Professional Documents

Culture Documents

Common Stock Valuation Methods

Uploaded by

Sushant MaskeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Common Stock Valuation Methods

Uploaded by

Sushant MaskeyCopyright:

Available Formats

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Valuation of Common Stock

Common Stock Valuation

Common Stock is also known as equity shares and holders of these shares are the owners

of the company.

Equity shares provide the long term sources of the fund and are used to finance long term

assets.

Their liabilities, is limited to the amount of their investment.

Common stock does not have a maturity date.

In case of listed public limited company they can be sale in secondary market.

In the event of liquidation, common stocks are paid only after payment of all liabilities

including liabilities for preferred shareholders.

Par Value/face value of shares of public limited companies shall be Rs. 50 per share or

shall be equivalent to such amount exceeding Rs. 50 as is divisible by the figure ten as

provided in the memorandum of association and articles of association.

Method for Valuation of Equity

Dividend Discount Model (DDM)

Free Cash Flow Approach

1) Valuation of Shares by Dividend Discount Model (DDM) or Dividend Growth

Method:

P0=D1/(Ke-gc)

Po = D1/(1+Ke)1 +D2/(1+Ke)2 …………………………… + Dα/(1+Ke)α

Where,

Po = Intrinsic Value of shares

D = Dividend per share expected

CA RAJENDRA MANGAL JOSHI 1

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Ke = Required rate of return

The above equation can be modified by considering following situations:

Situation I: Price at zero period, (i.e. value today) when intension of investor is to hold the

shares for one year

P0 = (D1+ P1)/ (1+Ke)1 ---------- (i)

IF D1=D0 (1+gc)

P1=Po (1+gc) --------- (ii)

Now, substituting value of P1 from equation (ii) to equation (i),

P0 = [D1+ Po (1+gc)]/ (1+Ke)1

Or, P0(1+Ke)1= [D1+ Po (1+gc)]

Or, P0+P0Ke = D1+P0+P0gc

Or, PoKe = D1+P0gc

Or, P0Ke – P0gc =D1

Or, P0 (Ke-gc) = D1

Or, P0 =D1/(Ke-gc)

Situation II: When investor intent to hold the shares for n numbers of years

Po = D1/(1+Ke)1 +D2/(1+Ke)2 …………………… + Dn/(1+Ke)n + Pn/ (1+Ke)n

If n = 4 years

Po = D1/(1+Ke)1 +D2/(1+Ke)2 + D3/(1+Ke)3 + D4/(1+Ke)4 + P4/ (1+Ke)4

Or, Po = D1/(1+Ke)1 +D2/(1+Ke)2 + D3/(1+Ke)3 + P3/ (1+Ke)3

[Since, P3 = D4/(1+Ke)1 + P4/ (1+Ke)1]

Or, Po = D1/(1+Ke)1 +D2/(1+Ke)2 + P2/ (1+Ke)2

[Since, P2 = D3/(1+Ke)1 + P3/ (1+Ke)1]

Or, Po = D1/(1+Ke)1 + P1/ (1+Ke)1 [Since, P1 = D2/(1+Ke)1 + P2/ (1+Ke)1]

Po = D1/ (Ke-gc)

Now,

Case I: No growth (i.e. gc=0)

Po = D1/ (Ke-gc)

Or, P0=D1/Ke

CA RAJENDRA MANGAL JOSHI 2

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Case II: If growth is constant

Po = D1/ (Ke-gc)

Case III: Computation of Market Price of Share today (P0) when there are multiple

growth rates

Po = D1/(1+Ke)1 +D2/(1+Ke)2 ……………………… + Dn/(1+Ke)n + Pn/ (1+Ke)n

Pn (Value of share at the beginning of years when g become constant) =

D(n+1)/(Ke-gc)

Question No: 1

Compute the value of following stock, if investors require 20 percent return.

a. A stock paid Rs. 14 dividend per share, which is expected to be continued forever. b. A stock

paid Rs. 8 dividend per share in last year. Dividend is expected to grow at a constant rate of 6

percent forever.

Answer:

a. P0 = D1/Ke = Rs. 14/20% = Rs. Rs. 70

b. P0 = D1/(Ke-gc) = Rs. 8 (1.06)/(20%-6%) = Rs. 8.48/14% =Rs. 60.57

Question No: 2

An investor has made investment in the equity share of Pacific Chemicals Ltd. The capitalization

rate of the company is 20 per cent and the current dividend is 25 per share.

You are required to calculate the value of the company’s equity share if the company is slowly

sinking with an annual decline rate of 10% in the dividend. (3 Marks)

(December 2010)

Answer:

The value of the company’s equity share is given by the following formula:

Ve = D1/(k – g), where D1 is the dividend in the year 1, k is the capitalization rate and g is the

growth rate in dividend.

The value of equity share in the given condition is derived as follows:

Ve = Rs. 25 (1 – 0.10)/[(0.20 – (– 0.10)] = Rs. 25 x 0.90/0.30 = Rs. 22.50/0.30 = Rs. 75

Multiple growth rate:

Question No. 3

CA RAJENDRA MANGAL JOSHI 3

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Excess Ltd. currently pays a dividend of NRs. 40 per share and this dividend is expected to grow

at a 15 per cent annual rate for 3 years, then at a 10 per cent rate for the next 3 years, after which

it is expected to grow at a 5 percent rate forever.

What value would place on the stock if an 18 percent rate of return were required?

(6 Marks) (June 2009)

Answer:

The present value of stock is NRs.452.99. The workings are as per below:

Statement showing the Value of the Share

----------------------------------------------------------------------------------------------

PV Factor

End of Dividend @ 18% PV of Dividend

----------------------------------------------------------------------------------------------

Year 1 40 (1.15) = 46.00 0.84746 38.98

2

Year 2 40 1.15) = 52.90 0.71818 37.99

3

Year 3 40 (1.15) = 60.84 0.60863 37.03

Year 4 60.84 (1.10) = 66.92 0.51579 34.52

2

Year 5 60.84 (1.10) = 73.62 0.43711 32.18

3

Year 6 60.84 (1.10) = 80.98 0.37043 30.00

210.70

----------------------------------------------------------------------------------------------

Year 7 dividend = NRs. 80.98 X 1.05

= NRs. 85.03

Market Value at the end of Year 6 = NRs. 85.029/ (0.18 – 0.05)

= NRs. 85.03/0.13

= NRs. 654.08

Present Value of Market Value at the end of Year 6 = 0.37043 X 654.08

= NRs. 242.29

Hence, Value of the Share = NRs. 210.70 + NRs. 242.29

= NRs. 452.99

Question No: 4

XYZ Ltd. is foreseeing a growth rate of 12% per annum in the next 2 years. The growth rate is

likely to fall to 10% for the third year and fourth year. After that the growth rate is expected to

stabilise at 8% per annum. If the last dividend paid was Rs. 1.50 per share and the investors'

required rate of return is 16%, find out the intrinsic value per share of Z Ltd. as of date. You may

use the following table: (10 Marks)

CA RAJENDRA MANGAL JOSHI 4

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Years 0 1 2 3 4 5

Discounting factor at 16% 1 0.86 0.74 0.64 0.55 0.48

(June 2010)

Answer:

Present value of dividend stream for first 2 years:

Rs. 1.50 (1.12) x 0.86 + 1.50 (1.12)2 x 0.74

Rs. 1.68 x 0.86 + 1.88 x 0.74

Rs. 1.45 + 1.39 = 2.84 (A)

Present value of dividend stream for next 2 years:

Rs. 1.88 (1.1) x 0.64 + 1.88 (1.1)2 x 0.55

Rs. 2.07 x 0.64 + 2.28 x 0.55

Rs. 1.33 + 1.25 = 2.58 (B)

Market value of equity share at the end of 4th year computed by using the constant dividend growth

model would be:

P4= D5

Ks - gn

Where D5 is dividend in the fifth year, gn is the growth rate and Ks is required rate of return.

Now, D5 =D4 (1 + gn)

D5 =Rs. 2.28 ( 1 + 0.08)

=Rs. 2.46

P4 = Rs. 2.46

0.16 - 0.08

= Rs. 30.75

Present market value of P4= 30.75 x 0.55 = Rs. 16.91 (C)

Hence the intrinsic value per share of Z Ltd. would be

A + B + C i.e. Rs. 2.84 + 2.58 + 16.91 = Rs. 22.33

Question No: 5

XYZ, Inc, has an odd dividend policy. The company has just paid a dividend of Rs. 12 per share

and has announced that it will increase the dividend by Rs. 6 per share for each of the next four

years, and then never pay another dividend. If you required 10 percent return on the company's

stock, how much will you pay for a share today?

Answer:

CA RAJENDRA MANGAL JOSHI 5

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Do= Rs. 12

D1=Rs.12+Rs.6 =Rs. 18

D2=Rs.18+Rs.6=Rs.24

D3= Rs. 24+Rs.6=Rs.30

D4=Rs.30+Rs.6=Rs.36

D5 to Dœ =0

Now,

P0 =D1/(1+Ke)1+D2/(1+Ke)2+D3/(1+Ke)3+D4/(1+Ke)4+P4/(1+Ke)4

=18/(1+0.1)1+24//(1+0.1)2+30/(1+0.1)3+36/(1+0.1)4+0

=16.38+19.92+22.50+24.48

=Rs. 83.28

Question No: 6

Kantipur Enterprises recently paid a dividend, Do, of Rs. 12.5. The company expects to have

supernormal growth of 20 percent for 2 years before the dividend is expected to grow at a constant

rate of 5 percent. The firm's cost of equity is 10 percent. a. What year is the terminal, or horizon,

date? b. What is the firm's horizon, or terminal, value? c. What is the firm's intrinsic value today,

Po?

Answer: (Self Practice)

Question No 7:

Max Mobile Ltd (MM) is expanding rapidly, and it currently needs to retain all of its earnings,

hence it does not pay any dividends. However, investors expect MM to begin paying dividends,

with first dividend of Rs. 4 coming 3 years from today. The dividend should grow rapidly-at a rate

of 20 percent per year –during Years 4 and 5. After Year 5, the company should grow at a constant

rate of 6 percent per year. If the required return on the stock is 12 percent, what is the value per

share of your firm's stock?

Answer: (Self Practice)

Computation of growth under the Gordon Model:

Growth (gc)

gc= br

Simple average method or

compound average method

CA RAJENDRA MANGAL JOSHI 6

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Question No. 8

a) If retention ratio = 60% and IRR of the new investment =20%, what will be

growth of the company?

b) If, D0 = Rs. 6 and D4 =Rs 8.16, find the growth rate?

Solution:

a) gc = br=60% X 20%=60% X 0.2 =12%

b) Simple average method,

= (Rs. 8.16- Rs. 6)/Rs. 6*100% =36%, therefore gc = 36%/4 = 9%

Compound average method,

D4=D0 (1+gc)4

Or, Rs.8.16=Rs. 6(1+gc)4

Or, (1+gc)4 =Rs 8.16/Rs 6 =1.36

Or, 1+gc = (1.36)1/4 =1.08

Or, gc=1.08-1=8%

Main assumption of Gordon, Ke> gc

Question No. 9

A company has a total investment of Rs. 4,000,000 in assets and 40,000 outstanding ordinary

shares at Rs. 100 per share (par value). It earns at a rate of 15 percent on its investment, and has a

consistent policy of retaining 50 percent of the earnings. If the appropriate discount rate of the firm

is 10 percent:

(3+4=7 Marks)

i) Determine the price of its share using Gordon’s model.

ii) What shall happen to the price of the shares if the company has a payout of 20 per cent and

60 per cent respectively?

(December 2009)

Answer:

(a) Price of Share using Gordon’s model:

The share valuation model of Gordon is as follows:

P0 = DIV1 = (1 – b)EPS1 = (1 – b)rA , where

k–g k – br k – br

A denotes investment per share, which is Rs. 100 in the present case.

When the payout is 50 per cent, the price of share will be:

CA RAJENDRA MANGAL JOSHI 7

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

P0 = (1 – 0.5) 0.15 x 100 = 0.5 x 15 = 7.5/0.025 = Rs. 300

0.10 – (0.15 x 0.5) 0.10 – 0.075

(b) Price of Share at Payout of 20 and 60 percent:

(i) Payout of 20 per cent

gc = br = 80% x 0.15 = 12%, since Ke (10%) < gc (12%) value could not be computed by

Gordon model.

P0 = (1 – 0.8) 0.15 x 100 = 0.2 x 15 = 3/-0.02 = Rs. -150

0.10 – (0.15 x 0.8) 0.10 – 0.12

(ii) Payout of 60 per cent:

P0 = (1 – 0.4) 0.15 x 100 = 0.6 x 15 = 9/0.04 = Rs. 225

0.10 – (0.15 x 0.4) 0.10 – 0.06

Computation of Ke :

CAPM Model, Ke=RL + (Rm-RL)ꞵ

Earning to price ratio, Ke =EPS/P0 =1/P/E ratio

Ke =Bond Yield + risk premium approach

Question No. 10

An investor is seeking the price to pay for a security, whose standard deviation is 4%. The

correlation coefficient for the security with the market is 0.9 and the market standard deviation is

3.2%. The return from the government security and the market portfolio are 6.2% and 10.8%

respectively. The investor knows that, by calculating the required return, he can then determine

the price to pay for the security.

Required:

(2.5+2.5=5 Marks)

i) What is the required return on the security?

ii) What is the price of the security, if it is paying Rs. 25 of dividend per share

and its expected growth rate is 4?

[July 2015]

Answer:

i) The market sensitivity index i.e. the beta factor:

Standard deviation of an asset 0.04

β= ------------------------------------------------------*CORsm = -------------*.9 = 1.125

Standard deviation of Market 0.032

CA RAJENDRA MANGAL JOSHI 8

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Now, the expected return on the security can be ascertained with the help of CAPM equation as

follows:

Ke = Rf + (Rm-Rf) β

=6.2 + (10.8-6.2) × 1.125

=11.375%

ii) Price of security

Do (1+g)

Po = Ke-g

25(1+0.04)

= 0.11375-0.04

=Rs. 352.54

Question No. 11

You are considering an investment in the common stock of NEA Corp. The stock is expected to

pay a dividend of Rs. 14 a share at the end of the year. The stock has a beta equal to 1.5, the risk-

free rate is 6 percent, and the market risk premium is 4 percent. The stock's dividend is expected

to grow at some constant rate, g. The stock currently sells for Rs. 200 a share. Assuming the market

is in equilibrium, what does the market believe will be the stock price at the end of 3 years?

Answer:

Ke = Rf + (Rm-Rf) β = 6% + 4%x1.5 [Market risk premium = (Rm-R L)]

=12%

Po = D1/(Ke-gc)

Or, Rs. 200 = Rs. 14/( 12%-gc)

Or, gc = 5%

Now,

P3= D4/(Ke-gc) =Rs.16.21/(12%-5%) =Rs. 16.21/0.07 = Rs. 231.57

D4 =D1 (1+gc)3 =Rs 14(1+0.05)3 = Rs.16.21

Additional questions

Question No. 12

Northern California Fruit Company’s latest earnings are Rs. 2 per share. Earnings per share are

expected to grow at a 20 percent compounded annually for 4 years, at a 12 percent annually for the

next 4 years and at 6 percent thereafter. The dividend-pay-out ratio is expected to be 25 percent for

the first 4 years, 40 percent for the next 4 years and 50 percent thereafter. At the end of year 8, the

CA RAJENDRA MANGAL JOSHI 9

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

price -earnings ratio for the company is expected to be 8.5 times, where year 9’s expected earnings

per share are used in the denominator.

Required:

(4+4=8 Marks)

i) If the required rate of return is 14 present, what is the present market price

per share?

ii) If the present market price per share is Rs. 30, what is the stocks expected

return?

[June 2018]

Answer:

Growth Earning(Rs.) DP Ratio Dividend(Rs.)

Year 0 - 2.00 - -

Year 1 20% 2.40 25% 0.60

Year 2 20% 2.88 25% 0.72

Year 3 20% 3.46 25% 0.86

Year 4 20% 4.15 25% 1.04

Year 5 12% 4.65 40% 1.86

Year 6 12% 5.21 40% 2.08

Year 7 12% 5.84 40% 2.34

Year 8 12% 6.54 40% 2.62

Year 9 6% 6.93 50% 3.47

B. Price at the End of Eight Year

Given,

P8/E9 = 8.5Times

P8 = 8.5 * E9

P8 = 58.90

Therefore, price per share at the end of year 8 ( P8) will be = Rs. 58.90

C. Calculation of Current Market Price Per Share

CA RAJENDRA MANGAL JOSHI 10

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

2.34 2.62 58.90

Rs 26.72 / Share

ii) Calculation of Stock’s Expected Return on Market Price of Rs. 30 Per Share

2.34

2.62 58.90

The expected rate of return needs to be calculated using interpolation technique.

Therefore we need to use Hit and Trial Method at different rate.

Try at 10 % of Discount Rate

2.34 2.62 58.90

P0 = Rs. 34.87

As given market price of Rs. 30 lies in between the price per share of Rs. 32.76 and Rs.

25.25 calculated using the discount rate at 10% and 14% respectively; therefore value can

be interpolated in between 10% and 14%.

Through interpolation

Expected Rate of Return = LR X [HR-LR]

= 10% + 34.87 - 30 X [14%-10%]

34.87 - 26.72

= 10 + 4.87/8.15

= 12.39%

Therefore the expected return at current market Price of NRs 30 is

11.47%.

Question No. 13

SSC Ltd. is considering the immediate purchase of some, or all, of the share capital of one of two

firms- SG Ltd. and CG Ltd. Both SG and CG have one million ordinary shares issued and neither

company has any debt capital outstanding.

CA RAJENDRA MANGAL JOSHI 11

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Both SG Ltd. and CG Ltd. are expected to pay a dividend in one year’s time. SG's expected

dividend amounts to Rs. 30 per share and that of CG is Rs. 27 per share. Dividends will be paid

annually and are expected to increase over time. SG’s dividends are expected to display perpetual

growth at a compound rate of 6% per annum. CG’s dividend will grow at the annual compound

rate of 33⅓% until a dividend of Rs. 64 per share is reached in year 4. Thereafter CG’s dividend

will remain constant.

If SSC is able to purchase all the equity capital of either company, then the reduced competition

would enable SSC to save some advertising and administrative costs which would amount to Rs.

225,000 per annum indefinitely and, in year 2, to sell some office space for Rs. 800,000. SSC would

change some operations of any company completely taken over, the details are:

SG – No dividend would be paid until year 3. Year 3 dividend would be Rs. 25 per share and

dividends would then grow at 10% per annum indefinitely.

CG – No change in total dividends in years 1 to 4, but after year 4 dividend growth would be 25%

per annum compounded until year 7. Thereafter annual dividend per share would remain constant

at the year 7 amount.

An appropriate discount rate for the risk inherent in all the cash flows mentioned is 15%.

Required:

(4+6=10 Marks)

i) Calculate the value per share for a minority investment in each of the companies, SG

and CG, which would provide the investor with a 15% rate of return.

ii) Calculate the maximum amount per share which SSC should consider paying for each

company in the event of a complete takeover.

[June 2019]

Answer:

i) Using the dividend valuation model, the value of ordinary shares is given by;

Vs = D0 (1+g)

Ke-g

Where D0 (1 + g) is the dividend due in one year.

Ke is the cost of equity or required return.

g is the anticipated growth in dividends.

Now,

Value per share of SG =30/(0.15-0.06)

= Rs. 333.33

CA RAJENDRA MANGAL JOSHI 12

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

The model must be modified slightly to estimate the value per share of CG as follows:

= D1/(1+Ke)1 + D2/(1+ Ke)2+ D3/(1+ Ke)3+ D4/(1+ Ke)4 × 1/ Ke

= 27/(1.15)1 + 27(1.33)/(1.15)2 +27(1.33)2/(1.15)3 +64/(1.15)3 ×1/0.15

=23.48+27.15+31.40+243.95

= Rs. 362.8

ii) Maximum price in the event of a complete take-over:

Present value of cost savings:

Administrative costs= 225,000/0.15

= Rs. 1,500,000

Sale of office space = 800,000 x 0.7562

= Rs. 604,960

Total = Rs. 2,104,960

Saving per share = Rs. 2,104,960/1,000,000 = Rs.2.10

Value per share of SG (with change in operations):

Vs =25/(1.15)2×1/(0.15-0.10) = Rs.378.05

Maximum price = Rs. 378.05+Rs. 2.10 = Rs. 380.15

Value per share of CG:

Vc=27/1.15+(27×1.33)/(1.15)2 +

27×(1.33)2/(1.15)3+64/(1.15)4+(64×1.25)/(1.15)5+64×(1.25)2/(1.15)6+64×(1.25)

3

/(0.15) ×(1/(1.15)6

=23.48+27.15+31.40+36.59+39.77+43.23+313.25

=Rs. 562.13

Maximum price = 562.13+2.10

=Rs. 564.23

Valuation of equity by Free Cash Flow approach:

(I) Free Cash Flow of Firm (FCFF) method:

FCFF is the excess cash to the firm after reinvestment.

Computation

FCFF = EBIT x (1-t) +D&A - Change on working capital-CAPEX

OR

FCFF = Net income +Non cash expenses+Interest (1-t) - Change on working capital -

CAPEX

Value of Firm = FCFF1/(K0-gc)

CA RAJENDRA MANGAL JOSHI 13

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Total Value of Equity = Value of Firm-Value of Debts

Per share value of equity =Total value of equity/No. of equity shares

Question No: 14

Balance sheet

Assets 2020 2019

Cash 30 15

Accounts receivables 90 45

Inventory 120 90

Current assets 240 150

Gross PPE 1100 900

Accumulated Depreciations 570 420

Net PPE 530 480

Total Assets 770 630

Liabilities 2020 2019

Sundry Creditors 60 60

Short term debt 60 30

Current Liabilities 120 90

Long term debt 242 300

Common Stock 150 150

Retained earnings 258 90

Total Capital and Liabilities 770 630

Income Statement

Particulars 2020 2019

Sales 900 750

Less: Cost of sales 360 300

Gross Profit 540 450

Administration and selling expenses 105 90

EBITDA 435 360

Depreciation 150 120

EBIT 285 240

Interest Expenses 45 30

EBT 240 210

Less: Tax (@30%) 72 63

EAT 168 147

CA RAJENDRA MANGAL JOSHI 14

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Required compute FCFF.

Answer:

FCFF = EBIT x (1-t) +D&A+/- Change on working capital-CAPEX

EBIT 285

tax rate 30%

EBIT x (1-t) 199.5

Depreciation and Amortization 150

Changes in WC 2020 2019 Changes Remarks

Accounts receivables 90 45 45 outflow

Inventory 120 90 30 outflow

Sundry Creditors 60 60 0

75 Outflow

Note: Cash and short term debts should not be taken for computing changes in WC

CAPEX 2020 2019 Changes Remarks

PPE 1100 900 200 Outflow

FCFF Computation

EBIT x (1-t) 199.5

Depreciation and Amortization 150

Changes in WC -75

CAPEX -200

FCFF 74.5

Question No: 15

Bhardhwaj Trader Ltd. is a growing supplier of office materials. Analysts project the following

free cash flow during the next 3 years of operation of the company, after which the free cash flow

is expected to grow at a constant rate of 7%.

Year 1 2 3

Free cash flow (Rs. in millions) (20) 30 40

The firm's weighted average cost of capital is 13%.

Required:

(3+2+2=7 Marks)

i) What is the terminal value of free cash flows after 3 rd year?

CA RAJENDRA MANGAL JOSHI 15

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

ii) What is the value of the firm today?

iii) If the company has Rs. 100 million in debt and 10 million ordinary shares

outstanding, what is the price per share?

[June 2017]

Answer:

i) Terminal Value of Free Cash Flows after 3rd year:

Free Cash Flow of 3rd year (1+g)

= (WACC-g)

40(1+0.07)

=

0.13-0.07

=

Rs. 713.33 Million

ii) Calculation of Value of the Firm Today

Year FCF/Terminal Value (Rs. in millions) PVIF @ 13% PV (Rs. in millions)

1 (20) 0.8850 (17.70)

2 30 0.7831 23.493

3 40 0.6931 27.724

3 713.33 0.6931 494.41

Value of the Firm Today 527.927

iii) Calculation of Price Per Share

Value of Common

Equity = Value of Firm Today - Value of Debt

= 527.927 Million - 100 Million

= Rs. 427.927 Million

Value of Equity

Price Per Share =

No. of Equity Share

Rs. 427.927 Million

=

10 Million

= Rs. 42.7927

CA RAJENDRA MANGAL JOSHI 16

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

Question No: 16

The valuation of a company has been done by an investment analyst. Based on an expected free

cash flow of Rs. 5.40 million for the following year and an expected growth rate of 9 percent, the

analyst has estimated the value of the company to be Rs. 180 million. However, he committed a

mistake of using the book values of debt and equity.

The book value weights employed by the analyst are not known, but you know that the company

has a cost of equity of 20 percent and post-tax cost of debt of 10 percent. The market value of

equity is thrice its book value, whereas the market value of its debt is nine-tenth of its book value.

Required:

[7 Marks]

Calculate the correct value of the company.

[June 2019]

Answer:

Cost of capital by applying Free Cash Flow to Firm (FCFF) Model is as follows:

Value of Firm (V0) = FCFF1 / (Ko - gn)

Where, FCFF1 = Expected FCFF in year 1

Ko = Cost of Capital

gn = Growth rate =9%

Thus Rs. 180 m = 5.4 m / (Kc - gn)

Since, g = 9%

Ko -9% = 5.4/180

Ko = 0.03 +0.09 = 12%

Now, let X be the weight of debt and given cost of equity = 20% and cost of debt=10%,

Then 20% (1-X) + 10%X = 12%

Hence, X=0.80, so book value weight of debt was 80% and accordingly book value

weight of equity was 20%

Thus, correct weight should be 60 (thrice of book value of equity) and 72 (nine-tenth of

book value) of debt

Cost of capital = Ko= 20% (60/132) + 10% (72/132) = 14.55%

Correct value of the firm = Rs. 5.4 m / (0.1455 - 0.09) = Rs. 97.3 m

Computation of Return on shares

I) Dividend Yield = D1/P0

D1= Expected dividend

P0 = Current Price

II) Capital Gain or Loss Yield = (P1-P0)/P0

P1= Closing Price

CA RAJENDRA MANGAL JOSHI 17

ICAN REVISION CLASS - VALUATION OF COMMON STOCK

P0= Opening Price

III) Rate of Return on stock (Ke) =Dividend Yield + Capital Gain or Loss Yield

Question No: 17

Chaudhary Automobile Company is experiencing a period of repaid growth. Earnings and

dividends are expected to grow at a rate of 12 percent during the next 2 years, at 10 percent in the

third year, and at a constant rate of 5% thereafter. Company's last dividend was Rs. 10, and the

required rate of return on the stock is 15 percent. a. Calculate the value of the stock today b.

Calculate P1 and P2. c. Calculate the dividend yield and capital gain yield for year 1, 2 and 3.

Answer: (Self practice)

Year Dividend Yield Capital gain or loss Total Return

yield (ke)=Dividend Yield

+ Capital gain or loss

Yield

1 =D1/P0= =(P1-P0)/P0

2 =D2/P1= =(P2-P1)/P1

3 =D3/P2= =(P3-P2)/P2

*****

CA RAJENDRA MANGAL JOSHI 18

You might also like

- NAHTA Professional Classes Fund Accounting QuestionsDocument48 pagesNAHTA Professional Classes Fund Accounting Questionsmonudeep aggarwalNo ratings yet

- Graded Illustrations on Capital Budgeting TechniquesDocument57 pagesGraded Illustrations on Capital Budgeting TechniquesVishesh GuptaNo ratings yet

- Security Law Practical QuestionsDocument18 pagesSecurity Law Practical QuestionsIsha YadavNo ratings yet

- Introduction To Final AccountsDocument38 pagesIntroduction To Final AccountsCA Deepak Ehn88% (8)

- Corporate Law RTP CAP-II June 2016Document18 pagesCorporate Law RTP CAP-II June 2016Artha sarokar100% (1)

- Advanced Accounts 1 PDFDocument304 pagesAdvanced Accounts 1 PDFJohn Louie NunezNo ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsNikhilNo ratings yet

- CA Ipcc Costing Suggested Answers For Nov 20161Document12 pagesCA Ipcc Costing Suggested Answers For Nov 20161Sai Kumar SandralaNo ratings yet

- 120 Income Tax - IIDocument21 pages120 Income Tax - IIPriya Dharshini PdNo ratings yet

- CAF-Business Economics PDFDocument40 pagesCAF-Business Economics PDFadnan sheikNo ratings yet

- Chapter 3 MeasurementDocument19 pagesChapter 3 MeasurementMustafa Nabeel Zaman100% (1)

- 4 Branch AccountsDocument18 pages4 Branch AccountsBAZINGANo ratings yet

- Hire Purchase PeqDocument21 pagesHire Purchase PeqRishikaNo ratings yet

- Question Paper PDFDocument17 pagesQuestion Paper PDFSaianish KommuchikkalaNo ratings yet

- CA IPCC Notes On Liquidation of A Company 5U6B6RVIDocument5 pagesCA IPCC Notes On Liquidation of A Company 5U6B6RVIVinayNo ratings yet

- Ratio AnalysisDocument42 pagesRatio AnalysiskanavNo ratings yet

- Analysis of VariancesDocument40 pagesAnalysis of VariancesSameer MalhotraNo ratings yet

- IMT 58 Management Accounting M3Document23 pagesIMT 58 Management Accounting M3solvedcareNo ratings yet

- Chapter-07 (Regression Analysis) - Md. Monowar Uddin TalukdarDocument31 pagesChapter-07 (Regression Analysis) - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Suggested - Answer - CAP - II - June - 2011 4Document64 pagesSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- Class Discussion Questions For Capital Gains ChapterDocument3 pagesClass Discussion Questions For Capital Gains ChapterHdkakaksjsbNo ratings yet

- Accounts Previous Year PapersDocument37 pagesAccounts Previous Year PapersAlankritaNo ratings yet

- CA FINAL SFM DERIVATIVES Futures SUMMARYDocument9 pagesCA FINAL SFM DERIVATIVES Futures SUMMARYsujeet mauryaNo ratings yet

- Ipcc Cost Accounting RTP Nov2011Document209 pagesIpcc Cost Accounting RTP Nov2011Rakesh VermaNo ratings yet

- Solution To Right Issue CA FINAL SFM by PRAVINN MAHAJANDocument15 pagesSolution To Right Issue CA FINAL SFM by PRAVINN MAHAJANPravinn_Mahajan100% (1)

- Financial AccountingDocument60 pagesFinancial AccountingSurajNo ratings yet

- AssignmentDocument5 pagesAssignmentEthan HuntNo ratings yet

- Class I - Basis of TaxationDocument50 pagesClass I - Basis of TaxationMukunda Bhusal100% (1)

- Topic 8 - AS 20Document10 pagesTopic 8 - AS 20love chawlaNo ratings yet

- Numericals On Capital BudgetingDocument3 pagesNumericals On Capital BudgetingRevati ShindeNo ratings yet

- Accounting for Business Combinations and Internal ReconstructionsDocument27 pagesAccounting for Business Combinations and Internal ReconstructionsbinuNo ratings yet

- TVM Chapter 6 Key ConceptsDocument27 pagesTVM Chapter 6 Key ConceptsMahe990No ratings yet

- Departmental Accounting ProblemsDocument12 pagesDepartmental Accounting ProblemsRajesh NangaliaNo ratings yet

- 12 (A) - Contract Costing: Model Wise Analysis of Past Exam Papers of IpccDocument19 pages12 (A) - Contract Costing: Model Wise Analysis of Past Exam Papers of Ipccgopi kansalNo ratings yet

- CAP III - Suggested Answer Papers - All Subjects - June 2019 PDFDocument133 pagesCAP III - Suggested Answer Papers - All Subjects - June 2019 PDFsantosh thapa chhetriNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- 46793bosinter p8 Seca cp5 PDFDocument42 pages46793bosinter p8 Seca cp5 PDFIsavic AlsinaNo ratings yet

- IPL Teams Strike Gold with Sports AnalyticsDocument15 pagesIPL Teams Strike Gold with Sports Analyticsravitejathentu100% (1)

- As 16Document11 pagesAs 16Harsh PatelNo ratings yet

- Depreciation Accounting (As 10)Document7 pagesDepreciation Accounting (As 10)Aman SinghNo ratings yet

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- CHP 2. Contract Costing SumsDocument59 pagesCHP 2. Contract Costing SumsUchit MehtaNo ratings yet

- Bank Discount CalculationDocument3 pagesBank Discount CalculationPrakash ViswaNo ratings yet

- 123 - AS Question Bank by Rahul MalkanDocument182 pages123 - AS Question Bank by Rahul MalkanPooja GuptaNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Jnu - Solved - Paper (1) - 1 PDFDocument193 pagesJnu - Solved - Paper (1) - 1 PDFparas hasijaNo ratings yet

- FRSA Practice Questions For AssignmentDocument8 pagesFRSA Practice Questions For AssignmentSrikar WuppalaNo ratings yet

- P5 Acca - 11 Divisional Performance Evaluation BeckerDocument30 pagesP5 Acca - 11 Divisional Performance Evaluation BeckerDanesh Kumar Rughani100% (1)

- CVP Question 6Document1 pageCVP Question 6Humphrey OsaigbeNo ratings yet

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- CA Inter Paper 1 All Question PapersDocument205 pagesCA Inter Paper 1 All Question PapersNivedita SharmaNo ratings yet

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- Capital Gain and IFOS - SolutionDocument6 pagesCapital Gain and IFOS - SolutionVenkataRajuNo ratings yet

- Tax Guide for Manufacturing CompanyDocument10 pagesTax Guide for Manufacturing CompanynikhilramaneNo ratings yet

- Format of Trading Profit Loss Account Balance Sheet PDFDocument6 pagesFormat of Trading Profit Loss Account Balance Sheet PDFsonika7100% (1)

- Joint Products & by Products: Solutions To Assignment ProblemsDocument5 pagesJoint Products & by Products: Solutions To Assignment ProblemsXNo ratings yet

- Financial Analysis of Sun PharmaDocument7 pagesFinancial Analysis of Sun PharmahemanshaNo ratings yet

- UntitledDocument6 pagesUntitledShuHao ShiNo ratings yet

- Additional Solved Problems and MinicasesDocument154 pagesAdditional Solved Problems and Minicasesashok100% (1)

- Assignment chp10Document10 pagesAssignment chp10Aalizae Anwar YazdaniNo ratings yet

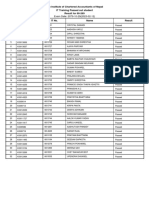

- MS Word: Marks AllocationDocument1 pageMS Word: Marks AllocationSushant MaskeyNo ratings yet

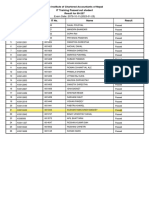

- Exam Date: 2079-10-29 (2023-02-12) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalDocument1 pageExam Date: 2079-10-29 (2023-02-12) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalSushant MaskeyNo ratings yet

- Exam Date: 2079-11-26 (2023-03-10) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalDocument1 pageExam Date: 2079-11-26 (2023-03-10) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalSushant MaskeyNo ratings yet

- 500 Question SetDocument72 pages500 Question SetSushant MaskeyNo ratings yet

- CamScanner Document ScansDocument72 pagesCamScanner Document ScansSushant MaskeyNo ratings yet

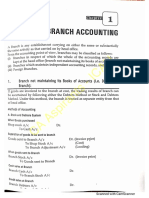

- Branch AccountingDocument51 pagesBranch AccountingSushant MaskeyNo ratings yet

- Budget Numerical PDFDocument5 pagesBudget Numerical PDFDilip BhusalNo ratings yet

- Budget AnswersDocument6 pagesBudget AnswersSushant MaskeyNo ratings yet

- IT ResultDocument1 pageIT ResultSushant MaskeyNo ratings yet

- Company ActDocument198 pagesCompany Actमेनसन लाखेमरूNo ratings yet

- Risk Return Basics/Portfolio Management: Learning Objective of The ChapterDocument34 pagesRisk Return Basics/Portfolio Management: Learning Objective of The ChapterSushant MaskeyNo ratings yet

- Cash ManagementDocument14 pagesCash ManagementSushant MaskeyNo ratings yet

- Risk Return Basics/Portfolio Management: Learning Objective of The ChapterDocument34 pagesRisk Return Basics/Portfolio Management: Learning Objective of The ChapterSushant MaskeyNo ratings yet

- Ican Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Document16 pagesIcan Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Sushant MaskeyNo ratings yet

- Common Stock Valuation MethodsDocument18 pagesCommon Stock Valuation MethodsSushant Maskey0% (1)

- Chapter 4: LeverageDocument15 pagesChapter 4: LeverageSushant MaskeyNo ratings yet

- 00 GC 7 G2 BPLXaal OX4 MSV 1617714838Document8 pages00 GC 7 G2 BPLXaal OX4 MSV 1617714838Sushant MaskeyNo ratings yet

- Leverage: Understanding Operating, Financial and Combined LeverageDocument15 pagesLeverage: Understanding Operating, Financial and Combined LeverageSushant MaskeyNo ratings yet

- Overheads PracticalDocument37 pagesOverheads PracticalSushant Maskey100% (1)

- Labour: (A) (B) (C) (D) (E)Document40 pagesLabour: (A) (B) (C) (D) (E)Sushant MaskeyNo ratings yet

- Ican Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Document16 pagesIcan Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Sushant MaskeyNo ratings yet

- EDP Audit CIS Environment MeaningDocument7 pagesEDP Audit CIS Environment MeaningSushant MaskeyNo ratings yet

- Z Ab I590 TIl 4 A3 o 6 O7 PYt 1617546492Document5 pagesZ Ab I590 TIl 4 A3 o 6 O7 PYt 1617546492Sushant MaskeyNo ratings yet

- URP Income Tax Part SolutionsDocument127 pagesURP Income Tax Part SolutionsSushant MaskeyNo ratings yet

- CAPII Suggested Dec2015Document87 pagesCAPII Suggested Dec2015Sushant MaskeyNo ratings yet

- Labour/Employee Cost: Classification of Labor CostDocument9 pagesLabour/Employee Cost: Classification of Labor CostSushant MaskeyNo ratings yet

- Overheads TheoryDocument11 pagesOverheads TheorySushant MaskeyNo ratings yet

- RD TReeqim RSFH XACz 0 W91617196460Document10 pagesRD TReeqim RSFH XACz 0 W91617196460Sushant MaskeyNo ratings yet

- NIOjid Akjc MDI9 L 5 Ulv I1617282937Document4 pagesNIOjid Akjc MDI9 L 5 Ulv I1617282937Sushant MaskeyNo ratings yet

- Bekasi Power Concept LNG Infrastructure and Cold Energy Harvesting ProjectDocument3 pagesBekasi Power Concept LNG Infrastructure and Cold Energy Harvesting ProjectLiauw CooperationNo ratings yet

- Investing in Gold Everything You Should KnowDocument21 pagesInvesting in Gold Everything You Should KnowAniruddha PatilNo ratings yet

- Phil Equity Peso Bond FundDocument2 pagesPhil Equity Peso Bond Funderic aunzoNo ratings yet

- Study Session 05: Shemal MustaphaDocument11 pagesStudy Session 05: Shemal MustaphafirefxyNo ratings yet

- Basel IiiDocument32 pagesBasel Iiivenkatesh pkNo ratings yet

- Royal Bafokeng Full-IntegratedDocument176 pagesRoyal Bafokeng Full-IntegratedLungisaniNo ratings yet

- Srei Consolidates 100% Shareholding in Srei Equipment Finance Limited ("SEFL") (Company Update)Document3 pagesSrei Consolidates 100% Shareholding in Srei Equipment Finance Limited ("SEFL") (Company Update)Shyam SunderNo ratings yet

- I. Activity/Exercises 1:: Apply It in Real LifeDocument3 pagesI. Activity/Exercises 1:: Apply It in Real LifeCarl Jared S. CalubNo ratings yet

- A Comparative Study of Stock Market and Bullion Market in India - Investors' Point of ViewDocument20 pagesA Comparative Study of Stock Market and Bullion Market in India - Investors' Point of ViewarcherselevatorsNo ratings yet

- TD BANK-JUL-28-TD Economic-Teranet-National Bank House Price IndexDocument1 pageTD BANK-JUL-28-TD Economic-Teranet-National Bank House Price IndexMiir ViirNo ratings yet

- Axis Inspection Report FY14-15Document31 pagesAxis Inspection Report FY14-15Moneylife FoundationNo ratings yet

- BR20161021 EnergyStorageDocument11 pagesBR20161021 EnergyStoragezacharioudakisNo ratings yet

- Wind Farm Project Finance: Financing and Technical RequirementsDocument19 pagesWind Farm Project Finance: Financing and Technical RequirementsRahul Kumar AwadeNo ratings yet

- Questionnaire NW OrgDocument3 pagesQuestionnaire NW OrgEldhose JoseNo ratings yet

- MKT465 CH 7Document32 pagesMKT465 CH 7Ahmed Farzan AnikNo ratings yet

- Schreibman Contributions 2011-2012Document8 pagesSchreibman Contributions 2011-2012David LombardoNo ratings yet

- 21 Yelena SmirnovaDocument20 pages21 Yelena Smirnovalekha1997No ratings yet

- Cost of Capital Practice QuestionsDocument2 pagesCost of Capital Practice QuestionskhubaibNo ratings yet

- Chap 005Document38 pagesChap 005Thanh Son100% (1)

- Course Outline: Course Scope and MissionDocument10 pagesCourse Outline: Course Scope and MissionKismat PatelNo ratings yet

- Useful Excel ShortcutsDocument6 pagesUseful Excel ShortcutsalbertNo ratings yet

- Chapter 10Document37 pagesChapter 10badrfakriNo ratings yet

- CRISIL Research Cust Bulletin Jan12Document20 pagesCRISIL Research Cust Bulletin Jan12cse10vishalNo ratings yet

- KPMG Ory - Insights - 27 - October - 2023 - Rbi - Issues - Master - Direction - Non - Banking - Company - Scale - Based - RegulationDocument27 pagesKPMG Ory - Insights - 27 - October - 2023 - Rbi - Issues - Master - Direction - Non - Banking - Company - Scale - Based - RegulationRangerNo ratings yet

- Audit of Hospital and ClubsDocument35 pagesAudit of Hospital and ClubsRajVishwakarma100% (3)

- CCS University Master's Program Course ContentDocument26 pagesCCS University Master's Program Course Contentanu_acharyaNo ratings yet

- Case Study On InfosysDocument9 pagesCase Study On InfosysChirag NiyogiNo ratings yet

- Midtown St. Joseph Neighborhood Revitalization AnalysisDocument13 pagesMidtown St. Joseph Neighborhood Revitalization AnalysismattbuchananNo ratings yet

- Answers: Target Customer in Engineering & ConstructionDocument12 pagesAnswers: Target Customer in Engineering & Constructionzuka jincharadze100% (2)

- Megatrend BitcoinsDocument7 pagesMegatrend BitcoinsDesi BlackpepperNo ratings yet