Professional Documents

Culture Documents

Got 15

Uploaded by

Annisa0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

got 15

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageGot 15

Uploaded by

AnnisaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

we go into 2021, the general sentiment is

optimistic and that the global economy will be

on track to recovery once the vaccines become

available to the general population. Many countries

have already forecasted post-pandemic growth in

anticipation of the pandemic coming under control.

Indonesia’s economy is expected to grow at the

pre-pandemic rate with the return of domestic

consumption, bolstered by higher government

spending and foreign investments. The government

is already committed to maintain the cost of basic

necessities as part the social protection programs

under PEN. Many welcomed the government’s

recent effort to boost foreign investments to create

more jobs in Indonesia.

However, uncertainties remain as we transit into

post-pandemic recovery. The uneven pace of

recovery for different economies as well as across

industry sectors will upset plans and frustrate

supply chains. In such an erratic environment,

prices of commodities, such as wheat, skimmed

milk powder and crude palm oil, will remain volatile,

and together with the fluctuating rupiah exchange

rate, will add to the variability in our cost structure.

However these risks are not new to ICBP, and we

have planned for such periods of uncertainty.

During the year, the Board of Commissioners

(“BOC”) and the Board of Directors (“BOD”) have

met regularly to deliberate on company policies,

strategies and key issues. On behalf of the BOC, I

would like to commend the BOD for the excellent

teamwork putting in place effective strategies to

cope with the unprecedented global crisis. The

BOD has not only steered ICBP towards growth and

profitability during a difficult year and amid intense

competition, it has done so while adhering to

good corporate governance (“GCG”) practices andbawah PEN. Banyak pihak

juga menyambut baik upaya pemerintah baru-baru

ini untuk meningkatkan investasi asing dimana

hal ini diharapkan akan menciptakan lebih banyak

lapangan pekerjaan di Indonesia.

Namun demikian, ketidakpastian akan tetap ada di

masa peralihan menuju pemulihan pasca pandemi.

Laju pemulihan yang tidak merata di berbagai negara

maupun sektor, akan menimbulkan gangguan mata

rantai pasokan. Di tengah kondisi yang tidak menentu

ini, harga komoditas seperti gandum, skimmed

milk powder dan minyak kelapa sawit, akan terus

bergejolak. Ditambah dengan fluktuasi nilai tukar

rupiah, hal ini akan mempengaruhi struktur biaya

perusahaan. Namun risiko ini bukanlah sesuatu yang

baru bagi ICBP, dan kami telah memperkirakannya.

Di sepanjang tahun 2020, Dewan Komisaris dan

Direksi melakukan pertemuan berkala untuk

You might also like

- Got 16Document1 pageGot 16AnnisaNo ratings yet

- Got 14Document1 pageGot 14AnnisaNo ratings yet

- Got 15Document1 pageGot 15AnnisaNo ratings yet

- Got 15Document1 pageGot 15AnnisaNo ratings yet

- Got 14Document1 pageGot 14AnnisaNo ratings yet

- Got 14Document1 pageGot 14AnnisaNo ratings yet

- Got 13Document2 pagesGot 13AnnisaNo ratings yet

- Got 13Document2 pagesGot 13AnnisaNo ratings yet

- Perubahan Komposisi Anggota Dewan Komisaris Dan Alasan PerubahannyaDocument1 pagePerubahan Komposisi Anggota Dewan Komisaris Dan Alasan PerubahannyaAnnisaNo ratings yet

- Got 16Document1 pageGot 16AnnisaNo ratings yet

- Our Operating Context in 2019Document2 pagesOur Operating Context in 2019AnnisaNo ratings yet

- New 4Document1 pageNew 4AnnisaNo ratings yet

- Purpose-Led and Future-FitDocument2 pagesPurpose-Led and Future-FitAnnisaNo ratings yet

- Got 16Document1 pageGot 16AnnisaNo ratings yet

- Got 13Document2 pagesGot 13AnnisaNo ratings yet

- New 4Document1 pageNew 4AnnisaNo ratings yet

- Kewarganegaraan: Indonesia Tempat, Tanggal Lahir: Jakarta, 15 Maret 1960 (57 Tahun) Domisili: JakartaDocument1 pageKewarganegaraan: Indonesia Tempat, Tanggal Lahir: Jakarta, 15 Maret 1960 (57 Tahun) Domisili: JakartaAnnisaNo ratings yet

- Kewarganegaraan: Indonesia Tempat, Tanggal Lahir: Palembang, 10 Juni 1968 (49 Tahun) Domisili: JakartaDocument1 pageKewarganegaraan: Indonesia Tempat, Tanggal Lahir: Palembang, 10 Juni 1968 (49 Tahun) Domisili: JakartaAnnisaNo ratings yet

- New 5Document1 pageNew 5AnnisaNo ratings yet

- New 4Document1 pageNew 4AnnisaNo ratings yet

- Making Your Meetings More ProductiveDocument2 pagesMaking Your Meetings More ProductiveAnnisaNo ratings yet

- CH 02Document29 pagesCH 02cheetattNo ratings yet

- New 5Document1 pageNew 5AnnisaNo ratings yet

- Kewarganegaraan: Indonesia Tempat, Tanggal Lahir: Palembang, 10 Juni 1968 (49 Tahun) Domisili: JakartaDocument1 pageKewarganegaraan: Indonesia Tempat, Tanggal Lahir: Palembang, 10 Juni 1968 (49 Tahun) Domisili: JakartaAnnisaNo ratings yet

- Beams11 ppt01Document42 pagesBeams11 ppt01Nia TambunanNo ratings yet

- Bisnis: L/O/G/ODocument58 pagesBisnis: L/O/G/OAnnisaNo ratings yet

- Account ReceiveableDocument2 pagesAccount ReceiveableAnnisaNo ratings yet

- BusinessDocument6 pagesBusinessAnnisaNo ratings yet

- Articles 1Document2 pagesArticles 1AnnisaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoKUMAR PRATIKNo ratings yet

- Structure and Functions of Brics - AnkitaDocument9 pagesStructure and Functions of Brics - AnkitaAnkita SinghNo ratings yet

- Toaz - Info Tata Consultancy Services Payslip PRDocument2 pagesToaz - Info Tata Consultancy Services Payslip PRRLP TECHNOLOGYNo ratings yet

- Asnorweek 6Document3 pagesAsnorweek 6Abdul Raof D. HadjirasulNo ratings yet

- Epf Employer & Employee ContributionDocument2 pagesEpf Employer & Employee Contributionbobot91No ratings yet

- API BN - CAB.XOKA - CD DS2 en Excel v2 676209Document73 pagesAPI BN - CAB.XOKA - CD DS2 en Excel v2 676209JanaIvanovaNo ratings yet

- DAC List ODA Recipients For Reporting 2021 FlowsDocument1 pageDAC List ODA Recipients For Reporting 2021 FlowsHunter HelmsyNo ratings yet

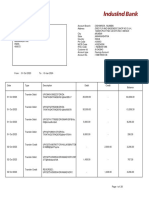

- Bank Statement IndusindDocument28 pagesBank Statement IndusindRohit RajagopalNo ratings yet

- 1A. HDFC Apr 2020 EstatementDocument10 pages1A. HDFC Apr 2020 EstatementNanu PatelNo ratings yet

- Characteristics of Developed CountriesDocument28 pagesCharacteristics of Developed CountriesCasie Mack100% (1)

- Quizlet - SOM CH 7Document13 pagesQuizlet - SOM CH 7Bob KaneNo ratings yet

- The Macroeconomic Impact of Remittances in the PhilippinesDocument46 pagesThe Macroeconomic Impact of Remittances in the PhilippinesBrian Jason PonceNo ratings yet

- Japan's Automakers Face EndakaDocument8 pagesJapan's Automakers Face EndakaShrey ChaudharyNo ratings yet

- Specialist OfficerDocument2 pagesSpecialist Officeraakash sahaNo ratings yet

- WOTCDocument2 pagesWOTCSa MiNo ratings yet

- Sales Data AnalysisDocument6 pagesSales Data AnalysisSandeep Rao VenepalliNo ratings yet

- Payslip Summary for Rahul DasDocument3 pagesPayslip Summary for Rahul DasasdNo ratings yet

- Eefc Queries - FedaiDocument4 pagesEefc Queries - FedaicallvkNo ratings yet

- Resolution - 205-2021 - Inviting Japanese InvestorsDocument2 pagesResolution - 205-2021 - Inviting Japanese InvestorsNitzshell Torres-Dela Torre100% (1)

- Islamabad Electric Supply Company: Say No To CorruptionDocument1 pageIslamabad Electric Supply Company: Say No To Corruptionhash guru100% (1)

- Cobalt General 2Document3 pagesCobalt General 2Andrea MorenoNo ratings yet

- Various Countries Foreign Direct Investment (Fdi) in India and Its Impact On Gross Domestic Production (GDP) of IndiaDocument11 pagesVarious Countries Foreign Direct Investment (Fdi) in India and Its Impact On Gross Domestic Production (GDP) of IndiaIAEME PublicationNo ratings yet

- Pay Bill of Gazzetted OfficerDocument1 pagePay Bill of Gazzetted OfficerPita 1No ratings yet

- Chapter - 18 Trends in UrbanizationDocument25 pagesChapter - 18 Trends in UrbanizationgopeNo ratings yet

- Great Depression of 1929Document21 pagesGreat Depression of 1929Pradeep GuptaNo ratings yet

- Ethiopia: An Emerging Market Opportunity?: Batch 2020 22 Section DDocument3 pagesEthiopia: An Emerging Market Opportunity?: Batch 2020 22 Section DShiksha SurekaNo ratings yet

- GST invoice for electrical equipment saleDocument1 pageGST invoice for electrical equipment saleA.T RamNo ratings yet

- What AilsDocument6 pagesWhat AilsAbhay SinghNo ratings yet

- Should supermarkets prioritize selling locally produced foodDocument2 pagesShould supermarkets prioritize selling locally produced foodTanveer GagnaniNo ratings yet

- Summary of Nigeria Economic ReportDocument5 pagesSummary of Nigeria Economic ReportAnthony EtimNo ratings yet