Professional Documents

Culture Documents

A Responsible Approach To Insolvency: A. Read The Article Below and Answer These Questions

Uploaded by

Maria Heniko Halima0 ratings0% found this document useful (0 votes)

66 views2 pagesTugas

Original Title

bing

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTugas

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

66 views2 pagesA Responsible Approach To Insolvency: A. Read The Article Below and Answer These Questions

Uploaded by

Maria Heniko HalimaTugas

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

A. Read the article below and answer these questions.

A responsible approach to insolvency

By Jonathan Moules

Simon Longfield, restructuring partner at Grant Thorton, an accountancy firm, answer the

following question about company insolvency.

I am a director of a small retail business. My accountant has recently warned me that,

following a sharp downturn in trading, the business is unlikely to be able to survive much

longer. I am worried about my responsibilities and my financial liabilities if the business

becomes insolvent. So what should I be doing right now?

As soon as the directors of a company foresee, or even become aware of the

possibility of, an administration situation, they need to act carefully to avoid the business

trading insolvently,as the penalties for doing this can be severe. These ‘remedies’ may

include personal liability for creditors debts, disqualification as a company director and, in

extreme cases, imprisonment where fraudulent trading has taken place.

So, as a director, how do you protect the company and yourself from such risk if

insolvency is possibly imminent? The principal steps include fulfilling the normal duties

expected of a company director, which are set out in the constitution (articles) of the

company and the Companies Act. Most importantly, the interests of the company’s creditors

must become a priority.

Firstly, the directors must understand the company’s current financial situation, assess

the prospects for its future viability and act quickly on the position they judge the company

to be in. They should use the following information to arrive at a judment of the company’s

current position: up-to-date statutory accounts, management accounts and forecast based on

the company’s latest order book.

Afterthat, if the directors decide that their company is moving towards an insolvency

position, they need to take independent profesional advice from a specilaist or licensed

insolvency practioner and, additionally, tke advice for themselves personally, if necessary.

Next, they need to ensure that the assets of the company are always protected and

secure and not sold for less than their value. In addition, as well as making sure that they do

not take on new supplies or lines of credit that they know the company cannot repay, the

directors must be able to show at all times that they are acting in the best interest of all the

company’s existing creditors. This last measure is essential to avoid any accusation of special

or prefential treatment of specific creditors.

Finally, directors should hold regular meetings and keep minutes of the disscusions

they have and the key decisions they make. If there is any doubt about this, they should detail

the circumstances that justify continued trading. If they are convinced thet the business will

be able to ‘ride out the strom, then the company and its directors can continue in the the

normal way.

However, as soon as they identify that their business is likely to become insolvent, the

directors need to act quickly to seek the proctection tha an insovency (administration)

procedure can offer. It is the job of a licensed insolvency practionioner to help company

directors put in place the most suitable procedure if the business can continue to trade in any

way.

You might also like

- Unit 14Document4 pagesUnit 14Oktawia TwardziakNo ratings yet

- Top Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomFrom EverandTop Home-Based Business Ideas for 2020: 00 Proven Passive Income Ideas To Make Money with Your Home Based Business & Gain Financial FreedomNo ratings yet

- Unit SBDocument6 pagesUnit SBPaola Andrea Peña AraujoNo ratings yet

- Entrepreneurship and Small Business EnvironmentDocument6 pagesEntrepreneurship and Small Business EnvironmentFaiq AlekberovNo ratings yet

- TASKDocument4 pagesTASKMUHAMMAD BILAL AFZAAL bba-fa19-045No ratings yet

- The Audacity to Hustle: How I started a trucking company from my prison cellFrom EverandThe Audacity to Hustle: How I started a trucking company from my prison cellNo ratings yet

- Intro To Corporate FinanceDocument75 pagesIntro To Corporate FinanceRashid HussainNo ratings yet

- InsolvencyDocument7 pagesInsolvencyjawadkollackanNo ratings yet

- Starting a Sole Proprietorship Business as a One-Person VentureDocument11 pagesStarting a Sole Proprietorship Business as a One-Person VentureSiara SerraoNo ratings yet

- Forms of Business OrganizationDocument14 pagesForms of Business Organizationbhagyashreejana22No ratings yet

- Should You Convert Your Sole Proprietorship to an LLC or CorporationDocument6 pagesShould You Convert Your Sole Proprietorship to an LLC or CorporationChloeNo ratings yet

- Finance 2222Document4 pagesFinance 2222nichadarat raksasatNo ratings yet

- Factors Governing The Selection of A Suitable Form of Ownership Business OrganizationDocument16 pagesFactors Governing The Selection of A Suitable Form of Ownership Business OrganizationEmmanuel Kwame Ocloo100% (1)

- Math 12-ABM Org - Mgt-Q1-Week-8Document20 pagesMath 12-ABM Org - Mgt-Q1-Week-8Nice D. ElseNo ratings yet

- 5 Ways RevampDocument4 pages5 Ways RevampAmlann MohantyNo ratings yet

- Company Directors' Responsibilities During Financial DifficultiesDocument4 pagesCompany Directors' Responsibilities During Financial Difficultiesnichadarat raksasatNo ratings yet

- EO Notes 2Document35 pagesEO Notes 2Dr Kennedy Amadi.PhDNo ratings yet

- Crypto Insolvency Article 2019Document8 pagesCrypto Insolvency Article 2019Sonja PrstecNo ratings yet

- Role of A Financial ManagerDocument13 pagesRole of A Financial ManagerpratibhaNo ratings yet

- Corporate FinanceDocument128 pagesCorporate FinanceParitosh KaushikNo ratings yet

- Top Ten Legal MistakesDocument5 pagesTop Ten Legal Mistakessucker21No ratings yet

- organizationDocument4 pagesorganizationMaria CongNo ratings yet

- Differences in-WPS OfficeDocument11 pagesDifferences in-WPS OfficeHitesh KumarNo ratings yet

- Barclays Case - ChandraDocument8 pagesBarclays Case - ChandraMamta Pradhan100% (1)

- 1 Sole Proprietorship Business in IndiaDocument6 pages1 Sole Proprietorship Business in IndiaEMBA IITKGPNo ratings yet

- Diane Elizabeth B. Camansag BSAT-2 41653Document1 pageDiane Elizabeth B. Camansag BSAT-2 41653diane camansagNo ratings yet

- Business OrganizationDocument23 pagesBusiness OrganizationSamarth Mehrotra0% (1)

- IBC & Debt RRecoveryDocument3 pagesIBC & Debt RRecoverySoorya ShrinivasNo ratings yet

- Forms of Business Organisation ExplainedDocument36 pagesForms of Business Organisation ExplainedApril DaltonNo ratings yet

- Business Finance TADocument9 pagesBusiness Finance TAOlivier MNo ratings yet

- Entrepreneurship Unit 01Document9 pagesEntrepreneurship Unit 01SurajNo ratings yet

- Business Forms ExplainedDocument39 pagesBusiness Forms ExplainedPrances Pelobello50% (2)

- Business Theme 2Document17 pagesBusiness Theme 2CNo ratings yet

- Business TypesDocument22 pagesBusiness TypesOnepiece LuffyNo ratings yet

- Chapter 7 Forms of Business OwnershipDocument3 pagesChapter 7 Forms of Business OwnershipAntonio Mark AnthonyNo ratings yet

- Business Organisation: BBA I SemDocument49 pagesBusiness Organisation: BBA I SemAnchal LuthraNo ratings yet

- A Basic Assumption of Accounting Is That A Business The Contrary Is DiscoveredDocument25 pagesA Basic Assumption of Accounting Is That A Business The Contrary Is DiscoveredYismawNo ratings yet

- Symbiosis International (Deemed University) : (Established Under Section 3 of The UGC Act 1956)Document11 pagesSymbiosis International (Deemed University) : (Established Under Section 3 of The UGC Act 1956)Aniket RauthanNo ratings yet

- Entrepreneurship Unit 1Document8 pagesEntrepreneurship Unit 1SURAJ KUMARNo ratings yet

- Industrial OwnershipDocument64 pagesIndustrial OwnershipJennifer Padilla JuanezaNo ratings yet

- Mefa 4th UnitDocument21 pagesMefa 4th UnitNaga Lakshmi0% (1)

- Sole ProprietorshipDocument10 pagesSole ProprietorshipJoynul Abedin67% (6)

- Forms of OwnershipDocument9 pagesForms of OwnershipKumar AnuragNo ratings yet

- When Asked What Accountants DoDocument3 pagesWhen Asked What Accountants DoEurresse TalisicNo ratings yet

- Handling The Day-To-Day Operations.: What Can The Money Be Used ForDocument13 pagesHandling The Day-To-Day Operations.: What Can The Money Be Used ForFreddy Savio D'souzaNo ratings yet

- Short Questions Dhrity RoyDocument6 pagesShort Questions Dhrity RoyRuslan AdibNo ratings yet

- Forms of Business: Sole Proprietorship, Partnership, CorporationDocument4 pagesForms of Business: Sole Proprietorship, Partnership, CorporationLaurever CaloniaNo ratings yet

- What Factors Influence The Entrepreneur in Choosing The Business Form?Document18 pagesWhat Factors Influence The Entrepreneur in Choosing The Business Form?k prathibaNo ratings yet

- Sole Propwriter ProjectDocument6 pagesSole Propwriter ProjectRashid AliNo ratings yet

- Forms of Business OrganisationDocument9 pagesForms of Business OrganisationvmktptNo ratings yet

- Chapter - 01-Business SystemDocument8 pagesChapter - 01-Business SystemTaohidNo ratings yet

- Careers, Forms of Business, and Ethics in FinanceDocument2 pagesCareers, Forms of Business, and Ethics in FinanceRachellee MagbutongNo ratings yet

- BM Unit III NotesDocument23 pagesBM Unit III NotesDurga Prasad SmartNo ratings yet

- Business EthicsDocument50 pagesBusiness EthicsAvegail Ocampo TorresNo ratings yet

- Abakada CompanyDocument6 pagesAbakada CompanyjieunNo ratings yet

- Guide For Employees in Insolvency SituationsDocument12 pagesGuide For Employees in Insolvency SituationsRobert MooreNo ratings yet

- Ecu302 Financial ManagementDocument5 pagesEcu302 Financial ManagementJack KimaniNo ratings yet

- English TaskDocument3 pagesEnglish TaskMaria Heniko HalimaNo ratings yet

- Elements of Office Work 2020tugasDocument4 pagesElements of Office Work 2020tugasMaria Heniko HalimaNo ratings yet

- Patrisia.A.Egu (20120028) Maria Heniko Halima (20120023) Cllas: Management BDocument1 pagePatrisia.A.Egu (20120028) Maria Heniko Halima (20120023) Cllas: Management BMaria Heniko HalimaNo ratings yet

- Complete The Sentences With The Past Continuous or Past Simple Tense Using The Pictures As Cues. Look at The Option BelowDocument3 pagesComplete The Sentences With The Past Continuous or Past Simple Tense Using The Pictures As Cues. Look at The Option BelowMaria Heniko HalimaNo ratings yet

- A Responsible Approach To Insolvency: A. Read The Article Below and Answer These QuestionsDocument2 pagesA Responsible Approach To Insolvency: A. Read The Article Below and Answer These QuestionsMaria Heniko HalimaNo ratings yet

- The Procedure TextDocument1 pageThe Procedure TextMaria Heniko HalimaNo ratings yet

- Tugas Kelompok BingDocument2 pagesTugas Kelompok BingMaria Heniko HalimaNo ratings yet

- Complete The Sentences With The Past Continuous or Past Simple Tense Using The Pictures As Cues. Look at The Option BelowDocument3 pagesComplete The Sentences With The Past Continuous or Past Simple Tense Using The Pictures As Cues. Look at The Option BelowMaria Heniko HalimaNo ratings yet

- B.Understanding Expressions: ' (Line 15)Document2 pagesB.Understanding Expressions: ' (Line 15)Maria Heniko HalimaNo ratings yet

- El241 PDFDocument57 pagesEl241 PDFAnanda NandaNo ratings yet

- Bahasa Inggris Last TugasDocument4 pagesBahasa Inggris Last TugasMaria Heniko HalimaNo ratings yet

- 11 Letter WordsDocument637 pages11 Letter WordstrakdsNo ratings yet

- Paragraph WritingDocument22 pagesParagraph WritingarvindranganathanNo ratings yet

- Acute cholecystitis pathogenesis, diagnosis and clinical featuresDocument38 pagesAcute cholecystitis pathogenesis, diagnosis and clinical featuresAdrian BăloiNo ratings yet

- Black FlagsDocument12 pagesBlack Flagsmrashid_usmanNo ratings yet

- Measuring Speed of Light LabDocument5 pagesMeasuring Speed of Light LabTanzid SultanNo ratings yet

- Step-By-Step Guide to Praying the RosaryDocument3 pagesStep-By-Step Guide to Praying the Rosaryyeng0% (1)

- MNM3711 International MarketingDocument70 pagesMNM3711 International MarketingKefiloe MoatsheNo ratings yet

- Case Application (New Pay Plan) Alizay Waheed Kayani 24347Document2 pagesCase Application (New Pay Plan) Alizay Waheed Kayani 24347Alizay KayaniNo ratings yet

- Global Product Classification (GPC) Standards Maintenance Group (SMG)Document1 pageGlobal Product Classification (GPC) Standards Maintenance Group (SMG)YasserAl-mansourNo ratings yet

- Jamanisal 2015 4 1 5 PDFDocument7 pagesJamanisal 2015 4 1 5 PDFDuge AnggrainiNo ratings yet

- Chap 02 ProbabilityDocument37 pagesChap 02 ProbabilityKent Braña TanNo ratings yet

- SBA Observation Checklist SAMPLESDocument4 pagesSBA Observation Checklist SAMPLESPincianna WilliamsNo ratings yet

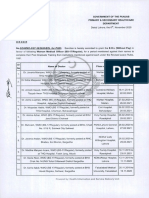

- Punjab govt grants EOL to doctors for postgraduate trainingDocument2 pagesPunjab govt grants EOL to doctors for postgraduate trainingMasroor HassanNo ratings yet

- Self DayaoskiiiDocument5 pagesSelf DayaoskiiiJoan Tabuena100% (1)

- Lol Wellness Principles For Dynamic LivingDocument171 pagesLol Wellness Principles For Dynamic LivingTumwine Kahweza ProsperNo ratings yet

- Core 13 UcspDocument3 pagesCore 13 UcspJanice DomingoNo ratings yet

- Unit 4.2Document69 pagesUnit 4.2ainhoa cNo ratings yet

- Ks3 Mathematics 2009 Level 3 5 Paper 2Document28 pagesKs3 Mathematics 2009 Level 3 5 Paper 2spopsNo ratings yet

- Hospital Visit ReportDocument8 pagesHospital Visit ReportSuraj JadhavNo ratings yet

- Assessing ViolenceDocument6 pagesAssessing ViolenceKarlo Jose Dao-ayanNo ratings yet

- American Ceramic: SocietyDocument8 pagesAmerican Ceramic: SocietyPhi TiêuNo ratings yet

- SFA Manual Rev 1 2020 - FinalDocument126 pagesSFA Manual Rev 1 2020 - Final763092No ratings yet

- Reference: A Visual Dictionary By: D.K. Ching: ArchitectureDocument75 pagesReference: A Visual Dictionary By: D.K. Ching: ArchitectureRemzskie PaduganaoNo ratings yet

- Puyat v. ZabarteDocument3 pagesPuyat v. Zabartesuperwezowski7No ratings yet

- 2021 4 12 Jennifer EnglertDocument77 pages2021 4 12 Jennifer Englertdiana winklerNo ratings yet

- Suretyship and Guaranty CasesDocument47 pagesSuretyship and Guaranty CasesFatima SladjannaNo ratings yet

- Cruz Vs Dir. of PrisonDocument3 pagesCruz Vs Dir. of PrisonGeeanNo ratings yet

- 8638 All SlidesDocument268 pages8638 All SlidesMariyum SanaNo ratings yet

- OMCC Board ResolutionDocument1 pageOMCC Board ResolutionOrient MansionNo ratings yet

- English Proficiency TrainingDocument21 pagesEnglish Proficiency TrainingDayang GNo ratings yet