Professional Documents

Culture Documents

p17 SVGZ

Uploaded by

John JohnsonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

p17 SVGZ

Uploaded by

John JohnsonCopyright:

Available Formats

1 Accounting as a profession

Illustration 2

Objectivity

Referring again to the situation in Illustration 1, you should resist any

pressure to make the business’s performance look better than it is. You

should point out that it is your professional duty to apply accounting

concepts (such as consistency, accruals, prudence, etc.) to ensure that

you provide reliable information.

Accountants must not allow bias, conflict of interest or the undue

influence of others to override professional and business judgments.

Key terms

Illustration 3

Professional

Professional competence and due care competence and

due care: Keeping

One of your clients has asked your advice about a tax issue. It appears

knowledge and skills

that the legislation on this issue has recently changed but you are not

at the appropriate

familiar with the changes in legislation.

level in order to deliver

You should not provide any advice at this stage. You should identify

the ser vices to clients

someone in the firm who has the knowledge to answer the quer y.

diligently.

If time permits, you should seek to update your own knowledge in

Confidentiality:

this specialist field, perhaps asking permission to go on a training

avoiding the disclosure

programme or making use of online support.

of information to others

To exercise sound judgment an accountant must stay abreast with

without permission;

relevant laws, regulations and technical standards. Practising due care

not using a client’s

means when an accountant does not have expertise in an area they

information for personal

should consult with other professionals.

advantage. (The only

exceptions being where

Illustration 4

there are legal or ethical

Condentiality reasons to provide the

information.)

One of your clients, a local business, has recently been advertising for

new sta. A friend of yours has applied for one of the posts and has

Professional behaviour :

asked you if you think the business is financially stable.

taking personal

responsibility for

You should decline to comment on the financial stability of your

adopting the highest

client. You would point out that this information is confidential. You

standards of the

might suggest to your friend that they ask the question directly at

profession by complying

the inter view with the potential employer.

with legal requirements

An accountant must not disclose any financial information of a client

and regulations and

to third parties without proper and specific authority, unless there is a

avoiding any action

legal or professional right or duty to disclose. Also the accountant must

that would discredit the

not use the information for his or her personal advantage or for the

profession.

advantage of third parties.

15

You might also like

- Tata Steel Europe LTDDocument22 pagesTata Steel Europe LTDEntertainment OverloadedNo ratings yet

- Building Planning & DrawingDocument5 pagesBuilding Planning & Drawingshreeprashant849160% (5)

- CAPE Applied Maths U2 P2 2018 SolutionsDocument28 pagesCAPE Applied Maths U2 P2 2018 SolutionsJohn JohnsonNo ratings yet

- Impact of Government Policy and Regulations in BankingDocument65 pagesImpact of Government Policy and Regulations in BankingNiraj ThapaNo ratings yet

- 23 Code of Ethics For Professional Accountants: An Ethical Practice Is The Bedrock of An Accountant's SuccessDocument46 pages23 Code of Ethics For Professional Accountants: An Ethical Practice Is The Bedrock of An Accountant's SuccesstrishaNo ratings yet

- Overhauling Air Compressor On ShipsDocument12 pagesOverhauling Air Compressor On ShipsTun Lin Naing100% (3)

- A Muslim Reformist in Communist Yugoslavia The Life and Thought of Husein Äx90 Ozo (Husein Mekic, Sejad) (Z-Library)Document212 pagesA Muslim Reformist in Communist Yugoslavia The Life and Thought of Husein Äx90 Ozo (Husein Mekic, Sejad) (Z-Library)Raeed IslamNo ratings yet

- Code of Etichs of Professional AccountantsDocument40 pagesCode of Etichs of Professional AccountantsYamateNo ratings yet

- Code of Ethics For Professional AccountantsDocument17 pagesCode of Ethics For Professional AccountantsJay Mark AbellarNo ratings yet

- CODE OF ETHICS - Professional Accountants PDFDocument31 pagesCODE OF ETHICS - Professional Accountants PDFAJ BlazaNo ratings yet

- Quiz 1Document13 pagesQuiz 1수지No ratings yet

- Module 2.2 Code of EthicsDocument29 pagesModule 2.2 Code of EthicsMary Grace Dela CruzNo ratings yet

- 1) Code of Ethics For AuditorsDocument29 pages1) Code of Ethics For Auditorsrajes wari50% (2)

- Project Report On e BikesDocument57 pagesProject Report On e Bikesrh21940% (5)

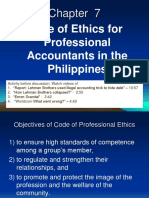

- Chapter 7 Code of Ethics For Professional Accountants in The PhilippinesDocument29 pagesChapter 7 Code of Ethics For Professional Accountants in The PhilippinesJames Diaz100% (3)

- Part B-Professional Accountant in Public PracticeDocument58 pagesPart B-Professional Accountant in Public PracticeAlliahDataNo ratings yet

- CIMA Notes 1st Exam CoverageDocument9 pagesCIMA Notes 1st Exam CoverageKatrina TabiosNo ratings yet

- Chapter 17 ReportingDocument11 pagesChapter 17 ReportingJanine MosatallaNo ratings yet

- Business and Professional Ethics 7Th Edition Brooks Solutions Manual Full Chapter PDFDocument67 pagesBusiness and Professional Ethics 7Th Edition Brooks Solutions Manual Full Chapter PDFtarascottyskiajfzbq100% (11)

- CFA Level II - EthicsDocument4 pagesCFA Level II - EthicsHelloWorldNowNo ratings yet

- De - Guzman - Module 12Document8 pagesDe - Guzman - Module 12Ma Ruby II SantosNo ratings yet

- The Code of Ethics For Professional AccountantsDocument2 pagesThe Code of Ethics For Professional Accountantsfely lopezNo ratings yet

- Code of Professional Ethics: The Accountancy Act of 2004Document51 pagesCode of Professional Ethics: The Accountancy Act of 2004Just SomeoneNo ratings yet

- Class Note For Code of Ethics of ICAN-2018 NBBDocument18 pagesClass Note For Code of Ethics of ICAN-2018 NBBBharat KhanalNo ratings yet

- Opaud Midterm PDFDocument8 pagesOpaud Midterm PDFThea LicupNo ratings yet

- WK 3 4 Ethical Issues Trade Secrets...Document2 pagesWK 3 4 Ethical Issues Trade Secrets...bautista bautistaNo ratings yet

- Chapter 3Document56 pagesChapter 3Michael AnthonyNo ratings yet

- CODE OF ETHICS For Professional Accountants in TheDocument61 pagesCODE OF ETHICS For Professional Accountants in TheDiana Rose BassigNo ratings yet

- Business Ethics Part 2Document23 pagesBusiness Ethics Part 2Gilner PomarNo ratings yet

- Multiple Choice: Auditing & Assurance Principles AT.113-Code of Ethics - Part II Nu Sports AcademyDocument7 pagesMultiple Choice: Auditing & Assurance Principles AT.113-Code of Ethics - Part II Nu Sports AcademyPatrickMendozaNo ratings yet

- Kenneths Report Ce LawsDocument8 pagesKenneths Report Ce LawsKenneth E. FerreriaNo ratings yet

- Key Concepts in AccountingDocument9 pagesKey Concepts in AccountingSunday OcheNo ratings yet

- Ethics: Model Rules, Section 240.15, Rules of Professional ConductDocument2 pagesEthics: Model Rules, Section 240.15, Rules of Professional ConductHugoSalidoNo ratings yet

- Section 320, 321, 330, 340 SummaryDocument6 pagesSection 320, 321, 330, 340 SummaryMuhammadNaumanNo ratings yet

- Lecture Notes: Auditing Theory AT.0102-Code of Ethics - Part I MAY 2020Document8 pagesLecture Notes: Auditing Theory AT.0102-Code of Ethics - Part I MAY 2020MaeNo ratings yet

- Audit Final Fast Track Book 2Document155 pagesAudit Final Fast Track Book 2ishan ishanNo ratings yet

- Chapter 5 MarlouDocument7 pagesChapter 5 MarlouCarla ZanteNo ratings yet

- The Code of Professional EthicsDocument33 pagesThe Code of Professional EthicsPrima FacieNo ratings yet

- Code of Ethics Reviewer - CompressDocument44 pagesCode of Ethics Reviewer - CompressGlance Piscasio CruzNo ratings yet

- Examples of Conflicts of InterestDocument5 pagesExamples of Conflicts of InterestRaymond LeeNo ratings yet

- MCDocument32 pagesMCyung kenNo ratings yet

- Chapter 2Document21 pagesChapter 2Danish NabilNo ratings yet

- Rodriguez Zyra-Denelle 08 JournalDocument11 pagesRodriguez Zyra-Denelle 08 JournalDaena NicodemusNo ratings yet

- Code of Ethics of Professional Accountants in The PhilippinesDocument9 pagesCode of Ethics of Professional Accountants in The PhilippinesYamateNo ratings yet

- Professional Ethics Formative Mark Scheme 090921Document62 pagesProfessional Ethics Formative Mark Scheme 090921Jeane LeeNo ratings yet

- ConfidentialityDocument12 pagesConfidentialityVidula KNo ratings yet

- Code of Ethics 2010 Fatal Flaw ReviewDocument6 pagesCode of Ethics 2010 Fatal Flaw ReviewGabriela Lourdes SandovalNo ratings yet

- Code of Conduct AuditingDocument2 pagesCode of Conduct AuditingZakyaNo ratings yet

- MAA250 Topic 6 - StudentDocument47 pagesMAA250 Topic 6 - StudentDuankai LinNo ratings yet

- Module-05 - Ethics, Corporate Governance and Business Law - by MD - Monowar FCA, CPA, FCMA - 2nd EditionDocument6 pagesModule-05 - Ethics, Corporate Governance and Business Law - by MD - Monowar FCA, CPA, FCMA - 2nd EditionMark MarasiganNo ratings yet

- 2015 11-February Part-3 MemorandumDocument5 pages2015 11-February Part-3 Memorandumgrateful mabundaNo ratings yet

- Professional EthicsDocument16 pagesProfessional Ethics18UF16 SeenivasNo ratings yet

- Assignment in EthicsDocument5 pagesAssignment in EthicsAlexandria EvangelistaNo ratings yet

- Iccp Code of EthicsDocument2 pagesIccp Code of EthicsYeji BabeNo ratings yet

- T3 - Ethics - Seminar - Q - AnswerDocument4 pagesT3 - Ethics - Seminar - Q - AnswerPham TungNo ratings yet

- W2 Professional Ethics Revised 29 Mac 2021Document33 pagesW2 Professional Ethics Revised 29 Mac 2021YalliniNo ratings yet

- Exploring The Iesba Code: Installment 6: Conflicts of InterestDocument2 pagesExploring The Iesba Code: Installment 6: Conflicts of InterestElena PanainteNo ratings yet

- PSGLE 121 Contract ClausesDocument44 pagesPSGLE 121 Contract Clausestest testNo ratings yet

- Lecture Notes: Auditing & Assurance Principles AT.112-Code of Ethics - Part I Nu Sports Academy LagunaDocument8 pagesLecture Notes: Auditing & Assurance Principles AT.112-Code of Ethics - Part I Nu Sports Academy LagunaPatrickMendozaNo ratings yet

- Code of Ethics For Professional Accountants: B&P Inter ConsultDocument12 pagesCode of Ethics For Professional Accountants: B&P Inter ConsultKalimullah KhanNo ratings yet

- COE. Act. 9298Document8 pagesCOE. Act. 9298Mark Kenneth ParagasNo ratings yet

- Topic 5 - Code of Ethics For AuditorsDocument39 pagesTopic 5 - Code of Ethics For Auditors黄勇添No ratings yet

- Practice Standards AND Ethical Considerations: Basic Responsibilities of Management ConsultantsDocument2 pagesPractice Standards AND Ethical Considerations: Basic Responsibilities of Management ConsultantsEricka AudijeNo ratings yet

- AuditingDocument12 pagesAuditingMY GODNo ratings yet

- MCQ-for lecture-QUIZ REVISED-QUESTIONS ANSWERS-for LecturerDocument6 pagesMCQ-for lecture-QUIZ REVISED-QUESTIONS ANSWERS-for Lecturercynthiama7777No ratings yet

- UntitledDocument34 pagesUntitledJ. EDUNo ratings yet

- WKST 6Document4 pagesWKST 6John JohnsonNo ratings yet

- TST Csecengbg 01219020 Mayjune2018Document28 pagesTST Csecengbg 01219020 Mayjune2018Shelly Ramkalawan50% (4)

- Professional Behaviour: Illustration 5Document1 pageProfessional Behaviour: Illustration 5John JohnsonNo ratings yet

- p17 SVGZDocument1 pagep17 SVGZJohn JohnsonNo ratings yet

- Develop Your Exam Skills: Paper 1Document1 pageDevelop Your Exam Skills: Paper 1John JohnsonNo ratings yet

- Accounting Ethics: Ethical Principles of AccountingDocument1 pageAccounting Ethics: Ethical Principles of AccountingJohn JohnsonNo ratings yet

- p14 SVGZDocument1 pagep14 SVGZJohn JohnsonNo ratings yet

- p9 SVGZDocument1 pagep9 SVGZJohn JohnsonNo ratings yet

- Practice QuestionsDocument1 pagePractice QuestionsJohn JohnsonNo ratings yet

- Practice Questions: 5. Careers in AccountingDocument1 pagePractice Questions: 5. Careers in AccountingJohn JohnsonNo ratings yet

- p9 SVGZDocument1 pagep9 SVGZJohn JohnsonNo ratings yet

- p9 SVGZDocument1 pagep9 SVGZJohn JohnsonNo ratings yet

- Setting The Scene: Syllabus CoverageDocument1 pageSetting The Scene: Syllabus CoverageJohn JohnsonNo ratings yet

- Hamlet Greek TragedyDocument21 pagesHamlet Greek TragedyJorge CanoNo ratings yet

- My Slow Carb Diet Experience, Hacking With Four Hour BodyDocument37 pagesMy Slow Carb Diet Experience, Hacking With Four Hour BodyJason A. Nunnelley100% (2)

- Batangas Polytechnic College: The Morning After Case 7Document4 pagesBatangas Polytechnic College: The Morning After Case 7Jonard Marco RomeroNo ratings yet

- MC DuroDesign EDocument8 pagesMC DuroDesign Epetronela.12No ratings yet

- Marathi Book ListDocument4 pagesMarathi Book ListGajanan PatilNo ratings yet

- Class ProgramsDocument30 pagesClass Programsludivino escardaNo ratings yet

- Nano Technology Oil RefiningDocument19 pagesNano Technology Oil RefiningNikunj Agrawal100% (1)

- Rhinitis Allergic: Elma Wiliandini G4A020043Document10 pagesRhinitis Allergic: Elma Wiliandini G4A020043elma wiliandiniNo ratings yet

- International Business of Pizza HutDocument13 pagesInternational Business of Pizza Hutpratikdotia9100% (2)

- Krok 1 Stomatology: Test Items For Licensing ExaminationDocument28 pagesKrok 1 Stomatology: Test Items For Licensing ExaminationhelloNo ratings yet

- Standard Operating Procedures in Drafting July1Document21 pagesStandard Operating Procedures in Drafting July1Edel VilladolidNo ratings yet

- The Ambiguity of Micro-UtopiasDocument8 pagesThe Ambiguity of Micro-UtopiaspolkleNo ratings yet

- Education PhilosophyDocument8 pagesEducation PhilosophyJustine Jerk BadanaNo ratings yet

- Hechethorn - The Secret Societies of All Ages and Countries, Vol. I (1875) PDFDocument417 pagesHechethorn - The Secret Societies of All Ages and Countries, Vol. I (1875) PDFsongpoetNo ratings yet

- Media Evaluation: Laura MaccioDocument16 pagesMedia Evaluation: Laura Maccioapi-26166574No ratings yet

- Coronavirus Disease (COVID-19) : Situation Report - 125Document17 pagesCoronavirus Disease (COVID-19) : Situation Report - 125CityNewsTorontoNo ratings yet

- Matisse As Printmaker: Matisse'S Printmaking ProcessesDocument2 pagesMatisse As Printmaker: Matisse'S Printmaking ProcessesWriterIncNo ratings yet

- LP Understanding The Writing ProcessDocument8 pagesLP Understanding The Writing Processargus.dump11No ratings yet

- Lesson Plan 9th Grade ScienceDocument2 pagesLesson Plan 9th Grade Scienceapi-316973807No ratings yet

- ! Warning: Servomotor TestDocument1 page! Warning: Servomotor Testjoku jokunenNo ratings yet

- Tesla Roadster (A) 2014Document25 pagesTesla Roadster (A) 2014yamacNo ratings yet

- CONTEXTUALIZED DLP Q1 W1 Day1Document6 pagesCONTEXTUALIZED DLP Q1 W1 Day1QUEENIE BUTALIDNo ratings yet

- Assessment of The Role of Radio in The Promotion of Community Health in Ogui Urban Area, EnuguDocument21 pagesAssessment of The Role of Radio in The Promotion of Community Health in Ogui Urban Area, EnuguPst W C PetersNo ratings yet