Professional Documents

Culture Documents

AckoPolicy-DBTR00434107494 00

Uploaded by

Syed's Way PoolOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AckoPolicy-DBTR00434107494 00

Uploaded by

Syed's Way PoolCopyright:

Available Formats

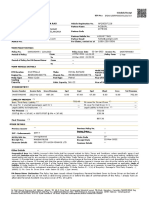

LIABILITY ONLY POLICY - PRIVATE BIKE

Certificate of Insurance cum Policy Schedule

POLICY DETAILS VEHICLE DETAILS

Insured Name: ABDUL KHUDDUS Registration Number: KA01HR7406

Pincode: 562125 Make/Model: TVS Jupiter (110CC)

23 Oct 21 (00:00 hrs) to 22 Oct 23 (23:59 Fuel type: petrol

Period of Insurance:

hrs)

Purchase Year: 2016

Policy Issuance Date: 20 Oct 21

Engine No: BG4FG1698207

Policy Number: DBTR00434107494/00

Chassis No: MD626BG48G1F02895

Owner Number: XXXXXX7070

Owner Email: aXXXXXXXXXX6@gmail.com

PREMIUM DETAILS (₹)

Liability Premium

Basic Third Party Liability ₹ 1504.0

Net Liability Premium ₹ 1504.00

IGST (18%) ₹ 271.0

Total Premium ₹ 1775.00

Geographical Area: India

Please Note: Previous Policy document is required in case of claim within 30 days of Acko Policy Start Date.

INTERMEDIARY DETAILS

Policy Issuing Office: Direct - Mumbai Intermediary Name: Direct

Phone Number: N/A Intermediary Code: N/A

Acko General Insurance Ltd.

Unit No. 301, 3rd Floor, E Wing, Lotus Corporate Park, Goregaon (E), Mumbai- 400063

Email: hello@acko.com | Helpline: 1800 266 2256 | www.acko.com For Acko General Insurance Ltd.

CIN : U66000MH2016PLC287385 | IRDAI Reg No. 157 | UIN: IRDAN157P0009V01201718 Duly Constituted Attorney

LIABILITY ONLY POLICY - PRIVATE BIKE

Certificate of Insurance cum Policy Schedule

Limitations As To Use: The Policy covers use of the vehicle for any purpose other than: a) Hire or Reward b) Carriage of goods (other than samples or personal luggage) c) Organized racing d)

Pace making e) Speed testing f) ReliabilityTrials g) Any purpose in connection with Motor Trade. Persons or Class of Persons entitled to drive: Any person including the insured, provided that a

person driving holds a valid driving license at the time of the accident and is not disqualified from holding or obtaining such a license. Provided also that the person holding a valid learner's license

may also drive the vehicle and that such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989. Limits of Liability. 1. Under Section II-1 (i) of the policy - Death of

or bodily injury - Such amount as is necessary to meet the requirements of the Motor Vehicles Act, 1988. 2. Under Section II - 1(ii) of the policy - Damage to Third Party Property - Rs. 100000 3. P.

A. Cover under Section III for Owner - Driver(CSI): Rs. 0.0. Terms, Conditions & Exclusions: As per the Indian Motor Tariff. A personal copy of the same is available free of cost on request & the

same is also available at our website.

I / We hereby certify that the policy to which the certificate relates as well as the certificate of insurance are issued in accordance with the provision of chapter X, XI of M. V.Act 1988. "The stamp

duty of Rs. 0.50 paid by electronic medium vide GRAS Deface no. 0001649200202122 dated 12/07/2021 as prescribed in Government Notification Revenue & Forest Department No. Mudrank -

2017/C.R.97/M-1, dated 09/01/2018. GSTN: 27AAOCA9055C1ZJ." IMPORTANT NOTICE: The Insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this

Schedule. Any payment made by the Company by reason of wider terms appearing in the Certificate in order to comply with the Motor Vehicle Act, 1988 is recoverable from the Insured. See the

clause headed "AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY" in the policy wordings. Disclaimer: The Policy shall be void from inception if the premium cheque is not realized. In

the event of misrepresentation, fraud or non-disclosure of material fact, the Company reserves the right to cancel the Policy. The policy is issued basis the information provided by you, which is

available with the company. In case of discrepancy/non recording of relevant information in the policy, the insured is requested to bring the same to the notice of the company within 15 days. This

Policy is to be read in conjunction with the Policy wordings (https://www.acko.com/download) available on the website of the Company. On renewal, the benefits provided under the policy and/or

terms and conditions of the policy including premium rate may be subject to change.

Prohibition of Rebated (Section 41) of the Insurance Act - 1938 (as amended)

1. No person shall allow or offer to allow, either directly or indirectly as an inducement to any person to take out or renew or continue and insurance in respect of any kind or risk relating to lives or

property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy

accept any rebate expect such rebate as may be allowed in accordance with the prospectus or tables of the Insurer.

2. Any person making default in complying with the provisions of this section shall be liable for a penalty which may extend to 10 lakh rupees.

Acko General Insurance Ltd.

Unit No. 301, 3rd Floor, E Wing, Lotus Corporate Park, Goregaon (E), Mumbai- 400063

Email: hello@acko.com | Helpline: 1800 266 2256 | www.acko.com For Acko General Insurance Ltd.

CIN : U66000MH2016PLC287385 | IRDAI Reg No. 157 | UIN: IRDAN157P0009V01201718 Duly Constituted Attorney

You might also like

- DL7CK7894 - Acko Insurance PolicyDocument1 pageDL7CK7894 - Acko Insurance PolicyTAUSEEF HASSANNo ratings yet

- Comprehensive Bike Insurance PolicyDocument2 pagesComprehensive Bike Insurance PolicyVijay KumarNo ratings yet

- Liability Only Policy - Private Car: Policy Details Vehicle DetailsDocument1 pageLiability Only Policy - Private Car: Policy Details Vehicle DetailsSmarttNo ratings yet

- Acko Group Travel TC AbhibusDocument25 pagesAcko Group Travel TC AbhibusSreekanthNo ratings yet

- Policy PDFDocument4 pagesPolicy PDFshubhamNo ratings yet

- Digit Two-Wheeler Package Policy: Go Digit General Insurance LTDDocument2 pagesDigit Two-Wheeler Package Policy: Go Digit General Insurance LTDDURAI RAJNo ratings yet

- Honda Civic Insurance (20-21) PDFDocument10 pagesHonda Civic Insurance (20-21) PDFGuru CharanNo ratings yet

- Digit Two-Wheeler Package Policy: Go Digit General Insurance LTDDocument2 pagesDigit Two-Wheeler Package Policy: Go Digit General Insurance LTDManoj KukrejaNo ratings yet

- PolicySoftCopy 128978270Document2 pagesPolicySoftCopy 128978270amit malikNo ratings yet

- Bale Ramu RemovedDocument7 pagesBale Ramu Removedsarath potnuriNo ratings yet

- AckoPolicy-DCCR00184233989 00Document5 pagesAckoPolicy-DCCR00184233989 00Prakash ThimmaiahNo ratings yet

- Og 20 3820 1803 00000045 PDFDocument5 pagesOg 20 3820 1803 00000045 PDFShaikh AsifNo ratings yet

- 17-11-2022 Policy DocDocument1 page17-11-2022 Policy DocOfficial Sumit SafeshopNo ratings yet

- AckoPolicy-DBCR00192340429 00Document1 pageAckoPolicy-DBCR00192340429 00Arumugam BagavathippanNo ratings yet

- Comprehensive Policy SummaryDocument6 pagesComprehensive Policy SummaryRajesh NatarajanNo ratings yet

- Bajaj Allianz General Insurance CompanyDocument4 pagesBajaj Allianz General Insurance Companysarath potnuriNo ratings yet

- Keshan Amar ChauhanDocument3 pagesKeshan Amar ChauhanTusharNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument5 pagesBajaj Allianz General Insurance Company LTDsarthakNo ratings yet

- AckoPolicy-DBCR00117227928 00Document1 pageAckoPolicy-DBCR00117227928 00Rahul SrivastavaNo ratings yet

- Confirmation of Your Two Wheeler Policy atDocument2 pagesConfirmation of Your Two Wheeler Policy atShiwam KumarNo ratings yet

- Comprehensive Two-Wheeler Policy DetailsDocument4 pagesComprehensive Two-Wheeler Policy DetailsSoftway GoaNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument11 pagesBajaj Allianz General Insurance Company LTDmahesh jhaNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument8 pagesBajaj Allianz General Insurance Company LTDrandhirrajputNo ratings yet

- Comprehensive Policy with ConsumablesDocument6 pagesComprehensive Policy with ConsumablesJeet TrivediNo ratings yet

- Digit Two-Wheeler Policy - Bundled: Go Digit General Insurance LTDDocument3 pagesDigit Two-Wheeler Policy - Bundled: Go Digit General Insurance LTDbharat bansalNo ratings yet

- Anurag SinghDocument2 pagesAnurag SinghSureshJaiswalNo ratings yet

- Comprehensive Bike Insurance CoverageDocument1 pageComprehensive Bike Insurance CoverageMrajyalakshmi RajyalskshmiNo ratings yet

- Bajaj Allianz General Insurance Company LTDDocument16 pagesBajaj Allianz General Insurance Company LTDAYUSH PRADHANNo ratings yet

- New India Private Car PolicyDocument2 pagesNew India Private Car PolicyvenkivlrNo ratings yet

- Co Mprehens Ive Po Licy Co Mprehens Ive Po Licy: Acko AdvantageDocument6 pagesCo Mprehens Ive Po Licy Co Mprehens Ive Po Licy: Acko AdvantageRajesh NatarajanNo ratings yet

- GjojDocument1 pageGjojSirish KumarNo ratings yet

- Insurance Copy Activa 1255 PDFDocument4 pagesInsurance Copy Activa 1255 PDFDivya SuvarnaNo ratings yet

- Policy ScheduleDocument1 pagePolicy ScheduleShankar Nath100% (1)

- Half Deck Open Goo KFZ: IRDAN158RP0001V01201819Document2 pagesHalf Deck Open Goo KFZ: IRDAN158RP0001V01201819Samrat NanguNooriNo ratings yet

- Go Digit Two-Wheeler Liability Only Policy ScheduleDocument2 pagesGo Digit Two-Wheeler Liability Only Policy Scheduleharshil gandhiNo ratings yet

- HDFC Two Wheeler PolicyDocument3 pagesHDFC Two Wheeler PolicybalaNo ratings yet

- Digit Two-Wheeler Package Policy: Go Digit General Insurance LTDDocument2 pagesDigit Two-Wheeler Package Policy: Go Digit General Insurance LTDपंडित धर्मैंद्र कुमार पाठकNo ratings yet

- Car Insurance 2019Document3 pagesCar Insurance 2019Bhavin GamiNo ratings yet

- SmartDrive Motor Insurance Policy SummaryDocument2 pagesSmartDrive Motor Insurance Policy Summarysunil dhanjuNo ratings yet

- AckoPolicy-DBCR00422614023 00Document1 pageAckoPolicy-DBCR00422614023 00PHP ProgrammingHubNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsSiddharth MohanNo ratings yet

- Ap-39-W-9404 RameshDocument3 pagesAp-39-W-9404 Rameshsarath potnuri100% (1)

- Acko Bike Policy - DBCR00137810413 - 00 PDFDocument1 pageAcko Bike Policy - DBCR00137810413 - 00 PDFYogesh SinghNo ratings yet

- United India Insurance Company LimitedDocument9 pagesUnited India Insurance Company LimitedMumtaj KhudbuddinNo ratings yet

- United PolicyDocument3 pagesUnited Policymuskan malhotraNo ratings yet

- Acko Bike Policy - DBTR00126261926 - 00Document1 pageAcko Bike Policy - DBTR00126261926 - 00harshith sbNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document3 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)sarath potnuriNo ratings yet

- Welcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Document3 pagesWelcome To Aditya Birla Insurance Brokers Limited, A Subsidiary of Aditya Birla Capital Limited!Vaibhav SinghalNo ratings yet

- Your Vehicle Details: Additional CoverDocument1 pageYour Vehicle Details: Additional CoverchetanNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- The Oriental Insurance Company LimitedDocument3 pagesThe Oriental Insurance Company LimitedDibya DillipNo ratings yet

- Ap28dd7228 Krishna HydDocument2 pagesAp28dd7228 Krishna Hydsarath potnuriNo ratings yet

- Go Digit General Insurance LTD.: IRDAN158RP0003V01201718Document2 pagesGo Digit General Insurance LTD.: IRDAN158RP0003V01201718sarath potnuriNo ratings yet

- Smart Drive Two Wheeler Insurance Policy DetailsDocument1 pageSmart Drive Two Wheeler Insurance Policy Detailshaja immranNo ratings yet

- Sub:Risk Assumption Letter: Insured Vehicles DetailsDocument4 pagesSub:Risk Assumption Letter: Insured Vehicles Detailssumant samuelNo ratings yet

- Policy Copy (5) - UnlockedDocument6 pagesPolicy Copy (5) - UnlockedVignesh PNo ratings yet

- 0 ResearchDocument1 page0 ResearchnarendraNo ratings yet

- Activa NBike InsuranceDocument2 pagesActiva NBike InsuranceVeni PriyaNo ratings yet

- AckoPolicy-DBTR00719701851 00Document2 pagesAckoPolicy-DBTR00719701851 00vasanthkumar.santhu2No ratings yet

- 2023 Bike - Insurance 1Document2 pages2023 Bike - Insurance 1romyphd14No ratings yet

- TicketDocument3 pagesTicketsandeep uttaralaNo ratings yet

- Letter of AppointmentDocument4 pagesLetter of Appointmentrahultanwar2022100% (2)

- Electronic Reservation Slip IRCTC E-Ticketing Service (Agent)Document3 pagesElectronic Reservation Slip IRCTC E-Ticketing Service (Agent)Rock fire memesNo ratings yet

- Electronic Reservation Slip IRCTC E-Ticketing Service (Agent)Document3 pagesElectronic Reservation Slip IRCTC E-Ticketing Service (Agent)Rock fire memesNo ratings yet

- KSEI License CardDocument2 pagesKSEI License CardSyed's Way Pool67% (3)

- TicketDocument3 pagesTicketsandeep uttaralaNo ratings yet

- TicketDocument3 pagesTicketsandeep uttaralaNo ratings yet

- IRCTC e-ticket details for travel from HOWRAH JN to YESVANTPUR JNDocument1 pageIRCTC e-ticket details for travel from HOWRAH JN to YESVANTPUR JNSyed's Way PoolNo ratings yet

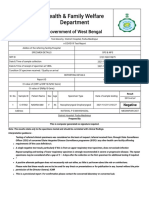

- Health & Family Welfare Department: Government of West BengalDocument2 pagesHealth & Family Welfare Department: Government of West BengalSyed's Way PoolNo ratings yet

- Claim IntimationDocument2 pagesClaim IntimationSyed's Way PoolNo ratings yet

- Visit Id: R7790499Document1 pageVisit Id: R7790499Syed's Way PoolNo ratings yet

- Provisional Certificate For COVID-19 Vaccination - 1 Dose: Beneficiary DetailsDocument1 pageProvisional Certificate For COVID-19 Vaccination - 1 Dose: Beneficiary DetailsSyed's Way PoolNo ratings yet

- FOS000306442854Document1 pageFOS000306442854Syed's Way PoolNo ratings yet

- Raja LeeterDocument3 pagesRaja LeeterSyed's Way PoolNo ratings yet

- Covid-19 Test Report: Paent InformaonDocument1 pageCovid-19 Test Report: Paent InformaonSyed's Way PoolNo ratings yet

- Raja LeeterDocument3 pagesRaja LeeterSyed's Way PoolNo ratings yet

- Covid-19 Test Report: Paent InformaonDocument1 pageCovid-19 Test Report: Paent InformaonSyed's Way PoolNo ratings yet

- SYNERGY Fake Job Offer LetterDocument5 pagesSYNERGY Fake Job Offer LetterSyed's Way PoolNo ratings yet

- AckoPolicy-DBTR00434107494 00Document2 pagesAckoPolicy-DBTR00434107494 00Syed's Way PoolNo ratings yet

- Covid-19 Test Report: Paent InformaonDocument1 pageCovid-19 Test Report: Paent InformaonSyed's Way PoolNo ratings yet

- Industrial DesignDocument11 pagesIndustrial Designridhimaamit100% (2)

- Commercial Transactions 2020Document73 pagesCommercial Transactions 2020Elizabeth ChilufyaNo ratings yet

- This Study Resource Was: I. Situational Analysis & QuestionsDocument2 pagesThis Study Resource Was: I. Situational Analysis & QuestionsElad BreitnerNo ratings yet

- Deed of AssignmentDocument3 pagesDeed of AssignmenthellojdeyNo ratings yet

- MInor To ContractsDocument28 pagesMInor To ContractsDakshita DubeyNo ratings yet

- Agent Commission Agreement - Gil TuplanoDocument3 pagesAgent Commission Agreement - Gil TuplanoBobby BilloteNo ratings yet

- CACI Jury Instruction 3712Document1 pageCACI Jury Instruction 3712bpr123No ratings yet

- Annual investment policy statementDocument13 pagesAnnual investment policy statementLow Kim HoeNo ratings yet

- Theoretical and Regulatory Framework of LeasingDocument24 pagesTheoretical and Regulatory Framework of Leasingamitsingla19100% (1)

- Watsco Employee Form - NikolasDocument5 pagesWatsco Employee Form - NikolasNikolas GonçalvesNo ratings yet

- Hire Purchase Law RevisedDocument46 pagesHire Purchase Law RevisedBilliee ButccherNo ratings yet

- Catotocan vs. Lourdes School of Quezon City Et Al.Document2 pagesCatotocan vs. Lourdes School of Quezon City Et Al.Nej AdunayNo ratings yet

- Vesting ClauseDocument4 pagesVesting ClauseChris ChanNo ratings yet

- Agency AgreementDocument3 pagesAgency AgreementLegal Forms100% (2)

- Certificate of Insurance SummaryDocument5 pagesCertificate of Insurance SummaryDevanshu GoswamiNo ratings yet

- Fillable Node Form - 2020Document4 pagesFillable Node Form - 2020Sunshine ComputersNo ratings yet

- Unit 2 Business Organisations: 3.enterprise 4. Business Concern 5. Commerce 6. Business VentureDocument15 pagesUnit 2 Business Organisations: 3.enterprise 4. Business Concern 5. Commerce 6. Business VentureCristina DeluNo ratings yet

- LIC Society Resale NOCDocument4 pagesLIC Society Resale NOCPrakash MhadeshwarNo ratings yet

- 825 SylDocument4 pages825 SylMohamed ArafaNo ratings yet

- Insurance Claim Filing DeadlineDocument2 pagesInsurance Claim Filing Deadlineshookt panboiNo ratings yet

- Lalican VS Insular LifeDocument7 pagesLalican VS Insular LifeKeanu RibsNo ratings yet

- Allied Banking Corporation vs. Equitable PCI Bank ruling on rehabilitation court powersDocument2 pagesAllied Banking Corporation vs. Equitable PCI Bank ruling on rehabilitation court powersFrancis Coronel Jr.0% (1)

- Non Exclusive Listing Joint Venture AgreementDocument2 pagesNon Exclusive Listing Joint Venture AgreementagustianNo ratings yet

- Bail Bondsman Wayne David Collins Sued For The 7th TimeDocument84 pagesBail Bondsman Wayne David Collins Sued For The 7th Timestephen6dibertNo ratings yet

- Agreement Between Carrier and ShipperDocument4 pagesAgreement Between Carrier and ShipperMuhamad AziziNo ratings yet

- Court Case Over Breach of ContractDocument4 pagesCourt Case Over Breach of ContractJhanvi singhNo ratings yet

- Judicial and Extra Judicial Foreclosure of MortgageDocument11 pagesJudicial and Extra Judicial Foreclosure of Mortgagekatrinaelauria5815100% (2)

- Ncnda BDG DiamondDocument6 pagesNcnda BDG DiamondPenny100% (1)

- Digest Author: Amber GagajenaDocument2 pagesDigest Author: Amber GagajenapeniaaaaNo ratings yet

- Formation of the contract - the offer chapterDocument14 pagesFormation of the contract - the offer chaptermariam raafatNo ratings yet