Professional Documents

Culture Documents

Fixed Income Market Report - 22.11.2021

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fixed Income Market Report - 22.11.2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

22ND NOVEMBER 2021

FIXED INCOME MARKET REPORT

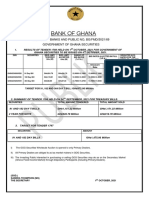

TENDER #1773 TREASURY RATES YIELD (15th Nov. – 19th Nov. 2021)

FIXED INCOME MARKET HIGHLIGHTS

At last week’s auction, a total of GH¢534.34 million was raised in 91-Day bills

and GH¢121.39 million was raised in 182-Day bills as compared to GH¢1,088.54

million raised in 91-Day bills and GH¢148.07 million raised in 182-Day bills at the

previous week’s auction.

Yields for 91-Day bill went up marginally by 0.16% to close at 12.50% whilst the

182-Day bills declined by 0.23% to settle at 13.22%.

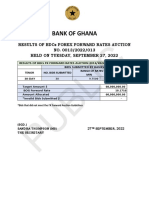

The target for the next auction (Tender #1774) is GH¢1,390.00 million in 91, 182

and 364 Day bills.

Results of last week’s Treasury Bill Auction

91 & 182 Day T-Bills (GH¢ Million) GOG Treasuries Current Previous Change (%)

91-Day T-Bill 12.50% 12.48% 0.16%

182-Day T-Bill 13.19% 13.22% -0.23%

708.00 BREAKDOWN OF TOTAL AMOUNT RAISED THIS WEEK

182-Day Bill

19%

655.93 655.73

BOG Offer Tendered Accepted

Breakdown of total amount raised this week

Treasuries Bids Tendered Bids Accepted

(GH¢ MN) (GH¢ MN)

91-Day T-Bill 534.54 534.34

91-Day Bill

182-Day T-Bill 121.39 121.39 81%

Totals 655.93 655.73

SUMMARY OF OCT. 2021 GFIM ACTIVITIES Next Auction Details

GHANA FIXED INCOME MARKET Treasuries Bids Tendered (GH¢ MN)

YEAR Jan.-Oct. 2021 Jan.-Oct. 2020 Change Tender No. 1774

VOLUME 172,605,783,613 85,002,566,575 103.06% Target Size GH¢1,390 million

VALUE (GH¢) 179,160,342,714.23 86,777,805,364.73 106.46% Auction Date 26th November, 2021

NO. OF TRADES 278,135 147,649 88.36% Settlement Date 29th November, 2021

Source: Ghana Stock Exchange Securities on offer 91-Day, 182, 364-Day bills

KEY ECONOMIC INDICATORS

Indicator Current Previous ANALYSTS

Monetary Policy Rate September 2021 13.50% 13.50%

Godwin Kojo Odoom: Senior Research Analyst

Real GDP Growth Q2 2021 3.90% 3.10%

Inflation October 2021 11.00% 10.60% Edna Awurama Fosua: Analyst

Reference rate October 2021 13.46% 13.51%

Source: GSS, BOG, GBA Nelson Cudjoe Kuagbedzi: Analyst

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Sample Complaint Against California Insurance Company For Bad FaithDocument3 pagesSample Complaint Against California Insurance Company For Bad FaithStan Burman80% (5)

- COA CIRCULAR NO. 2023-003 June 14 2023Document14 pagesCOA CIRCULAR NO. 2023-003 June 14 2023Jennifer Go100% (2)

- Connecting Strategy To ExecutionDocument13 pagesConnecting Strategy To ExecutionrpreidNo ratings yet

- Classification of Businesses: Revision AnswersDocument2 pagesClassification of Businesses: Revision AnswersJane Lea100% (6)

- FR-212 Iso 9001-2015 Stage 2-Surveillance Audit ReportDocument5 pagesFR-212 Iso 9001-2015 Stage 2-Surveillance Audit ReporttriveshNo ratings yet

- COTO Full Document - Oct 2020Document1,320 pagesCOTO Full Document - Oct 2020Danie100% (11)

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Activity 1 Venn Diagram of Financial Market and Financial InstitutionsDocument1 pageActivity 1 Venn Diagram of Financial Market and Financial InstitutionsBea3No ratings yet

- Fin AcctgDocument9 pagesFin AcctgCarl Angelo0% (1)

- Exam Chap 13Document60 pagesExam Chap 13asimNo ratings yet

- The Rampant Case of Unemployment in The PhilippinesDocument3 pagesThe Rampant Case of Unemployment in The PhilippinesTomas DocaNo ratings yet

- Dkeff Guarantor FormDocument2 pagesDkeff Guarantor FormDallas SmithNo ratings yet

- BSBCMM401 Make A Presentation (Task1 Part B)Document4 pagesBSBCMM401 Make A Presentation (Task1 Part B)pidchayapon sawangvongNo ratings yet

- Determining Dimensional Stability of Resilient Floor Tile After Exposure To HeatDocument3 pagesDetermining Dimensional Stability of Resilient Floor Tile After Exposure To HeatAlma EspinosaNo ratings yet

- Topic 1 - Creating Customer Value and EngagementDocument27 pagesTopic 1 - Creating Customer Value and EngagementZhi YongNo ratings yet

- Dwnload Full Thermodynamics An Interactive Approach 1st Edition Bhattacharjee Solutions Manual PDFDocument36 pagesDwnload Full Thermodynamics An Interactive Approach 1st Edition Bhattacharjee Solutions Manual PDFjefferyphillips68roj100% (9)

- Scientia L 2023Document244 pagesScientia L 2023john umaru rikkaNo ratings yet

- Od 123557026424340000Document1 pageOd 123557026424340000Sahil HasanNo ratings yet

- Remedial Account Management and Skip TracingDocument29 pagesRemedial Account Management and Skip TracingIsagani BaldecañasNo ratings yet

- Sale 238 26-06-2023Document2 pagesSale 238 26-06-2023Creeper TechnologiesNo ratings yet

- TDS - 1K RAL 9005 Black-ZFDocument4 pagesTDS - 1K RAL 9005 Black-ZFBharath OXYNo ratings yet

- Investor Presentation MARCH 2011: A Global Leader in Integrated Clean Air Solutions For IndustryDocument33 pagesInvestor Presentation MARCH 2011: A Global Leader in Integrated Clean Air Solutions For IndustrymynameisvinnNo ratings yet

- Neelima Prabhala - IndiaDocument3 pagesNeelima Prabhala - Indiadharmendratyagi232No ratings yet

- Dokumen PDFDocument21 pagesDokumen PDFMark AlcazarNo ratings yet

- International Accounting Standard With ExamplesDocument15 pagesInternational Accounting Standard With ExamplesAmna MirzaNo ratings yet

- Pretty in Pink Word Resume TemplateDocument2 pagesPretty in Pink Word Resume TemplateanishkadiyalaNo ratings yet

- Service Plan For 2GO TravelDocument33 pagesService Plan For 2GO TravelPaulino OccupadoNo ratings yet

- Ethno StoriesDocument38 pagesEthno StoriesjcaylaNo ratings yet

- Rheostats OCT2010Document16 pagesRheostats OCT2010youplaiNo ratings yet

- Bill of Lading AustriaDocument2 pagesBill of Lading AustriaTitik KurniyatiNo ratings yet

- Mgt2 - Assessment Task 7Document3 pagesMgt2 - Assessment Task 7Rev Richmon De ChavezNo ratings yet