Professional Documents

Culture Documents

INDIAN INCOME TAX RETURN FOR SALARY AND INTEREST INCOME

Uploaded by

shivam raiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

INDIAN INCOME TAX RETURN FOR SALARY AND INTEREST INCOME

Uploaded by

shivam raiCopyright:

Available Formats

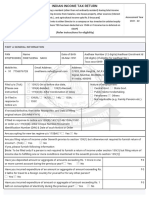

INDIAN INCOME TAX RETURN

[For individuals being a resident (other than not ordinarily

resident) having total income upto Rs.50 lakh, having Income

from Salaries, one house property, other sources (Interest etc.), Assessment

ITR-1

and agricultural income upto Rs.5 thousand] Year

SAHAJ

[Not for an individual who is either Director in a company or has 2021 - 22

invested in unlisted equity shares or in cases where TDS has

been deducted u/s 194N or if income-tax is deferred on ESOP]

(Refer instructions for eligibility)

PART A GENERAL INFORMATION

PAN Name Date of Birth Aadhaar Number (12 digits)/Aadhaar Enrolment Id (28 digits)

BQOPD9048L LAXMI DEVI 24-Mar-1976 (If eligible for Aadhaar No.)

9xxx xxxx 5083

Mobile No. Email Address Address:

+ 93 8789195279 Srai112001@gmail.com 1b/66, Bermo S.O, Bermo, BOKARO, 35-Jharkhand, 91-India, 829104

Filed u/s (Tick) ✔ 139(1)-On or before due date, Nature of employment-

[Please see 139(4)-Belated, 139(5)-Revised, Central Govt. State Govt.

instruction] 119(2)(b)- After Condonation of delay Public Sector Undertaking

Pensioners Others

Or Filed in 139(9), 142(1), 148, 153A, ✔ Not Applicable (e.g. Family Pension etc.)

response to notice 153C

u/s

If revised/defective, then enter Receipt No. and Date of filing original return

(DD/MM/YYYY)

If filed in response to notice u/s 139(9)/142(1)/148/153A/153C or order u/s 119

(2)(b)- enter Unique Number/Document Identification Number (DIN) & Date of

such Notice or Order

Are you opting for new tax regime u/s 115BAC ? Yes ✔ No

Are you filing return of income under Seventh proviso to section 139(1) but otherwise not required to furnish return of income? - (Tick)

Yes ✔ No

If yes, please furnish following information

[Note: To be filled only if a person is not required to furnish a return of income under section 139(1) but filing return of income due to fulfilling

one or more conditions mentioned in the seventh proviso to section 139(1)]

Have you deposited amount or aggregate of amounts exceeding Rs. 1 Crore in one or more current 0

account during the previous year?

Yes ✔ No

Have you incurred expenditure of an amount or aggregate of amount exceeding Rs. 2 lakhs for 0

travel to a foreign country for yourself or for any other person?

Yes ✔ No

Have you incurred expenditure of amount or aggregate of amount exceeding Rs. 1 lakh on 0

consumption of electricity during the previous year? Yes ✔ No

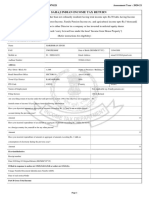

PART B GROSS TOTAL INCOME Whole- Rupee ( ) only

B1 i Gross Salary (ia+ib+ic) i 0

a Salary as per section 17(1) ia 0

b Value of perquisites as per ib 0

section 17(2)

c Profit in lieu of salary as per ic 0

section 17(3)

ii Less allowances to the extent exempt u/s 10 ii 0

(Ensure that it is included in salary income u/s 17(1)/17(2)/17(3) )

iii Net Salary (i - ii) iii 0

0

iv Deductions u/s 16 (iva + ivb+ivc) iv 0

a Standard deduction u/s 16(ia) iva 0

b Entertainment allowance u/s 16 ivb 0

(ii)

c Professional tax u/s 16(iii) ivc 0

v Income chargeable under the head 'Salaries' (iii - iv) B1 0

B2 Tick applicable option

Self-Occupied Let Out Deemed Let Out

i Gross rent received/ receivable/ lettable value during the year i 0

ii Tax paid to local authorities ii 0

iii Annual Value (i - ii) iii 0

iv 30% of Annual Value iv 0

v Interest payable on borrowed capital v 0

vi Arrears/Unrealised rent received vi 0

during the year less 30%

vii Income chargeable under the head 'House Property' (iii - iv - v) + vi (If loss, put B2 0

the figure in negative)

Note: - Maximum loss from House Property that can be set-off is INR 2,00,000. To

avail the benefit of carry forward and set off of loss, please use ITR-2

B3 Income from Other Sources B3 2,32,517

S.No Nature of Income Description ( If Any Other Total Amount

selected)

1 Interest from Deposit (Bank/Post Office/Cooperative Society) 0 2,32,517

Less: Deduction u/s 57(iia) (in case of family pension only) 0

B4 Gross Total Income (B1+B2+B3) (If loss, put the figure in negative) B4 2,32,517

Note: To avail the benefit of carry forward and set off of loss, please use ITR-2

Part C - Deductions and Taxable Total Income (Refer instructions for Deduction limit as per Income-tax Act. Please note that the

deduction in respect of the investment/ deposit/ payments for the period 01-04-2020 to 31-07-2020 cannot be claimed again, if already

claimed in the AY 2020-21)

S. Section Amount System Calculated

No.

C1. 80C - Life insurance premia, deferred annuity, contributions to 0 0

provident fund, subscription to certain equity shares or

debentures, etc.

C2. 80CCC - Payment in respect Pension Fund,etc. 0 0

C3. 80CCD(1) - Contribution to pension scheme of Central 0 0

Government

C4. 80CCD(1B) - Contribution to pension scheme of Central 0 0

Government

C5. 80CCD(2) - Contribution to pension scheme of Central 0 0

Government by employer

C6. 80D Deduction in respect of Health Insurance premia (Please fill 0 0

80D Schedule. This field is auto-populated from schedule 80D.)

C7. 80DD - Maintenance including medical treatment of a dependent 0 0

who is a person with disability

C8. 80DDB - Medical treatment of specified disease 0 0

C9. 80E - Interest on loan taken for higher education 0 0

C10. 80EE - Interest on loan taken for residential house property 0 0

C11. 80EEA - Deduction in respect of interest on loan taken for certain 0 0

house property

C12. 80EEB - Deduction in respect of purchase of electric vehicle 0 0

C13. 80G - Donations to certain funds, charitable institutions, etc. 0 0

(Please fill 80G Schedule. This field is auto-populated from

schedule.)

C14. 80GG - Rent paid 0 0

C15. 80GGA - Certain donations for scientific research or rural 0 0

development (Please fill 80GGA Schedule. This field is auto-

populated from schedule.)

C16. 80GGC - Donation to Political party 0 0

C17. 80TTA - Interest on deposits in savings Accounts 0 0

C18. 80TTB- Interest on deposits in case of senior citizens 0 0

C19. 80U-In case of a person with disability 0 0

Total Deductions (Add items C1 to C19) 0 0

Note: Total deductions under chapter VI A cannot exceed GTI.

Total Income 2,32,520

Exempt income (For reporting Purposes)

S.No Nature of Income Description ( If Any Other selected) Total Amount

1 Agriculture Income (less than equal to Rs.5000) 5,000

Total Amount 5,000

PART D - COMPUTATION OF TAX PAYABLE

D1 Tax 0 D2 Rebate u 0 D3 Tax 0

payable /s 87A payable

on total after

income rebate

D4 Health 0 D5 Total Tax 0 D6 Relief u/s 0

and and Cess 89

education (Please

Cess ensure to

@4% on submit

D3 Form 10E

to claim

this relief)

D7 Interest u 0 D8 Interest u 0 D9 Interest u 0

/s 234A /s 234B /s 234C

D10 Fee u/s 0 D11 Total Tax, Fee and Interest (D5+D7+D8+D9+D10 - D6) 0

234F

D12 Total 4,524 D13 Amount 0 D14 Refund 4,520

Taxes payable (D12-

Paid (D11- D11) (if

D12) (if D12>D11)

D11>D12)

PART E - OTHER INFORMATION

Details of all Bank Accounts held in India at any time during the previous year (excluding dormant accounts)

Sl. IFS Code of the Bank Name of the Bank Account Number Select Account for Refund

Credit

1 SBIN0001235 STATE BANK OF INDIA 33477332462 ✔

2 UCBA0000247 UCO BANK 02470100005132

1. Minimum one account should be selected for refund credit.

2. In case of Refund, multiple accounts are selected for refund credit, then refund will be credited to one of the account decided by CPC after

processing the return.

Schedule 80D

1 Whether you or any of your family member (excluding parents) is a senior citizen? Not claiming for Self/Family

(a) Self & Family 0

(i) Health Insurance 0

(ii) Preventive Health Checkup 0

(b) Self & Family (Senior Citizen) 0

(i) Health Insurance 0

(ii) Preventive Health Checkup 0

(iii) Medical Expenditure (This deduction to be claimed on which health insurance is not 0

claimed)

2 Whether any one of your parents is a senior citizen Not claiming for parents

(a) Parents 0

(i) Health Insurance 0

(ii) Preventive Health Checkup 0

(b) Parents (Senior Citizen) 0

(i) Health Insurance 0

(ii) Preventive Health Checkup 0

(iii) Medical Expenditure 0

3 Eligible Amount of Deduction 0

Schedule 80G: Details of donations entitled for deduction under section 80G

A. Donations entitled for 100% deduction without qualifying limit, (where any row is filled by the user, all the fields in that row should become

mandatory)

S No. Name of the Address City or State Pincode PAN of Amount of donation Eligible Amount of

Donee Town or Code the Donee Donation

Donation in cash Donation in other Total Donation

District

mode

- 0 0 0 0

Total A 0 0 0 0

B. Donations entitled for 50% deduction without qualifying limit (where any row is filled by the user, all the fields in that row should become mandatory)

S No. Name of the Address City or State Pincode PAN of Amount of donation Eligible Amount of

Donee Town or Code the Donee Donation

Donation in cash Donation in other Total Donation

District

mode

- 0 0 0 0

Total B 0 0 0 0

C. Donations entitled for 100% deduction subject to qualifying limit (where any row is filled by the user, all the fields in that row should become

mandatory)

S No. Name of the Address City or State Pincode PAN of Amount of donation Eligible Amount of

Donee Town or Code the Donee Donation

Donation in cash Donation in other Total Donation

District

mode

- 0 0 0 0

Total C 0 0 0 0

D. Donations entitled for 50% deduction subject to qualifying limit (where any row is filled by the user, all the fields in that row should become

mandatory)

S No. Name of the Address City or State Pincode PAN of Amount of donation Eligible Amount of

Donee Town or Code the Donee Donation

Donation in cash Donation in other Total Donation

District

mode

- 0 0 0 0

Total D 0 0 0 0

E. Donations (A + B + C+ D) 0 0 0 0

Schedule 80GGA: Details of donations for scientific research or rural development

S No. Relevant Name of Address City or State Pincode PAN of Date of Amount of donation Eligible

Clause under

the Town or Code the Donation Amount of

which Donation Donation in Total

Donee District Donee in cash Donation

deduction is

in cash other mode Donation

claimed

- 0 0 0 0

Total Donation 0 0 0 0

Schedule-IT Details of Advance Tax and Self-Assessment Tax payments

BSR Code Date of Deposit (DD/MM/YYYY) Serial Number of Challan Tax paid

Col (1) Col (2) Col (3) Col (4)

Total 0

Details of Tax Deducted at Source (TDS) on Salary Income

Sl.No. TAN of the Deductor Name of the Deductor Income chargeable under Total Tax Deducted

salaries

1 2 3 4

Total 0

Details of Tax Deducted at Source (TDS) from Income Other than Salary

Sl. TAN of the Name of the Gross receipt which is Year of Tax Deducted TDS Credit out of (5)

No. Deductor Deductor subject to tax deduction tax claimed this year

deduction

1 2 3 4 5 6

1 MUMS89571G state bank of india 60,307 2020 4,524 4,524

Total 4,524

Details of Tax Deducted at Source [As per Form 16C furnished by the Payer(s)]

Sl. PAN Aadhaar Name of the Gross receipt which is Year of Tax Deducted TDS Credit out of (6)

No. of the Number Tenant subject to tax claimed this year

Tenant of tax deduction deduction

the

Tenant

1 2 3 4 5 6 7

Total 0

Details of Tax Collected at Source (TCS)

Sl. Name of the Tax Collected TCS Credit out of (5)

No. Tax Collector Gross payment which is Year of claimed this year

Collection subject to tax

Account tax collection collection

Number of

the

Collector

1 2 3 4 5 6

Total 0

VERIFICATION

I, LAXMI DEVI son/ daughter of bhagwat yadav solemnly declare that to the best of my knowledge and belief, the information given in

the return is correct and complete and is in accordance with the provisions of the Income-tax Act, 1961. I further declare that I am making this

return in my capacity as Self and I am also competent to make this return and verify it. I am holding permanent account number

BQOPD9048L

Date: 18-Sep-2021

If the return has been prepared by a Tax Return Preparer (TRP) give further details below:

Identification No. of TRP Name of TRP Counter Signature of TRP

If TRP is entitled for any reimbursement from the Government, amount thereof 0

You might also like

- Indian Income Tax Return Acknowledgement Number 285727510040322Document6 pagesIndian Income Tax Return Acknowledgement Number 285727510040322Prasad KumarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Alok Kumar BanerjeeNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Riten ParikhNo ratings yet

- Acknowledgement Number Tax ReturnDocument6 pagesAcknowledgement Number Tax ReturnVikas KumarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Piyush PatelNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)rajdeep maityNo ratings yet

- Chirag's Father Last Year ItrDocument6 pagesChirag's Father Last Year ItrTWINKLE GAJJARNo ratings yet

- INDIAN INCOME TAX RETURN FOR SALARIED INDIVIDUALSDocument6 pagesINDIAN INCOME TAX RETURN FOR SALARIED INDIVIDUALSMenoddin shaikhNo ratings yet

- Acknowledgement Number 762728030311221 Tax ReturnDocument6 pagesAcknowledgement Number 762728030311221 Tax ReturnAKASH SINGHNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Chief Engineer Hydro Project & Quality ControlNo ratings yet

- Indian Income Tax Return for Salary IncomeDocument6 pagesIndian Income Tax Return for Salary IncomeNeeraj JoshiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Amit KumarNo ratings yet

- Form PDF 471387520080921Document6 pagesForm PDF 471387520080921PriyanshuNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Kokila ShamNo ratings yet

- Form PDF 583178960301221Document6 pagesForm PDF 583178960301221Jayant KumarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)CA AJAY JOSHINo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)singam jasNo ratings yet

- Form PDF 767967830311221Document6 pagesForm PDF 767967830311221ClaptrapjackNo ratings yet

- Form PDF 141540220090721Document6 pagesForm PDF 141540220090721navdeepdecentNo ratings yet

- INDIAN INCOME TAX RETURN FOR SALARIED INDIVIDUALSDocument6 pagesINDIAN INCOME TAX RETURN FOR SALARIED INDIVIDUALSIsaac Joel RajNo ratings yet

- ITR-1 Acknowledgement for FY 2021-22Document6 pagesITR-1 Acknowledgement for FY 2021-22Director GGINo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)chandrakala telangNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Rajat DubeyNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Dhar RakulNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Anandraj Sharadrao Pawar YedshiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)SaurabhLBondeNo ratings yet

- Form PDF 788420380311221Document6 pagesForm PDF 788420380311221VinuNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pradip kr BhattacharyaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)kalyangmailNo ratings yet

- Resham Kaur Form - PDF - 713453130311221Document6 pagesResham Kaur Form - PDF - 713453130311221navdeep kaurNo ratings yet

- Return Form - 692429350311221Document6 pagesReturn Form - 692429350311221Santhosh KumarNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pandian KNo ratings yet

- Form PDF 401621100220322Document6 pagesForm PDF 401621100220322Aravai BDONo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pavani MsrNo ratings yet

- INDIAN INCOME TAX RETURN FOR SALARY AND OTHER INCOMEDocument6 pagesINDIAN INCOME TAX RETURN FOR SALARY AND OTHER INCOMEGaurawNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Neethu SheelaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)CA Madhu Sudhan ReddyNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Sanjay SanNo ratings yet

- Acknowledgement Number 457810310271221 Indian Income Tax ReturnDocument6 pagesAcknowledgement Number 457810310271221 Indian Income Tax ReturnPankaj GuptaNo ratings yet

- Form PDF 500272630130921Document6 pagesForm PDF 500272630130921Technical Section- Sr.DEE/G/ASNNo ratings yet

- Indian Income Tax Return: Part A General InformationDocument8 pagesIndian Income Tax Return: Part A General InformationDevbrat BoseNo ratings yet

- ITR1 - Part 6 (Preview Before Submission)Document8 pagesITR1 - Part 6 (Preview Before Submission)gaurav gargNo ratings yet

- Form PDF 710115910211021Document6 pagesForm PDF 710115910211021manuNo ratings yet

- Form PDF 525484870281221Document6 pagesForm PDF 525484870281221potod29484No ratings yet

- INDIAN INCOME TAX RETURNDocument9 pagesINDIAN INCOME TAX RETURNDaniel DasNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document10 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Kiruthika nagarajanNo ratings yet

- Form PDF 779696090311221Document6 pagesForm PDF 779696090311221Sumit SainiNo ratings yet

- Indian Income Tax Return: Part A General InformationDocument8 pagesIndian Income Tax Return: Part A General Informationsushilprajapati10_77No ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 787227030061220 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 787227030061220 Assessment Year: 2020-21Hitesh VishalNo ratings yet

- Form PDF 253535800070821Document8 pagesForm PDF 253535800070821kotasrihariNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 187409060100121 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 187409060100121 Assessment Year: 2020-21MOHAN KORA GOVINDARAJULUNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 244195670070221 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 244195670070221 Assessment Year: 2020-21Simran Jeet SinghNo ratings yet

- INDIAN INCOME TAX RETURN FOR SALARY AND OTHER SOURCESDocument5 pagesINDIAN INCOME TAX RETURN FOR SALARY AND OTHER SOURCES2020MSM022 NilabjaSahaNo ratings yet

- Form PDF 278542640201221Document6 pagesForm PDF 278542640201221anandcemtradNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 371707780280620 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 371707780280620 Assessment Year: 2020-21Upen PalNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 524687300050920 Assessment Year: 2020-21asmit somNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21शुभम निकमNo ratings yet

- Acknowledgement Number 129564520091221 Indian Income Tax ReturnDocument6 pagesAcknowledgement Number 129564520091221 Indian Income Tax Returnshivam kumarNo ratings yet

- 21-22Document6 pages21-22quicklykissme1No ratings yet

- Rock Engineering-14Document10 pagesRock Engineering-14tanujaayerNo ratings yet

- RP 70 K 39 RFns QLZD UDocument2 pagesRP 70 K 39 RFns QLZD Ushivam raiNo ratings yet

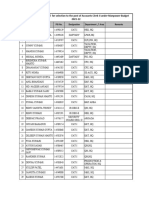

- List of Applicants Applied For Selection To The Post of Accounts Clerk-II Under Manpower Budget 2021-22Document17 pagesList of Applicants Applied For Selection To The Post of Accounts Clerk-II Under Manpower Budget 2021-22shivam raiNo ratings yet

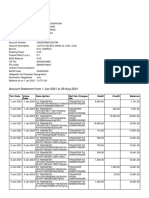

- Account Statement From 1 Jan 2021 To 29 Aug 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument14 pagesAccount Statement From 1 Jan 2021 To 29 Aug 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceshivam raiNo ratings yet

- Bike Insurance PDFDocument2 pagesBike Insurance PDFChaudharyShubhamSachan46% (85)

- LIABILITY ONLY POLICY - PRIVATE BIKEDocument1 pageLIABILITY ONLY POLICY - PRIVATE BIKERajesh chowdaryNo ratings yet

- MN 2022Document2 pagesMN 2022shivam raiNo ratings yet

- Mn:Mining Engineering: General InstructionsDocument15 pagesMn:Mining Engineering: General InstructionsSunilNo ratings yet

- B. Tech. (Mining, Semester III)Document1 pageB. Tech. (Mining, Semester III)shivam raiNo ratings yet

- Bike Insurance PDFDocument2 pagesBike Insurance PDFChaudharyShubhamSachan46% (85)

- SyllabusDocument1 pageSyllabusshivam raiNo ratings yet

- Mine Atmosphere Composition DetectionDocument8 pagesMine Atmosphere Composition Detectionshivam raiNo ratings yet

- Blasting Techniques in Surface MiningDocument11 pagesBlasting Techniques in Surface Miningshivam raiNo ratings yet

- Dealing With Underground FireDocument11 pagesDealing With Underground Fireshivam raiNo ratings yet

- The Institute of Chartered Accountants of India: Foundation Examination - December 2021Document1 pageThe Institute of Chartered Accountants of India: Foundation Examination - December 2021shivam raiNo ratings yet

- B.Tech Diploma Combined MIN - V - Factor of Safety.Document17 pagesB.Tech Diploma Combined MIN - V - Factor of Safety.shivam raiNo ratings yet

- Advancine Ventilation 12Document11 pagesAdvancine Ventilation 12shivam raiNo ratings yet

- Faculty Name - Prof. Satya Prakash Program - DIT IV (MIN) Batch - 2018-21 Course - Mine DevelopmentDocument11 pagesFaculty Name - Prof. Satya Prakash Program - DIT IV (MIN) Batch - 2018-21 Course - Mine Developmentshivam raiNo ratings yet

- Ent 1Document10 pagesEnt 1shivam raiNo ratings yet

- Short Listed AMI For GeMDocument17 pagesShort Listed AMI For GeMshivam raiNo ratings yet

- Numerical of MVDocument14 pagesNumerical of MVshivam raiNo ratings yet

- Surface mining dust control measuresDocument7 pagesSurface mining dust control measuresshivam raiNo ratings yet

- Faculty Name - Prof. Satya Prakash Program - B.Tech IV & DIT IV (MIN) Batch - 2018-22 & 2018-21 Course - Mine EnvironmentDocument10 pagesFaculty Name - Prof. Satya Prakash Program - B.Tech IV & DIT IV (MIN) Batch - 2018-22 & 2018-21 Course - Mine Environmentshivam raiNo ratings yet

- Short Listed AMI For GeMDocument17 pagesShort Listed AMI For GeMshivam raiNo ratings yet

- RonmentDocument18 pagesRonmentshivam raiNo ratings yet

- Mine Fan: Prof. Satya PrakashDocument19 pagesMine Fan: Prof. Satya Prakashshivam raiNo ratings yet

- Mine Environment Oxygen, Nitrogen and Carbon DioxideDocument12 pagesMine Environment Oxygen, Nitrogen and Carbon Dioxideshivam raiNo ratings yet

- Mine Environment Bullet PointsDocument4 pagesMine Environment Bullet Pointsshivam raiNo ratings yet

- Combined-2019-7-13.04.2020-Principle of Management Process PlanningDocument21 pagesCombined-2019-7-13.04.2020-Principle of Management Process Planningshivam raiNo ratings yet

- Monthly Remittance ReturnDocument1 pageMonthly Remittance ReturnAnalyn DomingoNo ratings yet

- Tax Reviewer - Train Law - Rates and ComputationsDocument5 pagesTax Reviewer - Train Law - Rates and ComputationsCelestiaNo ratings yet

- Dol Form Report (Erds)Document67 pagesDol Form Report (Erds)Latisha WalkerNo ratings yet

- TRUE OR FALSE (p.179,180)Document2 pagesTRUE OR FALSE (p.179,180)Aberin GalenzogaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)CA Madhu Sudhan ReddyNo ratings yet

- CA FINAL DT Amendment Book BY Durgesh SinghDocument115 pagesCA FINAL DT Amendment Book BY Durgesh SinghRaviteja GundabattulaNo ratings yet

- CGT OTQ2 - Day 2Document2 pagesCGT OTQ2 - Day 2HusseinNo ratings yet

- Estate Tax LECDocument6 pagesEstate Tax LECbobo kaNo ratings yet

- Dante Budi Caroko Agung's Depreciation Quiz AnswersDocument3 pagesDante Budi Caroko Agung's Depreciation Quiz Answersthoriq priNo ratings yet

- New Form 15G PDFDocument2 pagesNew Form 15G PDFSoma Sundar50% (2)

- IM3 Partnership Operations ProblemsDocument4 pagesIM3 Partnership Operations ProblemsXivaughn Sebastian0% (1)

- Pandemic DeadlinesDocument19 pagesPandemic DeadlinesChristine Joyce TaluaNo ratings yet

- Annex J - Notice To TaxpayerDocument2 pagesAnnex J - Notice To TaxpayerChris RodriguezNo ratings yet

- INCOME TAX PAYMENTDocument1 pageINCOME TAX PAYMENTSkjhkjhkjhNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Icai Study Material MCQS: Be Chargeable To TaxDocument19 pagesIcai Study Material MCQS: Be Chargeable To TaxMr. indigoNo ratings yet

- Act CPRDocument5 pagesAct CPRshahzad_financeNo ratings yet

- PT Hanson International Tbk 2015 Financial ReportDocument146 pagesPT Hanson International Tbk 2015 Financial ReportFirman HiremaxiNo ratings yet

- CVBU Spare Parts Distrubution FormDocument20 pagesCVBU Spare Parts Distrubution FormSBT ISBNo ratings yet

- Davao Eagle Commercial January Income StatementDocument6 pagesDavao Eagle Commercial January Income Statementablay logeneNo ratings yet

- TAX-Midterm ExamDocument9 pagesTAX-Midterm ExamShafni DulnuanNo ratings yet

- Income Tax 2nd PretestDocument3 pagesIncome Tax 2nd PretestEllaMay Delazerna0% (1)

- Final - Canton - Part 1 - Competitive AssessmentDocument15 pagesFinal - Canton - Part 1 - Competitive AssessmentAdam CuencaNo ratings yet

- Feb 22 GHM BillDocument12 pagesFeb 22 GHM Billmandali vivekamNo ratings yet

- Adjustment and TransactionsDocument6 pagesAdjustment and TransactionsEasin Mohammad RomanNo ratings yet

- Ukff3083 Financial Statement AnalysisDocument4 pagesUkff3083 Financial Statement AnalysisChong Jk100% (1)

- ATO ID 2002 - 319 Beverage Analyst - Purchase of Wine For TastingDocument4 pagesATO ID 2002 - 319 Beverage Analyst - Purchase of Wine For Tastingjo lamosNo ratings yet

- Format PT Galaxy Elektronik 2Document53 pagesFormat PT Galaxy Elektronik 2sabrina damayantiNo ratings yet

- Commissioner of Internal Revenue vs. Far East Bank & Trust Company (Now Bank of The Philippine Islands) G.R. No. 173854, March 15, 2010 FactsDocument3 pagesCommissioner of Internal Revenue vs. Far East Bank & Trust Company (Now Bank of The Philippine Islands) G.R. No. 173854, March 15, 2010 FactsBrent TorresNo ratings yet

- ACFrOgBWnU5pY1 VTEVkoQtR - 0Rkg7FFpY57K2UdGKU7ruDXN8xM4n5pZK92SR172nx70t 8HLnc1K qfD4D1ZRYRxx4qKKjZLotL9JqtUw1n7K2SPRAr3tnJHbVW56URi7mLk5wN6CatILDMwTDocument2 pagesACFrOgBWnU5pY1 VTEVkoQtR - 0Rkg7FFpY57K2UdGKU7ruDXN8xM4n5pZK92SR172nx70t 8HLnc1K qfD4D1ZRYRxx4qKKjZLotL9JqtUw1n7K2SPRAr3tnJHbVW56URi7mLk5wN6CatILDMwTmercyvienhoNo ratings yet