Professional Documents

Culture Documents

Four Year Profit Projection

Uploaded by

damir101Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Four Year Profit Projection

Uploaded by

damir101Copyright:

Available Formats

Four Year Profit Projection

Enter your Company Name here

2002 % 2003 % 2004 % 2005 %

Sales $ - 100.00% $ - 100.00% $ - 100.00% $ - 100.00%

Cost/ Goods Sold (COGS) - - - - - - - -

Gross Profit $ - - $ - - $ - - $ - -

Operating Expenses

Notes on Preparation

Salary (Office & Overhead) $ - - $ - - $ - - $ - -

Payroll (taxes etc.) - - - - - - -

Note: You may want to print this information to use as reference later. To delete these instructions, click the -

Outside Services - - border of this text- box and then press

- the DELETE key.- - - -

Supplies (off and operation) - - - is not a necessary

A long term forecast - part of a basic -business plan. However,

- - tool to help you-

it is an excellent

Repairs/ Maintenance - - -

open up your thinking -

about the company's -

future. Furthermore, -

venture capitalists - always want a -

will almost

long term forecast to get a feel for growth prospects.

Advertising - - - forecast, the less- accuracy you can- maintain, so use round

The further out you - - where you know

numbers, except -

Car, Delivery and Travel - - - rent expense if-you have a long term

exact amounts; e.g.: - lease. - - -

Accounting and Legal - - The most important- part of the long -term forecast is not- the numbers themselves,

- but the assumptions

- underlying

-

the numbers. So make sure your assumptions are stated clearly and in detail in a narrative attachment. This will

Rent - - communicate your - vision of the company's

- - you anticipate -realizing that vision.

future and how - -

Telephone - - You will note that-there are some lines

- on the bottom of- this spreadsheet which

- may not be on - a twelve-month P-

& L. This is to help you do some planning about funding growth:

Utilities - - -

- NET PROFIT BEFORE TAX is the-same as Net Profit- on a 12-month Profit

- and Loss spreadsheet.

- -

Insurance - - -

- INCOME TAX allows - how much of your

you to estimate - profit will have to- go to the IRS. - -

- NET PROFIT AFTER TAX is what is left for you to use.

Taxes (real estate etc.) - - - - - -

- OWNER DRAW/ DIVIDENDS is how much the owners plan to take out for themselves. - -

Interest - - - - - -

- ADJUSTMENT TO RETAINED EARNINGS is the amount of profit actually left in the business to increase- -

Depreciation - - Owners' Equity and- fund growth. - - - - -

Other expense (specify) - - - - - - - -

Other expense (specify) - - - - - - - -

Total Expenses $ - - $ - - $ - - $ - -

Net Profit Before Tax - - - -

Income Taxes - - - -

Net Profit After Tax - - - -

Owner Draw/ Dividends - - - -

Adj. to Retained Earnings $ - $ - $ - $ -

You might also like

- Inquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPDocument10 pagesInquiry Ali Vasquez The Florida Bar Re UPL Marty Stone MRLPNeil GillespieNo ratings yet

- ChatGPT PromptsDocument105 pagesChatGPT PromptsJohn ErichNo ratings yet

- Coti GIW Rep 26x28LSA PDFDocument3 pagesCoti GIW Rep 26x28LSA PDFjohan diazNo ratings yet

- Budgeting and Forecasting: and The Impact On ProfitabilityDocument33 pagesBudgeting and Forecasting: and The Impact On ProfitabilityHassan AzizNo ratings yet

- Investment Banking ExcelDocument28 pagesInvestment Banking ExcelJohn ChiwaiNo ratings yet

- Magic Quadrant For G 734654 NDXDocument35 pagesMagic Quadrant For G 734654 NDXm.ankita92No ratings yet

- Slip Gaji (3)Document2 pagesSlip Gaji (3)Olele Olala50% (2)

- Profit and Loss ProjectionDocument3 pagesProfit and Loss ProjectionDokumen SayaNo ratings yet

- Pt. Patco Elektronik Teknologi Standard Operating Procedure PurchasingDocument8 pagesPt. Patco Elektronik Teknologi Standard Operating Procedure Purchasingmochammad iqbal100% (1)

- CitikeyDocument54 pagesCitikeyJacob PochinNo ratings yet

- IT Budget Template ExcelDocument6 pagesIT Budget Template ExcelJosé Manuel Montero OrtegaNo ratings yet

- Case Study-Design Thinking in IBMDocument50 pagesCase Study-Design Thinking in IBMSANYA KAPOORNo ratings yet

- Your CFO Guy - 7 Chart TemplatesDocument6 pagesYour CFO Guy - 7 Chart TemplatesOaga GutierrezNo ratings yet

- Hyundai Forklift Trucks Service Manual Updated 09 2021 Offline DVDDocument23 pagesHyundai Forklift Trucks Service Manual Updated 09 2021 Offline DVDwalterwatts010985wqa100% (129)

- Chapter IDocument6 pagesChapter IRamir Zsamski Samon100% (2)

- Case Study 3: Fountain Pens LimitedDocument3 pagesCase Study 3: Fountain Pens Limitedtanya singh100% (1)

- Separate and Consolidated Dayag Part 6Document4 pagesSeparate and Consolidated Dayag Part 6NinaNo ratings yet

- Four Year Profit Projection: Enter Your Company Name HereDocument1 pageFour Year Profit Projection: Enter Your Company Name HereMisscreant EveNo ratings yet

- Four Year Profit ProjectionDocument1 pageFour Year Profit ProjectionDebbieNo ratings yet

- Four Year Profit ProjectionDocument1 pageFour Year Profit Projectionbaderf75No ratings yet

- ME13Document4 pagesME13Joana Marie SajolNo ratings yet

- Financial History & Ratios: Enter Your Company Name HereDocument1 pageFinancial History & Ratios: Enter Your Company Name HereNadia.ishaqNo ratings yet

- Financial History and RatiosDocument1 pageFinancial History and RatiosRosana Alves LaudelinoNo ratings yet

- Company Financial History and RatiosDocument1 pageCompany Financial History and Ratiospradhan13No ratings yet

- Financial History & Ratios: Enter Your Company Name HereDocument1 pageFinancial History & Ratios: Enter Your Company Name HereJeffrey BahnsenNo ratings yet

- Financial Statement of Company Plus Class NotesDocument10 pagesFinancial Statement of Company Plus Class NotesAlex FernandoNo ratings yet

- Financial History and Ratios1Document1 pageFinancial History and Ratios1Omotola Olukayode OsineyeNo ratings yet

- Financial History and Ratios1Document1 pageFinancial History and Ratios1Mukhlish AkhatarNo ratings yet

- Financial TemplateDocument6 pagesFinancial TemplateLiyin LeeNo ratings yet

- Balance Sheet (Projected) : Enter Your Company Name HereDocument1 pageBalance Sheet (Projected) : Enter Your Company Name HereFadiNo ratings yet

- Vishnu Parmar, IBA Vishnu Parmar, IBA University of Sindh, Jamshoro University of Sindh, JamshoroDocument30 pagesVishnu Parmar, IBA Vishnu Parmar, IBA University of Sindh, Jamshoro University of Sindh, JamshoroSehrish DogarNo ratings yet

- Balance Sheet (Projected) : Enter Your Company Name HereDocument1 pageBalance Sheet (Projected) : Enter Your Company Name Hereshahana salimNo ratings yet

- 353147462-Ex Cel-Constr Uction-Pr Oject-Manag Ement-Tem Plates-Constr Uction-Bud Get-Temp LateDocument2 pages353147462-Ex Cel-Constr Uction-Pr Oject-Manag Ement-Tem Plates-Constr Uction-Bud Get-Temp LateBob RenauxNo ratings yet

- Igloa - Costs SpeasioDocument1 pageIgloa - Costs SpeasioSteve MedhurstNo ratings yet

- PT 1Document5 pagesPT 1Loraine SegumalianNo ratings yet

- Firms With Negative EarningsDocument10 pagesFirms With Negative Earningsakhil reddy kalvaNo ratings yet

- Form 2 Pondy Hex Plant 160614Document7 pagesForm 2 Pondy Hex Plant 160614Anonymous qNNkLoVksNo ratings yet

- Ratio CalculationDocument9 pagesRatio CalculationNazrinNo ratings yet

- The Financial Plan: Hisrich Peters ShepherdDocument24 pagesThe Financial Plan: Hisrich Peters ShepherdStylo ButtniNo ratings yet

- Balance Sheet Projected 1Document1 pageBalance Sheet Projected 1Marco Antônio Rodrigues SilvaNo ratings yet

- Balance Sheet (Projected) : Enter Your Company Name HereDocument1 pageBalance Sheet (Projected) : Enter Your Company Name HereMUHAMMAD -No ratings yet

- (Lengkap) Templete Laporan Keuangan UMKMDocument59 pages(Lengkap) Templete Laporan Keuangan UMKMHardi alifinNo ratings yet

- Balance Sheet Projected 1Document1 pageBalance Sheet Projected 1Fred CastroNo ratings yet

- Automated or Computerized Payroll System: by Marjorie D. Escueta Marvin E. Prendol Sonnylyn R. Rico Apple Rose C. YanongDocument46 pagesAutomated or Computerized Payroll System: by Marjorie D. Escueta Marvin E. Prendol Sonnylyn R. Rico Apple Rose C. YanongJamimi MimiNo ratings yet

- Mapas Mentales y ConceptualesDocument6 pagesMapas Mentales y ConceptualesAlex OsorioNo ratings yet

- Employee AttritionDocument37 pagesEmployee AttritionChandan Priyadarshi100% (1)

- First Accomplishment ProjectionsDocument26 pagesFirst Accomplishment Projectionsmoses kisakyeNo ratings yet

- Azurea Spa - Bohol Yearly Budget TemplateDocument2 pagesAzurea Spa - Bohol Yearly Budget TemplateAzurea SpaNo ratings yet

- Rubric Sa Pag UulatDocument1 pageRubric Sa Pag UulatGabrielle AlonzoNo ratings yet

- Ratio (3 Marks)Document4 pagesRatio (3 Marks)mehtaharshit0709No ratings yet

- WhizdmDocument99 pagesWhizdmVikas ShahNo ratings yet

- Sample Expense ReportDocument1 pageSample Expense Reportmharaynel.afableNo ratings yet

- Balance Sheet Projected 1Document1 pageBalance Sheet Projected 1Carlos CoutoNo ratings yet

- Start Up Costs CalculatorDocument5 pagesStart Up Costs CalculatorSmita KumarNo ratings yet

- Full Case Study - WeWorkDocument16 pagesFull Case Study - WeWorkVanshika SharmaNo ratings yet

- USAID SMEA Project: Guidance On Grant Application Budget FormDocument6 pagesUSAID SMEA Project: Guidance On Grant Application Budget FormCh. Muhammad AnwarNo ratings yet

- Template For Financial ProjectionDocument32 pagesTemplate For Financial ProjectionRussel Jess HeyranaNo ratings yet

- Thomas Frank's Budget Modeler Template!Document13 pagesThomas Frank's Budget Modeler Template!Andreas FosshaugNo ratings yet

- ACC 201 Company Accounting Workbook Template 2Document20 pagesACC 201 Company Accounting Workbook Template 2dee.ride.wit.meNo ratings yet

- 1699611082master Web Ad - TV 14112023Document11 pages1699611082master Web Ad - TV 14112023javedNo ratings yet

- LLH9e Appendix ADocument40 pagesLLH9e Appendix ASANCHITA PATINo ratings yet

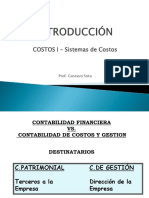

- COSTOS I - Sistemas de Costos: Prof. Gustavo SotaDocument30 pagesCOSTOS I - Sistemas de Costos: Prof. Gustavo SotaMauro CabreraNo ratings yet

- EntrepreneurshipDocument4 pagesEntrepreneurshipcauilan.cameron11No ratings yet

- 20Paper20and20Printing20Brochure201.1920 20webspreadsDocument7 pages20Paper20and20Printing20Brochure201.1920 20webspreadsBenjie DucutNo ratings yet

- Work System DesignDocument51 pagesWork System Designadarsh vemaliNo ratings yet

- Traf Presentation India WebcastDocument48 pagesTraf Presentation India WebcastSwastik GroverNo ratings yet

- Session 7: Estimating Cash Flows: Aswath DamodaranDocument15 pagesSession 7: Estimating Cash Flows: Aswath Damodaranthomas94josephNo ratings yet

- 3-Year Profit and Loss Projection: Merca OnlineDocument3 pages3-Year Profit and Loss Projection: Merca OnlineOrlandoAvendañoNo ratings yet

- Análisis EstratégicoDocument1 pageAnálisis EstratégicoMarlon VelezNo ratings yet

- Market Structure & PricingDocument42 pagesMarket Structure & PricingsuperanujNo ratings yet

- Six Sigma Project Charter TemplateDocument7 pagesSix Sigma Project Charter TemplateBhuvan B.SNo ratings yet

- L.C.Gupta Committee PurposeDocument3 pagesL.C.Gupta Committee PurposeAbhishek Kumar SinghNo ratings yet

- Waste To WealthDocument13 pagesWaste To Wealthprashant singhNo ratings yet

- Money Indian Currency Is Rupees and Paise. Let Us Look at Some Currency Notes and Coins That We UseDocument6 pagesMoney Indian Currency Is Rupees and Paise. Let Us Look at Some Currency Notes and Coins That We UseDhivya APNo ratings yet

- LEGAL ETHICS. Canon 2Document27 pagesLEGAL ETHICS. Canon 25h1tfac3No ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAron Rabino ManaloNo ratings yet

- MHI-05-D11 - CompressedDocument4 pagesMHI-05-D11 - CompressedDr. Amit JainNo ratings yet

- ECO Ebook by CA Mayank KothariDocument404 pagesECO Ebook by CA Mayank KothariHemanthNo ratings yet

- The Rise of NFT FundraisingDocument36 pagesThe Rise of NFT FundraisingTrader CatNo ratings yet

- Review of Related Literature OutlineDocument4 pagesReview of Related Literature OutlineSiote ChuaNo ratings yet

- Business Management Case Study: Ducal Aspirateurs: Instructions To CandidatesDocument5 pagesBusiness Management Case Study: Ducal Aspirateurs: Instructions To CandidatesJuan Antonio Limo DulantoNo ratings yet

- Sue PisciottaDocument3 pagesSue PisciottaSubhadip Das SarmaNo ratings yet

- Economic Influences On Logistics - Business Case Study 2023Document3 pagesEconomic Influences On Logistics - Business Case Study 2023Bowie LeckieNo ratings yet

- Labor Costs in Manufacturing IndustriesDocument18 pagesLabor Costs in Manufacturing Industriesminhduc2010No ratings yet

- Bs in Business Administration Marketing Management: St. Nicolas College of Business and TechnologyDocument6 pagesBs in Business Administration Marketing Management: St. Nicolas College of Business and TechnologyMaria Charise TongolNo ratings yet

- Invitation To CPD On Predicting Corporate FailureDocument6 pagesInvitation To CPD On Predicting Corporate Failureyakubu I saidNo ratings yet

- Tenant Verification Form PDFDocument2 pagesTenant Verification Form PDFmohit kumarNo ratings yet

- A Case Study Analysis of The Montreal (CANADA) Chapter of The Hells Angels Outlaw Motorcycle Club (HAMC) (1995-2010) : Applying The Crime Business Analysis Matrix (CBAM)Document22 pagesA Case Study Analysis of The Montreal (CANADA) Chapter of The Hells Angels Outlaw Motorcycle Club (HAMC) (1995-2010) : Applying The Crime Business Analysis Matrix (CBAM)Ryan29No ratings yet

- Faktor Resiko TBDocument15 pagesFaktor Resiko TBdrnurmayasarisihombingNo ratings yet