Professional Documents

Culture Documents

FAR - Chapter 3 - Analyzing Transactions To Start A Business

Uploaded by

Belle Mendoza0 ratings0% found this document useful (0 votes)

28 views4 pagesOriginal Title

FAR - Chapter 3 - Analyzing Transactions to Start a Business

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views4 pagesFAR - Chapter 3 - Analyzing Transactions To Start A Business

Uploaded by

Belle MendozaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

Accounting Equation - accounting tool used - Usually paid in cash but may also be

when transactions are analyzed as to their paid using property or service

effects on assets, liabilities, and equity.

Net assets or net worth - determined by

Accounting Framework - set of accounting deducting total liabilities from total assets

standards and operating guidelines used in Owner’s equity - net assets claimable by the

analyzing transactions and preparing financial owner

statements that stakeholders need in Equity - residual right or interest of the

decision-making. owner(s) in the entity’s net worth

- Can be called Partners’ Equity

● Financial position is based on 3 (partnership) and Shareholders’

elements -- assets, liabilities, equity Equity (corporation)

● Financial performance is based on 2

elements -- revenue and expense Account - device used to record the changes

(increases or decreases) in the accounting

Assets - economic resources owned and elements

controlled by the business

- Used in operating the business and Asset Accounts

would benefit the business over a ● Cash refers to currencies, coins,

number of years checks, and bank drafts.

- A resource obtained by the business a. Cash on Hand - located within

as a result of a past event from which the entity

future economic benefits are expected b. Cash in Bank - monies

- Land, building, cash, furniture and deposited in a bank

fixtures, equipment, supplies, etc. ● Furniture and Fixtures refer to

tables, chairs, desks, and cabinets

Economic benefit - ability of the asset to ● Equipment - machines, printers,

produce future cash flows for the business computers, aircon, etc.

whether directly (when asset is sold for cash)

or indirectly (when used to create other Liability Accounts - usually identified as

assets like machine to produce goods) payable or d

ue to.

● Assets are claimable by two parties: ● Accounts payable

owner(s) and creditors ● Notes payable

● Loans payable

Liabilities - obligation to do or pay ● Mortgage due to Land Bank, etc.

- Debts of the business owing to

outside parties like banks, financing Owner’s Equity Accounts

companies, and suppliers of goods ● Owner’s Capital - investments made

and services by the owner

- Present obligation arising from a past ● Owner’s Drawing - withdrawal of

event wherein the settlement is business assets for personal use

expected to result in an outflow of ● (Revenues and expenses also

resources from the enterprise represent changes in capital)

Transaction - exchange of values between 2 EFFECTS OF TRANSACTIONS

parties expressed in monetary terms. The Transactions Assets Liabilities Equity

values exchange are assumed to be of equal

amount Investment of

Double Entry Bookkeeping - for every value assets + +

received, there is an equal value parted Withdrawal of

- Also called Venetian Model assets - -

Monetary Measurement Principle -

Purchase of

transaction must be stated in terms of money

assets in cash +/-

YOU DO NOTE: Transactions that are Purchase of

considered non-financial in nature (no assets in account + +

exchange of values) should not be recorded

Settlement of

EXAMPLES: liabilities in cash - -

- The business hired tourist guides for a

Settlement of

salary of Php 10,000 each

- The business signed a lease contract

liabilities with a +/-

note

for the use of office space

- An order for office supplies was Settlement of

placed for Php 5,000 liabilities using - +

personal cash

(Just because may value na naka-indicate, it

doesn’t mean na irerecord na agad siya.

Dapat minention na nagbayad na like: QUALITATIVE ATTRIBUTES OF

- The travel agency paid cash for FINANCIAL INFORMATION

services rendered by tourist guides (TIP: it’s better if basahin to sa book kasi may

- The business used the office space mga explanation siya and stuff)

and paid the lessor

- The business received the supplies 1. Understandability

and paid cash - must use clear terminologies

- orderly presentation of reports

Statement of Financial Position - list of - users must have reasonable

assets, liabilities, and owner’s equity knowledge of finance accounting and

- Formerly called Balance Sheet economics to come up with good

- Informs users of the business’ assessment and sound judgment

accumulated wealth and obligations

- Used to determine liquidity and 2. Relevance

solvency of the business - prescribes the quality of information

- Usually prepared yearly that will influence the user to make a

- Interim statement may be prepared sound decision

(monthly or quarterly) - must give the feedback value (past

● Accounts Payable is a liability performance of business) to project

represented by an oral promise to pay what might happen in the future

● Notes Payable is a liability supported (predictive value)

by a promissory note

Constraints in reporting Relevant Information Principles - laws or rules that guide the

a. Materiality. depends whether an item conduct and practice of the profession

(by nature or size) will influence the - used in identifying, measuring, and

user’s decision or not. (read p. 52 for reporting financial information

more!)

b. Timeliness. reports must be given The accounting principles depend on

within the period needed to form the pronouncement made by the PICPA

judgment through its Accounting Standards Council

(now called Financial Reporting Standards

3. Reliability Council or FRSC).

- can the financial statements be FRSC has members coming from:

depended upon by the users? 1. PICPA

- Should be objective and free from 2. SEC

errors or misstatements 3. BIR

Four Things to be Considered: 4. CHED (Commission on Higher

a. Faithful representation - information Education)

must not mislead users 5. Financial Executives (FINEX)

b. Substance over form - 6. PRC

c. Prudence - exercise caution when

using estimates HOW STANDARDS ARE PROCESSED

- never overstate or understate ● FRSC prepares exposure drafts that are

accounts disseminated to the accounting members

d. Neutrality - information should be ● Series of dialogues with members

useful to ALL users, it should not ● The council meets & finalizes the

show any form of bias standards

e. (extra?) Completeness - value of ● Standards are circulated via bulletins

information may be enhanced to help ● Seminars are conducted to enlighten

users make informed judgment members on how the standard should be

applied

4. Comparability ● Standard is formalized and approved by

- helps identify the changes that take FRSC

place in the entity between two or ● Standard forms part of the Financial

more periods Reporting Standards (FRS)

- users can determine the change or

trend of the entity’s performance ACCOUNTING PRINCIPLES USED IN

- Rule of Comparability complements PREPARATION AND PRESENTATION OF

the Rule of Consistency FINANCIAL STATEMENTS FROM PAS 1

- Consistency requires uniformity of (Read book for more info!)

accounting treatment in every period

1. Going Concern Principle

ACCOUNTING PRINCIPLES (GAAP) - primary guide in preparing FS

- norm of conduct of a place of - it is expected that the business will

standards promulgated by an continue to exist indefinitely

authoritative body

- financial statements should be

prepared on a going concern basis

unless management intends to close

the business

Assets like properties should be

recognized at cost without regard to the

changes in market values (same lang dapat

yung value kung magkano siya nabili.

Mag-iiba lang dapat yung value upon exit of

the business)

2. Business Entity Concept

- A business enterprise is separate and

distinct from its owner/investor

- only the assets, liabilities, revenue,

and expenses of the entity should be

included, NO personal assets & liab

3. Exchange Price or Cost Principle

4. Measurement in Terms of Money

5. Accrual Assumption

6. Objectivity

7. Reporting Period

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Multiple Choice-Problems: Total 225,000Document13 pagesMultiple Choice-Problems: Total 225,000IT GAMING50% (2)

- Multiple Choice-Problems: Total 225,000Document13 pagesMultiple Choice-Problems: Total 225,000IT GAMING50% (2)

- CA-BAR Flow Charts Remedies PDFDocument85 pagesCA-BAR Flow Charts Remedies PDFGevork Jabakchurian100% (1)

- Accounting Reviewer PrelimsDocument6 pagesAccounting Reviewer PrelimsRona Via AbrahanNo ratings yet

- FABM Accounting FundamentalsDocument17 pagesFABM Accounting FundamentalsKyle Kyle67% (3)

- Financial Model - Real Estate DevelopmentDocument7 pagesFinancial Model - Real Estate DevelopmentAdnan Ali100% (1)

- Overview of key business conceptsDocument32 pagesOverview of key business conceptsJemuell RedNo ratings yet

- Accounting Reviewer PDFDocument13 pagesAccounting Reviewer PDFJireh Dugayo80% (5)

- Accounting as an Information SystemDocument9 pagesAccounting as an Information SystemDyvine100% (1)

- FABM 2 Third Quarter Test ReviewerDocument5 pagesFABM 2 Third Quarter Test ReviewergracehelenNo ratings yet

- Fabm 1ST Sem CH1234Document12 pagesFabm 1ST Sem CH1234Mary Franchesca RodaNo ratings yet

- GAAP-based accounting principles explainedDocument5 pagesGAAP-based accounting principles explainedPun YeetahNo ratings yet

- Fabm1 - Reviewer: AccountingDocument7 pagesFabm1 - Reviewer: AccountingBaluyut, Kenneth Christian O.No ratings yet

- Fabm 2 PDFDocument3 pagesFabm 2 PDFgk concepcionNo ratings yet

- Fabm1 1Document6 pagesFabm1 1Kiana OrtegaNo ratings yet

- Accounting ConceptsDocument3 pagesAccounting ConceptsVic BalmadridNo ratings yet

- Accounting Fundamentals and ProfessionsDocument14 pagesAccounting Fundamentals and ProfessionsTimone PurinoNo ratings yet

- Overview of Accounting Standards PAS 1-23Document16 pagesOverview of Accounting Standards PAS 1-23John DavisNo ratings yet

- Conceptual Framework Chapter 1-10Document112 pagesConceptual Framework Chapter 1-10Earone MacamNo ratings yet

- 23 24. TheoryDocument5 pages23 24. TheorySanjeev JayaratnaNo ratings yet

- ACCOUNTINGDocument6 pagesACCOUNTINGFe VhieNo ratings yet

- Accounting - PonesDocument4 pagesAccounting - PonesLuisa PonesNo ratings yet

- Day 1 Note (Accounting Concepts, Principles and Merchandising Accounting)Document11 pagesDay 1 Note (Accounting Concepts, Principles and Merchandising Accounting)Janette AngligenNo ratings yet

- Intensive Basic AccountingDocument4 pagesIntensive Basic AccountingMaryll Cyan Magnaye100% (2)

- Def of Assets and LiabilitiesDocument6 pagesDef of Assets and LiabilitieslancealcarazNo ratings yet

- SELF MADE Conceptual Framework of AccounDocument15 pagesSELF MADE Conceptual Framework of AccounCamelia CanamanNo ratings yet

- What is accounting and its key conceptsDocument8 pagesWhat is accounting and its key conceptsmy tràNo ratings yet

- ACCA101 Study Guide: Exams 1.1 Key ConceptsDocument4 pagesACCA101 Study Guide: Exams 1.1 Key ConceptsBeatrice Dominique C. PepinoNo ratings yet

- CFAS Part 1Document3 pagesCFAS Part 1AINAH SALEHA MIMBALAWAGNo ratings yet

- Cfas NotesDocument19 pagesCfas NotesChristine Joy AbrantesNo ratings yet

- Lecture Notes BSND AccountingDocument4 pagesLecture Notes BSND AccountingCassandra NaragNo ratings yet

- Accounting ReviewerDocument12 pagesAccounting ReviewerYanela YishaNo ratings yet

- CBSE 11th Commerce Sample Accountancy IDocument18 pagesCBSE 11th Commerce Sample Accountancy ILakshmi PonduriNo ratings yet

- ACCTG 101 Chapter 1 11Document60 pagesACCTG 101 Chapter 1 11Jemalyn TarucNo ratings yet

- External Users - The Government, Those Who Provide Funds and Those Who Have Various Interests in TheDocument16 pagesExternal Users - The Government, Those Who Provide Funds and Those Who Have Various Interests in TheKristine dela CruzNo ratings yet

- CHAP 1 FinaccDocument19 pagesCHAP 1 FinaccQuyên NguyễnNo ratings yet

- Cfas Chapter 3 Qualitative Characteristics: Free From ErrorDocument5 pagesCfas Chapter 3 Qualitative Characteristics: Free From ErrorKyle RiegoNo ratings yet

- LS 1 - ACCOUNTING AND ITS ENVIRONMENT Part 2Document53 pagesLS 1 - ACCOUNTING AND ITS ENVIRONMENT Part 2Danielle Angel Malana100% (1)

- Fabm 2Document5 pagesFabm 2Robillos FaithNo ratings yet

- Financial AccountingDocument3 pagesFinancial AccountingJaimee CruzNo ratings yet

- Unit 1Document28 pagesUnit 1Yash MehrotraNo ratings yet

- Fa (Mubs) Mba 2018-19Document185 pagesFa (Mubs) Mba 2018-19henrywasulaNo ratings yet

- Accounting cycle and cash managementDocument11 pagesAccounting cycle and cash managementmichelle donaireNo ratings yet

- Why we study accountingDocument34 pagesWhy we study accountingTimone PurinoNo ratings yet

- Statement of Cash Flows - Lecture NotesDocument6 pagesStatement of Cash Flows - Lecture NotesSteven Sanderson100% (8)

- Foundations of Financial Reporting and The Classified Balance SheetDocument32 pagesFoundations of Financial Reporting and The Classified Balance SheetKariza ReyesNo ratings yet

- Acc PDFDocument61 pagesAcc PDFSmarika BistNo ratings yet

- ACN3112 T1 The Conceptual Framework For Financial ReportingDocument30 pagesACN3112 T1 The Conceptual Framework For Financial ReportingNURIN SOFIYA BT ZAKARIA / UPMNo ratings yet

- buss1030-notesDocument71 pagesbuss1030-notesvladimirputino1No ratings yet

- ACCOUNTING PROCESS and CLASSIFICATIONDocument26 pagesACCOUNTING PROCESS and CLASSIFICATIONvdhanyamrajuNo ratings yet

- Essential Elements of The Definition of AccountingDocument9 pagesEssential Elements of The Definition of AccountingPamela Diane Varilla AndalNo ratings yet

- FSA SummaryDocument39 pagesFSA SummaryElias MacherNo ratings yet

- Fundamentals of Acocunting and Business Management 1 2Document14 pagesFundamentals of Acocunting and Business Management 1 2kristinekaylegusimat12No ratings yet

- Basic Accounting Concepts and PrinciplesDocument16 pagesBasic Accounting Concepts and PrinciplesRenmar CruzNo ratings yet

- Curs 2 EnglezaDocument2 pagesCurs 2 EnglezaConstantin MihaiNo ratings yet

- Chapter 1 - Introduction To Cost & Management AccountingDocument30 pagesChapter 1 - Introduction To Cost & Management AccountingJiajia MoxNo ratings yet

- Quiz 4 - Conceptual Framework For Financial ReportingDocument7 pagesQuiz 4 - Conceptual Framework For Financial ReportingZariyah RiegoNo ratings yet

- Introduction To Accounting: Basic Financial StatementsDocument15 pagesIntroduction To Accounting: Basic Financial StatementsStellaNo ratings yet

- Accounting Transactions ExplainedDocument3 pagesAccounting Transactions Explained11ABM Isamiel Grace MendozaNo ratings yet

- FABM-PrelimDocument5 pagesFABM-PrelimIvana CianeNo ratings yet

- 11th Class PDFDocument67 pages11th Class PDFVikas PandeyNo ratings yet

- 3.accounts Revision by Topper InstituteDocument24 pages3.accounts Revision by Topper InstituteDristi SaudNo ratings yet

- Screenshot 2022-09-28 at 1.19.27 AMDocument19 pagesScreenshot 2022-09-28 at 1.19.27 AMLabhya GuptaNo ratings yet

- 2. Financial controlDocument9 pages2. Financial controlima funtanaresNo ratings yet

- Chapter 5 - Training and Development of Human ResourcesDocument9 pagesChapter 5 - Training and Development of Human ResourcesBelle MendozaNo ratings yet

- Chapter 1Document20 pagesChapter 1Belle MendozaNo ratings yet

- Ideologies of Globalism: January 2010Document33 pagesIdeologies of Globalism: January 2010marc1895No ratings yet

- CHAPTER 2 Human Resource Planning (HRP) Human Resoucre Planning (HRP)Document9 pagesCHAPTER 2 Human Resource Planning (HRP) Human Resoucre Planning (HRP)Belle Mendoza100% (1)

- Wages and Salary Administration TheoriesDocument15 pagesWages and Salary Administration TheoriesBelle MendozaNo ratings yet

- FAR - Chapter 2 - The Demands of Global E-CommerceDocument3 pagesFAR - Chapter 2 - The Demands of Global E-CommerceBelle MendozaNo ratings yet

- Nanotechnology Chapter Summary: Impacts, Tools and MaterialsDocument7 pagesNanotechnology Chapter Summary: Impacts, Tools and MaterialsBelle MendozaNo ratings yet

- Purposive Communication: Characteristics of LanguageDocument6 pagesPurposive Communication: Characteristics of LanguageBelle MendozaNo ratings yet

- Introduction To Financial Accounting - EDITEDDocument7 pagesIntroduction To Financial Accounting - EDITEDWaleed MustafaNo ratings yet

- PCM - Learning Task #1 (PS)Document25 pagesPCM - Learning Task #1 (PS)Belle MendozaNo ratings yet

- Scientific Method Starting From Aristotle.: TH THDocument6 pagesScientific Method Starting From Aristotle.: TH THBelle MendozaNo ratings yet

- Reviewer Chapter 7Document5 pagesReviewer Chapter 7Belle MendozaNo ratings yet

- Reviewer For Sts Chapter 9Document4 pagesReviewer For Sts Chapter 9Belle MendozaNo ratings yet

- Solid Wastes Module 4Document2 pagesSolid Wastes Module 4Belle MendozaNo ratings yet

- Solid Wastes Module 4Document2 pagesSolid Wastes Module 4Belle MendozaNo ratings yet

- Bataan has fallen: The inspiring speechDocument6 pagesBataan has fallen: The inspiring speechBelle MendozaNo ratings yet

- Solid Wastes Module 4Document2 pagesSolid Wastes Module 4Belle MendozaNo ratings yet

- Specific Module 5 Introduction To The Community and Community AssessmentDocument6 pagesSpecific Module 5 Introduction To The Community and Community AssessmentBelle MendozaNo ratings yet

- CC module explores impacts of climate change like sea level riseDocument2 pagesCC module explores impacts of climate change like sea level riseBelle MendozaNo ratings yet

- Cwts Module 3Document6 pagesCwts Module 3Belle MendozaNo ratings yet

- History of Accounting // Father of AccountingDocument4 pagesHistory of Accounting // Father of AccountingBelle MendozaNo ratings yet

- Dream Board BusinessDocument9 pagesDream Board BusinessBelle MendozaNo ratings yet

- 7 Environemental Principles (Module 4)Document2 pages7 Environemental Principles (Module 4)Belle MendozaNo ratings yet

- Fundamentals of AccountingDocument18 pagesFundamentals of AccountingBelle MendozaNo ratings yet

- SBU - Syllabus in Criminal Law I (Updated For AY 2023-2024) CLEANDocument29 pagesSBU - Syllabus in Criminal Law I (Updated For AY 2023-2024) CLEANCarmela Luchavez AndesNo ratings yet

- Government of Tamilnadu Department of Employment and TrainingDocument11 pagesGovernment of Tamilnadu Department of Employment and Trainingjohn chellamuthuNo ratings yet

- Fraction 1Document5 pagesFraction 1Anjal NasheetNo ratings yet

- SOciology QuestionDocument7 pagesSOciology QuestionmaishNo ratings yet

- Chapter 4. Basel's Principle For Effective Risk Data Aggregation and Risk ReportingDocument30 pagesChapter 4. Basel's Principle For Effective Risk Data Aggregation and Risk ReportingBelle AnnaNo ratings yet

- Elements of GlobalizationDocument2 pagesElements of Globalizationvalleriejoyescolano2No ratings yet

- Comprehensive International Energy LawDocument198 pagesComprehensive International Energy LawVlada ZastavlenkoNo ratings yet

- Credit Suisse Risked So Much On Archegos For So Little - BloombergDocument12 pagesCredit Suisse Risked So Much On Archegos For So Little - BloombergKelvin LamNo ratings yet

- Indo-Russian Relations in Recent Times: - Manali JainDocument6 pagesIndo-Russian Relations in Recent Times: - Manali JainGautya JajoNo ratings yet

- Chapter - IDocument42 pagesChapter - IAbineshwaran SaravananNo ratings yet

- Project Proposal: Saan Aabot Ang BENTE Mo? We Mask, Shield, and Disinfect You From VirusDocument7 pagesProject Proposal: Saan Aabot Ang BENTE Mo? We Mask, Shield, and Disinfect You From Virusmel laguinlinNo ratings yet

- Acquiring Competent PersonnelDocument8 pagesAcquiring Competent PersonnelSam MoldesNo ratings yet

- Special 510 (K) Summary: Medtronic VascularDocument6 pagesSpecial 510 (K) Summary: Medtronic VascularManoj NarukaNo ratings yet

- Barangay Gibraltar: Tel No. 443 - 5630Document2 pagesBarangay Gibraltar: Tel No. 443 - 5630Aida Potacag BuasenNo ratings yet

- Ethics ReviewerDocument4 pagesEthics ReviewerAlyson Barrozo50% (2)

- Notice seeking refund and compensation for defective Asian paintsDocument4 pagesNotice seeking refund and compensation for defective Asian paintsMr.M.Dhinakar Asst.ProfessorNo ratings yet

- The Oxford Handbook On Popular Music in PDFDocument33 pagesThe Oxford Handbook On Popular Music in PDFJulianNo ratings yet

- BBA 602 Unit 3 Strategic Implementation PDFDocument6 pagesBBA 602 Unit 3 Strategic Implementation PDFAbhitak MoradabadNo ratings yet

- Jeffrey Mckellop Crim ComplaintDocument27 pagesJeffrey Mckellop Crim ComplaintLaw&CrimeNo ratings yet

- Brainy Kl6 Unit Test 1 A PDFDocument1 pageBrainy Kl6 Unit Test 1 A PDFwiktoriaNo ratings yet

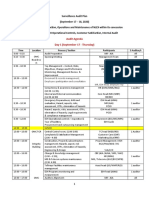

- Surveillance Audit PlanDocument3 pagesSurveillance Audit PlanJessa VillanuevaNo ratings yet

- Careplus Group BHD: Case StudyDocument6 pagesCareplus Group BHD: Case StudyKhaw Seek ChuanNo ratings yet

- Replevin - DBP Vs Honorable Carpio Feb 1, 2017Document4 pagesReplevin - DBP Vs Honorable Carpio Feb 1, 2017Elias IbarraNo ratings yet

- Lecture 3. Theories On Gender - Theoritical PerspectiveDocument17 pagesLecture 3. Theories On Gender - Theoritical Perspectiverafael baesaNo ratings yet

- Samarah - Article Template - 2021Document5 pagesSamarah - Article Template - 2021Nurchaliq MajidNo ratings yet

- Impartial Court or Tribunal - Office of The Court Administrator vs. Judge Hector B. SaliseDocument8 pagesImpartial Court or Tribunal - Office of The Court Administrator vs. Judge Hector B. SaliseAngel CabanNo ratings yet

- Budget Accountability PPT 15 Feb 2024 JLPDocument38 pagesBudget Accountability PPT 15 Feb 2024 JLPkyla penaverdeNo ratings yet

- Final Exam Purposive CommunicationDocument2 pagesFinal Exam Purposive CommunicationReñer Aquino Bystander0% (1)