0% found this document useful (0 votes)

25 views4 pagesAnalisis DDM PTBA: Rekomendasi Beli

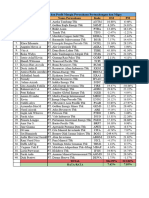

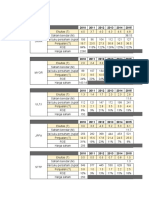

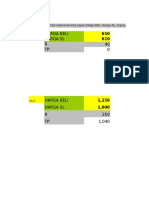

The document analyzes PT. Tambang Batubara Bukit Asam (Persero) Tbk using the DDM and P/E ratio methods. Using DDM, the intrinsic value is calculated as IDR 2,773.53. Using P/E ratio, the intrinsic value is IDR 2,470. Both methods find the stock to be overvalued with a margin of safety below 30%, so the recommendation is to buy the stock.

Uploaded by

Nur Aini Lutfinissa'Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

25 views4 pagesAnalisis DDM PTBA: Rekomendasi Beli

The document analyzes PT. Tambang Batubara Bukit Asam (Persero) Tbk using the DDM and P/E ratio methods. Using DDM, the intrinsic value is calculated as IDR 2,773.53. Using P/E ratio, the intrinsic value is IDR 2,470. Both methods find the stock to be overvalued with a margin of safety below 30%, so the recommendation is to buy the stock.

Uploaded by

Nur Aini Lutfinissa'Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd