Professional Documents

Culture Documents

It Tell Us How Much Cash Is Generated From The Business Operation. It Is Increasing So We Add Them in The Cash Flow Statements

Uploaded by

Abdullah Qureshi0 ratings0% found this document useful (0 votes)

7 views4 pagesOriginal Title

Cashflows

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views4 pagesIt Tell Us How Much Cash Is Generated From The Business Operation. It Is Increasing So We Add Them in The Cash Flow Statements

Uploaded by

Abdullah QureshiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

interpretations

(In rupees) 2020 2019

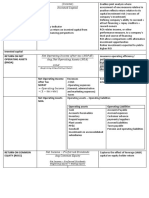

Cash flows from operating activities

It tell us how much cash is generated from

the business operation. It is increasing so

Cash generated form Operations 2,233,681,592 356,368,988 we add them in the cash flow statements.

Income tax paid is expense which is

treated in operating activity. Because

company paid taxes on cash generated

from operation. All expenses are deduct

in operating activities. We deduct income

tax paid from cash generate from

income Tax paid (143,595,154) (143,097,562) operation.

Long term deposits are the type of assets.

If the assets value is increased we

subtract it in operational activities.

Company asset increased in both year so

Net increase in long term deposits (6,960,00) (666,200) we subtract it from operating cash.

It is the expense on the long term

borrowing. It is the expense on company

account to so subtract it in operating

Finance cost paid 332,245,846 (347,176,241) activity.

This is the cash amount from operating

activities of company. In 2019, its value is

negative which shows that company

generate high expenses than it revenue.

Which is shows shortage of cash from

operating activities. But in 2020 it shows

a positive sign which is good for

Net cash used in operating activities 1,750,880,592 (134,571,015) company.

Cashflow from Investing activities

Fixed assets are the part of investing

activities. When the fixed assets

increased it will be subtracted. Here the

company fixed assets increased from

Capital expenditure on property, plant and previous year so we deduct it in investing

equipment (418,113,503) (264,341,221) activity

It is the amount which is received from

the sale of asset. The disposal amount

Proceeds from disposal of Operating fixed decreased from the previous years so we

assets 8,479,840 34,537,889 add them in investing activity.

We can also it in investing activity

because it increased in each year. In 2020

there is no sale of investment property so

Proceeds from disposal of investment property - 5,000,000 we will left it blank?

When the company received dividend

from the investment. So the dividend is

added un investing activities. Company

Dividend received 2,735,589 2,976,953 get from in both years so we add it.

Net Cash used in Investing activities (406,898,074) (176,826,379) This is total cash amount in investing

activity. In both year, the value is

negative which means that company is

using more cash than generating in

investing activity.

Cash flows from Financing activities

It the part of liability. Liability is the part

of financing activity. Because we borrow

money for financing our company. If the

company liability increased we add them

in financing activities. In both year

Long term finance obtained 118,565,192 88,640,000 liabilities are increased so we add them.

Company settle down it liability by

paying of cash. Liability is decreased so

Repayment of Long-term financing (190,488,999) (262,452,687) we subtract it.

Again company settle down it liability so

the liability amount decreased so we

subtract it. But company pay it in 2020 so

Ex- Sponsor Loan repaid (210,257,600) - we only subtract it from 2020

Short term is also part of liability. In

2019 liability is increased so we add then

Short term borrowing – net ( more than 1 in 2019 where as liability is decreased in

year) (571,399,999) 877,688,840 2020 so we subtract it from 2020 year.

Dividend paid to stockholder are part of

financing activity. It decreased our cash.

Dividend Paid (151,328,624) (60,592,087) So we subtract it from financing activity.

It is the total cash generate from

financing activity. In 2019 it shows a

positive amount which is good for

company. It means that company finance

more cash for company. Where as in

2020 it is negative amount which means

that company has shortage of money for

financing and this is because company

Net Cash from financing activities (1,004,910,030) 643,284,066 settle most of it liability in 2020.

It is the total cash from three activities of

cash flow. It is given in positive amount.

So its means that company is performing

Net Increase in Cash and Cash equivalent 339,072,488 331,886,672 well.

Cash and Cash equivalent at the beginning of It shows the available cash amount at the

the year 426,876,902 94,990,230 start of new year.

It shows the available cash amount at the

end of the year. In 2019 at the end of the

year there high cash amount than

beginning which means that company

generate high cash this year same in the

2020 company have high cash value at

the end of year which is god sign for the

company. It means that company have

enough cash for operation and company

Cash and Cash equivalent at the end of year 765,949,390 426,876,902 is performing well.

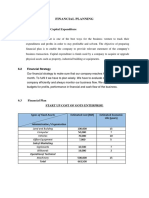

Kohinoor Textile Mill

Statement of Cash flows for the year ended 30 June 2020

interpretation

(In rupees) 2019 2018

Cash flows from

operating activities

It tell us how much cash is generated from the business

Cash generated from operation. It is increasing so we add them in the cash

Operations 356,368,988 309,477,627 flow statements

Income tax paid is expense which is treated in

operating activity. Because company paid taxes on

cash generated from operation. All expenses are

deduct in operating activities. We deduct income tax

Income tax paid (143,097,562) (94,086,703) paid from cash generate from operation.

Long term deposits are the type of assets. If the

assets value is increased we subtract it in

Net increase in long term operational activities. Company asset increased in

deposits (666,200) (214,270) both year so we subtract it from operating cash.

It is the expense on the long term borrowing. It is

the expense on company account to so subtract it in

Finance cost paid (347,176,241) (263,186,815) operating activity.

This is the cash amount from operating activities of

company. In 2018, its value is negative which shows

that company generate high expenses than it

revenue. Which is shows shortage of cash from

Net cash used in operating activities. But in 2019 it shows a negative

operating activities (134,571,015) (48,010,161) sign which is bad for company.

Cashflow from Investing

activities

Fixed assets are the part of investing activities.

When the fixed assets increased it will be

Capital expenditure on subtracted. Here the company fixed assets

property, plant and decreased from previous year so we deduct it in

equipment (264,341,221) (720,845,360) investing activity

It is the amount which is received from the sale of

Proceeds from disposal of asset. The disposal amount increase from the

Operating fixed assets 34,537,889 11,966,680 previous years so we add them in investing activity.

These are short term capital gains which are held only

Proceeds from disposal of for a year as we can see that the outcome is 5,000,000

investment property 5,000,000 gain.

The dividend given by the company has increased form

last year due to increase in profits as stated in income

Dividend received 2,976,953 1,609,653 statement

This is total cash amount in investing activity. In

both year, the value is negative which means that

Net Cash used in company is using more cash than generating in

Investing activities (176,826,379) (707,269,027) investing activity.

Cashflows from

Financing activities

It the part of liability. Liability is the part of

financing activity. Because we borrow money for

financing our company. If the company liability

Long term finance decrease we add them in financing activities. In last

obtained 88,640,000 415,700,000 year liabilities are increased so we add them.

Repayment of Long-term Company settle down it liability by paying of cash.

financing (262,452,687) (212,838,766) Liability is decreased so we subtract it.

Short term is also part of liability. In 2019 liability is

Short term borrowing - increased so we add them in 2019 where as liability

net 877,688,840 633,562,000 is also in positive so we addt it from 2019 year.

Dividend paid to stockholder are part of financing

activity. It decreased our cash. So we subtract it

Dividend Paid (60,592,087) (55,519,568) from financing activity.

It is the total cash generate from financing activity.

In 2019 it shows a positive amount which is good for

company but it is low then 2018 as there was a

project of BMR which was a huge investment It

means that company finance more cash for

company. Where as in 2018 it is positive amount

which means that company has ecess of money for

Net Cash from financing financing and this is because company settle most of

activities 643,284,066 780,903,666 it liability in 2018

It is the total cash from three activities of cash flow.

Net Increase in Cash and It is given in positive amount. So its means that

Cash equivalent 331,886,672 25,624,478 company is performing well.

Cash and Cash It shows the available cash amount at the start of

equivalent at the new year.

beginning of the year 94,990,230 69,365,752

It shows the available cash amount at the end of the

year. In 2019 at the end of the year there high cash

amount than beginning which means that company

generate high cash this year same in the 2018

company have high cash value at the end of year

Cash and Cash which is god sign for the company. It means that

equivalent at the end of company have enough cash for operation and

year 426,876,902 94,990,230 company is performing well.

You might also like

- DCF-Valuation-Course-Notes-365-Financial-AnalystDocument12 pagesDCF-Valuation-Course-Notes-365-Financial-AnalystArice BertrandNo ratings yet

- Ilovepdf MergedDocument41 pagesIlovepdf MergedShreyanshi AgarwalNo ratings yet

- Company Valuation - Course NotesDocument10 pagesCompany Valuation - Course NotesAfonsoNo ratings yet

- Company ValuationDocument10 pagesCompany ValuationJia MakhijaNo ratings yet

- Cash Flow - InvestopediaDocument4 pagesCash Flow - InvestopediaBob KaneNo ratings yet

- Course: Financial Accounting and Analysis: Answer 1: Introduction: Cash Flow StatementDocument3 pagesCourse: Financial Accounting and Analysis: Answer 1: Introduction: Cash Flow StatementJobin BabuNo ratings yet

- Financial Accounting Analysis ExamDocument10 pagesFinancial Accounting Analysis ExamDharmik UpadhyayNo ratings yet

- M/s. XYZ: About Your Valuation ReportDocument16 pagesM/s. XYZ: About Your Valuation ReportBhushan GowdaNo ratings yet

- Financial Ratio AnalysisDocument31 pagesFinancial Ratio AnalysisKeisha Kaye SaleraNo ratings yet

- Group 11 - FA AssignmentDocument30 pagesGroup 11 - FA AssignmentShreyanshi AgarwalNo ratings yet

- Idea Cash FlowDocument23 pagesIdea Cash FlowSurbhi GroverNo ratings yet

- PPF, Insurances (X) : New CC + New CR + Past Re + R - E - DDocument4 pagesPPF, Insurances (X) : New CC + New CR + Past Re + R - E - Dakash srivastavaNo ratings yet

- Practice Solution 2Document4 pagesPractice Solution 2Luigi NocitaNo ratings yet

- Session - Cash FlowsDocument42 pagesSession - Cash Flowsmohit rajputNo ratings yet

- Document 42Document5 pagesDocument 42Comm SofianNo ratings yet

- Financial Statements 2, ModuleDocument4 pagesFinancial Statements 2, ModuleSUHARTO USMANNo ratings yet

- Analyze Cash FlowsDocument5 pagesAnalyze Cash FlowsAmit VarmaNo ratings yet

- Financial Planning: 6.1 Start-Up Cost and Capital ExpenditureDocument4 pagesFinancial Planning: 6.1 Start-Up Cost and Capital ExpenditurearefeenaNo ratings yet

- DR 02278881Document2 pagesDR 02278881Anh AnhNo ratings yet

- FIN-573 - Lecture 2 - Jan 28 2021Document33 pagesFIN-573 - Lecture 2 - Jan 28 2021Abdul BaigNo ratings yet

- Finance Accounting & AnalysisDocument7 pagesFinance Accounting & AnalysisRochak SinglaNo ratings yet

- Review of Financial Statement PreparationDocument5 pagesReview of Financial Statement PreparationMarinel VergaraNo ratings yet

- Financial Accounting To Submit Aman Rana 1Document11 pagesFinancial Accounting To Submit Aman Rana 1aman ranaNo ratings yet

- Mod Financial Accounting Analysis 6Document14 pagesMod Financial Accounting Analysis 6aman ranaNo ratings yet

- Particulars Observation InferenceDocument2 pagesParticulars Observation InferenceChetan KejriwalNo ratings yet

- IN Financial Management 1: Leyte CollegesDocument20 pagesIN Financial Management 1: Leyte CollegesJeric LepasanaNo ratings yet

- ch3 Slides PostedDocument28 pagesch3 Slides Postedakshitnagpal9119No ratings yet

- Prudential PLC Ar 2020Document404 pagesPrudential PLC Ar 2020Lim KaixianNo ratings yet

- Liquidation Basis AccountsDocument18 pagesLiquidation Basis AccountsUsman AliNo ratings yet

- Financial Accounting and Analysis AssignmentDocument13 pagesFinancial Accounting and Analysis Assignmentbhaskar paliwalNo ratings yet

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanNo ratings yet

- Swayansu Sahoo (200409120049)Document6 pagesSwayansu Sahoo (200409120049)BigBox Audio LibraryNo ratings yet

- Chapter 2: Evaluation of Financial PerformanceDocument41 pagesChapter 2: Evaluation of Financial PerformanceNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- Day 5 - Cash FlowsDocument24 pagesDay 5 - Cash FlowsRehan HabibNo ratings yet

- LACER - FS and Notes 2018 PDFDocument13 pagesLACER - FS and Notes 2018 PDFErben ReyesNo ratings yet

- 1capital and Revenue TransactionsDocument11 pages1capital and Revenue Transactionsdilhani sheharaNo ratings yet

- Financial Statements Based On Philippine Accounting Standards (Pas)Document34 pagesFinancial Statements Based On Philippine Accounting Standards (Pas)eli broquezaNo ratings yet

- Fabm 2 - Module 4Document4 pagesFabm 2 - Module 4Kelvin SaplaNo ratings yet

- Balance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Document18 pagesBalance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Mohammad ElabedNo ratings yet

- Procter & Gamble Hygiene and Health Care Limited: Annual Report 2020-21Document14 pagesProcter & Gamble Hygiene and Health Care Limited: Annual Report 2020-21parika khannaNo ratings yet

- E8.10. Accounting Relations For Kimberly-Clark Corporation (Medium)Document3 pagesE8.10. Accounting Relations For Kimberly-Clark Corporation (Medium)Fashion ThriftNo ratings yet

- Financial Accounting and AnalysisDocument10 pagesFinancial Accounting and AnalysisHimanshi YadavNo ratings yet

- Assg2 - Open UniversityDocument26 pagesAssg2 - Open UniversityAzrul MuhamedNo ratings yet

- ROI (Income) Enables joint analysis of return on investment and profitabilityDocument4 pagesROI (Income) Enables joint analysis of return on investment and profitabilityAmelieNo ratings yet

- Cash Flow StatementDocument14 pagesCash Flow StatementMohd AtifNo ratings yet

- Session 5a Cash Flow Statement: HI5020 Corporate AccountingDocument11 pagesSession 5a Cash Flow Statement: HI5020 Corporate AccountingFeku RamNo ratings yet

- Hand Protection PLC Financial ReportDocument8 pagesHand Protection PLC Financial ReportasankaNo ratings yet

- Chapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesDocument29 pagesChapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesChieMae Benson QuintoNo ratings yet

- Financial Accounting & AnalysisDocument16 pagesFinancial Accounting & AnalysisMohit ChaudharyNo ratings yet

- Apex Cash Flow 1Document16 pagesApex Cash Flow 1livinnitchNo ratings yet

- NGA-SCE Financial Accounting Analysis AssignmentDocument21 pagesNGA-SCE Financial Accounting Analysis Assignmentmohammad fakhruddinNo ratings yet

- Case Study - Financial Statements & Future ProspectsDocument8 pagesCase Study - Financial Statements & Future Prospectsmm3289No ratings yet

- 1-6 Statement of Cash FlowDocument26 pages1-6 Statement of Cash FlowHazel Joy DemaganteNo ratings yet

- Assignment 2: Measuring and Reporting Assets and LiabilitiesDocument9 pagesAssignment 2: Measuring and Reporting Assets and LiabilitiesDerek DalgadoNo ratings yet

- National College of Business Administration & Economics Front Lane Campus (FLC)Document7 pagesNational College of Business Administration & Economics Front Lane Campus (FLC)Abdul RehmanNo ratings yet

- Financial Performance AnalysisDocument15 pagesFinancial Performance AnalysisNada Negad100% (1)

- Statement of Cash Flow - Ias 7Document5 pagesStatement of Cash Flow - Ias 7Benjamin JohnNo ratings yet

- Sorry Company Financial Analysis Warns of BankruptcyDocument5 pagesSorry Company Financial Analysis Warns of BankruptcyRevatee HurilNo ratings yet

- Advance Performance ManagementDocument17 pagesAdvance Performance ManagementSaddy ButtNo ratings yet

- A Large Refinery and Petrochemical Complex Is Plan...Document4 pagesA Large Refinery and Petrochemical Complex Is Plan...Abdullah QureshiNo ratings yet

- Anamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionDocument12 pagesAnamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionAbdullah QureshiNo ratings yet

- Anamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionDocument12 pagesAnamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionAbdullah QureshiNo ratings yet

- Question - 1 What Is Tax Amnesty. Answers - : Advanced Taxation Assignment # 1Document3 pagesQuestion - 1 What Is Tax Amnesty. Answers - : Advanced Taxation Assignment # 1Abdullah QureshiNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- EthicsDocument10 pagesEthicsAbdullah QureshiNo ratings yet

- Case Study 2 On-Time Delivery: 2. What Does Business Ethics Say?Document1 pageCase Study 2 On-Time Delivery: 2. What Does Business Ethics Say?Abdullah QureshiNo ratings yet

- Advance Performance ManagementDocument17 pagesAdvance Performance ManagementSaddy ButtNo ratings yet

- Caf 6 Tax Spring 2019Document5 pagesCaf 6 Tax Spring 2019Raza Ali SoomroNo ratings yet

- Class Project Topic: Women HarassmentDocument10 pagesClass Project Topic: Women HarassmentAbdullah QureshiNo ratings yet

- North West Company: Analyzing Financial Performance: SolvencyDocument5 pagesNorth West Company: Analyzing Financial Performance: SolvencyAbdullah QureshiNo ratings yet

- Class Project Topic: Women HarassmentDocument10 pagesClass Project Topic: Women HarassmentAbdullah QureshiNo ratings yet

- EthicsDocument10 pagesEthicsAbdullah QureshiNo ratings yet

- Class Project Topic: Women HarassmentDocument10 pagesClass Project Topic: Women HarassmentAbdullah QureshiNo ratings yet

- 1) Rights and Duties Positive and Negative RightsDocument3 pages1) Rights and Duties Positive and Negative RightsAbdullah QureshiNo ratings yet

- Assighment 1 TaxDocument3 pagesAssighment 1 TaxAbdullah QureshiNo ratings yet

- Task 1 - Questions: CHCCOM005 - AssignmentDocument4 pagesTask 1 - Questions: CHCCOM005 - AssignmentAbdullah QureshiNo ratings yet

- Question - 1 What Is Tax Amnesty. Answers - : Advanced Taxation Assignment # 1Document3 pagesQuestion - 1 What Is Tax Amnesty. Answers - : Advanced Taxation Assignment # 1Abdullah QureshiNo ratings yet

- Chap 6 SummaryDocument2 pagesChap 6 SummaryAbdullah QureshiNo ratings yet

- Caf 6 Tax Spring 2019 2Document5 pagesCaf 6 Tax Spring 2019 2Abdullah QureshiNo ratings yet

- Lyxor Chinah: Mean Variance 1.92% 1.92% Standard Deviation 13.87% 13.87%Document18 pagesLyxor Chinah: Mean Variance 1.92% 1.92% Standard Deviation 13.87% 13.87%Abdullah QureshiNo ratings yet

- Kohinoor Textile Mill: Statement of Cash Flows For The Year Ended 31 June 2019Document2 pagesKohinoor Textile Mill: Statement of Cash Flows For The Year Ended 31 June 2019Abdullah QureshiNo ratings yet

- Kohinoor Textile Mill: Statement of Cash Flows For The Year Ended 31 June 2019Document2 pagesKohinoor Textile Mill: Statement of Cash Flows For The Year Ended 31 June 2019Abdullah QureshiNo ratings yet

- ABDocument7 pagesABAbdullah QureshiNo ratings yet

- Engineering Economics Assignment BETE 54D Present WorthDocument1 pageEngineering Economics Assignment BETE 54D Present WorthAbdullah QureshiNo ratings yet

- Computation of Income Tax LiabilityDocument6 pagesComputation of Income Tax LiabilityAbdullah QureshiNo ratings yet

- Kohinoor Textile Mill: Statement of Cash Flows For The Year Ended 31 June 2019Document2 pagesKohinoor Textile Mill: Statement of Cash Flows For The Year Ended 31 June 2019Abdullah QureshiNo ratings yet

- ABDocument7 pagesABAbdullah QureshiNo ratings yet

- Kaveri Seeds - June 2021Document10 pagesKaveri Seeds - June 2021gaurav guptaNo ratings yet

- Entrepreneurial Law NotesDocument70 pagesEntrepreneurial Law NotesPhebieon Mukwenha100% (1)

- Chapter 16Document10 pagesChapter 16RAden Altaf Wibowo PutraNo ratings yet

- Smith+Nephew - Global 2022Document260 pagesSmith+Nephew - Global 2022Akshit KumarNo ratings yet

- Group 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplDocument13 pagesGroup 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplSarah WuNo ratings yet

- Vinati Organics: Newer Businesses To Drive Growth AheadDocument6 pagesVinati Organics: Newer Businesses To Drive Growth AheadtamilNo ratings yet

- 2020 How To Configuration Content S4HGR V2Document261 pages2020 How To Configuration Content S4HGR V2Mamatha PendurthyNo ratings yet

- Stock Market Modeling and Forecasting, ChenDocument166 pagesStock Market Modeling and Forecasting, ChenIsmith Pokhrel100% (2)

- Review Problems 1rDocument8 pagesReview Problems 1rYousefNo ratings yet

- FLI 2015 Annual Report Highlights Long-Term GrowthDocument49 pagesFLI 2015 Annual Report Highlights Long-Term GrowthJoyce DomingoNo ratings yet

- Marketable SecuritiesDocument23 pagesMarketable SecuritiesSunitha KarthikNo ratings yet

- Dividend Yields Impact Stock Returns Beyond CAPMDocument12 pagesDividend Yields Impact Stock Returns Beyond CAPMTom QuilleNo ratings yet

- What Are The Other Classifications of Corporations? (PT 2)Document17 pagesWhat Are The Other Classifications of Corporations? (PT 2)jobelle barcellanoNo ratings yet

- Zxdaw 3Document56 pagesZxdaw 3kingNo ratings yet

- Good Company (India) LTD - Model Financial Statements - March 2015Document95 pagesGood Company (India) LTD - Model Financial Statements - March 2015Nidhi JainNo ratings yet

- Nama Nama AkunDocument26 pagesNama Nama AkunTia YuliandiniNo ratings yet

- Annual Report: Petrochina Company LimitedDocument292 pagesAnnual Report: Petrochina Company LimitedJennieNo ratings yet

- Common Stocks - WorksheetDocument7 pagesCommon Stocks - Worksheetvwfn8f7xmtNo ratings yet

- Annual Financials For Funskool Inc.: View RatiosDocument16 pagesAnnual Financials For Funskool Inc.: View RatiosJames19898No ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- CORPORATE FINANCE WORKSHEETDocument55 pagesCORPORATE FINANCE WORKSHEETMatthew WilliamsNo ratings yet

- 2020 21 RGICL Annual ReportDocument113 pages2020 21 RGICL Annual ReportShubrojyoti ChowdhuryNo ratings yet

- FINANCE FUNCTIONS AND MANAGEMENTDocument13 pagesFINANCE FUNCTIONS AND MANAGEMENTCharming AshishNo ratings yet

- Pitino Acquired 90 Percent of Brey's Outstanding SharesDocument40 pagesPitino Acquired 90 Percent of Brey's Outstanding SharesKailash KumarNo ratings yet

- Zimsec - Nov - 2016 - Ms 3Document9 pagesZimsec - Nov - 2016 - Ms 3Wesley KisiNo ratings yet

- Financial Management Module With Exercises Revised Module 11.02.22 1Document124 pagesFinancial Management Module With Exercises Revised Module 11.02.22 1Seph Agetro100% (1)

- 17Q June 2016Document95 pages17Q June 2016Juliana ChengNo ratings yet

- 99th AGM AR WEB 16 07 2018 PDFDocument184 pages99th AGM AR WEB 16 07 2018 PDFpks009No ratings yet

- Essential guide to Apartment Owners Association complianceDocument8 pagesEssential guide to Apartment Owners Association complianceSwathi JainNo ratings yet

- 8 As 21 Consolidated Financial StatementsDocument26 pages8 As 21 Consolidated Financial StatementssmartshivenduNo ratings yet