Professional Documents

Culture Documents

Daily Equity Market Report - 01.12.2021

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 01.12.2021

Uploaded by

Fuaad DodooCopyright:

Available Formats

01ST DECEMBER 2021

DAILY EQUITY MARKET REPORT

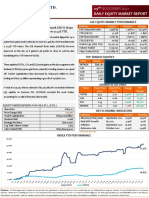

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: The Ghana Stock market

Indicator Current Previous Change

lost 23.49 points to return 46.44% YTD. GSE-Composite Index 2,843.27 2,866.76 -23.49pts

The benchmark GSE Composite Index (GSE-CI) shed 23.49 points to YTD (GSE-CI) 46.44% 47.65% -2.54%

GSE-Financial index 2,091.38 2,091.38 0.00pts

close trading at 2,843.27 representing a YTD return of 46.44%. The GSE

YTD (GSE-FSI) 17.31% 17.31% 0.00%

Financial Stock Index (GSE-FSI) however, remained flat to close trading Market Cap. (GH¢ MN) 64,232.24 64,461.65 -229.41

at 2,091.38 also translating into a YTD return of 17.31%. Volume Traded 60,501 1,110,671 -94.55%

Value Traded (GH¢) 90,768.75 1,106,621.83 -91.80%

This caused Market Capitalization to decrease by GH¢229.41 million to

close trading at GH¢64.23 billion representing a growth of 18.55% in 2021. TOP TRADED EQUITIES

Ticker Volume Value (GH¢)

MTNGH 26,898 31,739.64

A total of 60,501 shares valued at GH¢90,768.75 was traded in eight (8)

GOIL 26,664 48,528.48

equities compared to Tuesday’s volume of 1,110,671 shares valued at RBGH 3,900 2,340.00

GH¢1,106,621.83 a decrease of 94.55% and 91.80% in volumes and value CAL 1,858 1,616.46

EGL 844 2,135.32

53.4% of value traded

traded respectively.

Ghana Oil Company Limited (GOIL) recorded the largest share of trades, GAINER

Ticker Close Price Open Price Change YTD

accounting for 53.4% of total value traded. (GH¢) (GH¢) Change

MTNGH 1.18 1.20 -1.67% 84.38%

EQUITY UNDER REVIEW: FAN MILK PLC. (FML)

Share Price GH¢4.00 KEY ECONOMIC INDICATORS

Price Change (YtD) 272.00% Indicator Current Previous

Market Capitalization GH¢467.15 million Monetary Policy Rate November 2021 14.50% 13.50%

Dividend Yield 0.00% Real GDP Growth Q2 2021 3.90% 3.10%

Earnings Per Share GH¢-0.1560 Inflation October 2021 11.00% 10.60%

Avg. Daily Volume Traded 8,086 Reference rate October 2021 13.47% 13.46%

Value Traded (YtD) GH¢ 6,228,907.00 Source: GSS, BOG, GBA

MTN GHANA RECENT SHARE PRICE PERFORMANCE BENCHMARK INDICES YTD PERFORMANCE

60.00%

1.35

1.33

1.32

50.00%

1.30

40.00% 46.44%

1.25 1.24

1.25

30.00%

1.20 1.21

1.20

20.00%

1.18

1.15

10.00%

17.31%

1.10

0.00%

21-Nov

29-Nov

1-Nov

5-Nov

7-Nov

9-Nov

13-Nov

17-Nov

25-Nov

11-Nov

15-Nov

19-Nov

23-Nov

27-Nov

3-Nov

1-Dec

4-Jan 4-Feb 4-Mar 4-Apr 4-May 4-Jun 4-Jul 4-Aug 4-Sep 4-Oct 4-Nov

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Daily Equity Market Report - 30.11.2021Document1 pageDaily Equity Market Report - 30.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.11.2021Document1 pageDaily Equity Market Report - 24.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 23.08.2022Document1 pageDaily Equity Market Report - 23.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.01.2022Document1 pageDaily Equity Market Report - 04.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 07.02.2022Document1 pageDaily Equity Market Report - 07.02.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 25.08.2022Document1 pageDaily Equity Market Report - 25.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.08.2022Document1 pageDaily Equity Market Report - 10.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-10.01.2022Document1 pageDaily Equity Market Report-10.01.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 09.11.2021Document1 pageDaily Equity Market Report - 09.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.07.2022Document1 pageDaily Equity Market Report - 21.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 10.03.2022Document1 pageDaily Equity Market Report - 10.03.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 20.07.2022Document1 pageDaily Equity Market Report - 20.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.11.2021Document1 pageDaily Equity Market Report - 17.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.07.2022Document1 pageDaily Equity Market Report - 27.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report 18.08.2022 2022-08-18Document1 pageDaily Equity Market Report 18.08.2022 2022-08-18Fuaad DodooNo ratings yet

- Daily Equity Market Report - 21.06.2022Document1 pageDaily Equity Market Report - 21.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.05.2022Document1 pageDaily Equity Market Report - 26.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.07.2022Document1 pageDaily Equity Market Report - 14.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 03.08.2022Document1 pageDaily Equity Market Report - 03.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.05.2022Document1 pageDaily Equity Market Report - 18.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report-28.10.2021Document1 pageDaily Equity Market Report-28.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.05.2022Document1 pageDaily Equity Market Report - 17.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 24.08.2022Document1 pageDaily Equity Market Report - 24.08.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 15.10.2021Document2 pagesWeekly Capital Market Recap Week Ending 15.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.07.2022Document1 pageDaily Equity Market Report - 28.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 02.08.2022Document1 pageDaily Equity Market Report - 02.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2022Document1 pageDaily Equity Market Report - 01.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 01.06.2022 2022-06-01Document1 pageDaily Equity Market Report 01.06.2022 2022-06-01Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 20.08.2021Document2 pagesWeekly Capital Market Recap Week Ending 20.08.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.11.2021Document1 pageDaily Equity Market Report - 15.11.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.09.2021Document1 pageDaily Equity Market Report - 06.09.2021Fuaad DodooNo ratings yet

- Market ReportDocument1 pageMarket ReportFuaad DodooNo ratings yet

- Daily Equity Market Report - 23.05.2022Document1 pageDaily Equity Market Report - 23.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2021Document1 pageDaily Equity Market Report - 05.10.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report 04.07.2022 2022-07-04Document1 pageDaily Equity Market Report 04.07.2022 2022-07-04Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.06.2022Document1 pageDaily Equity Market Report - 14.06.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 15.09.2022Document1 pageDaily Equity Market Report - 15.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 25.05.2022Document1 pageDaily Equity Market Report - 25.05.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.07.2022Document1 pageDaily Equity Market Report - 26.07.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 01.09.2021Document1 pageDaily Equity Market Report - 01.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 13.09.2022Document1 pageDaily Equity Market Report - 13.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 14.09.2022Document1 pageDaily Equity Market Report - 14.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 06.07.2022 2022-07-06Document1 pageDaily Equity Market Report 06.07.2022 2022-07-06Fuaad DodooNo ratings yet

- Daily Equity Market Report - 08.09.2021Document1 pageDaily Equity Market Report - 08.09.2021Fuaad DodooNo ratings yet

- Weekly Capital Market Recap Week Ending 03.09.2021Document2 pagesWeekly Capital Market Recap Week Ending 03.09.2021Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.08.2022Document1 pageDaily Equity Market Report - 17.08.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 29.11.2021 2021-11-29Document1 pageDaily Equity Market Report 29.11.2021 2021-11-29Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- BOG Auctresults 625 WED 20 OCT 21Document1 pageBOG Auctresults 625 WED 20 OCT 21Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

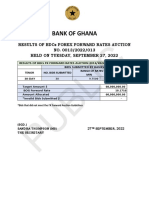

- Bdcs FX Forward Auction Result No 0014Document1 pageBdcs FX Forward Auction Result No 0014Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Auctresults 1766Document1 pageAuctresults 1766Fuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Auctresults 1818Document1 pageAuctresults 1818Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Press Release - Mobile Money Loan Defaulters 28 09 2022Document1 pagePress Release - Mobile Money Loan Defaulters 28 09 2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Bdcs FX Forward Auction Result No 0013Document1 pageBdcs FX Forward Auction Result No 0013Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- 30 Sample Essays Band 9 IELTS of SimonDocument29 pages30 Sample Essays Band 9 IELTS of SimonKhang TranNo ratings yet

- Isso Class 10 Sample PaperDocument2 pagesIsso Class 10 Sample PaperVineet Talele100% (1)

- Marketing CommunicationDocument8 pagesMarketing CommunicationAruna EkanayakaNo ratings yet

- Accounting Problem B Abeleda (AutoRecovered)Document14 pagesAccounting Problem B Abeleda (AutoRecovered)xjammer100% (2)

- 02 Activity 2Document1 page02 Activity 2Nica GalandeNo ratings yet

- Case Study RajeevDocument1 pageCase Study Rajeevyatin rajput100% (1)

- Ch4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Document45 pagesCh4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Wenhui TuNo ratings yet

- Term Paper (Business Mathematics)Document34 pagesTerm Paper (Business Mathematics)Omar Faruk100% (1)

- Control AccountDocument10 pagesControl AccountTeo Yu XuanNo ratings yet

- Role of Governments and Nongovernmental Organizations: Chapter OverviewDocument29 pagesRole of Governments and Nongovernmental Organizations: Chapter OverviewKaete CortezNo ratings yet

- Shobha DevelopersDocument212 pagesShobha DevelopersJames TownsendNo ratings yet

- Report of Accountability For Accountable FormsDocument2 pagesReport of Accountability For Accountable FormsDilg-car Baguio75% (4)

- DS112 Development Perspectives I Course OverviewDocument68 pagesDS112 Development Perspectives I Course OverviewDanford DanfordNo ratings yet

- The State of Mysore Vs The Workers of Gold Mines, AIR 1958 SC 923 Art. 39 (2), The Constitution of India Art. 39 (3), The Constitution of IndiaDocument3 pagesThe State of Mysore Vs The Workers of Gold Mines, AIR 1958 SC 923 Art. 39 (2), The Constitution of India Art. 39 (3), The Constitution of IndiaSanu RanjanNo ratings yet

- Term Paper IN Theories and Practices of Ecological TourismDocument2 pagesTerm Paper IN Theories and Practices of Ecological Tourismkristel jadeNo ratings yet

- Trading The Ichimoku WayDocument4 pagesTrading The Ichimoku Waysaa6383No ratings yet

- Answer SheetDocument49 pagesAnswer SheetMaryamKhalilahNo ratings yet

- 1.1.1 Political StabilityDocument3 pages1.1.1 Political StabilityCuong VUongNo ratings yet

- Barangay Annual Gender and Development (Gad) Plan and Budget FY 2021Document8 pagesBarangay Annual Gender and Development (Gad) Plan and Budget FY 2021HELEN CASIANONo ratings yet

- Summer Project On Chocolate Industry in Lotte India Corporation Ltd1Document51 pagesSummer Project On Chocolate Industry in Lotte India Corporation Ltd1jyotibhadra67% (3)

- Presentation On Risk Based Auditing For NGOsDocument26 pagesPresentation On Risk Based Auditing For NGOsimranmughalmaniNo ratings yet

- Mergers and Acquisitions: Mcgraw-Hill/IrwinDocument23 pagesMergers and Acquisitions: Mcgraw-Hill/IrwinHossain BelalNo ratings yet

- Friedrich Ulrich Maximilian Johann Count of LuxburgDocument4 pagesFriedrich Ulrich Maximilian Johann Count of LuxburgjohnpoluxNo ratings yet

- Industry Analysis - BankingDocument33 pagesIndustry Analysis - BankingANUSHKANo ratings yet

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Step: 1Document24 pagesStep: 1LajukNo ratings yet

- Module 13 Cost Accounting ManufacturingDocument23 pagesModule 13 Cost Accounting Manufacturingnomvulapetunia460No ratings yet

- Pump Quotation DetailsDocument2 pagesPump Quotation Detailsdhavalesh1No ratings yet

- Corporate Social Responsibility &Document13 pagesCorporate Social Responsibility &Sumedh DipakeNo ratings yet

- An Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevanceDocument2 pagesAn Introduction To Marxism - Its Origins, Key Ideas, and Contemporary RelevancemikeNo ratings yet