Professional Documents

Culture Documents

Banking System Takes Part An Important Place in A Nation

Uploaded by

Niaz AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking System Takes Part An Important Place in A Nation

Uploaded by

Niaz AhmedCopyright:

Available Formats

Banking system takes part an important place in a nation’s economy because of its intermediary role, it

ensures apportionment and relocation of resources and keeps up the motivation of economic activities.

It plays a central economic development of a country and from the core at the money market in any

country. In a developing country like Bangladesh the banking system as a whole has an important role

play in the progress of the economic development. The necessity of SME loan activities cannot be

ignored in any ways because of its dependency in the banking sector. It can be considered as the

important part of any bank as it shows the banking operations. It provides the opportunity to growth of

banking profit and also develops its clients needed. So, SME loan plays a significant role at banking

sector. I strongly believe that any business cannot grow in higher position without helping of credit

facilities. In this report I have tried my best to provide almost all of the basic idea of SME financing of

UBL. 1.2 Research Aim The aim of this research is to find out the procedure and profit by using SME loan

of UBL and also find out what type of problem face by customers of UBL at banijya branch. 1.3

Background of the Problem : Loan section is very important for any bank. Although the performance of

SME Loan section of UBL is good, however still some problems and the customers are facing these

problems while taking SME loan service from UBL, Uttara branch. So to find out the actual problems and

to give some suggestions. 1.4 Problem Statement : Performance of the SME facilities that are provided

and the problems faced by the customers at Uttara Bank Limited Banijya Branch. 3 1.5 Objective of the

report: The report emphasizes on two types of objectives which are given below. 1. Broad Objective 2.

Specific Objective 1.5.1 Broad objectives: The main objective of the study is to evaluate the SME loan

activities of Uttara Bank LTD at Banijya Branch. 1.5.2 Specific objectives: The specific objective of this

reports are: To evaluate the loan appraisal and recovery process of SME loan. To know the

enterprise selection criteria to provide SME loan. To know the term and conditions of SME loan. To

know the financial output from SME loan of UBL. 1.6 Scope of the Report : Uttara Bank Limited, one of

the oldest private commercial banks, a commitment to Quality and excellence in service is the property

of their identity. There is a gap between the theoretical knowledge and practical knowledge. Our

internship program has been launched mainly to bridge the gap.The scope of the study covers the

organizational overview and structure, background, objectives, capital and reserves, basic functions,

investment and performance analysis of the bank .This report is the outcome of the study on SME

Financing of Uttara Bank Limited. The study has covered a curtail idea on UBL, taking proposal of SME

loan, analysing credit and performing activities for sanctioning loan by SME department of UBL. This will

eventually refer that how the bank help customers securing their cash and assets, getting credit facility,

repaying loan amount and bank’s regulatory compliance, lending policy etc. 4 1. 7 Limitations of the

Report: On the way of my study, I have faced the following problems that may be termed as the

limitation or shortcoming of the study. The main limitations encountered in producing this report are:

Time, space and security constraints Some clients feel hesitate to give opinion Authority did not disclose

much information Relevant papers and documents were not available. Not possible to collect data &

information from all the branches The information of Uttara Bank Ltd. was not found in a structured way

You might also like

- Media Planning - Definitions The Definition of Media Planning Given by Some Philosophers AreDocument5 pagesMedia Planning - Definitions The Definition of Media Planning Given by Some Philosophers AreNiaz AhmedNo ratings yet

- Mission BkashDocument1 pageMission BkashNiaz AhmedNo ratings yet

- Factor # 10. Media FrequencyDocument5 pagesFactor # 10. Media FrequencyNiaz AhmedNo ratings yet

- Introduction To Managerial AccDocument6 pagesIntroduction To Managerial AccNiaz AhmedNo ratings yet

- Southeast University: Course Code: ACT5113/ACT513 Semester: Summer 2021 Section: 1Document4 pagesSoutheast University: Course Code: ACT5113/ACT513 Semester: Summer 2021 Section: 1Niaz AhmedNo ratings yet

- What Is Strategic ManagementDocument3 pagesWhat Is Strategic ManagementNiaz AhmedNo ratings yet

- High Low Method EDITEDDocument9 pagesHigh Low Method EDITEDNiaz AhmedNo ratings yet

- Define Different Types of Market Risk and Idiosyncratic Risk With Examples in The Context of Bangladeshi Firms To Operate A BusinessDocument43 pagesDefine Different Types of Market Risk and Idiosyncratic Risk With Examples in The Context of Bangladeshi Firms To Operate A BusinessNiaz Ahmed100% (1)

- The Company Selected Is Unilever and The Brand Selected Is KnorrDocument8 pagesThe Company Selected Is Unilever and The Brand Selected Is KnorrNiaz AhmedNo ratings yet

- GRPs For TV Are Calculated Generally For A Week or A MonthDocument10 pagesGRPs For TV Are Calculated Generally For A Week or A MonthNiaz AhmedNo ratings yet

- Southeast University: Assignment OnDocument4 pagesSoutheast University: Assignment OnNiaz AhmedNo ratings yet

- Media Planning Is The Series of Decisions Involved in Delivering The PromoDocument13 pagesMedia Planning Is The Series of Decisions Involved in Delivering The PromoNiaz AhmedNo ratings yet

- Answer To The Question NoDocument6 pagesAnswer To The Question NoNiaz AhmedNo ratings yet

- HRM Assignment - Midterm (Fall 20)Document4 pagesHRM Assignment - Midterm (Fall 20)Niaz AhmedNo ratings yet

- Objective: Curriculum Vitae Md. Motaher Hossain Contact & DetailsDocument2 pagesObjective: Curriculum Vitae Md. Motaher Hossain Contact & DetailsNiaz AhmedNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- As Level Accounting Notes.Document75 pagesAs Level Accounting Notes.SameerNo ratings yet

- Cycle Test Ii AnswerDocument46 pagesCycle Test Ii Answersumitha ganesanNo ratings yet

- IDFC FIRST Bank Limited Sixth Annual Report FY 2019 20Document273 pagesIDFC FIRST Bank Limited Sixth Annual Report FY 2019 20Nihal YnNo ratings yet

- 10 1Document7 pages10 1Maxene YbañezNo ratings yet

- Select A Company Listed On An InternationallyDocument4 pagesSelect A Company Listed On An InternationallyTalha chNo ratings yet

- Financial StatementsDocument23 pagesFinancial StatementsShin Shan JeonNo ratings yet

- Instructions:: Assignmnet 2 - Chapter 7 (Petty Cash & Bank Reconciliation)Document5 pagesInstructions:: Assignmnet 2 - Chapter 7 (Petty Cash & Bank Reconciliation)Success LibraryNo ratings yet

- Act130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Document15 pagesAct130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Nhel AlvaroNo ratings yet

- Chap. 8. The Search For Entrepreneurial Ventures NewDocument39 pagesChap. 8. The Search For Entrepreneurial Ventures NewAudrey CoronadoNo ratings yet

- Documents Required For Registration As Type I - NBFC-NDDocument3 pagesDocuments Required For Registration As Type I - NBFC-NDvignesh ACSNo ratings yet

- Sample Buyer Presentation - 2Document13 pagesSample Buyer Presentation - 2mauricio0327No ratings yet

- Bonds: Formulas & ExamplesDocument12 pagesBonds: Formulas & ExamplesAayush sunejaNo ratings yet

- Cara Menghitung Ex-Factory Price (Contoh Soal)Document2 pagesCara Menghitung Ex-Factory Price (Contoh Soal)Gilang ArafatNo ratings yet

- 362 End Term FRA SecDDocument5 pages362 End Term FRA SecDkhushali goharNo ratings yet

- Re: Notice of Dishonor of Checks: 29 April 2017 Ms. Maria Clara 22 Fatima ST, Barangay Plainview, Mandaluyong CityDocument2 pagesRe: Notice of Dishonor of Checks: 29 April 2017 Ms. Maria Clara 22 Fatima ST, Barangay Plainview, Mandaluyong CitykookNo ratings yet

- Nagindas Khandwala CollegeDocument50 pagesNagindas Khandwala CollegeRitika_swift13No ratings yet

- CSEC POA June 2014 P1 PDFDocument12 pagesCSEC POA June 2014 P1 PDFjunior subhanNo ratings yet

- 5.3 Income StatementDocument4 pages5.3 Income StatementHiNo ratings yet

- Company Profile HDFC BankDocument7 pagesCompany Profile HDFC Bankdominic wurdaNo ratings yet

- Lecture 3 Part 1 - Adjusting The AccountsDocument55 pagesLecture 3 Part 1 - Adjusting The AccountsIsyraf Hatim Mohd TamizamNo ratings yet

- Boe FS 2019Document169 pagesBoe FS 2019Qorxmaz AydınlıNo ratings yet

- Broker:: Hero Insurance Broking India Pvt. LTDDocument1 pageBroker:: Hero Insurance Broking India Pvt. LTDAakash MotorsNo ratings yet

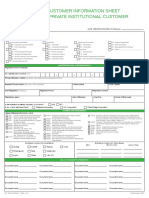

- Landbank Customer Information Sheet CorporationDocument6 pagesLandbank Customer Information Sheet CorporationMayNo ratings yet

- Moc 2Document13 pagesMoc 2pryaparagNo ratings yet

- Peer-Review Assessment Course 1aDocument5 pagesPeer-Review Assessment Course 1aSamael LightbringerNo ratings yet

- Solution - Problems 1-8 Cash and Cash EquivalentsDocument3 pagesSolution - Problems 1-8 Cash and Cash Equivalentsanon_965241988No ratings yet

- AF205 Assignment 2 - Navneet Nischal Chand - S11157889Document3 pagesAF205 Assignment 2 - Navneet Nischal Chand - S11157889Shayal ChandNo ratings yet

- Akowonjo TC BillDocument2 pagesAkowonjo TC BillJadesola AdeoyeNo ratings yet

- Business Combinations : Ifrs 3Document45 pagesBusiness Combinations : Ifrs 3alemayehu100% (1)

- 2023-10-28 Sub Prime Mortgage Crisis V0.02amDocument13 pages2023-10-28 Sub Prime Mortgage Crisis V0.02amb23036No ratings yet