Professional Documents

Culture Documents

Capital Allowances (w5)

Capital Allowances (w5)

Uploaded by

Limpho Teddy PhateOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Allowances (w5)

Capital Allowances (w5)

Uploaded by

Limpho Teddy PhateCopyright:

Available Formats

Capital allowances

Definition

Capital allowances, otherwise known as depreciation of assets is the spreading of an asset’s cost

through its enter useful life in the business.

The depreciations are treated as an expenses in the income statement. Likewise, the capital

allowances are allowable deductions from the business income. Capital allowances are calculated

using the prescribed tax rates and methods is allowed as a deduction.

For the purpose of calculating depreciation allowance, depreciable assets are classified into four

groups with depreciation rate set out below;

Group 1 (25%)

auto mobiles, taxis, light general purpose trucks, tractors for use over the road, special tools and

devices.

Group 2 (20%)

Office furniture, fixtures and equipment, computers and peripherals, data handling equipment,

buses, heavy general purpose trucks, trailers, trailer mounted containers, construction equipment.

Group 3 (10%)

Any depreciable asset not included in the other groups

Group 4 (5%)

Rail road cars and locomotives and railroad equipment, vessels, barges, tugs, and similar water

transportations equipment, industrial buildings, engines and turbines, public utility plant

Methods of calculating capital allowances

Similar to accounting, in taxation capital allowances can be calculated using different methods

1. Single asset method

2. Pooling of assets method

Single asset method

This is the default method of calculating capital allowances and is considered the most reliable

method as it takes into account timing (the date at which an asset was bought and sold) when

calculating the depreciation of an asset.

In this method assets are not grouped; every asset is depreciated individually and follows a similar

approach to the reducing balance method of calculating depreciation for account.

Calculating the allowance

Each asset is depreciated on its own and follows a similar approach to the reducing balance method

of accounting.

Example of layout

March 2013: cost XXX

Capital allowance (1 month) (XX)

April 2013: ACB XXX

Capital allowance (XX)

April 2014: ACB XXX

Capital allowance (XX)

April 2015: ACB XXX

Disposal proceeds XXX

Gain/loss on disposal XX

Pooling method

This method is elected for by the taxpayers to claim capital allowances. Once the election has been

made for this method it cannot be reversed. Assets of a similar group are all depreciated together as

a group no separation of individual assets happens. The pulling method cannot be applied to group 4

assets.

In this method, only assets that are used fully in the business are allowed to be pulled and it is

assumed that all assets are purchased half way through the year so the purchase dates do not

matter.

Calculating the allowance

Year ended 31 March 2014 Group 1 Group 2 Group 3

Opening balance XXX XXX XXX

Half current year acquisitions XXX XXX XXX

Half past year acquisitions XXX XXX XXX

Less: disposal (XX) (XX) (XXX)

Balance of the pool XXX XXX XXX

Capital allowance @ 25% (XX)

Capital allowance @ 20% (XX)

Capital allowance @ 10% (XX)

ACB XXX XXX XXX

Gains or losses on disposal of assets

Gains on disposal form part of gross income and losses on disposal are allowable deductions

Single method assets: The gain or loss on the disposal of the assets is calculated as the sales

proceeds less the adjusted cost base of the asset at the date of disposal.

Pooling method: Gains or losses on disposal is only recognised when the whole pool is disposed of.

It is calculated as the sales proceeds less the balance of the pool in the year the disposal took place.

Where the balance of the pool at the end of a year is less than M500 and no assets have been

acquired in that year, the balance becomes an allowable deduction

You might also like

- Taxation - Attack OutlineDocument12 pagesTaxation - Attack OutlineLisa Strelchuk Thomas100% (2)

- Micro Notes On A2 IAL AccountingDocument15 pagesMicro Notes On A2 IAL AccountingRajibul Haque Shumon100% (2)

- Petrol PumpDocument14 pagesPetrol Pumpnafis ahmadNo ratings yet

- Paul M. Getty - Tax Deferral Strategies Utilizing The Delaware Statutory TrustDocument184 pagesPaul M. Getty - Tax Deferral Strategies Utilizing The Delaware Statutory TrustwaynesailNo ratings yet

- Larson16ce QuickStudySolutions Ch03Document11 pagesLarson16ce QuickStudySolutions Ch03zdgf dfg562465No ratings yet

- Preparation of Financial Statement For A Sole TraderDocument8 pagesPreparation of Financial Statement For A Sole TraderDebbie Debz100% (2)

- CHAPTER 16 PartnershipDocument22 pagesCHAPTER 16 PartnershipbabarNo ratings yet

- Case StudyDocument6 pagesCase StudyArun Kenneth100% (1)

- Ethylene 2520oxide Cost 2520Estimation&EconomicsDocument14 pagesEthylene 2520oxide Cost 2520Estimation&EconomicsBelema Thomson100% (1)

- CooperativesDocument2 pagesCooperativesRealGenius (Carl)No ratings yet

- Budgeting 1Document20 pagesBudgeting 1mohajansanjoy1975No ratings yet

- AC 102 Financial Statements FormatsDocument5 pagesAC 102 Financial Statements FormatsBendroza MelatosiNo ratings yet

- POA FormatsDocument7 pagesPOA FormatsWilliNo ratings yet

- Asset Disposal Explanation and ExercisesDocument6 pagesAsset Disposal Explanation and ExercisesbokangpublishinghouseNo ratings yet

- Incorporated Associations Sample Incorporated Association Financial ReportsDocument9 pagesIncorporated Associations Sample Incorporated Association Financial ReportsJoemar Legreso100% (1)

- Classified Is and BSDocument1 pageClassified Is and BSSoumik MutsuddiNo ratings yet

- Accountancy Fundamentals Quarter 1Document4 pagesAccountancy Fundamentals Quarter 1JeromeNo ratings yet

- Business Finance: Session 3: Financial StatementsDocument45 pagesBusiness Finance: Session 3: Financial StatementsXia AlliaNo ratings yet

- Compendium of CDD Forms and Tools-F (Version 04192016)Document31 pagesCompendium of CDD Forms and Tools-F (Version 04192016)ronilsalconNo ratings yet

- Notes To The Financial StatementsDocument27 pagesNotes To The Financial StatementsnellyNo ratings yet

- As 17Document6 pagesAs 17abhishekkapse654No ratings yet

- Management Accounting Unit-2Document9 pagesManagement Accounting Unit-2prof.hpk18No ratings yet

- Merchandising Operations: Inventory Base. These Items Are Then Resold To Customers and Recorded As Sales RevenueDocument12 pagesMerchandising Operations: Inventory Base. These Items Are Then Resold To Customers and Recorded As Sales RevenueMingxNo ratings yet

- Ias 1-Presentation of Financial StatementsDocument21 pagesIas 1-Presentation of Financial StatementsChumani GqadaNo ratings yet

- Cash Flow StatementDocument16 pagesCash Flow Statementrajesh337masssNo ratings yet

- Module 5 - Ias 2 Inventory (CN)Document14 pagesModule 5 - Ias 2 Inventory (CN)Given RefilweNo ratings yet

- Employee Benefit Plan Trust - Provident FundDocument4 pagesEmployee Benefit Plan Trust - Provident FundMuhammad Asif KhanNo ratings yet

- Ifrs 5: Non-Current Assets Held For Sale and Discontinued OperationsDocument15 pagesIfrs 5: Non-Current Assets Held For Sale and Discontinued OperationsangaNo ratings yet

- Chapter 18 - Accounts of Clubs and Society-2Document3 pagesChapter 18 - Accounts of Clubs and Society-2abeggmprt 1303No ratings yet

- Company Final AccountsDocument13 pagesCompany Final Accountsshanthala mNo ratings yet

- 06 Handout 1Document19 pages06 Handout 1Johnlloyd CahuloganNo ratings yet

- Consolidated Statement of Profit or Losses and Other Comprehensive IncomeDocument10 pagesConsolidated Statement of Profit or Losses and Other Comprehensive IncomeTinashe ZhouNo ratings yet

- Financial Statement of Sole Trader LHADocument2 pagesFinancial Statement of Sole Trader LHASameer AliNo ratings yet

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- 10532lectuer 5 FADocument28 pages10532lectuer 5 FANajia SalmanNo ratings yet

- Academy of Contemporary Islamic Studies (ACIS) : Madam Ratnawatie PanieDocument14 pagesAcademy of Contemporary Islamic Studies (ACIS) : Madam Ratnawatie PanieAssalamualaikum Semua SemuaNo ratings yet

- (Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR CompleteDocument12 pages(Accaglobalbox - Blogspot.com) Consolidation and Cash FLows SBR Completets tanNo ratings yet

- Financial Statement Analysis & Ratio AnalysisDocument21 pagesFinancial Statement Analysis & Ratio Analysissriharsha5877454No ratings yet

- PPE Part 2 ModuleDocument13 pagesPPE Part 2 ModuleNatalie SerranoNo ratings yet

- Psa VDocument5 pagesPsa Vsunkanmi4890No ratings yet

- Formats of Income Statement, Balance Sheet & Cash Flow StatementDocument3 pagesFormats of Income Statement, Balance Sheet & Cash Flow StatementAli RazaNo ratings yet

- Chapter 21 IAS 1Document4 pagesChapter 21 IAS 1Chandan SamalNo ratings yet

- Company Financials - Cash FlowDocument17 pagesCompany Financials - Cash FlowJack SangNo ratings yet

- Depreciaiton-VIProvision For DepreciationDocument2 pagesDepreciaiton-VIProvision For DepreciationRashid UsmanNo ratings yet

- Investments in Noncurrent Operating Assets - Utilization and RetirementDocument42 pagesInvestments in Noncurrent Operating Assets - Utilization and Retirementhashimhash100% (1)

- Unit 02 Preparation of Financial Statement As Per IND AS 01Document13 pagesUnit 02 Preparation of Financial Statement As Per IND AS 01Deepak LNo ratings yet

- Financial Accounting: Accounting - Process of Identifying, Measuring, and Communicating EconomicDocument7 pagesFinancial Accounting: Accounting - Process of Identifying, Measuring, and Communicating EconomicKyle Daniel PimentelNo ratings yet

- Accounting and Finance Unit 4Document28 pagesAccounting and Finance Unit 4vasudhaNo ratings yet

- Notes of Financial Statements or Final AccountsDocument11 pagesNotes of Financial Statements or Final Accountsrxcha.josephNo ratings yet

- Fundamentals of Accounting and Business ManagementDocument4 pagesFundamentals of Accounting and Business ManagementSan Juan Ezthie100% (1)

- Chapter 29 SheDocument126 pagesChapter 29 SheAiraNo ratings yet

- Public Sector Accounting and ReportingDocument9 pagesPublic Sector Accounting and Reportingsunkanmi4890No ratings yet

- 05 - Accounting For Merchandising Operations (Notes) PDFDocument6 pages05 - Accounting For Merchandising Operations (Notes) PDFJamie ToriagaNo ratings yet

- Mepa Unit 5Document18 pagesMepa Unit 5Tharaka RoopeshNo ratings yet

- Fundamentals of Accountancy, Business, and Management 2: Prepared By: Mark Vincent B. Bantog, LPTDocument15 pagesFundamentals of Accountancy, Business, and Management 2: Prepared By: Mark Vincent B. Bantog, LPTSherlock HolmesNo ratings yet

- Working Capital Management Formula SheetDocument2 pagesWorking Capital Management Formula SheetAnonymous SJ4xSoIvbNo ratings yet

- Presentation of The Philippine Public Sector Accounting Standards (Ppsas)Document21 pagesPresentation of The Philippine Public Sector Accounting Standards (Ppsas)Leonardo Don Alis CordovaNo ratings yet

- BanksDocument37 pagesBanksMuhammad Asif KhanNo ratings yet

- Tax3702 Exam Quick NotesDocument8 pagesTax3702 Exam Quick NotesnhlakaniphoNo ratings yet

- Financial Statements of A PartnershipDocument12 pagesFinancial Statements of A PartnershipCharlesNo ratings yet

- Practical Accounting One PDFDocument46 pagesPractical Accounting One PDFDea Lyn BaculaNo ratings yet

- Journal Entries: Example 1: Whole-Period Depreciation in The Period of PurchaseDocument2 pagesJournal Entries: Example 1: Whole-Period Depreciation in The Period of PurchasemulualemNo ratings yet

- Form One NotesDocument2 pagesForm One NotesSalim Abdulrahim Bafadhil50% (2)

- 2020 08a Presentation FS PPDocument21 pages2020 08a Presentation FS PPAngel TomNo ratings yet

- Partnership AccountsDocument19 pagesPartnership AccountsJovy IvyNo ratings yet

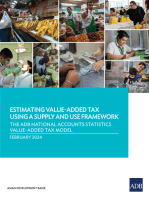

- Estimating Value-Added Tax Using a Supply and Use Framework: The ADB National Accounts Statistics Value-Added Tax ModelFrom EverandEstimating Value-Added Tax Using a Supply and Use Framework: The ADB National Accounts Statistics Value-Added Tax ModelNo ratings yet

- Chapter 11 Pas 36 Impairment of AssetsDocument7 pagesChapter 11 Pas 36 Impairment of AssetsJoelyn Grace MontajesNo ratings yet

- Career Paths Accounting SB-33Document1 pageCareer Paths Accounting SB-33YanetNo ratings yet

- Discounted Cash Flow ModelDocument9 pagesDiscounted Cash Flow ModelMohammed IrfanNo ratings yet

- SAP ConfigDocument170 pagesSAP ConfigShrouk GamalNo ratings yet

- Answer Scheme Tutorial Questions - Accounting Non-Profit OrganizationDocument7 pagesAnswer Scheme Tutorial Questions - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- Rapport Annuel SICAV-FIS Audited Signed 20131231Document259 pagesRapport Annuel SICAV-FIS Audited Signed 20131231LuxembourgAtaGlanceNo ratings yet

- Statics of Rigid Bodies 1: Email AddressDocument15 pagesStatics of Rigid Bodies 1: Email AddressKc Kirsten Kimberly MalbunNo ratings yet

- B291 TMA - Fall - 2022-2023 (AutoRecovered)Document12 pagesB291 TMA - Fall - 2022-2023 (AutoRecovered)Reham AbdelazizNo ratings yet

- Fa Far Sesi 2Document28 pagesFa Far Sesi 2hdyhNo ratings yet

- AUD of PPE Problem 2Document11 pagesAUD of PPE Problem 2Jay LloydNo ratings yet

- King Abdul Aziz University: IE 255 Engineering EconomyDocument11 pagesKing Abdul Aziz University: IE 255 Engineering EconomyJomana JomanaNo ratings yet

- Accounting Standards Based Questions PDFDocument24 pagesAccounting Standards Based Questions PDFGaurav GangNo ratings yet

- Asset Retirement White PaperDocument18 pagesAsset Retirement White PaperRakesh Nataraj100% (1)

- Chap 027-LeasingDocument19 pagesChap 027-LeasingChotto MateNo ratings yet

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- I. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10Document2 pagesI. Answer Any Five Sub-Questions, Each Sub-Question Carries Two Marks. 5x2 10RavichandraNo ratings yet

- Final Exam - Project Appraisal (Palendeng, Sellya Gabriela)Document7 pagesFinal Exam - Project Appraisal (Palendeng, Sellya Gabriela)tiphanie lumintangNo ratings yet

- FI-AA Post CapitalizationDocument5 pagesFI-AA Post CapitalizationMinyongExpress VlogNo ratings yet

- Dana Mutia Journal Statement Period 31 July 2015Document47 pagesDana Mutia Journal Statement Period 31 July 2015Alma SiwiNo ratings yet

- Capital Budgeting (R)Document32 pagesCapital Budgeting (R)KRISHNENDU JASHNo ratings yet

- Seminar 4 Set Work SolutionsDocument5 pagesSeminar 4 Set Work SolutionsStephanie XieNo ratings yet

- General Instruction Manual: Organization Consulting DepartmentDocument12 pagesGeneral Instruction Manual: Organization Consulting DepartmentJithuRajNo ratings yet

- Jawaban Intermedit Kieso s21-1 Dan s21-2Document5 pagesJawaban Intermedit Kieso s21-1 Dan s21-2muhammad ridwan dudutNo ratings yet

- 3rd Sem AccountsDocument67 pages3rd Sem Accountsharamilanda2004No ratings yet