Professional Documents

Culture Documents

Capital Budgeting CBPM B

Uploaded by

CM Alfin Setiadi02Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting CBPM B

Uploaded by

CM Alfin Setiadi02Copyright:

Available Formats

soal 1

investasi = 5M Nilai residu = 1M

R = 10%

laba bersih

tahun 1 Rp 950,000,000

2 Rp 1,100,000,000

3 Rp 1,250,000,000 PENYUSUTAN=

4 Rp 1,400,000,000

5 Rp 1,650,000,000

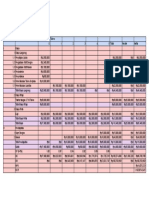

A. CASH FLOW

RUMUS= LABA BERSIH + PENYUSUTAN

TAHUN EAT (LABA BERSIH) DEP NCF

1 Rp 950,000,000 Rp 800,000,000 Rp 1,750,000,000

2 Rp 1,100,000,000 Rp 800,000,000 Rp 1,900,000,000

3 Rp 1,250,000,000 Rp 800,000,000 Rp 2,050,000,000

4 Rp 1,400,000,000 Rp 800,000,000 Rp 2,200,000,000

5 Rp 1,650,000,000 Rp 800,000,000 Rp 2,450,000,000

C. NET PRESENT VALUE

(1+R)'n

TAHUN NCF R = 10% PV

1 Rp 950,000,000 1.1 Rp 863,636,364

2 Rp 1,100,000,000 1.21 Rp 909,090,909

3 Rp 1,250,000,000 1.331 Rp 939,143,501

4 Rp 1,400,000,000 1.4641 Rp 956,218,838

5 Rp 1,650,000,000 1.61051 Rp 1,024,520,183

Rp 6,350,000,000 total Rp 4,692,609,794

io Rp 5,000,000,000 io Rp 5,000,000,000

Rp 1,350,000,000 npv Rp 307,390,206

D. IRR (Internal Rate Return)

Tahun NCF R =10% PV

1 Rp 950,000,000 1.1 Rp 863,636,364

2 Rp 1,100,000,000 1.21 Rp 909,090,909

3 Rp 1,250,000,000 1.331 Rp 939,143,501

4 Rp 1,400,000,000 1.4641 Rp 956,218,838

5 Rp 1,650,000,000 1.61051 Rp 1,024,520,183

IRR

𝟑𝟎𝟕.𝟑𝟗𝟎.𝟐𝟎𝟔

IRR = 10% + x (20%-10%)

𝟏.𝟎𝟐𝟒.𝟓𝟐𝟎.𝟏𝟖𝟑−𝟔𝟔𝟑.𝟎𝟗𝟕.𝟗𝟗𝟒

= 10% + (0,85 X 10%) = 10% + 8,5% = 18,5%

Rp 4,000,000,000 5 TH

Rp 800,000,000

B. PAYBACK PERIODE

CI

TAHUN CO EAT

0 Rp 5,000,000,000

1 Rp 950,000,000

2 Rp 1,100,000,000

3 Rp 1,250,000,000

4 Rp 1,400,000,000

5 Rp 1,650,000,000

pp = 2 + ((5000-(1350)/ 700-(1350))

2 + (6350/2050)

2,3 Tahun

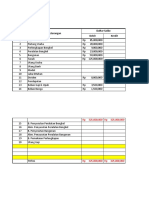

E. PROTABILITY INDEX

NPV PI = SIGMA PV/IO

Rp 4,136,363,636 0.93852195888259

Rp 3,227,272,727

Rp 2,288,129,226 KETERANGAN

Rp 1,331,910,389

Rp 307,390,206

NPV R= 20% PV NPV

Rp 4,136,363,636 1.2 Rp 791,666,667 Rp 4,208,333,333

Rp 3,227,272,727 1.44 Rp 763,888,889 Rp 3,444,444,444

Rp 2,288,129,226 1.728 Rp 723,379,630 Rp 2,721,064,815

Rp 1,331,910,389 2.074 Rp 675,154,321 Rp 2,045,910,494

Rp 307,390,206 2.488 Rp 663,097,994 Rp 1,382,812,500

TOTAL Rp 3,617,187,500

IO Rp 5,000,000,000

NPV Rp 1,382,812,500

CI

DEP NCF AKUMULASI NCF

-Rp 5,000,000,000

Rp 800,000,000 Rp 1,750,000,000 -Rp 3,250,000,000

Rp 800,000,000 Rp 1,900,000,000 -Rp 1,350,000,000

Rp 800,000,000 Rp 2,050,000,000 Rp 700,000,000

Rp 800,000,000 Rp 2,200,000,000 Rp 2,900,000,000

Rp 800,000,000 Rp 2,450,000,000 Rp 5,350,000,000

pp = investasi awal/ cf

2.5

PI > 1, LAYAK INVESTASI

PI < 1, TIDAK LAYAK INVESTASI

You might also like

- PESDH CashflowDocument1 pagePESDH CashflowAliyya Husna RochimahNo ratings yet

- Evapro FarlyFahreza 008Document13 pagesEvapro FarlyFahreza 008hexsbayNo ratings yet

- Rincian PinjamanDocument20 pagesRincian Pinjamanmaliktaufik22No ratings yet

- Dimas Adijaya Nugraha - Tugas Individu B2Document7 pagesDimas Adijaya Nugraha - Tugas Individu B2Sie Keamanan Dimas adijaya nugrahaNo ratings yet

- Kelayakan Investasi Panel SuryaDocument2 pagesKelayakan Investasi Panel SuryaEfraim RorongsombaNo ratings yet

- Iswandi AITDocument4 pagesIswandi AITIswandi Irianto PutraNo ratings yet

- Tugas Akhir, Riswan ASP-08Document12 pagesTugas Akhir, Riswan ASP-08Lord GamingNo ratings yet

- P AngkaDocument17 pagesP AngkaAdhekaNo ratings yet

- Penambangan Sistem RoyaltiDocument6 pagesPenambangan Sistem Royaltidimar agusriawanNo ratings yet

- ORAKOREKDocument8 pagesORAKOREKACCOUNTING BUPDANo ratings yet

- Penilaian Pengetahuan Spreadsheet Hal 92 Bye FaraDocument20 pagesPenilaian Pengetahuan Spreadsheet Hal 92 Bye FaraNabilah khoirunisaNo ratings yet

- Femin Lovitasari AK 1Document7 pagesFemin Lovitasari AK 1TiaraAngelNo ratings yet

- M Alvian STRDocument3 pagesM Alvian STRBANG SYNNo ratings yet

- Membuatlaporankeuangansupervisiterbaru 120912000253 Phpapp02Document13 pagesMembuatlaporankeuangansupervisiterbaru 120912000253 Phpapp02Kayla MardhiyyahNo ratings yet

- Rheznanda Rizki Saputra - 023002001080 - Lembar KerjaDocument13 pagesRheznanda Rizki Saputra - 023002001080 - Lembar KerjananaNo ratings yet

- Worksheet Bengkel Rajawali MotorDocument3 pagesWorksheet Bengkel Rajawali Motornazwa passaNo ratings yet

- CASHFLOWDocument5 pagesCASHFLOWnisa alfrilianiNo ratings yet

- Anggaran Harga Pokok ProduksiDocument2 pagesAnggaran Harga Pokok ProduksiBENNY WAHYUDINo ratings yet

- Sil & Deposito 2023Document1 pageSil & Deposito 2023putririzqijannatulfirdausNo ratings yet

- Akuntansi - AtimDocument2 pagesAkuntansi - AtimDinda ArdiyaniNo ratings yet

- AKL AkmmDocument3 pagesAKL AkmmAvrina Rosa WiriantiNo ratings yet

- Penjualan Angsuran - Bunga MenurunDocument3 pagesPenjualan Angsuran - Bunga MenurunDewayu Elsa ArnitiNo ratings yet

- Perhitungan KPRDocument4 pagesPerhitungan KPRAmy BaidiNo ratings yet

- Lampiran Perhitungan Jawaban UASDocument4 pagesLampiran Perhitungan Jawaban UASZaldy ZulkarnainNo ratings yet

- Ade Tia Nursobah - 21110010 - IFSI (S1) - UAS PPADocument2 pagesAde Tia Nursobah - 21110010 - IFSI (S1) - UAS PPAghefiraNo ratings yet

- Tugas Real Proyek - D041191030 - Nur Isnun NadiyahDocument39 pagesTugas Real Proyek - D041191030 - Nur Isnun Nadiyahsiti namirah aprilliahNo ratings yet

- TUGAS Akutansi (Anju Maighericho Napitupulu) (23302041)Document15 pagesTUGAS Akutansi (Anju Maighericho Napitupulu) (23302041)Kage gamingNo ratings yet

- Latihan Akuntansi Dasar 2Document5 pagesLatihan Akuntansi Dasar 2cungcungNo ratings yet

- Latihan Keempat 9 KasusDocument17 pagesLatihan Keempat 9 Kasusjustinlex2No ratings yet

- Praktikum PerpajakanDocument105 pagesPraktikum PerpajakanSartika TariganNo ratings yet

- Form Daftar Gaji, Rekap, Jurnal FixDocument34 pagesForm Daftar Gaji, Rekap, Jurnal Fix-No ratings yet

- Cashflow MIP SMSTR 2Document1 pageCashflow MIP SMSTR 2dadanarman81No ratings yet

- T3 NewDocument11 pagesT3 NewVirus LifeafterNo ratings yet

- T4 NewDocument25 pagesT4 NewVirus LifeafterNo ratings yet

- T5 NewDocument25 pagesT5 NewVirus LifeafterNo ratings yet

- Jawaban Pre TestDocument3 pagesJawaban Pre TestAnjelina InaNo ratings yet

- Rp800,000,000 - Rp900,000,000 - Rp1,380,000,000 - Rp1,380,000,000 - Rp182,000,000 - Rp222,000,000Document6 pagesRp800,000,000 - Rp900,000,000 - Rp1,380,000,000 - Rp1,380,000,000 - Rp182,000,000 - Rp222,000,000Andi Muh Said Gurbahco AkhyarNo ratings yet

- LAT2Document19 pagesLAT2Angel WingzzNo ratings yet

- Rab Panel AugerDocument2 pagesRab Panel AugerAutomasi VSANo ratings yet

- Studi Kasus 5Document2 pagesStudi Kasus 5Puput tri MaharaniNo ratings yet

- Lat Bab 3 Hal 65Document5 pagesLat Bab 3 Hal 65Irma RullydaNo ratings yet

- Bunga Flat, Efektif, AnuitasDocument5 pagesBunga Flat, Efektif, AnuitasMelina ManurungNo ratings yet

- Kertas Kerja PPH 21 - 222 - Yani Nurpati Pancarani - JanuariDocument5 pagesKertas Kerja PPH 21 - 222 - Yani Nurpati Pancarani - JanuariYani NurpatiNo ratings yet

- LK Poa 2018 PerubahanDocument229 pagesLK Poa 2018 PerubahanCicah HandayaniNo ratings yet

- Latihan 7 Deswita SDocument2 pagesLatihan 7 Deswita SDeswita SusantiNo ratings yet

- Akuntansi 7.8Document6 pagesAkuntansi 7.8Lisa PrisciliaNo ratings yet

- Kn!dit Kn!ditDocument1 pageKn!dit Kn!ditREG.A/41921100002/DESI INDRIYANTINo ratings yet

- TUGAS Azmy SaputraDocument17 pagesTUGAS Azmy SaputraazmysaputrahNo ratings yet

- Praktikum PerpajakanDocument12 pagesPraktikum PerpajakanJanni Mellian Fitri88% (16)

- Take Home H-10 - Ratna Siti SondariDocument6 pagesTake Home H-10 - Ratna Siti Sondariratna siti sondariNo ratings yet

- Akuntansi Perusahaan JasaDocument3 pagesAkuntansi Perusahaan Jasa003Nyco DhanaNo ratings yet

- Jawaban SatuDocument9 pagesJawaban SatuKiki YantiNo ratings yet

- Akt. Perpajakan (Putri Paula Riani Wijaya) 2020310026Document3 pagesAkt. Perpajakan (Putri Paula Riani Wijaya) 2020310026Putri PaulaNo ratings yet

- Akuntansi Pert 12-Errin VallelyDocument14 pagesAkuntansi Pert 12-Errin VallelyInggil Rizky NingtiyasNo ratings yet

- Perhitungan Gaji & UpahDocument5 pagesPerhitungan Gaji & UpahYulinda SaledaNo ratings yet

- M.Aqshal - 1706621010 - Kuis AKL 1Document4 pagesM.Aqshal - 1706621010 - Kuis AKL 1AqshalNo ratings yet