Professional Documents

Culture Documents

Questions

Uploaded by

Risvana RizzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questions

Uploaded by

Risvana RizzCopyright:

Available Formats

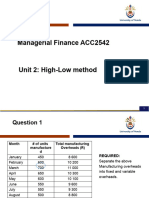

Question 3

a) Contribution margin per unit= selling price per unit – variable cost per unit

=10 – 7 = $3 per unit

b) Contribution margin percentage = contribution margin per unit / selling price per unit *100

= 3 / 10 *100 = 30%

c) Breakeven Quantity = fixed cost / contribution margin per unit

= 90000 / 3

= 30000 units

d) Breakeven in $ = Fixed cost / contribution margin percentage

= 90000 / 30 * 100

=$300,000

e) Target Profit = 30000

New contribution = target profit + fixed cost = 30000+90000

= 120000

f) Income from operations

Particulars Amount (in$)

Sales 50000*10 500000

Less: Variable cost 50000*7 (350000)

Contribution 50000*3 150000

Less : fixed cost 90000

Net income 60000

Question 4

a) Activity rate for each activity

Activity Cost driver cost No:of drivers Cost per

activity

fabrication dlh 300000 20000 15

assembly dlh 120000 20000 6

setup dlh 100000 250 400

Material moves 80000 400 200

handling

Activity rates for each activity:

Fabrication : 15

Assembly : 6

Setup : 400

Material handling : 200

b) Activity based rate for each product

particulars printer scanner

1) Fabrication 75000 225000

2) Assembly 90000 30000

3) setup 12000 88000

4) material handling 10000 70000

Total overhead cost 187000 413000

units 6000 6000

Activity based – 31.17 68.83

factory overhead

rate per unit

You might also like

- AET Assignment C Kate ThomsonDocument12 pagesAET Assignment C Kate ThomsonaymenmoatazNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Assignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundDocument5 pagesAssignment-1 Classic Pen Company: Developing An Abc Model: Case BackgroundRitika Sharma0% (1)

- Trade Advance AgreementDocument31 pagesTrade Advance AgreementRisvana Rizz100% (1)

- Bid Evaluation Report Sample TemplateDocument2 pagesBid Evaluation Report Sample Templatemarie100% (8)

- Manual MIB 303S-13/33Document58 pagesManual MIB 303S-13/33Daniel Machado100% (1)

- HRM OmantelDocument8 pagesHRM OmantelSonia Braham100% (1)

- Illustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesDocument4 pagesIllustration1: For The Production of 10000 Units of A Product, The Following Are The Budgeted ExpensesGabriel BelmonteNo ratings yet

- Name-Niraj Tawde Class - FY - MMS Roll No-55: Rohidas Patil Institute of Management StudiesDocument16 pagesName-Niraj Tawde Class - FY - MMS Roll No-55: Rohidas Patil Institute of Management StudiesmaheshNo ratings yet

- 2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Document5 pages2m00154 S.y.b.com - Bms Sem Ivchoice Based 78512 Group A Finance Strategic Cost Management Q.p.code53273Navira MirajkarNo ratings yet

- Tutorial Unit 2 High-Low SolutionsDocument12 pagesTutorial Unit 2 High-Low SolutionsNdivho MavhethaNo ratings yet

- Management and Financial Accounting: (Assignment-2)Document10 pagesManagement and Financial Accounting: (Assignment-2)kashish Agarwal100% (1)

- Acc Assign Sem 2Document7 pagesAcc Assign Sem 2xuanylimNo ratings yet

- Management and Financial Accounting Assessment-2Document6 pagesManagement and Financial Accounting Assessment-2saranyaNo ratings yet

- Accounts Assignment 104Document6 pagesAccounts Assignment 104busybeefreedomNo ratings yet

- BYLC Case BudgetingDocument3 pagesBYLC Case BudgetingNoshin TabassumNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Full Cost of Product Per Unit 170Document5 pagesFull Cost of Product Per Unit 170Shafaq ZafarNo ratings yet

- ABC CostingDocument7 pagesABC CostingNafiz RahmanNo ratings yet

- Charles AKMENDocument11 pagesCharles AKMENCharles GohNo ratings yet

- (w8) ABC Class ExerciseDocument6 pages(w8) ABC Class ExerciseDarya KoroviyNo ratings yet

- Chapter 5 - ExercisesDocument6 pagesChapter 5 - Exercisesotaku25488No ratings yet

- Arcadia and Enterprise Co. Worked ExamplesDocument22 pagesArcadia and Enterprise Co. Worked ExamplesIvy TulesiNo ratings yet

- s15 16 (AutoRecovered)Document14 pagess15 16 (AutoRecovered)R GNo ratings yet

- Job Costing ADMDocument18 pagesJob Costing ADMSiddhanta MishraNo ratings yet

- ABC - Practice Set Answer and SolutionDocument4 pagesABC - Practice Set Answer and SolutionYvone Ehnnery BumosaoNo ratings yet

- Tugas-Kasus - 4.12Document3 pagesTugas-Kasus - 4.12niti dsNo ratings yet

- A 2021MBA010 NiraliOswal Case Scenarios RBCDocument3 pagesA 2021MBA010 NiraliOswal Case Scenarios RBCmohammedsuhaim abdul gafoorNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- Budgetary ControlDocument14 pagesBudgetary ControlCool BuddyNo ratings yet

- Answers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyDocument10 pagesAnswers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyAnonymous vA2xNfNo ratings yet

- F5 Solution 1 & 2Document2 pagesF5 Solution 1 & 2dy sovathNo ratings yet

- Tugas Kasus Akuntansi Manajemen ABCDocument3 pagesTugas Kasus Akuntansi Manajemen ABCutari yani dewiNo ratings yet

- Activity Based Costing - Mellow LTDDocument8 pagesActivity Based Costing - Mellow LTDAdi KurniawanNo ratings yet

- DownloadDocument18 pagesDownloadGaurav MandotNo ratings yet

- AccountingDocument4 pagesAccountingFerrNo ratings yet

- 03 Tadzoa Francis EXO 03 COSTDocument4 pages03 Tadzoa Francis EXO 03 COSTrita tamohNo ratings yet

- DR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingDocument6 pagesDR Rachna Mahalwla - B.Com III Year Management Accounting Flexible BudgetingSaumya JainNo ratings yet

- CH 10 SolDocument7 pagesCH 10 SolNotty SingerNo ratings yet

- ABC Costing Autumn 19Document15 pagesABC Costing Autumn 19Tory IslamNo ratings yet

- f5 Worksheet BPPDocument19 pagesf5 Worksheet BPPYashna SohawonNo ratings yet

- Buget ExcelDocument9 pagesBuget ExcelKhushbu PandeyNo ratings yet

- Additional Chapter AssignmentDocument4 pagesAdditional Chapter AssignmentM GualNo ratings yet

- 02 Tamiform Hilda Ngelah - Exercise 02 CostDocument7 pages02 Tamiform Hilda Ngelah - Exercise 02 Costrita tamohNo ratings yet

- Business Accounting and Finance: QUESTION 1 (P17-2A)Document9 pagesBusiness Accounting and Finance: QUESTION 1 (P17-2A)sang_ratu_1No ratings yet

- CMA Garrison SuggestedSolutions Chap2Document12 pagesCMA Garrison SuggestedSolutions Chap2PIYUSH SINGHNo ratings yet

- 06 Incremental AnalysisDocument11 pages06 Incremental AnalysisannarheaNo ratings yet

- Relevant Costing - SolutionsDocument3 pagesRelevant Costing - SolutionsSwiss HanNo ratings yet

- Particulars Units Unit Cost (RS) Total Cost (RS)Document3 pagesParticulars Units Unit Cost (RS) Total Cost (RS)ginish12No ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

- Wilkerson SolutionDocument4 pagesWilkerson SolutionPriyanshi SharmaNo ratings yet

- DAIBB Accounting 2020Document14 pagesDAIBB Accounting 2020BelalHossainNo ratings yet

- Activity Based Costing SystemDocument18 pagesActivity Based Costing SystemMAXA FASHIONNo ratings yet

- ABC Model For A UniversityDocument20 pagesABC Model For A UniversityrahulNo ratings yet

- Budgetary Control SolutionDocument9 pagesBudgetary Control SolutionAnkita VaswaniNo ratings yet

- SCM Solved 2Document11 pagesSCM Solved 2Madhu kumarNo ratings yet

- 03 Tazoah Francis Exercise 03 CostDocument4 pages03 Tazoah Francis Exercise 03 Costrita tamohNo ratings yet

- Answers:: Cost of Goods Manufactured Schedule For The Year EndedDocument5 pagesAnswers:: Cost of Goods Manufactured Schedule For The Year EndedAsim boidyaNo ratings yet

- 2 - Behaviour of CostDocument4 pages2 - Behaviour of CostTeresa TanNo ratings yet

- Chapter 22Document14 pagesChapter 22Nguyên BảoNo ratings yet

- Activity Based Cost: Number of Set-Ups 120 200 200 Customer Orders 8000 8000 16000Document23 pagesActivity Based Cost: Number of Set-Ups 120 200 200 Customer Orders 8000 8000 16000Bennie KingNo ratings yet

- Chapter - 1 Cost Sheet - Problems - & - Solution - 3-9Document12 pagesChapter - 1 Cost Sheet - Problems - & - Solution - 3-9Legends CreationNo ratings yet

- Fixed Cost Vs Variable CostDocument24 pagesFixed Cost Vs Variable Costsrk_soumyaNo ratings yet

- A Case Study of Credit Card DebtDocument1 pageA Case Study of Credit Card DebtRisvana RizzNo ratings yet

- WordtopdfDocument1 pageWordtopdfRisvana RizzNo ratings yet

- Company Identification: (Links To An External Site.)Document2 pagesCompany Identification: (Links To An External Site.)Risvana RizzNo ratings yet

- NetflixDocument1 pageNetflixRisvana RizzNo ratings yet

- Regular Payments Savings Plan: A Three Methods ApproachDocument2 pagesRegular Payments Savings Plan: A Three Methods ApproachRisvana RizzNo ratings yet

- Hamad Accounting ReportDocument6 pagesHamad Accounting ReportRisvana RizzNo ratings yet

- Expert Dunn CarpentryDocument30 pagesExpert Dunn CarpentryRisvana RizzNo ratings yet

- FIN3120 Exam Paper May 2022Document4 pagesFIN3120 Exam Paper May 2022Risvana RizzNo ratings yet

- A Three Methods Approach: Compound InterestDocument2 pagesA Three Methods Approach: Compound InterestRisvana RizzNo ratings yet

- Hamad Accounting ReportDocument5 pagesHamad Accounting ReportRisvana RizzNo ratings yet

- Advanced Accounting ACC 410: College of Business AdministrationDocument2 pagesAdvanced Accounting ACC 410: College of Business AdministrationRisvana RizzNo ratings yet

- Contribution Margin Is Computed by Deducting Variable Cost Per Unit From Selling PriceDocument1 pageContribution Margin Is Computed by Deducting Variable Cost Per Unit From Selling PriceRisvana RizzNo ratings yet

- MGT 3103 Final Project and PresentationDocument9 pagesMGT 3103 Final Project and PresentationRisvana RizzNo ratings yet

- Group Assignment Student Copy 3Document6 pagesGroup Assignment Student Copy 3Risvana RizzNo ratings yet

- AgreementDocument4 pagesAgreementJeson JoseNo ratings yet

- CASEDocument2 pagesCASERisvana RizzNo ratings yet

- Computation of Assets and LiabilitiesDocument1 pageComputation of Assets and LiabilitiesRisvana RizzNo ratings yet

- EOQDocument1 pageEOQRisvana RizzNo ratings yet

- Part 1, 2, 4 and 7Document1 pagePart 1, 2, 4 and 7Risvana RizzNo ratings yet

- Discussion 1Document1 pageDiscussion 1Risvana RizzNo ratings yet

- Tesla Toy Company Budget Project InstructionsDocument4 pagesTesla Toy Company Budget Project InstructionsRisvana RizzNo ratings yet

- Quiz 2Document2 pagesQuiz 2Risvana RizzNo ratings yet

- Online Catering Home Delivery ServiceDocument11 pagesOnline Catering Home Delivery ServiceYESHUDAS JIVTODENo ratings yet

- Discussion 2Document1 pageDiscussion 2Risvana RizzNo ratings yet

- I Want To Do My Project I Want It To Finish in 1 Week To Send It To The DR 3 - Project PDFDocument1 pageI Want To Do My Project I Want It To Finish in 1 Week To Send It To The DR 3 - Project PDFRisvana RizzNo ratings yet

- ACC 4153 Group ProjectDocument7 pagesACC 4153 Group ProjectRisvana RizzNo ratings yet

- Fy19 20 FastfactsDocument1 pageFy19 20 FastfactsRisvana RizzNo ratings yet

- Wallmax C&F Owners Account Particulars Transactions Closing BalanceDocument1 pageWallmax C&F Owners Account Particulars Transactions Closing BalanceRisvana RizzNo ratings yet

- Add New Question (Download - PHP? SC Mecon&id 50911)Document9 pagesAdd New Question (Download - PHP? SC Mecon&id 50911)AnbarasanNo ratings yet

- TIP - IPBT M - E For MentorsDocument3 pagesTIP - IPBT M - E For Mentorsallan galdianoNo ratings yet

- PDFDocument18 pagesPDFDental LabNo ratings yet

- Guide To Networking Essentials Fifth Edition: Making Networks WorkDocument33 pagesGuide To Networking Essentials Fifth Edition: Making Networks WorkKhamis SeifNo ratings yet

- Traffic Speed StudyDocument55 pagesTraffic Speed StudyAnika Tabassum SarkarNo ratings yet

- Inductive Grammar Chart (Unit 2, Page 16)Document2 pagesInductive Grammar Chart (Unit 2, Page 16)Michael ZavalaNo ratings yet

- A88438-23 Critical Procedure 11-01 - Pipeline Cut Outs - A5X9W9Document7 pagesA88438-23 Critical Procedure 11-01 - Pipeline Cut Outs - A5X9W9mahmoudNo ratings yet

- Mittal Corp LTD 22ND November 2022Document4 pagesMittal Corp LTD 22ND November 2022Etrans 9No ratings yet

- MAS-02 Cost Terms, Concepts and BehaviorDocument4 pagesMAS-02 Cost Terms, Concepts and BehaviorMichael BaguyoNo ratings yet

- Non-Hazardous Areas Adjustable Pressure Switch: 6900P - Piston SensorDocument2 pagesNon-Hazardous Areas Adjustable Pressure Switch: 6900P - Piston SensorDiana ArredondoNo ratings yet

- Mind Mapping BIOTEKDocument1 pageMind Mapping BIOTEKAdrian Muhammad RonalNo ratings yet

- Transportation and Academic Performance of Students in The Academic TrackDocument3 pagesTransportation and Academic Performance of Students in The Academic TrackMary-Jay TolentinoNo ratings yet

- West Bengal Joint Entrance Examinations Board: Provisional Admission LetterDocument2 pagesWest Bengal Joint Entrance Examinations Board: Provisional Admission Lettertapas chakrabortyNo ratings yet

- Steinway Case - CH 03Document5 pagesSteinway Case - CH 03Twēéty TuiñkleNo ratings yet

- BGD Country en Excel v2Document2,681 pagesBGD Country en Excel v2Taskin SadmanNo ratings yet

- Supply DemandProblems With Solutions, Part 1Document16 pagesSupply DemandProblems With Solutions, Part 1deviNo ratings yet

- 02Document257 pages02shaney navoaNo ratings yet

- Item No. 6 Diary No 6856 2024 ConsolidatedDocument223 pagesItem No. 6 Diary No 6856 2024 Consolidatedisha NagpalNo ratings yet

- Maverick Research: World Order 2.0: The Birth of Virtual NationsDocument9 pagesMaverick Research: World Order 2.0: The Birth of Virtual NationsСергей КолосовNo ratings yet

- Airport Demand ModelDocument26 pagesAirport Demand ModelbsvseyNo ratings yet

- NGOs in Satkhira PresentationDocument17 pagesNGOs in Satkhira PresentationRubayet KhundokerNo ratings yet

- International Business EnvironmentDocument5 pagesInternational Business EnvironmentrahulNo ratings yet

- Renvoi in Private International LawDocument4 pagesRenvoi in Private International LawAgav VithanNo ratings yet

- Advanced Excel Training ManualDocument6 pagesAdvanced Excel Training ManualAnkush RedhuNo ratings yet

- Ex 6 Duo - 2021 Open-Macroeconomics Basic Concepts: Part 1: Multple ChoicesDocument6 pagesEx 6 Duo - 2021 Open-Macroeconomics Basic Concepts: Part 1: Multple ChoicesTuyền Lý Thị LamNo ratings yet

- 2 1 PDFDocument18 pages2 1 PDFالمهندسوليدالطويلNo ratings yet