Professional Documents

Culture Documents

Risk Return Basics/Portfolio Management: Learning Objective of The Chapter

Uploaded by

Sushant MaskeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Return Basics/Portfolio Management: Learning Objective of The Chapter

Uploaded by

Sushant MaskeyCopyright:

Available Formats

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Risk Return Basics/Portfolio

Management

Learning Objective of the Chapter:

1) Risk and uncertainty.

2) Meaning of Portfolio Management.

3) Computation of Return of individual security.

4) Computation of Return of portfolio of securities.

5) Computation of total risk of individual security.

6) Computation of total risk of portfolio of securities.

7) Computation of systematic risk of individual security.

8) Computation of systematic risk of portfolio of securities.

9) CAPM return.

10) Security Market Line.

11) Over valuation and under valuation.

12) Allocation of total risk into systematic and unsystematic risk.

13) Computation of beta of unlisted company.

14) Computation of CML return

Risk and uncertainty

In common parlance the term 'Risk' and 'uncertainty' have synonymous meaning. However, they differ

from each other's explained below:

Risk

Risk may be defined as "the chance of future loss that can be foreseen" in other words, in case of risk

an estimate can be made about the degree of happening of the loss. This is usually done by assigning

probabilities to the risk on the basis of past data and the probable trends.

Uncertainty

Uncertainty may be defined as "the unforeseen chance for future loss or damages" in case of

uncertainty since the firm cannot anticipate the future loss and hence, it cannot directly deal with it in

its planning process as is possible in the case of risk.

For example, a firm cannot foresee the loss which may be due to destruction of its plant on account

of earthquake.

PORTFOLIO MANAGEMENT

Portfolio Management Meaning:

CA RAJENDRA MANGAL JOSHI 1

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Portfolio is the term used for all the securities held by an investors.

The term portfolio management mean shuffling within the portfolio to achieve the objective of

the portfolio.

PORTFOLIO Risk

Return MANAGEMENT

I) Computation of Expected rate of return

a) For individual security:

(i) If probability is not given

R̅A = ΣR̅A

N

Question No 1:

Return of

Demand Return of

Security B

Conditions Security A (RA)

(RB)

2017 10% 20%

2018 12% 24%

2019 5% 10%

ΣRA=27% ΣRB=54%

R̅A =27%/3 =9%

R̅B =54%/3 =18%

(ii) If probability is given

Question No: 2

Demand Conditions Probability (P) Return of Security A (RA) Return of Security B (RB)

Strong 30% 100% 20%

Normal 40% 15% 15%

CA RAJENDRA MANGAL JOSHI 2

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Weak 30% (70%) 10%

Compute expected return for security A and B.

Solution:

Demand Probability Return of Security Return of Security

RA X P RB X P

Conditions (P) A (RA) B (RB)

Strong 30% 100% 20% 30% 6%

Normal 40% 15% 15% 6% 6%

Weak 30% (70%) 10% (21%) 3%

R̅A =15% R̅B=15%

(iii) Computation of Holding Period Return (HPR)

Return = Dividend return + Capital gain or loss

= D1/P0 + (P1-P0)/P0

Question No: 3

Stocks X and Y have the following historical dividend and price data:

Year Stock "X" Stock "Y"

Dividend Year-end Dividend Year-end price

(Rs.) price(Rs.) (Rs.) (Rs.)

2014 - 12.25 - 22.00

2015 1.00 9.75 2.40 18.50

2016 1.05 11.00 2.60 19.50

2017 1.15 13.75 2.85 25.25

2018 1.30 13.25 3.05 22.50

2019 1.50 15.50 3.25 24.00

Calculate:

(i) Realized rate of return (or holding period return) for each stock in each year.

(ii) Calculate expected rate of return of stock X and Y.

Question No: 4

Compute the expected return of Question No 3 if following probability of occurrence are given:

Year Probability (Rs.)

CA RAJENDRA MANGAL JOSHI 3

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

2015 10%

2016 15%

2017 20%

2018 25%

2019 30%

b) Computation of Return for Portfolio of Securities:

Return of the portfolio is the weighted average of return of the individual security in the portfolio.

RP = RA X W A + RB X WB…………………..+ Rn X Wn

Question No: 5

In Question No: 2, if Mr. R hold 50% of his investment in security A and 50% in security Y, what will

be his portfolio return?

Solution:

__

RP = RA X W A + W B X RB

=15%X0.5 + 15% X 0.5

= 15 %

II) Measurement of Risk

a) For Individual security:

Risk of the individual security is measured by computing the standard deviation.

Higher the standard deviation higher will be the risk.

If Probability not given,

Variance (VX) = σ2 = Σ(X-X̅)2

n

𝝈 = √𝐕𝐚𝐫𝐢𝐚𝐧𝐜𝐞

If probability is also given,

Variance = 𝝈𝟐 = Σ(X-𝐗)2 x P

𝝈 = 𝐕𝐚𝐫𝐢𝐚𝐧𝐜𝐞

Question No: 6

Compute the standard deviation for security A and B from the date given in Question No: 2.

CA RAJENDRA MANGAL JOSHI 4

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Solution:

Demand (RB-

Pro. (RA- (RB- (RA-R̅B)2

Condition (RA) (RA-R̅A) (RB-R̅B) R̅B)2 x

(P) (RB) R̅A)2 R̅B)2 xP

s P

20 (100%- (20%-

Strong 30% 100%

% 15%)=85% 15%)=5% 7,225 25 2,167.50 7.50

15 (15%- (15%-

Normal 40% 15%

% 15%)=0 15%)=0 - - - -

10 (-70%- (10%-

Weak 30% -70%

% 15%)=-85% 15%)=-5% 7,225 25 2,167.50 7.50

Σ 4,335.00 15.00

VA = 4,335

VB = 15

σA = 65.84 %

σB = 3.87 %

III) Computation of Co-variance (COV)

If Probability not given

COVXM = Σ (X-X̅)(M-M̅)

N

If probability is also given

COVXM = Σ (X-X̅)(M-M̅) x P

Cov is a measure that combines the variance (or Volatility) of stock’s returns the tendency of

those return to move up or down at the same time other stock’s move up or down.

Question No: 7

Compute the COVXY for Question No 1 & 2.

IV) Correlation Co-efficient:

rAB = COV AB/σA σB

CA RAJENDRA MANGAL JOSHI 5

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Correlation coefficient can be computed from +1 to -1.

+1 = Perfectively Positive

-1 = Perfectively Negative

Between +1 to -1 = moderate

Question No: 8

Compute the rXY for Question No 1.

V) For the Portfolio risk:

Risk of the portfolio of securities are measured by computing the combined standard

deviation.

Computation of σ of two security portfolio :

σ12 = W1212 + W1212 + 2 W11 W22 r12

Question No: 9

Compute the standard deviation of portfolio from the date given in Question No: 2, if WA =50% and

WB=50% and rAB =0.9

Unlike portfolio return which is simply the weighted average of the return of the individual

security portfolio risk (i.e. δ) is not the weighted average; it will depend upon the co-relation

between securities.

I) If co-relation is perfectly positive:

σ12 = W1σ1 + W2σ2

II) If co-relation is perfectly negative:

σ12 = W1σ1 - W2σ2

III) If the co-relation is moderate, variation/ δ will moderately change depending upon whether

co-relation is ‘+ve’ or ‘-ve’.

σ12 = W1212 + W 1212 + 2 W 11 W22 r12

IV) If co-relation is Zero:

σ12 = √ W 21σ21 + W 22σ22

Computation of σ for three security portfolio:

________________________________________________________________

σ123 = √ W 21 σ21+W 22 σ22+W 23 σ23+2W 1W 2σ1σ2r1.2+2W 1W3σ1σ3r1.3+2W 2W 3σ2σ3r2.3

OR

CA RAJENDRA MANGAL JOSHI 6

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

________________________________________________________________

σ123 = √ W 21 σ21+W 22 σ22+W 23 σ23+2W 1W 2Cov1.2+2W 1W 3Cov1.3+2W 2W 3Cov2.3

For eg. Security 1, 2, 3

1.1 2.1 3.1

1.2 2.2 3.2

1.3 2.3 3.3

____________________________________________________________________

σ123 = √ W1σ1W1σ1+ W2σ2W2σ2+W3σ3W3σ3 + W1σ1W2σ2+ W2σ1W2σ1+ W1σ1W3σ3+ W3σ3W1σ1

+W2σ2W3σ3+ +W3σ3W2σ2

VI) Computation of Co-efficient of Variation (CV)

CV / R

The co-efficient of variation shows the risk per unit of the return and it provides a more meaningful

basis for comparison when the expected returns on two alternatives are not same.

VII) Risk Aversion Vs Required Rate of Returns

Most investors are risk averse.

Risk Averse investor are conservative investor they choose less risky investment.

If Market dominated by the risk adverse investor, riskier securities must have higher

expected returns, than less risky securities.

If above situation does not prevailed, buying and selling (arbitration process) in the market

will force it to occur.

VIII) Minimum Variance Portfolio:

W X = (σY2 –Cov XY)/ σ2x + σ2y – 2 Covxy

Where,

W X = is the proportion of investment in security X.

W Y = 1- W X

Example:

P Ltd. and Q Ltd. have low positive correlation coefficient of +0.5. Their respective risk and return

profile is as under:

Rp = 10% Rq =15%

σp = 20% σq = 25%

Compute the portfolio of P & Q to minimize risk.

Solution:

CA RAJENDRA MANGAL JOSHI 7

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

P Ltd. Q Ltd.

Return 10% 15%

Risk (S.D.) 20% 25%

Correlation (rPQ) 0.5

Covariance (COVPQ) = 𝜎 × 𝜎 × r

= 20 × 25 × 0.5 = 250

Overall risk,

.

Proportion of investment in security P =

×

( )

=

×

=

= = 0.71=71%

Proportion of investment in security Q = 1- 0.71

= 0.29=29%

IX) Capital Assets pricing model or method (CAPM)

Total Risk in portfolio management can be classified into:

i) Diversifiable / unsystematic /companies specific risk

ii) Non diversifiable / systematic / market risk

Companies specific risk can be totally eliminated. Therefore according to CAPM the risk which matters

in Portfolio management is systematic or non-diversifiable or market risk and degree of this risk for

different companies may be different and it is measured by Greek letter Beta (β).

CA RAJENDRA MANGAL JOSHI 8

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Β of a security measures the sensitivity of the returns of a security to market rate of returns. i. e. it

measures the change in the return of security for a given change in market rate of return.

For example beta equals 2 of X Ltd signifies that for 1 % change/variation in the market return the

return of X Ltd will change by 2%.

The beta of the market as a whole is average beta, being equal to one.

Securities with beta greater than 1 are call aggressive securities and those of beta less than 1 are

called defensive securities.

Statistically, Beta is calculated as below:

Β(X) = COV M,X/δ2M

= (δM δx rMX)/ δ2M

= δx rMX/ δM

Under CAPM the fundamentally required rate of return a security based upon its systematic risk is

calculated as below:

CAPM return of security x (RX) = RL + (RM-RL)βx

So under CAPM, Ke = Rx

X) Security Market Line (SML)

SML

XI) Market Risk Premium = (RM-RL)

XII) Security Risk Premium = (RM-RL) βx

Example

The risk premium for the market is 10%. Assuming Beta values of 0, 0.25, 0.42, 1.00 and 1.67.

Compute the risk premium on Security X.

Solution

CA RAJENDRA MANGAL JOSHI 9

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Market Risk Premium is 10%

β Value of X Risk Premium of Security X

0.00 0%

0.25 2.50%

0.42 4.20%

1.00 10.00%

1.67 16.70%

XIII) Why Beta of market is equal to 1

βm = Covmm / σm2

= rmm * σm * σm / σm2

= rmm

=1

The correlation of the rate of return on the market portfolio with itself must be positive and perfect.

Hence, it is proved that the Beta of the market portfolio is equal to 1.

XIV) Portfolio beta:

Portfolio beta is the weighted average of all individual securities’ beta included in the portfolio.

Β P = W1β1+W2β2…………………+ Wnβn

XV) CAPM Return of the Portfolio

(RP) = RL + (RM-RL) βP

Example

Treasury Bills give a return of 5%. Market Return is 13% (i) What is the market risk premium (ii)

Compute the β Value and required returns for the following combination of investments.

Treasury Bill 100 70 30 0

Market 0 30 70 100

Solution

Risk Premium Rm – Rf = 13% - 5% = 8%

β is the weighted average investing in portfolio consisting of market β = 1 and treasury bills (β =

0)

CA RAJENDRA MANGAL JOSHI 10

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Portfolio Treasury Β Rj = Rf + β × (Rm – Rf)

Bills: Market

1 100:0 0 5% + 0(13%-5%)=5%

2 70:30 0.7(0)+0.3(1)=0.3 5%+0.3(13%-5%)=7.40%

3 30:70 0.3(0)+0.7(1)=0.7 5%+0.7(13%-5%)=10.60%

4 0:100 1 5%+1.0(13%-5%)=13%

Example

Pearl Ltd. expects that considering the current market prices, the equity share holders should get a

return of at least 15.50% while the current return on the market is 12%. NRB has closed the latest

auction for Rs. 2500 crores of 182 day bills for the lowest bid of 4.3% although there were bidders

at a higher rate of 4.6% also for lots of less than Rs. 10 crores. What is Pearl Ltd’s Beta?

Solution

Determining Risk free rate: Two risk free rates are given. The aggressive approach would be to

consider 4.6% while the conservative approach would be to take 4.3%. If we take the moderate

value then the simple average of the two i.e. 4.45% would be considered

Application of CAPM

Rj = Rf + β (Rm – Rf)

15.50% = 4.45% + β (12% - 4.45%)

. % . % .

β= =

% . % .

= 1.464

XVI) Under price Over Price:

a) Graphical method:

Securities plotted above the line are better performing securities i.e. underpriced.

Securities plotted on the line are fairly priced securities.

Securities placed below the line are low performing securities i.e. overpriced.

Question No: 10

Rf = 6%

Rm = 10%

β=1

Plot the following securities into security market line

A B C D E F G

Return 12% 11% 8% 9% 10% 13% 14%

Beta 0.25 1.25 1 0.75 1 0.5 0.75

CA RAJENDRA MANGAL JOSHI 11

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Beta Required return

0.25 6% + 0.25 (10%-6%) = 7%

0.5 6% + 0.50 (10%-6%) = 8%

0.75 6% + 0.75 (10%-6%) = 9%

1 10

1.25 11

Return

Better performing / Underpriced = A, F, G

Equilibrium point – B, E, D

Low performing / Overpriced = C

b) Comparison with expected return and CAPM return:

(i) When CAPM < Expected Return – Buy: This is due to the stock being undervalued

i.e. the stock gives more return than what it should give.

(ii) When CAPM > Expected Return – Sell: This is due to the stock being overvalued

i.e. the stock gives less return than what it should give.

(iii) When CAPM = Expected Return – Hold: This is due to the stock being correctly

valued i.e. the stock gives same return than what it should give.

Question No: 11

The expected returns and Beta of three stocks are given below

Stock A B C

Expected Return (%) 18 11 15

CA RAJENDRA MANGAL JOSHI 12

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Beta Factor 1.7 0.6 1.2

If the risk free rate is 9% and the expected rate of return on the market portfolio is 14% which of

the above stocks are over, under or correctly valued in the market? What shall be the strategy?

Solution

Required Rate of Return is given by

Rj = Rf + β (Rm-Rf)

For Stock A, Rj = 9 + 1.7 (14 - 9) = 17.50%

Stock B, Rj = 9 + 0.6 (14-9) = 12.00%

Stock C, Rj = 9 + 1.2 (14-9) = 15.00%

Required Return % Expected Return % Valuation Decision

17.50% 18.00% Under Valued Buy

12.00% 11.00% Over Valued Sell

15.00% 15.00% Correctly Valued Hold

XVII) Capital Market Line (CML) Return

0 σo σ1 σ

CA RAJENDRA MANGAL JOSHI 13

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

For example,

RL = 6%

RM = 15%

σM =25%

If Mr. A has total amount of Rs. 1,00,000

Now Mr. A invest Rs. 40,000 @ RL and invest Rs. 60,000 in market portfolio (RM).

Now Mr. A’s return of portfolio will be = 6% X Rs. 40,000/Rs. 100,000 +15% X Rs. 60,000/Rs. 100,000

= 2.4% + 9%

= 11.4 %

σP = W1212 + W 1212 + 2 W 11 W22 r12

= W 2σ2

= W MσM

= 25% x 0.6 = 15%

Now Mr. A invest Rs. 150,000 in market portfolio (RM) by taking loan of Rs. 50,000 @ RL.

CA RAJENDRA MANGAL JOSHI 14

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Now Mr. A’s return of portfolio will be = 6% X Rs. (-50,000)/Rs. 150,000 +15% X Rs. 150,000/Rs.

100,000

= (-2%) + 22.5%

= 20.5%

σP = W MσM

= 25% x 150% = 37.5%

CML Return = RL + (RM-RL) X σX

σM

Example: You are able to both borrow and lend at the risk-free rate of 9%. The market portfolio

of securities has an expected return of 15% and a standard deviation of 21%. Determine the

expected return and standard deviations of the following portfolios:

(a) All wealth is invested in the risk-free asset.

(b) All wealth is invested in the market portfolio.

(c) One third is invested in the risk-free asset and two thirds in the market portfolio.

(d) All wealth is invested in the market portfolio. Furthermore, you borrow an additional one third of your

wealth to invest in the market portfolio.

Solution:

Given,

Risk-free rate = 9%

Expected return on market portfolio = 15%

Market Risk = 21%

Risk-free asset Market

Return 9% 15%

S.D. 0% 21%

(a) If all wealth is invested in risk-free asset, then expected return is 9% and risk will be 0%.

(b) If all wealth is invested in market portfolio, expected return is 15% and risk will be 21%.

(c) If one third is invested in the risk-free asset and two thirds in the market portfolio.

Return = 9% × 0.33 + 15% × 0.67

= 2.97 + 10.05

= 13.02

Risk = 0.33 + 21% × 0.67

= 14.07

(d) If all wealth is invested in the market portfolio by adding an additional 1/3 of your wealth to invest in

the market portfolio:

Expected return = 1 + × 15% - × 9

= × 15% -

= 17%

Or, = 15% + × 15% − × 9% = 17%

CA RAJENDRA MANGAL JOSHI 15

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Risk = × 21% − 0 ×

= 28%

XIX) Allocation of total risk of security into Systematic risk and unsystematic risk

Total risk (σ) = Systematic risk + Unsystematic risk.

The systematic risk can be calculated by using following formula:

S.D. approach

Systematic risk = S.D. of market index X βi

= σm βi

Unsystematic risk = Total variance - Systematic risk.

∈i = σi - Systematic risk.

Total risk (σi) = Systematic risk + Unsystematic risk.

= βi σm +∈i

Variance approach

Systematic risk = Variance of market index X β2i

= σ2m β2i

Unsystematic risk = Total variance - Systematic risk.

∈i2 = σi2 - Systematic risk.

Total risk (σ2i) = Systematic risk + Unsystematic risk.

= βi2 σ2m +∈2i

Question No: 12

The following details are given for X and Y companies’ stocks and the NEPSE Index for a period

of one year. Calculate the systematic and unsystematic risk for the companies’ stocks.

X Stock Y Stock NEPSE

2

Variance of return (σ ) 6.30 5.86 2.25

Beta 0.71 0.685

Solution:

Company X:

Systematic risk = βi2 × Variance of market index

= (0.71)2 × 2.25 = 1.134

Unsystematic risk (∈i2) = Total variance of security return - systematic risk

= 6.3 – 1.134

CA RAJENDRA MANGAL JOSHI 16

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

= 5.166

2

Total risk (σ x) = βι2 × σm2 + ∈t2

= 1.134 + 5.166 = 6.3

Company Y:

Systematic risk = β i 2 × σ m2

= (0.685)2 x 2.25 = 1.056

Unsystematic risk = Total variance of the security return - systematic risk.

= 5.86-1.056 = 4.804

Total risk (σ2y) = βι2 × σm2 + ∈t2

= 1.056 + 4.804 = 5.86

XX) Computation of Beta of unlisted company

Steps:

• Identity the proxy firm (listed firm).

Step 1

• Compute the Beta of proxy firm.

Step 2 • Beta (listed firm) = COVXM / σ2M

• De-leverage

Step 3 • ꞵU = ꞵL / [1+D/E(1-t)]

• Re-leverage

Step 4 • ꞵL = ꞵU X [1+D/E(1-t)]

Note:

Unlevered beta (ꞵU) also known as Assets Beta.

Levered beta (ꞵL) also known as Equity Beta.

Some More Questions

Question No. 13:

An investor holds the following portfolio:

---------------------------------------------------------------------------------------------------

Share Beta Investment (Rs.)

CA RAJENDRA MANGAL JOSHI 17

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

---------------------------------------------------------------------------------------------------

Sigma 0.8 2,500,000

Beta 1.2 3,500,000

Alpha 1.5 4,000,000

----------------------------------------------------------------------------------------------

You are required to answer the following questions: (3+3=6 Marks)

i) What is the portfolio beta of the investor?

ii) What is the expected rate of return on the investor’s portfolio, if the risk-free rate is 8

percent and the expected return on market portfolio is 18 percent?

(June 2009)

Answer:

i. The portfolio beta of the investor is 1.22. (W.N. 1)

ii. The expected rate of return on the investor’s portfolio is 20.2 percent. (W.N. 2)

Working Notes

W.N.1

For given beta, the required rate of return is obtained using the following formula:

Share Investment (NRs.) Weight Beta Weight * Beta

Sigma 2,500,000 0.25 0.8 0.20

Beta 3,500,000 0.35 1.2 0.42

Alpha 4,000,000 0.40 1.5 0.60

Σ Weight * Beta = Portfolio Beta 1.22

W.N.2

We have Expected Return on Investor's Portfolio E (rp) = Rf + Bp (Rm – Rf)

Where

Rf = Risk Free Return

Bp = Portfolio Beta

Rm = Return on Market Portfolio

Hence,

E (rp) = 8 % + 1.22 (18 % - 8%)

= 20.2 %

Question No. 14:

a) A risky portfolio has an expected market return of 14%. What should be the proportion of investment

in risky and risk free investment of a portfolio to secure 20% expected portfolio return, where

government securities are earning 5%? (5 Marks)

b) Jessica wishes to know the expected return on her following portfolio, when the risk-free rate is 7%

and the return on market is expected to be 20%. (5 Marks)

CA RAJENDRA MANGAL JOSHI 18

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Security Percentage of Portfolio Beta factor of Security

R 15 0.2

S 10 1.2

T 5 1.8

U 30 0.9

V 25 0.2

W 15 0.8

c) Explain the concept of an efficiency frontier. (5 Marks)

(December 2009)

Answer:

a) Expected market return on risky portfolio, E (rm) = 14%

Risk free rate of return (rf) = 5%

Expected return on total portfolio, E (rp) = 20%

Now,

E (rp) = Wm * E (rm) + (1- Wm) * rf

20% = Wm * 14% + (1- Wm) * 5%

Wm = 15/9= 1.667

Wf = 1-1.667 = -0.667

Therefore, the proportion of risky investment in the portfolio is 166.67%, and

the proportion of risk free investment is –66.67%.

b) Portfolio’s beta (β) = 0.15*0.2+0.1*1.2+0.05*1.8+0.3*0.9+0.25*0.2+0.15*0.8

= 0.68

Now,

Expected return on the portfolio of Jessica would be

Rp = Rf+ β (Rm – Rf)

= 7% + 0.68 (20% – 7%)

= 15.84%

Therefore, Jessica’s expected rate of return on portfolio is 15.84% .

(c) The efficiency frontier traces out the set of available portfolio combinations consistent with risk

aversion, i.e. all portfolios which maximize expected returns for a given risk or minimize risk for a given

return. The aim of any rational risk-averting investor is to locate on the boundary, although precisely

where will depend on the extent of his or her risk-aversion.

Question No: 15

M/s X. Ltd. has three divisions, each of approximately the same size. Its Finance Department has

estimated the rates of return for different states of nature as given. (15 Marks)

CA RAJENDRA MANGAL JOSHI 19

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

State Probability Rm Rate of Return Rate of Return Rate of

of Division 1 of Division 2 Return of

Division 3

Great 0.25 0.35 0.40 0.6 0.20

Good 0.25 0.20 0.36 0.3 0.12

Average 0.25 0.13 0.24 0.16 0.08

Horrible 0.25 -0.08 0 -0.26 -0. 02

a) If the risk free rate is 9 %, what rate of return does the market require for each division?

b) What is the beta of the entire company?

c) If the company has 30 percent of its funds provided by riskless debt and the remainder by equity

what is the equity beta for the company?

d) Which of the divisions should be kept? Which should be spun off?

e) What will the company's beta be if the actions in part (d) are undertaken?

(June 2010)

Answer:

Calculation of the expected return of market, division1, division 2, division 3.

State Prob. Rm R1 R2 R3 pjRm pjR1 PjR2 PjR3

Great 0.25 0.35 0.40 0.6 0.20 0.0875 0.10 0.15 0.05

Good 0.25 0.20 0.36 0.3 0.12 0.05 0.09 0.075 0.03

Average 0.25 0.13 0.24 0.16 0.08 0.0325 0.06 0.04 0.02

Horrible 0.25 -0.08 0 -0.26 -0. 02 -0.02 0 -0.065 -0.005

Total 0.15 0.25 0.20 0.095

Expected Return from market E(Rm) = ∑ pjRm= 0.15 =15%

Expected Return from division 1 E(R1) = ∑ pjR1= 0.25 =25%

Expected Return from division 2 E(R2) = ∑ pjR2= 0.20 =20%

Expected Return from division 3 E(R3) = ∑ pjR3= 0.095 =9.5%

Calculation of the market variance ( cov1m, cov2m,cov3m)

State [Rm-E(Rm)]2 *Pj [R1-E(R1)][Rm- [R2-E(R2)][Rm- [R3-E(R3)][Rm-

E(Rm)] * Pj E(Rm)] * Pj E(Rm)] * Pj

Great 0.01 0.0075 0.02 0.00525

Good 0.000625 0.001375 0.00125 0.0003125

Average 0.0001 0.00005 0.0002 0.000075

Horrible 0.0132 0.014375 0.02645 0.0066125

Total 0.02395 0.023300 0.0495 0.01225

Market Variance σm2 = ∑[Rm-E(Rm)]2 * Pj = 0.02395

CA RAJENDRA MANGAL JOSHI 20

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Covariance between division 1 and market cov1m = ∑ [R1-E(R1)][Rm-E(Rm)] * Pj =0.023300

Covariance between division 2 and market cov2m = ∑[R2-E(R2)][Rm-E(Rm)] * Pj = 0.0495

Covariance between division 3 and market cov3m = ∑[R3-E(R3)][Rm-E(Rm)] * Pj = 0.01225

Calculation of Betas

Beta of division 1 β1 = cov1m/ σm2= 0.023300/0.02395 = 0.97287

Beta of division 2 β 2= cov2m/ σm2= 0.0495/0.02395 = 2.067

Beta of division 3 β3 = cov3m/ σm2= 0.01225/0.02395 = 0.5115

a. Required Rate of return for each division

E(Rj) = Rf + [E(Rm) – Rf] βj

E(Rj) = 9% + [15% – 9%] βj

E(R1) = 9% + [15% – 9%] 0.97287 = 14.8%

E(R2) = 9% + [15% – 9%] 2.067 = 21.4%

E(R3) = 9% + [15% – 9%] 0.5115 = 12.1%

b. The Beta of the entire company

Average beta (β) = 0.97287 + 2.067 + 0.5115/3 = 1.18614

c. The equity beta for the company

Proportion of riskless debt (Wd) = 0.3

Beta of the riskless debt (βd) =0

Proportion of equity (Ws) = 0.70

We have,

β = βdWd + βsWs

1.18614 = 0*3.3 + 0.7 * βs

βs = 1.18614/0.7 = 1.6945

OR,

ꞵL (Equity Beta) = ꞵU x [1+D/E(1-t)]

= ꞵU x [1+D/E]

= ꞵU x [(E+D)/E]

= ꞵU x [(0.7+0.3)/0.7]

= 1.18614/0.7

= 1.6945

d. Division 1 should be kept. Division 2 and division 3 spun off.

e. If the action in Part (d) taken, the company's beta will be equal to division 1. So the company's beta

will be 0.97287.

Question No: 16

An investor saw an opportunity to invest in a new security with excellent growth potential. He wants to

invest more than he had, which was only Rs. 100,000. He sold another security short with an expected

rate of return of 15%. The total amount he sold was Rs. 400,000, and the total amount he invested in the

CA RAJENDRA MANGAL JOSHI 21

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

growth security, which had an expected rate of return of 30%, was Rs. 500,000. Assuming no margin

requirements, what is the investor’s expected rate of return?

(4 Marks)

[June 2011]

Answer:

Computing the portfolio weights for each security is done with the formula:

Investment in A (sold short)

Total equity investment

From the given problem, we find:

WA = - Rs, 400,000/ Rs. 100,000 = - 4.0

WB = Rs. 500,000 / Rs. 100,000 = 5.0

Rp = (- 4 x 0.15) + (5 x 0.30) = - 0.60 + 1.50 = 0.90, or 90%.

Thus, the expected rate of return on this portfolio is 90%.

Question No: 17

Stock X has an expected rate of return of 10 percent, a beta coefficient of 0.8, and a standard deviation of

expected return of 15 percent. Stock Y has an expected rate of return of 15 percent, a beta coefficient of

1.5, and a standard deviation of expected returns of 20 percent. The risk-free rate is 4 percent, and the

market risk premium is 6 percent.

Required: (2+2+2+2=8 Marks)

i) Which stock is riskier in terms of total risk?

ii) Which stock is riskier for diversified investor?

iii) Calculate each stock’s required rate of return. What is its significance?

iv) Calculate expected return of a portfolio that has Rs. 60,000 invested in Stock X and

Rs. 40,000 invested in Stock Y?

[December 2011]

Answer:

Given,

Stock X Stock Y

Expected rate of return 10% 15%

Beta coefficient 0.8 1.5

Standard deviation of expected return 15% 20%

Rf = 4%

Market risk Premium (MRP) = 6%

i. Total risk is measured by coefficient of variance (CV).

CV of stock X= standard deviation/Expected rate of return

CV of stock X= 0.15/0.1= 1.5

CV of stock Y= 0.2/0.15=1.3333

CA RAJENDRA MANGAL JOSHI 22

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Since stock X has higher CV, stock X is riskier than stock Y.

ii. Which stock is riskier for diversified investor?

For diversified investor, the stock having higher Beta is more riskier. Beta measures the risk

of individual assets relative to the market portfolio. The beta of the market portfolio is 1.

Assets with beta less than 1 are called defensive assets and assets with beta greater than 1

are called aggressive assets. Risk free assets have a beta equal to zero. Therefore, Stock Y is

riskier as it has higher beta.

iii. Calculate each stock’s required rate of return. What is its significance?

Required rate of return= Rf +Beta × MRP

Required rate of return of X = 4%+6% × 0.8=8.8%

Required rate of return of Y= 4%+6%×1.5=13%

iv) Calculate expected return of a portfolio that has Rs 60,000 invested in Stock X and

Rs 40,000 invested in Stock Y

Expected Rate of Stock X = 10%

Expected Rate of Stock Y = 15%

Expected Rate of Portfolio = 10% 0.6 + 15% 0.4

= 6% + 6%

= 12%

Questions No. 18

P has an expected return of 22 percent and standard deviation of 40 percent. Q has an expected return

of 24 percent and standard deviation of 38 percent. P has a beta of 0.86 and that of Q is 1.24. The

correlation between the returns of P and Q is 0.72. The standard deviation of the market return is 20

percent.

Required: (2+2+2+1=7 Marks)

i) Is investing in Q better than investing in P?

ii) If you invest 30 percent in Q and 70 percent in P, what is your expected rate of return

and the portfolio standard deviation?

iii) What is the market portfolio’s expected rate of return and how much is the risk-free

rate?

iv) What is the beta of portfolio if P’s weight is 70 percent and Q's 30 percent?

[June 2013]

Answer:

CA RAJENDRA MANGAL JOSHI 23

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

i) P has lower return and higher standard deviation than Q. Therefore, investing in Q will give more

return with less volatility. However, investing in both will yield diversification advantage.

(ii) Expected rate of return (rp) = 22× 0.7 + 24 × 0.3 = 22.6%

Portfolio standard deviation(σ )

= 𝑊 𝜎 + 𝑊 𝜎 + 2𝑊 𝑊 × 𝑟 𝜎 𝜎

=√0.7 × 0.4 × 0.3 × 0.38 + 2 × 0.7 × 0.3 × 0.72 × 0.4 × 0.38

=√0.0784 + 0.0129960 + 0.0459648

=√0.1373608

=0.37

=37%

i) The risk- free rate will be the same for P and Q. Their rates of return are given as follows:

rp, 22=rf +(rm-rf) 0.86

rq, 24=rf+(rm-rf) 1.24

rp-rq , -2= (rm-rf) (-0.38)

rm-rf ,-2/-0.38=5.26%

rp , 22=rf+(5.26) 0.86

rf = 17.5%

rq = 24=rf+(5.26) 1.24

rf = 17.5%

rm – 17.5 =5.26

rm = 22.76%

∴Market portfolio expected return (rm) = 22.76%

Risk-free rate (rf) = 17.5%

iv) 𝛽pq = 𝛽p× 𝑤p+𝛽q× 𝑤q =0.86× 0.7 + 1.24 × 0.3 = 0.974

Question No. 19

The data for the three securities A, B and C are as follows:

1.

Securities Likely Return Standard Deviation

A 16% 0.21

B 16% 0.20

C 21% 0.25

Does anyone security dominates another? Which type of investor prefers security C?

(3 Marks) [June 2013]

CA RAJENDRA MANGAL JOSHI 24

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Answer:

-In case of security A and B return is equal but security B has comparatively lower standard

deviation i.e. it has lower risk, hence security B dominates security A.

-Investors who prefer high return will prefer security C irrespective of having risk i.e. high standard

deviation. He belongs to risk taking group.

Question No. 20

Following is the data regarding six securities:

Securities A B C D E F

Return % 10 10 15 5 11 10

Risk (SD) % 5 6 13 5 6 7

Required: (2+4=6 Marks)

i) Which of three securities will be selected by an investor and why?

ii) Assuming perfect negative correlation, analyse whether it is preferable to invest 80%

of money in Security A and 20% in Security C or to invest 100% of money in Security E.

[December 2014]

Answer:

i) Arranging the securities in the increasing order of risk:

Risk % Return % Security Invest

5 10 A Yes

5 5 D No

6 10 B No

6 11 E Yes

7 10 F No

13 15 C Yes

Securities A, E and C should be selected. The investor will try to minimize risk and maximize return.

Therefore, security A is better than D, security E is better than B and C is better with highest

return.

(ii) Calculation of overall return and overall standard deviation (Risk) when 80% in Security A and

20% in Security C is invested.

Overall return = ReturnA×WeightA+ ReturnC×WeightC

CA RAJENDRA MANGAL JOSHI 25

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

= 10%×0.8 + 15%×0.2

=11%

Overall Variance (SD2) = (SDA× WA)2 + (SDC× WC)2 + 2× (SDA× WA) × (SDC× WC) ×rAC

SD2 = (5×0.80)2 + (13×0.20)2 + 2 ×(5×0.8) × (13×0.2) × (-1)

SD2 = 16 + 6.76 + 2 X 4 X 2.6 X (-1)

= 22.76 - 20.8

= 1.96

SD = 1.4

Summary

Alternative-1 Alternative-2

(100% in E)

(80% in A and 20% in C)

SD (%) 1.4 6

Overall return (%) 11 11

Conclusion:

Since same return i.e. 11% is available from lower risk (SD) of 1.4 %, Alternative-1 is preferable

over alternative-2.

Question No. 21

The Investment Analytics Division of R Investment Bank presented the following forecast pertaining to

share price and dividend of X Bank Ltd., an "A" Class Licensed Institution, during its regular performance

review meeting for the current financial year 2072-73:

Economic Share Price (Rs.) Dividend (Rs.)

Conditions High Low Average

High Growth 350 300 325 22

Expansion 310 280 295 18

CA RAJENDRA MANGAL JOSHI 26

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Stagnation 280 250 265 13

Decline 230 200 215 10

The Bank has recently declared dividend of Rs. 13 per share and is currently trading at Rs. 265 per share

in the Nepal Stock Exchange. Due to the ongoing political stalemate and the aftermath of recent mega

earthquake, the Analytics Division has estimated higher probability for the stagnant economic conditions

and lower probability for the high growth conditions. The probability estimates are presented as under:

Economic Conditions Probability

High Growth 10%

Expansion 20%

Stagnation 60%

Decline 10%

Required: (7 Marks)

Calculate and evaluate the expected rate of return and the riskiness of shares of X Bank Ltd.

[December 2015]

Answer:

Tables showing calculation of Expected Rate of Return

Table -1

Economic Share Price Dividend Expected Expected Return

Conditions High Low Average Dividend Capital Gain

Return %

1 2 3 4 5 6=5/CP 7=(4-CP)/CP 8=6+7

High Growth 350 300 325 22 8.30% 22.64% 30.94%

Expansion 310 280 295 18 6.79% 11.32% 18.11%

Stagnation 280 250 265 13 4.91% 0% 4.91%

Decline 230 200 215 10 3.77% -18.87% -15.10%

Note: Here, current market price is considered as cost price( C P) to the investment bank.

Table -2

Economic Conditions Return Probability Expected Return

1 2 3 4=2×3

High Growth 30.94% 10% 3.09%

Expansion 18.11% 20% 3.62%

Stagnation 4.91% 60% 2.95%

Decline -15.10% 10% -1.51%

Total 8.15%

CA RAJENDRA MANGAL JOSHI 27

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

The expected return of share is 8.15%; however, the total return is anticipated to vary between -

15.10% under the adverse condition to 30.94% under the most favorable condition. The expected return

is the average return of share computed by adjusting probabilities for various economic conditions.

The riskiness of Share is based on the following formula:

n

ơ2 = ∑ [ RI - E(R)]2 × PI

I=1

Where;

RI = Return on various economic conditions,

E(R) = Expected Rate of Return

PI = Probability of various economic conditions

Economic Return Expected Differences Square of Probability Expected

Conditions Return in Return Difference Variance

1 2 3 4=2-3

High Growth 30.94% 8.15% 22.79% 5.19% 10% 0.52%

Expansion 18.11% 8.15% 9.96% 0.99% 20% 0.19%

Stagnation 4.91% 8.15% -3.24% 0.10% 60% 0.06%

Decline -15.10% 8.15% -23.25% 5.40% 10% 0.54%

Total 1.31%

ơ2 = 1.31%

ơ =

√1.31% = 11.44%

The share's average dispersion is 10.89% which is considered high and therefore a risky investment for

share investors. Considering the low expected rate of return and high standard deviation, rational

investors will look into other better alternatives.

Question No. 22

The following data relating to two securities, A and B.

A B

Expected return 22% 17%

Beta factor 1.5 0.7

Assume Risk Free Interest (Rf)=10% and Return Market (Rm)=18%. Find out whether the securities A and

B are correctly priced? (5 Marks)

CA RAJENDRA MANGAL JOSHI 28

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

[June 2016]

Answer:

Calculation of return under CAPM

Company A=Rf+B(Rm-Rf)

=10+1.5(18-10)

=22%

Company B=Rf+B(Rm-Rf)

=10+0.7(18-10)

=15.6%

Security E(R) Expected Return Return under CAPM Position

A 22% 22% Correctly Priced

B 17% 15.6% Under Priced

The return from security A exactly equal to the calculated return under CAPM hence it is correctly priced

securities.

The return from security B is better than the return under CAPM. It indicates a favorable position .i.e.

the security is currently traded at underpriced position.

Question No. 23

The following data relate to two securities, A and B:

A B

Expected Return 22% 17%

Beta Factor 1.5 0.7

Risk Free Interest rate is 10% and Return on Market is 18%.

Required: (5 Marks)

Find out whether the securities A and B are correctly priced?

[June 2017]

Answer:

Calculation of return under CAPM

Company A=Rf+B(Rm-Rf)

=10+1.5(18-10)

=22%

Company B=Rf+B(Rm-Rf)

=10+0.7(18-10)

=15.6%

Security E(R) Expected Return Return under CAPM Position

CA RAJENDRA MANGAL JOSHI 29

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

A 22% 22% Correctly Priced

B 17% 15.6% Under Priced

The return from security A exactly equal to the calculated return under CAPM hence it is correctly priced

securities.

The return from security B is better than the return under CAPM. It indicates a favorable position; i.e. the

security is currently traded at underpriced position.

Question No. 24

Mr. X, an investor, is seeking the price to pay for the security whose standard deviation is 5%. The

correlation coefficient for the security with the market is 0.75 and the market standard deviation is 4%.

The return from the risk-free securities is 6% and from the market portfolio is 11%. Mr. X knows that only

by calculating the required rate of return, he can determine the price to pay for the security.

Required: (5 Marks)

What is the required rate of return on the security?

[December 2017]

Answer:

Standard deviation of the security = 5%

Correlation coefficient of portfolio with market = 0.75%

Market standard deviation = 4%

Risk-free rate of return = 6%

Expected return on market portfolio = 11%

The market sensitivity index i.e. the beta factor can be calculated as follows:

Standard deviation of the security 0.05

β= ------------------------------------------------------× CORsm = -------------×.75= 0.9375

Standard deviation of Market 0.04

Now, the expected return on the investment can be ascertained with the help of CAPM

equation as follows:

Rs = Irf +(Rm-Irf) β

= 6 + (11-6)×0.9375

= 10.69%

Question No. 25

CA RAJENDRA MANGAL JOSHI 30

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Ms. Smile currently holds two equity shares X and Y in equal proportion with the following risk and return

characteristics:

Return (RX) 24% Return (RY) 19%

σX 28% σY 23%

The returns of these securities have a positive correlation of 0.6.

Required: (3+2=5 Marks)

i) Calculate the portfolio return and risk.

ii) How much should the correlation coefficient be to bring the portfolio risk to her desired 15% level?

[June 2018]

Answer:

i) The portfolio return and risk are as under:

Portfolio Return [E(RP)] = RX × ProportionX + RY × ProportionY

= 24% × 50% + 19% × 50%

= 12% + 9.5%

= 21.5%

Portfolio risk [σP]= √ ơX2× ProportionX2 + ơY2×ProportionY2 + 2 × ơX×

ProportionX × ơY × ProportionY × CorrelationXY

= √ 282 × 0.502 + 232 × 0.502 + 2 × 28 × 0.50 × 23 × 0.50 × 0.6

= √ 521.45 = 22.84%

ii) If Ms Smile desires the portfolio standard deviation to remain at 15%, then correlation

of equity shares X and Y shall be -0.321 as below:

152 = 282 × 0.502 + 232 × 0.502 + 2 × 28 × 0.50 × 23 × 0.50 × CorXY

225 = 328.25 + 322 CorXY

CorXY = (225 - 328.25)/322

= - 0.321

Question No. 26

As an investment manager, you are given the following information of investments:

Investment in Initial Return (Rs.) Market price at Beta

Price (Rs.) year end (Rs.)

CA RAJENDRA MANGAL JOSHI 31

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Cement Ltd. (Equity share) 25 2 (Dividend) 50 0.80

Steel Ltd. (Equity share) 35 2 (Dividend) 60 0.70

Liquor Ltd. (Equity share) 45 2 (Dividend) 135 0.50

GON Bond. 1,000 140 (Interest) 1,005 0.99

Risk free return may be taken at 14%.

Required: (5+2=7 Marks)

i) Calculate expected rate of returns of portfolio by using CAPM.

ii) Calculate average return of the portfolio.

[December 2018]

Answer:

In the given case, market return is not given. Hence, we should calculate the market return

assuming the given securities represent the market as follows:

Investment in Market Price

Initial Price (Rs.) Return (Rs.) at year end (Rs.)

Cement Ltd 25 2 50

Steel Ltd 35 2 60

Liquor Ltd 45 2 135

GON Bond 1,000 140 1,005

Total 1,105 146 1,250

Market Return (Rm) = Closing price + Return – Opening price

Opening price

= (1250+146-1105)/1105

= 0.2633 i.e. 26.33%

Now,

i) Expected Return on Individual security

Under CAPM, expected return = Rf + (Rm – Rf)β

Cement Ltd 14% +0.8 (26.33%-14%) = 23.86%

Steel Ltd 14% +0.7 (26.33%-14%) = 22.63%

Liquor Ltd 14% +0.5 (26.33%-14%) = 20.16%

GON Bonds 14% +0.99 (26.33%-14%) = 26.21%

ii) Average Return of portfolio

= 23.86%×25/1105 + 22.63%×35/1105 + 20.16%×45/1105 + 26.21%×1,000/1105

= 25.80%

CA RAJENDRA MANGAL JOSHI 32

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

Question No. 27

Mr. X is to invest his funds in two securities, P & Q. The relevant information is as follows:

P Q

Expected return 12% 20%

Standard deviation 10% 18%

Coefficient of correlation ‘r’ between P & Q = 0.15

He has decided to consider only five portfolios of P & Q as follows:

(a) All funds invested in P

(b) 50% of funds in each of P & Q

(c) 75% funds in P and 25% in Q

(d) 25% funds in P and 75% in Q

(e) All funds invested in Q

Required: [7 Marks]

i) Calculate return under different portfolios.

ii) Calculate Risk factor associated with these portfolios.

iii) Which portfolio is best for him from the risk point of view?

iv) Which portfolio is best for him from the return point of view?

[June 2019]

Answer:

Given that,

Return of P (Rp) = 12%

Return of Q (Rq) = 20%

Std Deviation of P (σp) = 10%

Std Deviation of Q (σq) = 18%

Coefficient of correlationbetween P & Q (r) = 0.15

i) Expected Return under different portfolio

Portfolio Return = Rp x Wp + Rq x Wq Return

All funds invested in P = 12% x 1 + 20% x 0 12%

50% of funds in each of P & Q = 12% x 0.50 + 20% x 0.50 16%

75% funds in P and 25% in Q = 12% x 0.75 + 20% x 0.25 14%

25% funds in P and 75% in Q = 12% x 0.25 + 20% x 0.75 18%

All funds invested in Q = 12% x 0 + 20% x 1 20%

ii) Risk Factor associated under different portfolio

Risk = (σpWp) + (σqWq) + 2 (σpWp) (σqWq) r

All funds invested in P

= (10%𝑥1) + (18%𝑥0) + 2 (10%𝑥1)(18%𝑥0)0.15

= 10%

50% of funds in each of P &Q

CA RAJENDRA MANGAL JOSHI 33

ICAN REVISION CLASS, FINANCIAL MANAGEMENT

= (10%𝑥0.50) + (18%𝑥0.50) + 2 (10%𝑥0.50)(18%𝑥0.50)0.15

= 10.93%

75% funds in P and 25% in Q

= (10%𝑥0.75) + (18%𝑥0.25) + 2 (10%𝑥0.75)(18%𝑥0.25)0.15

= 9.31%

25% funds in P and 75% in Q

= (10%𝑥0.25) + (18%𝑥0.75) + 2 (10%𝑥0.25)(18%𝑥0.75)0.15

= 14.09%

All funds invested in Q

= (10%𝑥0) + (18%𝑥1) + 2 (10%𝑥0)(18%𝑥1)0.15

= 18%

iii) Portfolio of investment of 75% in P and 25% in Q is best for him from the point of

risk as this portfolio has lowest risk of 9.31%

iv) Portfolio of investment of 100% in Q is best for him from the point of return as this

portfolio has highest return of 20%

*****

CA RAJENDRA MANGAL JOSHI 34

You might also like

- Chap 5-Pages-45-46,63-119Document59 pagesChap 5-Pages-45-46,63-119RITZ BROWNNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Financial Feasibility of Constructing Consultancy CentreDocument11 pagesFinancial Feasibility of Constructing Consultancy Centrenisarg_No ratings yet

- Chartered Accountancy Professional CAP-II TitleDocument104 pagesChartered Accountancy Professional CAP-II TitleBAZINGANo ratings yet

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Capital Structure and Leverages-ProblemsDocument7 pagesCapital Structure and Leverages-ProblemsUday GowdaNo ratings yet

- Accounting from Incomplete Records: Trading and Profit Loss StatementDocument21 pagesAccounting from Incomplete Records: Trading and Profit Loss StatementbinuNo ratings yet

- Working Capital QuestionsDocument10 pagesWorking Capital QuestionsVaishnavi VenkatesanNo ratings yet

- RISK and RETURN With SolutionsDocument33 pagesRISK and RETURN With Solutionschiaraferragni100% (2)

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- Chapter 4: LeverageDocument15 pagesChapter 4: LeverageSushant MaskeyNo ratings yet

- Working Capital Management - NumericalsDocument9 pagesWorking Capital Management - NumericalsAnjali JainNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774No ratings yet

- Branch Accounting Examination BankDocument71 pagesBranch Accounting Examination BankNicole TaylorNo ratings yet

- Solution On Estimation of Working CapitalDocument5 pagesSolution On Estimation of Working Capitaljeta_prakash100% (2)

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- Cost & Finance RTP Nov 15Document41 pagesCost & Finance RTP Nov 15Aaquib ShahiNo ratings yet

- FFM Updated AnswersDocument79 pagesFFM Updated AnswersSrikrishnan SNo ratings yet

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- 1 Working CapitalDocument63 pages1 Working CapitalDeepika Mittal50% (2)

- Account Past Questions Compilation (2009june - 2020 Dec.)Document246 pagesAccount Past Questions Compilation (2009june - 2020 Dec.)Prashant Sagar Gautam100% (2)

- Q1Document31 pagesQ1Bhaskkar SinhaNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Over Heads Additional Sums PDFDocument40 pagesOver Heads Additional Sums PDFShiva AP100% (1)

- MEA AssignmentDocument13 pagesMEA Assignmentankit07777100% (1)

- Not For Profit OrganizationDocument69 pagesNot For Profit OrganizationDristi SaudNo ratings yet

- DEPARTMENTAL ACCOUNTSDocument17 pagesDEPARTMENTAL ACCOUNTSAyush AcharyaNo ratings yet

- Point of IndifferenceDocument3 pagesPoint of IndifferenceSandhyaNo ratings yet

- Ca Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFDocument28 pagesCa Inter - Nov 2018 - Advanced Accounts - Suggested Answers PDFHIMANSHU NNo ratings yet

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- Sdathn Ripsryd@r@ea@pis - Unit) : - SolutionDocument16 pagesSdathn Ripsryd@r@ea@pis - Unit) : - SolutionAnimesh VoraNo ratings yet

- 18 Chapter4 Unit 1 2 Hire Purchase and Instalment PaymentDocument17 pages18 Chapter4 Unit 1 2 Hire Purchase and Instalment Paymentnarasimha_gudiNo ratings yet

- Receivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearDocument6 pagesReceivable Management Llustration 1: A Company Has Prepared The Following Projections For A YearJC Del MundoNo ratings yet

- Labour: (A) (B) (C) (D) (E)Document40 pagesLabour: (A) (B) (C) (D) (E)Sushant MaskeyNo ratings yet

- Financial AccountingDocument60 pagesFinancial AccountingSurajNo ratings yet

- Calculating operating, financial and combined leverageDocument4 pagesCalculating operating, financial and combined leveragek,hbibk,n0% (1)

- Problems From Unit - 5Document8 pagesProblems From Unit - 5jeganrajrajNo ratings yet

- Tough LekkaluDocument42 pagesTough Lekkaludeviprasad03No ratings yet

- Com203 - Final Accounts of Insurance CompaniesDocument23 pagesCom203 - Final Accounts of Insurance CompaniesSanaullah M SultanpurNo ratings yet

- Cost of Capital: Vivek College of CommerceDocument31 pagesCost of Capital: Vivek College of Commercekarthika kounderNo ratings yet

- Calculate Learning Curve CostsDocument8 pagesCalculate Learning Curve Costszoyashaikh20No ratings yet

- Chapter 8 Operating CostingDocument13 pagesChapter 8 Operating CostingDerrick LewisNo ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- Valuation of Securities - ASSIGNMENTDocument63 pagesValuation of Securities - ASSIGNMENTNaga Nagendra0% (2)

- Problems On Working CapDocument25 pagesProblems On Working Capamazing19inNo ratings yet

- Cost Sheet - Pages 16Document16 pagesCost Sheet - Pages 16omikron omNo ratings yet

- Cost of Capital-ProblemsDocument6 pagesCost of Capital-ProblemsUday GowdaNo ratings yet

- Ebit Eps AnalysisDocument2 pagesEbit Eps AnalysisUma N100% (1)

- Chapter # 6 Departmental AccountDocument36 pagesChapter # 6 Departmental AccountRooh Ullah KhanNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Inventory Valuation-ProblemsDocument3 pagesInventory Valuation-ProblemsKaran100% (1)

- DepartmentalDocument17 pagesDepartmentalPapiya DeyNo ratings yet

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- Recivable ManagmentDocument26 pagesRecivable ManagmentAnkita MukherjeeNo ratings yet

- Sums On PortfolioDocument8 pagesSums On PortfolioPrantikNo ratings yet

- JWCh06 PDFDocument23 pagesJWCh06 PDF007featherNo ratings yet

- Risk, Return, and Valuation: by The Mcgraw-Hill Companies, Inc. Click Here For Terms of UseDocument3 pagesRisk, Return, and Valuation: by The Mcgraw-Hill Companies, Inc. Click Here For Terms of UseIndrani DasguptaNo ratings yet

- MS Word: Marks AllocationDocument1 pageMS Word: Marks AllocationSushant MaskeyNo ratings yet

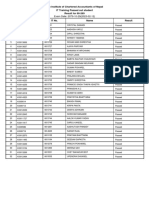

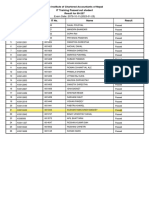

- Exam Date: 2079-10-29 (2023-02-12) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalDocument1 pageExam Date: 2079-10-29 (2023-02-12) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalSushant MaskeyNo ratings yet

- Exam Date: 2079-11-26 (2023-03-10) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalDocument1 pageExam Date: 2079-11-26 (2023-03-10) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalSushant MaskeyNo ratings yet

- 500 Question SetDocument72 pages500 Question SetSushant MaskeyNo ratings yet

- CamScanner Document ScansDocument72 pagesCamScanner Document ScansSushant MaskeyNo ratings yet

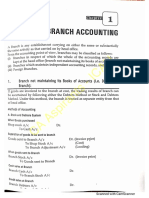

- Branch AccountingDocument51 pagesBranch AccountingSushant MaskeyNo ratings yet

- Budget Numerical PDFDocument5 pagesBudget Numerical PDFDilip BhusalNo ratings yet

- Budget AnswersDocument6 pagesBudget AnswersSushant MaskeyNo ratings yet

- IT ResultDocument1 pageIT ResultSushant MaskeyNo ratings yet

- Company ActDocument198 pagesCompany Actमेनसन लाखेमरूNo ratings yet

- Risk Return Basics/Portfolio Management: Learning Objective of The ChapterDocument34 pagesRisk Return Basics/Portfolio Management: Learning Objective of The ChapterSushant MaskeyNo ratings yet

- Common Stock Valuation MethodsDocument18 pagesCommon Stock Valuation MethodsSushant Maskey0% (1)

- Ican Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Document16 pagesIcan Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Sushant MaskeyNo ratings yet

- Leverage: Understanding Operating, Financial and Combined LeverageDocument15 pagesLeverage: Understanding Operating, Financial and Combined LeverageSushant MaskeyNo ratings yet

- Chapter 4: LeverageDocument15 pagesChapter 4: LeverageSushant MaskeyNo ratings yet

- 00 GC 7 G2 BPLXaal OX4 MSV 1617714838Document8 pages00 GC 7 G2 BPLXaal OX4 MSV 1617714838Sushant MaskeyNo ratings yet

- Common Stock Valuation MethodsDocument18 pagesCommon Stock Valuation MethodsSushant Maskey0% (1)

- Overheads PracticalDocument37 pagesOverheads PracticalSushant Maskey100% (1)

- Labour: (A) (B) (C) (D) (E)Document40 pagesLabour: (A) (B) (C) (D) (E)Sushant MaskeyNo ratings yet

- Ican Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Document16 pagesIcan Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Sushant MaskeyNo ratings yet

- EDP Audit CIS Environment MeaningDocument7 pagesEDP Audit CIS Environment MeaningSushant MaskeyNo ratings yet

- Z Ab I590 TIl 4 A3 o 6 O7 PYt 1617546492Document5 pagesZ Ab I590 TIl 4 A3 o 6 O7 PYt 1617546492Sushant MaskeyNo ratings yet

- URP Income Tax Part SolutionsDocument127 pagesURP Income Tax Part SolutionsSushant MaskeyNo ratings yet

- CAPII Suggested Dec2015Document87 pagesCAPII Suggested Dec2015Sushant MaskeyNo ratings yet

- Labour/Employee Cost: Classification of Labor CostDocument9 pagesLabour/Employee Cost: Classification of Labor CostSushant MaskeyNo ratings yet

- Overheads TheoryDocument11 pagesOverheads TheorySushant MaskeyNo ratings yet

- RD TReeqim RSFH XACz 0 W91617196460Document10 pagesRD TReeqim RSFH XACz 0 W91617196460Sushant MaskeyNo ratings yet

- NIOjid Akjc MDI9 L 5 Ulv I1617282937Document4 pagesNIOjid Akjc MDI9 L 5 Ulv I1617282937Sushant MaskeyNo ratings yet

- Financial Accounting - 1Document42 pagesFinancial Accounting - 1MajdiNo ratings yet

- Manual For SOA Exam MLC.: Chapter 5. Life Annuities. Section 5.4. N-Year Certain AnnuitiesDocument10 pagesManual For SOA Exam MLC.: Chapter 5. Life Annuities. Section 5.4. N-Year Certain AnnuitiesadelNo ratings yet

- Admission of Partner PDFDocument6 pagesAdmission of Partner PDFBHUMIKA JAINNo ratings yet

- Preqin - Corp Investor - IndiaDocument21 pagesPreqin - Corp Investor - Indiasavan anvekarNo ratings yet

- Final Project Report - Excel SheetDocument24 pagesFinal Project Report - Excel SheetrajeshNo ratings yet

- Joka Bulls CaseDocument2 pagesJoka Bulls Caseshivam kumarNo ratings yet

- LPP Formulation ProblemsDocument7 pagesLPP Formulation ProblemsRavindra BabuNo ratings yet

- East Coast Yacht's Expansion Plans-06!02!2008 v2Document3 pagesEast Coast Yacht's Expansion Plans-06!02!2008 v2percyNo ratings yet

- Feenstra Taylor Econ Capitulo 13Document60 pagesFeenstra Taylor Econ Capitulo 13João Carlos Silvério FerrazNo ratings yet

- Concept of DerivativesDocument7 pagesConcept of DerivativesveerabhadrayyaNo ratings yet

- Colgate Financial Model SolvedDocument33 pagesColgate Financial Model SolvedVvb SatyanarayanaNo ratings yet

- Portfolio Selection Theory ExplainedDocument3 pagesPortfolio Selection Theory ExplainedMufti AliNo ratings yet

- Corporation Accounting - DividendsDocument13 pagesCorporation Accounting - DividendsAlejandrea LalataNo ratings yet

- Level I Ethics Quiz 1Document9 pagesLevel I Ethics Quiz 1Mohammad Jubayer AhmedNo ratings yet

- Case Study:: Axis REITDocument9 pagesCase Study:: Axis REITAhmad Mustaqim SulaimanNo ratings yet

- Form A Application FormDocument6 pagesForm A Application FormBoinzb TNo ratings yet

- Forex QuizDocument20 pagesForex Quizgeetainderhanda4430No ratings yet

- Nyse Sap 2018Document190 pagesNyse Sap 2018Naveen KumarNo ratings yet

- Investment advice for client seeking retirement planningDocument16 pagesInvestment advice for client seeking retirement planningJaihindNo ratings yet

- Flowers Industries, Inc. (Abridged) : October 2008Document24 pagesFlowers Industries, Inc. (Abridged) : October 2008MJ SapiterNo ratings yet

- Karaoke Bar Business Case StudyDocument3 pagesKaraoke Bar Business Case StudyMark Louie Aguilar33% (3)

- FEDAI RulesDocument39 pagesFEDAI Rulesnaveen_ch522No ratings yet

- 04 Notes - The Net Present Value (NPV) PDFDocument7 pages04 Notes - The Net Present Value (NPV) PDFAlberto ElquetedejoNo ratings yet

- Undergraduate Story Templates for IBDocument4 pagesUndergraduate Story Templates for IBKerr limNo ratings yet

- Arbitrage Trading in Commodities-4Document2 pagesArbitrage Trading in Commodities-4James LiuNo ratings yet

- Debt Financing: Corporate Finance, 5E (Berk/Demarzo)Document4 pagesDebt Financing: Corporate Finance, 5E (Berk/Demarzo)Alexandre LNo ratings yet

- Towers Watson Tail Risk Management Strategies Oct2015Document14 pagesTowers Watson Tail Risk Management Strategies Oct2015Gennady NeymanNo ratings yet

- Calculating Incremental ROIC's: Corner of Berkshire & Fairfax - NYC Meetup October 14, 2017Document19 pagesCalculating Incremental ROIC's: Corner of Berkshire & Fairfax - NYC Meetup October 14, 2017Anil GowdaNo ratings yet

- The Sammons Associates Annual Heads of Equity Research SurveyDocument4 pagesThe Sammons Associates Annual Heads of Equity Research SurveytcawarrenNo ratings yet