Professional Documents

Culture Documents

Assignment Module 6: Problem Solving Exercise (Case Study)

Uploaded by

Maria Hannah GallanoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Module 6: Problem Solving Exercise (Case Study)

Uploaded by

Maria Hannah GallanoCopyright:

Available Formats

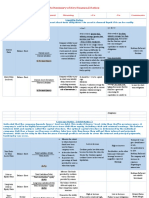

ASSIGNMENT MODULE 6:

PROBLEM SOLVING EXERCISE (Case Study)

WORKING CAPITAL FINANCIAL RATIO ANALYSIS SPREAD SHEET

Motorola Motorola

Company computed

Financial SIGNIFICANCE FORMULA Ratio Interpretation Evaluation

Ratio (Sample)

1) Current measures a firm’s Current Ratio = Given: The higher the current Favorable-

Ratio ability to pay off its Current Assets / ratio, the more liquid

short-term liabilities Current Liabilities CA = 17,134 CR the company is. that means

with its current CL = 9,705 Commonly acceptable the company

= 17,134 / can more

assets. It is current ratio is 2; it's a

important measure CR =? 9,705 comfortable financial easily make

of liquidity because = 1.765482 position for most current debt

short-term liabilities enterprises. For most payments and

or 177%

are due within the industrial companies, the company

next year. 1.5 may be an is good short-

acceptable current term financial

ratio.

strength.

Low values for the

current ratio (values

less than 1) indicate

that a firm may have

difficulty meeting

current obligations.

2) Acid Test measures the Acid Ratio = Given: The higher the quick Favorable-

Ratio ability of a Liquid Assets / ratio, the better the

company to pay its Current Liabilities AC position of the that means

current liabilities the company

LA = = 11,003 / company. The

when they come has more

6,507+59+4 commonly acceptable

due with only quick 9,705 quick assets

,437 current ratio is 1, but than current

assets.

CL = 9,705 = 1.133745 may vary from industry liabilities.

or 113% to industry. A company

AC =? with a quick ratio of

less than 1 cannot

currently pay back its

current liabilities; it's

the bad sign for

investors and partners.

3) Cash measures a firm’s Cash Position Given: Cash ratio is not as Favorable-

Position ability to pay off its Ratio = [(cash & popular in financial that means a

Ratio current liabilities Bank) + short- CPR analysis as current or company’s 0.6

with only cash and term securities] / quick ratios, its is considered

Cash = = 6,566 /

cash equivalents. Current Liabilities usefulness is limited. acceptable.

6,507 9,705

There is no common

Short term = = 0.676558 norm for cash ratio. In

59 some countries a cash

or 68%

ratio of not less than

CL = 9,705

0.2 is considered as

acceptable. But ratio

that are too high may

CPR =? show poor asset

utilization for a

company holding large

amounts of cash on its

balance sheet.

4) Inventory Measures how Inventory Given: The higher the Favorable-

turnover many times turnover Ratio = inventory turnover, the that means a

Ratio average inventory Cost of Goods ITR better, since high company

is “turned” or sold Sold / Average Cost of = 17, 938 / inventory turnover turnover ratio

during a period. In Goods Sold 2,869 typically means is 6.25 that

other words, it Inventory at Cost = 17, 938 a company is selling indicates good

measures how = 6.25 or goods quickly, and inventory

many times a IAT = 2,869 625% there is considerable turnover ratio

company sold its demand for their

total average products.

inventory dollar Low inventory

ITR =?

amount during the turnover, on the other

year. hand, would likely

indicate weaker sales

and declining demand

for a company’s

products.

You might also like

- Key Financial Ratios (VIP)Document10 pagesKey Financial Ratios (VIP)Ahmed HeshamNo ratings yet

- Liquidity Only.: Ex Payable AmountDocument12 pagesLiquidity Only.: Ex Payable AmountPranshu SahasrabuddheNo ratings yet

- Key Financial Ratios (M.N) FinialDocument10 pagesKey Financial Ratios (M.N) FinialYousab KaldasNo ratings yet

- Ratio Summary TableDocument11 pagesRatio Summary TableMaika NarcisoNo ratings yet

- Formula Financial RatioDocument4 pagesFormula Financial RatioRubiatul Adawiah Zainal AriffinNo ratings yet

- Ratio Analysis InterpretationDocument10 pagesRatio Analysis Interpretationpre.meh21No ratings yet

- Analysis and Interpretation of Financial StatementsDocument29 pagesAnalysis and Interpretation of Financial StatementsJessiEsquivelNo ratings yet

- Financial RatiosDocument2 pagesFinancial Ratiosyohan_phillipsNo ratings yet

- Ratio Report Excel Template Copy El - Copy 2Document21 pagesRatio Report Excel Template Copy El - Copy 2api-736389893No ratings yet

- Pmcf8 Midterm Part 2set B QuizDocument4 pagesPmcf8 Midterm Part 2set B QuizMaria Hannah GallanoNo ratings yet

- Ratio Analysis: Submitted in Partial Towards The Degree ofDocument17 pagesRatio Analysis: Submitted in Partial Towards The Degree ofWhite HatNo ratings yet

- Ratio Analysis - FACDocument4 pagesRatio Analysis - FACPravallika NadakuditiNo ratings yet

- FABM2 - Q1 - V2a Page 102 114Document12 pagesFABM2 - Q1 - V2a Page 102 114Kate thilyNo ratings yet

- Compute and Interpret Liquidity RatiosDocument3 pagesCompute and Interpret Liquidity RatiosANKITA SHENDRENo ratings yet

- Ratio Analysis: Broad Categories of RatiosDocument7 pagesRatio Analysis: Broad Categories of RatiosAkhil NigudkarNo ratings yet

- Financial RatiosDocument13 pagesFinancial Ratiosakash ThakurNo ratings yet

- Financial Statement AnalysisDocument8 pagesFinancial Statement AnalysisTrina Joy HomerezNo ratings yet

- Chapter 7Document49 pagesChapter 7Natasha GhazaliNo ratings yet

- 1 Financial Statements AnalysisDocument5 pages1 Financial Statements AnalysisMark Lawrence YusiNo ratings yet

- FM Tea B-62Document12 pagesFM Tea B-62sayali bangaleNo ratings yet

- Note On Financial Ratio FormulaDocument5 pagesNote On Financial Ratio FormulachthakorNo ratings yet

- Financial Ratio FormulasDocument5 pagesFinancial Ratio FormulasBrenden KapoNo ratings yet

- Liquidity Debt Management Asset Management Profitability Return To InvestorsDocument5 pagesLiquidity Debt Management Asset Management Profitability Return To InvestorsJayNo ratings yet

- RATIODocument5 pagesRATIOJing Jing RomeroNo ratings yet

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio Analysissarangpethe100% (4)

- Group 2 Financial RatiosDocument28 pagesGroup 2 Financial RatiosLovely dela RosaNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisGina FabunanNo ratings yet

- Debt To Asset: Consolidated Ratios 2020 2019 2018 Averag e Favorable or Unfavorable CommentDocument2 pagesDebt To Asset: Consolidated Ratios 2020 2019 2018 Averag e Favorable or Unfavorable CommentfavourNo ratings yet

- Financial RatiosDocument3 pagesFinancial RatiosluudieulinhNo ratings yet

- I. Liquidity Ratio: SolutionsDocument1 pageI. Liquidity Ratio: SolutionsChristian AribasNo ratings yet

- Dmart AccountsDocument18 pagesDmart AccountsDrishti KataraNo ratings yet

- Financial Statements AnalysisDocument10 pagesFinancial Statements AnalysisNurliyana HazwaniNo ratings yet

- Pyq Flashcards Ratios&APDocument4 pagesPyq Flashcards Ratios&APkala1975No ratings yet

- Financial Statements PrintDocument12 pagesFinancial Statements PrintashurameshNo ratings yet

- Ratio Analysis of Timken India: Sr. No. Ratio Formula Years InterpretationDocument4 pagesRatio Analysis of Timken India: Sr. No. Ratio Formula Years InterpretationSachin WahaneNo ratings yet

- Ratio Name Interpretation Interpretation Current RatioDocument4 pagesRatio Name Interpretation Interpretation Current Ratiotamanna rashid shime0% (1)

- Week 7 Formula SheetDocument1 pageWeek 7 Formula SheetHarsahej MokhaNo ratings yet

- Financial RatiosDocument9 pagesFinancial RatiosTariq qandeelNo ratings yet

- Ratios FormulaDocument2 pagesRatios FormulaMURSYIDAH ABD RASIDNo ratings yet

- 1 Financial Statements AnalysisDocument5 pages1 Financial Statements AnalysisMariel BalanditanNo ratings yet

- Estee LauderDocument116 pagesEstee LauderHa DaoNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisJayaNo ratings yet

- Current Ratio: Current Assets ÷ Current LiabilitiesDocument3 pagesCurrent Ratio: Current Assets ÷ Current LiabilitiesPatricia Bawiin †No ratings yet

- Fa ReferralsDocument7 pagesFa ReferralsMEGH TUMANENo ratings yet

- Financial Ratio AnalysisDocument2 pagesFinancial Ratio AnalysisFayad CalúNo ratings yet

- Liquidity Vs ProfitabilityDocument14 pagesLiquidity Vs ProfitabilityPrateek JainNo ratings yet

- 1 Financial Statements AnalysisDocument6 pages1 Financial Statements AnalysisJamaica DavidNo ratings yet

- Group Course Project: A Financial Statement Analysis A Comparative Analysis of Apple, Inc. and Alphabet IncDocument9 pagesGroup Course Project: A Financial Statement Analysis A Comparative Analysis of Apple, Inc. and Alphabet IncCoupon NurseNo ratings yet

- Sno. Ratios Formula Result Analysis Liquidity RatioDocument6 pagesSno. Ratios Formula Result Analysis Liquidity RatioIndrani PanNo ratings yet

- Financial Management RatiosDocument6 pagesFinancial Management RatiosCharlotte PalmaNo ratings yet

- Financial Ratios and Their InterpretationDocument10 pagesFinancial Ratios and Their InterpretationPriyanka_Bhans_7838100% (3)

- Current RatioDocument3 pagesCurrent RatioQuỳnh'ss Đắc'ssNo ratings yet

- Financial Statements AnalysisDocument6 pagesFinancial Statements Analysisangelika dijamcoNo ratings yet

- IFT Notes For Level I CFA Program: R24 Financial Analysis TechniquesDocument6 pagesIFT Notes For Level I CFA Program: R24 Financial Analysis TechniquesashwingrgNo ratings yet

- Financial Ratio AnalysisDocument2 pagesFinancial Ratio Analysismaterials4studyNo ratings yet

- 6.financial RatiosDocument13 pages6.financial RatiosYousab KaldasNo ratings yet

- Financial Analysis & Planning - Ratio AnalysisDocument15 pagesFinancial Analysis & Planning - Ratio AnalysisPriyanka SharmaNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- HHDocument1 pageHHMaria Hannah GallanoNo ratings yet

- Gallano Maria Hazel AdjustmentDocument1 pageGallano Maria Hazel AdjustmentMaria Hannah GallanoNo ratings yet

- Pmcf8 Midterm Part 2set A QuizDocument3 pagesPmcf8 Midterm Part 2set A QuizMaria Hannah GallanoNo ratings yet

- Pmcf8 Midterm Part 2set B QuizDocument4 pagesPmcf8 Midterm Part 2set B QuizMaria Hannah GallanoNo ratings yet

- Financial Risk IdentificationDocument3 pagesFinancial Risk IdentificationMaria Hannah GallanoNo ratings yet

- Camry Group Activity Bsba-Fm3aDocument12 pagesCamry Group Activity Bsba-Fm3aMaria Hannah GallanoNo ratings yet

- Assignment For PMCF8 Module 2:: 1. What Is Wealth Management? Explain BrieflyDocument3 pagesAssignment For PMCF8 Module 2:: 1. What Is Wealth Management? Explain BrieflyMaria Hannah GallanoNo ratings yet

- PopulationDocument13 pagesPopulationMaria Hannah GallanoNo ratings yet

- Factors Implication EffectDocument3 pagesFactors Implication EffectMaria Hannah GallanoNo ratings yet

- Mahindra Sona R 22102013Document3 pagesMahindra Sona R 22102013ukalNo ratings yet

- Management SOPDocument12 pagesManagement SOPsparkle shresthaNo ratings yet

- 3 - 01 - 10 - Appendix L - Letter of RepresentationDocument4 pages3 - 01 - 10 - Appendix L - Letter of RepresentationHariprasad B RNo ratings yet

- G Izekf - KR FD K TKRK Gs FD BL Foi DK Vko' D Bunzkt DS'K CQD O Fmiksftv JFTLVJ Esa DJ FN K X K GsaaDocument4 pagesG Izekf - KR FD K TKRK Gs FD BL Foi DK Vko' D Bunzkt DS'K CQD O Fmiksftv JFTLVJ Esa DJ FN K X K GsaaRakesh AryaNo ratings yet

- Partnership Agreement (Short Form)Document2 pagesPartnership Agreement (Short Form)Legal Forms91% (11)

- Security Analysis and Portfolio Management Mba Project Report PDFDocument31 pagesSecurity Analysis and Portfolio Management Mba Project Report PDFvishnupriya0% (1)

- Mock Examination FinAccDocument18 pagesMock Examination FinAccPaul Justin Sison MabaoNo ratings yet

- Vinati OrganicsDocument6 pagesVinati OrganicsNeha NehaNo ratings yet

- Form 16 Part BDocument4 pagesForm 16 Part BDharmendraNo ratings yet

- Payroll Management SystemDocument8 pagesPayroll Management SystemMayur Jondhale MJNo ratings yet

- Advanced Global Trading - AGT Arena #1Document38 pagesAdvanced Global Trading - AGT Arena #1advanceglobaltradingNo ratings yet

- Interim ReportDocument20 pagesInterim ReportanushaNo ratings yet

- A K Rubber Vetting ReportDocument2 pagesA K Rubber Vetting ReportSJDKSSDWNo ratings yet

- CFA Research Report - Team APUDocument30 pagesCFA Research Report - Team APUAnonymous 6A1OAiGidZNo ratings yet

- Business PlanDocument5 pagesBusiness PlanColegiul de Constructii din HincestiNo ratings yet

- Bacc 404 Ass 1Document6 pagesBacc 404 Ass 1Denny ChakauyaNo ratings yet

- Public Trust Registration Office: Trust Accounts Submission Verification FormDocument1 pagePublic Trust Registration Office: Trust Accounts Submission Verification FormHashtag ComputersNo ratings yet

- Ayush International 1.50 LakhDocument29 pagesAyush International 1.50 LakhSatyaki PaulNo ratings yet

- Birla Sun Life InsuranceDocument17 pagesBirla Sun Life InsuranceKenen BhandhaviNo ratings yet

- Assignment On Analysis of Annual Report ofDocument9 pagesAssignment On Analysis of Annual Report oflalagopgapangamdas100% (1)

- Steps in Accounting CycleDocument34 pagesSteps in Accounting Cycleahmad100% (4)

- Group 2 Section B PDFDocument33 pagesGroup 2 Section B PDFShaikh Saifullah KhalidNo ratings yet

- Payroll Summary For The Month of AugustDocument46 pagesPayroll Summary For The Month of AugustAida MohammedNo ratings yet

- Valuation Methods From Technology InnovationDocument1 pageValuation Methods From Technology InnovationMiguel Angel Herrera TriviňoNo ratings yet

- Multiple Choice: Theory 1 Theory 2 Problems 1 Problems 2Document2 pagesMultiple Choice: Theory 1 Theory 2 Problems 1 Problems 2Vivienne Rozenn LaytoNo ratings yet

- Ms. Janet A. Encarnacion Philippine Stock Exchange, Inc.: Metropolitan Bank & Trust CompanyDocument2 pagesMs. Janet A. Encarnacion Philippine Stock Exchange, Inc.: Metropolitan Bank & Trust CompanyBusinessWorldNo ratings yet

- DepositoryDocument29 pagesDepositoryChirag VaghelaNo ratings yet

- Sample Loan ProposalDocument20 pagesSample Loan Proposalhardmoneyteam94% (16)

- Business Plan Flight Training AviationDocument28 pagesBusiness Plan Flight Training AviationTa Man100% (1)

- SFM PDFDocument731 pagesSFM PDFRam IyerNo ratings yet