Professional Documents

Culture Documents

P

Uploaded by

Devesh Kumar0 ratings0% found this document useful (0 votes)

6 views6 pagesOriginal Title

291105870-P

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views6 pagesP

Uploaded by

Devesh KumarCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 6

Case Analysis: Apollo Health and Lifestyle Limited: Retail

Franchising in the

Healthcare Industry

Case Analysis 1: Dr. Piyush Sinha

This case deals with the concepts and issues that the franchisees

are facing. The

main difference between the franchisee and dealership lies in focus

of process

against product. The first issue of decision of entry in a

franchisee is

characterized by the thumb rule of 2 + 3. In the

beginning, the company must run

2 of the outlets on its own before franchising 3 of

its new outlets to demonstrate

a good quality service delivery. Another issue comes when we

determine the

market potential and size. However, there are so many potholes

when it comes

to estimate potential using classical methods. The unprecedented

growth rate of

Indian market as well as level of detailed information

available for trading areas

is always miscalculated. Several attitudinal, both affective

and cognitive, factors

create a gap between intention and actual purchase. It

is commonly perceived

that in highly potent markets, companies tend to take a

leap based on only

demographic information and ignore the lifestyle and attitudinal

factors. Issue

that the company will sustain or not in the long run can

be sorted out with timely

and consistent deliveries of the promises made in the clinics.

After market

estimation, it needs to have the proper resources, processes and

systems for

harnessing the potential. In the case study, Apollo doesn’t

have finance related

issues, but the knowledge of running a hospital maybe tricky

in running a clinic

as the target customer base is entirely different. In such

a case, Apollo should

understand that franchising is a bottom up business and macro

strategy may not

work here. They should rather focus on clinic per clinic

operations and

determine customer value-based market segments and then devise

delivery

mechanism accordingly.

Case Analysis 2: R C Natarajan

Mr Natarajan analyses the case on the basis of feasibility of

Apollo’s foray into

the primary and preventive healthcare. As Apollo is a chain

of super specialty

hospitals, the cost of expansion is quite high. There is a need

in the country for

more outlets for primary and preventive healthcare, which will

enhance the life

expectancy as well as lessen the burden off the tertiary

healthcare sector. This

will also enhance the brand image of Apollo and make it the

first choice in the

secondary and tertiary sectors. Although there will be a little

cannibalization of

OPD patients of Apollo hospitals, other players wont match with

AHLL due to its

economies of scale and economics of scope, in the long run.

The growth model is

AHLL is through the increased volumes (customers), rather

than increased

margins and thus it is getting difficult for it to

breakeven early. The gestation

period of 4 years is huge for a franchisee. It has to

assume its initial losses as

investment for popularizing AHLL in the local market and keep

its focus on longterm returns. Two more aspects affection

the franchisee agreement is the initial

license fee and the royalty. The license fee of Rs 20

lakh seems to be on a much

higher side while the royalty of 55 irrespective of the

profitability of the firm

seems to spoil the relationship. The technical support by visits

of doctors from

Apollo Hospitals seems more of a monitoring work rather than

a support in

functioning. On a similar note, the marketing communication

front is equally

non-effective so far. AHLL strives to position itself as

a one stop value-for-money

primary healthcare facility. But, both its core ad campaigns, “Life

must be good”

and “And you thought we’re expensive” fail to enhance the core

message of the

company and seem pretty ordinary amidst the plethora of

advertisements of

lifestyle products. Right now, a number of things need to

be modified. The initial

license fee should be reduced to Rs 10 lakh and the

royalty should be pegged to

PBT and not to the gross income, and it should be in

the range of 20-30 per cent.

It should also depute their doctors to the clinics for

timely checkup.

Case Analysis 3: M N Tripathy

Here, the problem is of misinterpretation of the meaning of

the word

“franchisee”, which led to a executable business idea failing

miserably. Those

disappointment of the franchisee plan stems starting with the center

Comprehension from claiming ‘branding’ Also ‘brand quality. ’

Some place An

befuddle about desires between AHLL and the franchisees over upon

what

amount of the brand is worth will be irritating the cost-benefit

mathematical

statement to both of them. AHLL clearly supposes that those Apollo

facility mark

may be worth Rs 20 lakh Similarly as An one-time authorizing

expense and

acknowledges the 5 % charge ahead income Likewise an

twelve-month fee,

payable quarterly, Similarly as reasonable. The franchisees hope that

the Apollo

brand name might naturally get those patients in Furthermore they might

have

the capacity with run a profitable operation good from the begin.

Unfortunately,

in the administration industry, a greater amount along these

lines in the social

insurance industry, it may be not enough should need a

highest point class

product; it must a chance to be dependably supported by

a highest point

population administration. A more sensible picture could be given

with

somewhat more preservationist evaluations of revenue and a

projection of a

misfortune for the initial two years before benefits are made.

This would temper

down the desires of the franchisee and maybe additionally

diminish the quantity

of utilizations for establishments, with concomitant sparing of

time for shortposting the imminent candidates. Therefore, some

transforms require with be

constructed. Secure another mark to those ‘Apollo Clinic,’

disassociating itself

starting with those Apollo lineage, yet maintaining the aggregation

character

furthermore its proposition should be An ‘value’ mark for

yearning white collar

class clients.

Case Analysis 4: Narsimhan Rajkumar

Mr Rajkumar asserts that service management entails three

intricately linked

issues: service operations management; service marketing management,

and

service provider management. The core of all these issues is

the heterogeneity

which means both the employees and the customers are involved in

the service

quality. On one hand, variability in the service will lead to

high customer

satisfaction, on the other hand this will brand the franchisee in

its own unique

way making it somewhat bigger than the brand itself. The

problem Apollo faces

is in giving a different brand image to both Apollo

Hospitals and AHLL. Any

service can be seen on two parameters—Divergence (the amount

of freedom

allowed to the service provider) and Complexity (the number

of predefined steps

taken to provide the service). Therefore, one way to resolve

its current issues

would be to reduce the number of fronts it is

focusing on like consultancy. One

more would be to invest heavily in IT infrastructure, which

would help the

providing value to patients as well as in process

standardarisation.

Case Analysis 5: Sanal Kumar Velayudhan

The revenue from royalty for AHLL is 48 per cent of the

projected revenue of Rs

7.89 crore. As royalty paid is a fixed percentage of

franchisee revenue, the

revenue of the franchisee also diminishes and so do the

interest level of existing

franchisees and the willingness to invest by businessmen. Thus,

educating

customers is necessary for these franchisees to make more profit.

Communication should rely on somewhat paid advertising also, apart

from the

word of mouth publicity. The reach in tier 2 and 3 cities

and towns should be

increased leveraging the franchisee model. Personal selling effort

is required

particularly in the initial stage. AHLL needs to put

resources into brand building

for picking up con-fidence of the franchisees. The franchisee

on build up ing the

business has faithful clients fulfilled by the nature of

administration. He might

then understand that the franchisor is not giving quality to

the eminence paid on

a repeat ring premise.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Battle of MegiddoDocument102 pagesThe Battle of MegiddoyskndrNo ratings yet

- Djinn The WishmastersDocument5 pagesDjinn The WishmastersPreston HalcombNo ratings yet

- TMC451 Sample - Skema JWPDocument2 pagesTMC451 Sample - Skema JWPraihana abdulkarimNo ratings yet

- Muscles of Facial ExpressionDocument93 pagesMuscles of Facial Expressionsiddu76100% (2)

- Harry Potter and The Sorceror's StoneDocument17 pagesHarry Potter and The Sorceror's StoneParth Tiwari50% (4)

- Rochelle L. Villegas, RMTDocument2 pagesRochelle L. Villegas, RMTJigsaw PHNo ratings yet

- Labyrinth Weir DesignDocument15 pagesLabyrinth Weir Designchutton681No ratings yet

- Post Graduate Diploma in Guidance and Counselling (PGDGC)Document11 pagesPost Graduate Diploma in Guidance and Counselling (PGDGC)Devesh KumarNo ratings yet

- Diploma in Early Childhood Care and Education (DECCE)Document2 pagesDiploma in Early Childhood Care and Education (DECCE)Devesh KumarNo ratings yet

- Cdoe Deposited Fee For Admission BAG2021Document18 pagesCdoe Deposited Fee For Admission BAG2021Devesh KumarNo ratings yet

- Final Reallocation of LLB Centre Unreserved and MRC With Note Revised On TopDocument24 pagesFinal Reallocation of LLB Centre Unreserved and MRC With Note Revised On TopDevesh KumarNo ratings yet

- Guest Faculty For UploadingDocument4 pagesGuest Faculty For UploadingDevesh KumarNo ratings yet

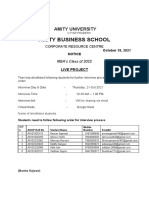

- Amity University: After Filling The Enrollment Form Kindly Submit To The Student CoordinatorDocument1 pageAmity University: After Filling The Enrollment Form Kindly Submit To The Student CoordinatorDevesh KumarNo ratings yet

- Documents 4609ekantarDocument3 pagesDocuments 4609ekantarDevesh KumarNo ratings yet

- TOWS Analysis of Bharti AirtelDocument3 pagesTOWS Analysis of Bharti AirtelDevesh KumarNo ratings yet

- Q3 Porter 5 ForcesDocument6 pagesQ3 Porter 5 ForcesDevesh KumarNo ratings yet

- Documents 90dddtitanDocument1 pageDocuments 90dddtitanDevesh KumarNo ratings yet

- Adaptive Teaching Guide TemplateDocument11 pagesAdaptive Teaching Guide TemplateAni Pearl PanganibanNo ratings yet

- Exhibit 7 - WJM To ADA Kwasnik Re Smigel-SignedDocument4 pagesExhibit 7 - WJM To ADA Kwasnik Re Smigel-SignedAnonymous LzKfNS48tNo ratings yet

- The Parable of The Mangrove Man PoemDocument6 pagesThe Parable of The Mangrove Man PoemS MNo ratings yet

- AnnotatbibDocument13 pagesAnnotatbibapi-498292476No ratings yet

- 10th STD Smart English 2021-22 EditionDocument46 pages10th STD Smart English 2021-22 EditionSecure Chennai100% (1)

- 2G Feature ListDocument135 pages2G Feature ListPraveen DubeyNo ratings yet

- Law437 Basic Features All PrintedDocument121 pagesLaw437 Basic Features All PrintedcfgqymsqdhNo ratings yet

- SFN Expanding The Genetic Causes of Small Fiber Neuropathy SCN Genes and BeyondDocument13 pagesSFN Expanding The Genetic Causes of Small Fiber Neuropathy SCN Genes and BeyondOTTO VEGA VEGANo ratings yet

- Spirit of The Century Spirit of The Fantastic Character SheetDocument2 pagesSpirit of The Century Spirit of The Fantastic Character SheetTrixyblueeyesNo ratings yet

- M1 Questions REV SP23Document2 pagesM1 Questions REV SP23Melia MorrisNo ratings yet

- Chichewa Kalata Ndi Chimangirizo 1Document15 pagesChichewa Kalata Ndi Chimangirizo 1dysonjonas269No ratings yet

- Assignment 1Document23 pagesAssignment 1Nguyen Tien Phat (K15 HCM)No ratings yet

- Factors of Individual Behavior in An Organization and Its Performance at WorkDocument6 pagesFactors of Individual Behavior in An Organization and Its Performance at WorkImpact JournalsNo ratings yet

- CinderellaDocument6 pagesCinderellaainiNo ratings yet

- Feeding Power To Arduino - The Ultimate GuideDocument24 pagesFeeding Power To Arduino - The Ultimate GuideMUSTAFANo ratings yet

- 261 - TQB - Test HK2-11Document3 pages261 - TQB - Test HK2-11An LêNo ratings yet

- NP and Computational Intractability: Slides by Kevin Wayne. All Rights ReservedDocument52 pagesNP and Computational Intractability: Slides by Kevin Wayne. All Rights ReservedpreethiNo ratings yet

- Nin/Pmjay Id Name of The Vaccination Site Category Type District BlockDocument2 pagesNin/Pmjay Id Name of The Vaccination Site Category Type District BlockNikunja PadhanNo ratings yet

- LibreView Guide - Italian PaperDocument12 pagesLibreView Guide - Italian PaperJesus MuñozNo ratings yet

- A Glimpse Into The Past Assess RubricDocument3 pagesA Glimpse Into The Past Assess RubricReagan SmithNo ratings yet

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentOrigamiGalati BrailaNo ratings yet

- Soc6 - Advanced Social TheoryDocument10 pagesSoc6 - Advanced Social Theoryrabarber1900No ratings yet

- MQB 09 WS 2Document4 pagesMQB 09 WS 2Nasmer BembiNo ratings yet