Professional Documents

Culture Documents

Cost of Production Report - Sheet1

Uploaded by

cherein6soriano6paelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Production Report - Sheet1

Uploaded by

cherein6soriano6paelCopyright:

Available Formats

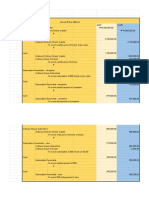

Illustration: Cost of Production Report.

Case 1. Manufacturing company with only one(1) processing department; with befinning

beginning

inventory:materials

inventory;materials

added

added

at the

at the

beginning

beginning

of the

of the

process.

process

Kimberly Mfg. Corporation manufactures peanut butter in a single department . Data for the month of March, 2016 are as follows:

Units:

Work in process, beginning

Materials, 100% complete, conversion cost, 80% complete 200 units

Started in process during the period 2,000 units

Completed and transferred out 2,080 units

Work in process, end

Materials, 100% complete, conversion cost, 50% complete 120 units

Cost:

Work in process, beginning

Materials, 100 % complete ₱3,000.00

Conversion cost, 80% complete 2,000.00 ₱5,000.00

Cost added during this period

Materials 30,000.00

Conversion cost 19,400.00

₱54,400.00

Required: 1. Prepare Cost of Production Report, Weighted average method and appropriate accounting entries.

2. Prepare Cost of Production Report, FIFO method and appropriate accounting entries.

SOLUTION:

1. Weighted Average Method

KIMBERLY MFG. CORPORATION Journal Entries:

Cost of Production Report - Weighted Average Method

for the month ended March 31,2016 1. Work in process ₱30,000.00

Materials ₱30,000.00

Quantity Schedule and Equivalent Units To record materials used

Quantity Equivalent units #

Schedule Materials Conversion 2. Work in process 19,400.00

Units to be accounted for: Various accounts 19,400.00

Work in process, beginning 200 To record conversion costs

Started in process during the period 2,000 #

Total units to be accounted for 2,200 3. Finished Goods Inventory 52,000.00

Units accounted for: Work in process 52,000.00

Completed and transferred out 2,080 2,080 2,080 To record cost of goods completed

Work in process, end (Materials, 100%; Conversion cost,50%) 120 120 60 and transferred to finished goods.

Total units accounted for 2,200 2,200 2,140 #

Total and Unit costs

Costs

Total Materials Conversion

Cost to be accounted for:

Cost added by department:

Work in process, beginning ₱5,000.00 ₱3,000.00 ₱2,000.00

Added this period 49,400.00 30,000.00 19,400.00

Total cost to be accounted for ₱54,400.00 ₱33,000.00 ₱21,400.00

Cost per equivalent unit ₱25.00 ₱15.00 ₱10.00

Cost accounted for

Completed and transferred out (2,080 units x P25.00) ₱52,000.00

Work in process, end:

Materials ( 120 units x P15.00 ) ₱1,800.00

Conversion costs (60 units x P10.00) 600.00

2,400.00

Total cost accounted for ₱54,400.00

2. FIFO Mehtod

KIMBERLY MFG. CORPORATION Journal Entries:

Cost of Production Report - FIFO Method

for the month ended March 31,2016 1. Work in process ₱30,000.00

Materials ₱30,000.00

Quantity Schedule and Equivalent Units To record materials used.

Quantity Equivalent Units #

Schedule Materials Conversion 2. Work in process 19,400.00

Units to be accounted for Various accounts 19,400.00

Work in process, beginning 200 To record conversion costs

Started in process during the period 2,000 #

Total units to be accounted for 2,200 3. Finished Goods Inventory 52,012.00

Units accounted for; Work in process 52,012.00

Completed and transferred out; To record cost of goods completed

From work in process, beginning 200 40 and transferred to finished goods.

From started in process during the period 1,880.00 1880 1880

Work in process, end (Materials - 100%,Conversion -50%) 120 120 60

Total units accounted for 2,200 2,000 1980

Total and Unit Costs

Costs

Total Materials Conversion

Cost to be accounted for

Work in process, beginning ₱5,000.00

Cost added by department:

Added this period 49,400.00 ₱30,000.00 ₱19,400.00

Total cost to be accounted for ₱54,400.00 ₱30,000.00 ₱19,400.00

Cost per equivalent unit ₱24.80 ₱15.00 ₱9.80

Cost accounted for:

Completed and transferred out:

From work in process, beginning:

Beginning cost ₱5,000.00

Cost to complete:

Conversion (40 units x P9.80) 392.00 ₱5,392.00

From started during the period (1,880 units x P24.80) 46,620.00

Total 52,012.00

Work in process, end:

Materials (120 units x P15.00) 1,800.00

Conversion costs (60 units x P9.80) 588.00 2,388.00

Total cost accounted for ₱54,400.00

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Mobile Phone CloningDocument38 pagesMobile Phone CloningDevansh KumarNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- How To FingerDocument18 pagesHow To FingerAgiabAbera100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Procedure To Destroy Occultic or Cursed ObjectsDocument5 pagesProcedure To Destroy Occultic or Cursed ObjectsJuan Jaylou Ante100% (1)

- Ralph Alan Dale 1972 Hypnotism and EducationDocument21 pagesRalph Alan Dale 1972 Hypnotism and EducationFrancis Gladstone-Quintuplet100% (2)

- 01-13 PWE3 ConfigurationDocument97 pages01-13 PWE3 ConfigurationRoger ReisNo ratings yet

- The Entheogen Review׃ Vol. 16, No. 1 (2008)Document44 pagesThe Entheogen Review׃ Vol. 16, No. 1 (2008)HoorayFrisbeeHead100% (2)

- UF6 ManualDocument24 pagesUF6 ManualPhil Ruby Tigers0% (1)

- Applied Statistics in Business and Economics 5th Edition Doane Solutions ManualDocument26 pagesApplied Statistics in Business and Economics 5th Edition Doane Solutions ManualSharonMartinezfdzp100% (44)

- BudgetingDocument2 pagesBudgetingcherein6soriano6paelNo ratings yet

- Cherein Pael - Midterm Project Sept 30 - PROBLEM1Document1 pageCherein Pael - Midterm Project Sept 30 - PROBLEM1cherein6soriano6paelNo ratings yet

- Allocation of Common Costs - Sheet1Document2 pagesAllocation of Common Costs - Sheet1cherein6soriano6paelNo ratings yet

- The Master Budget HandoutsDocument4 pagesThe Master Budget Handoutscherein6soriano6paelNo ratings yet

- B. Research A Country of Your Choice. Share Information of The FollowingDocument4 pagesB. Research A Country of Your Choice. Share Information of The Followingcherein6soriano6paelNo ratings yet

- 1st VoyageDocument40 pages1st Voyagecherein6soriano6paelNo ratings yet

- Journal Entry Method - Exercise #4 - Sheet1Document2 pagesJournal Entry Method - Exercise #4 - Sheet1cherein6soriano6paelNo ratings yet

- Exercise-1 pg.103Document4 pagesExercise-1 pg.103cherein6soriano6paelNo ratings yet

- DLP L05 - Challenges in AdolescenceDocument3 pagesDLP L05 - Challenges in AdolescenceSora YamazakiNo ratings yet

- 3 Parts of A Science Fair ProjectDocument5 pages3 Parts of A Science Fair ProjectGeorge Oswald Junior CarringtonNo ratings yet

- General Office Administration Level 1 (CVQ) PDFDocument129 pagesGeneral Office Administration Level 1 (CVQ) PDFddmarshall2838No ratings yet

- STP280 - 24Vd - UL (H4 Connector) - AZDocument2 pagesSTP280 - 24Vd - UL (H4 Connector) - AZkiranpandey87No ratings yet

- The Awakened Goat: Playable RaceDocument2 pagesThe Awakened Goat: Playable RacePJ FlandersNo ratings yet

- TranscriptDocument1 pageTranscriptGursharanjit SinghNo ratings yet

- James Rachels - What Is MoralityDocument26 pagesJames Rachels - What Is MoralityKiara Lagrisola100% (1)

- What Is A CodebookDocument5 pagesWhat Is A CodebookAxmed YaasiinNo ratings yet

- Tpa6404 q1Document12 pagesTpa6404 q1siogNo ratings yet

- Unidad 1 - Paco (Tema 3 - Paco Is Wearing A New Suit) PDFDocument24 pagesUnidad 1 - Paco (Tema 3 - Paco Is Wearing A New Suit) PDFpedropruebaNo ratings yet

- Cse205 Computer-Architecture-And-Organization TH 2.00 Ac26Document2 pagesCse205 Computer-Architecture-And-Organization TH 2.00 Ac26Ravi ThejaNo ratings yet

- Lesson 2 - Língua Inglesa 7Document21 pagesLesson 2 - Língua Inglesa 7Shara Maria Venâncio SilvaNo ratings yet

- TDS - 0121 - CapaCare Classic - 201912Document5 pagesTDS - 0121 - CapaCare Classic - 201912ayviwurbayviwurbNo ratings yet

- SKV-FM-QA-12 Non Conformity and Corrective ActionDocument1 pageSKV-FM-QA-12 Non Conformity and Corrective ActionSaurabh BhadouriyaNo ratings yet

- QP English Viii 201920Document14 pagesQP English Viii 201920Srijan ChaudharyNo ratings yet

- Literature Review of Centella AsiaticaDocument6 pagesLiterature Review of Centella Asiaticaea3vk50y100% (1)

- Arahan Dan Soalan Tugasan Jkp513e417e Sa 20222023Document4 pagesArahan Dan Soalan Tugasan Jkp513e417e Sa 20222023skblueNo ratings yet

- Cedarwood ChromatographyDocument6 pagesCedarwood ChromatographyMartinaNo ratings yet

- Clapham - Creativity TrainingDocument11 pagesClapham - Creativity TrainingNevenka JakšićNo ratings yet

- DBMS - Lab CAT2 Code SWE1001 SLOT L47+48 DATE 16/10/19Document2 pagesDBMS - Lab CAT2 Code SWE1001 SLOT L47+48 DATE 16/10/19msroshi madhuNo ratings yet

- Peter Wink Resume Aug 2019Document1 pagePeter Wink Resume Aug 2019api-471317467No ratings yet

- Washback Effect in Teaching English As An International LanguageDocument13 pagesWashback Effect in Teaching English As An International LanguageUyenuyen DangNo ratings yet