Professional Documents

Culture Documents

O2C accounting cycle entries

Uploaded by

MAHESH CHOWDARY0 ratings0% found this document useful (0 votes)

41 views3 pagesOriginal Title

sap AP AR Entries

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

41 views3 pagesO2C accounting cycle entries

Uploaded by

MAHESH CHOWDARYCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

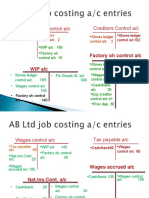

O2C Cycle with Accounting Entries

ORDER TO CASH

PARTICULARS DR CR SPL NOTES ACCOUNT IS

PULLED FROM

Sales order entry

No Accounting

Sales Order Pick

From Sub Inventory A/c 100 At Standard Cost Sub-inventory

Material A/c

Setup

To Sub Inventory A/c 100 At Standard Sub-inventory

Cost(Staging) Material A/c

Setup

Sales Order Issue

COGS 100 It can be fetched from Master

five places Item/Org/Order

Type/Line

Type/Shipping

Params

To Sub Inventory A/c 100 At Standard Cost Sub-inventory

Material A/c

Setup

Transaction level

Receivable A/c 120 Auto Accounting

Tax A/c 10 Auto Accounting

Freight A/c 10 Auto Accounting

Revenue A/c 100 Auto Accounting

Receipts

Receipts with no

remittance method

Cash 100 Before application of Receipt class

the receipt

Unapplied A/c 100 Receipt class

Unapplied A/c 100 After application of the Receipt class

receipt to the

transaction

Receivables A/c 100 Receipt class

Cash A/c 100 Receipt class

Unidentified A/c 100 In case of receipt Receipt class

without customer or

transaction

Unidentifed A/c 100 when customer Receipt class

indentified

Unapplied A/c 100 Receipt class

Receipts with

remittance method.

Confirmed receipts A/c 100 At the time receipt Receipt class

entry

Unapplied A/c 100 Receipt class

Remitted receipts A/c 100 On remittance to bank Receipt class

Confirmed receipts A/c 100 Receipt class

Cash 100 On clearance of cheque Receipt class

Remitted receipts A/c 100 Receipt class

Receipts with

discount/unearned

discounts

Cash 90 At the time earned Bank

discounts

Discount earned A/c 10 Receivable

activity

Receivable A/c 100 Transaction Type

Cash 90 At the time of Bank

unearned discount

Discount unearned A/c 10 Receivable

activity

Receivables A/c 100 Transaction type

Following Accounting entries will be generated for O2C

Sales order creation – No entries

Pick release:

Inventory Stage A/c…………………Debit

Inventory Finished goods a/c……..Credit

Ship confirm:

Cogs A/c ……………………………Debit

Inventory Organization a/c………Credit

Receviable:

Receviable A/c………………………Debit

Revenue A/c………………………Credit

Tax ………………..…………………Credit

Freight…………..….……………….Credit

Cash:

Cash A/c Dr…………………………Debit

Receivable A/c……………………….Credit

Accounting Entries for AR

Once the Order is shipped then Material account will be

credit and COGS Account will be debit.

At the time of Invoice creation

Revenue account will be credit and receivable account

will

be debit.

At the time of receipt creation.

Receivable account will be credit and Bank payment

account

will be debit

You might also like

- French Business Dictionary: The Business Terms of France and CanadaFrom EverandFrench Business Dictionary: The Business Terms of France and CanadaNo ratings yet

- O2C accounting cycle entriesDocument3 pagesO2C accounting cycle entriesMAHESH CHOWDARYNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- O2C Cycle Accounting EntriesDocument3 pagesO2C Cycle Accounting Entriessudharsan49100% (1)

- Wiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2017: Covering all SASs, SSAEs, SSARSs, and InterpretationsNo ratings yet

- Oracle Order To Cash Accounting in R12Document2 pagesOracle Order To Cash Accounting in R12Hitesh100% (6)

- Principles Practice of Accounting Test 2 CH 2 Unscheduled Solution 1660118347Document11 pagesPrinciples Practice of Accounting Test 2 CH 2 Unscheduled Solution 1660118347Prabhat MishraNo ratings yet

- SR No Process Link: B2B!A1 DP!A1 SOW Inter - Org ISO P2P O2C ADJ STD Cost Misc Rec Misc - Payments MOWDocument32 pagesSR No Process Link: B2B!A1 DP!A1 SOW Inter - Org ISO P2P O2C ADJ STD Cost Misc Rec Misc - Payments MOWMunish GuptaNo ratings yet

- Accounting Entries For Payables and ReceivablesDocument2 pagesAccounting Entries For Payables and Receivableskotesh kumNo ratings yet

- AP and FA accounting entriesDocument4 pagesAP and FA accounting entriesIrfan MohammadNo ratings yet

- Oracle Applications EBS - Accounting EntriesDocument43 pagesOracle Applications EBS - Accounting EntriesUdayraj SinghNo ratings yet

- Oracle Applications EBS - Accounting EntriesDocument31 pagesOracle Applications EBS - Accounting EntriesBeverly Baker-Harris100% (1)

- Accounting IntroductionDocument4 pagesAccounting Introductionpranav1931129No ratings yet

- Accounting Entries in OracleDocument31 pagesAccounting Entries in OracleConrad RodricksNo ratings yet

- Oracle Accounting EntriesDocument59 pagesOracle Accounting EntriesRavindra Reddy100% (1)

- Inventory and purchase accounting processDocument2 pagesInventory and purchase accounting processnitinnawarNo ratings yet

- R12 Budget & EncumbranceDocument29 pagesR12 Budget & EncumbranceHaslina HasanNo ratings yet

- Oracle Applications EBSDocument34 pagesOracle Applications EBSyramesh77No ratings yet

- Manage sales, purchases, payments and inventory with this accounting document templateDocument5 pagesManage sales, purchases, payments and inventory with this accounting document templateanurgNo ratings yet

- Oracle Applications EBS - Accounting Entries - v1.0Document31 pagesOracle Applications EBS - Accounting Entries - v1.0sureshNo ratings yet

- 10 Sales 52 Issues CMDocument16 pages10 Sales 52 Issues CMChadwick E VanieNo ratings yet

- Oracle Applications EBS - Accounting Entries - V1.0Document31 pagesOracle Applications EBS - Accounting Entries - V1.0Mina SamehNo ratings yet

- P2P & O2C (Entries)Document9 pagesP2P & O2C (Entries)hari koppalaNo ratings yet

- Oracle Fusion Example of Consigned Inventory AccountingDocument5 pagesOracle Fusion Example of Consigned Inventory AccountingrowentanNo ratings yet

- 013 Double-Entry-AccoutningDocument11 pages013 Double-Entry-Accoutningcaparvez25No ratings yet

- Job Costing L5updated2Document5 pagesJob Costing L5updated2viony catelinaNo ratings yet

- Cust Vend Clearing SAPDocument14 pagesCust Vend Clearing SAPpersfolderNo ratings yet

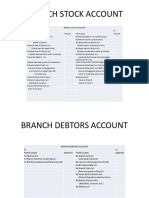

- Stock & Debtors System FormatsDocument9 pagesStock & Debtors System Formatsvani jainNo ratings yet

- Issue of DebenturesDocument36 pagesIssue of Debentureskeshavl122238No ratings yet

- Accounting EntriesDocument10 pagesAccounting EntriesArun AravindNo ratings yet

- System: Tab Name Side Tabs Add EditDocument29 pagesSystem: Tab Name Side Tabs Add EditSyed ZaffarNo ratings yet

- Accounting BasicsDocument11 pagesAccounting BasicsDhwani SoniNo ratings yet

- Accounts Payable JournalDocument16 pagesAccounts Payable JournalDebashis1982No ratings yet

- SR No Process LinkDocument31 pagesSR No Process LinkVaradhi ReddyNo ratings yet

- Atm Cafm Practical Revision NotesDocument95 pagesAtm Cafm Practical Revision Notesdroom8521No ratings yet

- Accounting EntriesDocument31 pagesAccounting EntriesKotesh KumarNo ratings yet

- Inventory and Sales Accounting EntriesDocument9 pagesInventory and Sales Accounting Entrieswalips1No ratings yet

- No Accounting Document Generated: No Accounting Document Generated: Based On The Purchase Order and The Quantity Actually ReceivedDocument5 pagesNo Accounting Document Generated: No Accounting Document Generated: Based On The Purchase Order and The Quantity Actually ReceivedAmanNo ratings yet

- Profit and Loss P&L Statement StatementDocument3 pagesProfit and Loss P&L Statement StatementShreepathi AdigaNo ratings yet

- Control Accounts Topic 1 PDFDocument9 pagesControl Accounts Topic 1 PDFpaul nsalambaNo ratings yet

- SAP Accounting EntriesDocument8 pagesSAP Accounting Entriesprodigious84No ratings yet

- Accounting EntriesDocument7 pagesAccounting EntriesVikram Thodupunoori100% (1)

- AssetAccounting, Excise, Cash JournalDocument4 pagesAssetAccounting, Excise, Cash JournalsrinivasNo ratings yet

- Sample Sop Manual 3Document23 pagesSample Sop Manual 3Tariq Nizam MalikNo ratings yet

- Intacc NotesDocument11 pagesIntacc NotesKeith SalesNo ratings yet

- Error Correction (Part 2) - Suspense Accounts (Including RQS)Document6 pagesError Correction (Part 2) - Suspense Accounts (Including RQS)King JulianNo ratings yet

- ERP Journals EntriesDocument10 pagesERP Journals Entriessainath_karetiNo ratings yet

- GL For CinDocument11 pagesGL For Cinrohit12345aNo ratings yet

- Practice Material 1 SolutionDocument22 pagesPractice Material 1 SolutionTineNo ratings yet

- AgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportDocument3 pagesAgingbyGeneralLedgerAccount - Receivables Aging by General Ledger Account ReportsureshNo ratings yet

- The Bookkeeper For Sam Kaplin Equipment Repair Made A Number PDFDocument1 pageThe Bookkeeper For Sam Kaplin Equipment Repair Made A Number PDFAnbu jaromiaNo ratings yet

- P2P AccountingDocument22 pagesP2P AccountingHimanshu MadanNo ratings yet

- CIN Accounting Entries-SAPDocument7 pagesCIN Accounting Entries-SAPGopal's DestinyNo ratings yet

- Accounts Receivables: To Mr. ZulfiqarDocument14 pagesAccounts Receivables: To Mr. ZulfiqarJM LangamanNo ratings yet

- Accounts Receivables: To Mr. ZulfiqarDocument14 pagesAccounts Receivables: To Mr. Zulfiqarjolina aficialNo ratings yet

- Accounting Entries For Procure To PayDocument3 pagesAccounting Entries For Procure To PaymajidNo ratings yet

- Accounting Entries For MMDocument5 pagesAccounting Entries For MMJim D'souza25% (4)

- SCM Accounting EntriesDocument2 pagesSCM Accounting EntriespriyatondonNo ratings yet

- Chapt 6 - Financial Ratio Analysis - CabreraDocument35 pagesChapt 6 - Financial Ratio Analysis - CabreraLancerAce22No ratings yet

- Test Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: March, 2022 Mock Test Paper 1 Foundation Course Paper - 1: Principles and Practice of AccountingVinithaNo ratings yet

- 4th Annual Aerotropolis Brochure 7 PDFDocument6 pages4th Annual Aerotropolis Brochure 7 PDFPablo Gil-CornaroNo ratings yet

- Routing and Scheduling Functions ExplainedDocument4 pagesRouting and Scheduling Functions ExplainedKishore ReddyNo ratings yet

- GGGI - Procurement Rules (2018) PDFDocument25 pagesGGGI - Procurement Rules (2018) PDFFerry MarkotopNo ratings yet

- 467-NR PartC 2021-07Document591 pages467-NR PartC 2021-07MirceaNo ratings yet

- Grammer SeatsDocument36 pagesGrammer SeatsSNS EQUIPMENTNo ratings yet

- SmartPlant PID Design Validation PDFDocument2 pagesSmartPlant PID Design Validation PDFshahidNo ratings yet

- Nielson Vs Lepanto - LaborDocument2 pagesNielson Vs Lepanto - LaborKRISCELL LABORNo ratings yet

- Chapter 8Document7 pagesChapter 8Jimmy LojaNo ratings yet

- hrm352 Ca 1Document8 pageshrm352 Ca 1api-580528603No ratings yet

- Tax Advantages & Disadvantages: of Multiple Entity StructuresDocument4 pagesTax Advantages & Disadvantages: of Multiple Entity StructuresDemewez AsfawNo ratings yet

- Unit-5 Final AccountsDocument7 pagesUnit-5 Final AccountsSanthosh Santhu0% (1)

- Halo Spillover Effects in Social Media Do Product Recalls of One Brand Hurt or Help Rival BrandsDocument4 pagesHalo Spillover Effects in Social Media Do Product Recalls of One Brand Hurt or Help Rival Brandsbreiterjanosch1No ratings yet

- Repair Maintenance FormDocument3 pagesRepair Maintenance FormDaus SallehNo ratings yet

- STANDARD COSTING Materials LaborDocument2 pagesSTANDARD COSTING Materials LaborCesNo ratings yet

- Dispute Freight ContractDocument15 pagesDispute Freight ContractVy Trần Thị ThảoNo ratings yet

- Buelow, Zucweiler, Rosacker (2011) Evaluation Methods For Hospital ProjectsDocument10 pagesBuelow, Zucweiler, Rosacker (2011) Evaluation Methods For Hospital ProjectsMa Al OtsanNo ratings yet

- The Fashion Channel: Case QuestionsDocument8 pagesThe Fashion Channel: Case QuestionsPiyushNo ratings yet

- Brief Background About DruckerDocument4 pagesBrief Background About DruckerTabitha WatsaiNo ratings yet

- Prelim QuizDocument5 pagesPrelim QuizShania Liwanag100% (2)

- 1.3 SCP201 Assignment Worksheet - Jan 2023 PDFDocument4 pages1.3 SCP201 Assignment Worksheet - Jan 2023 PDFfang weiNo ratings yet

- Who Will Teach Silicon Valley To Be Ethical?: Status Author Publishing/Release Date Publisher LinkDocument4 pagesWho Will Teach Silicon Valley To Be Ethical?: Status Author Publishing/Release Date Publisher LinkElph Music ProductionNo ratings yet

- Online Banking Service Agreement: Page 1 of 30 800356 (0520)Document30 pagesOnline Banking Service Agreement: Page 1 of 30 800356 (0520)Abdelkebir LabyadNo ratings yet

- Sparrow: Distributed, Low Latency SchedulingDocument16 pagesSparrow: Distributed, Low Latency SchedulingVersátil IdiomasNo ratings yet

- Improvement of Construction Procurement System ProcessesDocument121 pagesImprovement of Construction Procurement System ProcessesBeauty SairaNo ratings yet

- The Contemporary World Pointer AimeeDocument3 pagesThe Contemporary World Pointer Aimeebobadillamarie156No ratings yet

- Restaurant Accounting With Quic - Doug Sleeter-4Document21 pagesRestaurant Accounting With Quic - Doug Sleeter-4ADELALHTBANINo ratings yet

- Sustainable Lighting PDFDocument40 pagesSustainable Lighting PDFgilbertomjcNo ratings yet

- Ontel v. Shop LC - ComplaintDocument29 pagesOntel v. Shop LC - ComplaintSarah BursteinNo ratings yet