Professional Documents

Culture Documents

Home Assignment (3) : Project 101 of Billya Spare Parts

Home Assignment (3) : Project 101 of Billya Spare Parts

Uploaded by

Ahmed Rabie0 ratings0% found this document useful (0 votes)

1 views2 pagesOriginal Title

Home-Assignment-3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesHome Assignment (3) : Project 101 of Billya Spare Parts

Home Assignment (3) : Project 101 of Billya Spare Parts

Uploaded by

Ahmed RabieCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

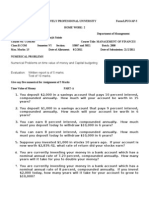

Home Assignment (3): Project 101 of Billya Spare Parts

"Billya Spare Parts" is a company specialized in the manufacturing of

auto-spare parts. The first project of the company coded "Project 101" is

now under study and the following data and information are presented:

1. The establishment year of "Project 101" will be followed by seven

operating years. This project is exempted from the income tax for the first

five years of operating while it will be taxed at a flat rate of 20% for each

of the last two years of operating.

2. The cash current operating sales revenue is estimated at L.E 5 million for

each of the first five years of operating and L.E 5.09 million for each of the

last two years of operating. In addition to the cash current operating sales

revenue, it is expected to collect in cash a net residual value of L.E 1.146

million at the end of the seventh year of operating.

3. The investment costs are estimated at a total of L.E 10 million including

L.E 2.5 million for the project's land, L.E 6 million for the depreciable fixed

assets where the annual depreciation is estimated at L.E 0.84 million for

every operating year, L.E 1 million for the long-term intangibles which will

be equally amortized during the first four years of operating, and L.E 0.5

million for the first working capital of the first 3 months of operating.

4. 11% interest loan of L.E 4.5 million will be obtained just before the start of

the first year of operating. The principal of the loan will be repaid through

three yearly equal installments. The interest charges at the end of each of

these first three years of operating are estimated as follows in L.E

millions: 0.495, 0.330 and 0.165 respectively.

5. The accounting net profit at the end of each of the first five years of

operating will be in L.E millions: 0.915, 1.08, 1.245, 1.41 and 1.66

respectively. The "after-tax accounting net profit" will be L.E 1.4 million

for each of the last two years of operating. All cash operating costs will be

paid when it will be incurred.

6. The discount rate of the company is currently 17%.

Required:

a. Calculate the annual income tax for each of the seven years of operating.

b. Prepare a table to compute for each operating year the current operating

cash cost exclusive of interest.

c. Use the direct way to prepare a table to compute the NCF from the

project's view.

d. Calculate the Net Present Value (NPV), and give a brief comment.

e. Is the Internal Rate of Return (IRR) of "Project 101" 16% or 17% or 18%?

For guidance, the PV of L.E 1, i.e. 1/(𝟏 + 𝒓)𝒏 :

Years 1 2 3 4 5 6 7 8

16% 0.8621 0.7432 0.6407 0.5523 0.4761 0.4104 0.3538 0.3046

17% 0.8547 0.7305 0.6244 0.5337 0.4561 0.3898 0.3332 0.2848

18% 0.8475 0.7182 0.6086 0.5158 0.4371 0.3704 0.3139 0.2660

Approximate the NPV only to the nearest L.E 1000.

You might also like

- AIFS Case Study SolutionsDocument4 pagesAIFS Case Study SolutionsOmarChehimi83% (6)

- Alifia Farradita Fedli / 119410006 1.2. The Accumulation and Amount FunctionDocument9 pagesAlifia Farradita Fedli / 119410006 1.2. The Accumulation and Amount Functionfarra dita fedliNo ratings yet

- CF Group Assignment - 2Document2 pagesCF Group Assignment - 2Maggie0% (1)

- Corporate Finance FinalsDocument66 pagesCorporate Finance FinalsRahul Patel50% (2)

- WaterPlayPart2 Summer 2019Document2 pagesWaterPlayPart2 Summer 2019ChaituNo ratings yet

- Tutorial 4 QuestionsDocument4 pagesTutorial 4 Questionsguan junyan0% (1)

- LBO Modeling Test Example - Street of WallsDocument18 pagesLBO Modeling Test Example - Street of WallsVineetNo ratings yet

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDocument84 pagesFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiNo ratings yet

- Electronics Unlimited Case StudyDocument1 pageElectronics Unlimited Case StudyHinhHinhNo ratings yet

- Assignment Capital Budgeting Mini ProjectDocument2 pagesAssignment Capital Budgeting Mini ProjectArslanNo ratings yet

- Corporate Financial Management I: SBS - BA Dual Program: BBA - BFDocument4 pagesCorporate Financial Management I: SBS - BA Dual Program: BBA - BFDanik El ZuniNo ratings yet

- PRQZ 2Document26 pagesPRQZ 2Hoa Long ĐởmNo ratings yet

- F 9Document32 pagesF 9billyryan1100% (2)

- NPV & Capital Budgeting QuestionsDocument8 pagesNPV & Capital Budgeting QuestionsAnastasiaNo ratings yet

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- "ABS" Project Case: "ABS" Is The First Project of The CU Company. The Economic Life of This Project Is 8Document16 pages"ABS" Project Case: "ABS" Is The First Project of The CU Company. The Economic Life of This Project Is 8islam hamdyNo ratings yet

- Lbo Modeling Test Example: StreetofwallsDocument18 pagesLbo Modeling Test Example: StreetofwallsLesterNo ratings yet

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- Problems On Cash FlowsDocument14 pagesProblems On Cash FlowsAbin Jose100% (2)

- p1 Managerial Finance August 2017Document24 pagesp1 Managerial Finance August 2017ghulam murtazaNo ratings yet

- 2011-08-13 221103 Acoutning QuestionsDocument4 pages2011-08-13 221103 Acoutning QuestionsNuha AbdelkarimNo ratings yet

- Project Financial Appraisal - NumericalsDocument5 pagesProject Financial Appraisal - NumericalsAbhishek KarekarNo ratings yet

- Revision BBMF2813Document3 pagesRevision BBMF2813Fred LeletNo ratings yet

- Cffinalb SPR 11Document10 pagesCffinalb SPR 11Arun PrabuNo ratings yet

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAdora Chielka SalesNo ratings yet

- 7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFDocument32 pages7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFPrasanna SharmaNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument6 pagesInstitute of Actuaries of India: ExaminationsRochak JainNo ratings yet

- Problem Set 04 - Introduction To Excel Financial FunctionsDocument3 pagesProblem Set 04 - Introduction To Excel Financial Functionsasdf0% (1)

- Finances em 2Document3 pagesFinances em 2Craaft NishiNo ratings yet

- Ch4 ApplicationDocument4 pagesCh4 ApplicationMUSTAFANo ratings yet

- Institute of Actuaries of India: ExaminationsDocument5 pagesInstitute of Actuaries of India: ExaminationsHemanshu JainNo ratings yet

- Financial Management Assignment (Working Capital) by Anshul KhannaDocument4 pagesFinancial Management Assignment (Working Capital) by Anshul KhannaAnshul KhannaNo ratings yet

- IRR of The ProjectDocument9 pagesIRR of The Projectsamuel kebedeNo ratings yet

- HW Week 5 Fin/571Document5 pagesHW Week 5 Fin/571trelvisd0% (1)

- Investment Decision Rule For ItDocument2 pagesInvestment Decision Rule For ItIzzahIkramIllahiNo ratings yet

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- Capital Budgeting Exercise1Document14 pagesCapital Budgeting Exercise1Bigbi Kumar100% (1)

- Capital BudgetingDocument6 pagesCapital Budgetingkaf_scitNo ratings yet

- Capital Budgeting Exercise 1Document2 pagesCapital Budgeting Exercise 1Mohamed ZaitoonNo ratings yet

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaNo ratings yet

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- Seminar 10Document24 pagesSeminar 10Tharindu PereraNo ratings yet

- Revision Question 2023.11.21Document5 pagesRevision Question 2023.11.21rbaambaNo ratings yet

- Chap 11-EXDocument1 pageChap 11-EXvytltqs170172No ratings yet

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1lyellNo ratings yet

- Engineering Economy Problem1Document11 pagesEngineering Economy Problem1frankRACENo ratings yet

- Finance RTP Cap-II June 2016Document37 pagesFinance RTP Cap-II June 2016Artha sarokarNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Advanced Financial Management: Thursday 10 June 2010Document10 pagesAdvanced Financial Management: Thursday 10 June 2010Waleed MinhasNo ratings yet

- Endterm ExamDocument6 pagesEndterm ExamMasTer PanDaNo ratings yet

- Question One Acca 2014 June QN 1Document4 pagesQuestion One Acca 2014 June QN 1Joseph Timasi ChachaNo ratings yet

- Icaew FMDocument16 pagesIcaew FMcima2k15No ratings yet

- Department of Economics Boğaziçi University Economics of Corporate Finance EC 485Document3 pagesDepartment of Economics Boğaziçi University Economics of Corporate Finance EC 485Shravan DeekondaNo ratings yet

- Estimation of Project Cash Flows: RequiredDocument4 pagesEstimation of Project Cash Flows: Requiredjjayakumar_vjNo ratings yet

- Engineering EconomyDocument4 pagesEngineering EconomyHenley Pasion NivalNo ratings yet

- Caselet 1Document2 pagesCaselet 1SUBHAJYOTI PALNo ratings yet

- Module 3 - Capital Budgeting - 3A - Questions 2022-23Document10 pagesModule 3 - Capital Budgeting - 3A - Questions 2022-23Manya GargNo ratings yet

- 9 - Case Navneet EnterpriseDocument1 page9 - Case Navneet EnterpriseJay GuptaNo ratings yet

- d15 Hybrid f9 Q PDFDocument8 pagesd15 Hybrid f9 Q PDFhelenxiaochingNo ratings yet

- Assignment 2Document4 pagesAssignment 2Jayanth Appi KNo ratings yet

- Du PontDocument8 pagesDu PontTên Hay ThếNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 6.a. Audit of CashDocument21 pages6.a. Audit of CashdewiNo ratings yet

- MATH 108X - Budgeting Case Study Excel File: Text Box For Part #5Document4 pagesMATH 108X - Budgeting Case Study Excel File: Text Box For Part #5Emmanuel Nsa0% (1)

- JBCC Payment Certificate PBA 2142.aug07Document1 pageJBCC Payment Certificate PBA 2142.aug07Francois EhlersNo ratings yet

- Nifty & Bank Nifty Technical - Sentimental Overview - Investing - Com IndiaDocument4 pagesNifty & Bank Nifty Technical - Sentimental Overview - Investing - Com IndiasudhakarrrrrrNo ratings yet

- AccountingDocument17 pagesAccountingKimberly Mae AriasNo ratings yet

- 20 2023 12 03 05 PMDocument4 pages20 2023 12 03 05 PMChidinma NnoliNo ratings yet

- Financial Acct2 2Nd Edition Godwin Solutions Manual Full Chapter PDFDocument56 pagesFinancial Acct2 2Nd Edition Godwin Solutions Manual Full Chapter PDFphongtuanfhep4u100% (10)

- FAR 3.2 & MAS - 2.2.1.3 Ul Cpa Review Center R.D.BalocatingDocument14 pagesFAR 3.2 & MAS - 2.2.1.3 Ul Cpa Review Center R.D.Balocatingfghhnnnjml100% (1)

- Accounting Chapter 3Document14 pagesAccounting Chapter 3Huy Nguyễn NgọcNo ratings yet

- Swot Analysis of Asset Classes: 1. Gold and Precious MetalsDocument9 pagesSwot Analysis of Asset Classes: 1. Gold and Precious MetalsFemi SamNo ratings yet

- Macro Quiz 5 PDFDocument4 pagesMacro Quiz 5 PDFcvofoxNo ratings yet

- Ashok KumarDocument2 pagesAshok Kumarapexlofi93421No ratings yet

- Kumpulan 2 - Kancil Group ProjectDocument58 pagesKumpulan 2 - Kancil Group ProjectYamunasri Mari100% (1)

- W2 - Key Tutorial 3Document5 pagesW2 - Key Tutorial 3Rules of Survival MALAYSIANo ratings yet

- Dissertation Report On Reliance Mutual FundDocument8 pagesDissertation Report On Reliance Mutual FundWriteMyPapersDiscountCodeCleveland100% (1)

- Financial Models - 2022Document9 pagesFinancial Models - 2022Hamza AsifNo ratings yet

- Factors Affecting Deposit MobilizationDocument13 pagesFactors Affecting Deposit MobilizationVu Minh ChauNo ratings yet

- MA BudgetingDocument46 pagesMA Budgetingfrancis MagobaNo ratings yet

- Deposit: Characteristics of The Contract of Deposit: What Is Contract of Deposit?Document4 pagesDeposit: Characteristics of The Contract of Deposit: What Is Contract of Deposit?Nicole Reign EscusaNo ratings yet

- Basic Banking Awareness Questions AnswersDocument7 pagesBasic Banking Awareness Questions AnswersSoumyaprakash PaniNo ratings yet

- Macro Final 2019Document124 pagesMacro Final 2019Sabiha SaeedNo ratings yet

- Loan Application FormDocument6 pagesLoan Application FormJagdeep MehraNo ratings yet

- CRISIL Mutual Fund Ranking Methodology Dec 2015Document5 pagesCRISIL Mutual Fund Ranking Methodology Dec 2015krajeshkumarxNo ratings yet

- PPTDocument21 pagesPPTRazan TataiNo ratings yet

- INVESTMENT AND COMPETITION LAW - Unit 2Document62 pagesINVESTMENT AND COMPETITION LAW - Unit 2saif aliNo ratings yet

- SPDR Barclays Capital Short Term Corporate Bond ETF 1-3YDocument2 pagesSPDR Barclays Capital Short Term Corporate Bond ETF 1-3YRoberto PerezNo ratings yet