Professional Documents

Culture Documents

Auditing intangibles quiz

Uploaded by

rodell pabloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing intangibles quiz

Uploaded by

rodell pabloCopyright:

Available Formats

UNIVERSITY OF CALOOCAN CITY Auditing and Assurance: Concepts and

Application I

Quiz – Audit of Intangibles

SITUATIONAL

Situation 1:

DM Corporation was organized in 2007. Its accounting records include only one account for

all intangible assets. The following is a summary of the entries that have been recorded

and posted during the years 2007 and 2008:

Intangibles

7/1/07 Franchise expiring on June 30,2015 252,000

10/1 Advance payment on lease expiring on

October 1, 2009 168,000

12/31 Net loss for 2007 including

incorporation fee, P6,000, and related

legal fees of organizing the business,

P30,000 (all incurred in 2007) 96,000

1/2/08 Acquired patent with a useful life of 10

years 444,000

3/1 Cost of developing a secret formula 450,000

4/1 Goodwill purchased 1,670,400

6/1 Goodwill recognized by the entity

arising from good reputation to the

public and profitable position in the

market 6,000,000

7/1 Legal fees for successful defense of

patent purchase on 1/2 75,900

10/1 Research and development costs on a new

project 960,000

Situation 2:

On December 31, 2016, King company purchased for P4,000,000 cash all of the

outstanding ordinary shares of Jaica Company when Jaica’s statement of financial

position showed net assets of P3,200,000. Jaica’s assets and liabilities had fair

value different from the carrying amount as follows:

Carrying Amount Fair Value

PPE – net 5,000,000 5,750,000

Other assets 500,000 -0-

Long-term debt 3,000,000 2,800,000

This examination is intended for the use of University of Caloocan City. Any unauthorized reproduction of this examination is prohibited.Page 1

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- IntangiblesDocument3 pagesIntangiblesjane dillanNo ratings yet

- Intangible Assets HomeworkDocument5 pagesIntangible Assets HomeworkIsabelle Guillena100% (2)

- AP.3403 Audit of Intangible AssetsDocument3 pagesAP.3403 Audit of Intangible AssetsMonica GarciaNo ratings yet

- ACCO 30053 - Audit of Intangible Assets & Investment Property - MARPDocument3 pagesACCO 30053 - Audit of Intangible Assets & Investment Property - MARPBanna SplitNo ratings yet

- Applied Auditing Audit of Intangibles: Problem No. 1Document2 pagesApplied Auditing Audit of Intangibles: Problem No. 1danix929No ratings yet

- Assessment Activities Module 1: Intanible AssetsDocument16 pagesAssessment Activities Module 1: Intanible Assetsaj dumpNo ratings yet

- Tutorial MFRS 101 Presentation Financial StatementDocument4 pagesTutorial MFRS 101 Presentation Financial StatementashabalqisNo ratings yet

- Ia3 Midterm QuizDocument11 pagesIa3 Midterm QuizJalyn Jalando-onNo ratings yet

- Review Questions On Standard-1Document4 pagesReview Questions On Standard-1George Adjei100% (1)

- GUIDELINE ANSWERS FOR COMPANY ACCOUNTS AND AUDITING PRACTICESDocument80 pagesGUIDELINE ANSWERS FOR COMPANY ACCOUNTS AND AUDITING PRACTICESmkeyNo ratings yet

- Diagnostic Exam 1 23 AKDocument11 pagesDiagnostic Exam 1 23 AKAbegail Kaye BiadoNo ratings yet

- ReSA B45 FAR Final PB Exam Questions, Answers SolutionsDocument21 pagesReSA B45 FAR Final PB Exam Questions, Answers SolutionsKeith Clyde Lagapa MuycoNo ratings yet

- Audit of Intangible AssetsDocument5 pagesAudit of Intangible Assetsdummy accountNo ratings yet

- Business CombinationDocument8 pagesBusiness CombinationCORNADO, MERIJOY G.No ratings yet

- Problems SeptDocument3 pagesProblems SeptMARIA THERESA AZURESNo ratings yet

- Acc313 314 Audit of Intangibles For PostingDocument4 pagesAcc313 314 Audit of Intangibles For PostingJonalyn May De VeraNo ratings yet

- FR Last 4 MTPDocument98 pagesFR Last 4 MTPSHIVSHANKER AGARWALNo ratings yet

- Bv2018 Revised Conceptual FrameworkDocument18 pagesBv2018 Revised Conceptual FrameworkTeneswari RadhaNo ratings yet

- Audit of Financial StatementsDocument3 pagesAudit of Financial StatementsGwyneth TorrefloresNo ratings yet

- C1 Business Combi AssignmentDocument2 pagesC1 Business Combi AssignmentkimberlyroseabianNo ratings yet

- Acc05 Far Handout 7Document5 pagesAcc05 Far Handout 7Jullia BelgicaNo ratings yet

- Icab Professional Level Taxation - II Suggested Answer May June 2011 To Nov Dec 2018Document274 pagesIcab Professional Level Taxation - II Suggested Answer May June 2011 To Nov Dec 2018ShuvodebNo ratings yet

- Funding Capital ProjectsDocument12 pagesFunding Capital ProjectsMuktar jiboNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Problems Week 1 2Document6 pagesProblems Week 1 2Maria Jessa HernaezNo ratings yet

- B326 MTA Fall 2017-2018 MGLDocument7 pagesB326 MTA Fall 2017-2018 MGLmjlNo ratings yet

- ISRS 4400 Case BookDocument6 pagesISRS 4400 Case BookSaadat AkhundNo ratings yet

- Consolidated StatementsDocument4 pagesConsolidated StatementsRyan Joseph Agluba Dimacali100% (1)

- 02 - Audit of Property, Plant and EquipmentDocument8 pages02 - Audit of Property, Plant and EquipmentAlarich CatayocNo ratings yet

- FR (New) A MTP Final Mar 2021Document17 pagesFR (New) A MTP Final Mar 2021ritz meshNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationBianca IyiyiNo ratings yet

- Competency Exam Practice-211Document5 pagesCompetency Exam Practice-211marites yuNo ratings yet

- Audit of PPE accounts and related valuationDocument8 pagesAudit of PPE accounts and related valuationAlyna JNo ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Here are the requirements:1. Total current assets CA2. Total noncurrent assets NCA3. Total current liabilities CL4. Total noncurrent liabilities NCLDocument4 pagesHere are the requirements:1. Total current assets CA2. Total noncurrent assets NCA3. Total current liabilities CL4. Total noncurrent liabilities NCLBrit NeyNo ratings yet

- Exercises 04 - Intangibles INTACC2Document3 pagesExercises 04 - Intangibles INTACC2EmzNo ratings yet

- Bacc 237 Assignment two ( Multiple choice) (2)Document10 pagesBacc 237 Assignment two ( Multiple choice) (2)TarusengaNo ratings yet

- AACP1.IM6 - Audit of Intangible AssetsDocument4 pagesAACP1.IM6 - Audit of Intangible AssetsLucy HeartfiliaNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- Instruction: Answer The Following Questions Problem 1Document11 pagesInstruction: Answer The Following Questions Problem 1nicole bancoroNo ratings yet

- FM Ii Case 4 Group 5Document8 pagesFM Ii Case 4 Group 5AntonNo ratings yet

- Exercises 04 - Intangibles INTACC2 PDFDocument3 pagesExercises 04 - Intangibles INTACC2 PDFKhan TanNo ratings yet

- Intangible AssetsDocument2 pagesIntangible AssetsIra BenitoNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Financial Statement Analysis for Entity Providing Trial BalanceDocument3 pagesFinancial Statement Analysis for Entity Providing Trial BalanceMansour HamjaNo ratings yet

- 7 Audit of IntangiblesDocument3 pages7 Audit of IntangiblesCarieza CardenasNo ratings yet

- Audit of Intangibles Consolidated PDFDocument29 pagesAudit of Intangibles Consolidated PDFRosemarie VillanuevaNo ratings yet

- BBM 301 Advanced Accounting IntroDocument13 pagesBBM 301 Advanced Accounting Introlil telNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- CK Shah VUAPURWATA Mid-Semester Exam Q&ADocument26 pagesCK Shah VUAPURWATA Mid-Semester Exam Q&Aangel100% (1)

- Mand CHODocument7 pagesMand CHOMichael BaguyoNo ratings yet

- Take Home Quiz Consolidated Business AccountingDocument2 pagesTake Home Quiz Consolidated Business AccountingTheodore BayalasNo ratings yet

- Impairment Sample ExerciseDocument4 pagesImpairment Sample Exerciselet me live in peaceNo ratings yet

- Green Plastic Products - QuestionDocument10 pagesGreen Plastic Products - QuestionNaruto MangaNo ratings yet

- University of Central Punjab: Project Appraisal & Credit ManagementDocument6 pagesUniversity of Central Punjab: Project Appraisal & Credit ManagementMisha ButtNo ratings yet

- 9216 - IFRS 3 Business Combination Stock AcquisitionDocument3 pages9216 - IFRS 3 Business Combination Stock AcquisitionMarianeNo ratings yet

- Initial Public Offering: An Introduction to IPO on Wall StFrom EverandInitial Public Offering: An Introduction to IPO on Wall StRating: 5 out of 5 stars5/5 (1)

- Economic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresFrom EverandEconomic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresNo ratings yet

- MSQ-01 - Cost Behavior & CVP AnalysisDocument10 pagesMSQ-01 - Cost Behavior & CVP AnalysisDanica Reyes QuintoNo ratings yet

- Question 2 (1 Point)Document4 pagesQuestion 2 (1 Point)rodell pabloNo ratings yet

- 2604-Audit of Cash and Cash EquivalentsDocument29 pages2604-Audit of Cash and Cash Equivalentsrodell pabloNo ratings yet

- LECTURE I InvestmentDocument5 pagesLECTURE I Investmentrodell pabloNo ratings yet

- Accounting 202 - CVP AnalysisDocument20 pagesAccounting 202 - CVP Analysisrodell pabloNo ratings yet

- Mas Midterm 2020Document5 pagesMas Midterm 2020rodell pabloNo ratings yet

- Part 4: Absorption and Variable Costing/Product Costing: Melziel A. Emba University of The East - ManilaDocument129 pagesPart 4: Absorption and Variable Costing/Product Costing: Melziel A. Emba University of The East - Manilarodell pabloNo ratings yet

- Variable Costing ConceptsDocument10 pagesVariable Costing Conceptsrodell pabloNo ratings yet

- Multiple-Choice QuestionsDocument1 pageMultiple-Choice Questionsrodell pabloNo ratings yet

- ReSA PW Taxation Pt. 2Document12 pagesReSA PW Taxation Pt. 2rodell pabloNo ratings yet

- Cpa Review School of The Philippines ManilaDocument15 pagesCpa Review School of The Philippines ManilaDarlyn ValdezNo ratings yet

- Table 1Document26 pagesTable 1rodell pabloNo ratings yet

- RFBT EditDocument22 pagesRFBT Editrodell pabloNo ratings yet

- ReSA PW Taxation Pt. 2Document12 pagesReSA PW Taxation Pt. 2rodell pabloNo ratings yet

- Tax 2018Document7 pagesTax 2018MelodyLongakitBacatanNo ratings yet

- 5 6316717223813579043 PDFDocument36 pages5 6316717223813579043 PDFGeorgianne Isla AllejeNo ratings yet

- Table 1Document22 pagesTable 1rodell pabloNo ratings yet

- TaxDocument10 pagesTaxaud theoNo ratings yet

- RFBTDocument5 pagesRFBTrodell pabloNo ratings yet

- 4 S4 4 S10 6 7 Stock Contingency?Document11 pages4 S4 4 S10 6 7 Stock Contingency?rodell pabloNo ratings yet

- AP-701 (MCQs Theories On RAP, TOC, ST)Document17 pagesAP-701 (MCQs Theories On RAP, TOC, ST)rodell pabloNo ratings yet

- Analysis of cost and profit data for multiple productsDocument24 pagesAnalysis of cost and profit data for multiple productsrodell pabloNo ratings yet

- Stock contingency analysis and asset allocationDocument53 pagesStock contingency analysis and asset allocationrodell pabloNo ratings yet

- FOREXQUIZ2021Document6 pagesFOREXQUIZ2021rodell pabloNo ratings yet

- Toaz - Info October 2016 Advanced Financial Accounting Reporting Final Pre Boarddocx PRDocument18 pagesToaz - Info October 2016 Advanced Financial Accounting Reporting Final Pre Boarddocx PRrodell pabloNo ratings yet

- PRTC Practial Accounting 1Document56 pagesPRTC Practial Accounting 1Pam G.71% (21)

- atDocument11 pagesatrodell pabloNo ratings yet

- TaxDocument10 pagesTaxaud theoNo ratings yet

- AFAR ProblemsDocument45 pagesAFAR ProblemsElena Llasos84% (31)

- 1Document4 pages1sushi100% (1)

- Arid Agriculture University, Rawalpindi: Mid Exam / Spring 2020 (Paper Duration 48 Hours) To Be Filled by TeacherDocument2 pagesArid Agriculture University, Rawalpindi: Mid Exam / Spring 2020 (Paper Duration 48 Hours) To Be Filled by TeacherObaid Ahmed AbbasiNo ratings yet

- A New Way Shop, Meet Rise: To andDocument8 pagesA New Way Shop, Meet Rise: To andAmit GolaNo ratings yet

- Chapter - 1Document34 pagesChapter - 1newayfisehaNo ratings yet

- Order Detail: Our Story Wine Store Cellar Door Mailing ListDocument2 pagesOrder Detail: Our Story Wine Store Cellar Door Mailing ListEric Wilden-ConstantinNo ratings yet

- Big data competitive advantages businessesDocument2 pagesBig data competitive advantages businessesDeeana SioufiNo ratings yet

- Project Management Best Practices: Achieving Global Excellence (Kerzner, H. 2006)Document3 pagesProject Management Best Practices: Achieving Global Excellence (Kerzner, H. 2006)Dwi KurniawanNo ratings yet

- MakeAnimated PowerPoint Slide by PowerPoint SchoolDocument9 pagesMakeAnimated PowerPoint Slide by PowerPoint SchoolMUHAMMAD HAMZA JAVEDNo ratings yet

- Study Guide-FRM24Document30 pagesStudy Guide-FRM24motiquotes4No ratings yet

- Bangladesh Leasing Industry OverviewDocument22 pagesBangladesh Leasing Industry OverviewAyesha SiddikaNo ratings yet

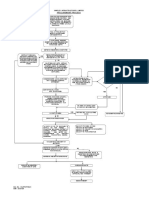

- 27 Flow Chart For Procurement Process Rev1Document1 page27 Flow Chart For Procurement Process Rev1Prasanta ParidaNo ratings yet

- Relation Between Auditing and Behavioural ScienceDocument9 pagesRelation Between Auditing and Behavioural ScienceSanika KulkarniNo ratings yet

- Application DocsDocument54 pagesApplication Docsthe next miamiNo ratings yet

- Claim I CiciDocument9 pagesClaim I Cicipallavi dholeNo ratings yet

- Reynaldo Gulane Cleaners Worksheet SEPTEMBER 30, 2015 DebitDocument4 pagesReynaldo Gulane Cleaners Worksheet SEPTEMBER 30, 2015 DebitNicole SarmientoNo ratings yet

- Corporate Personality SlidesDocument36 pagesCorporate Personality SlidesshanhaolihaiNo ratings yet

- Training of Trainers - Unit 9 - Week 7Document3 pagesTraining of Trainers - Unit 9 - Week 7c rajNo ratings yet

- France La Banque PostaleDocument1 pageFrance La Banque PostaleDRISS TAZINo ratings yet

- Souvenir Shop BUSINESS OVERVIEWDocument15 pagesSouvenir Shop BUSINESS OVERVIEWTirthankar MohantyNo ratings yet

- Lecture One: The Pay Model: Course Name: Compensation ManagementDocument25 pagesLecture One: The Pay Model: Course Name: Compensation ManagementInzamamul HaqueNo ratings yet

- FiboDocument49 pagesFiboCerio DuroNo ratings yet

- Otm On CloudDocument4 pagesOtm On CloudiamrameceNo ratings yet

- GAP Code Vendor ConductDocument6 pagesGAP Code Vendor ConductawekeNo ratings yet

- Coursework 1: Module: Business Communication Module Code: Sbl-105 Module Leader: Patience ConlonDocument13 pagesCoursework 1: Module: Business Communication Module Code: Sbl-105 Module Leader: Patience ConlonLame JoelNo ratings yet

- Pressure Testing ProcedureDocument4 pagesPressure Testing Proceduredavideristix100% (1)

- IB Business Management Exam Questions and Answers PDocument20 pagesIB Business Management Exam Questions and Answers PSai Suhas100% (6)

- Survey On Customer Satisfaction of Medical Tourism in INDIA With Special Reference To Kerela StateDocument41 pagesSurvey On Customer Satisfaction of Medical Tourism in INDIA With Special Reference To Kerela Statebapunritu0% (1)

- AIMA HR01 Assignment 1Document3 pagesAIMA HR01 Assignment 1Rachna0% (1)

- South Africa's New Progressive Magazine Standing For Social JusticeDocument48 pagesSouth Africa's New Progressive Magazine Standing For Social JusticeBenjamin Glyn FogelNo ratings yet

- Oa Sba 1Document18 pagesOa Sba 1Darion JeromeNo ratings yet

- Project Management FundamentalsDocument25 pagesProject Management FundamentalsAmo Frimpong-Manso100% (1)