check from Munir Rs. 1,360; Discount Rs. 140 (not deposited)

25 Cash sales Rs. 2,100; Paid wages by bank Rs. 1,500

28 Deposited Munir’s check into bank

29 Payment by check to Anees for Rs. 175; Discount received Rs. 25

30 Munir’s check has been dishonored and return by bank

Ghulam Fatima

Cash Book

For the month ended November 30th, 2016

Receipt side Payment side

Data Description Ref Cash Bank Dis. Data Description Ref Cash Bank Dis.

2016 2016

Nov. 1 Nov. 1

4 6

6 12

19 13

20 13

21 19

25 19

28 25

28

29

30

Total 9,120 44,060 140 Total 9,120 44,060 25

Dec 1

www.accountancyKnowledge.com 2 Cash Book II

13

Problems Accounting

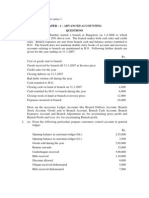

Problem # 13.3: Enter the following transactions in the Cash Book with Cash, Bank and Discount column for A R Khan

and Co. for December, 2016 (all figures in Rupees)

1 Cash in hand 400 14 Electricity charges paid 10

1 Balance at bank (Overdraft) 5,000 16 Drew check for personal use 700

4 Invested further owner's equity 10,000 17 Cash sales 2,500

4 Deposited into bank 6,000 18 Collected from Umer by check (n.d) 4,000

5 Sold goods for cash 3,000 19 Umer's check deposited into bank 4,000

6 Collected from debtor Imran and Co. 8,000 22 Drew check for business use 150

Dividend received by check and

6 Discount allowed to Imran and Co. 200 24 deposited 50

10 Purchased goods for cash 5,500 25 Commission received by check (n.d) 230

Paid from Bank, salary of the office

11 Paid to Kamran and Co. our creditor 2,500 27 staff 1,500

11 Discount received from Kamaran and Co. 65 28 Check of 25th deposited into bank 230

13 Commission paid to agent 530 29 Paid salary of the manager by cash 500

14 Office furniture purchased 200 30 Deposited cash into bank 1,000

14 Rent paid 50

A R Khan

Cash Book

For the month ended December, 2016

Receipt side Payment side

Date Description Ref Cash Bank Dis Date Description Ref Cash Bank Dis

2016 2016

Dec 1 Dec 1

4 4

4 10

5 11

6 13

17 14

18 14

19 14

22 16

24 19

25 22

28 27

30 28

29

30

Jan 1

www.accountancyKnowledge.com 3 Cash Book II

13

Problems Accounting

Problem # 13.4: Prepare Petty Cash Book on imprest system from the following particulars for Minha Shukat Ltd.

2016

Sept1. Received for petty cash payments Rs. 1,000

4. Paid for stationery Rs. 140

9. Paid for postage Rs. 80

10. Paid for printing charges Rs. 150

11. Paid for carriage Rs. 125

17. Paid for telegrams Rs. 25

20. Purchased envelops Rs. 30

21. Paid for coffee to office staff Rs. 30

22. Paid for office cleaning Rs. 50

30. Paid to Faiza Munir Rs. 200

Minha Shukat Ltd.

Petty Cash Book

For the month ended September, 2016

Amount Printing

Received Date Description VN Total Postage & Carriage Travelling Miscellaneous

Payments Stationery Expenses Expenses

2016

1,000 Sep 1

10

11

17

20

21

22

30

Total 830 135 290 125 -0- 280

Balance c/d 170

170 Oct 1 Balance b/d

830 1 Cash

www.accountancyKnowledge.com 4 Cash Book II

You might also like

- LCCI Kidolgozott Szóbeli TételekDocument51 pagesLCCI Kidolgozott Szóbeli Tételekszab2295% (21)

- PAS 33-Earnings Per ShareDocument26 pagesPAS 33-Earnings Per ShareGeoff MacarateNo ratings yet

- Project Plan Timeline and Highlight Template ExcelDocument4 pagesProject Plan Timeline and Highlight Template ExcelMj PrjptNo ratings yet

- Audit of CashDocument3 pagesAudit of CashCleopha Mae Torres100% (3)

- Audit of Cash PDFDocument3 pagesAudit of Cash PDFVincent SampianoNo ratings yet

- 09.30.2017 Audit of CashDocument7 pages09.30.2017 Audit of CashPatOcampoNo ratings yet

- PSFR Exam GuideDocument31 pagesPSFR Exam Guideathancox5837No ratings yet

- Chapter 7: Pathways To Entrepreneurial Ventures: True/FalseDocument5 pagesChapter 7: Pathways To Entrepreneurial Ventures: True/Falseelizabeth bernalesNo ratings yet

- 12.foundation Accounting Fasttrack Handwritten Notes by CMA CS RohanNimbalkarDocument142 pages12.foundation Accounting Fasttrack Handwritten Notes by CMA CS RohanNimbalkarsnehajainsneha52No ratings yet

- Xi Annual NewDocument5 pagesXi Annual NewPragadeshwar KarthikeyanNo ratings yet

- Cash N Cash Equivalent Problem Set 1Document3 pagesCash N Cash Equivalent Problem Set 1Jamaica DavidNo ratings yet

- Cash Book-3Document4 pagesCash Book-3YuriNo ratings yet

- Assignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundDocument6 pagesAssignment 1. Your Client, A Successful Small Business, Has Never Given Much Attention To A SoundThricia Mae Lorenzo IgnacioNo ratings yet

- Question 1Document3 pagesQuestion 1Mohammad Tariq AnsariNo ratings yet

- Rahma Consulting RevisiDocument23 pagesRahma Consulting RevisiMutia AlhasanahNo ratings yet

- Subsidiary Books - DPP 03 - (Aarambh 2024)Document3 pagesSubsidiary Books - DPP 03 - (Aarambh 2024)Shubh KhandelwalNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- Cash BookDocument3 pagesCash BookYuriNo ratings yet

- Notes CashbookDocument5 pagesNotes CashbookAdika Denish0% (1)

- Financial Accounting Part 1: Cash & Cash EquivalentDocument7 pagesFinancial Accounting Part 1: Cash & Cash EquivalentHillary Grace VeronaNo ratings yet

- Additional IllustrationsDocument4 pagesAdditional Illustrationsledaj19139No ratings yet

- JR Mec Iii Term 06-12-18Document4 pagesJR Mec Iii Term 06-12-18M JEEVARATHNAM NAIDUNo ratings yet

- PROBLEM 1 RESA Anna Corp. Uses The Direct Method To Prepare Its Statement of Cash Flows. Anna Corp.'s TrialDocument16 pagesPROBLEM 1 RESA Anna Corp. Uses The Direct Method To Prepare Its Statement of Cash Flows. Anna Corp.'s TrialJomar Villena100% (2)

- CCP102Document15 pagesCCP102api-3849444No ratings yet

- Bba Bcom Ll.b-I-Fincncial Accounting CC01Document2 pagesBba Bcom Ll.b-I-Fincncial Accounting CC01vijay.s12usNo ratings yet

- AEC 115-Bank Reconciliation AssignmentDocument3 pagesAEC 115-Bank Reconciliation AssignmentJeyssa YermoNo ratings yet

- Bank Reconciliation - SolutionsDocument6 pagesBank Reconciliation - SolutionsNIAZ HUSSAINNo ratings yet

- Rectification of Error1Document4 pagesRectification of Error1Typical GamerNo ratings yet

- AUD02 - 05 Audit of Cash and Cash EquivalentsDocument3 pagesAUD02 - 05 Audit of Cash and Cash EquivalentsMark BajacanNo ratings yet

- Take Home Exam 1 Cash and Cash EquivalentsDocument2 pagesTake Home Exam 1 Cash and Cash EquivalentsJi Eun VinceNo ratings yet

- CE1 - BK - Final Exam - 2017 - Paper2 - ADocument9 pagesCE1 - BK - Final Exam - 2017 - Paper2 - A6y7ccd7ndnNo ratings yet

- Quiz 1 - Audit of CashDocument4 pagesQuiz 1 - Audit of CashmillescaasiNo ratings yet

- Cash Book and Bank Reconciliation Lecture IDocument10 pagesCash Book and Bank Reconciliation Lecture IDavidNo ratings yet

- Bba 1 Sem Business Accounting 21102401 Oct 2021Document4 pagesBba 1 Sem Business Accounting 21102401 Oct 2021lizabnamazliaNo ratings yet

- 5.Cash-Bank Book (Three Column)Document6 pages5.Cash-Bank Book (Three Column)jangirvihan2No ratings yet

- Tutorial Set FourDocument6 pagesTutorial Set FourNathaniel MensahNo ratings yet

- Cash Book II - Accounting-Workbook - Zaheer-SwatiDocument4 pagesCash Book II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Cash BookDocument4 pagesCash BookDivyanka RanjanNo ratings yet

- Cash Problem 1Document3 pagesCash Problem 1Dawson Dela CruzNo ratings yet

- F5 Bafs 2 QueDocument13 pagesF5 Bafs 2 Queouo So方No ratings yet

- (Module 3) ProblemsDocument17 pages(Module 3) ProblemsArriane Dela CruzNo ratings yet

- Accounting For Managers - Practical ProblemsDocument33 pagesAccounting For Managers - Practical ProblemsdeepeshmahajanNo ratings yet

- Adjusting Entries Discussion and Solution5Document23 pagesAdjusting Entries Discussion and Solution5Garp BarrocaNo ratings yet

- ACCO TestDocument6 pagesACCO TestvrindadevigtmNo ratings yet

- Financial Accounting Past Paper 2019Document3 pagesFinancial Accounting Past Paper 2019Rana Hanzila TahirNo ratings yet

- Audit of Cash - SW8Document7 pagesAudit of Cash - SW8d.pagkatoytoyNo ratings yet

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- Dissolution + Single EntryDocument18 pagesDissolution + Single EntryOm JainNo ratings yet

- Transaction Review RKPL, Draft ReportDocument13 pagesTransaction Review RKPL, Draft ReportJoni alauddinNo ratings yet

- Assignment On ABM 4Document6 pagesAssignment On ABM 4Calyx OxfordNo ratings yet

- Exercises On Cash PDFDocument6 pagesExercises On Cash PDFFely MaataNo ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- Cash Book WorksheetDocument11 pagesCash Book WorksheetRaashiNo ratings yet

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- Bank ReconciliationDocument3 pagesBank ReconciliationjinyangsuelNo ratings yet

- AUDITINGDocument4 pagesAUDITINGClene DoconteNo ratings yet

- Class Exercise Bank ReconciliationDocument6 pagesClass Exercise Bank ReconciliationDalia ElarabyNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- Auditing Problems Ryan Jay J. Carasco Cash and Cash EquivalentDocument8 pagesAuditing Problems Ryan Jay J. Carasco Cash and Cash EquivalentChester GuioguioNo ratings yet

- Auditing Problems Ryan Jay J. Carasco Cash and Cash EquivalentDocument8 pagesAuditing Problems Ryan Jay J. Carasco Cash and Cash EquivalentMa. Trixcy De VeraNo ratings yet

- Bank Reconciliation Statement 6Document2 pagesBank Reconciliation Statement 6suresh kumar10No ratings yet

- As 1 Cash and Cash EquivalentsDocument2 pagesAs 1 Cash and Cash EquivalentsRodlyn LajonNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- 2a. Job Order Costing CRDocument17 pages2a. Job Order Costing CRAnaly Omandac PelayoNo ratings yet

- Problems Rectification of Errors Unsolved 1 5Document6 pagesProblems Rectification of Errors Unsolved 1 5Racquel ReyesNo ratings yet

- Problems Rectification of Errors Unsolved 1 5Document6 pagesProblems Rectification of Errors Unsolved 1 5Racquel ReyesNo ratings yet

- Problems Rectification of Errors Unsolved 1 5Document6 pagesProblems Rectification of Errors Unsolved 1 5Racquel ReyesNo ratings yet

- Definition of Break-Even AnalysisDocument3 pagesDefinition of Break-Even AnalysisRacquel ReyesNo ratings yet

- Problems Trial BalanceDocument5 pagesProblems Trial BalanceMUHAMMED RABIHNo ratings yet

- Ia Vol 1 Valix 2019 Answer KeyDocument232 pagesIa Vol 1 Valix 2019 Answer KeyRacquel ReyesNo ratings yet

- FM ReviewerDocument2 pagesFM ReviewerRacquel ReyesNo ratings yet

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- MMPC-002 Human Resource ManagementDocument299 pagesMMPC-002 Human Resource ManagementSangam PatariNo ratings yet

- Shreyash Retail Private Limited,: Grand TotalDocument1 pageShreyash Retail Private Limited,: Grand TotalyeswanthNo ratings yet

- Second Interview QuestionsDocument3 pagesSecond Interview QuestionsAkhilesh SinghNo ratings yet

- Design For XDocument22 pagesDesign For XKarandeep SinghNo ratings yet

- Sourcing Destination of The Food Articles at RelianceDocument20 pagesSourcing Destination of The Food Articles at RelianceVivek SinghNo ratings yet

- Working Jocil 06Document83 pagesWorking Jocil 06Phani Deepika Koritala0% (1)

- TDS Form 16 & 16ADocument14 pagesTDS Form 16 & 16AVaibhav NagoriNo ratings yet

- Chapter 01: From Beginning To End: An Overview of Systems Analysis and DesignDocument12 pagesChapter 01: From Beginning To End: An Overview of Systems Analysis and DesignronilNo ratings yet

- 9.1 HANA. It Is Owned by SAP SE, A German International SoftwareDocument5 pages9.1 HANA. It Is Owned by SAP SE, A German International SoftwareCarlos EugeneNo ratings yet

- Plant Assets and Intangible AssetsDocument14 pagesPlant Assets and Intangible AssetsSamuel DebebeNo ratings yet

- Constellation Software SH Letters (Merged)Document105 pagesConstellation Software SH Letters (Merged)RLNo ratings yet

- Implementation of Multi-Year Tariff FrameworkDocument20 pagesImplementation of Multi-Year Tariff Frameworkpawan kumar raiNo ratings yet

- Lahore School of Economics. Advance Corporate Finance. MBA II - Winter 2014. Dr. Sohail ZafarDocument6 pagesLahore School of Economics. Advance Corporate Finance. MBA II - Winter 2014. Dr. Sohail Zafarsarakhan0622No ratings yet

- Data Visualization Using Tableau (WEEK-1)Document9 pagesData Visualization Using Tableau (WEEK-1)Balaji SNo ratings yet

- Supervisor Workplace Skills Series: DelegationDocument14 pagesSupervisor Workplace Skills Series: Delegationrossaniza RamlanNo ratings yet

- CV Template Accounts PayableDocument4 pagesCV Template Accounts PayableAnonymous RuB6o4No ratings yet

- Bergin T 2012Document6 pagesBergin T 2012Sin Yee FUNGNo ratings yet

- Batch ProductionDocument9 pagesBatch Productionraj chopdaNo ratings yet

- OFFERDocument35 pagesOFFERNur KhaleedaNo ratings yet

- 10.1 Thesis - FachiDocument85 pages10.1 Thesis - FachiMadalitso MukiwaNo ratings yet

- Ebay: Connecting Internationally Slides by Simon (BUBT)Document26 pagesEbay: Connecting Internationally Slides by Simon (BUBT)Simon HaqueNo ratings yet

- Confidentiality AgreementDocument2 pagesConfidentiality AgreementTobey RabinoNo ratings yet

- TSR OverviewDocument16 pagesTSR OverviewDual DaveNo ratings yet

- Brochure ISO 14001Document6 pagesBrochure ISO 14001Mario Marcus HyppolitoNo ratings yet

- AFAB Vat-Zero Rating Application & RequirementsDocument3 pagesAFAB Vat-Zero Rating Application & RequirementsUnicargo Int'l ForwardingNo ratings yet

- Comparative Study of Capital MarketDocument77 pagesComparative Study of Capital MarketZameer AhmedNo ratings yet