Professional Documents

Culture Documents

Government of Karnataka FAQs on Co-operative Society Audit Procedures

Uploaded by

ajitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government of Karnataka FAQs on Co-operative Society Audit Procedures

Uploaded by

ajitCopyright:

Available Formats

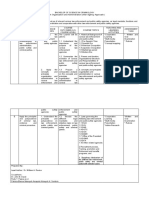

Govern

ment of

Karnatak

a

FREQUENTLY ASKED QUESTIONS

Questions Answers

1. What is the procedure for As per the provisions of Rule 29B(3) the Co-operative

selection of auditors for societies are grouped based on their working capital /

the audit of co-operative turnover and based on the experience, auditors are also

societies? classified and published in the departmental website address

http://www.sahakaradarpana.kar.nic.in The Co-operative

Societies according to their group have to select auditors in

their General Body as per Section 63(2) of Karnataka Co-

operative Societies Act.

2. Is the audit of all co- No, Co-operative Societies are to be audited either by the

operative societies to be departmental officers / auditors or by the Chartered

conducted only by Accountants, whom the General Body of the society selects

officers / officials of the from the list of eligible auditors maintained and published

department of Co- by the department.

operative Audit? and

whether Chartered

Accountants can conduct

the audit?

3. Should the Co-operative Yes, as per the provisions of Rule 30 of Karnataka Co-

Societies pay the Audit operative Societies Rules 1960 guidelines were issued by

Fee for the audit the department. Please refer the following circulars

conducted by the

department? (1) ADF/ADC/52/2012-13, dated:21-09-2013.

(1) Government Order No.: CO/09/CLM/2007, Bangalore,

dated:08-03-2007.

(2) Government Order No.: CO/198/CLM/2010, Bangalore,

dated:04-01-2011.

4. Should the co-operative Yes. The guidelines issued by Director of

societies follow the Co-operative Audit as per Rule 30 of Karnataka

guidelines issued by the Co-operative Societies Rules 1960 has to be followed.

Director of Co-operative

Audit with regard to the

remuneration to the

Chartered Accountants

for having conducted

audit.

5. Whether Scale of Audit Yes, as per the guidelines issued by the Director of Co-

Fee is fixed? operative audit on 21-09-2013, No.: ADF/ADC/ 52/2012-

13

6. Is there any provision for Yes. If it appears to the State Government on an application

re-audit? If so what is the by a Co-operative Society or otherwise that it is necessary

procedure? or expedient to re-audit the accounts of a society, the state

Government may, by an order provide for such re-audit as

per Section 63(13) of Karnataka Co-operative Societies Act.

7. Who will issue the Audit The Auditor who conducts the audit has to issue the audit

Report? report as per Section 63(8) of Karnataka Co-

operative Societies Act.

.

8. Whom should be Concerned District Deputy Director of Co-operative Audit

contacted for any to be contacted for any clarification.

clarification regarding

audit of co-operative

society

9. Is it only Co-operative It is mandatory for all co-operative institutions to prepare

Society should prepare the financial statements and the schedules and submit the

and submit financial same before the auditor within 30 days of the closure of that

statements and other co-operative year as per section 63(7) of Karnataka

relevant schedule to Co-operative Societies Act & as per Rule 29(3) of

audit? Karnataka Co-operative Societies Rules.

10. Whether audit report is to Yes. The department of co-operative audit has prescribed

be given in the prescribed audit report format for different types of co-operative

format. societies. The audit report in the prescribed format along

with schedules and certificate is to be issued by the

concerned auditor.

The auditors are free to narrate all other details which are

required to be narrated in detail.

11. Is it mandatory for the Yes. It is mandatory for the auditor conducting audit of co-

auditor conducting audit operative societies to follow Karnataka Co-

of co-operative societies operative Societies Act 1959 & Rules 1960, departmental

to follow Karnataka Co- audit instructions, manual, circulars issued by the Director

operative Societies Act & of Co-operative Audit/Souharda co-

Rules operatives/Nabard/RBI/Government Orders and other

related rules.

12. Is it mandatory for Yes. As per Section 63(1) of the Karnataka Co-operative

Chartered Accountant to Societies Act and as per Section 33(1) of Karnataka

get enlisted in the eligible Souharda Co-operatives Act, the Director of Co-operative

auditors before Audit is the authority to prepare and maintain the list of

conducting the audit of eligible auditors.

co-operative society /

souharda co-operatives?

You might also like

- Reliance Jio Infocomm Limited Annual Report 2019-20Document132 pagesReliance Jio Infocomm Limited Annual Report 2019-20pragya pathakNo ratings yet

- HDFC BankDocument239 pagesHDFC BankGagandeep SinghNo ratings yet

- Persons and Family Relations 1st and 2nd Exam Reviewer 1Document52 pagesPersons and Family Relations 1st and 2nd Exam Reviewer 1NealPatrickTingzon50% (4)

- Main Audit Report - SDCC 2018 SSNDocument84 pagesMain Audit Report - SDCC 2018 SSNDIWAKAR SHIVRAM DESAINo ratings yet

- 18th Annual Report of BVFCL For The Year 2019-20Document129 pages18th Annual Report of BVFCL For The Year 2019-20udiptya_papai2007No ratings yet

- Financial Statements Results 2022 23Document20 pagesFinancial Statements Results 2022 23bhanwardeep882No ratings yet

- Pemanggilan English RUPST 2024 UploadDocument5 pagesPemanggilan English RUPST 2024 UploaddalinemNo ratings yet

- 38th Annual General Meeting Notice PDFDocument24 pages38th Annual General Meeting Notice PDFSanguta PrasadNo ratings yet

- Cera Annual ReportDocument81 pagesCera Annual ReportSingh HarmanNo ratings yet

- Chapter 10 Question BankDocument39 pagesChapter 10 Question BankVINUS DHANKHARNo ratings yet

- Ultra TechDocument208 pagesUltra TechOp FfNo ratings yet

- Appointment of Auditors of Coop Housing SocietyDocument4 pagesAppointment of Auditors of Coop Housing Societydmk.murthyNo ratings yet

- Edited Audit Manual PDFDocument234 pagesEdited Audit Manual PDFXYZ123No ratings yet

- AGM Notice TataElxsiDocument12 pagesAGM Notice TataElxsiArun KumarNo ratings yet

- Notice and Annual Report 2017-18Document276 pagesNotice and Annual Report 2017-18GAURAV KUMARNo ratings yet

- Scrip Code: 500295 Scrip Code: VEDL Sub: Outcome of Board Meeting Held On July 21, 2023 - Financial ResultsDocument20 pagesScrip Code: 500295 Scrip Code: VEDL Sub: Outcome of Board Meeting Held On July 21, 2023 - Financial ResultsMankaranNo ratings yet

- Notice of 104th AGM of TPCLDocument19 pagesNotice of 104th AGM of TPCLSatyasheel ChandaneNo ratings yet

- Jubilant Ingrevia AGM NoticeDocument12 pagesJubilant Ingrevia AGM NoticeJayesh IsamaliyaNo ratings yet

- Auditing PRIs Act Gen 20-07-2002Document58 pagesAuditing PRIs Act Gen 20-07-2002Sourav KumarNo ratings yet

- Notice-59th AGMDocument13 pagesNotice-59th AGMnitintimesbackupNo ratings yet

- Rajshree Sugars 34th AGM NoticeDocument114 pagesRajshree Sugars 34th AGM NoticeAkshay BcaNo ratings yet

- Tvs Motor Company Limited: Ordinary BusinessDocument8 pagesTvs Motor Company Limited: Ordinary BusinessRaja BetaNo ratings yet

- Suggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- K. Murali Mohan: Sole ProprietorDocument3 pagesK. Murali Mohan: Sole ProprietoraravNo ratings yet

- KEC Notice of AGM FY 2021 22Document12 pagesKEC Notice of AGM FY 2021 22mohitbabuNo ratings yet

- Orient 17Document164 pagesOrient 17nabenupNo ratings yet

- RHF Annual Report 2020-21Document132 pagesRHF Annual Report 2020-21crsmaniNo ratings yet

- Rexnord Annual Report FY 2015 16Document52 pagesRexnord Annual Report FY 2015 16shahavNo ratings yet

- 2023020717Document42 pages2023020717Vishal JainNo ratings yet

- Annual-Report 2019-20-Final-Low-Resolution-newDocument286 pagesAnnual-Report 2019-20-Final-Low-Resolution-newHossam El DefrawyNo ratings yet

- WPL 15868 PB Notice PDFDocument23 pagesWPL 15868 PB Notice PDFkid crazyNo ratings yet

- Policy For Selection and Appointment of Statutory Central Auditors (Scas) For The Year 2022-23Document15 pagesPolicy For Selection and Appointment of Statutory Central Auditors (Scas) For The Year 2022-23Anand LuharNo ratings yet

- Joint Audit Guide 2024Document9 pagesJoint Audit Guide 2024jhxvjfw67pNo ratings yet

- Steps Approach Coopsoc Audit 30062018Document150 pagesSteps Approach Coopsoc Audit 30062018Ritesh AgarwalNo ratings yet

- ResoldocDocument17 pagesResoldocAyush GargNo ratings yet

- Ashoka Buildcon AR FY19Document252 pagesAshoka Buildcon AR FY19PratikNo ratings yet

- Audited Fianancial Results For Year Ended 31st March 2023Document8 pagesAudited Fianancial Results For Year Ended 31st March 2023ashverya agrawalNo ratings yet

- RCOM Annual Report 2021 22Document196 pagesRCOM Annual Report 2021 22Utsav KhowalaNo ratings yet

- Roots Industries Annual Report 2019Document84 pagesRoots Industries Annual Report 2019Mr. K.S. Raghul Asst Prof MECH0% (1)

- Notice of 26th Annual General MeetingDocument12 pagesNotice of 26th Annual General MeetingLaxmikant RathiNo ratings yet

- Compliance Newsletter_March, 2024Document13 pagesCompliance Newsletter_March, 2024Chiranjibi PandaNo ratings yet

- NHPC Limited 45th AGM NoticeDocument23 pagesNHPC Limited 45th AGM NoticeSag SagNo ratings yet

- Ambuja Cements Limited: Notice of Postal BallotDocument8 pagesAmbuja Cements Limited: Notice of Postal BallotPankaj TiwariNo ratings yet

- Balrampur Chini Q4FY20Document21 pagesBalrampur Chini Q4FY20premNo ratings yet

- Notice: Ordinary BusinessDocument10 pagesNotice: Ordinary BusinessEsha ChaudharyNo ratings yet

- Gillanders Arbuthnot Company AGM NoticeDocument73 pagesGillanders Arbuthnot Company AGM NoticetheadityaNo ratings yet

- Master Circular Oct 11, 2022Document18 pagesMaster Circular Oct 11, 2022Sarim FazliNo ratings yet

- Documentservice PDFDocument27 pagesDocumentservice PDFMayank KumarNo ratings yet

- Magna Electro Castings - 31.3.2021Document118 pagesMagna Electro Castings - 31.3.2021BHARGAVINo ratings yet

- Hindustan Copper 2017Document115 pagesHindustan Copper 2017Fredrick TimotiusNo ratings yet

- Banking Law Notes Which Are Helpful For Exams Last Minute StudiesDocument31 pagesBanking Law Notes Which Are Helpful For Exams Last Minute StudiesCRIC WORLDNo ratings yet

- Annual_Report_2022_2023r3kVwbhIE8Document109 pagesAnnual_Report_2022_2023r3kVwbhIE8prajju788792No ratings yet

- Cera Sanitaryware Annual Report 2023Document177 pagesCera Sanitaryware Annual Report 2023Ashu RaghuwanshiNo ratings yet

- BIS List of 946 Items 5Document82 pagesBIS List of 946 Items 5AvijitSinharoyNo ratings yet

- Annual Report 2019 20Document126 pagesAnnual Report 2019 20Himanshu SharmaNo ratings yet

- SBI-Life12644 NoticeDocument14 pagesSBI-Life12644 NoticeSag SagNo ratings yet

- MPL Annual Report 2020-2021Document131 pagesMPL Annual Report 2020-2021NOWFALNo ratings yet

- Type Text HereDocument9 pagesType Text HerevineminaiNo ratings yet

- Corporate Governance Code ReformsDocument16 pagesCorporate Governance Code ReformsnikhilbalanNo ratings yet

- Seventy First Annual Report 2006 2007Document63 pagesSeventy First Annual Report 2006 2007Ashwani KumarNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- 10 Things To Do When Speaking To Have - PresenceDocument1 page10 Things To Do When Speaking To Have - PresenceajitNo ratings yet

- 5 Types of Data Analytics and Their ProminenceDocument3 pages5 Types of Data Analytics and Their ProminenceajitNo ratings yet

- Bad Days - 53x12Document2 pagesBad Days - 53x12ajitNo ratings yet

- Cajournal Jan2023 9Document3 pagesCajournal Jan2023 9ajitNo ratings yet

- 17 - 20 View and Counterview August 2018Document4 pages17 - 20 View and Counterview August 2018ajitNo ratings yet

- ICAI Ready Referencer 2020Document100 pagesICAI Ready Referencer 2020ajitNo ratings yet

- Cajournal Jan2023 12Document4 pagesCajournal Jan2023 12ajitNo ratings yet

- 34 View and Counterview AprilDocument5 pages34 View and Counterview AprilajitNo ratings yet

- Self KnowledgeDocument21 pagesSelf KnowledgeajitNo ratings yet

- Cajournal Jan2023 15Document2 pagesCajournal Jan2023 15ajitNo ratings yet

- Headcount PlanningDocument4 pagesHeadcount PlanningajitNo ratings yet

- GST Exemption - SRCCDocument26 pagesGST Exemption - SRCCajitNo ratings yet

- Goal Setting TheoryDocument2 pagesGoal Setting TheoryajitNo ratings yet

- Cajournal Jan2023 13Document3 pagesCajournal Jan2023 13ajitNo ratings yet

- Improve Breathing - 53x12Document2 pagesImprove Breathing - 53x12ajitNo ratings yet

- Hydration - 53x12Document2 pagesHydration - 53x12ajitNo ratings yet

- Rehydration - 53x12Document2 pagesRehydration - 53x12ajitNo ratings yet

- Reasonable Investor (S) : T C.W. LDocument58 pagesReasonable Investor (S) : T C.W. LajitNo ratings yet

- Tapering - 53x12Document1 pageTapering - 53x12ajitNo ratings yet

- Asset Allocation MistakesDocument10 pagesAsset Allocation MistakesajitNo ratings yet

- GST Annual Return & Reco StatmntDocument56 pagesGST Annual Return & Reco StatmntajitNo ratings yet

- Differential Incidence of Procrastination Between Blue and White-Collar WorkersDocument8 pagesDifferential Incidence of Procrastination Between Blue and White-Collar WorkersajitNo ratings yet

- Music, Mind, and MeaningDocument14 pagesMusic, Mind, and MeaningajitNo ratings yet

- Training & Hormones - 53x12Document2 pagesTraining & Hormones - 53x12ajitNo ratings yet

- Brief Facts: Page 1 of 5Document5 pagesBrief Facts: Page 1 of 5ajitNo ratings yet

- Controversies in Input Tax Credit RestrictionsDocument33 pagesControversies in Input Tax Credit RestrictionsajitNo ratings yet

- Taxguru - In-Dividend Stripping and Bonus StrippingDocument10 pagesTaxguru - In-Dividend Stripping and Bonus StrippingajitNo ratings yet

- Sector Business Cycle AnalysisDocument12 pagesSector Business Cycle AnalysisThinh DoNo ratings yet

- FATCA & CRS UpdatesDocument54 pagesFATCA & CRS UpdatesajitNo ratings yet

- Controversies Val Section56 AnupShahDocument70 pagesControversies Val Section56 AnupShahajitNo ratings yet

- Fiduciary RelationshipsDocument29 pagesFiduciary RelationshipsRavikantDhanushDeshmukhNo ratings yet

- Request For Removal From The Register of Marriage CelebrantsDocument3 pagesRequest For Removal From The Register of Marriage Celebrantspretea msNo ratings yet

- Arrest and Booking FormDocument1 pageArrest and Booking FormMosawan AikeeNo ratings yet

- POEA Holds Philsa Liable for Illegal ExactionsDocument2 pagesPOEA Holds Philsa Liable for Illegal ExactionsKhryz CallëjaNo ratings yet

- Chapter 20Document45 pagesChapter 20srirama raoNo ratings yet

- MULTI-VENTURES CAPITAL V StalwartDocument1 pageMULTI-VENTURES CAPITAL V StalwartPhilip SuplicoNo ratings yet

- PC Danny Major - Wrongly Jailed by West Yorkshire PoliceDocument3 pagesPC Danny Major - Wrongly Jailed by West Yorkshire PolicePoliceCorruptionNo ratings yet

- North Myrtle Beach Noise Ordinance Oct. 4, 2021Document6 pagesNorth Myrtle Beach Noise Ordinance Oct. 4, 2021ABC15 NewsNo ratings yet

- Philippines Supreme Court upholds no set-off of reforestation charges against tax liabilityDocument2 pagesPhilippines Supreme Court upholds no set-off of reforestation charges against tax liabilityCeresjudicataNo ratings yet

- ZIMBABWE_REFRIGERATION_ASSOCIATION_DRAFT_CONSTITUTION_AND_RULES_Revised_FinaDocument12 pagesZIMBABWE_REFRIGERATION_ASSOCIATION_DRAFT_CONSTITUTION_AND_RULES_Revised_FinaKudzai ManyanyeNo ratings yet

- Terms and ConditionsDocument2 pagesTerms and ConditionsAdrienne87aNo ratings yet

- Sal Panelo, Filipino lawyer and Duterte's Chief Legal CounselDocument2 pagesSal Panelo, Filipino lawyer and Duterte's Chief Legal CounselRENGIE GALONo ratings yet

- Topic 14 - Estate PlanningDocument57 pagesTopic 14 - Estate PlanningArun GhatanNo ratings yet

- Analysis of Rehabilitation Programs in Pasig City JailDocument2 pagesAnalysis of Rehabilitation Programs in Pasig City JailJohn Kevin DizonNo ratings yet

- Mock Polity Test SectionDocument17 pagesMock Polity Test SectionYuseer AmanNo ratings yet

- Checklist of Requirements For Building Permit Application - TIEZADocument5 pagesChecklist of Requirements For Building Permit Application - TIEZARandolph QuilingNo ratings yet

- Proceeds of Crime Act Establishes Management DirectorateDocument47 pagesProceeds of Crime Act Establishes Management DirectoratejideNo ratings yet

- Lesson 1Document26 pagesLesson 1Kristel Jen E. RosalesNo ratings yet

- Law Enforcement Organization and Administration (Inter-Agency Approach)Document3 pagesLaw Enforcement Organization and Administration (Inter-Agency Approach)Seagal Umar100% (3)

- Black Codes ActivityDocument3 pagesBlack Codes Activityapi-359633679No ratings yet

- Macn-Ssn - (435922529) Affidavit of Universal Sovereign Security NumberDocument2 pagesMacn-Ssn - (435922529) Affidavit of Universal Sovereign Security Numbertheodore moses antoine bey100% (1)

- Foi 26868..Document3 pagesFoi 26868..Eliot GanoshiNo ratings yet

- Bryskman ComplaintDocument12 pagesBryskman ComplaintasamahavvNo ratings yet

- The COMELEC's Power To Administer Elections Includes The Power To Conduct A Plebiscite Beyond The Schedule Prescribed by LawDocument3 pagesThe COMELEC's Power To Administer Elections Includes The Power To Conduct A Plebiscite Beyond The Schedule Prescribed by LawNat DuganNo ratings yet

- UK Parliament sovereignty affected by devolution, EU law and human rightsDocument12 pagesUK Parliament sovereignty affected by devolution, EU law and human rightsMuhammad Salman QureshiNo ratings yet

- Tax Remedies DigestsDocument50 pagesTax Remedies DigestsybunNo ratings yet

- Ebook PDF CJ 2017 The Justice Series 1st Edition by James A Fagin PDFDocument41 pagesEbook PDF CJ 2017 The Justice Series 1st Edition by James A Fagin PDFphilip.pelote179100% (36)

- Tanzo vs. DrilonDocument2 pagesTanzo vs. DrilonMartin RegalaNo ratings yet