Professional Documents

Culture Documents

Submitted By: Poushali Rudra MAKAUT Roll: 13600920044 Sec - A MBA - 24

Uploaded by

Poushali Rudra0 ratings0% found this document useful (0 votes)

11 views3 pagesThis document contains a student's answers to three questions regarding cost accounting calculations. For the first question, the student calculates prime cost by taking the opening stock of raw materials, purchases of raw materials, expenses on raw materials, closing stock of raw materials, direct wages, and direct expenses. For the second question, the student computes factory cost by taking into account raw materials consumed, direct wages, direct expenses, factory expenses, and opening and closing stocks of work in progress. For the third question, the student prepares a cost sheet showing calculations for raw materials used, prime cost, factory overhead, production cost, cost of goods sold, selling expenses, total cost, profit, and sales.

Original Description:

Assignment

Original Title

Assignment 2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a student's answers to three questions regarding cost accounting calculations. For the first question, the student calculates prime cost by taking the opening stock of raw materials, purchases of raw materials, expenses on raw materials, closing stock of raw materials, direct wages, and direct expenses. For the second question, the student computes factory cost by taking into account raw materials consumed, direct wages, direct expenses, factory expenses, and opening and closing stocks of work in progress. For the third question, the student prepares a cost sheet showing calculations for raw materials used, prime cost, factory overhead, production cost, cost of goods sold, selling expenses, total cost, profit, and sales.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views3 pagesSubmitted By: Poushali Rudra MAKAUT Roll: 13600920044 Sec - A MBA - 24

Uploaded by

Poushali RudraThis document contains a student's answers to three questions regarding cost accounting calculations. For the first question, the student calculates prime cost by taking the opening stock of raw materials, purchases of raw materials, expenses on raw materials, closing stock of raw materials, direct wages, and direct expenses. For the second question, the student computes factory cost by taking into account raw materials consumed, direct wages, direct expenses, factory expenses, and opening and closing stocks of work in progress. For the third question, the student prepares a cost sheet showing calculations for raw materials used, prime cost, factory overhead, production cost, cost of goods sold, selling expenses, total cost, profit, and sales.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

MB 202

Unit 3: Class Assignment-2

Submitted By: Poushali Rudra

MAKAUT Roll: 13600920044

Sec – A; MBA - 24

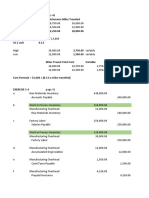

Q1: Calculate prime cost from the following information:-

Opening stock of raw material = INR 2,50,000

Purchased raw material = INR 15,00,000

Expenses incurred on raw material = INR 1,00,000

Closing stock of raw material = INR 4,50,000

Wages = INR 9,52,000

Direct expenses = INR 4,68,000

Ans.

PARTICULARS AMOUNT (INR)

Opening Stock of RM 2,50,000

(+) Purchase of RM 15,00,000

(+) Expenses on RM 1,00,000

(-) Closing Stock of RM (4,50,000)

Raw Materials Consumed 14,00,000

(+) Direct Wages 9,52,000

(+) Direct Expenses 4,68,000

Prime Cost 28,20,000

Q2: Compute factory cost from the following details:-

Raw material consumed = Rs 50,00,000

Direct wages = Rs20,00,000

Direct expenses = Rs 10,00,000

Factory expenses 80% of direct wages

Opening stock of work in progress = Rs 15,00,000

Closing stock of work in progress = Rs 21,00,000

Ans.

PARTICULARS AMOUNT (INR) AMOUNT (INR)

Raw Material Consumed 50,00,000

(+) Direct Wages 20,00,000

(+) Direct Expenses 10,00,000

Prime Cost 80,00,000

(+) Factory Expenses [80% * 20,00,000] 16,00,000

(+) Opening Stock WIP 15,00,000

(-) Closing Stock of WIP (21,00,000)

To 10,00,000

Work Cost/Net Factory Cost 90,00,000

Q3: Prepare cost sheet from the following particulars:

Raw material purchased = Rs. 2,40,000

Paid freight charges = Rs 20,000

Wages paid to laborers = Rs 70,000

Directly chargeable expenses = Rs 50,000

Factory on cost = 20% of prime cost

General and administrative expenses = 4% of factory cost

Selling and distribution expenses = 5% of production cost

Profit 20% on sales

Opening stock (Rs.) Closing stock (Rs.)

Raw material 30,000 40,000

Work in progress 35,000 48,000

Finished goods 40,000 55,000

Ans:

PARTICULARS AMOUNT (INR) AMOUNT (INR)

Opening Stock of RM 30,000

(+) Purchase of RM 2,40,000

(+) Freight Charges Paid 20,000

(-) Closing Stock of RM (40,000)

Raw Material Consumed 2,50,000

(+) Wages Paid to Labour 70,000

(+) Directly Chargeable expenses 50,000

Prime Cost 3,70,000

(+) Factory on Cost (20% * 3,70,000) 74,000

(+) Opening Stock of WIP 35,000

(-) Closing Stock of WIP (48,000)

Factory Cost 4,31,000

(+) Office and Administrative Charges (4% * 4,31,000) 17,240

Production Cost 4,48,240

(+) Opening Stock of Finished Goods 40,000

(-) Closing Stock of Finished Goods (55,000)

Cost of Goods Sold 4,33,240

(+) Selling and Distribution Expenses (5% * 4,48,240) 22,412

Total Cost 4,55,652

Profit (4,55,652 * (20/80)) 1,13,913

Sales 5,69,565

You might also like

- Cuck Cost Accounting PDFDocument119 pagesCuck Cost Accounting PDFaponojecy50% (2)

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- January 2023: On Field Investment ResearchDocument39 pagesJanuary 2023: On Field Investment ResearchPavel VeselovNo ratings yet

- Computing CosgDocument6 pagesComputing CosgAngelica BayaNo ratings yet

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Valuation of GoodwillDocument11 pagesValuation of GoodwillardhaNo ratings yet

- How To Trade AUD, NZD, CAD: With Boris Schlossberg and Kathy LienDocument69 pagesHow To Trade AUD, NZD, CAD: With Boris Schlossberg and Kathy LienForu FormeNo ratings yet

- Title R.A. 7432 R.A. 9257 R.A. 9994 - ExpandedDocument11 pagesTitle R.A. 7432 R.A. 9257 R.A. 9994 - ExpandedAngel Alejo AcobaNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Practical Problems and Solution of Cost SheetDocument7 pagesPractical Problems and Solution of Cost SheetAdityasai Gudimalla75% (4)

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- F.Y.B.B.A Sem 1 Financial Accounting Unit CostingDocument3 pagesF.Y.B.B.A Sem 1 Financial Accounting Unit CostingSamir ParekhNo ratings yet

- Cost Sheet ProblemsDocument5 pagesCost Sheet ProblemsshamilaNo ratings yet

- Acc Assignment Sem 2Document23 pagesAcc Assignment Sem 2Luqman HaqimNo ratings yet

- Spring 2018 Mgt402 1 SolDocument3 pagesSpring 2018 Mgt402 1 SolSyed Ali HaiderNo ratings yet

- Question No 2 Relevant Company Schedule For Direct Material UsedDocument15 pagesQuestion No 2 Relevant Company Schedule For Direct Material Usedyasir shahNo ratings yet

- Cost Accounting & Control 1Document8 pagesCost Accounting & Control 1Mary Lace VidalNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Cost Accounting AnswersDocument10 pagesCost Accounting AnswersHaris KhanNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- Cost Sheet Preparation ProblemsDocument2 pagesCost Sheet Preparation Problems12007856No ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Assignment On Cost SheetDocument3 pagesAssignment On Cost SheetRashmi KumariNo ratings yet

- Answer - Test - Corporate FinanceDocument7 pagesAnswer - Test - Corporate FinanceKuzi TolleNo ratings yet

- Solution Prelim ExamDocument30 pagesSolution Prelim ExamMedalla NikkoNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Assingm. Acc Sem 2Document9 pagesAssingm. Acc Sem 2Muhammad SyahmiNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- Job Cost Sheet - Job J-832-LMDocument2 pagesJob Cost Sheet - Job J-832-LMAbrar Ahmed KhanNo ratings yet

- Problem 9.10 SolutionDocument4 pagesProblem 9.10 SolutionPrincess Dhazerene M. ReyesNo ratings yet

- Assignment - 1 (MGT 402) Name: Mohsin Id: Mc190202341Document3 pagesAssignment - 1 (MGT 402) Name: Mohsin Id: Mc190202341MOHSIN AKHTARNo ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- COGS Practise Questions 2 SolutionDocument13 pagesCOGS Practise Questions 2 SolutionBisma ShahabNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Q1.What Is Meant by Cost Sheet?explain The Importance of Cost SheetDocument4 pagesQ1.What Is Meant by Cost Sheet?explain The Importance of Cost SheetHeena SorenNo ratings yet

- Cost Sheet: Meaning: Cost Sheet or A Cost Statement Is "A Document Which Provides For TheDocument5 pagesCost Sheet: Meaning: Cost Sheet or A Cost Statement Is "A Document Which Provides For TheVasudev ANo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Acc GPDocument4 pagesAcc GPMuhammad SyahmiNo ratings yet

- Unit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDocument14 pagesUnit-1 Cost Accounting and Cost Sheet Choose The Best AnswerDhanu ShriNo ratings yet

- MA-II Assignment I - Cost SheetDocument3 pagesMA-II Assignment I - Cost Sheetshriya2413100% (1)

- Avoid Copying As It Is From Lecture or Internet Use Your Own Words To ExplainDocument6 pagesAvoid Copying As It Is From Lecture or Internet Use Your Own Words To ExplainMuhammad BilalNo ratings yet

- Unit CostingDocument9 pagesUnit Costinggmehul703No ratings yet

- Manufacturing Account Worked Example Question 17Document6 pagesManufacturing Account Worked Example Question 17Roshan RamkhalawonNo ratings yet

- Job Order Costing SolutionDocument9 pagesJob Order Costing SolutionMariah VillanNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Cost Sheet PracticeDocument1 pageCost Sheet PracticeRajat TiwariNo ratings yet

- ACFrOgB RMmDOyNGnH6OC7MUXs7ooL-fMhVbs7t gTrgusxdECM3XrREt29Ozsh44LglDesXMLNmlPC9XDJ6WpbaqKJCLQrxnXbM1k1dDzC0gOeq7RVY8wo2NLiZEZfz41KEgegyBxN-eg4WRW2yDocument8 pagesACFrOgB RMmDOyNGnH6OC7MUXs7ooL-fMhVbs7t gTrgusxdECM3XrREt29Ozsh44LglDesXMLNmlPC9XDJ6WpbaqKJCLQrxnXbM1k1dDzC0gOeq7RVY8wo2NLiZEZfz41KEgegyBxN-eg4WRW2yDollarNo ratings yet

- Chapter 2 - 1 - IllustrationDocument6 pagesChapter 2 - 1 - IllustrationYonas BamlakuNo ratings yet

- Cost Problems 100Document20 pagesCost Problems 100aquedeus.88No ratings yet

- MA MathDocument16 pagesMA MathAvijit SahaNo ratings yet

- Task 1: Cost Classfication Task 1 Has 3 Questions in TotalDocument3 pagesTask 1: Cost Classfication Task 1 Has 3 Questions in TotalNgọc Trâm TrầnNo ratings yet

- Suggested Answer - Syl12 - Dec2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl12 - Dec2014 - Paper - 19 Final Examination: Suggested Answers To QuestionsRanadeep ReddyNo ratings yet

- Cost Sheet QuestionsDocument5 pagesCost Sheet QuestionsDrimit GhosalNo ratings yet

- Confidential DataDocument12 pagesConfidential Datagayathri bangaramNo ratings yet

- Confidential DataDocument10 pagesConfidential Datagayathri bangaramNo ratings yet

- Cost SheetDocument6 pagesCost SheetAishwary Sakalle100% (1)

- MCMCDocument6 pagesMCMCIT GAMINGNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Course Name: 2T7 - Cost AccountingDocument56 pagesCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- WK 2c Lesson 2 Problem Solving IllustrationDocument2 pagesWK 2c Lesson 2 Problem Solving IllustrationRosethel Grace GallardoNo ratings yet

- Chapter - 8: 8.1. Traffic SurveyDocument6 pagesChapter - 8: 8.1. Traffic SurveyPoushali RudraNo ratings yet

- Assignment Mm304, Poushali Rudra-13600920044Document7 pagesAssignment Mm304, Poushali Rudra-13600920044Poushali RudraNo ratings yet

- Field Assignment-Personality: IntroductionDocument2 pagesField Assignment-Personality: IntroductionPoushali RudraNo ratings yet

- ASSIGNMENT3 Case Study On PersonalityDocument3 pagesASSIGNMENT3 Case Study On PersonalityPoushali Rudra100% (1)

- Eco 1-3Document3 pagesEco 1-3Joyal ThomasNo ratings yet

- Demand, Supply, and Market Equilibrium: Hapter ObjectivesDocument34 pagesDemand, Supply, and Market Equilibrium: Hapter ObjectivesHussein YassineNo ratings yet

- Namma Kalvi 11th Economics Study Material em 216598Document44 pagesNamma Kalvi 11th Economics Study Material em 216598durairaju2403No ratings yet

- 18feb14 Global Macro Outlook 14 15Document16 pages18feb14 Global Macro Outlook 14 15Calin PerpeleaNo ratings yet

- MKG Case StudyDocument2 pagesMKG Case Studypraku_jhaNo ratings yet

- 05 - 07-07-2013 Case StudyDocument5 pages05 - 07-07-2013 Case StudyDavy SornNo ratings yet

- Ac040 NoteDocument54 pagesAc040 NoteAdam OngNo ratings yet

- Group Project 2Document2 pagesGroup Project 2Mike ZarifehNo ratings yet

- BSEB Arts Economics Model Paper 2022Document44 pagesBSEB Arts Economics Model Paper 2022Md AfrojNo ratings yet

- MITI - National E-Commerce Strategic Roadmap OverviewDocument26 pagesMITI - National E-Commerce Strategic Roadmap Overviewலிவண்யா பிரியா மணிமாறன்100% (2)

- Fa2 Inventory Valuation TestDocument4 pagesFa2 Inventory Valuation Testamna zaman100% (1)

- Case StudyDocument2 pagesCase StudyIrem AàmarNo ratings yet

- Chap 6 and Chap 8Document7 pagesChap 6 and Chap 8Raheela Shaikh75% (4)

- Factor of Currency Develuation PakistanDocument8 pagesFactor of Currency Develuation PakistanjavedalyNo ratings yet

- AJIO-JIT Return and SPF PolicyDocument11 pagesAJIO-JIT Return and SPF PolicyAshish MishraNo ratings yet

- Accounting Round 1Document6 pagesAccounting Round 1Malhar ShahNo ratings yet

- Pact 215 Project CDocument8 pagesPact 215 Project CYENG KABIGTINGNo ratings yet

- Valuation of Bonds and StocksDocument71 pagesValuation of Bonds and Stocksnaag1000No ratings yet

- 1Document17 pages1Saurabh Saran100% (1)

- The Time Value of Money: All Rights ReservedDocument55 pagesThe Time Value of Money: All Rights ReservedNad AdenanNo ratings yet

- Weekly CryptoDocument13 pagesWeekly CryptoForkLogNo ratings yet

- 014 Mr. Ping Ping KhmerDocument1 page014 Mr. Ping Ping Khmerវិស្វករ សំណង់ ខ្មែរNo ratings yet

- Quick Revision Notes (CPT Economics December 2014) ReadyDocument32 pagesQuick Revision Notes (CPT Economics December 2014) ReadyKiranDudu67% (3)

- Prequalifying ExaminationDocument6 pagesPrequalifying ExaminationVincent Villalino LabrintoNo ratings yet

- Chapter 16 Lean Supply Chain Management XXXDocument75 pagesChapter 16 Lean Supply Chain Management XXXNguyen Tran Thanh Thuy (K17 DN)No ratings yet