Professional Documents

Culture Documents

Financial History and Ratios

Uploaded by

Rosana Alves LaudelinoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial History and Ratios

Uploaded by

Rosana Alves LaudelinoCopyright:

Available Formats

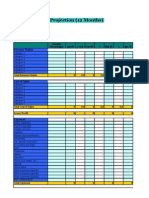

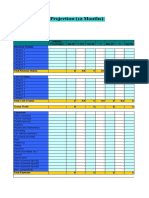

Financial history & ratios

Enter your Company Name here

In Thousands

Fiscal Year Ends Jun-30

RMA Current: from

Average mm/yyyy to

% mm/yyyy % 2000 % 1999 % 1998 %

Assets

Cash/ Equivalents £ - - £ - - £ Notes -on Preparation - £ - -

Trade Receivables - - - - - may want to -print this information

Note: You - -

to use as reference

Inventory Value - - - - later. To

- delete these instructions,

- click the

- border of this

- text box

All other current - - - - and then- press the DELETE

- key. - -

Total Current The value of a spreadsheet is that it puts a lot of information in one

Assets - - - - place to - facilitate comparison

- - Enter information

and analysis. - from

Fixed Assets (net) - - - - your past- three years' financial

- statements

- and from current

- year-to-

Intangibles (net) - - - - date statements,

- if available,

- but simplify

- the information

- in two ways

to fit into this format:

All other - - - - - - - -

Total Assets £ - 0.00% £ - 0.00% £ 1] Compress

- your0.00% £

chart of accounts. - financial

Your 0.00%

statements, no

doubt, have many more lines than are provided on this spreadsheet.

Combine categories to fit your numbers into this format.

Liabilities/ Equity %

2] Condense the numbers for ease of comprehension. We

Notes payable (ST) £ - - £ - - £ recommend

- that you express

- £ your values

- in thousands,

-

Current L. T. Debt - - - - rounding

- to the nearest

- £100; i.e., £3,275

- would be entered

- as

$3.3.

Trade Payables - - - - - - - -

Income Tax 3] Fill in the "RMA Avg." column.

Payable - - - - a. "RMA" - refers to the book

- Statement Studies,

- published

- annually

by Robert Morris Associates, who are now called the Risk

All other current - - - - - - - -

Management Association. The book contains financial average data

Total Current sorted by type of business and size of firm. It is a standard reference

Liabilities - - - - -

for bankers and -

financial analysts. You -

can find it at - libraries,

major

Long-term Debt - - - - or ask -your banker. - - -

b. Enter the percentages and ratios from RMA for your size and type

Deferred Taxes - - - - -

of business in the "RMA- Avg." column. You

- will note that- the format

All other non- of our spreadsheet is exactly the same as the format in the RMA

current - - - - book. - - - -

Net Worth - - - - c. Note- that for some of- the ratios, the RMA

- book gives- three

numbers. These are the median (the value in the middle of the

Total Liabilities & range; i.e.: the "average"), the upper quartile (the value half way

Net Worth £ - 0.00% £ - 0.00% £ between - the middle0.00% £

and the extreme - case),

upper 0.00%

and the lower

quartile (the value half way between the middle and the extreme

lower case).

Income Data %

Net Sales £ - 100.00% £ - 100.00% £ 4] Analyse

- 100.00%

your £

financial history: - 100.00%

Cost of Sales a. Look for significant changes in absolute values (£) or relative

(COGS) - - - - distribution

- of Assets, Liabilities,

- or Expenses

- (%). What- do these

changes tell you about how your company is evolving?

Gross Profit - - - - b. Also- look for changes- in your ratios. -Why are ratio values

- shifting,

Operating and what does this mean?

Expenses - - - - c. If you

- are unfamiliar with

- ratio analysis, - study the "Explanation

- ...

Operating Profit - - - - and Definition

- of Ratios"- sections near the- front of the RMA

- book.

They are exceptionally clear and well written. Periodic ratio analysis

All other expenses - - - - - you valuable insights

will give - -

into the financial - of your

dynamics

Pre-tax Profit £ - - £ - - £ company.- - £ - -

d. If your ratio values differ from the industry average for similar

firms, try to understand why, and explain in the business plan.

Ratio Analysis

Current Ratio 0.0 - - - -

Inventory Turnover 0.0 - - - -

Debt/ Net Worth 0.0 - - - -

% Return on Tang.

N/W 0.00% - - - -

% Return on

Assets 0.00% - - - -

You might also like

- Financial History & Ratios: Enter Your Company Name HereDocument1 pageFinancial History & Ratios: Enter Your Company Name HereJeffrey BahnsenNo ratings yet

- Financial History & Ratios: Enter Your Company Name HereDocument1 pageFinancial History & Ratios: Enter Your Company Name HereNadia.ishaqNo ratings yet

- Financial History and Ratios1Document1 pageFinancial History and Ratios1Omotola Olukayode OsineyeNo ratings yet

- Company Financial History and RatiosDocument1 pageCompany Financial History and Ratiospradhan13No ratings yet

- Financial History and Ratios1Document1 pageFinancial History and Ratios1Mukhlish AkhatarNo ratings yet

- Four Year Profit ProjectionDocument1 pageFour Year Profit ProjectionDebbieNo ratings yet

- Four Year Profit Projection: Enter Your Company Name HereDocument1 pageFour Year Profit Projection: Enter Your Company Name HereMisscreant EveNo ratings yet

- Four Year Profit ProjectionDocument1 pageFour Year Profit Projectiondamir101No ratings yet

- Company Name: Purchase Without Tax Invoice / Exp Incl BillDocument10 pagesCompany Name: Purchase Without Tax Invoice / Exp Incl BillrockyrrNo ratings yet

- SCABAADocument3 pagesSCABAAHelen Joy Grijaldo JueleNo ratings yet

- Precedent Transaction Template - NewDocument5 pagesPrecedent Transaction Template - NewAmay SinghNo ratings yet

- Financial History and Ratios 08Document1 pageFinancial History and Ratios 08poornimaR100% (2)

- Annual Organization Budget With Cash FlowDocument6 pagesAnnual Organization Budget With Cash FlowDiegoNo ratings yet

- 3-Year Profit and Loss Projection: Merca OnlineDocument3 pages3-Year Profit and Loss Projection: Merca OnlineOrlandoAvendañoNo ratings yet

- Profit and Loss ProjectionDocument3 pagesProfit and Loss ProjectionDokumen SayaNo ratings yet

- BookkeepingDocument4 pagesBookkeepingAriel MercialesNo ratings yet

- (Lengkap) Templete Laporan Keuangan UMKMDocument59 pages(Lengkap) Templete Laporan Keuangan UMKMHardi alifinNo ratings yet

- Delay Analysis 2019Document4 pagesDelay Analysis 2019Alsayed DiabNo ratings yet

- Financial TemplateDocument6 pagesFinancial TemplateLiyin LeeNo ratings yet

- GST Annual Return 2021 2022Document99 pagesGST Annual Return 2021 2022AUTHENTIC SURSEZNo ratings yet

- Anexo 3 - Plantilla PresupuestalDocument4 pagesAnexo 3 - Plantilla PresupuestalDann PerezNo ratings yet

- Cash Flow SpreadsheetDocument4 pagesCash Flow SpreadsheetIzwan HafizNo ratings yet

- 6,13 Open EconomyDocument7 pages6,13 Open EconomyHiệp Nguyễn Thị MinhNo ratings yet

- Template Trading ComparablesDocument3 pagesTemplate Trading ComparablesAmay SinghNo ratings yet

- Four Year Profit ProjectionDocument1 pageFour Year Profit Projectionbaderf75No ratings yet

- 11 Abab Ppe Lapsing As of November 2021Document47 pages11 Abab Ppe Lapsing As of November 2021cedro08No ratings yet

- Work Program 26 Oct 2021Document4 pagesWork Program 26 Oct 2021Muhammad QasimNo ratings yet

- FLA Budget Template 9yU3DcADocument8 pagesFLA Budget Template 9yU3DcAGoytom NeayeNo ratings yet

- 1707317440553-BOQ Kako-Waia Road Improvement .XLSX 2Document1 page1707317440553-BOQ Kako-Waia Road Improvement .XLSX 2marabsagenciesltdNo ratings yet

- SSC TBH Dump Prints Ps Rlip v1Document3 pagesSSC TBH Dump Prints Ps Rlip v1Giovanni Ondong TabanaoNo ratings yet

- 2.041 Project Cost ReportDocument13 pages2.041 Project Cost Reportpratik ghavateNo ratings yet

- CNHS Canteen E-SalesDocument1 pageCNHS Canteen E-Salestiffany portezNo ratings yet

- PL Bs FormatDocument782 pagesPL Bs FormatNATIONAL FARMERS PRODUCER COMPANYNo ratings yet

- 12 Month Profit and Loss WorksheetDocument6 pages12 Month Profit and Loss Worksheetaregb18No ratings yet

- P-9 Cost Estimating WorksheetDocument3 pagesP-9 Cost Estimating WorksheetλλNo ratings yet

- Masterclass DSDocument11 pagesMasterclass DS71762202100No ratings yet

- Profit and Loss StatementDocument3 pagesProfit and Loss Statementchetnaa100% (1)

- Profit Loss 12 MonthDocument6 pagesProfit Loss 12 MonthMstefNo ratings yet

- Exchange Rates Submission Through SmartView For BudgetDocument3 pagesExchange Rates Submission Through SmartView For BudgetVuruvakilisurya PrakashNo ratings yet

- Writing Skill OneDocument1 pageWriting Skill OneSylvia CHENNo ratings yet

- 5.random ForestDocument12 pages5.random Forestpatil_555No ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisVdvg SrinivasNo ratings yet

- Adobe Scan Dec 29, 2023Document1 pageAdobe Scan Dec 29, 2023jarnav003No ratings yet

- Business Budget 12monthsDocument4 pagesBusiness Budget 12monthsArie KristionoNo ratings yet

- High Level Building Blocks - DrawioDocument1 pageHigh Level Building Blocks - DrawioSumanta DuttaNo ratings yet

- Salary Adjustment SpreadsheetDocument4 pagesSalary Adjustment SpreadsheetanasNo ratings yet

- Ratio (3 Marks)Document4 pagesRatio (3 Marks)mehtaharshit0709No ratings yet

- Power Generation Financial ModelDocument56 pagesPower Generation Financial ModelArun Munjal20% (5)

- Business-Budget 12monthsDocument5 pagesBusiness-Budget 12monthsSRININo ratings yet

- Cash-Flow Lunar: Luna Ian. Feb. Mar. Apr. Mai IncasariDocument2 pagesCash-Flow Lunar: Luna Ian. Feb. Mar. Apr. Mai IncasariCalinCristeaNo ratings yet

- Date-Shift Input Your CGL 2019 Raw Mark As Per Answer KeyDocument4 pagesDate-Shift Input Your CGL 2019 Raw Mark As Per Answer Keypiyush33% (3)

- Fast - R & Pay.Document128 pagesFast - R & Pay.sufyanNo ratings yet

- CFA Level 1 Quant NotesDocument13 pagesCFA Level 1 Quant NotesAbhi BehlNo ratings yet

- Business-Budget 12monthsDocument6 pagesBusiness-Budget 12monthsReza KurniaNo ratings yet

- 01 Chapter 0 and Chapter 1 Class Notes Part 1Document40 pages01 Chapter 0 and Chapter 1 Class Notes Part 1Ameen AhmadNo ratings yet

- A-BD-09-WIP SheetDocument31 pagesA-BD-09-WIP SheetIrfan BiradarNo ratings yet

- New Kuswaha Electric CentreDocument12 pagesNew Kuswaha Electric Centreafroz khanNo ratings yet

- Status FormatDocument4 pagesStatus FormatAlven Villena DicenNo ratings yet

- McDonalds Financial AnalysisDocument11 pagesMcDonalds Financial AnalysisHooksA01No ratings yet

- Export Excel Dashboards ToDocument19 pagesExport Excel Dashboards ToKhuda BukshNo ratings yet

- Depreciation Methods Comparison1Document8 pagesDepreciation Methods Comparison1Rosana Alves LaudelinoNo ratings yet

- Detailed Sales ForecastDocument3 pagesDetailed Sales ForecastRosana Alves LaudelinoNo ratings yet

- Curva ABC: Item Preço Médio VendasDocument6 pagesCurva ABC: Item Preço Médio VendasRosana Alves LaudelinoNo ratings yet

- Controle de VisitasDocument42 pagesControle de VisitasRosana Alves LaudelinoNo ratings yet

- Contas A Pagar e Receber DashboardDocument39 pagesContas A Pagar e Receber DashboardRosana Alves LaudelinoNo ratings yet

- Planilha - Cálculo Cartão de CréditoDocument3 pagesPlanilha - Cálculo Cartão de Créditodaniel sampaioNo ratings yet

- SABRE GDS Booking Instructions For Transavia PDFDocument51 pagesSABRE GDS Booking Instructions For Transavia PDFMáté Bence TóthNo ratings yet

- Controle de ProduçãoDocument65 pagesControle de ProduçãoRosana Alves LaudelinoNo ratings yet

- Concepts & Conventions in AccountingDocument5 pagesConcepts & Conventions in Accountingpratz dhakateNo ratings yet

- FABM 1 NotesDocument6 pagesFABM 1 NotesAnne MoralesNo ratings yet

- Chapter One: Dividend and Dividend PolicyDocument34 pagesChapter One: Dividend and Dividend PolicyEyayaw AshagrieNo ratings yet

- Hedge Funds ProjectDocument8 pagesHedge Funds ProjectAyesha PattnaikNo ratings yet

- Capital Budegting - Project and Risk AnalysisDocument46 pagesCapital Budegting - Project and Risk AnalysisUpasana Thakur100% (1)

- Axa Philippines Mock Exam-Investment Link Products (Vul)Document7 pagesAxa Philippines Mock Exam-Investment Link Products (Vul)SHAMIR LUSTRE100% (1)

- Prasun Patel - Banking & FinanceDocument3 pagesPrasun Patel - Banking & FinanceGhanshyam NfsNo ratings yet

- OpTransactionHistory30 10 2023Document12 pagesOpTransactionHistory30 10 2023bimalNo ratings yet

- Chevron FCFF 4.4.23Document3 pagesChevron FCFF 4.4.23William RomeroNo ratings yet

- FM Skill Based Questions - 2Document2 pagesFM Skill Based Questions - 2rohitcshettyNo ratings yet

- SudhirDocument79 pagesSudhirRakshit KashyapNo ratings yet

- Daily Fund Report-PCSO Daily ReportDocument2 pagesDaily Fund Report-PCSO Daily ReportFranz Thelen Lozano CariñoNo ratings yet

- Types of Valuing Goodwill: (A) Simple Profit MethodDocument3 pagesTypes of Valuing Goodwill: (A) Simple Profit MethodcnagadeepaNo ratings yet

- ADM Monthly and Quarterly Contest - AMJ'18Document16 pagesADM Monthly and Quarterly Contest - AMJ'18dharam singhNo ratings yet

- SPF Managed SBLC Program OverviewDocument22 pagesSPF Managed SBLC Program OverviewPattasan UNo ratings yet

- Topic 2 (A) - The Recording ProcessDocument53 pagesTopic 2 (A) - The Recording ProcessNabilah NajwaNo ratings yet

- Cheng Company: Selected Transactions From The Journal of June Feldman, Investment Broker, Are Presented BelowDocument4 pagesCheng Company: Selected Transactions From The Journal of June Feldman, Investment Broker, Are Presented BelowHà Anh Đỗ100% (1)

- Chapter 2Document22 pagesChapter 2John Edwinson JaraNo ratings yet

- FormSchV 261110 For The FY Ending On 310310 24 .PDF Veenapani VanijyaDocument8 pagesFormSchV 261110 For The FY Ending On 310310 24 .PDF Veenapani VanijyaParasNo ratings yet

- The Legend of Situ BagenditDocument3 pagesThe Legend of Situ BagenditVisby NNo ratings yet

- Module1-Assignment 3 - 2017ABPS1332HDocument14 pagesModule1-Assignment 3 - 2017ABPS1332HNamitNo ratings yet

- Overcoming Challenges in An Unrecognized EconomyDocument8 pagesOvercoming Challenges in An Unrecognized Economyamira yonisNo ratings yet

- Finance 16UCF519-FINANCIAL-MANAGEMENTDocument23 pagesFinance 16UCF519-FINANCIAL-MANAGEMENTHuzaifa Aman AzizNo ratings yet

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Solution 1674112112Document47 pagesCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Solution 1674112112pari maheshwariNo ratings yet

- CF Assignment Draft 1Document3 pagesCF Assignment Draft 138Nguyễn Ngọc Bảo TrânNo ratings yet

- Chapters 6-10 PDFDocument40 pagesChapters 6-10 PDFeuwilla100% (4)

- Customer Satisfaction Canara BankDocument53 pagesCustomer Satisfaction Canara BankAsrar70% (10)

- Lembar Kerja Unit 3 - PT Prima ElektronikDocument12 pagesLembar Kerja Unit 3 - PT Prima ElektronikNi'matul Mukarromah100% (1)

- Chapter 10 - Cash and Financial InvestmentsDocument2 pagesChapter 10 - Cash and Financial InvestmentsLouiza Kyla AridaNo ratings yet