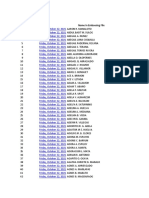

Professional Documents

Culture Documents

Business Math Quarter 3 Week 8

Uploaded by

Gladys Angela ValdemoroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Math Quarter 3 Week 8

Uploaded by

Gladys Angela ValdemoroCopyright:

Available Formats

Business Math- SHS Grade 11

Student’s

Name Grade and Section

___________________________________ ________________________

Teacher Date Submitted

___________________________________ ________________________

Introduction

Did you know that break-even analysis is a very important factor in understanding the

financial health of a company? It helps determine the relationship among various elements

such as costs (variable and fixed), prices, and volume of sales that will make revenue and

total cost equal, which means that there is no profit nor loss.

This learning activity will explain the break-even point, the way it is computed, and

the formula in determining the break-even point. This packet also includes analyzing and

solving various problems which involve buying and selling of products that could enhance

the analytical and problem-solving skills.

Another important topic included is to help you understand how interest is applied on

either investment or obligation. As you go through, a scientific calculator is essential for

significant computations.

Let’s begin.

Learning Competencies

1. Determine the break-even point.

2. Solve problems involving buying and selling products.

3. Compute interest specifically as applied to mortgage, amortization, and on

services/utilities and on deposits and loans.

Activities

Lesson 1

Break-Even Points

Break-Even Point Definition

Break-even point is the level of production at which the total revenues equal the total

expenses during a manufacturing process in a given accounting period. Since revenues

equaled expenses, the net income for the period will be zero.

Calculating the Break-Even Point

To calculate the break-even point, sales and costs are needed. Costs include fixed

costs and variable costs. Fixed costs are expenses that remain relatively the same and do

not change based on production or sales volume. Examples are rent or mortgage expenses,

RO_Business Mathematics_Grade 11_Q3_LP 8 1

salaries of employees, loans, equipment expenses and capital expenditures. Variable

costs are not consistent, and change based on the production output or a change in sales

volume. It is the cost of producing each product. Examples are wages, utilities, commissions,

and marketing. Variable costs are flexible and can go up and down every month based on

business activities. Cost of Goods Sold (COGS) is considered a variable cost because the

amount will vary based on the quantity of products produced and the cost of the materials

used to manufacture products. Another important factor in break-even analysis is the

revenue.

R=px , where R is the revenue, p is the price and x is the number of units

At break-even, the total cost TC is compared with the total revenue R to determine the

level of production (that is, number of units produced) at which TC=R.

To determine the number of units to be sold to break-even, we can assume that:

Sales = Variable Costs + Fixed Costs

If we let x represent the number of units to break-even, we can use the following

formula adapted from the above formula.

Px=vx + FC , where P=unit Price

x=number of units

v=variable cost per unit ;∧¿

FC =¿ cost

Therefore, the break-even point BEP in number of units would be:

FC

x=

P−v

The break-even point BEP in pesos would be:

BEP in Pesos = (Unit Price) (BEP in Units)

Example 1:

Calculate the break-even point in sales units and sales in pesos from the following

information:

Unit price ₱20

Variable cost ₱8

Fixed costs ₱12,000

Solution:

Substituting the given values into the formula for break-even point in sales

units, we get:

FC

BEP∈Units(x)=

P−v

₱ 12,000

BEP∈Units ( x )=

₱ 20−₱ 8

x=1000 units

BEP∈Pesos=(Unit Price)( BEP∈Units)

¿( ₱ 20)(1,000)

BEP∈Pesos=₱ 20,000

Example 2:

Ace Merchandising’s variable cost per unit is ₱ 8.00. The company’s rent expense is

₱ 4,000; salaries expense is ₱ 8,000 and bank loan amortization is ₱ 4,000. If the company

sold a total of 20,000 units yielding total sales of ₱ 200,000, find the BEP in units and BEP

in pesos.

variable cost per unit ( v )=₱ 8.00

Rent expense ¿ ₱ 4,000

RO_Business Mathematics_Grade 11_Q3_LP 8 2

Salaries expense ¿ ₱ 8,000

Bank loan amortization ¿ ₱ 4,000

Number of units sold ( x )=20,000

Total sales ¿ ₱ 200,000

First, we need to find the FC, that is

Rent expense ¿ ₱ 4,000

Salaries expense ¿ ₱ 8,000

Bank loan amortization ¿ ₱ 4,000

Total ¿ ₱ 16,000.00

Next, we need to find the unit price, that is

Total sales

Unit Price=

number of Units sold

₱ 200,000

Unit Price=

20,000

Unit Price= ₱ 10.00

Then, we can now find the BEP in units and BEP in pesos

FC

a. BEP∈Units(x)=

P−v

₱ 16,000

BEP∈Units(x)=

₱ 10−₱ 8

₱ 16,000

BEP∈Units(x)=

₱2

BEP∈Units ( x )=8,000

b. BEP∈Pesos=(Unit Price)( BEP∈Units)

¿( ₱ 10)(8,000)

BEP∈Pesos=₱ 80,000

Lesson 2

Buying and Selling

Solving Problems Involving Buying and Selling of Products

This is an application of your previous lessons designed to enhance your analytical

as well as problem solving skills. In this lesson, you will be analyzing and solving various

problems involving buying and selling of products.

Example 1

Janine buys a girl’s cologne for P35. The rate of mark-up based on cost is 25%. Find

the selling price and the mark-up.

Solution: MU = 0.25 x 35

= ₱ 8.75

SP = ₱35 + ₱8.75

SP = ₱ 43.75

The selling price of girl’s cologne is ₱ 43.75 which includes a mark-up of ₱ 8.75

RO_Business Mathematics_Grade 11_Q3_LP 8 3

Example 2

Find the cost and mark-up of one ream of white long bond paper being sold for P125

with a 20% mark-up based on selling price.

Solution:

MU = (MU%) (SP) C = SP – MU

= 0.20 x ₱125 = ₱125 – ₱25.00

=₱25.00 = ₱100.00

The cost price of one ream of long white bond paper is P100.00 and the mark-

up is ₱25.00.

Example 3

Mang Gorio, a meat vendor in Barangay San Isidro, supplies meat not only in his

own barangay but also in the neighboring barangays. He decided to increase the price of

meat by ₱5 per kilo. If the cost of pork is ₱270 per kilo with a 25% mark-up, what is its new

selling price with the additional increase of ₱5? By how much is the rate of mark-up based

on cost increased by adding ₱5 to the regular selling price of the pork?

Solution:

MU ¿ ( 0.25 ) ( ₱ 270 )

¿ ₱ 67.50

Selling price before the increase:

SP=C + MU

¿ ₱ 270+ ₱ 67.50

¿ ₱ 337.50

Selling price after increase:

PS=₱ 337.50+ ₱ 5.00

PS=₱ 342.50

Combined Rate of Mark-up and Mark-on

₱ 67.50+ ₱ 5.00

¿

₱ 270.00

₱ 72.50

¿

₱ 270.00

¿ 0.2685 x 100

¿ 26.85 %

The mark-up is increased by 1.85% by the additional mark-on of P5.00 by Mang

Gorio.

Lesson 3

Interests and Its Application

Simple and Compound Interest on Deposit and Loan: A Recall

Simple interest – the charging interest rate r based on a principal P over t number

of years.

I =Prt

Example 1 (Simple Interest on Deposits)

RO_Business Mathematics_Grade 11_Q3_LP 8 4

You deposited ₱ 500,000 in a bank that offers 6% per annum. You intend to withdraw

the money after 8 years. How much interest will you earn after 8 years?

Solution

Given: P = ₱ 500,000

r = 6%

t = 8 years

I =?

I =Prt

= (₱ 500,000) (0.06) (8)

= ₱ 240,000

At the end of 8 years, you would have earned ₱ 240,000 worth of money. Add it to

your deposit, you would have ₱ 740,000 in your bank account.

Example 2 (Simple Interest on Loans)

Masha borrowed ₱950,000 from a bank. The bank charges 12% simple interest per

year. How much interest will be added to her loan after 3 years?

Solution:

Given: P = P950,000

R = 12%

T = 3 years

I =Prt

= (₱ 950,000) (0.12) (3)

= ₱ 342,000

After 3 years, Masha must pay ₱ 342,000 interest. Add it to her loan, she will have to

pay ₱ 1,292,000 worth of money.

Compound interest – the interest on the first compounding period is added on the

principal, which will then be the basis for the interest to be computed for the next period.

It is important that you get familiar with compounding frequency. You will use m to

denote the compounding frequency. See the table provided on the next page.

Compounding Frequency Value of m

Annually 1

Semi-annually 2

Quarterly 4

Monthly 12

Bi-monthly 24

Weekly 52

Daily 365

You will use this formula in order to compute for compound interest.

I =¿

Example 3 (Compound Interest on Deposits)

Suppose you decided to deposit ₱480,000 in another bank that offers 6%

compounded semi-annually. How much interest would you earn after 5 years?

Solution:

Given: P = ₱480,000

r = 6%

RO_Business Mathematics_Grade 11_Q3_LP 8 5

t = 5 years

m = 2 (semi-annually)

I =¿

I =¿

I =¿

I =[₱ 480,000(1.343916379)]−₱ 480,000

I =₱ 645,079.86−₱ 480,000

I =₱ 165,079.86

After 5 years, you would have earned P165,079.86 interest in a bank that offers

semi-annual compound interest.

Utilities and Services – these are products/schemes that make business

transactions easy and comfortable. However, a certain amount must be paid in exchange

for the services offered.

Example 4

Pure Waters is the only distributor of potable water in the locality. Your family

received ₱ 678.40 water bill for May with due date on June 5. A 10% penalty is charged for

delayed payment. If you pay 3 days after the due date, how much is the penalty? How

much is your total expenditure on water consumption for the month?

Solution:

Penalty = (₱678.40) (0.10)

= ₱67.84

Total expenditure = ₱ 678.40 + ₱ 67.84

= ₱ 746.24

Mortgages

A mortgage loan uses property as collateral. The lender usually requires a down

payment for the loan. The down payment represents a certain percentage of the purchase

price of the property.

Example 1

Assume that you wish to purchase a second-hand motor bike worth ₱44,000 and the

seller requires 20% down payment. How much would your initial cash out be? Find the

amount of the mortgage?

Solution:

Remember that down payment is a percentage of the purchase price. To compute for

the down payment:

Down payment = (Purchase price) (Down payment rate)

= (₱44,000.00) (20%)

= ₱8,800.00

The amount of the mortgage loan is the balance after paying the down payment:

Mortgage loan = Purchase price - Down payment

= ₱44,000.00 - ₱8,800.00

= ₱35,200.00

Example 2

RO_Business Mathematics_Grade 11_Q3_LP 8 6

Mr. Guevarra decided to borrow ₱1,500,000 to buy a residential lot. The effective

rate of interest is 7.5%. The loan must be paid in full in one year. How much must Mr.

Guevarra pay after one year? How much interest is paid by Mr. Guevarra after one year?

Solution:

Given:

P (loan’s initial amount) = ₱1,500,000

i (interest rate) = 7.5%

n (total number of payments) = 1

Find: F (total amount due after maturity) = ?

I (total amount of interest paid) = ?

F = P (1 + i)n

= ₱1,500,000 (1 + 7.5%)1

= ₱1,500,000 (1 + .075)1

= ₱1,500,000 (1.075)

= ₱1,612,500

The amount P1,612,500 must be paid by Mr. Guevarra after one year.

To compute for interest, we simply deduct the loan’s initial amount from the maturity

value.

I =F−P

I =¿₱1,612,500.00 - ₱1,500,000.00

I =₱ 112,500.00

Interest and Amortization

A loan is amortized if both the principal and interest are paid by a sequence of equal

periodic payments. If there were no interest rate, determining your periodic payment would

be simple. A bank, however, will collect interest in order to make money. The series of

payments made until the end of the loan term is your amortization.

Example 1 (Amortization on Loans)

Suppose you obtain ₱350,000.00 loan payable in 3 years. The bank charged you 5%

interest annually. However, payments must be made monthly. Determine your monthly

amortization.

Solution:

Before you proceed to the computation, it is important that you understand annual

percentage rate or APR. The 5% is APR. Since you will make monthly payments, you must

convert the 5% APR into a monthly rate.

You must divide 5% by 12 to get 0.416%. Your monthly rate is 0.416%. To determine

the monthly payment, use the following formula:

A=iP ¿ ¿

where A is the monthly payment

P is the loan’s initial amount

i is the monthly interest rate; and

n is the total number of payments

Going back to our example:

RO_Business Mathematics_Grade 11_Q3_LP 8 7

[ ( 0.416 % ) ( ₱ 350,000.00 ) ](1+0.416 %)(12)(3)

A=

(1+0.416 %)(12 )( 3)−1

[ ( 0.00416 )( ₱ 350,000.00 ) ](1+0.00416)36

A=

(1+0.00416)36−1

(₱ 1456.00)(1.161194667)

A=

0.161194667

A=₱ 10,488.56

Amortization Schedule

An amortization schedule is a table which shows the division of each payment into

principal and interest, together with the outstanding loan balance after each payment is

made. This part of the module will help you construct an amortization schedule using two

repayment programs namely:

1. Equal Principal Payments- under this arrangement, the loan is repaid in equal amounts

of principal. The installments are unequal, however, because the interest payment is

largest in the first year and becomes smaller as the principal is gradually paid.

2. Equal Amortization- the loan is repaid in equal installments. The amount applied to

principal is smallest in the first year, then the same payments to principal gradually

increases through the payment years, the largest of which is made on the last year. The

decreasing payments on interests, however, equalizes the uneven payments on

principal.

Example 1 (Equal Principal Payments)

Assume a ₱ 120,000 loan payable in 12 years at 8% annual interest. Construct an

amortization schedule using the equal principal payments program.

Solution:

The amortization schedule will be constructed using the following steps:

Step 1. Determine the amount of principal repaid each period by dividing the principal by

the number of payments

For the above example, it would equal to ₱ 120,000 ÷ 12 years = ₱ 10,000.

Step 2. Multiply the periodic interest rate by the outstanding balance at the beginning of

year to determine how much of this payment will go toward interest.

For the first row, ₱ 120,000 x 8% = ₱ 9,600

Step 3. Add the principal portion to the interest portion to determine the total payment for

the period.

For the first row, ₱ 10,000 + ₱ 9,600 = ₱ 19,600

Step 4. Go to the next row and repeat only steps 2 through 4.

Below is the illustration of the equal principal payment scheme above.

Outstanding principal Repayment of principal Interest due at Total payment

Year

at beginning of year at end of year end of year at end of year

1 ₱ 120,000.00 ₱ 10,000.00 ₱ 9,600.00 ₱ 19,600.00

2 110,000 10,000.00 8,800 18,800

RO_Business Mathematics_Grade 11_Q3_LP 8 8

3 100,000 10,000.00 8,000 18,000

4 90,000 10,000.00 7,200 17,200

5 80,000 10,000.00 6,400 16,400

6 70,000 10,000.00 5,600 15,600

7 60,000 10,000.00 4,800 14,800

8 50,000 10,000.00 4,000 14,000

9 40,000 10,000.00 3,200 13,200

10 30,000 10,000.00 2,400 12,400

11 20,000 10,000.00 1,600 11,600

12 10,000 10,000.00 800 10,800

Example 2 (Equal Amortization Payments)

Assume a ₱ 120,000 loan payable in 1 year at 8% annual interest compounded

monthly. Construct an amortization schedule using the equal amortization payments

program.

Solution:

The amortization schedule will be constructed using the following steps:

Step 1. Determine the amount of amortization payment for each period using this formula:

8%

A=iP ¿ ¿ ; i= =0.667 %

12

[ ( 0.667 % ) ( ₱ 120,000.00 ) ](1+0.667 %)(12)(1)

A=

(1+0.667 %)( 12)( 1)−1

[ ( 0.00667 )( ₱ 120,000.00 ) ](1+0.00667)12

A=

(1+0.00667)12−1

(₱ 800.40)(1.083042541)

A=

0.083042541

A=₱ 10,438.83

For the above example, the monthly amortization is equal to ₱ 10,438.83. The

outstanding balance at the beginning of the month shall decrease by ₱ 10,438.83.

Step 2. Multiply the periodic interest rate by the outstanding balance at the beginning of

month

to determine how much of this payment will go toward interest.

For the first row, ₱ 120,000 x 0.00667 = P800.40

Step 3. Subtract the interest portion from the total payment at the end of the month to

determine the amount of principal paid for the period.

For the first row, ₱ 10,438.83 – ₱ 800.40 = ₱ 9,638.43

Step 4. Go to the next row and repeat only steps 2 through 4.

Below is the illustration of the equal amortization payment scheme above.

RO_Business Mathematics_Grade 11_Q3_LP 8 9

Month Outstanding principal at Repayment of principal Interest due at Total payment at

beginning of the month at end of the month end of the month end of the month

1st ₱ 120,000.00 ₱ 9,638.43 ₱ 800.40 ₱ 10,438.83

2nd 109,561.17 9,708.05 730.77 10,438.83

3rd 99,122.34 9,777.68 661.15 10,438.83

4th 88,683.51 9,847.31 591.52 10,438.83

5th 78,244.68 9,916.94 521.89 10,438.83

6th 67,805.85 9,986.56 452.27 10,438.83

7th 57,367.02 10,056.19 382.64 10,438.83

8th 46,928.19 10,125.82 313.01 10,438.83

9th 36,489.36 10,195.45 243.38 10,438.83

10th 26,050.53 10,265.07 173.76 10,438.83

11th 15,611.70 10,334.70 104.13 10,438.83

12th 5,172.87 10,404.37 34.50 10,438.83

Practice Exercises

1. Find the break-even point in units and in peso given that the unit price of a certain

commodity is ₱ 15.00; variable cost, ₱ 5.00; and total fixed cost, ₱ 12,000.

2. Grace merchandising’s variable cost per unit is P8.00. The company’s rent expense

is P4,000.00; salaries expense is P8,000.00 and bank loan amortization is

P4,000.00. If the company sold a total of P20,000.00 units yielding a total sale of

P200,000.00, find the BEP in units and BEP in pesos.

3. A polo costs Mr. Moreno P150.00 and he decides to mark it up by 20% of the selling

price. Find the selling price and mark-up for the said polo.

4. During a Grand Sale, a Nike sneaker regularly priced at P5,000.00 was sold at 55%

discount. The cost of the Nike sneaker is P3,540.00 and expenses are 12% of the

regular selling price.

a. How much is the selling price of Nike sneaker?

b. What was the amount of the mark-down?

c. What was the rate of mark-down?

5. A ₱ 7,800,500 loan was granted to Hyae Photography. The loan carries 9% annual

interest compounded quarterly for 3 years. Prepare an amortization schedule using

the equal amortization payment program. Use the table below as your guide.

Outstanding principal Repayment of Interest due at Total payment

Instalment

at beginning of the principal at end of end of the at end of the

Period

period the period period period

1st ₱ 7,800,500.00 ₱ ₱ ₱

2nd

3rd

4th

5th

6th

7th

8th

9th

10th

11th

12th

RO_Business Mathematics_Grade 11_Q3_LP 8 10

Evaluation

1. Big Sister company’s variable cost per unit is ₱ 5.00. The company’s salaries expense

for its employees is ₱ 6,000 and leasehold expense of ₱ 4,000. The unit price of their

main commodity is ₱ 13. Find the BEP in units and BEP in pesos.

2. The company’s variable cost per unit is ₱ 7.00 and total fixed cost is ₱ 9,000.00. if the

company sold a total of 10,000 units yielding a total sale of ₱ 150,000.00 ,find the

break-even point in units and in peso.

3. Naga Supermart paid P12,000 for a set of dishes. Expenses are 10% of the selling

price while the required profit is 15% of the selling price. During an inventory sale, the

set of dishes was marked down by 30%.

a. What was the regular selling price?

b. What was the sale price?

c. What was the profit or loss?

4. What is the amortization payment for a P500,000.00 loan which carries 12% annual

interest compounded monthly for 3 years?

5. A P30,000.00 loan was granted to a janitor carrying 6% interest compounded monthly

payable in a year. Prepare for him an amortization schedule using the equal principal

payments scheme. Use the table below as you guide.

Outstanding principal at Repayment of principal Interest due at end Total payment at

Month

beginning of the month at end of the month of the month end of the month

1 P30,000.00 P P P

2

3

4

5

6

7

8

9

10

11

12

Answer Key

Practice Exercises

1. The break-even point BEP in number of units would be:

X= FC

(P-v)

BEP in Units (x) = P12,000.00 = P12,000.00 =1,200.00 units

P 15-5 P10

The break- even point BEP in pesos would be:

BEP in Pesos = Unit Price x BEP in Units

BEP in Pesos = 1,200 units x P15 = P18,000.00

2. The break-even point BEP in number of units would be:

X= FC

(P-v)

Unit Price = P200,000/20,000 units

= P10.00

BEP in Units (x) =P16,000 = P16,000 = 8,000 units

RO_Business Mathematics_Grade 11_Q3_LP 8 11

P10-8 2

The break-even point BEP in pesos would be:

BEP in Pesos = Unit Price x BEP in units

BEP in Pesos = 8,000 units x P 10 = P80,000

3. 100% - 20% = 80% (Cost of polo is 80% of the selling price.)

C = 0.80S

150 = 0.80S

S = 150/.80

= P187.50

Mr. Moreno sells the polo at P187.50

MU = S – C

MU = P187.50 – P150.00

MU = P37.50

The mark-up on the polo is P37.50

4. A. 100% - 55% = 45% (the sale price is 45% of the selling price)

SP = 0.45 X S

= 0.45 X P5,000.00

= P2,250.00

The sale price of the Nike sneaker is P2,250.00

B. CTOTAL =C+E

= 3,540.00 + 0.12 X P5,000.00

= P4,140.00

P = SP – CTOTAL

= 2,250 – 4,140

= P1,890.00 (Loss)

The loss made on the sale was P1,890.00

C. Markdown rate = 1,890.00 / 2,250.00

= 84%

5.

Outstanding Repayment Interest due at

Total payment at

Instalment principal at of principal at end end of the period

end of the period

Period beginning of the of the period (col 2 x

(col 3 + col 4)

period (col 4 - col 3) 0.0225)

1st P7,800,500.00 P573,472.49 P175,511.25 P748,983.74

2nd 7,051,516.26 590,324.62 158,659.12 748,983.74

3rd 6,302,532.52 607,176.76 141,806.98 748,983.74

4th 5,553,548.78 624,028.89 124,954.85 748,983.74

5th 4,804,565.04 640,881.03 108,102.71 748,983.74

6th 4,055,581.30 657,733.16 91,250.58 748,983.74

7th 3,306,597.56 674,585.29 74,398.45 748,983.74

8th 2,557,613.82 691,437.43 57,546.31 748,983.74

9th 1,808,630.08 708,289.56 40,694.18 748,983.74

10th 1,059,646.34 725,141.70 23,842.04 748,983.74

11th 310,662.60 741,993.83 6,989.91 748,983.74

12th 0 0 0 0

Reflection

RO_Business Mathematics_Grade 11_Q3_LP 8 12

I have learned that ____________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

I wish to ask my teacher about __________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

References

1. Business Mathematics by Norma D. Lopez-Mariano, PhD

2. Business Mathematics Teaching Guide for Senior High School

3. Business Math Textbook (Government Property) Copyright @ 2016 by Vibal

Group, Inc and Brian Roy C. Lopez, Leah C. Martin-Lundag, and Keneth Adrian

Dagal. Pages 72-77 ,96-101

4. Business Mathematics by Norma D. Lopez-Mariano, PhDABM – Accountancy,

Business and Management K12 First Edition Pages 128-130

5. The Commission on Higher Education in collaboration with the Philippine Normal

University Teaching guide for Senior High School K-12 Business Mathematics pages

67-99.

Development Team

Writer: EMMYLOYD C. BIERSO, T-II

Editors/Reviewers: PAULO C. MOJOS, T-II

MARIA ASUNCION T. BRIZUELA, T-II

REYNALDO C. CAÑEZO JR., MT-I

JULMA B. CARGULLO, MT-I

DIOLETA B. BORAIS, EPS 1 MATHEMATICS

Layout Artist: ROSE ANN B. FLORENCIO, SST-I

RO_Business Mathematics_Grade 11_Q3_LP 8 13

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Deposit Product Record Form Individual Rev3a4 DEPEDDocument2 pagesDeposit Product Record Form Individual Rev3a4 DEPEDGladys Angela Valdemoro0% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Customer Information File Form - Individual Rev5 (8.5 X 13)Document2 pagesCustomer Information File Form - Individual Rev5 (8.5 X 13)KRYSTEL JUMANOYNo ratings yet

- Budget Sheet AcccDocument1 pageBudget Sheet AcccJohn GoodenNo ratings yet

- 004 - NRI - Main Application Form - FillableDocument6 pages004 - NRI - Main Application Form - FillableAnkur MishRraNo ratings yet

- Individual Daily Log and Accomplishment Report: Damaso R. Rubia Memorial High SchoolDocument8 pagesIndividual Daily Log and Accomplishment Report: Damaso R. Rubia Memorial High SchoolGladys Angela ValdemoroNo ratings yet

- E RPMS PORTFOLIO Design 4 - DepEdClickDocument42 pagesE RPMS PORTFOLIO Design 4 - DepEdClickGladys Angela ValdemoroNo ratings yet

- Universal Data Privacy Consent Form DEPEDDocument2 pagesUniversal Data Privacy Consent Form DEPEDGladys Angela Valdemoro50% (2)

- DepEd List of Expiring Cards For Renewal As of 10 19 2021 RevisedDocument174 pagesDepEd List of Expiring Cards For Renewal As of 10 19 2021 RevisedGladys Angela ValdemoroNo ratings yet

- Grades Sheets 12 ArchimedesDocument5 pagesGrades Sheets 12 ArchimedesGladys Angela ValdemoroNo ratings yet

- TGCIP Session 1Document63 pagesTGCIP Session 1Gladys Angela ValdemoroNo ratings yet

- SHS Class Teachers ProgramDocument7 pagesSHS Class Teachers ProgramGladys Angela ValdemoroNo ratings yet

- Mean Percentage Score TemplateDocument7 pagesMean Percentage Score TemplateGladys Angela ValdemoroNo ratings yet

- 201 File LabelDocument6 pages201 File LabelGladys Angela ValdemoroNo ratings yet

- UntitledDocument8 pagesUntitledGladys Angela ValdemoroNo ratings yet

- Creative NonfictionDocument13 pagesCreative NonfictionGladys Angela ValdemoroNo ratings yet

- FABM 1 Learning PlanDocument33 pagesFABM 1 Learning PlanGladys Angela ValdemoroNo ratings yet

- Org-Mgt Q1 M1Document12 pagesOrg-Mgt Q1 M1Gladys Angela ValdemoroNo ratings yet

- Table Of: Individual Learning Monitoring Plans Lesson Plans Teacher-Made/modified Learning ResourcesDocument19 pagesTable Of: Individual Learning Monitoring Plans Lesson Plans Teacher-Made/modified Learning ResourcesGladys Angela ValdemoroNo ratings yet

- Fundamentals of Accountancy, Business and Management 2 2Document14 pagesFundamentals of Accountancy, Business and Management 2 2Gladys Angela ValdemoroNo ratings yet

- Fundamentals of Accountancy, Business and Management 2 2: The Cash Flow Statement: Components and StructuresDocument15 pagesFundamentals of Accountancy, Business and Management 2 2: The Cash Flow Statement: Components and StructuresGladys Angela ValdemoroNo ratings yet

- Fundamentals of Accountancy, Business and Management 2 2Document15 pagesFundamentals of Accountancy, Business and Management 2 2Gladys Angela ValdemoroNo ratings yet

- Fundamentals of Accountancy, Business and Management 2 2: (Fabm 2)Document16 pagesFundamentals of Accountancy, Business and Management 2 2: (Fabm 2)Gladys Angela Valdemoro100% (1)

- Fundamentals of Accountancy, Business and Management 2 2: Elements of The Statement of Comprehensive IncomeDocument16 pagesFundamentals of Accountancy, Business and Management 2 2: Elements of The Statement of Comprehensive IncomeGladys Angela ValdemoroNo ratings yet

- Input Data Sheet For SHS E-Class Record: Learners' NamesDocument7 pagesInput Data Sheet For SHS E-Class Record: Learners' NamesGladys Angela ValdemoroNo ratings yet

- Fundamentals of Accountancy, Business and Management 2 2: Statement of Financial Position - Account FormDocument14 pagesFundamentals of Accountancy, Business and Management 2 2: Statement of Financial Position - Account FormGladys Angela ValdemoroNo ratings yet

- 1st Periodical Test in Oral Com - in ContextDocument1 page1st Periodical Test in Oral Com - in ContextGladys Angela ValdemoroNo ratings yet

- HARI - SHANKAR U - Resume - 23Document1 pageHARI - SHANKAR U - Resume - 23eg0mqx80No ratings yet

- Star Two V Paper CityDocument2 pagesStar Two V Paper CityPam RamosNo ratings yet

- Antichresis HandoutDocument3 pagesAntichresis HandoutKC ManglapusNo ratings yet

- Everything You Need To Know About Buying A New HomeDocument15 pagesEverything You Need To Know About Buying A New HomeAna BandeiraNo ratings yet

- Calculating Return On Investment in Real EstateDocument10 pagesCalculating Return On Investment in Real EstateKdedjeNo ratings yet

- Good Faith EstimateDocument3 pagesGood Faith EstimateafncorpNo ratings yet

- 2011 ANZ Annual ResultsDocument132 pages2011 ANZ Annual ResultsArvind BhisikarNo ratings yet

- Is Your Mortgage Status Designated - Inactive - (MERS)Document9 pagesIs Your Mortgage Status Designated - Inactive - (MERS)mptacly9152No ratings yet

- Office Assistant Resume Sample: Your Full NameDocument7 pagesOffice Assistant Resume Sample: Your Full NameAnna ChristineNo ratings yet

- CORE 3 - Handle FinancesDocument86 pagesCORE 3 - Handle FinancesMarizon Pagalilauan MuñizNo ratings yet

- Fom 12 Midterm Review of AwesomenessDocument38 pagesFom 12 Midterm Review of AwesomenessSauel snyderNo ratings yet

- Wesco 1990 Letter To ShareholdersDocument20 pagesWesco 1990 Letter To ShareholdersBuySideMetricsNo ratings yet

- CTBC App Form 3Document2 pagesCTBC App Form 3Quen RamosNo ratings yet

- Spoorthi BennurDocument58 pagesSpoorthi BennurSarva ShivaNo ratings yet

- Provincial Assessors Office Citizens CharterDocument6 pagesProvincial Assessors Office Citizens CharterMeryl Cayla C. GuintuNo ratings yet

- Edgington V Fitzmaurice (1885) EWCA Civ 1 (7 March 1885)Document4 pagesEdgington V Fitzmaurice (1885) EWCA Civ 1 (7 March 1885)nassaropiyo15No ratings yet

- Here Is Where The Parties Provide For Their Offers and Bargain With Each Other."Document12 pagesHere Is Where The Parties Provide For Their Offers and Bargain With Each Other."Madeline AtintoNo ratings yet

- Fomc Minutes 20230201Document13 pagesFomc Minutes 20230201ZerohedgeNo ratings yet

- Majestic Tamworth InformationDocument29 pagesMajestic Tamworth InformationMetaGaxy DAONo ratings yet

- Trường Đại Học Kinh Tế - Đhqg Hà NộiDocument11 pagesTrường Đại Học Kinh Tế - Đhqg Hà NộiPhan Thị Thu ThảoNo ratings yet

- Final MortgageDocument5 pagesFinal Mortgageapi-301270815No ratings yet

- 5 Top French Mortgage TipsDocument8 pages5 Top French Mortgage TipsWanro SwanepoelNo ratings yet

- Highlights of Proposed Ability-To-Repay RulesDocument3 pagesHighlights of Proposed Ability-To-Repay RulesForeclosure FraudNo ratings yet

- Attorney Steven N. Malitz Litigation VictoriesDocument15 pagesAttorney Steven N. Malitz Litigation VictoriesArnstein & Lehr LLPNo ratings yet

- 1 Subdivision Development Dec11 PowerpointDocument128 pages1 Subdivision Development Dec11 Powerpointjomarie apolinarioNo ratings yet

- Bank of IndiaDocument17 pagesBank of IndiaShawn BuckNo ratings yet

- Asian Cathay Finance and Leasing Corporation vs. GravadorDocument12 pagesAsian Cathay Finance and Leasing Corporation vs. GravadorAnonymous WDEHEGxDhNo ratings yet

- Ira Sohn Presentation 2014.05.05Document111 pagesIra Sohn Presentation 2014.05.05Zerohedge50% (2)