Professional Documents

Culture Documents

Assignment#12 External Growth Strategies Mergers, Acquisitions, Alliances

Uploaded by

Anjaneth A. Villegas0 ratings0% found this document useful (0 votes)

12 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageAssignment#12 External Growth Strategies Mergers, Acquisitions, Alliances

Uploaded by

Anjaneth A. VillegasCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Self‐Study Questions

1. Most of the mergers and acquisitions shown in Figure 14.1 are

horizontal (i.e., they are between companies within the same sector).

Some of these horizontal mergers and acquisitions are between

companies in the same country; some cross national borders. Are there

any reasons why horizontal mergers and acquisitions are likely to be

more beneficial than other types of mergers and acquisitions

(diversifying and vertical) and involve less risk? Among these

horizontal mergers and acquisitions, which do you think will be more

successful: those between companies in the same country or those that

cross borders?

2. A large number of studies examining the success of M&A have

examined their impact on shareholder returns. Most of these studies

measure changes in the market value of the merging companies from

before the merger announcement to several months after. What do

these studies tell us about the effects of mergers and acquisitions?

3. Commenting on the Pixar acquisition (Strategy Capsule 14.1), Disney's

CEO stated: “You can accomplish a lot more as one company than you

can as part of a joint venture.” Do you agree? Illustrate your answer by

referring to some of the joint ventures (or alliances) referred to in this

chapter. Would these have been more successful as mergers?

4. In the motor industry, companies have followed different

internationalization paths. Toyota expanded organically, establishing

subsidiaries in overseas markets. Ford went on an acquisition spree,

buying Volvo, Jaguar, Land Rover, and Mazda. General Motors has

made extensive use of strategic alliances (Figure 14.3). Which strategy

is best? Which strategy would you recommend to Chinese automobile

manufacturers such as SAIC and Dongfeng?

You might also like

- Strategic Alliances: Three Ways to Make Them WorkFrom EverandStrategic Alliances: Three Ways to Make Them WorkRating: 3.5 out of 5 stars3.5/5 (1)

- Chapter 9Document10 pagesChapter 9Mansoor KhalidNo ratings yet

- Strategic Alliances Between LENOVO and IBMDocument29 pagesStrategic Alliances Between LENOVO and IBMSumedhAmane100% (4)

- Chapter 9 Case StudyDocument2 pagesChapter 9 Case StudyJemima LopezNo ratings yet

- Strategy Management Chp.8-Global StrategyDocument6 pagesStrategy Management Chp.8-Global StrategyNabilah UsmanNo ratings yet

- Multinational Business Finance by Shapiro Chapter 1 SolutionsDocument10 pagesMultinational Business Finance by Shapiro Chapter 1 SolutionsEdward YangNo ratings yet

- Assignment#12 External Growth Strategies Mergers, Acquisitions, AlliancesDocument3 pagesAssignment#12 External Growth Strategies Mergers, Acquisitions, AlliancesPatricia CruzNo ratings yet

- Apple EditedDocument11 pagesApple Editedjulius wambuiNo ratings yet

- Market Entry Strategy To Be Successful in International MarketDocument27 pagesMarket Entry Strategy To Be Successful in International MarketParul JainNo ratings yet

- Case Study 1Document4 pagesCase Study 1Naomi ChanNo ratings yet

- Niharika IDPDocument8 pagesNiharika IDPsamNo ratings yet

- International Joint Ventures - Sasmita MohantyDocument17 pagesInternational Joint Ventures - Sasmita MohantySasmita RoutrayNo ratings yet

- IB Essay QuestionsDocument4 pagesIB Essay QuestionsJoey Zahary GintingNo ratings yet

- Final Hill Hult GBT 10e IM Ch13 SGDocument9 pagesFinal Hill Hult GBT 10e IM Ch13 SGJeff CagleNo ratings yet

- Strategic AlianceDocument23 pagesStrategic Aliancepinku_thakkarNo ratings yet

- Lecture Notes: Chapter 13 - Global StrategiesDocument3 pagesLecture Notes: Chapter 13 - Global StrategiesnikowawaNo ratings yet

- Chap 8Document5 pagesChap 8Sinthya Chakma RaisaNo ratings yet

- Chapter 13 SUMMARYDocument11 pagesChapter 13 SUMMARYHamza AlBulushiNo ratings yet

- Mini Case Chapter 9Document4 pagesMini Case Chapter 9Angelina AliciaNo ratings yet

- Non-Generic Competitive StrategiesDocument22 pagesNon-Generic Competitive StrategiesShah Maqsumul Masrur TanviNo ratings yet

- Empirical StudyDocument16 pagesEmpirical StudyAdam LenarskiNo ratings yet

- BusinessDocument6 pagesBusinessNGNo ratings yet

- Ford Motor Company Strategic Fit With THDocument10 pagesFord Motor Company Strategic Fit With THFaisal Rehman100% (1)

- Chapter Exercise IE W5Document3 pagesChapter Exercise IE W5Atikah ZainuddinNo ratings yet

- Title of The Project Report: Horizontal Merger / AcquisitionDocument4 pagesTitle of The Project Report: Horizontal Merger / AcquisitionNeha SinghNo ratings yet

- Luo JournalofWorldBusiness2007 AcoopetitionperspectiveofglobalcompetitionDocument17 pagesLuo JournalofWorldBusiness2007 AcoopetitionperspectiveofglobalcompetitionTanja AshNo ratings yet

- Unit 4 International Market Entry Strategies: StructureDocument21 pagesUnit 4 International Market Entry Strategies: Structuresathishar84No ratings yet

- MNC SDocument35 pagesMNC SHamis Rabiam MagundaNo ratings yet

- Business Policy and Strategy PDFDocument13 pagesBusiness Policy and Strategy PDFAnmol GuptaNo ratings yet

- Module 8 Strategic Management 2ND Sem 2021 2022Document4 pagesModule 8 Strategic Management 2ND Sem 2021 2022Lady Lou Ignacio LepasanaNo ratings yet

- Livro Administração Estratégica de Mercado CAP 07Document5 pagesLivro Administração Estratégica de Mercado CAP 07Eleny Dos AnjosNo ratings yet

- Lecture 5Document11 pagesLecture 5Skyy I'mNo ratings yet

- Joint Ventures Synergies and BenefitsDocument5 pagesJoint Ventures Synergies and BenefitsleeashleeNo ratings yet

- Global Market Entry Strategies: Licensing, Investment, and Strategic AlliancesDocument7 pagesGlobal Market Entry Strategies: Licensing, Investment, and Strategic AlliancesGautam BhallaNo ratings yet

- A Study of Mergers and Acquisitions in India and Their Impact On The Operating Performance and Shareholder WealthDocument41 pagesA Study of Mergers and Acquisitions in India and Their Impact On The Operating Performance and Shareholder WealthJarina JohnsonNo ratings yet

- Summary 8 2018Document4 pagesSummary 8 2018Stanley HoNo ratings yet

- Overview of Mergers and Acquisitions PDFDocument5 pagesOverview of Mergers and Acquisitions PDFEchuOkan1No ratings yet

- Structuring An International Joint Venture in The European UnionDocument9 pagesStructuring An International Joint Venture in The European UnionChengsen GuoNo ratings yet

- Competitor AnalysisDocument7 pagesCompetitor AnalysisAzman ShahNo ratings yet

- Chap015 PDFDocument21 pagesChap015 PDFSadia SaeedNo ratings yet

- Investment Entry Modes: Wholly Owned Subsidiaries, Joint Ventures, and Strategic AlliancesDocument8 pagesInvestment Entry Modes: Wholly Owned Subsidiaries, Joint Ventures, and Strategic AlliancesSang Ayu JuniariNo ratings yet

- Critical Assessment of Performance of Mergers and AcquisitionsDocument12 pagesCritical Assessment of Performance of Mergers and AcquisitionsThe IjbmtNo ratings yet

- Business Strategy Assignment 1 - 2018 - AnswerDocument3 pagesBusiness Strategy Assignment 1 - 2018 - AnswerSudhansu Swain100% (1)

- The Competitive Advantage of Strategic AlliancesDocument9 pagesThe Competitive Advantage of Strategic Alliancesnimbusmyst100% (2)

- Alliance Formation, Both Globally and Locally, Chapter 9Document6 pagesAlliance Formation, Both Globally and Locally, Chapter 9Jeralden Namoc BalaguaNo ratings yet

- Pathfinder Ch05Document22 pagesPathfinder Ch05daniNo ratings yet

- Dec 2009Document17 pagesDec 2009Murugesh Kasivel EnjoyNo ratings yet

- Profitability Merger Portfolio 27Document22 pagesProfitability Merger Portfolio 27Chaudhry Adeel WaheedNo ratings yet

- Questionnaire: Personal/Professional DetailsDocument19 pagesQuestionnaire: Personal/Professional DetailssatishNo ratings yet

- Mergers, Acquisitions and Firms' Performance: Experience of TATA IndustryDocument18 pagesMergers, Acquisitions and Firms' Performance: Experience of TATA IndustryayraNo ratings yet

- Speaking 5Document48 pagesSpeaking 5greenlife.linhNo ratings yet

- Internationalization: 12.1 Internationalization and Globalization, DifferencesDocument10 pagesInternationalization: 12.1 Internationalization and Globalization, DifferencesxodiacNo ratings yet

- The Long-Term Performance of Venture Capital Backed IPOs: Comparing The United States and EuropeDocument37 pagesThe Long-Term Performance of Venture Capital Backed IPOs: Comparing The United States and EuropeBelizarNo ratings yet

- Problems in M & A SuccessDocument9 pagesProblems in M & A Successpurple0123No ratings yet

- SocDocument3 pagesSocKaren MagsayoNo ratings yet

- Strategic Alliances-Factors Influencing Success and Failure AbstractDocument24 pagesStrategic Alliances-Factors Influencing Success and Failure AbstractSanjay DhageNo ratings yet

- Ranbaxy Dissertation June 2010Document40 pagesRanbaxy Dissertation June 2010NabinSundar NayakNo ratings yet

- Chap 014Document18 pagesChap 014Kuthubudeen T M0% (1)

- Mergers and Acquisition ProjectDocument21 pagesMergers and Acquisition ProjectNivedita Kotian100% (1)

- Post Merger Performance of Firms Following A Merger or AcquisitionDocument9 pagesPost Merger Performance of Firms Following A Merger or AcquisitionGuillaumeVHNo ratings yet

- Assignment#10 Global Strategy and The Multinational CorporationDocument1 pageAssignment#10 Global Strategy and The Multinational CorporationAnjaneth A. VillegasNo ratings yet

- Cash ReturnsDocument1 pageCash ReturnsAnjaneth A. VillegasNo ratings yet

- Assignment#9 Vertical Integration and Scope of The FirmDocument1 pageAssignment#9 Vertical Integration and Scope of The FirmAnjaneth A. VillegasNo ratings yet

- Chapter 10 and 12 Answer KeyDocument5 pagesChapter 10 and 12 Answer KeyAnjaneth A. VillegasNo ratings yet

- Assignment#9 Vertical Integration and Scope of The FirmDocument1 pageAssignment#9 Vertical Integration and Scope of The FirmAnjaneth A. VillegasNo ratings yet

- Assignment#9 Vertical Integration and Scope of The FirmDocument1 pageAssignment#9 Vertical Integration and Scope of The FirmAnjaneth A. VillegasNo ratings yet

- Assignment 4 Module 4 - Project For The Midterm Exam Period Narrative ReportDocument1 pageAssignment 4 Module 4 - Project For The Midterm Exam Period Narrative ReportAnjaneth A. VillegasNo ratings yet

- Assignment#10 Global Strategy and The Multinational CorporationDocument1 pageAssignment#10 Global Strategy and The Multinational CorporationAnjaneth A. VillegasNo ratings yet

- Assignment#9 Vertical Integration and Scope of The FirmDocument1 pageAssignment#9 Vertical Integration and Scope of The FirmAnjaneth A. VillegasNo ratings yet

- Introduction To Literature Activity 1: Week1Document1 pageIntroduction To Literature Activity 1: Week1Anjaneth A. VillegasNo ratings yet

- Assignment#12 External Growth Strategies Mergers, Acquisitions, AlliancesDocument1 pageAssignment#12 External Growth Strategies Mergers, Acquisitions, AlliancesAnjaneth A. VillegasNo ratings yet

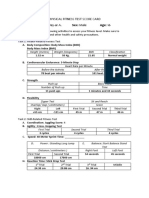

- Physical Fitness Test Score CardDocument1 pagePhysical Fitness Test Score CardAnjaneth A. VillegasNo ratings yet

- Dashboard My Courses AIS 02-19 Quizzes Quiz #3: Started On State Completed On Time Taken Marks Grade 30.00 100Document7 pagesDashboard My Courses AIS 02-19 Quizzes Quiz #3: Started On State Completed On Time Taken Marks Grade 30.00 100Anjaneth A. VillegasNo ratings yet

- Personal-Business Letter Block Style: Freedom High SchoolDocument11 pagesPersonal-Business Letter Block Style: Freedom High SchoolAnjaneth A. VillegasNo ratings yet

- For The Best Teacher in My LifeDocument1 pageFor The Best Teacher in My LifeAnjaneth A. VillegasNo ratings yet

- "Baluarte de San Diego": Name: Villegas, Anjaneth A. Year/Section: 1BSA-5ABM Professor: Mr. Christopher FigueroaDocument3 pages"Baluarte de San Diego": Name: Villegas, Anjaneth A. Year/Section: 1BSA-5ABM Professor: Mr. Christopher FigueroaAnjaneth A. VillegasNo ratings yet

- Evaluation of Leader Group Work Evaluation of Swot and Tows AnalysisDocument2 pagesEvaluation of Leader Group Work Evaluation of Swot and Tows AnalysisAnjaneth A. VillegasNo ratings yet

- Case StudyDocument14 pagesCase StudyAnjaneth A. VillegasNo ratings yet

- BlueprintDocument2 pagesBlueprintAnjaneth A. VillegasNo ratings yet