Professional Documents

Culture Documents

Exercises and Case Study - Financial Management

Uploaded by

John Verlie EMpsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercises and Case Study - Financial Management

Uploaded by

John Verlie EMpsCopyright:

Available Formats

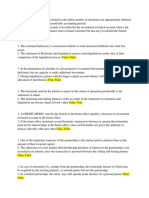

TEST I: ESSAY

1. Explain the three(3) decision areas in finance.

2. Why is cash flow more important than accounting income?

3. Why is market value more important than book value?

TEST II: CASE STUDY

The J.B Chavez Company has experienced two consecutive years of improved sales and foresees the

need to increase its investment in inventories and receivables to meet yet a third year of increased

sales. Chavez’s financial manager, J.B Chavez, recently approached the company’s bank to discuss the

possibility of extending the firm’s line of credit to cover firm’s projected future fund requirements. The

financial statements for the firm are shown below:

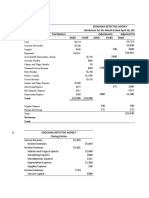

Balance Sheet

As of December 31, 2017 & 2016

2016 2017

Assets

Cash ₱ 225 ₱ 175

Accounts Receivables 450 430

Inventory 575 625

Current Assets ₱ 1,250 ₱ 1,230

Plant & Equipment 2,200 2,500

Less: Accumulated Depreciation 1,000 1,200

Net Plant and Equipment ₱ 1,200 ₱ 1,300

Total Assets ₱ 2,450 ₱ 2,530

Liabilities and Owner's Equity

Current Liabilities

Accounts Payable ₱ 250 ₱ 115

Notes Payable-Current - 115

Current Liabilities ₱ 250 ₱ 230

Non Current Liabilities

Bonds 600 600

Owner's Equity:

Paid up capital 900 900

Retained earnings 700 800

Total Owner's Equity ₱ 1,600 ₱ 1,700

Total Liabilities and Owner's Equity ₱ 2,450 ₱ 2,530

You might also like

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- QuickBooks Online Certification Exam Answers PDF 2021Document6 pagesQuickBooks Online Certification Exam Answers PDF 2021Mercy Fe FernandezNo ratings yet

- Accounting Principles 10th Edition Weygandt & Kimmel Chapter 1Document40 pagesAccounting Principles 10th Edition Weygandt & Kimmel Chapter 1ZisanNo ratings yet

- IAS 1 Financial Statement Presentation GuideDocument7 pagesIAS 1 Financial Statement Presentation GuideMd AladinNo ratings yet

- Restaurant Project ReportDocument11 pagesRestaurant Project ReportKaushik Kansara85% (20)

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Coursebook Chapter 9 AnswersDocument5 pagesCoursebook Chapter 9 AnswersAhmed Zeeshan92% (12)

- Octane Service StationDocument8 pagesOctane Service StationKalyan Kumar83% (6)

- Prelim Quiz Preparation of Balance Sheet and Income StatementDocument8 pagesPrelim Quiz Preparation of Balance Sheet and Income StatementCHARRYSAH TABAOSARES100% (2)

- Presentation On Recycling of PlasticDocument22 pagesPresentation On Recycling of PlasticTushar YadavNo ratings yet

- 07 Activity 1-EnTREPDocument2 pages07 Activity 1-EnTREPClar PachecoNo ratings yet

- Marco Company Bankruptcy Statement of Affairs and Estimated RecoveryDocument4 pagesMarco Company Bankruptcy Statement of Affairs and Estimated Recoveryarif budi hermansahNo ratings yet

- Fin CH 2 ProblemsDocument9 pagesFin CH 2 Problemsshah118850% (4)

- Prepare Financial Statements From Trial Balance in ExcelDocument5 pagesPrepare Financial Statements From Trial Balance in ExcelShania FordeNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 3rd StatementDocument3 pages3rd StatementJoshNo ratings yet

- Partnership Liquidation and AccountingDocument4 pagesPartnership Liquidation and Accountingnadea06_20679973No ratings yet

- Chapter 1-Problem 1 To 5: Charles Company Balance Sheet As On 31st Dec AssetsDocument9 pagesChapter 1-Problem 1 To 5: Charles Company Balance Sheet As On 31st Dec AssetsSimran HarchandaniNo ratings yet

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Document5 pagesMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidNo ratings yet

- Balance SheetDocument1 pageBalance SheetKathleen Joyce ParangatNo ratings yet

- Def Corporation Statemenrt of Financial Position December 31, 2014Document2 pagesDef Corporation Statemenrt of Financial Position December 31, 2014Aizen IchigoNo ratings yet

- General JournalDocument5 pagesGeneral Journalmonicaaa melianaaaNo ratings yet

- General JournalDocument5 pagesGeneral Journal૨εƒ XianNo ratings yet

- General JournalDocument5 pagesGeneral Journal૨εƒ XianNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Statement of Financial Position As at 31st March 2015Document52 pagesStatement of Financial Position As at 31st March 2015Shameel IrshadNo ratings yet

- Financial StatementDocument4 pagesFinancial StatementJoshNo ratings yet

- SCF - OCF - FCF of JCB ChavezDocument2 pagesSCF - OCF - FCF of JCB ChavezRodel LemorinasNo ratings yet

- PT 1 (Alemany)Document5 pagesPT 1 (Alemany)Thrisha AlemanyNo ratings yet

- ABC Co. Balance Sheet 2009Document1 pageABC Co. Balance Sheet 2009xenniNo ratings yet

- JRHR - 4 Fundidora de MtyDocument5 pagesJRHR - 4 Fundidora de MtyRoberto RodríguezNo ratings yet

- Kirby Company Financial AnalysisDocument6 pagesKirby Company Financial AnalysisvanessaNo ratings yet

- M - 30 S 2020 o ($'000) ($'000) ADocument10 pagesM - 30 S 2020 o ($'000) ($'000) AAmmar TahirNo ratings yet

- 704Document5 pages704Bhoomi GhariwalaNo ratings yet

- Maquoketa River Resort Adjusted Trial BalanceDocument11 pagesMaquoketa River Resort Adjusted Trial Balancemohitgaba19No ratings yet

- Exercises P Class 1 2022Document5 pagesExercises P Class 1 2022Angel MéndezNo ratings yet

- Maynard A Balance SheetDocument3 pagesMaynard A Balance SheetFaisal Habibie YurzalNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- Igcse - Extented Tutoring - 2023 - 2024 - Final AccountsDocument7 pagesIgcse - Extented Tutoring - 2023 - 2024 - Final AccountsMUSTHARI KHANNo ratings yet

- Accounting Assignment 2 PDFDocument6 pagesAccounting Assignment 2 PDFA. HanifahNo ratings yet

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- (Kunci) Asistensi 4Document8 pages(Kunci) Asistensi 4Randomly EmailNo ratings yet

- MGT213 06 Financial Planning and Forecasting ExerciseDocument3 pagesMGT213 06 Financial Planning and Forecasting ExercisePablo InocencioNo ratings yet

- BITAVARRA c2 p2-1Document4 pagesBITAVARRA c2 p2-1Lady Margarette BitavarraNo ratings yet

- Exercise Chap 2 NLKTDocument10 pagesExercise Chap 2 NLKTalexnguyen21007No ratings yet

- Cashflow QuestionDocument2 pagesCashflow QuestionMick MingleNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- 07 Activity 1Document2 pages07 Activity 1Ronald varrie BautistaNo ratings yet

- Problem Sheet 4 Summer 22Document4 pagesProblem Sheet 4 Summer 22Md Tanvir AhmedNo ratings yet

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDocument4 pagesQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendNo ratings yet

- Accounting Cycle1Document4 pagesAccounting Cycle1Ahmer NaeemNo ratings yet

- ABM Fundamentals of AccountingDocument3 pagesABM Fundamentals of AccountingtsukiNo ratings yet

- Jankyle EdiongDocument10 pagesJankyle EdiongPasa YanNo ratings yet

- CAREFUL COMPANY CASH FLOW STATEMENTDocument7 pagesCAREFUL COMPANY CASH FLOW STATEMENTKate NuevaNo ratings yet

- Team Assignment - Team 5 - TK1Document12 pagesTeam Assignment - Team 5 - TK1Benyamin AminNo ratings yet

- T Ran Sak Sijo U RN Alp O Stin G T Rial B Alan Ce A D Ju Stin G E N Tries A D Ju Sted Trial B Alan Cef in An Cial Statem en TC Lo Sin GDocument5 pagesT Ran Sak Sijo U RN Alp O Stin G T Rial B Alan Ce A D Ju Stin G E N Tries A D Ju Sted Trial B Alan Cef in An Cial Statem en TC Lo Sin GAnggelia TiyantiNo ratings yet

- AssetsDocument2 pagesAssetsDier DalapNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Kimmel Acct 7e Ch02 A Further Look at Financial StatementsDocument74 pagesKimmel Acct 7e Ch02 A Further Look at Financial StatementsElectronNo ratings yet

- MAY 2017 EXAM CHIEF EXAMINER'S REPORTDocument27 pagesMAY 2017 EXAM CHIEF EXAMINER'S REPORTAnna MwitaNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- FMC Case Study: Key Financial Ratios in 2012 and 2011Document3 pagesFMC Case Study: Key Financial Ratios in 2012 and 2011John Verlie EMpsNo ratings yet

- Three (3) Major Decisions The Finance Manager Would TakeDocument11 pagesThree (3) Major Decisions The Finance Manager Would TakeJohn Verlie EMpsNo ratings yet

- Exercises and Case Study - Financial ManagementDocument1 pageExercises and Case Study - Financial ManagementJohn Verlie EMpsNo ratings yet

- Explain The Three (3) Decisions Areas of FinanceDocument3 pagesExplain The Three (3) Decisions Areas of FinanceJohn Verlie EMpsNo ratings yet

- Financial Management: Sources of Funds: Topic 13Document23 pagesFinancial Management: Sources of Funds: Topic 13John Verlie EMpsNo ratings yet

- Exercises and Case Study - Financial ManagementDocument1 pageExercises and Case Study - Financial ManagementJohn Verlie EMpsNo ratings yet

- Explain The Three (3) Decisions Areas of FinanceDocument3 pagesExplain The Three (3) Decisions Areas of FinanceJohn Verlie EMpsNo ratings yet

- Universidad de Zamboanga: School of Business ManagementDocument3 pagesUniversidad de Zamboanga: School of Business ManagementJohn Verlie EMpsNo ratings yet

- Illustrative Case Problem U Company Has Forecast Credit Sales For The Fourth Quarter of The YearDocument2 pagesIllustrative Case Problem U Company Has Forecast Credit Sales For The Fourth Quarter of The YearJohn Verlie EMpsNo ratings yet

- SMEs Financing Options For Entrepreneurs PresentationDocument23 pagesSMEs Financing Options For Entrepreneurs PresentationJohn Verlie EMpsNo ratings yet

- Three (3) Major Decisions The Finance Manager Would TakeDocument11 pagesThree (3) Major Decisions The Finance Manager Would TakeJohn Verlie EMpsNo ratings yet

- Finance: Analysis of Financial Statements RatiosDocument18 pagesFinance: Analysis of Financial Statements RatiosJohn Verlie EMpsNo ratings yet

- Segmented Reporting and Performance Evaluation (Managerial Accounting)Document19 pagesSegmented Reporting and Performance Evaluation (Managerial Accounting)John Verlie EMpsNo ratings yet

- Assessment 1 - Managerial EconomicsDocument1 pageAssessment 1 - Managerial EconomicsJohn Verlie EMpsNo ratings yet

- Banking SWOT Strengths Employment GrowthDocument2 pagesBanking SWOT Strengths Employment GrowthJohn Verlie EMpsNo ratings yet

- 67 1 3Document22 pages67 1 3bhaiyarakeshNo ratings yet

- Translation Methods: - Current/Noncurrent Method - Monetary/Nonmonetary Method - Temporal Method - Current Rate MethodDocument29 pagesTranslation Methods: - Current/Noncurrent Method - Monetary/Nonmonetary Method - Temporal Method - Current Rate MethodRajipah OsmanNo ratings yet

- Ambuja Cements: Profit & Loss AccountDocument15 pagesAmbuja Cements: Profit & Loss Accountwritik sahaNo ratings yet

- Accounting Chapter 2Document4 pagesAccounting Chapter 2Ebony Ann delos SantosNo ratings yet

- Travel Agency Marketing PlanDocument20 pagesTravel Agency Marketing PlanGregsyNo ratings yet

- MIDTERMDocument8 pagesMIDTERMhaech jaemNo ratings yet

- Piecemeal DistributionDocument5 pagesPiecemeal DistributionYashfeen HakimNo ratings yet

- Excel File For Financial Ratio Activities UpdatedDocument4 pagesExcel File For Financial Ratio Activities Updated0a0lvbht4No ratings yet

- Fundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookDocument7 pagesFundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookShekhar TNo ratings yet

- Accounting Part 1: TheoriesDocument6 pagesAccounting Part 1: Theoriesnd555No ratings yet

- ABSS Print JobDocument3 pagesABSS Print JobhumaiNo ratings yet

- Audit Of Liabilities Substantive ProceduresDocument28 pagesAudit Of Liabilities Substantive ProceduresHello Kitty100% (1)

- Scope of Opening A Multi Cuisine Restaurant at BIT Mesra - Vikash VarnwalDocument32 pagesScope of Opening A Multi Cuisine Restaurant at BIT Mesra - Vikash VarnwalVarnwal Vikash100% (4)

- Solutions - Chapter 2Document29 pagesSolutions - Chapter 2Dre ThathipNo ratings yet

- Panera Case InfoDocument8 pagesPanera Case InfoCharlie RNo ratings yet

- Mba AceDocument4 pagesMba AceJitesh ThakurNo ratings yet

- Module Number 6 (Ppe Revalution) Question No. 1Document4 pagesModule Number 6 (Ppe Revalution) Question No. 1ARISNo ratings yet

- Retirement of A PartnerDocument6 pagesRetirement of A Partnerprksh_451253087No ratings yet

- 4357 8498 1 SMDocument12 pages4357 8498 1 SMAnu ReetNo ratings yet

- Chapter - V Data Analysis & InterpretationDocument26 pagesChapter - V Data Analysis & InterpretationMubeenNo ratings yet

- College of Accountancy: Midterm Examination in Financial Accounting and ReportingDocument6 pagesCollege of Accountancy: Midterm Examination in Financial Accounting and ReportingALMA MORENANo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Solution:: Purchases, Cash Basis P 2,850,000Document2 pagesSolution:: Purchases, Cash Basis P 2,850,000Jen Deloy50% (2)

- Focus and Question: Erica Cristsl Bolante Bsba FM 1Document6 pagesFocus and Question: Erica Cristsl Bolante Bsba FM 1Erica BolanteNo ratings yet

- MS-4 Dec 2012 PDFDocument4 pagesMS-4 Dec 2012 PDFAnonymous Uqrw8OwFWuNo ratings yet

- Problem 8Document3 pagesProblem 8Coleen Lara SedillesNo ratings yet