Professional Documents

Culture Documents

Tax Lead Batch 3 Preweek 1pdf PDF Free

Tax Lead Batch 3 Preweek 1pdf PDF Free

Uploaded by

Artgiven BaraquioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Lead Batch 3 Preweek 1pdf PDF Free

Tax Lead Batch 3 Preweek 1pdf PDF Free

Uploaded by

Artgiven BaraquioCopyright:

Available Formats

LEARNING ADVANCEMENT REVIEW CENTER

RM 413 DONA AMPARO BUILDING ESPANA BOULEVARD CORNER G. TOLENTINO ST.

SAMPALOC, MANILA PW 1

CONTACT # (02) 244 6342

6342 / 0915 537 1189 / 0943 595 5364

TAXATION GARCIA/ CO/ WONG

PART 1

BASIC PRINCIPLES -INHERENT POWERS OF TAXATION

1. Taxation is the act of laying a tax, i.e. the process or means by which the sovereign, through its lawmaking body, raises

income to defray the necessary expenses of government.

The power of taxation proceeds upon the theory that the existence of the government is a necessity, that it cannot

continue without means to pay its expenses and that for this means it has a right to compel all its citizens and property

within its limits to contribute.

A. True; True

B. True ; False

C. False ; True

D. False ; False

2. The principal purpose of taxation is to raise revenue for governmental needs (revenue purpose), which of the following

secondary purposes of taxation is not a compensatory purpose

A. To reduce excessive inequalities of wealth

B. To maintain high level of employment

C. To control inflation

D. To implement the police power of the State to promote the general welfare.

3. The basis is the reciprocal duties of protection and support between the State and its inhabitants. The State collects

taxes from the subjects of taxation in order that it may be able to perform the functions of government.

The citizens on the other hand, pays taxes in order that they may be secured in the enjoyment of the benefits of organized

society (benefits receivedtheory).

Taxes are the lifeblood of the Government and their prompt and certain availability are imperious (expecting obedience)

need.

A. True; True; True

B. True ; False; True

C. False ; True; True

D. False ; False; True

4. Which is not a manifestation of the lifeblood theory?

A. Imposition of tax even in the absence of Constitutional grant.

B. Right to select objects of taxation.

C. No injunction to enjoin (or stop) tax collection.

D. Fixing the amount or rate of the tax.

5. The power of taxation is comprehensive, plenary, unlimited and supreme. This power is, however, subject to inherent

and constitutional limitations.

It is subject to Constitutional and inherent limitations, hence, it is not an absolute power than can be exercised by the

legislature anyway it pleases.

A. True; True

B. True ; False

C. False ; True

D. False ; False

6. Which is not a characteristics or nature of the state’s power to tax?

A. It is inherent in sovereignty.

B. It is legislative in character.

C. It is subject to Constitutional and inherent limitations.

D. It is essentially administrative in character.

7. Which is not a basic principle of a sound tax system?

A. Fiscal Adequacy

B. Equality or Theoretical Justice

C. Administrative Feasibility

D. Eminent Domain

BASIC PRINCIPLES-LIMITATIONS ON POWER OF TAXATION

8. Which is not an inherent limitation of taxation?

A. International comity

B. Territorial jurisdiction

C. Double taxation

D. Due Process of Law

BASIC PRINCIPLES - TAX AND OTHER CHARGES

9. Which is not a characteristic of TAX?

A. It is an enforced contribution;

B. It is proportionate in character;

C. It is payable in money;

LEADTAX Pre Week Page 1 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

D. It is levied on persons and property within and without the jurisdiction of the State.

10. Which is false?

A. Tollis a sum of money collected for the use of something.

B. Special assessment is an enforced proportional contribution from owners of lands for special benefits resulting

from public improvements.

C. License fee or permit is a charge imposed under the police power for the purpose of regulations.

D. A Internal revenue is pecuniary aid directly granted by the government to an individual or private commercial

enterprise deemed beneficial to the public.

11. Shifting is the transfer of the burden of a tax by the original payer or the one to whom the tax was assessed or imposed to

another or someone else.

Tax evasion (tax dodging) is the use by the taxpayer of illegal means to defeat or lessen the payment of tax.

A. True; True

B. True ; False

C. False ; True

D. False ; False

POWERS AND AUTHORITY OF THE COMMISSIONER OF INTERNAL REVENUE

12. Which of the following is not a power of the commissioner of internal revenue?

A. Interpret tax laws and to decide tax cases.

B. Obtain information and to summon, examine, and take testimony of persons.

C. Make assessments and prescribe additional requirements for tax administration and enforcement.

D. Delegate the powers vested in him under the pertinent provisions of the Tax Code.

TAX REMEDIES- COMMISSIONER OF INTERNAL REVENUE

13. Which is not an authority of the commissioner of Internal Revenue?

A. Compromise the payment of any internal revenue tax;

B. Cancel or abate tax liability;

C. Credit or refund.

D. Enact tax laws.

TAX REMEDIES- GOVERNMENT

14. Which is a civil remedy for the collection of internal revenue taxes, fees, or charges, and any increment thereto resulting

from delinquency?

a) Distraint of personal property and

b) Levy upon real property and interest in or rights to real property.

c) Civil action or

d) Criminal action.

A. a and b

B. b and c

C. a,b and c

D. a, b, c, and d

TAX REMEDIES- GOVERNMENT

15. (Phil. CPA) A taxpayer filed her income tax return for 2000 on April 15, 2001 and paid the tax of P12,000. Upon audit of the

BIR, an assessment notice was issued on May 2, 2003 requiring the taxpayer to pay a deficiency tax of P50,000 not later

than July 15, 2003. The taxpayer may:

A. Go to the Supreme Court if the issues involved are pure question of law;

B. Ignore the assessment as the date of collection is beyond three (3) years as the taxable year covers 2000;

C. Request for an extension of time to pay the deficiency income tax;

D. Go to the Court of Tax Appeals to appeal the assessment made by the BIR.

16. (Phil. CPA modified) The following are related to the tax assessment of a taxpayer:

Date when assessment was received October 1, 2017

Petition for reconsideration was filed with BIR October 9, 2017

BIR decision of denial was received July 2, 2018

Second request for reconsideration was filed with the BIR July 15, 2018

Date revised assessment was received July 5, 2019

The last day to appeal to the Court of Tax Appeals is on:

A. July 15, 2019;

B. August 6, 2019;

C. August 4, 2019;

D. September 5, 2019.

Additions to Tax

17. (Phil. CPA Modified) Pio Company did not file his monthly VAT declaration for the month of January, 2017, which was due

for filing on February 20, 2017.

He was notified by the BIR of his failure to file the declaration, for which reason, he filed his declaration and paid the tax

only after the said notice on June 30, 2018. The tax due per monthly VAT declaration was P100,000.

LEAD TAX Pre Week Page 2 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

How much was the total amount due on June 30, 2018?

A. P100,000.00

B. P172,222.23

C. P177,214.62

D. P277,214.62

18. (Adapted) XYZ Corporation filed its income tax return for calendar year 1997 with a net taxable income of P500,000. At

the applicable income tax rate of 35% for the year 1997, its income tax amounted to P175,000. However, upon

investigation, it was disclosed that its income tax return was false or fraudulent because it did not report a taxable income

amounting to another P500,000. On its net income of P1,000,000, per investigation, the income tax due is P350,000.

Deducting its payment per return filed, the deficiency, excluding penalties, amounted to P175,000. It was duly informed of

this finding through the Preliminary Assessment Notice. Failing to protest on time against the preliminary assessment

notice, a formal letter of demand and assessment notice was issued on May 31, 1999 calling for payment of the deficiency

income tax on or before June 30, 1999.

a. How much was the total amount due?

b. Assuming that the calendar year 1997 deficiency income tax assessment against XYZ Corporation was not paid by

June 30, 1999, the deadline for payment of the assessment and assuming further that this assessment had already

become final and collectible. The corporation paid its tax assessment only by July 31, 1999.

a. b.

A. P175,000.00 P175,000.00

B. P304,771.68 307,784.25

C. P304,771.68 P312,863.79

D. P42, 271.68 P 45,284,25

19. (Phil. CPA) For filing false and fraudulent return, a surcharge is imposed. Which of the following is correct?

A. 50% administrative penalty

B. 50% criminal penalty

C. 25% plus 50%

D. 25% criminal penalty

ELECTRONIC FILING OF TAX RETURNS AND PAYMENT OF TAXES

20. It refers to the control number issued by the AAB to the BIR to confirm that tax payment has been credited to the account

of the government or recognized as revenue (internal revenue tax collection) by the Bureau of Treasury.

A. Electronic Filing and Payment System (EFPS)

B. Filing Reference Number

C. Confirmation Number

D. Acknowledgement Number

Receipts, Invoices and Books of Accounts

21. In cases where the sales or receipts in the preceding year exceed P30,000, receipt or invoice is issued for each sale or

transfer of merchandise or for services rendered valued at:

A. Not less than P10;

B. Not less than P20;

C. Not less than P25;

D. Regardless of the value.

22. When the quarterly sales, earnings, receipts or output exceed P50,000, what books of account shall be maintained by a

business entity?

A. Simplified set of bookkeeping records;

B. Journal and a ledger or their equivalents;

C. Either simplified set of bookkeeping records or journal and a ledger or their equivalents;

D. No books of account required.

TRANSFER TAXES

23. (ADAPTED) Which of the following is not included in the gross estate of a resident decedent who is under conjugal

partnership of gains?

A. House and lot inherited by the decedent during the marriage from his who predeceased the decedent.

B. Condominium unit transferred to his son for an insufficient consideration.

C. Jewelry purchased by the decedent during the marriage with his exclusive money of the decedent.

D. SMC Shares of stock inherited by the decedent’s surviving spouse during the marriage

24. Which of the following is not included in the gross estate of a resident decedent who is under conjugal partnership of gains?

A. House and lot inherited by the decedent during the marriage from his who predeceased the decedent.

B. Condominium unit transferred to his son for an insufficient consideration.

C. Jewelry purchased by the decedent during the marriage with his exclusive money of the decedent.

D. SMC Shares of stock inherited by the decedent’s surviving spouse during the marriage

25and 26. are based on the following:

25. (Adapted) A decedent dies on January 15, 2013. The interment is on January 31, 2013. The gross estate of the decedent is

P4,000,000. The following expenses are presented to you:

Expenses during the wake borne by relatives and friends P30,000

Mourning clothing of the widow and unmarried minor children 20,000

Obituary notice in a newspaper 50,000

Card of thanks published in a newspaper 30,000

Burial plot 80,000

Flowers placed on top of the burial lot when relatives visited on February 14, 2013 5,000

LEAD TAX Pre Week Page 3 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

Expenses during a family’s gathering to commemorate the 40thday after death of the 15,000

decedent on February 23, 2013

Accountant’s fee in gathering to commemorate the 40th day after death of the decedent 50,000

on February 23, 2013

Lawyer’s fee in representing the estate in case filed on August 15, 2013 70,000

Executor’s fee

January 15, 2013 to July 15, 2013 P120,000

July 16, 2013 to December 31, 2013 120,000 240,000

The deductible funeral expenses are:

A. P150,000.

B. P180,000.

C. P200,000.

D. none of the choices.

26. The deductible judicial expenses are:

A. P360,000.

B. P240,000.

C. P170,000.

D. none of the choices.

27.(Adapted) The following taxes are claimed as deduction from the gross estate of a decedent who dies on July 1, 2013.

Income tax on income earned from January 1 to June 30, 2013 P100,000

Income tax on income earned from July 1, 2013 to December 31, 2013 120,000

Real estate tax paid, January 1 to June 30, 2013 50,000

Unpaid real estate tax, July 1 to December 31, 2013 50,000

Unpaid property tax, January 1 to June 30, 2013 60,000

The correct amount of deductible taxes shall be:

A. P380,000.

B. P210,000.

C. P170,000.

D. none of the choices.

28.Which of the following shall be allowed as deduction from the gross estate of a non-resident alien decedent?

Old Law Train Law

A. Family home deduction Standard deduction / Transfer for public use

B. Medical expenses Standard deduction / Transfer for public use

C. Standard deduction Standard deduction / Transfer for public use

D. Transfer for public use Standard deduction / Transfer for public use

29.Which is of the following period for filing is true?

Old Law Train Law

Notice of death is filed 2 months after the decedent’s death Not required

Estate tax returns are filed 6 months after the decedent’s death 1 year after the decedent’s death

Notice of death is filed Estate tax returns are filed

A. True True

B. True False

C. False False

D. False True

30.S1-Under the TRAIN Law, the standard deduction is now P5,000,000

S2-Under the TRAIN Law, a CPA certification is required if the gross estate exceeds P5,000,000.

S3-Under the TRAIN Law, payment of estate tax is now allowed within 2 years from the date of death without civil

penalties or interest.

S1 S2 S3

A. True True True

B. True True False

C. True False False

D. False False False

31. to 34. are based on the following:

Harry had the following donations/transactions:

Date Donations

January 1 Donated a P150,000 diamond ring to her sister who

was getting married in March 15 of the same year.

March 1 Sold her personal car valued at P500,000 for

P200,000 to his uncle.

April 1 Sold his residential house to his brother for P1,500,000. The fair market value of the residential

house at the time of sale was P2,000,000.

June 1 Donated P100,000 to BinanCityfor public purpose and P50,000 to her brother who graduated from De La

Salle University.

31.How much was the donor’s tax for the gift made on January 1?

Old Law Train Law

A. P 30,000 P0

LEAD TAX Pre Week Page 4 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

B. P 1,000 P0

C. P 800 P 30,000

D. P 30,000 None of the choices

32.How much was the donor’s tax for the gift made on June 1?

Old Law Train Law

A. P 32,000 P 9,000

B. P 14,000 P 30,000

C. P 2,000 P 3,000

D. None of the choices None of the choices

33. Donation is completed:

A. when the donee accepts the donation and the acceptance is made known to the donor.

B. when the property donated is delivered actually or constructively to the donee.

C. when the donor’s tax is finally paid.

D. when it is determined that the donor has the capacity to make donations.

34.Donor’s return shall be filed within:

A. thirty (30) days after the donor executes a Deed of Donation.

B. thirty (30) days after the date the gift is made.

C. six (6) months after the date the gift is made

D. thirty (30) days after the donor pays the donor’s tax.

BUSINESS TAXES (Theories)

35.First statement: Only VAT-registered taxpayers are required to pay Value-Added Tax.

Second statement: Taxpayers whose gross annual sales or receipts exceed the VAT threshold amount are required to pay

Value-Added Tax in all cases.

A. Both statements are correct

B. Both statements are incorrect

C. Only the first statement is correct

D. Only the second statement is correct.

For Items 36 and 37

36.A VAT-registered lessor of apartment houses has the following gross rentals for the first quarter of the current year:

Gross rentals of 30 units at P10,000 per month per unit P3,600,000

Gross rentals of 10 units at P15,000 per month per unit 1,800,000

Total .................................................. P5,400,000

The VAT-registered lessor of apartment houses shall be:

A. subject to VAT on his gross rentals of P5,400,000.

B. subject to VAT on his gross rentals of P1,800,000.

C. subject to VAT on his gross rentals of P3,600,000.

D. exempt from VAT on his total gross rentals.

37.Under the TRAIN Law, the VAT-registered lessor of apartment houses shall be:

A. subject to VAT on his gross rentals of P5,400,000.

B. subject to VAT on his gross rentals of P1,800,000.

C. subject to VAT on his gross rentals of P3,600,000.

D. exempt from VAT on his total gross rentals.

38. The following transactions during the month of January, 2013 are recorded in the books of a VAT-registered taxpayer:

Purchase of three (3) office equipment at P150,000 each

Purchase of five (5) office furniture at P50,000 each

Importation of vehicle for transport used in business, P1,500,000

Based on the above data:

A. The total input taxes on the above transactions shall be amortized.

B. The input tax on office equipment and office furniture shall be credited in full.

C. Only the VAT on importation of vehicle for land transport shall be amortized.

D. The total input taxes on the above transactions may be amortized or credited in full depending on the choice of the

taxpayer.

39. Which of the following is allowed presumptive input tax?

A. Processor of sardines, mackerel and milk

B. Manufacturer of raw sugar

C. Processor of canned fruits

D. Manufacturer of packed instant champorado

40. The quarterly VAT return is filed:

A. Within twenty (20) days following the end of the quarter.

B. Within twenty-five (25) days following the end of the quarter.

C. Within sixty (60) days following the end of the quarter.

D. When the VAT payable is finally determined.

LEAD TAX Pre Week Page 5 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

41. One of the following is subject to the 3% percentage tax under Sec. 116:

A. Seller of fresh mangoes whose annual gross sales do not exceed the VAT threshold amount

B. Seller of canned fish whose annual gross sales exceed the VAT threshold amount

C. Seller of refined sugar whose annual gross sales do not exceed the VAT threshold amount

D. Seller of office supplies who is VAT-registered but whose gross annual sales do not exceed the VAT threshold

amount.

42. Which of the following is subject to common carriers tax?

A. Transportation contractors by land on their transport of goods and cargoes

B. Person who transports passengers by air

C. Domestic carrier by land relative their transport of passengers.

D. Person who transports goods and cargoes by sea

43. (Easy) Which of the following is not subject to franchise tax?

A. Franchise grantee of radio and/or television broadcasting whose gross annual receipts of the preceding year does

not exceed P10,000,000

B. Franchise grantees of gas and water utilities

C. PAGCOR and its licensees and franchisees

D. Franchise grantee of electric utilities

44. Rentals of property, real or personal, received by bank and non-bank financial intermediaries performing quasi-banking

functions are:

A. subject to Value-added Tax at 12%.

B. subject to Gross Receipts Tax at 7%.

C. subject to Gross Receipts Tax if the annual gross rentals do not exceed the VAT threshold amount.

D. not subject to any tax.

45.Which of the following is not subject to amusement tax?

A. Proprietor of videoke bars

B. Operator of cockpits

C. Lessee of bowling alleys

D. Lessee jai-alai and racetracks

For Items 46 and 47

46. Mr. X, a minimum wage earner, works for 123 Co. Mr. X is not engaged in business nor has any other source of income

other than his employment. For 2018, Mr. X earned a total compensation income of P135,000.00.The taxpayer contributed

to the SSS, Philhealth, and HDMF amounting to P5,000.00 and has received 13th month pay of P11,000.00. How much is

his income tax due?

A. EXEMPT

B. P135,000.00

C. P119,000.00

D. None of the choices

47. The following year, Mr. X earned, aside from his basic wage, additional pay of P140,000.00 which consists of the overtime

pay (P80,000.00), night shift differential (P30,000.00), hazard pay (P15.000.00) and holiday pay (P15,000.00). He has the

same benefits and contributions as in item 46. How much is his taxable income?

A. EXEMPT

B. P135,000.00

C. P140,000.00

D. P259,000.00

48. Ms. Terry operates a convenience store while she offers bookkeeping services to her clients. In 2018, her gross sales

amounted to P800,000.00, in addition to her receipts from bookkeeping services of P300,000.00. She already signified her

intention to be taxed at 8% income tax rate in her 1st quarter return. How much is her income tax due?

A. EXEMPT

B. P1,100,000.00

C. P 850,000.00

D. P 68,000.00

49. Ms. Terry above, failed to signify her intention to be taxed at 8% income tax rate on gross sales in her initial Quarterly

Income Tax Return, and she incurred cost of sales and operating expenses amounting to P600,000.00 and P200,000.00,

respectively, or a total of P800,000.00, how much is her income tax due?

A. EXEMPT

B. P1,100,000.00

C. P 300,000.00

D. P 10,000.00

50. Mr. Yoso signified his intention to be taxed at 8% income tax rate on gross sales in his 1st Quarter Income Tax Return. He

has no other source of income, His total sales for the first three (3) quarters amounted to P3,000,000.00 with 4th quarter

sales of P3,500,000.00.

How much is his annual income tax payable?

A. EXEMPT

B. P1,580,000.00

C. P509,200.00

D. P289,200.00

LEAD TAX Pre Week Page 6 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

51. Ms. RSVP is a prominent independent contractor who offers architectural and engineering services. Since her career

flourished, her total gross receipts amounted to P4,250,000.00 for taxable year 2018. Her recorded cost of service and

operating expenses were P2,150,000.00 and P1,000,000.00, respectively. How much is her tax due?

A. EXEMPT

B. P4,250,000.00

C. P1,100,000.00

D. P220,000.00

52. In 2018, Mr. Swabe owns a nightclub and videoke bar, with gross sales/receipts of P2,500,000.00. His cost of sales and

operating expenses are P1,000,000.00 and P600,000.00, respectively, and with non-operating income of P100,000.00. How

much is his tax due under graduated rates? Can he opt to be taxed at 8%?

Graduated Rates 8%

A. P1,000,000.00 Yes

B. P1,000,000.00 No

C. P 190,000.00 Yes

D. P 190,000.00 No

53. Mr. Madz, a Financial comptroller of JAC Company, earned annual compensation in 2018 of P1,500,000.00, inclusive of 13th

month and other benefits in the amount of P120,000.00 but net of mandatory contributions to SSS and Philhealth. Aside

from employment income, he owns a convenience store, with gross sales of P2,400,000. His cost of sales and operating

expenses are P1,000,000.00 and P600,000.00, respectively, and with non-operating income of P100,000.00. How much is

his tax due if

A. He opted an Eight Percent (8%) income tax rate on Gross Sales

B. He did not Opt for 8% income tax on Gross Sales/Receipts and other non-operating income

Graduated Rates 8%

A. P313,000.00 P1,410,000.00

B. P200,000.00 P2,310,000.00

C. P 513,000.00 P589,200.00

D. None of the choices None of the choices

54. On February 7, 2019, taxpayer tendered his resignation to concentrate on his business. His total compensation income

amounted to P150,000.00, inclusive of benefits of P20,000.00. His business operations for the taxable year 2019 remains

the same. How much is his tax due and payable if he opted for the eight percent (8%) income tax rate?

A. EXEMPT

B. P80,000.00

C. P130,000.00

D. P200,000.00

55. Mr. Wayne, an officer of BATS International Corp., earned in 2018 an annual compensation of P1,200,000.00, inclusive of

the 13th month and other benefits in the amount of P120,000.00. Aside from employment income, he owns a farm, with

gross sales of P3,500,000. His cost of sales and operating expenses are P1,000,000.00 and P600,000.00, respectively, and

with non-operating income of P100.000.00. How much is his tax due for 2018?

A. EXEMPT

B. P80,000.00

C. P130,000.00

D. P200,000.00

56. A lessor rents his 15 residential units for P14,500 per month. During the taxable year, his accumulated gross receipts

amounted to P2,610,000. Which is false?

A. He is not subject to VAT since the monthly rent per unit does not exceed P15,000.

B. He is also not subject to 3% Percentage Tax.

C. He is not subject to VAT whether he is a VAT registered entity or not.

D. He is subject to VAT whether he is a VAT registered entity or not.

57. Using the same data in number 56, assuming he has 20 residential units with the same monthly rent per unit and his

accumulated gross receipts during the taxable year amounted to P3,480,000, which of the following statement is false?

A. He is not subject to VAT since the monthly rent per unit does not exceed P15,000.

B. He is also not subject to 3% Percentage Tax.

C. He is not subject to VAT whether he is a VAT registered entity or not.

D. He is subject to VAT whether he is a VAT registered entity or not.

58. A lessor rents his 15 residential units for P15,500 per month. During the taxable year, his accumulated gross receipts

amounted to P2,790,000, which of the following statements is true?

A. He is not subject to VAT since the monthly rent per unit does not exceed P15,000.

B. He is also not subject to 3% Percentage Tax.

C. He is not subject to VAT whether he is a VAT registered entity or not.

D. He is not subject to VAT since his accumulated gross receipts did not exceed P3,000,000. However he is subject to

a 3% percentage tax.

59. Using the same data in number 58, assuming he has 20 residential units with the same monthly rent per unit and his

accumulated gross receipts during the taxable year amounted to P3,720,000, which of the following statements is true?

A. He is subject to VAT since the monthly rent per unit exceeds P15,000 and the accumulated earnings exceeded

P3,000,000 .

B. He is subject to 3% Percentage Tax.

C. He is not subject to VAT whether he is a VAT registered entity or not.

D. He is not subject to VAT since his accumulated gross receipts did not exceed P3,000,000. However he is subject to

a 3% percentage tax.

LEAD TAX Pre Week Page 7 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

60. A lessor rents his 2 commercial and 10 residential units for monthly rent of P60,000 and P15,000 per unit, respectively.

During the taxable year, his accumulated gross receipts amounted to P3,240,000 (P1,440,000 from commercial units and

P1,800,000 from residential units). Which of the following statements are false?

A. The P1,440,000 from commercial units is not subject to VAT since it did not exceed P3,000,000.

B. The P1,440,000 from commercial units is, however, subject to 3% Percentage Tax.

C. The P1,800,000 accumulated receipts from the residential units are not subject to Percentage Tax and exempt from

VAT since the monthly rent is not more than P15,000.

D. None of the above

61. Mr. JMLH signified his intention to be taxed at “8% income tax in lieu of the graduated income tax rates and percentage tax

under Section 116” in his 1st Quarter Income Tax. However, his gross sales/receipts during the taxable year have exceeded

the VAT threshold as follows:

January P250,000

February 250,000

March 250,000

April 250,000

May 250,000

June 250,000

July 250,000

August 250,000

September 250,000

October 1,000,000

November 1,000,000

December 1,000,000

Total gross sales/receipts P5,250,000

Which statement is false?

A. Mr. JMLH lost the option to pay the 8% commuted tax rate when his gross sales/receipts exceeded the three million

threshold during the 4th Quarter.

B. For business tax purposes, he is subject to the 12% VAT prospectively starting November 2018.

C. He is also required to update his registration from non-VAT to VAT on or before November 30, 2018.

D. None of the above

62. WPM is a rice dealer. His total annual gross sales and/or receipts do not exceed Three Million (P3,000,000.00), allowing him

to avail the following:

(a) WPM is a VAT-exempt taxpayer. He may elect to avail of the optional registration for VAT of exempt person under

Section 236 (H) of the 1997 Tax Code, as amended. Upon election of such option, he shall not be entitled to cancel his VAT

registration for the next three (3) years;

(b) WPM may elect to pay the 8% commuted tax rate on gross sales or receipts and other non-operating income in lieu of

the graduated income tax rates and the percentage tax under Section 24(A)(2)(b) of the 1997 Tax Code, as amended, since

his gross sales or receipts did not exceed Three Million Pesos (P3,000,000) during the taxable year. If he elects to pay the

8% commuted tax, he shall not be allowed to avail of the optional registration for VAT of exempt person provided by

Section 236(H) of the 1997 Tax Code, as amended.

A. True ; True

B. True ; False

C. False; True

D. False; False

63. What are the transactions which are no longer subject to zero-percent (0%)?

1. Sale of gold to BSP

2. Foreign-currency denominated sales

A. Both 1 and 2

B. 1 only

C. 2 only

D. Neither 1 nor 2

64. What are the transactions that will now be subject to twelve percent (12%) and no longer be subject to zero percent (0%),

upon the successful establishment and implementation of an enhanced VAT refund system by the Department of Finance

(DOF)?

1. The sale of raw materials or packaging materials to a non-resident buyer for delivery to a resident local export-oriented

enterprise to be used in manufacturing, processing, packing or repacking in the Philippines of the said buyer's goods, paid

for in acceptable foreign currency, and accounted for in accordance with the rules and regulations of the BSP;

2. The sale of raw materials or packaging materials to an export-oriented enterprise whose export sales exceed seventy

percent (70%) of total annual production;

3. Transactions considered export sales under Executive Order No. 226, otherwise known as the Omnibus Investments

Code of 1987, and other special laws

4. Processing, manufacturing or repacking goods for other persons doing business outside the Philippines which goods are

subsequently exported where the services are paid for in acceptable foreign currency and accounted for in accordance

with the rules and regulations of the BangkoSentral ng Pilipinas (BSP); and

5. Services performed by subcontractors and/or contractors in processing, converting, or manufacturing goods for an

enterprise whose export sales exceeds seventy percent (70%) of total annual production.

A. 1,2,3,4 and 5

B. 1,2,3 and 4

C. 1,2 and 3

D. 1 and 2

65. 1. Sale of real properties utilized for specialized housing as defined under RA No. 7279, and other related laws, such as RA

No. 7835 and RA No. 8763, wherein price ceiling per unit is Php 450,000.00 or as may from time to time be determined by

the HUDCC and the NEDA and other related laws;

2. Sale of residential lot valued at One Million Five Hundred Thousand Pesos (P1,500,000.00) and below, or house and lot

and other residential dwellings valued at Two Million Five Hundred Thousand Pesos (P2,500,000.00) and below, as adjusted

LEAD TAX Pre Week Page 8 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

using latest Consumer Price Index values. (If two or more adjacent lots are sold or disposed in favor of one buyer, for the

purpose of utilizing the lots as one residential lot, the sale shall be exempt from VAT only if the aggregate value of the lots

do not exceed One Million Five Hundred Thousand Pesos (P1,500,000.00). Adjacent residential lots, although covered by

separate titles and/or separate tax declarations, when sold or disposed to one and the same buyer, whether covered by one

or separate Deed of Conveyance, shall be presumed as a sale of one residential lot.)

Under the TRAIN Law which is true?

A. Both 1 and 2

B. 1 only

C. 2 only

D. Neither 1 nor 2

66. (Adapted) A VAT-registered public works contractor has the following data on services rendered in the Philippines for the

first quarter of 2007 (VAT-exclusive):

Contract price (foreign clients doing business

outside the Philippines) ($1:P50) $ 100,000

Contract price (private sector clients) P 5,000,000

Contract price (Government) 3,000,000

Collections from foreign clients $ 100,000

Collections from Government contracts 1,000,000

Collections from private sector clients 2,000,000

Purchases during the quarter

(used in private sector clients contracts) 800,000

Payments for services of a VAT-registered sub-

contractor (used in Government contracts) 400,000

Purchases during the quarter (used in

private sector clients and

government contracts only) 300,000

How much is the VAT payable for the quarter using 12% VAT?

A. P190,000

B. P170,000

C. P120,000

D. None

ITEMS 67 AND 68 Vanderwoodsen is a radio-TV broadcasting franchise grantee. The previous year, its gross receipts did not

exceed P 10,000,000. In the first month of the current year, it had the following data:

Gross receipts, sale of airtime P 2,000,000

Payments received from user of radio station’s

communications facilities for overseas

communications 500,000

Business expenses 700,000

67. How much was the franchise tax due?

A. P75,000

B. P60,000

C. P50,000

D. P40,000

68. How much was the overseas communications tax?

A. P250,000

B. P200,000

C. P75,000

D. P50,000

(Adapted)69 to 73 are based on the following: Audrey Foam Manufacturing Corp. is a VAT-registered enterprise. It has the

following data taken from its books of accounts for the first quarter of the fiscal year starting May 1, 2014 and ending April

30, 2015):

Domestic sale of goods P5,000,000

Sale of goods to senior citizens, net of 20% discount 800,000

Beginning inventory 300,000

Domestic purchases of goods for use in all transactions 500,000

Importation of goods for use in all transactions 700,000

Ending inventory 200,000

Payment for services for all transactions 450,000

Purchase of vehicle for land transport for use in all transactions (estimated life 5 years purchased

May 1, 2014) 2,500,000

Maintenance expense for the vehicle for land transport 100,000

Other operating expenses (including salaries of P100,000 given to senior citizen-employees)

500,000

Assistance given under Adopt-A-School Program to a state college 100,000

Monthly VAT paid (May and June) 300,000

69. How much is the creditable input tax?

A. P250,000

B. P198,000

C. P165,000

D. None of the choices

70. How much is the VAT payable?

A. P435,000

LEAD TAX Pre Week Page 9 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

B. P222,000

C. P135,000

D. None of the choices

71. How much is the total deductible expenses for income tax purposes?

A. P1,324,000

B. P1,124,000

C. P1,024,000

D. None of the choices

72. How much is the taxable net income for the quarter?

A. P3,552,000

B. P3,352,000

C. P2,352,000

D. None of the choices

73. When shall the income tax return and the quarterly VAT return be filed for the first fiscal quarter?

Quarterly ITR Quarterly VAT Return

A. September 30, 2014 September 30, 2014

B. September 25, 2014 August 31, 2014

C. November 15, 2014 August 20, 2014

D. September 29, 2014 August 25, 2014

74. Under the TRAIN Law,the following passive income are subject to

Resident/ Citizen NRA-NETB

A. PCSO winning amounting to P11,000 = 10% FWT PCSO winning amounting to P11,000= 10% FWT

B. PCSO winning amounting to P11,000 = 20% FWT PCSO winning amounting to P11,000= 25% FWT

C. PCSO winning amounting to P11,000 = Exempt PCSO winning amounting to P11,000= Exempt

D. PCSO winning amounting to P11,000 = Exempt PCSO winning amounting to P11,000= 25% FWT

75. The FWT for interest income from a Depository Bank under the Expanded Foreign Currency Deposit System is

RC NRC RA NRA-ETB NRA-NETB

A. 15% 15% 15% Exempt Exempt

B. 15% Exempt 15% Exempt Exempt

C. 15% Exempt 7.5% Exempt Exempt

D. 75% Exempt 7.5% Exempt Exempt

76. The FWT for interest income from a Depository Bank under the Expanded Foreign Currency Deposit System is

DC RFC NRFC

A. 15% 7.5% Exempt

B. 15% 15% Exempt

C. 15% Exempt Exempt

D. 75% 7.5% Exempt

77. The capital gains tax on sale of unlisted shares is:

RC NRC RA NRA-ETB NRA-NETB

A. 15% 15% 15% 15% 15%

B. 15% Exempt 15% Exempt Exempt

C. 15% Exempt 7.5% Exempt Exempt

D. 75% Exempt 7.5% Exempt Exempt

78. The capital gains tax on sale of unlisted shares is:

DC RFC NRFC

A. 15% 5% ; 10% 5% ; 10%

B. 15% 15% Exempt

C. 15% Exempt Exempt

D. 75% 7.5% Exempt

79. S1 - Preferential tax treatment shall not apply for employees of ROHQ, RHQ, OBU, and Petroleum service contractors and

subcontractors which registered with the Securities and Exchange Commission beginning 1 January 2018.

S2 - Amount of exempt 13th month pay and other benefits is increased to PHP90,000

A. True ; True

B. True ; False

C. False; True

D. False; False

80. Which of the following is subject to a corporate tax of 32%

A. PCSO

B. Government Service Insurance System

C. Social Security System

D. Local water district

81. Under the TRAIN Law, the following de minimis benefit ceiling increased, which is incorrect

A. Uniform allowance – increased to P5,000

B. Uniform allowance – increased to P6,000

C. Rice allowance – increased to P2,000 per month

D. Medical assistance to dependent – increased to P2,000 per year

(Items 82 and 83)In 2014, George James, single, supports the following: Earl, his significant other; Elirie, a legally adopted child

LEAD TAX Pre Week Page 10 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

who became 21 years old during the year; Vanessa, an 18-year old niece and Gorgonio, a senior citizen who is not related to

him. He earned P2,500,000.00 from his beauty parlor and received P250,000.00 as Christmas gift from his spinster aunt. He

had no other receipts for the year. The cost of services of the parlor was P500,000.00 and the expenses for the operation of his

beauty parlor amounted to P250,000.00.

82. The Output VAT for 2014 is:

A. P330,000

B. P300,000

C. P240,000

D. None

83. The taxable net income for 2014 if he avails of the optional standard deduction is:

A. P1,675,000.00

B. P1,500,000.00

C. P1,425,000.00

D. None

84. Which of the following income is not from a related trade, business or activity of a domestic proprietary educational

institution?

A. Income from the hospital where medical graduates are trained for residency

B. Income from the canteen situated within the school campus

C. Income from bookstore situated within the school campus

D. Income from rent of available office spaces in one of the school buildings

85. A tax imposed in the nature of a penalty to the corporation to deter tax avoidance of shareholders who avoid paying the

dividends tax on the earnings distributed to them by the corporation.

A. Minimum corporate income tax

B. Optional corporate income tax

C. Improperly accumulated earnings tax

D. Capital gains tax

86. Which of the following will not result to capital gains or losses?

A. Gains or losses on account of failure to exercise a privilege or option to buy or sell property

B. When a corporation distributes all of its assets in complete liquidation

C. When a partner retires or when the partnership is dissolved

D. Gains or losses from sale of office equipment

87. (Phil. CPA) Mr. Santiago purchased a life annuity for P100,000 which would pay him P10,000 a year. The life expectancy of

Mr. Santiago was 12 years. Which of the following would Mr. Santiago be able to exclude from his gross income?

A. P120,000

B. P100,000

C. P20,000

D. P10,000

88. The monetary value of the following housing privilege shall be fifty percent (50%) of the value of the benefit, except which

of the following?

A. If the employer leases a residential property for the use of his employee and the said property is the usual place of

residence of the employee

B. If the employer owns a residential property and the same is assigned for the use of his employee as his usual place

of residence

C. If the employer purchases a residential property on installment basis and allows his employee to use the same as

his usual place of residence

D. If the employer acquires a residential property and transfers the ownership to his employee without consideration.

89. NOLCO shall be availed of on a:

A. “first-in, first-out” basis.

B. “last-in, first-out” basis.

C. “weighted average” basis.

D. none of the choices.

90. Research and development expenses treated as deferred expenses shall be allowed as deduction ratably distributed over a

period of not less than:

A. 60 months beginning with the month ending the taxpayer’s taxable year.

B. 60 months beginning with the month in which the taxpayer first realizes benefits from such expenditures.

C. 30 months beginning with the month in which the taxpayer first realizes benefits from such expenditures.

D. 30 months beginning with the month in which the taxpayer first realizes benefits from such expenditures.

93. Which of the following may NOT be allowed to claim OSD in lieu of the itemized deductions?

A. Taxable estates and trusts

B. Domestic corporation

C. Resident foreign corporation

D. Non-resident foreign corporation

94. First statement: The additional exemption for dependent shall be claimed by only one of the spouses in the case of

married individuals.

LEAD TAX Pre Week Page 11 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

Second statement: The husband is the proper claimant of the additional exemption for qualified dependent children unless he

explicitly waives his right in favor of his wife.

A. True ; True

B. True ; False

C. False; True

D. False ; False

95. How much is the documentary stamp tax on deeds of sale and conveyance of real property?

I - Fifteen pesos (P15.00) when the consideration, or value received or contracted to be paid for such realty after making

proper allowance of any encumbrance, does not exceed One thousand pesos (P1,000) fifteen pesos (P15.00)

II - Fifteen pesos (P15.00) for each additional One thousand Pesos (P1,000), or fractional part thereof in excess of One

thousand pesos (P1,000) of such consideration or value

A. True ; True

B. True ; False

C. False; True

D. False ; False

96. There shall be allowed a deduction from gross income for entertainment, amusement and recreation expense in an amount

equivalent to the actual entertainment, amusement and recreation expense paid or incurred within the taxable year by the

taxpayer, but in no case shall such deduction exceed:

I - 0.50 % of net sales (gross sales less sales returns or allowances and sales discounts) for taxpayers engaged in sale of

goods or properties.

II - 1 % of net revenue (gross revenue less discounts) for taxpayers engaged in sale of services, including exercise of

profession and use or lease of properties.

A. True ; True

B. True ; False

C. False; True

D. False ; False

97. The taxpayer’s otherwise allowable deduction for interest expense shall be reduced by how much starting January 1, 2009?

A. Forty-five percent (45%) of the interest income subjected to final tax

B. Forty-two percent (42%) of the interest income subjected to final tax

C. Thirty-three percent (33%) of the interest income subjected to final tax

D. Twenty-five percent (25%) of the interest income subjected to final tax

98. At the option of the taxpayer, interest incurred to acquire property used in trade or business or exercise of profession may

be:

I - allowed as a deduction.

II - treated as a capital expenditure.

A. True ; True

B. True ; False

C. False; True

D. False ; False

99. Interest incurred or paid by the taxpayer on all unpaid business-related taxes:

I - shall be fully deductible from the gross income.

II - shall not be subject to reduction by an amount equal to certain percentage of the interest income subject to final tax.

A. True ; True

B. True ; False

C. False; True

D. False ; False

100. (Phil. CPA) Mrs. Evangelista owns a parcel of land worth P500,000 which she inherited from her father in 1990 when it was

worth P300,000. Her father purchased it in 1980 for P100,000. If Mrs. Evangelista transfers this parcel of land to her wholly

owned corporation in exchange for shares of stock of said corporation worth P450,000, Mrs. Evangelista’s deductible loss is:

A. Zero

B. P50,000.

C. P150,000.

D. P350,000.

PART 2

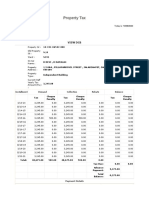

Tax on Transfer of Real Property Ownership

1. Which of the following is not subject to tax on transfer or real property ownership?

a. Sale or donation of real properties

b. Transfer of real properties through testate and intestate succession

c. Transfer of real property in complete liquidation by a corporation of its real properties to its stockholder

d. Transfer of ownership of real property pursuant o the Comprehensive Agrarian Law (CARP Law)

2. The tax base of the local tax on transfer of real property ownership is:

a. Total consideration involved in the acquisition of the property

b. Fair market value in case the monetary consideration involved in the transfer is not substantial

c. Total consideration involved in the acquisition of the property or fair market value in case the monetary

consideration involved in the transfer is not substantial, whichever is lower

d. Total consideration involved in the acquisition of the property or fair market value in case the monetary

consideration involved in the transfer is not substantial, whichever is higher

LEAD TAX Pre Week Page 12 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

3. When does the local tax on transfer or real property ownership accrue?

a. From the effective date of transfer of ownership of title every real property

b. Date of registration of the corresponding Deed of Conveyance

c. Any time within (6) months after the transfer of real property

d. Anytime the taxpayer signifies his desire to pay the local tax

4. Who shall have authority to collect the local transfer tax?

a. Province where the property is located

b. Residence of the transfer where the property is located

c. Principal office of the transferor where the property is located

d. Residence of the transferee where the property is located

5. An individual taxpayer sold his residential house and lot for P5,000,000 (fair market value was P4,000,000).

Question 1 – How much is the capital gains tax?

a. P300,000 b. P200,000 c. P75,000 d. None of the choices

Question 2 – How much is the documentary stamp tax?

a. P300,000 b. P200,000 c. P75,000 d. None of the choices

Question 3 – How much is the local transfer tax?

a. P75,000 b. P50,000 c. P25,000 d. None of the choices

Tax on business of Printing and publication

6. Which of the following is not subject to tax on business of printing and publication?

a. Printing and/or publication of books

b. Printing and/or publication of cards, posters, leaflets and handbills

c. Printing and/or publication of certificate , receipts, pamphlets and others of similar nature

d. Printing and/or publication of books and other reading materials prescribed by the Department of Education as

school texts or references

7. The rate of the tax on business or printing and publication must be fixed by a revenue ordinance and:

a. Should not be more than 50% of 1%

b. Should be more than 50% of 18%

c. Should be 1/20 of 1%

d. Should be more than 5%

8. Statement I: The tax on business of printing and publication shall accrue on the first day of January of each year.

Statement II: The tax on business of printing and publication shall be paid within the first 20 days of January or of each

subsequent quarter, as the case may be.

Statement III: The Sanggunian concerned may, for a justifiable reason or cause, extend the time for payment of this tax,

without surcharges or penalties, but only for a period not exceeding 6 months.

a. Only I and II are true

b. Only I and III are true

c. I, II and III are true

d. I, II and III are not true

9. Considering that the tax on business of printing and publication is in the nature of a business tax, which of the following

rules shall apply as far as the situs of the tax is concerned?

Rule 1: If the taxpayer maintains operates a branch of sales outlet where the sale or transaction is made and recorded, the

tax on such sale or transaction should be paid to the province where such branch or sales outlet is located.

Rule 2: In case where there is no branch or sales outlet in the province where the sale or transaction is made and recorded,

the tax on such sale or transaction should be paid to the province where the principal office is located.

a. Only Rule 1 applies

b. Only Rule 2 applies

c. Rule 1 and Rule 2 apply

d. Rule 1 and Rule 2 do not apply

e.

10. The following data are taken from the books of your client, single, in preceding calendar year:

Gross receipts from printing of books prescribed

by the Department of Education

as school texts or references P500,000

Gross receipts, printing of other books 200,000

Gross receipts, printing of cards, posters, leaflets and handbills 300,000

Cost of services 250,000

Deductible expenses 100,000

Question 1 – How much is the tax on business of printing and publication?

a. P5,000

b. P2,500

c. P2,003000

d. None of the choices

LEAD TAX Pre Week Page 13 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

Question 2 – How much was taxable net income in the preceding year?

a. P650,000

b. P100,000

c. Exempt from income tax

d. None of the choices

Franchise Tax

11. The rate of local franchise tax must be fixed by a revenue ordinance and :

a. Should not be more than 50% of 1%

b. Should be more than 50% of 1%

c. Should be 6%

d. Should be 10%

Tax on the Extraction of Sand, Gravel and Other Quarry Resources

12. The permit to extract and gravel and other quarry resources may only be issued pursuant to the revenue ordinance of the

Sangguniang Panlalawigan by the :

a. Provincial Governor.

b. Provincial Assessor.

c. Provincial Engineer.

d. Provincial Director of PNP.

13. Considering the nature of the quarrying activity, who may prescribe the time, manner, terms and conditions for the

payment of tax?

a. Provincial Governor.

b. Provincial Assessor.

c. Provincial Engineer.

d. Provincial Panlalawigan.

14. The Situs of the tax on extraction of sand, gravel and other quarry resources is :

a. Province where, the principal place of office of the taxpayer is located.

b. Province where the residence of the taxpayer is located.

c. Province where the quarry resources are extracted.

d. Any of the three province mentioned above.

15. Rakobato Company is engaged in quarrying business. It extracts sand and gravel in the Barangay Nabangig. Municipality of

Palanas, Province of Masbate. During a particular quarter, it extracted 500,000 cubic meters of sand from a public land

the fair market of which is P750,000. It also 200,000 cubic meters with fair market value of P250,000 from a quarry it

privately owns. How much tax on extraction will it be liable?

a. P100,000

b. P75,000

c. P50,000

d. None of the choices

16. Continuing with the preceding number, how shall the tax on extraction be distributed?

a. Nabangig, P30,000; Palanas P22,500; Masbate, P22,500

b. Nabangig, P25,000; Palanas P25,000; Masbate, P25,000

c. Nabangig, P40,000; Palanas P17,500; Masbate, P17,500

d. Nabangig, P0; Palanas P0; Masbate, P75,000

Professional Tax

17. Who among the following shall not be required to pay professional tax?

a. Person engaged in exercise or practice of his profession

b. Person who practice require government examination prior to their exercise or practice

c. Professionals exclusively employed by the government

d. None of the choice

Local Amusement Tax

18. Which among the following shall be subject both Value-Added Tax and the local Amusement Tax?

a. Theaters and cinemas

b. Cockpits

c. Concert halls

d. Circuses

Community Tax

19. Mr. and Mrs. A, resident citizens, had the following data for the calendar year:

Mr. A

Salaries and bonuses P500,750

Assessed value of land in USA 2,000,000

Assessed value of land in Manila 1,000,000

Mrs. A

Gross receipts from business P725,700

Zonal value of apartment house 3,000,000

Assessed value of apartment house 1,500,000

Income from apartment house 600,000

How much would be the total additional community tax due in the succeeding year aside from the P5 basic community tax

of each spouse?

a. P4,236

b. P2,500

LEAD TAX Pre Week Page 14 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

c. P1,826

d. P1,226

20. ABC corporation, domestic, had the following selected data in the preceding year:

Cash sales P3,390,000

Cost of sales 1,400,000

Operating expenses 900,000

Dividend received from a domestic corporation 50,000

Assessed value of land 500,000

FMV of land 1,000,000

Assessed value of building 700,000

Assessed value of machinery-Philippines 1,500,000

Assessed value of machinery-USA 2,000,000

How much would be the total basic and additional community taxes in the current year?

a. P2,956

b. P2,456

c. P1,376

d. P1,080

21. (Local Business Taxes) The following data are taken from the books of a VAT-registered manufacturer of cigarettes:

Gross sales P4,900,000

Sales returns 500,000

Sales discount, determinable at the time of sale 100,000

Excise tax 150,000

Value-added tax 540,000

Local tax passed-on to customers 100,000

For local business tax purposes, the taxable amount is:

a. P5,000,000 c. P3,710,000

b. P4,500,000 d. None of the choices

22. (Real Property Tax) A residential land is located in Metro Manila. Its fair market value is P5,000,000.

Question 1- How much is the basic real property tax, if any?

a. P30,000 c. P10,000

b. P20,000 d. None of the above

Question 2- How much is the special educational fund (SEF), if any?

a. P30,000 c. P10,000

b. P20,000 d. None of the choices

23. (Real Property Tax) An agricultural land is located in the province. Its fair market value is P2,000,000.

Question 1 – How much is the basic real property tax, if any?

a. P16,000 c. P4,000

b. P8,000 d. None of the choices

Question 2 – How much is the Special Educational Fund (SEF), if any?

a. P16,000 c. P4,000

b. P8,000 d. None of the choices

24. (Real Property Tax) A commercial land located in one of the cities in Metro Manila. Its fair market value is P10,000,000.

Question 1 – How much is the basic real property tax, if any?

a. P150,000 c. P50,000

b. P100,000 d. None of the choices

Question 2 – How much is the Special Educational Fund (SEF), if any?

a. P150,000 c. P50,000

b. P100,000 d. None of the choices

25. (Real Property Tax) A residential building located in one of the cities in Metro Manila has a fair market value of P10,000,000.

The city ordinance fixed the actual assessment level at 60%. How much is the real basic property tax, excluding the Special

Educational Fund (SEF)?

a. P120,000 c. P60,000

b. P100,000 d. None of the choices

Assessment Levels of Building

Class Fair Market Value Rate*

Residential P175,000 to P10,000,000 plus 0% to 60%

Agricultural P300,000 to P2,000,000 plus 25% to 50%

Commercial or Industrial 300,000 to P10,000,000 plus 30% to 80%

Timberland P300,000 to P2,000,000 plus 45% to 70%

*Actual assessment level fixed by ordinance

26. (Real Property Tax) An agricultural machinery located in the province has fair market value of P3,000,000. How much is the

real basic property tax, excluding Special Educational Fund (SEF)?

a. P12,000 c. P4,000

LEAD TAX Pre Week Page 15 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

b. P8,000 d. None of the choices

Assessment Levels of Machinery

Class Maximum Assessment Level

Residential 50%

Agricultural 40%

Commercial 80%

Industrial 80%

27. (PEZA) The ABC Company is a PEZA-registered manufacturer entitled to Income Tax Holiday (ITH) incentive for CY 2018. It is

the company’s fourth year of operations.

The following information pertain to the CY 2018 activities of the company:

Registered Unregistered

activities activities

Gross sales P121,700,000 P10,425,000

Cost of sales 103,400,000 7,297,500

Other income (net gain on disposal of office PPE) 550,500

Operating expenses of P9,890,100 (use 90%-10% allocation between registered and

unregistered activities)

Creditable withholding taxes (CWTs) from the first three (3) quarters amounted to P98,000 (including CWTs of P10,000 dated 2019)

while CWTs for the fourth quarter total P33,600 (excluding CWTs not in the name of ABC Company)

Question 1- How much is the 2% Minimum Corporate Income Tax (MCIT)?

a. P439,560 c. P62,550

b. P73,560 d. None of the choices

Question 2- How much is the 30% Regular Corporate Income Tax(RCIT)?

a. P1,103,400 c. zero

b. P806,697 d. None of the choices

Question 3- How much is the income tax still due?

a. P685,097 c. zero

b. P675,097 d. None of the choices

Regular Corporate Income Tax(RCIT) P806,697

Less: Creditable withholding taxes, first 3 quarters (88,000)

Creditable withholding taxes, fourth quarter (33,600)

Income tax still due P685,097

Question 4- Assuming the company is entitled to the 5% gross income tax (GIT), how much is the tax due?

a. P915,000 c. zero

b. P469,946 d. none of the choices

Question 5- Using the information in question no.4, determine the income tax still due to the BIR?

a. P1,721,697 c. P1,234,097

b. P1,600,000 d. None of the choices

Tariff and Customs Duties

29. A foreign country imposed very high and unreasonable duties on Philippine goods entering its jurisdiction without, however,

imposing the same high rates on goods coming from other countries. The remedy of the Philippine government in this situation is to

impose:

a. Countervailing duty

b. Anti-dumping duty

c. Marking duty

d. Discriminatory duty

30. A large quantity of goods were imported from a foreign country into the Philippines at a very low export prices that are much

less than their normal value, which threatens our domestic industry. The remedy of the Philippine government in this situation is to

impose:

a. Countervailing duty

b. Anti-dumping duty

c. Discriminatory duty

d. None of the foregoing

31. The amount that may be imposed on an ocean vessel for mooring at a pier in the country is:

a. Harbor fee

b. Wharfage fee

c. Berthing charge

d. None of the foregoing

32. The amount that may be imposed on vessels engaged in domestic trade to temporarily anchor at any port in the Philippines is:

a. Harbor fee

b. Arrastre charge

c. Lay up fee

d. None of the foregoing

33. The amount imposed on the owner or operator of a vessel for each entrance into or departure from a port of entry in the

Philippines is:

a. Harbor fee

b. Wharfage due

LEAD TAX Pre Week Page 16 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

c. Berthing charge

d. None of the foregoing

34. Which of the following is not absolutely banned from being imported into the Philippines?

a. Gambling devices

b. Treasonous articles

c. Obscene and immoral articles

d. None of the foregoing

35. Where the Collector of Customs has rendered a decision in a protest case that is adverse to the importer/owner, the latter may:

a. Appeal to the Commissioner of Customs within 15 days from the expiration of the 30-day period within which the Collector of

Customs must render his decision.

b. Appeal to the Commissioner of Customs within 15 days from receipt of the decision of the Collector of Customs.

c. Appeal to the Court of Tax Appeals within 30 days from receipt of the decision of the Collector of Customs.

d. None of the foregoing

36. Which of the following will render the determination of the customs duties, fees and charges by the Collector of Customs final

and conclusive?

a. Protest is filed simultaneously on the date in which payment is made by the importer/owner.

b. Protest is filed on the 15th day following the date in which payment is made by the importer/owner.

c. Appeal of the decision of the Collector of Customs to the Court of Tax Appeals is filed on the 15th day following the date in which

the decision is received by the importer /owner.

d. None of the foregoing

37. Which of the following statements is correct where the Commissioner of Customs affirmed the decision of the Collector of

Customs ordering the forfeiture of imported articles?

a. The importer/owner appeals tot he Court of Tax Appeals within 30 days from receipt of the adverse decision of the Commissioner

of Customs.

b. The importer/owner appeals to the Secretary of Finance within 30 days from receipt of the adverse decision of the Commissioner

of Customs.

c. The importer/owner appeals to the Secretary of Justice within 30 days from receipt of the adverse decision of the Commissioner

of Customs.

d. None of the foregoing

38. Which of the following statements is correct where the Collector of Customs rendered a decision against the government in a

seizure case involving an amount of P500,000?

a. Automatic review by the Commissioner of Customs

b. Automatic review by the Secretary of Finance

c. Automatic review by the Secretary of Justice

d. None of the foregoing

Local Government Tax Collecting Units

39. A resident of Davao City who does not agree with the real property tax assessment on his real property located in Pili,

Camarines Sur may file an appeal on the disputed assessment with the

a. Provincial Board of Assessment Appeals

b. Revenue District Officer

c. Court of Tax Appeals

d. City Board of Assessment Appeals

40. Not a party in the collection of real property tax in a city

a. Punong Barangay

b. City Mayor

c. City Treasurer

d. City Assessor

41. Which public office is not involved in the collection of community tax?

a. Provincial Treasurer’s Office

b. City Treasurer’s Office

c. City Assessor’s Office

d. Office of the Punong Barangay

42. A foreign corporation who wants to invest in the Philippines may register with the following, except

a. Assessor’s office where the principal office is located

b. Board of Investment

c. Bureau of Internal Revenue

d. Philippine Economic Zone Authority

43. The City Board of Assessment Appeals shall be composed of the following except

a. City Assessor

b. City Engineer

c. City Prosecutor

d. Registrar of Deed

PWDs/Senior Citizens

44. Masagana Corporation provides 20% discount to PWDs. It recorded the following during the year:

LEAD TAX Pre Week Page 17 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

Regular Customers PWD Total

Receipts P8,000,000 P1,000,000 P9,000,000

Cost of services 3,000,000 2,000,000 5,000,000

Other deductible expenses 1,000,000 1,000,000 2,000,000

Question 1: The amount of gross receipts to be reported is

a. P1,000,000 b. P1,250,000 c. P9,000,000 d. P9,250,000

Question 2: The taxable net income is

a. P750,000 b. P1,000,000 c. P1,750,000 d. P2,000,000

45. Masagana Corporation provides 25% discount to senior citizen. It recorded the following during the year:

Regular Senior Citizen Total

Gross sales P8,000,000 P2,000,000 P10,000,000

Cost of sales 5,000,000 1,000,000 6,000,000

Other deductible expenses 1,000,000 1,000,000 2,000,000

Question 1: The amount of gross sales to be reported is

a. P8,000,000 b. P9,500,000 c. P9,600,000 d. P10,000,000

Question 2: The taxable net income is

a. P1,750,000 b. P1,600,000 c. P1,800,000 d. P1,500,000

Documentary stamp tax

46. Effect of failure to affix a documentary stamp which is required by law, except

a. Shall not be recorded in the proper registry

b. Shall not be admitted as evidence in ay court

c. Shall not be valid

d. No notary public or other officer authorized to administer oaths shall add his jurat or acknowledgement

47. Which of the following is correct documentary stamp tax rate?

I. The original issue of shares P2 on each P200 of the par value of shares of stock

If without par value, based on the actual consideration

II. Sales, agreement to sell, deliveries or P1.50 on each P200 of the par value.

transfer of shares of stock

If without par value, the DST shall be 50% of the DST paid upon the original issue of

stock.

III. Bonds, debentures, certificate of stock Same as original issue of shares (P2/200)

or indebtedness issued in foreign country

IV. Debt instruments P1.50 on each P200

V. Bills of exchange P0.60 on each P200

VI. Real property P15 for every P1,000

a. I and II

b. I, II, and VI

c. II, IV and V

d. I, II, III, IV, V and VI

Excise tax

48. To improve her body shape, Miss Y decided to undergo liposuction procedure and sought the services of Doc. Vicky, a clinic

operated outside the hospital and owned by Belo Medical Group, Inc. Doc. Vicky charged Miss Y the amount of P50,000 inclusive

of 12% VAT but exclusive of excise tax for the service rendered.

Required:

1. Compute the excise tax.

2. Compute the amount to be collected from Miss Y.

Original price (inclusive of VAT) P50,000.00

Gross Receipts (net of 12% VAT) (P50,000 / 1.12) P44,642.85

Add:

5% excise tax (44,642.85 x 5%) 2,232.15

12% VAT (44,642.85+2,232.15) x 12% 5,625.00

Total amount to be Collected from Miss Y P52,500.00

In the books of Belo Medical Group, Inc.:

Cash 52,500

Excise Tax Expense 2,232.15

Excise Tax Payable 2,232.15

Output VAT 5,625.00

Service Income 46,875.00

49. To improve her body shape, Miss Y decided to undergo liposuction procedure and sought the services of Doc. Vicky, a clinic

operated outside the hospital and owned by Belo Medical Group, Inc. Doc. Vicky charged Miss Y the amount of P50,000 inclusive

of 12% VAT but inclusive of excise tax for the service rendered.

LEAD TAX Pre Week Page 18 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

Required:

1. Compute the excise tax.

2. Compute the amount to be collected from Miss Y.

Original price (inclusive of VAT and excise) P50,000.00

Gross Receipts (net of 12% VAT, inclusive of excise) (P50,000 / P44,642.85

1.12)

Gross Receipts (net of Excise and VAT) (44,642.86/105%) P42,517.01

Add:

5% excise tax (42,517.01 x 5%) 2,125.85

12% VAT (44,642.86 x 12%) 5,357.14

Total amount to be collected from Miss Y P50,000

50. Miss Sandara had invasive cosmetic procedure done by Doctor Sy, an individual practitioner operating a clinic inside a

hospital. The hospital bills Miss Sandara other fees (e.g. supplies and fees for the use of operating room and hospital facilities) in

the amount of P20,000, in addition to the fees charged by Doctor Sy of P50,000 (inclusive of 12% VAT, exclusive of excise) for the

service performed.

Required:

1. Compute the excise tax.

2. Compute the amount to be collected from Miss S.

Billings by Hospital (VAT Exempt) Note 1 P20,000.00

Add: 5% excise tax (20,000 x 5%) 1,000.00

Doctor’s Fee (50,000 / 112%) Note 2 44,642.86

Add: 5% excise tax (44,642.86 x 5%) 2,232.14

Add: 12% VAT (44,642.86 + 2,232.14) x 12% 5,625.00

Total Amount to be collected from Miss Sandara P73,500

Note 1: Medical, dental, hospital and veterinary services are exempt from value added tax under section 109 (G) of the NIRC, as

amended, except those rendered by professionals.

Note 2: Doctor Sy is presumed to be self-employed and his annual receipts exceeded the threshold for VAT of P3 Million.

In the books of Doctor Sy:

Accounts receivable – Hospital (44,642.86+5,625 – 4,464.28) P45,803.58

Excise tax expense 2,232.14

Prepaid tax (44,642.86 x 10% EWT) 4,464.28

Service fee (44,642.86 + 2,232.14) 46,875.00

Output VAT 5,625.00

Cash 45,803.58

Accounts receivable – Hospital 45,803.58

In the books of the Hospital:

Cash P21,000

Excise tax expense 1,000

Service income – Non-VAT P21,000

Excise tax payable 1,000

Cash 52,500

Payable to Doctor Sy 45,803.58

Excise Tax Payable for Doctor Sy 2,232.14

Expanded withholding tax payable – Prof. fee (44,642.86 x 10%) 4,464.28

The Hospital shall remit to the BIR the amount of P4,464.28 representing creditable income tax withheld from the fees charged by

Doctor Sy, in accordance with existing withholding tax regulations. In addition to this, the Hospital shall file a return of its monthly

gross receipts using BIR Form No. 2200-C and remit the 5% excise tax amounting to P3,232.14 based on the gross receipts (net of

12% VAT and 5% excise tax) collected from the client, together with the Monthly Summary of Cosmetic Procedures Performed as

required in Section 5.1 of RR 2-2019

51. (Excise tax on sweetened beverages – Carbonated Beverages) Dodo Manufacturing Corporation will remove from the

place of production 100 cases of Super Cola using HFCS and non-caloric sweetener. Each case contains 6 bottles of 1.5 liters each.

Required: Compute the excise tax to be paid before removal.

No. of cases 100

Multiplied by Number of bottles per case x 6

Total Number of bottles 600

Multiplied by content per bottle x 1.5L

Total Volume in Liters 900 L

Multiplied by Specific Tax Rate P12.00

Total Excise Tax to be paid before removal P10,800

LEAD TAX Pre Week Page 19 of 28

LEARNING ADVANCEMENT REVIEW CENTER LEAD

52. (Excise tax on sweetened beverages – Powdered Juice) Sweety Import Corp. will remove from customs custody 50

cases of Four Seasons Powdered Juice using caloric and non-caloric sweetener containing 144 packs by 25 grams. Each 25 grams

pack can make 1 Liter (per serving suggestion appearing on the label).

Required: Compute the excise tax to be paid before removal.

No. of Cases 50

Multiplied by no. of packs per case X 144

Total no. of packs 7,200

Multiplied by serving suggestion per pack in liters of volume X 1L

Total Volume in Liters 7,200 L

Multiplied by Specific Tax Rate X P6.00

Total Excise Tax to be paid before removal P43,200.00

53. True or False

I. NON-ESSENTIAL GOODS- is subject to Twenty percent (20%) based on the wholesale price or the value of importation used by

the Bureau of Customs in determining Tariff and Customs Duties, net of Excise and Value-Added taxes

II. SWEETENED BEVERAGES – Using purely coconut sap sugar purely steviol glycosides is exempt from excise tax.

a. True; False b. False; False c. False;True d. True; True

TARIFF AND CUSTOMS

54. 1st Statement: No regular court may intervene in assessment of real property taxes; it is the primary jurisdiction of the Board of

Assessors.

2nd Statement: No jurisdiction by court will lie against real property tax collection by the Local Government.

3rd Statement: No court may intervene in smuggling cases.

a. True, False, True

b. True, True, False

c. False, True, False

d. False, False, True

55. A device or scheme resorted to enable merchandise affected by taxes to be exported and later sold in foreign countries under the

same terms as if it is not taxed at all is called?

a. Import Entry

b. Manifest

c. Drawings

d. Drawback

56. The following are the functions of the Bureau of Customs, except?

a. Assessment and collection of revenues from imported articles and all other impositions under the Tariff and Customs Code.

b. Control smuggling and related frauds.

c. Supervision and control over the entrance and clearance of vessels and aircrafts.

d. To investigate the operation of tariff and customs laws, including their relation to the national revenues, their effects upon

industries and labor of the country and to submit reports of its investigation.

57. Julia an importer protested an assessment and. classification by the collector of customs. However, the collector of customs

denied Julia's protest. Hence, Julia went to appeal adverse decision by the collector of customs with the Commissioner of Custom,

which of the following statement is correct in case the Commissioner decides to favour or deny Julia?

I. Adverse decision against Julia appeal to Court of Tax Appeal.

Ii. Adverse decision against the government appeal to Court of Tax Appeal.

III. Adverse decision against Julia appeal to Secretary of Finance.

IV. Adverse decision against the government appeal to the Secretary of Finance.

a. I and II

b. III and IV

c. I and IV

d. I, II, III, and IV

58. Which of the following is a special duty?

a. Ad Valorem

b. Specific

c. Compounding Duty

d. Dumping Duty

PREFERENTIAL TAXATION