Professional Documents

Culture Documents

Ican Revision-Cash Management - Cap-Ii

Ican Revision-Cash Management - Cap-Ii

Uploaded by

Sushant MaskeyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ican Revision-Cash Management - Cap-Ii

Ican Revision-Cash Management - Cap-Ii

Uploaded by

Sushant MaskeyCopyright:

Available Formats

ICAN REVISION- CASH MANAGEMENT- CAP-II

Cash Management

A) Treasury Management

Meaning

Treasury Management is defined as ‘the corporate handling of financial matters, the generation of

external and internal funds for business, the management of currencies and cash flow and the

complex, strategies, policies and procedures of corporate finance”.

B) Functions of Treasury Department

a. Cash Management:

The efficient collection and payment of cash both inside the organization and to thirds

parties is the function of the treasury department. The involvement of the department with

the details of receivables and payables will be a matter of policy.

b. Currency Management:

The treasury department manages the foreign currency risk exposure of the company.

c. Funding management:

Treasury department is responsible for planning and sourcing the company’s short, medium

and long term cash needs. Treasury department will also participate in the decision on

capital structure and forecast future interest and foreign currency rates.

d. Banking:

It is important that a company maintains a good relationship with its bankers. Treasury

department carry out negotiations with bankers and act as the initial point of contract with

them.

e. Corporate Finance:

Treasury department is involved with both acquisition and divestment activities within the

group. In addition it will often have responsibility for investor relations. The latter activity

has assumed increased importance in markets where share-price performance is regarded

as crucial and may affect the company's ability to undertake acquisition activity or if the

price falls drastically, render it vulnerable to a hostile bid.

RAJENDRA MANGAL JOSHI,FCA 1

ICAN REVISION- CASH MANAGEMENT- CAP-II

C) The Need for Cash

Transaction need:

Speculative needs:

Precautionary needs:

E) Cash Management Strategies

In order to synchronies the cash receipt and payment. A firm needs to develop appropriate

strategies for cash management viz.

(i) Cash Planning: Cash budget, cash flow statement

(ii) Managing the cash flow: The cash inflow should be accelerated, while as far as

possible, the out flow should be decelerated.

(iii) Optimum cash level:

(iv) Investing surplus cash: (1) Safety (3) Maturity (2) Liquidity

F) Cash planning

Cash budget:

Format of Cash Budget

Cash Budget

From ……………… to ………………

Jun

Jan Feb March April May e

Particulars Rs Rs Rs Rs Rs Rs

A. Opening Cash Balance XXX XXX XXX XXX XXX XXX

B. Receipts

Cash Sales XXX XXX XXX XXX XXX XXX

Collection from debtors XXX XXX XXX XXX XXX XXX

Total Receipts (B) XXX XXX XXX XXX XXX XXX

C. Total Cash Payments:

Cash Purchases XXX XXX XXX XXX XXX XXX

Payments to creditors XXX XXX XXX XXX XXX XXX

Wages & Salaries XXX XXX XXX XXX XXX XXX

Interest on Debn XXX XXX XXX XXX XXX XXX

Tax Payment XXX XXX XXX XXX XXX XXX

RAJENDRA MANGAL JOSHI,FCA 2

ICAN REVISION- CASH MANAGEMENT- CAP-II

Total Payments (C ) XXX XXX XXX XXX XXX XXX

C. Surplus (Defict)[A+B-C] XXX XXX XXX XXX XXX XXX

Investment/Financing

D Temp. investments After keeping minimum

Realisation of temporary Investments to

E. maintain

F. Temporary loan

G Repayments of temporary loan

H Closing Cash Balance XXX XXX XXX XXX XXX XXX

Question No. 1

Prepared monthly cash budget for six months beginning from April 2015 in the basis of the

following information:-

i) Estimated monthly sales are follows:

Rs. Rs.

January 100,000 June 80,000

February 120,000 July 100,000

March 140,000 August 80,000

April 80,000 September 60,000

May 60,000 October 100,000

ii) Wages and salaries are estimated to be payable as follows:

Rs. Rs.

April 9,000 July 10,000

May 8,000 August 9,000

June 10,000 September 9,000

iii) Of the sales 80% is on credit and 20% for cash. 75% of the credit sales are collected within

one month and balance in two months. There are no bad debt losses.

iv) Purchases amount to 80% of sales and are made and paid for in the month preceding the sales.

v) The firm has 10% debentures of Rs. 1, 20,000. Interest on these has to be paid quarterly in

January, April and so on.

vi) The firm is to make an advance payment of tax of Rs 5,000 in july 2015.

vii) The firm had a cash balance of Rs 20,000 on April 1, 2015, which is the minimum desired

level of cash balance. any cash surplus/deficit above/below this level is made up by temporary

RAJENDRA MANGAL JOSHI,FCA 3

ICAN REVISION- CASH MANAGEMENT- CAP-II

investments/liquidation of temporary investments or temporary borrowings at the end of each

month (interest on these to be ignored)

Solution :

Monthly Cash Budget for the six months from Apr. to Sep

Rs. In "000"

Apri Jun

l May e July Aug Sept

Particulars Rs Rs Rs Rs Rs Rs

A. Total Cash Available

Opening Cash Balance 20 20 20 20 20 20

Cash Sales 16 12 16 20 16 12

Collection from debtors 108 76 52 60 76 68

144 108 88 100 112 100

B. Total Cash Payments:

Purchases 48 64 80 64 48 80

Wages & Salaries 9 8 10 10 9 9

Interest on Debn 3 - - 3 3 -

Tax Payment

60 72 90 82 57 89

84 36 (2) 18 55 11

C. Surplus (Defict)[A-B]

D. Investment/Financing

Temp. Investments After

keeping minimum

Cash balance of Rs 20,000 (64) (16) - - (35) -

Realisation of temporary

E. Investments to maintain

Cash balance of Rs 20,000 - - 22 2 - 9

F. Closing Cash Balance (C+D+E) 20 20 20 20 20 20

Working Notes:

i) Schedule of Collections from debtors : (Rs. "000")

RAJENDRA MANGAL JOSHI,FCA 4

ICAN REVISION- CASH MANAGEMENT- CAP-II

Particulars Feb Mar Apr May June July Aug Sept

Total Sales 120 140 80 60 80 100 80 60

Credit Sales(80% of total

sales) 96 112 64 48 64 80 64 48

Collection:

One month(75%) 72 84 48 36 48 60 48

Two month (25%) 24 28 16 12 16 20

Total Collections 108 76 52 60 75 68

(ii) Schedule of Payments to Trade Creditors: (Rs. "000")

Jun

Particulars Apr May e July Aug Sept Oct

A. Total Sales 80 60 80 100 80 60 100

B. Purchasing being 80%of

sales of next month 48 64 80 64 48 80

Question No. 2

From the following information relating to a departmental store, you are required to prepared for

the three months ending 31st March, 2015:-

Month wise cash budget on receipts and payments basis and

It is anticipated that the working capital at 1st January, 2015 will be as follows:

Rs. In’000’

Cash in hand and at bank 545

Short term investments 300

Debtors 2,570

Stock 1,300

Trade creditors 2,110

Other creditors 200

Dividends Payable 485

Tax due 320

Plant 800

Budgeted profit statement:

Rs. In’000’

January February March

Sales 2,100 1,800 1,700

Cost of sales 1.635 1,405 1,330

RAJENDRA MANGAL JOSHI,FCA 5

ICAN REVISION- CASH MANAGEMENT- CAP-II

Gross profit 465 395 370

Administrative, Selling and 315 270 255

Distribution expenses

Net profit before tax 150 125 115

Budgeted balances at the end of each month:

Rs. In’000’

31st Jan. 29th Feb. 31st March

Short term investment 700 - 200

Debtors 2,600 2,500 2,350

Stock 1,200 1,100 1,000

Trade creditors 2,000 1,950 1,900

Other creditors 200 200 200

Dividends payable 485 - -

Tax due 320 320 320

Plant (depreciation ignore) 800 1,600 1,550

Depreciation amount to Rs. 60,000 is included in the budgeted expenditure for each month.

(ii) Managing the cash flow:

Accelerating cash collections:

A firm can conserve cash and reduce its requirements for cash balances if it can speed up

its cash collections by issuing invoices quickly and taking other necessary steps for cash

collection. It can be accelerated by reducing the time lag between a customer pays bill and

the cheque is collected and funds became available for the firm’s uses. A firm can

decentralized collection system known as concentration banking and lock box system to

speed up cash collection and reduce float time.

a) Concentration banking:

In concentration banking the company establishes a number of strategic

collection centers in different regions instead of a single collection center at the

head office.

This system reduces the period between the times a customer mails in his

cheques and the time when they-became spendable funds with the company.

Payment received by the different collection centers are deposited with their

respective local banks which in turn transfer all surplus funds to the

concentration bank of head office.

RAJENDRA MANGAL JOSHI,FCA 6

ICAN REVISION- CASH MANAGEMENT- CAP-II

The concentration bank with which the company has its major bank account is

generally located at the headquarters concentration banking is one important.

b) Lock Box System:

While concentration banking, cheques are received by a collection centre and deposited

in the bank processing. The purpose of lock box system is to eliminate the time between

the receipts of remittances by the company and deposited in the bank.

A lock box arrangement usually is on regional basis which a company chooses according

to its billing patterns.

Under this arrangement, to the company rents the local post-office box and authorizes its

bank at each of the location to pick up remittances in the boxes customers are billed with

instruction to mail their remittances in the boxes.

The bank picks up the mail and deposits the cheque in the company’s account.

The cheques cleared after collection.

The company receives a deposit slip and lists all payments together with any other

materials in the envelope.

This procedure frees the company from handling and deposited with banks sooner and

become collected funds sooner than if they were processed by the company prior deposit.

In other words lag between the time cheques are received by the company and they are

actually deposited in the bank is eliminated.

The bank provides a number of services in addition to usual clearing of cheques and

requires compensation for them. Since the cost is almost directly proportional to the

number of cheques deposited. Lock box arrangements are usually not profitable if the

average remittance is small.

The appropriate rule for deciding whether or not to use a lock box system or for that

matter, concentration banking is simply to compare the added cost of the most efficient

system with the marginal income that can be generated from the released funds.

Its costs are less than income, the system is profitable, if the system is not profitable, it

is not worth undertaking.

RAJENDRA MANGAL JOSHI,FCA 7

ICAN REVISION- CASH MANAGEMENT- CAP-II

Different kinds of float with reference to management of cash:

The term float is used to refer to the periods that affect cash as it moves through the different

stages of the collection process. Four kinds of float with reference to management of cash are:

Billing float: The time between the sales and the mailing of invoice is the billing float.

Mail Float: This is the time when a cheque is being processed by post office, messenger

service or other means of delivery.

Cheque processing float: This is the time required for the seller to sort, record and deposit

the cheque after it has been received by the company.

Banking processing float: This is the time from the deposit of the cheque to the crediting

of fund in the sellers account.

II) Controlling Payments: A firm can increase its net float by speeding up collections. It can

also increase the net float by delayed disbursements of funds from the bank by increasing the

mail time. A company may make payment to its outstation suppliers by a cheque and send it

through mail. The delay in transit and collection of the cheque, will be used to increase the

float.

Question No. 3

National Inc. has grown from a small Regional firm with customers concentrated in Kathmandu

to a large, national wide firm serving customers through out the country. It has however, kept

its central billing system in Regional. On average, 5 days elapse from the time customers mail

payments until National is able to receive, process and deposit them. To shorten the collection

period, National is considering the installation of a lock box system consisting of 30 local

depository banks or lockbox operators and 8 regional concentration banks. The fixed cost of the

operating system are estimated to be Rs. 14,000 per month. Under this system, customer’s checks

would be received by the lock box operator 1-day after they are mailed, and daily collections

should average Rs. 30,000 at each location. The collection would be transferred daily to the

regional concentration banks. One transfer mechanism involves having the local depository banks

use “mail depository transfer checks, ‘or DTCs, to move the funds to the concentration banks;

the alternative would be to use electronic (wire) transfers. A DTC would cost only Rs. 0.75, but it

would take 2 days before funds were in the concentration bank and thus available to national.

Therefore, float time under the DTC system would be 1 day for mail plus 2 days for transfers or

3 days total, down from 5 days. A wire transfer would cost Rs. 11, but funds would be available

immediately, so float time would be only 1 day. If National’s opportunity cost is 11 percent, should

it initiate the lockbox system? If so, which transfer method should be used? (Assume that there

are 52x5=260 working days in a year)

RAJENDRA MANGAL JOSHI,FCA 8

ICAN REVISION- CASH MANAGEMENT- CAP-II

Question No. 4

Star Ltd. is a manufacturer of various electronic gadgets. The annual turnover for the year

2075/76 was Rs. 73 million. The company has a wide network of sales outlets all over the country.

All sales are for credit and are spread evenly throughout the year. All invoicing of credit sales is

carried out at the head office in Kathmandu. Sales documentation is sent by post, daily from each

location to the head office. Delays in preparing and dispatching invoices have come to the notice

of management.

An analysis of the delay in invoicing, being the interval between the date of sale and the date of

dispatch of the invoice, indicated the following pattern:

No. of days of delay in invoicing 3 4 5 6

% of weeks’ sales 20 10 40 30

A further analysis indicated that the debtors take on an average 36 days of credit before

paying. This period is measured from the day of dispatch of the invoice rather than the date

of sale.

It is proposed to hire an agency for undertaking the invoicing work at various locations. The

agency has assured that the maximum delay would be reduced to three days under the

following pattern:

No. of days of delay in invoicing 0 1 3

% of week’s sales 40 40 20

The agency has also offered, additionally, to monitor the collections which will reduce the

credit period to 30 days. Star Ltd. expects to save Rs. 4,000 per month in postage costs. All

working funds are borrowed from a local bank at simple interest rate of 20 % p.a.

The agency has quoted a fee of Rs. 200,000 p.a. for the invoicing work and Rs. 250,000 p.a.

for monitoring collections and is willing to offer a discount of Rs. 50,000 provided both the

works are given.

Required:

Advise Star Ltd. about the acceptance of agency’s proposal.

(December 2019, 7 Marks)

Solution:

Average Annual Sales (Rs in Million) 73

Number of Days in a Year 365

Average Daily Sales (Rs.) (73,000,000÷365) 200,000

Invoicing Function:

Average Days delay in Invoicing (Days) 4.8

(3*0.20+4*0.10+5*0.40+6*0.30)

Average Delay after Agency's Service (Days) 1

(0*0.40+1*0.40+3*0.20)

RAJENDRA MANGAL JOSHI,FCA 9

ICAN REVISION- CASH MANAGEMENT- CAP-II

Annual Saving in Invoicing Days 3.8

Release of Fund (Rs.) [ 3.8 Days * Rs 200,000] 760,000

Annual Saving in Opportunity Cost [ Rs 760,000 *20%] 152,000

Additional Saving on Collection Cost (Postage) (12*Rs

4,000) 48,000

Total Gross Saving under Invoicing Function (Rs) 200,000

Collection Function:

Annual Saving in Collection Days (36 Days - 30 Days) 6

Release of Fund (Rs.) [ 6 Days * Rs 200,000] 1,200,000

Annual Saving in Opportunity Cost [ Rs 1,200,000*20%] 240,000

Analysis of Offer of Agency

Work Saving (Rs) Cost of Decision

Agency (Rs)

Invoicing 200,000 200,000 Indifference

Collection 240,000 250,000 Reject

440,000 450,000

Discount (50,000)

Total Work 440,000 400,000 Accept

Question No. 7

ABC Ltd. operates four restaurants in Eastern and Western Region of Nepal. The manager of each

restaurant transfers funds daily from the local bank to the company’s principal bank in Kathmandu.

There are approximately 250 business days during a year in which transfers occur. Several methods

of transfer are available. A wire transfer results in immediate availability of funds, but the local

banks charge Rs. 5 per wire transfer. A transfer through an automatic clearing house involves next-

day settlement, or a 1-day delay, and costs Rs. 3 per transfer. Finally, a mail-based depository

transfer cheque arrangement costs Rs. 0.30 per transfer, and mailing times result in a 3-day delay

on average for the transfer to occur. This experience is the same for each restaurant. The company

presently uses depository transfer checks for all transfers. The restaurants have the following daily

average remittance:

Restaurant 1 Restaurant 2 Restaurant 3 Restaurant 4

Rs. 3,000 Rs. 4,600 Rs. 2,700 Rs. 5,200

RAJENDRA MANGAL JOSHI,FCA 10

ICAN REVISION- CASH MANAGEMENT- CAP-II

Required: (4+4=8 Marks)

i) If the opportunity cost of funds is 10 percent, which transfer procedure should be used for each

of the restaurants?

ii) If the opportunity cost of funds were 5 percent, what would be the optimal strategy?

[December 2018]

Answer:

i) If the opportunity cost of fund is 10%

Restaurant

1 2 3 4

Option I - Wire Transfer

Annual Transfer Cost [ 250 Transfer × Rs. 5] 1,250 1,250 1,250 1,250

Cost of Fund Blocked - - - -

Total Cost under Wire Transfer 1,250 1,250 1,250 1,250

Option II - Automated Clearing House [ ACH]

Annual Transfer Cost [ 250 Transfer × Rs. 3] 750 750 750 750

Cost of Fund Blocked (Avg. remittance × 10% 300 460 270 520

Total Cost under ACH 1,050 1,210 1,020 1,270

Option III - Mail Based Transfer Cheque

Annual Transfer Cost [ 250 Transfer × Rs. 0.3] 75 75 75 75

Cost of Fund Blocked (Avg. remittance×3×10%) 900 1380 810 1560

Total Cost Under Mail based transfer system 975 1,455 885 1,635

Option Option Option Option

Preferred Transfer Method for each Restaurant III II III I

ii) If the opportunity cost of fund is 5%

Restaurant

1 2 3 4

Option I - Wire Transfer

Annual Transfer Cost [ 250 Transfer × Rs 5] 1,250 1,250 1,250 1,250

Cost of Fund Blocked - -

- -

Total Cost under Wire Transfer 1,250 1,250 1,250 1,250

Option II - Automated Clearing House [ ACH]

Annual Transfer Cost [ 250 Transfer × Rs 3] 750 750 750 750

Cost of Fund Blocked (Avg. remittance × 5%) 150 230 135 260

Total Cost under ACH

900 980 885 1,010

RAJENDRA MANGAL JOSHI,FCA 11

ICAN REVISION- CASH MANAGEMENT- CAP-II

Option III - Mail Based Transfer Cheque

Annual Transfer Cost [ 250 Transfer × Rs 0.3]

75 75 75 75

Cost of Fund Blocked (Avg. remittance ×3×5%) 450 690 405 780

Total Cost Under Mail based transfer system

525 765 480 855

Preferred Transfer Method for each Restaurant Option Option Option Option

III III III III

Determining the Optimum Cash Balance:

CASH MANAGEMENT MODELS

Inventory type model

Stochastic models.

Willian J. Baumol’s Economic Order Quantity Model:

According to the model, optimum cash level is that level of cash where the carrying costs and

transactions costs are the minimum. The carrying costs refers to the cost of holding cash, namely,

the interest foregone on marketable securities. The transaction costs refers to the cost involved

in getting the marketable securities converted into cash. This happens when the firm falls short

of cash and has to sell the securities resulting in clerical, brokerage, registration and other costs.

The optimum cash balance according to this model will be that point where these two costs are

minimum. The formula for determining optimum cash balance is:

C= √2UP/S

Total Cost =No. of transactions X cost per transaction + Optimal cash balance/2 X S

Where,

C= Optimum cash balance

U= Annual ( or monthly) cash disbursement

P= Fixed cost per transaction

S= opportunity cost of one rupee p.a ( or p.m)

The model is based on the following assumptions:

i) Cash needs of the firm are known with certainty

ii) The cash is used uniformly over a period of time and it is also known with certainty

RAJENDRA MANGAL JOSHI,FCA 12

ICAN REVISION- CASH MANAGEMENT- CAP-II

iii) The holding cost is known and it is constant

iv) The transaction cost also remains constant

Question No. 5

A firm maintains a separate account for cash disbursement. Total disbursement are Rs. 1,05,000

per month or Rs. 12,60,000 per year. Administrative and transaction cost of transferring cash to

disbursement account is Rs. 20 per transfer. Marketable securities yield is 8% per annum.

Determine the optimum cash balance according to William J. Baumol model.

Question No. 6

Precious Metal Company needs to make Rs.800000 cash payments for next month. The annual

yield available on marketable securities is 6.5%. The Company’s fixed cost per transaction is

Rs.85.

a) What is the optimal cash conversion size for the company?

b) What is the total cost of holding cash during the coming month?

c) Assuming a 30 days month, how often the company will have to make conversion?

Miler-orr Cash Management Model:

According to this model the net cash flow is completely stochastic. When changes in cash balance

occur randomly the application of control theory serves a useful purpose. The Miller-orr model is

one of such control limit models. This model is designed to determine the time and size of

transfers between an investment account and cash account. In this model control limits are set

for cash balances. These limits may consist of u as upper limit, z as the return point; and L as the

lower point. When the cash balance reaches the upper limit, the transfer of cash equal to u-z is

invested marketable securities account to cash account is made. During the period when cash

balance stays between (u,z) and (z,L) i.e. high and low limits no transactions between cash and

marketable securities account is made. The high and low limits of cash balance are set up on the

basis of fixed cost associated with the securities transactions, the opportunity cost of holding cash

and the degree of likely fluctuations in cash balances. These limits satisfy the demands for cash

at the lowest possible total costs.

Question No. 12

The Seito Company has estimated that the standard deviation of its daily cash flows is Rs. 2500.

The firm pays Rs. 50 in transaction costs to transfer funds into and out of commercial paper that

pays 7.465 percent annual interest. The firm uses the Miller-orr Model to set its target cash

balance. Additionally, the firm has decided to maintain Rs. 10,000 minimum cash balance(Lower

limit).

RAJENDRA MANGAL JOSHI,FCA 13

ICAN REVISION- CASH MANAGEMENT- CAP-II

a) What is the firm’s target cash balance?

b) What are the upper and lower limits?

c) What are the Seito’s decision rules?

d) What is the firm’s expected average cash balance?

**** *

RAJENDRA MANGAL JOSHI,FCA 14

You might also like

- Compiler CAP II Cost AccountingDocument187 pagesCompiler CAP II Cost AccountingEdtech NepalNo ratings yet

- Chap 6Document27 pagesChap 6Basant OjhaNo ratings yet

- Chapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsDocument53 pagesChapter 4: Redemption of Pref Share & Debentures Topic: Redemption of Debentures. Practice QuestionsMercy GamingNo ratings yet

- Suggested Answer CAP II June 2017rDocument104 pagesSuggested Answer CAP II June 2017rBAZINGANo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- RTP June 19 AnsDocument27 pagesRTP June 19 AnsbinuNo ratings yet

- Home Work Section Working CapitalDocument10 pagesHome Work Section Working CapitalSaloni AgrawalNo ratings yet

- Revision Test Paper CAP II Dec 2017Document163 pagesRevision Test Paper CAP II Dec 2017Dipen AdhikariNo ratings yet

- Group - I Paper - 1 Accounting V2 Chapter 13 PDFDocument13 pagesGroup - I Paper - 1 Accounting V2 Chapter 13 PDFjashveer rekhiNo ratings yet

- Not For Profit OrganizationDocument69 pagesNot For Profit OrganizationDristi SaudNo ratings yet

- Coc Departmental Accounting Ca/Cma Santosh KumarDocument11 pagesCoc Departmental Accounting Ca/Cma Santosh KumarAyush AcharyaNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Suggested Answer CAP II June 2018Document128 pagesSuggested Answer CAP II June 2018Pradeep Bhattarai67% (3)

- CA Inter Cost Important Questions For CA Nov'22Document93 pagesCA Inter Cost Important Questions For CA Nov'2202 Tapasvee ShahNo ratings yet

- 5 6084915055709651012Document8 pages5 6084915055709651012Ajit Yadav100% (1)

- Revision - Test - Paper - CAP - II - June - 2017 9Document181 pagesRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNo ratings yet

- CA Ipcc Costing Suggested Answers For Nov 20161Document12 pagesCA Ipcc Costing Suggested Answers For Nov 20161Sai Kumar SandralaNo ratings yet

- 3246accounting - CA IPCCDocument116 pages3246accounting - CA IPCCPrashant Pandey100% (1)

- Paper - 3: Cost and Management Accounting Questions Material CostDocument31 pagesPaper - 3: Cost and Management Accounting Questions Material CostMohammed Mustafa KampuNo ratings yet

- Corporate Law RTP CAP-II June 2016Document18 pagesCorporate Law RTP CAP-II June 2016Artha sarokar100% (1)

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Cost & Finance RTP Nov 15Document41 pagesCost & Finance RTP Nov 15Aaquib ShahiNo ratings yet

- Extracted Chapter 1Document103 pagesExtracted Chapter 1PalisthaNo ratings yet

- Chapter 8 Operating CostingDocument13 pagesChapter 8 Operating CostingDerrick LewisNo ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- Cost Acc Nov06Document27 pagesCost Acc Nov06api-3825774100% (1)

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- Standard CostingDocument24 pagesStandard Costingharsh100% (1)

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- Sdathn Ripsryd@r@ea@pis - Unit) : - SolutionDocument16 pagesSdathn Ripsryd@r@ea@pis - Unit) : - SolutionAnimesh VoraNo ratings yet

- NON INTEGRATED TheoryDocument26 pagesNON INTEGRATED TheorySushant MaskeyNo ratings yet

- 11 - Working Capital ManagementDocument39 pages11 - Working Capital Managementrajeshkandel345No ratings yet

- Practice Accounts Prime PDFDocument56 pagesPractice Accounts Prime PDFShraddha NepalNo ratings yet

- June 2019 All Paper SuggestedDocument120 pagesJune 2019 All Paper SuggestedEdtech NepalNo ratings yet

- Key Factors: Q-1 Key-Factor Product Mix Decision - Minimum Production Condition - Additional CostDocument11 pagesKey Factors: Q-1 Key-Factor Product Mix Decision - Minimum Production Condition - Additional CostPRABESH GAJURELNo ratings yet

- 4 Branch AccountsDocument18 pages4 Branch AccountsBAZINGA100% (1)

- Contract Costing (Unsolved)Document6 pagesContract Costing (Unsolved)ArnavNo ratings yet

- Investment For Cap 11Document8 pagesInvestment For Cap 11binuNo ratings yet

- Pe2 Acc Nov05Document19 pagesPe2 Acc Nov05api-3825774No ratings yet

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDocument5 pagesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesAbimanyu ShenilNo ratings yet

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsDocument107 pagesNon-Integrated, Integrated & Reconciliation of Cost and Financial Accountsanon_67206536267% (3)

- 18 Chapter4 Unit 1 2 Hire Purchase and Instalment PaymentDocument17 pages18 Chapter4 Unit 1 2 Hire Purchase and Instalment Paymentnarasimha_gudiNo ratings yet

- Chapter 4 Share Capital and DebenturesDocument102 pagesChapter 4 Share Capital and DebenturesAbhay SharmaNo ratings yet

- Chapter 9 Accounting For Branches Including Foreign Branches PDFDocument61 pagesChapter 9 Accounting For Branches Including Foreign Branches PDFAkshansh MahajanNo ratings yet

- 35 Resource 11Document16 pages35 Resource 11Anonymous bf1cFDuepPNo ratings yet

- Scanner CAP II Income Tax VATDocument162 pagesScanner CAP II Income Tax VATEdtech NepalNo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyNo ratings yet

- Ca Ipcc Costing and Financial Management Suggested Answers May 2015Document20 pagesCa Ipcc Costing and Financial Management Suggested Answers May 2015Prasanna KumarNo ratings yet

- 11 AmalgmationDocument38 pages11 AmalgmationPranaya Agrawal100% (1)

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- Tough LekkaluDocument42 pagesTough Lekkaludeviprasad03No ratings yet

- 7948final Adv Acc Nov05Document16 pages7948final Adv Acc Nov05Kushan MistryNo ratings yet

- Advanced Accounting Ca Ipcc OldDocument36 pagesAdvanced Accounting Ca Ipcc OldKrishna Rama Theertha KoritalaNo ratings yet

- Cash Flow Statement N ProblemsDocument30 pagesCash Flow Statement N ProblemsNaushad GulNo ratings yet

- Accounting From Incomplete Records For BookDocument21 pagesAccounting From Incomplete Records For BookbinuNo ratings yet

- Operating Costing - Pages 32Document32 pagesOperating Costing - Pages 32omikron omNo ratings yet

- Chapter 22 Contract Costing - NoRestrictionDocument18 pagesChapter 22 Contract Costing - NoRestrictionMohammad SaadmanNo ratings yet

- FA (1st) Dec2017Document3 pagesFA (1st) Dec2017dkdjfNo ratings yet

- 11 Accountancy First Term Set ADocument6 pages11 Accountancy First Term Set Amcsworkshop777No ratings yet

- Cash Management PoliciesDocument6 pagesCash Management Policieskinggeorge352No ratings yet

- 500 Question SetDocument72 pages500 Question SetSushant MaskeyNo ratings yet

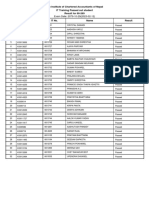

- Exam Date: 2079-11-26 (2023-03-10) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalDocument1 pageExam Date: 2079-11-26 (2023-03-10) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalSushant MaskeyNo ratings yet

- Layout Er SuggestDocument1 pageLayout Er SuggestSushant MaskeyNo ratings yet

- Cost of CapitalDocument37 pagesCost of CapitalSushant Maskey100% (1)

- IT ResultDocument1 pageIT ResultSushant MaskeyNo ratings yet

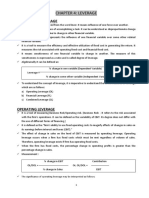

- Chapter 4: LeverageDocument15 pagesChapter 4: LeverageSushant MaskeyNo ratings yet

- Branch AccountingDocument51 pagesBranch AccountingSushant MaskeyNo ratings yet

- Capital StructureDocument31 pagesCapital StructureSushant Maskey100% (1)

- Exam Date: 2079-10-29 (2023-02-12) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalDocument1 pageExam Date: 2079-10-29 (2023-02-12) : IT Training Passed Out Student The Institute of Chartered Accountants of NepalSushant MaskeyNo ratings yet

- UntitledDocument72 pagesUntitledSushant MaskeyNo ratings yet

- Valn of CMN StockDocument18 pagesValn of CMN StockSushant Maskey0% (1)

- Budget AnswersDocument6 pagesBudget AnswersSushant MaskeyNo ratings yet

- MS Word: Marks AllocationDocument1 pageMS Word: Marks AllocationSushant MaskeyNo ratings yet

- Overheads PracticalDocument37 pagesOverheads PracticalSushant Maskey100% (1)

- Risk Return Basics/Portfolio Management: Learning Objective of The ChapterDocument34 pagesRisk Return Basics/Portfolio Management: Learning Objective of The ChapterSushant MaskeyNo ratings yet

- Ican Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Document16 pagesIcan Revision Class - Bond Valuation (Cap-Ii) : Ca Rajendra Mangal Joshi 1Sushant MaskeyNo ratings yet

- URP Income Tax Part SolutionsDocument127 pagesURP Income Tax Part SolutionsSushant MaskeyNo ratings yet

- EDP Audit CIS Environment MeaningDocument7 pagesEDP Audit CIS Environment MeaningSushant MaskeyNo ratings yet

- Chapter 4: LeverageDocument15 pagesChapter 4: LeverageSushant MaskeyNo ratings yet

- RD TReeqim RSFH XACz 0 W91617196460Document10 pagesRD TReeqim RSFH XACz 0 W91617196460Sushant MaskeyNo ratings yet

- NIOjid Akjc MDI9 L 5 Ulv I1617282937Document4 pagesNIOjid Akjc MDI9 L 5 Ulv I1617282937Sushant MaskeyNo ratings yet

- NON INTEGRATED TheoryDocument26 pagesNON INTEGRATED TheorySushant MaskeyNo ratings yet

- Labour/Employee Cost: Classification of Labor CostDocument9 pagesLabour/Employee Cost: Classification of Labor CostSushant MaskeyNo ratings yet

- CAPII Suggested Dec2015Document87 pagesCAPII Suggested Dec2015Sushant MaskeyNo ratings yet

- Labour: (A) (B) (C) (D) (E)Document40 pagesLabour: (A) (B) (C) (D) (E)Sushant MaskeyNo ratings yet

- Govt AuditingDocument12 pagesGovt AuditingSushant MaskeyNo ratings yet

- Industrial Enterprises Act 2076Document50 pagesIndustrial Enterprises Act 2076Sushant MaskeyNo ratings yet

- Budget & Budgetary ControlDocument15 pagesBudget & Budgetary ControlSushant MaskeyNo ratings yet

- Join Us On Telegram: Https://t.me/caaspirantsican2Document14 pagesJoin Us On Telegram: Https://t.me/caaspirantsican2Sushant MaskeyNo ratings yet

- Join Us On Telegram: Https://t.me/caaspirantsican2Document15 pagesJoin Us On Telegram: Https://t.me/caaspirantsican2Sushant MaskeyNo ratings yet

- Nps User Manual For Ddo'S: CMC LTD 1Document24 pagesNps User Manual For Ddo'S: CMC LTD 1RahulbetaNo ratings yet

- viewNitPdf 3094372 PDFDocument7 pagesviewNitPdf 3094372 PDFPratik GuptaNo ratings yet

- Phone Bill JulyDocument1 pagePhone Bill JulysudhirNo ratings yet

- Bank Branch Copy Bank Challan Form Applicant's Copy Bank Challan FormDocument1 pageBank Branch Copy Bank Challan Form Applicant's Copy Bank Challan FormSamrat MajumderNo ratings yet

- AUTODocument54 pagesAUTOELOUSOUANINo ratings yet

- Mid October, 2012 Edition of Warren County ReportDocument40 pagesMid October, 2012 Edition of Warren County ReportDan McDermottNo ratings yet

- Beer 2017-18 PDFDocument40 pagesBeer 2017-18 PDFPrasanth TalatotiNo ratings yet

- Notice of TenderDocument2 pagesNotice of Tendertony100% (22)

- Reyes Vs CA (Novation)Document2 pagesReyes Vs CA (Novation)Khay Ann100% (3)

- CMS Base II - Plan Segment DetailsDocument27 pagesCMS Base II - Plan Segment DetailsKrishna KingNo ratings yet

- Form 74Document4 pagesForm 74OgechinwankwoNo ratings yet

- Buytosell Subscription Form FaqDocument4 pagesBuytosell Subscription Form FaqChidinma NnoliNo ratings yet

- Local Treasury Operations ManualDocument52 pagesLocal Treasury Operations ManualAngelynne N. NieveraNo ratings yet

- Cash Advance SysthesisDocument18 pagesCash Advance SysthesisGERALD JABILLONo ratings yet

- Appendix 32 DVDocument1 pageAppendix 32 DVJeffree Lann AlvarezNo ratings yet

- Cert 2307V2018 Global MirakelDocument2 pagesCert 2307V2018 Global MirakelLeo BagtasNo ratings yet

- Basware Travel and Expense Management Fact Sheet A4Document4 pagesBasware Travel and Expense Management Fact Sheet A4gamallofNo ratings yet

- Share BuybackDocument28 pagesShare BuybackhaninadiaNo ratings yet

- Carrie Daves ReportDocument45 pagesCarrie Daves ReportGregory SMithNo ratings yet

- Card Account Number: Statement Date: 5342 7312 3017 6006 Payment Due Date: Minimum Amount Due: Credit Limit: Available LimitDocument1 pageCard Account Number: Statement Date: 5342 7312 3017 6006 Payment Due Date: Minimum Amount Due: Credit Limit: Available LimitNuruzzaman BiplobNo ratings yet

- Using The Lock Box Files in SAP FI: Erp Sap Sap FicoDocument2 pagesUsing The Lock Box Files in SAP FI: Erp Sap Sap FicojsphdvdNo ratings yet

- Manual On Financial Management of BarangayDocument26 pagesManual On Financial Management of BarangayJohn Arbrith Isip Esposo100% (1)

- Total Amount PayableDocument2 pagesTotal Amount PayableTushar SainiNo ratings yet

- Setoff BondDocument1 pageSetoff Bondmo100% (6)

- Account Number:: Hello..Document26 pagesAccount Number:: Hello..Alisha HandleyNo ratings yet

- Acctg 11 Q1 - FinalsDocument8 pagesAcctg 11 Q1 - FinalsIvy SaliseNo ratings yet

- Step by Step Process To Fill Online ApplicationformDocument4 pagesStep by Step Process To Fill Online ApplicationformSabya Sachee RaiNo ratings yet

- SAP FICO Master Data NotesDocument34 pagesSAP FICO Master Data NotesSoru SaxenaNo ratings yet

- Certified Payment Processing SpecialistDocument5 pagesCertified Payment Processing SpecialistaNo ratings yet

- Banking OmbudsmanDocument15 pagesBanking OmbudsmanViviliaaNo ratings yet