Professional Documents

Culture Documents

FAR Monthly Assessment November 2020

Uploaded by

Refinej WickerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAR Monthly Assessment November 2020

Uploaded by

Refinej WickerCopyright:

Available Formats

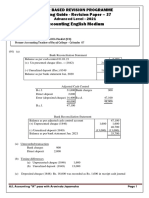

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

1. Determine which of the following statements are true:

I. All FRSC members should be CPAs.

II. A standard should be approved by all members of FRSC.

III. FRSC members are on full-time basis and have a compensation coming from the government.

A. I and II C. All of the statements

B. II and III D. None of the statements

2. The following statements relate to the concept of "revenue." Which statement is not true?

A. Deferred revenue is not synonymous with unrealized revenue.

B. The definition of revenue encompasses both income and gains.

C. Transactions like issuance of capital stock and payment of dividends between the business entity

and its owners cannot give rise to revenue.

D. Income determination is a technical term that refers to the process of identifying, measuring

and relating revenue and expenses during an accounting period.

3. Determine the false statement regarding the Conceptual Framework?

A. The Conceptual Framework is not a reporting standard and does not define standard for any

particular measurement or disclosure issue.

B. Under the Conceptual Framework, the concept of income encompasses both revenue and gains.

C. Users under the Framework that are interested in information about the continuance of an entity

when they have a long-term involvement with or are dependent on the entity pertain to

employees.

D. The Conceptual Framework sets out the concepts that underlie the preparation and presentation

of financial statements for external users only.

4. Which of the following statements is incorrect?

A. Cash which is restricted and not available for use within one year of the reporting period should

be included in noncurrent assets.

B. Cash in a demand deposit account, being held specifically for the retirement of long-term debts

not maturing currently, should be excluded from current assets and shown as a noncurrent

investment.

C. Investments which can be liquidated at once and with little risk of loss of principal may be

classified as cash equivalent and included in the caption "Cash and Cash equivalents"

D. Compensating balances are cash amounts that are not immediately accessible by the owner.

E. Cash and cash equivalents is always presented first in statement of financial position when

presenting current and non-current classifications.

5. All of the following costs should be expensed in the period they are incurred except for

A. manufacturing overhead costs for a product manufactured and sold in the same accounting period.

B costs which will not benefit any future period.

C. depreciation of idle manufacturing capacity resulting from an unexpected plant shutdown.

D. storage costs that are necessary in bringing the asset to its intended condition.

6. Evaluate whether the following statements are true or false:

I. Government grants related to consumable plants are within the scope of PAS 41.

II. ALL living animals are biological assets provided they are related to agricultural activity.

III. Cost to sell are the incremental costs directly attributable to the disposal of an asset, excluding

finance cost and income taxes but including transport costs.

KGAUCP 2017 A. B. C. D.

Statement I False False True True

Statement II False True True True

Statement III True True False True

7. The controller of the FURION INC. is trying to determine the amount of Cash and cash equivalents to

be reported on its December 31, 2014, statement of financial position. The following information is

provided:

1 Balances in the companys accounts at the BPI BANK:

Checking account—P540,000

Savings account— P884,000

2 Undeposited customer checks of P208,000.

3 Currency and coins on hand of P23,200.

4 Savings account at the BDO BANK with a balance of P350,000.This account is being used to

accumulate cash for future plant expansion (in 2016).

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 1

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

5 P800,000 balance in a checking account at the BDO BANK. In exchange for a line of credit,

FURION has agreed to maintain a minimum balance of P100,000 in this account.

6 Treasury bills; 30-day maturity bills totaling P600,000, and 180-day bills totaling P800,000.

What total amount of "cash and cash equivalents" should be reported in the current asset section of

the 2014 statement of financial position?

A. P3,055,200 C. P2,455,200

B. P2,955,200 D. P2,355,200

SOLUTION:

Balance in BPI BANK checking account P540,000

Balance in BPI BANK savings account 884,000

Undeposited customer checks 208,000

Currency and coins on hand 23,200

Checking account in BDO BANK 800,000

Treasury bills with 30-day maturity 600,000

Total cash and cash equivalents P3,055,200

8. The following information in relation to the receivable balance of ALDOUS CORP. for the year ended

December 31, 2019 is shown for the purpose of computing the proper amount to be reported on the

Statement of Financial Position.

The company is using the aging method in estimating its bad debts expense. The credit period

allowed by ALDOUS to its customers is on the average of 30 days.

Age of Receivables Amount

Under 30 days P2,000,000

31-60 days 1,000,000

61 - 90 days 500,000

91 -120 days 300,000

121 -150 days 200,000

The company based on experience has the following percent of collectability:

Accounts which are overdue for less than 30 days 98 %

Accounts which are overdue 31 - 60 days 95 %

Accounts which are overdue 61 - 90 days 80 %

Accounts which are overdue 91 -120 days 70 %

Accounts which are overdue for over 120 days 20 %

As of December 31, 2019, what amount is to be reported as the net realizable value of ALDOUS

CORP.’s accounts receivable?

A. P3,560,000 C. P3,665,000

B. P3,425,000 D. P3,835,000 KGAUCP 2019

9. On April 1, 2019, GRANGER CORP. sold goods costing P100,000 in exchange for P30,000 cash and

P120,000 worth of promissory note. The terms of the notes are as follows:

• The note bears an interest 8%. On transaction date, the effective interest rate for a similar

transaction is 10%.

• The principal amount is due in 3 equal payments every April 1 of each year, starting next year.

• All of the agreed interests are to be paid at maturity date.

What is the initial measurement of the notes receivable?

A. P121,113 C. P111,793

B. P113,900 D. P105,900

SOLUTION:

Principal (P40,000 x 2.4869) 99,476

Nominal interest (P19,200 x 0.7513) 14,424

Present value of notes receivable P113,900

10. SAUDI ARABIA CORP. submitted an inventory list on December 31, 2014 which showed a total of

P5,000,000.

• Excluded from the inventory was merchandise costing P80,000 because it was transferred to the

delivery department for packaging on December 28, 2014 and for shipping on January 2, 2015.

• The bill of lading and other import documents on a merchandise were delivered by the bank and

the trust receipt accepted by the entity on December 26, 2014. Taxes and duties have been paid

on this shipment but the broker did not deliver the merchandise until January 7, 2015. Cost of

the shipment totaled P800,000. This shipment was not included in the inventory on December

31, 2014.

• A review of the entitys purchase orders showed a commitment to buy P100,000 worth of

merchandise from ARABO CORP. This was not included in the inventory because the goods were

received on January 3, 2015. Suppliers invoice for P300,000 worth of merchandise dated

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 2

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

December 28, 2014 was received through the mail on December 30, 2014 although the goods

arrived only on January 4, 2015. Shipment terms are FOB shipping point. This item was

included in the December 31, 2014 inventory by the entity.

• Goods valued at P20,000 were received from SAUDO CORP. on December 28, 2014 for approval

by SAUDI ARABIA. The inventory team included this merchandise in the list but did not place

any value on it. On January 4, 2015, the entity informed the supplier by long distance telephone

of the acceptance of the goods and the suppliers invoice was received on January 7, 2015.

• On December 27, 2014, an order for P25,000 worth of merchandise was placed. This was

included in the year-end inventory although it was received only on January 5, 2015. The seller

shipped the goods FOB destination.

What is the correct inventory on December 31, 2014?

A. 5,055,000 C. 5,830,000

B. 5,555,000 D. 5,855,000 FA VALIX 2016

SOLUTION:

Inventory per book 5,000,000

Inventory transferred to delivery department 80,000

Shipment covered by bill of lading 800,000

Goods in transit, purchased FOB destination (25,000)

Correct inventory 5,855,000

Use the following information in answering the next item(s):

On April 1, 2018, TIGREAL CORP., a calendar year corporation, purchased the rights to a mine

amounting to P10,000,000. As of that date, the total estimated reserves were 4,800,000 tons.

TIGREAL was expecting an extraction of 40,000 tons per month. After restoring the site in a suitable

condition, the land’s residual value is expected to be P2,600,000. In addition, the market rate of

interest on that date is 12%.

The following information relates to the company’s results of operation for 3 years and other relevant

information:

2018 2019 2020

Estimated Restoration Cost 3,125,000

Exploration Cost (60% Successful) 1,000,000

Buildings and Houses on mining site 3,600,000

Photocopying Equipment 2,000,000

Extraction Cost 200,000 None 120,000

Mining Labor 300,000 150,000 350,000

Tons Extracted 100,000 None 100,000

Tons Sold 90,000 None 80,000

TIGREAL’s accounting policy is to use successful effort method in accounting its exploration cost.

Buildings and houses constructed on the mining site has a useful life of 12 years with no residual

value while the photocopying equipment has a useful life of 11 years with a residual value of

P350,000. Both items of PPE are available for use as of June 30, 2018. Buildings and houses’

depreciation are fully attributable to the mining operations while the equipment’s depreciation is 60%

attributable to the mining operations. During the period of shutdown, depreciation expense is

expensed outright. (Round off present value factors in 2 decimal places)

11. What is the total amount of expense in relation to the mining operations of TIGREAL CORP. for the

year 2018?

A. P1,246,750.00 C. P1,208,562.50

B. P1,153,750.00 D. P1,276,250.00

SOLUTION:

Inventoriable Costs: (COGS)

Depletion*(187,500 x 90/100) P168,750

Mining Labor (300,000 x 90/100) 270,000

Extraction Costs (200,000 x 90/100) 180,000

Depreciation – Buildings ** (75,000 x 90/100) 67,500

Depreciation – Equipment *** (75,000 x 60% x 90/100) 40,500

Non-inventoriable Costs:

Interest Expense (1,000,000 x 12% x 9/12) 90,000

Exploration – Unsuccessful (1,000,000 x 40%) 400,000

Depreciation – Equipment (75,000 x 40%) 30,000

Total Expense P1,246,750

*

Acquisition Cost P10,000,000

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 3

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

Exploration Cost (1,000,000 x 60%) 600,000

Restoration Cost (3,125,000 x 0.32) 1,000,000

Total Cost of Wasting Assets 11,600,000

Residual Value 2,600,000

Depletable Amount 9,000,000

Depletion (9,000,000/4,800,000 X 100,000) 187,500

** (3,600,000/4,800,000 x 100,000) 75,000

*** (1,650,000 / 11 x 6/12) 75,000

ENDING INVENTORY 80,750

12. What is the total amount of depreciation for the year 2019?

A. None C. P456,522

B. P150,000 D. P460,391

SOLUTION:

Depreciation – Buildings (3,600,000 – 75,000 / 11.5 yrs.) P306,522

Depreciation – Equipment (1,650,000 / 11 yrs.) 150,000

Total P456,522

13. What is the total amount of expense in relation to the mining operations of TIGREAL CORP. for the

year 2020?

A. P761,300 C. P965,431

B. P812,600 D. P858,431

SOLUTION:

Inventoriable Costs: (COGS)

Depletion * (187,500 x 70/100) 131,250

Mining Labor (350,000 X 70/100) 245,000

Extraction Costs (120,000 x 70/100) 84,000

Depreciation – Buildings ** (68,478 x 70/100) 47,935

Depreciation – Equipment *** (150,000 x 60% x 70/100) 63,000

Ending Inventory of 2018 sold in 2020 80,750

Non-inventoriable Costs:

Interest Expense (Jan. – Mar.)(1,120,000 x 12% x 3/12) 33,600

(Apr. – Dec.) (1,254,400 x 12% x 9/12) 112,896

Depreciation – Equipment (150,000 x 40%) 60,000

Total Expense 858,431

* (9,600,000/4,800,000 x 100,000) 187,500

** (3,600,000 – 75,000 – 306,522 / 4,700,000 x 100,000) 68,478

*** (1,650,000 / 11 yrs.) 150,000

14. In relation to PAS 36, Impairment of Assets, which of the following statements is (are) true?

I. Value in use is the amount of cash or cash equivalents that could currently be obtained by

selling an asset in an orderly disposal

II. Impairment tests are applied to both assets with limited lives and those with unlimited lives.

A. I only C. Both I and II

B. II only D. Neither I nor II

Use the following information in answering the next item(s):

On April 1, 2018, NATALIA CORP. purchased an office equipment with an installment price of

P150,000. The means of payments are as follows:

• P50,000 downpayment.

• Issued 5-year non-interest bearing note for the balance with an annual payment of P20,000. On

this date, the market rate of interest is 10%.

The company also incurred testing and installation cost amounting to 16,200 gross of the proceeds

from samples amounting to 1,200 while the cost of training the employee who will operate the

equipment amounted to P4,000. Installation and testing is necessary to prepare it to its intended

purpose and such was finished on June 30, 2018. (Round off present value factors in 2 decimal

places)

The equipment has a useful life of 10 years with a residual value of P20,800 and depreciated under

straight-line method.

15. What is the amount of expense presented in profit or loss for the year ended 2018?

A. P6,000.00 C. P15,685.00

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 4

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

B. P10,000.00 D. P14,685.00

SOLUTION:

2018:

Depreciation* (120,000/10 yrs x 6/12) P6,000

Interest Expense (75,800 x 10% x 9/12) 5,685

Employee Training 4,000

Total Expense 15,685

*Purchase Price [(20k x 3.79) + 50k] P125,800

DACs (16,200-1,200) 15,000

Initial Cost 140,800

Residual Value 20,800

Depreciable Amount 120,000

16. What is the amount of expense presented in profit or loss for the year ended 2019?

A. P12,000.00 C. P16,753.50

B. P18,648.50 D. P19,580.00

SOLUTION:

2019:

Depreciation (120,000/10) 12,000

Interest Expense (Jan. – Mar.) (75,800 x 10% x 3/12) 1,895

(Apr. – Dec.) (63,380 x 10% x 9/12) 4,753.50

Total Expense 18,648.50

17. S1: All government assistance are government grants but not all government grants are

government assistance.

S2: Loans forgave by the government are not government grants since there is no transfer of

resources to the entity.

S3: In relation to grant related to asset, using deduction from asset approach will result to a lower

depreciation expense than gross approach but the net amount presented in profit or loss is the

same to both methods.

A. True, false, false D. False, true, false

B. False, false, true E. True, true, false

C. True, true, false

18. Which of the following can be capitalized as an intangible asset?

A. Internally generated customer list.

B. Website development cost used internally and where the customers cannot place an order.

C. Cost of computer software incurred during operating stage.

D. None from the choices.

19. On January 1, 2019, the local government of Mandaluyong granted to HAYABUSA CORP. a non-

interest bearing loan amounting to P300,000 payable on December 31, 2021. The loan requires

annual equal payments. On the date of issuance, the market rate of interest is 12%.

I. Using the gross presentation, the deferred income from government grant as of December 31,

2019 is P59,820

II. Using the net presentation, the income from government grant for the year 2020 is 20,280

A. I only C. Both I and II

B. II only D. Neither I nor II

SOLUTION:

DIGG beg. (Discount on Notes Payable)(300,000 – 240,180) 59,820

IGG = Amortization of discount 2019 (240,180 x 12%) (28,822)

DIGG end. 30,998

IGG = Amortization of discount 2020 (169,002 x 12%) 20,280

Use the following information in answering the next item(s):

On May 1, 2019, PHARSA CORP. purchased land and building for a total price of P10,000,000. On that

date, the fair value of the land and building is P9,000,000 and P3,000,000, respectively. The existing

will be demolished and a new factory building will be constructed. Before the acquisition, PHARSA is

considering on many sites where its new building will be constructed but it chose one. Additional cost

relating to the purchase and construction of new building include the following:

Title guarantee P40,000

Option payments (1/4 was allocated to the purchased land and building) 400,000

Payments to tenants to vacate the land 100,000

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 5

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

Real estate taxes paid after May 1 60,000

Unpaid encumbrances over the land and building 50,000

Survey before construction of new building 100,000

Cost of razing the old building 50,000

Proceeds from sale of salvaged materials 10,000

Assessment by city for drainage project 70,000

Architects fee for new building 150,000

Insurance premium paid to workers 100,000

Payment of medical bills of employees accidentally injured 40,000

Material, labor and overhead costs 6,000,000

Savings on construction 100,000

Cost of changes to plans due to inefficiencies 50,000

Paving of streets and sidewalks (included in blueprint) 200,000

Excavation costs 30,000

Cost of elevator and escalator (included in blueprint) 150,000

Cost of temporary fences 20,000

Cost of removing temporary fences 5,000

Safety inspection costs 30,000

20. What is the cost of land?

A. P7,897,500 C. P7,710,000

B. P7,990,000 D. P7,600,000

21. What is the cost of new building?

A. P6,465,000 C. P6,725,000

B. P7,000,000 D. P6,370,000

22. What is the total amount expensed in profit or loss?

A. P2,712,500 C. P3,112,500

B. P3,012,500 D. P2,962,500

SOLUTION:

Land Old Building New Building

Purchase Price P7,500,000 P2,500,000

Title Guarantee 40,000

Option 75,000 25,000

Payments to tenants 75,000 25,000

Encumbrance 37,500 12,500

Cost of Survey 100,000

Demolition cost 50,000

Proceeds from demolition (10,000)

Special Assessment 70,000

Architect Fee 150,000

Insurance 100,000

Material, labor & OH 6,000,000

Sidewalks 200,000

Excavation costs 30,000

Elevator and Escalator 150,000

Temporary fences 20,000

Removal cost of fences 5,000

Safety inspection costs 30,000

Total Cost 7,897,500 2,562,500 6,725,000

Amount expensed in P/L:

Option for PPE not acquired P300,000

Real estate taxes 60,000

Medical bills not covered by insurance 40,000

Changes due to inefficiencies 50,000

Old building razed 2,562,500

TOTAL 3,012,500

Note: Savings on construction is not recognized in the books.

23. ALPHA CORP.(a NON-VAT entity) purchased a patent from ARGUS CORP. amounting to P280,000 on

April 1, 2019. ARGUS granted a 2% discount if ALPHA will fully pay the amount within 10 days after

the transaction date. A 12% VAT was also paid and the P280,000 amount is gross of VAT. It was

estimated that the patent’s remaining useful life and legal life are 10 years and 12 years, respectively.

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 6

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

Also, ALPHA estimated a residual value of P25,000 even though there is no active market for the

patent’s at the end of its useful life. What is amortization expense of the patent for the year 2019?

A. P20,625 C. P18,375

B. P18,750 D. P16,500

SOLUTION:

Amortization Expense (P275,0000* / 10 yrs. X 9/12) = P20,625

* [(280K/1.12)X 98%] + 30K]

24. Regarding Property, Plant, and Equipment, which of the following is true?

I. Land improvements are items of PPE that are non-depreciable and usually includes as its cost,

the cost of paving parkways and sidewalks.

II. Income earned from incidental operations are neither recognized as a deduction from cost of

PPE nor as income in profit or loss.

III. Depreciation ceases when the item of PPE becomes held for sale or derecognized whichever is

earlier.

A. Yes, Yes, No D. No, No, No

B. No, No, Yes E. Yes, No, Yes

C. Yes, No, No

Use the following information in answering the next item(s):

On March 2, 2019, KIMMY CORP. started the construction of its new building. The building was

completed on August 31, 2019. The expenditures on building was made as follows:

March 1 1,500,000 June 30 150,000

May 1 300,000 July 31 300,000

June 1 300,000 August 31 50,000

The following were the borrowings made by the company which are all outstanding during 2019:

Principal Borrowing cost

8% bank loan 1,000,000 80,000

10% short-term note 2,000,000 200,000

11.25% long-term loan 1,600,000 180,000

4,600,000 460,000

The 8% bank loan relates specifically to finance the construction of the building. P12,000 interest

income was earned until June 30, 2019 from temporarily investing the funds to bond investments.

25. What is the borrowing cost to be capitalized as cost of new building using traditional method?

A. P79,500 C. P127,000

B. P75,000 D. P123,000

SOLUTION:

3/1 (1,500,000 x 6/6) 1,500,000

5/1 (300,000 x 4/6) 200,000

6/1 (300,000 x 3/6) 150,000

7/1 (150,000 x 2/6) 50,000

8/1 (300,000 x 1/6) 50,000

8/31 (50,000 x 0/6) 0

W.A. Expenditures 1,950,000

Specific Borrowing 1,000,000

W.A. Expenditures General Borrowing 950,000

Capitalizable Borrowing Costs:

Specific (80,000 x 6/12) – (12,000 x 4/6) P32,000

General:

Actual (380,000 x 6/12) 190,000

Avoidable (950,000 x 10%) 95,000

Total P127,000

26. What is the borrowing cost to be capitalized as cost of new building using contemporary method?

A. P127,000 C. P79,500

B. P123,000 D. P75,000

SOLUTION:

3/1 (500,000 x 6/6) 500,000

5/1 (300,000 x 4/6) 200,000

6/1 (300,000 x 3/6) 150,000

7/1 (150,000 x 2/6) 50,000

8/1 (300,000 x 1/6) 50,000

8/31 (50,000 x 0/6) 0

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 7

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

W.A. Expenditures General Borrowing 950,000

Capitalizable Borrowing Costs:

Specific (80,000 x 6/12) – (12,000 x 4/6) P32,000

General:

Actual (380,000 x 6/12) 190,000

Avoidable (950,000 x 10%) 95,000

Total P127,000

27. LUNOX COMPANY purchased a factory machinery amounting to P6,000,000 on January 1, 2019. On

the same date, the company received P500,000 government grant from the national government.

LUNOX’s accounting policy is treat the grant as a reduction in the cost of the asset. The purchased

machine shall be depreciated using sum-of-the-years-digit method over 10 years with a residual

value of P500,000. During January, 2022, the government grant became fully repayable due to

LUNOX’s non-compliance on the attached conditions. What is the depreciation expense in 2022?

A. P700,000 C. P356,363

B. P945,455 D. P500,000

SOLUTION:

Cumulative Depreciation Not Recognized (500,000 x 27/55) 245,455

Updated Depreciation 2022 (3,300,000 – 500,000 x 7/28) 700,000

Total Depreciation Expense 945,455

Use the following information in answering the next item(s):

As of December 31, 2018, impairment indicators were present on HARLEY CORP’s cash generating

unit requiring the CGU to be tested for impairment. The recoverable amount of the cash generating

unit is P4,200,000 with the following carrying amounts:

Building P1,500,000

Goodwill 200,000

Equipment 1,000,000

Patent 500,000

Investment property 1,000,000

Land 600,000

Trademark 400,000

Individually, the fair value less cost to sell of the following assets was:

Equipment 900,000

Patent 450,000

Land 600,000

28. What is the impairment loss allocated to building?

A. P240,000 C. P336,207

B. P210,000 D. P224,138

29. What is the impairment loss allocated to Investment property?

A. P250,000 C. P160,000

B. P186,740 D. P224,138

SOLUTION:

Carrying Impairment Recoverable

Amount Loss Amount

Building 1,500,000 336,207 1,163,793

Goodwill 200,000 200,000 0

Equipment 1,000,000 100,000 900,000

Patent 500,000 50,000 450,000

Investment Property 1,000,000 224,138 775,862

Land 600,000 0 600,000

Trademark 400,000 89,655 310,345

5,200,000 1,000,000 4,200,000

Use the following information in answering the next item(s):

During 2019, ZHASK CORP. incurred the following costs in relation to its intangible assets:

At the beginning of January 2019, ZHASK started to develop a computer software product and the

following costs were incurred:

Completion of detailed program design P500,000

Coding costs after establishment of technological feasibility 1,000,000

Costs of producing product masters 500,000

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 8

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

Duplication of computer software from product masters 300,000

Packaging product 200,000

The capitalized cost of the computer software is to be amortized over a 5 year useful life and takes

full year’s amortization in the first year. Sixty percent of the software produced during the year were

sold.

On April 1, 2019 a franchise was purchased from GORD CORP. for P850,000. In addition, 6% of the

revenue from the franchise must be paid to GORD. Revenue from the franchise for 2006 was

P2,000,000. Carter estimates the useful life of the franchise to be 8 years and takes full year’s

amortization in the year of purchase.

30. What is the total amount expensed in profit or loss during 2019 in relation to the above information?

A. P1,179,687.50 C. P1,206,250.00

B. P1,326,250.00 D. P1,026,250.00

SOLUTION:

Computer Software:

Research and development P500,000

Amortization expense (1,500,000 / 5yrs x 60%) 180,000

Inventoriable cost (500,000 x 60%) 300,000

Franchise:

Amortization (850,000 / 8 yrs) 106,250

CFF (2M x 6%) 120,000

TOTAL EXPENSE 1,206,250

31. What is the carrying amount of the intangible assets to be presented in the statement of financial

position as of December 31, 2019?

A. P2,350,000.00 C. P1,970,312.50

B. P1,875,780.50 D. P1,943,750.00

SOLUTION:

Computer Software (1.5M X 4/5) Franchise (850k x 7/8)

32. GORD CORP. acquired equity securities during the year 2013 and designated as fair value to other

comprehensive income. An analysis of the investments on December 31, 2015 showed the following:

Securities Cost Market

A P 1,500,000 P1,400,000

B 2,200,000 2,000,000

C 3,000,000 2,900,000

D 3,800,000 3,600,000

Total P10,500,000 P9,900,000

If the Companys income tax rate is 35%, what amount of unrealized loss should be reported in

GORDs December 31, 2015 shareholders equity?

A. none C. P390,000

B. P200,000 D. P600,000

SOLUTION:

Aggregate fair market value P 9,900,000

Aggregate cost 10,500,000

Unrealized loss - to be reported in equity (P600,000)

Deferred tax asset (P600,000 x 35%) 210,000

Unrealized loss, net of tax (P390,000)

33. BALANAR CORP. bought 1,000 shares of PLDT shares as equity investments at fair value on January

10, Year 2 at PI50 per share and paid P2,250 as brokerage fee. On December 5, Year 1, a P10

dividend per share of PLDT had been declared to be paid on April 30, Year 2 to shareholders of

January 31, Year 2. There were no other transactions in Year 2 affecting the investment in PLDT:

At what amount should the investment in equity securities be initially recognized on January 10, Year

2?

A. P142,250 C. P152,250

B. P150,000 D. P162,250

SOLUTION:

(1,000 x 150) + 2,250 = 152,250; 152,250 – (1,000 x 10) = 142,250

34. HALIMAW CORP. had the following transactions in the ordinary shares of MUMU INC.:

January 5 Bought 4,000 ordinary shares, P100 par, at

P88.

June 15 Received 10% bonus issue.

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 9

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

August 31 Received P4 cash dividend for each ordinary

share.

October 10 Received stock rights to buy one new share

at P100 for every 5 shares held. Market

value of stock ex-right, P156.

November 15 Sold all stock rights at P4 per right.

What is the revised cost per share after receipt of the bonus issue?

A. P75 C. P85

B. P80 D. P90

SOLUTION:

88 ÷ 1.10 = 80

35. ALPHA CORP. bought 40% of BETA INC. s outstanding ordinary shares on January 2, 2015, for

P4,000,000. The carrying amount of BETA’s net assets at the purchase date totaled P9,000,000. Fair

values and carrying amounts were the same for all items except for plant and inventories, for which

fair values exceeded their carrying amounts by P900,000 and P100,000, respectively. The plant has

an 18-year life. All inventories were sold during 2015. During 2015, BETA reported profit of

P1,200,000 and paid a P200,000 cash dividend.

What amount should ALPHA report in its statement of comprehensive income from its investment in

BETA for the year ended December 31, 2015?

A. P480,000 C. P360,000

B. P420,000 D. P320,000

SOLUTION:

40% x 1.2M = 480,000; (40% x 900,000) ÷ 18 = 20,000

40% x 100,000 = 40,000; 480,000 – 20,000 – 40,000 = 420,000

36. Under IFRS 9, the cumulative balance of equity as a result of measuring financial assets at fair value

through other comprehensive income.

A. shall be reversed to profit or loss at the date the security is sold.

B. shall be reversed to profit or loss when there is objective evidence of impairment.

C. shall not be reversed to profit or loss but may be transferred to another equity account.

D. shall not be reversed to profit or loss and may not be transferred to another equity account.

37. An investor uses the equity method to account for investment in associate. The purchase price implies

a fair value of the investees depreciable assets in excess of the investees net asset carrying values.

The investees amortization of the excess

A. decreases the investment account.

B. decreases the goodwill account.

C. increases the investment income account.

D. does not affect the carrying value of the investment.

38. I. When potential voting rights exist, the investors share of profit or loss of the investee and of

changes in the investees equity is determined on the basis of "present ownership interest"

II. The loss of significant influence can occur with or without change in the absolute or relative

ownership interest.

A. True, true C. True, false

B. False, false D. False, true

39. For an investment accounted for under the equity method, the investment income recognized in profit

or loss for the year may be computed as

A. cash dividends received or receivable

B. share in the profit or loss of the associate plus amortization of undervaluation of assets

C. share in the profit or loss of the associate minus amortization of undervaluation of assets

D. share in the total comprehensive income of the associate minus amortization of undervaluation

of assets

40. In determining the value in use, which of the following cash flow is excluded from the computation?

I. Income tax receipts or payments.

II. Net cash flows received or paid on the disposal of the asset at the end of its useful life in an

arms length transaction which is after using the asset.

III. Future costs of improving or enhancing the assets performance.

A. I and II D. I, II and III

B. II and III E. Answer not given

C. I and III

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 10

SECOND MONTHLY ASSESSMENT EXAMIINATIONS

41. Which of the following is not a dividend income?

I. Cash dividend in lieu of stock dividend

II. Stock dividend on the same class of share

III. Stock dividend in lieu of cash dividend

A. I and II D. I, II and III

B. II and III E. Answer not given

C. I and III

42. I. Under the "successful effort" method of exploration cost accounting, only the exploration cost

directly related to the discovery of commercially producible natural resource is capitalized as

cost of the resource property.

II. The estimated restoration cost of a wasting asset can be only capitalized if the cost is an

existing present obligation of the entity which is either required by law or contract.

III. Under the wasting asset doctrine, a wasting asset corporation or an entity engaged in the

extraction of a natural resource, can legally return capital to shareholders during the lifetime of

the corporation.

A. True, true, true D. False, false, true

B. False, false, false E. True, true, false

C. True, false, true

43. Which of the following is an external source of that would indicate impairment of an asset?

I. Evidence of obsolescence or physical damage of an asset.

II. Significant decrease or decline in the market value of the asset.

III. The carrying amount of net assets of the entity is more than the "market capitalization".

A. I and II D. I, II and III

B. II and III E. Answer not given

C. I and III

44. Determine which of the following is within the scope of PAS 16, Property, Plant and Equipment:

I. Agricultural Coconut Trees where the purpose of the company is to harvest coconuts.

II. Equipment being rented to third parties under an operating lease agreement.

III. Imported cattle and calves held for exhibition purposes.

A. I and II D. III only

B. I and II E. I, II and III

C. II and III

45. In relation to Property, Plant and Equipment, determine whether the following statements are true or

false:

I. Initial element of cost of dismantling forms part as cost of a PPE provided the entity is obliged to

restore the PPE at the end of its life. The initial estimate is included by estimating the

undiscounted cash flow at the end of its life.

II. If an item of PPE is acquired through exchange, if its fair value is available at the time of

exchange, then it is initially recorded at fair value of asset received if a cash consideration is

either received or paid to equalize fair values.

III. If a company received an item of PPE through donation, it is debited to asset account at fair

value and credited to donated capital account regardless of the relationship of the company to

the donor.

A. B. C. D.

Statement I True False False True

Statement II False False True True

Statement III True False False True

- END OF EXAMINATION -

Financial Accounting & Reporting by Karim G. Abitago, CPA Page 11

You might also like

- Internal Control Measures: Page 1 of 7Document7 pagesInternal Control Measures: Page 1 of 7Lucy HeartfiliaNo ratings yet

- Advac SemifinalDocument8 pagesAdvac SemifinalDIVINE VILLENANo ratings yet

- Drill Problems - ConsolidationDocument6 pagesDrill Problems - Consolidationgun attaphanNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- ABC - Exercises (Answer Key 1)Document5 pagesABC - Exercises (Answer Key 1)Crystal ApinesNo ratings yet

- Partnership Dissolution: National College of Business and ArtsDocument5 pagesPartnership Dissolution: National College of Business and ArtsKate Jezel SantoniaNo ratings yet

- Aud Theo Compilation1Document97 pagesAud Theo Compilation1AiahNo ratings yet

- CH 17Document32 pagesCH 17Aldrin CabangbangNo ratings yet

- Answered Step-By-Step: Problem 1 Data Relating To The Shareholders' Equity of Carlo Co...Document5 pagesAnswered Step-By-Step: Problem 1 Data Relating To The Shareholders' Equity of Carlo Co...Jefferson MañaleNo ratings yet

- Business Combinations ExplainedDocument8 pagesBusiness Combinations ExplainedLabLab ChattoNo ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasTrixie HicaldeNo ratings yet

- Brilliant Cosmetics 2017 financial statement adjustmentsDocument3 pagesBrilliant Cosmetics 2017 financial statement adjustmentsVilma Tayum100% (1)

- Ac20 Quiz 3 - DGCDocument10 pagesAc20 Quiz 3 - DGCMaricar PinedaNo ratings yet

- Chapter 11 - RR: ConsignmentDocument17 pagesChapter 11 - RR: ConsignmentJane DizonNo ratings yet

- Pre-Test 3Document3 pagesPre-Test 3BLACKPINKLisaRoseJisooJennieNo ratings yet

- Group Quizbowl FormattedDocument17 pagesGroup Quizbowl FormattedSarah BalisacanNo ratings yet

- ACC 139 MCQ Sas 1-24Document35 pagesACC 139 MCQ Sas 1-24MaricrisNo ratings yet

- P2 Corporate Liquidation - GuerreroDocument19 pagesP2 Corporate Liquidation - GuerreroCelen OchocoNo ratings yet

- AST FinalsDocument20 pagesAST FinalsMica Ella San DiegoNo ratings yet

- NKNKDocument18 pagesNKNKSophia PerezNo ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- Detect Financial Fraud and ErrorsDocument11 pagesDetect Financial Fraud and ErrorsIvan LandaosNo ratings yet

- AP-03 Audit of Intangible AssetsDocument11 pagesAP-03 Audit of Intangible AssetsMitch MinglanaNo ratings yet

- The Professional CPA Review School - Auditing Problems First Preboard ExamDocument18 pagesThe Professional CPA Review School - Auditing Problems First Preboard ExamRodmae VersonNo ratings yet

- Cash and Receivables ReportingDocument29 pagesCash and Receivables ReportingJunneth Pearl Homoc0% (1)

- Tax 3216Document5 pagesTax 3216Rich William PagaduanNo ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Chapter 4 - Audit of InvestmentsDocument45 pagesChapter 4 - Audit of InvestmentsClene DoconteNo ratings yet

- Handout Audit of ReceivablesDocument6 pagesHandout Audit of ReceivablesJahanna MartorillasNo ratings yet

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaNo ratings yet

- FranchisingDocument10 pagesFranchisingKRABBYPATTY PHNo ratings yet

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- Petty Cash Fund Adjusted Balance and Shortage AmountDocument3 pagesPetty Cash Fund Adjusted Balance and Shortage AmountMary Rose Arguelles100% (1)

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocument3 pagesLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNo ratings yet

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)Document10 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)marygraceomacNo ratings yet

- Tax111 - Preferential Taxation Local Taxation Learning Exercises - StudentsDocument22 pagesTax111 - Preferential Taxation Local Taxation Learning Exercises - StudentsAimee Cute100% (1)

- Home Office and Branch Accounting PDFDocument3 pagesHome Office and Branch Accounting PDFJisselle Marie Custodio0% (1)

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur Salameda100% (1)

- Audit of Receivables: Problem No. 1Document6 pagesAudit of Receivables: Problem No. 1Kathrina RoxasNo ratings yet

- Consolidation at Acquisition DateDocument29 pagesConsolidation at Acquisition DateLee DokyeomNo ratings yet

- Balbin, Ma. Margarette P. Assignment #1Document7 pagesBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinNo ratings yet

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezNo ratings yet

- AFAR.3101 Partnership (Drill) : D. Advanced Financial AccountingDocument1 pageAFAR.3101 Partnership (Drill) : D. Advanced Financial Accountingvane rondinaNo ratings yet

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Chapter 4 SalosagcolDocument3 pagesChapter 4 SalosagcolElvie Abulencia-BagsicNo ratings yet

- Numbers 19, 20 and 21 (Corporate Liquidation)Document2 pagesNumbers 19, 20 and 21 (Corporate Liquidation)Tk KimNo ratings yet

- Assurance Services FundamentalsDocument10 pagesAssurance Services FundamentalsLysss EpssssNo ratings yet

- Midterm ExamDocument9 pagesMidterm ExamElla TuratoNo ratings yet

- Review Questions: Click On The Questions To See AnswersDocument10 pagesReview Questions: Click On The Questions To See AnswersJinjer Ann LanticanNo ratings yet

- Cost Accounting Guerrero Franchises Chap06Document17 pagesCost Accounting Guerrero Franchises Chap06AlexanNo ratings yet

- 09 X07 C ResponsibilityDocument8 pages09 X07 C ResponsibilityJune KooNo ratings yet

- Home Office Questions With AnswersDocument10 pagesHome Office Questions With AnswersDaniel Nichole MerindoNo ratings yet

- Post Quiz - Pre Engagement & Audit PlanningDocument10 pagesPost Quiz - Pre Engagement & Audit PlanningMA ValdezNo ratings yet

- QUIZ 4 - Income TaxDocument4 pagesQUIZ 4 - Income TaxTUAZON JR., NESTOR A.No ratings yet

- FAR Practice ProblemsDocument34 pagesFAR Practice ProblemsJhon Eljun Yuto EnopiaNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- Midterm Examination Suggested AnswersDocument9 pagesMidterm Examination Suggested AnswersJoshua CaraldeNo ratings yet

- ACC 122 Intermediate Accounting I Dean's Exam ReviewDocument11 pagesACC 122 Intermediate Accounting I Dean's Exam ReviewJaselle SanchezNo ratings yet

- Schedule of Fair Market Values of Real Properties (Small File)Document94 pagesSchedule of Fair Market Values of Real Properties (Small File)Refinej Wicker100% (1)

- TAX 03 Fundamentals of Income Taxation PDFDocument9 pagesTAX 03 Fundamentals of Income Taxation PDFNita Costillas De MattaNo ratings yet

- Negotiable Instruments Law and Anti-Bouncing Checks Law: Atty. Nicko Soriano, CpaDocument22 pagesNegotiable Instruments Law and Anti-Bouncing Checks Law: Atty. Nicko Soriano, CpaMedyNo ratings yet

- 04 Reo Ho Mas Fs AnalysisDocument6 pages04 Reo Ho Mas Fs AnalysisRefinej WickerNo ratings yet

- FAR Monthly Assessment November 2020Document11 pagesFAR Monthly Assessment November 2020Refinej WickerNo ratings yet

- Password Reset GuideDocument9 pagesPassword Reset GuideMA ELNo ratings yet

- TAX 03 Fundamentals of Income Taxation PDFDocument9 pagesTAX 03 Fundamentals of Income Taxation PDFNita Costillas De MattaNo ratings yet

- Far 05 InventoriesDocument10 pagesFar 05 InventoriesRefinej WickerNo ratings yet

- REO-Local-Taxation As of May 2020 REO-Local-Taxation As of May 2020Document20 pagesREO-Local-Taxation As of May 2020 REO-Local-Taxation As of May 2020Refinej WickerNo ratings yet

- Basic Considerations in Management Advisory ServicesDocument10 pagesBasic Considerations in Management Advisory ServicesRefinej WickerNo ratings yet

- Audit of ExpensesDocument18 pagesAudit of Expenseseequals mcsquaredNo ratings yet

- Payment Voucher Fnf23Document1 pagePayment Voucher Fnf23D E W A N ANo ratings yet

- Financial Performance Analysis of SIFCODocument8 pagesFinancial Performance Analysis of SIFCONamuna JoshiNo ratings yet

- Activity-2 Accounting EquationDocument3 pagesActivity-2 Accounting EquationAwais ur RehmanNo ratings yet

- Multiple Choice QuestionsDocument9 pagesMultiple Choice Questionskhankhan1No ratings yet

- Problem From Conceptual Framework and Accounting Standards by Valix Et Al., 2018Document3 pagesProblem From Conceptual Framework and Accounting Standards by Valix Et Al., 2018Jessel Mae Lim CabasagNo ratings yet

- Maximize Lead Gen with 40-Char Inbound Marketing TipsheetDocument3 pagesMaximize Lead Gen with 40-Char Inbound Marketing Tipsheetsantosh kumarNo ratings yet

- Schaeffler Vietnam Internship ReportDocument20 pagesSchaeffler Vietnam Internship ReportNghi TrầnNo ratings yet

- Managing IT Integration Risk in AcquisitionsDocument20 pagesManaging IT Integration Risk in AcquisitionsYurnida PangestutiNo ratings yet

- Montreaux Chocolate Usa: Group 1Document8 pagesMontreaux Chocolate Usa: Group 1Nikhil PathakNo ratings yet

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 37Malar SrirengarajahNo ratings yet

- Decision Making at Igate and Patni ComputersDocument16 pagesDecision Making at Igate and Patni ComputersAnkita NirolaNo ratings yet

- LH 2017 990Document44 pagesLH 2017 990Lazarus_HouseNo ratings yet

- Franchise Middle East: Business Village, Dubai, UAE DeiraDocument6 pagesFranchise Middle East: Business Village, Dubai, UAE DeiraNSNo ratings yet

- TITLE OYEDE EJIRO TRACY CVDocument4 pagesTITLE OYEDE EJIRO TRACY CVOYEDE TRACY EJIRONo ratings yet

- LH 263367Document27 pagesLH 263367SaygınNo ratings yet

- 081 000 Falk Wrapflex Elastomeric Couplings Part Number Guide BrochureDocument4 pages081 000 Falk Wrapflex Elastomeric Couplings Part Number Guide BrochureSmith Jonhatan Moya CarbajalNo ratings yet

- Essential Guide to Marketing StrategyDocument10 pagesEssential Guide to Marketing StrategyMayank BishtNo ratings yet

- Alcoa Corporation $45.80 Rating: Very NegativeDocument3 pagesAlcoa Corporation $45.80 Rating: Very Negativephysicallen1791No ratings yet

- Bustax Chapter 1Document9 pagesBustax Chapter 1Pineda, Paula MarieNo ratings yet

- Scan The QR Code To Access Project No. 2&3Document20 pagesScan The QR Code To Access Project No. 2&3Akshay Shukla100% (1)

- CH 3 PDFDocument29 pagesCH 3 PDFRefisa JiruNo ratings yet

- Windows The Art of Retail Display - NodrmDocument196 pagesWindows The Art of Retail Display - NodrmAlva ChristopherNo ratings yet

- Modern Approach to Material Management OrganizationDocument18 pagesModern Approach to Material Management OrganizationJoginder GrewalNo ratings yet

- Reporting LodgingDocument3 pagesReporting LodgingkaylamaepalmadelacruzNo ratings yet

- Marketing The New Venture: OutlineDocument41 pagesMarketing The New Venture: OutlineAnkit SinghNo ratings yet

- The Following Selected Transactions Were Completed by Green Lawn SuppliesDocument1 pageThe Following Selected Transactions Were Completed by Green Lawn SuppliesAmit PandeyNo ratings yet

- Formative Assessment NGEC 5Document2 pagesFormative Assessment NGEC 5dejayintongNo ratings yet

- Pantaloons Loyalty Program Rewards CustomersDocument5 pagesPantaloons Loyalty Program Rewards CustomersSrimon10No ratings yet

- La Consolacion College Manila: Finman IiDocument14 pagesLa Consolacion College Manila: Finman Iigerald calignerNo ratings yet