Professional Documents

Culture Documents

quản trị rủi

Uploaded by

Diệu QuỳnhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

quản trị rủi

Uploaded by

Diệu QuỳnhCopyright:

Available Formats

MID TERM

MID-TERM

1.What are the benefits of forming a captive insurance company? (click on the “Captive

Basics” link at the top of the page, and then “Why form a Captive” on the next screen)

Captive insurance refers to a subsidiary corporation established to provide insurance to the parent

company and its affiliates. A captive insurance company represents an option for many organizations,

from Fortune 500 companies to nonprofits, that want to take financial control and manage risks by

underwriting their own insurance rather than paying premiums to third party insurers.

The advantages of going captive are:

- Coverage tailored to meet your needs

- Reduced operating costs

- Improved cash flow

- Increased coverage and capacity

- Investment income to fund losses

- Greater control over claims and so on

- Smaller deductibles for operating units

- Additional negotiating leverage with underwriters

- Incentives for loss control

- Alternatives to the costly practice of trading dollars with underwriters in the working

layers of risk

Over 1,200 companies have already realized the advantages of captive insurance operations

licensed in Vermont. In fact, for several years now, Vermont has ranked as the number one

captive domicile in the United States and the number three-ranked domicile internationally. In

1981, Vermont realized the potential benefits of attracting captive insurance companies and

passed legislation providing the appropriate regulatory and taxation environment. Vermont

continues to be recognized as a quality domicile by captive owners, brokers, regulators, and

others in the industry due to its high level of professionalism. An ever-increasing number of

companies are further recognizing Vermont as their captive insurance domicile of choice. The

Benefits of Vermont's 1981 "Special Insurer Act" and the Changes Beyond. In 1981, Vermont

realized the potential benefits of attracting captive insurance companies and passed legislation

providing the appropriate regulatory and taxation environment.

Reasons for forming a captive include:

There are numerous potential advantages to forming a captive insurance company. Captive

insurance companies are formed for both economic and risk management purposes. For example,

by forming a captive insurance company, a business can dramatically lower insurance costs in

comparison to premiums paid to a conventional property and casualty insurance company. By

Mai THỊ Quỳnh -18071214

MID TERM

establishing one’s own insurance vehicle, costs for overhead, marketing, agent commissions,

advertising, etc., may result in significant savings in the form of underwriting profits, which can

be retained by the owner of the captive company.

Additionally, a captive insurance company can provide protection against risks which prove to

be too costly in commercial markets or may be generally unavailable. The inability to obtain

specialized types of coverage from commercial third-party insurers is another reason why clients

may choose to establish a captive insurance company. With a captive insurance company, a

business owner can address their self-insured risks by paying tax deductible premium payments

to their captive insurance company. To the extent the captive generates profits, those dollars

belong to the owner of the captive.

In most cases, to the extent existing P&C coverage is reasonably priced, business owners will

continue to maintain existing policies for their traditional coverage and supplement existing

coverage by addressing their self-insured risks with their own captive insurance company. Policy

features, coverage and limits can be drafted to meet specific enterprise exposures. This allows for

many risk-management advantages, including:

–The parent firm may have difficulty obtaining insurance

–To take advantage of a favorable regulatory environment

–Costs may be lower than purchasing commercial insurance

–A captive insurer has easier access to a reinsurer

–A captive insurer can become a source of profit

2a. Why is Vermont a popular domicile for captives? (click on the “Why Vermont” link

under “About Us”)

Since 1981, when Vermont was one of the first states to adopt captive enabling legislation, the

state has been at the forefront of the captive insurance industry. With one of the largest networks

of experienced and knowledgeable regulators, management professionals, in-house examiners

and service providers of any domicile, Vermont provides all of the resources necessary for your

captive to thrive. And, with unparalleled legislative support, you can be sure your captive is

strong, secure, and supported at every turn.

2b. How many Fortune 100 and Dow 30 companies have a Vermont captive? (see the

“About Us” link)

For nearly 40 years, Vermont has been a global leader in captive insurance. Vermont is first,

worldwide, in gross written premium and assets under management, and ranks third in the

number of active captive insurance companies. Vermont’s captive insurance industry serves 48

of the Fortune 100 corporations and 18 of the Dow 30. Vermont is also a five-time winner of

Captive Review’s top US Domicile honor.

Mai THỊ Quỳnh -18071214

MID TERM

3.How has the number of Vermont captives and the premiums written by these captives

grown over time? (see “Captive Statistics” link under “Captive Basics” to see some very

interesting charts)

The captive insurance market quickly responded to Vermont's appeal. Within a few years,

Vermont became the largest US captive domicile. Indeed, such well-known companies as H.J.

Heinz Co., Hormel Foods Corp., Sealed Air Corp., and Wells Fargo & Co. have set up Vermont

captives.

With 589 captives at year-end 2020, Vermont is not only—by far—the no. 1 US captive

domicile, it also is the world's third-largest captive domicile. And for some types of captives,

Vermont is the biggest domicile. For example, with nearly 90 risk retention groups (RRGs), a

special type of captive authorized under federal law, Vermont is the home of far more RRGs

than any other domicile.

The two industries that sponsor the most Vermont captives are healthcare and manufacturing,

each of which accounts for nearly 20 percent of the state's captives.

the number of Vermont captives in 2020 in the following

Pure 357

Risk retention group 87

Special purpose financial 38

Sponsored 43

Industrial insured 21

Association 12

Branch 3

Affiliated reinsurance company 2

Agency 1

Notably, Vermont’s 43 sponsored captives have experienced significant grow, with well over

300 cells

Mai THỊ Quỳnh -18071214

MID TERM

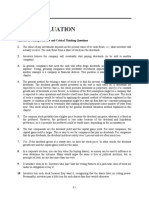

Figure 1: Number of captives by gross written premium

According to figure 1. Number of captives by gross written premium has a large fluctuation .

when number of captives over 150 , GWP in dollars (Millions) less than 1 million and

Number of captives less 25 , GWP in dollars (Millions) over 500 million

4a. What is the initial licensing fee for a Vermont captive, and what does it cost to renew

the license each year? (under the “Laws & Regulations” link at the top of the page, click on

“Vermont Captive Fees”)

Activity Related fee

Initial department licensure $500

Initial department licensure ( SPFI) $5,000

Mai THỊ Quỳnh -18071214

MID TERM

Annual license renewal due April 1 $500

Annual license renewal ( SPFI) due April 1 $5,000

b. What is the premium tax rate for business written by a Vermont captive insurer?

Millions of dollars Direct premium tax rate Assumed premiums tax rate

0-20 0.38% 0.214%

20-40 0.285% 0.143%

40-60 0.19% 0.048%

60+ 0.072% 0.024%

5a. How much surplus and capital are necessary to start a pure captive, an association

captive, and a risk retention group in Vermont? (under “Laws & Regulations,” click on

“Vermont Laws,” and then click on the “Title 8 Vermont Statutes Annotated” link. See

page 3 and page 4 to answer this question and the following question.)

Captive type Capital& surplus minimum requirements

Pure and brand captives USD $ 250,000

Association , industrial insured& agency USD $ 500,000

Risk retention group USD $ 1,000,000

5b. Does the surplus and capital requirement have to be met through cash? Explain.

(see Section 6004, part (c))

The insurance commissioner may prescribe additional surplus requirements based on the type,

volume and nature of the insurance business. Capital and surplus may be in the form of cash,

marketable securities, a trust approved by the commissioner and of which the commissioner is

the sole beneficiary, or an irrevocable letter of credit that uses the qualified format and is issued

by a qualified bank

Referencing:

International Risk Management Institute(2014–2021), Inc. (IRMI) “Vermont Department of

Financial Regulation, Captive Insurance Division” Available at :

https://www.captive.com/domiciles/vermont-captive-domicile-summary?

fbclid=IwAR0103Pbg4GEAnA_iThU6uYgU1mHXFn8SsrTod_Y6Pk0ybcrRciccB9R_2w

Department of Financial Regulation “ADVANTAGES OF CAPTIVE INSURANCE” Available

at :

https://dfr.vermont.gov/industry/captive-insurance/become-vermont-captive/advantages-captive-

insurance?fbclid=IwAR37-IQHJdnCLabsx3l-Zul5G9pBp_uPfRzXqADbC0I-KSZMeUxkUhzBIjI

written by Vermont captive insurance”Our numbers speak for themselves” ” Available at :

https://www.vermontcaptive.com/wp-content/uploads/2021/07/VTC0017-

21_Numbers_SSupdate_July21.pdf?

fbclid=IwAR3L3Pn4Hf3Gznnc1OHpTQvcTIO0BnIZ_2q9_jSeQYqwZ3yjmv2bpc0jGts

Oxford risk management group( 2021)“Why Form A Captive?” Available at :

Mai THỊ Quỳnh -18071214

MID TERM

https://www.oxfordrmg.com/why-form-a-captive/?fbclid=IwAR1A0LM3GUqo9QMTY_-

IzZpuCbBSPaz8D_xi9ngXOGlMfomTD6WHkQsXupM

Agency of commerce and community development” Available at :

https://accd.vermont.gov/economic-development/programs/captive-insurance?

fbclid=IwAR38C3FxgZQozMit4faKhZMvp5cXDNk3zb0yMqUqA8tO5ynZ3h_jjMqLya4

Mai THỊ Quỳnh -18071214

You might also like

- Midterm: Đỗ Thị Lâm Oanh-18071193Document5 pagesMidterm: Đỗ Thị Lâm Oanh-18071193Diệu QuỳnhNo ratings yet

- Welcome To TennesseeDocument43 pagesWelcome To Tennesseekarthik kondapalliNo ratings yet

- Frauds in Insurance SectorDocument22 pagesFrauds in Insurance SectorHarish ShettyNo ratings yet

- Affinity News October 2013 PDFDocument4 pagesAffinity News October 2013 PDFFinchSheffieldNo ratings yet

- 2009-11-20 Too Big To Fail: An Insufficient and Excessive $200 Billion ConDocument4 pages2009-11-20 Too Big To Fail: An Insufficient and Excessive $200 Billion ConJoshua RosnerNo ratings yet

- National Underwriter Sales Essentials (Life & Health): ProspectingFrom EverandNational Underwriter Sales Essentials (Life & Health): ProspectingNo ratings yet

- Solutions Manual Chapter Fifteen: Answers To Chapter 15 QuestionsDocument6 pagesSolutions Manual Chapter Fifteen: Answers To Chapter 15 QuestionsBiloni KadakiaNo ratings yet

- Metlife: July 11, 2011Document13 pagesMetlife: July 11, 2011MarketsWikiNo ratings yet

- Vehicle InsuranceDocument31 pagesVehicle Insurancedhanaraj82No ratings yet

- Key RatiosDocument5 pagesKey RatiosShreevathsaNo ratings yet

- Journal of Accountancy March 2013Document8 pagesJournal of Accountancy March 2013hhpdenverNo ratings yet

- 15th January, 2003 - Introduction To The Offshore Insurance Sector SVG Insurance Sector - Author Grenville A. John, Commissioner of Int'l InsuranceDocument3 pages15th January, 2003 - Introduction To The Offshore Insurance Sector SVG Insurance Sector - Author Grenville A. John, Commissioner of Int'l InsuranceLogan's LtdNo ratings yet

- Frauds and ScamsDocument100 pagesFrauds and ScamsSunil Rawat100% (1)

- Insurance Frauds: Prepared by Jaswanth Singh GDocument28 pagesInsurance Frauds: Prepared by Jaswanth Singh GJaswanth Singh RajpurohitNo ratings yet

- Article: A. View As A BBF StudentDocument10 pagesArticle: A. View As A BBF StudentDonnaFaithCaluraNo ratings yet

- AON WLTW ComplaintDocument35 pagesAON WLTW ComplaintXDL1No ratings yet

- External EnvironmentDocument14 pagesExternal Environmentbhumiksab7No ratings yet

- Business Interruption: Coverage, Claims, and Recovery, 2nd EditionFrom EverandBusiness Interruption: Coverage, Claims, and Recovery, 2nd EditionNo ratings yet

- IMB FullDocument16 pagesIMB Fullafira1809No ratings yet

- Northern General Insurance Policy AssignmentDocument18 pagesNorthern General Insurance Policy AssignmentBristir Majhe TumiNo ratings yet

- Fraud Awareness Training by The SIU GroupDocument49 pagesFraud Awareness Training by The SIU GroupDhananjay SharmaNo ratings yet

- Lecture 8 - Offshore Captive Insurance PDFDocument11 pagesLecture 8 - Offshore Captive Insurance PDFRaveesh HurhangeeNo ratings yet

- Directors and Officers Liability: Exposures, Risk Management and Coverage, 2nd EditionFrom EverandDirectors and Officers Liability: Exposures, Risk Management and Coverage, 2nd EditionNo ratings yet

- Insurance Insight: U Y C EDocument2 pagesInsurance Insight: U Y C EAtish GoolaupNo ratings yet

- Chapter Two 1Document45 pagesChapter Two 1vijayrebello4uNo ratings yet

- 120 Financial Planning Handbook PDPDocument10 pages120 Financial Planning Handbook PDPMoh. Farid Adi PamujiNo ratings yet

- What Is An Insurer?: Topic 3. Types of Insurers and Marketing SystemsDocument14 pagesWhat Is An Insurer?: Topic 3. Types of Insurers and Marketing SystemsLNo ratings yet

- Insurance Fraud PPT (Final)Document30 pagesInsurance Fraud PPT (Final)Gaurav Savlani83% (6)

- Progressive Insurance Industry AnalysisDocument16 pagesProgressive Insurance Industry AnalysisJordyn WebreNo ratings yet

- Introduction To D&O Insurance: Allianz Global Corporate & SpecialtyDocument11 pagesIntroduction To D&O Insurance: Allianz Global Corporate & SpecialtyUngurasu AndreiNo ratings yet

- Cfa Letter Fidelity Stewart MergerDocument3 pagesCfa Letter Fidelity Stewart MergerForeclosure FraudNo ratings yet

- InsuranceDocument7 pagesInsurancesarvesh.bhartiNo ratings yet

- Items To Consider When Switching Insurance CarriersDocument4 pagesItems To Consider When Switching Insurance CarriersjohnribarNo ratings yet

- Consumer Federation of AmericaDocument5 pagesConsumer Federation of AmericaANo ratings yet

- Reasons To Sell Life Insurance.: PortfolioDocument2 pagesReasons To Sell Life Insurance.: PortfolioWin VitNo ratings yet

- Country RiskDocument7 pagesCountry RiskAshleyNo ratings yet

- Malath Cooperative Insurance's range of services, products and policiesDocument4 pagesMalath Cooperative Insurance's range of services, products and policiesH MNo ratings yet

- MCWHDocument77 pagesMCWHK100% (1)

- Credit InsuranceDocument51 pagesCredit InsuranceMayur Federer Kunder100% (8)

- FLORIDA Complete Report Public Facing v128 003Document57 pagesFLORIDA Complete Report Public Facing v128 003Raymond HuangNo ratings yet

- Project On Marine Insurance With Reference To New India Assurance Company LTDDocument58 pagesProject On Marine Insurance With Reference To New India Assurance Company LTDnandiniNo ratings yet

- Annuities: Ection NtroductionDocument12 pagesAnnuities: Ection Ntroductionambasyapare1No ratings yet

- Lemonade TextDocument2 pagesLemonade TextSanti Hernandez RoncancioNo ratings yet

- Insurance Industry Transformation GuideDocument9 pagesInsurance Industry Transformation GuideUday DharavathNo ratings yet

- Credit InsuranceDocument56 pagesCredit InsuranceVineetaNo ratings yet

- Glossary of Insurance Terms Jan 2015Document6 pagesGlossary of Insurance Terms Jan 2015Tsegaye TadesseNo ratings yet

- A Study On Marine Insurance With Reference To New India Assurance Company LTDDocument58 pagesA Study On Marine Insurance With Reference To New India Assurance Company LTDnandiniNo ratings yet

- Insurance Law Lecture 2: Regulation in JamaicaDocument1 pageInsurance Law Lecture 2: Regulation in JamaicaMoni TbhNo ratings yet

- Claims Management in Life InsuranceDocument7 pagesClaims Management in Life InsurancerevathymuguNo ratings yet

- Insurance Companies As Financial Intermediaries: Risk and ReturnDocument54 pagesInsurance Companies As Financial Intermediaries: Risk and Returnfareha riazNo ratings yet

- Introduction to the Global Insurance IndustryDocument10 pagesIntroduction to the Global Insurance IndustryDivaxNo ratings yet

- Protect Your Business With Corporate InsuranceDocument44 pagesProtect Your Business With Corporate InsuranceNisha RathoreNo ratings yet

- PCUniversal 1Document265 pagesPCUniversal 1mdoverlNo ratings yet

- Loma 280Document110 pagesLoma 280Arpan Sikdar87% (23)

- Assignment 5Document1 pageAssignment 5Diệu QuỳnhNo ratings yet

- Information and Communication IndustryDocument2 pagesInformation and Communication IndustryDiệu QuỳnhNo ratings yet

- The Definition of Tourism in Great Britain: Does Terminological Confusion Have To Rule?Document4 pagesThe Definition of Tourism in Great Britain: Does Terminological Confusion Have To Rule?Diệu QuỳnhNo ratings yet

- Midterm AssignmentDocument1 pageMidterm AssignmentDiệu QuỳnhNo ratings yet

- 1: Identify and Explain The Main Issues in This Case StudyDocument1 page1: Identify and Explain The Main Issues in This Case StudyDiệu QuỳnhNo ratings yet

- Assignment 3Document1 pageAssignment 3Diệu QuỳnhNo ratings yet

- Câu 1: 13 Benefits and Challenges of Cultural Diversity in The WorkplaceDocument8 pagesCâu 1: 13 Benefits and Challenges of Cultural Diversity in The WorkplaceDiệu QuỳnhNo ratings yet

- Discuss Some of The Pressures On and Action Being Taken by Selected Industrialized Countries and Companies To Be More Socially and Environmentally Responsive To World ProblemsDocument1 pageDiscuss Some of The Pressures On and Action Being Taken by Selected Industrialized Countries and Companies To Be More Socially and Environmentally Responsive To World ProblemsDiệu QuỳnhNo ratings yet

- Assignment 4Document2 pagesAssignment 4Diệu QuỳnhNo ratings yet

- Chapter 6-Government Influence On Exchange RatesDocument6 pagesChapter 6-Government Influence On Exchange Ratesnguyễnthùy dươngNo ratings yet

- Group-2 VNPT Ins2029Document24 pagesGroup-2 VNPT Ins2029Diệu QuỳnhNo ratings yet

- Forecasting Techniques: Time Series MethodsDocument20 pagesForecasting Techniques: Time Series MethodsDiệu QuỳnhNo ratings yet

- Interest Rates and Bond Valuation: Answers To Concepts Review and Critical Thinking Questions 1Document8 pagesInterest Rates and Bond Valuation: Answers To Concepts Review and Critical Thinking Questions 1Diệu QuỳnhNo ratings yet

- Vinamilk Dairy Subsidiary Project in CanadaDocument14 pagesVinamilk Dairy Subsidiary Project in CanadaDiệu QuỳnhNo ratings yet

- LalalalaDocument2 pagesLalalalaDiệu QuỳnhNo ratings yet

- JIT System in InventoryDocument1 pageJIT System in InventoryDiệu QuỳnhNo ratings yet

- Assets Liabilities and Equity : Balance Sheet Dec 31, 20X1 Euro Translation Rate USDDocument2 pagesAssets Liabilities and Equity : Balance Sheet Dec 31, 20X1 Euro Translation Rate USDDiệu QuỳnhNo ratings yet

- Final marketing dịch vụDocument15 pagesFinal marketing dịch vụDiệu QuỳnhNo ratings yet

- hệ thống thông tinDocument1 pagehệ thống thông tinDiệu QuỳnhNo ratings yet

- Formal Presentation Evaluation Form-VNUISDocument2 pagesFormal Presentation Evaluation Form-VNUISDiệu QuỳnhNo ratings yet

- 12345Document4 pages12345Diệu QuỳnhNo ratings yet

- Supply Chain Structure: 1.1.sourceDocument2 pagesSupply Chain Structure: 1.1.sourceDiệu QuỳnhNo ratings yet

- Chapter 08 - Stock Valuation GuideDocument19 pagesChapter 08 - Stock Valuation GuideDiệu QuỳnhNo ratings yet

- Presentation IMDocument6 pagesPresentation IMDiệu QuỳnhNo ratings yet

- IMDocument4 pagesIMDiệu QuỳnhNo ratings yet

- Thuyết Trình Chiến Lược MarketingDocument1 pageThuyết Trình Chiến Lược MarketingDiệu QuỳnhNo ratings yet

- Presentation IMDocument6 pagesPresentation IMDiệu QuỳnhNo ratings yet

- The Key Success Factors Will Be Evaluated On A 40Document2 pagesThe Key Success Factors Will Be Evaluated On A 40Diệu QuỳnhNo ratings yet

- Urine Eaxmintaion ReportDocument7 pagesUrine Eaxmintaion Reportapi-3745021No ratings yet

- Bi Metallic Corrosion PDFDocument34 pagesBi Metallic Corrosion PDFDerek OngNo ratings yet

- Welfare Schemes in TelanganaDocument46 pagesWelfare Schemes in TelanganaNare ChallagondlaNo ratings yet

- Amul - BCG MatrixDocument9 pagesAmul - BCG MatrixBaidhani Mandal100% (1)

- Survitec Mooring Ropes BrochureDocument20 pagesSurvitec Mooring Ropes Brochurearifsarwo_wNo ratings yet

- Me, Myself, and My Dream CareerDocument12 pagesMe, Myself, and My Dream CareerJed CameronNo ratings yet

- SOP of Gram StainDocument5 pagesSOP of Gram Stainzalam55100% (1)

- Service Manual For High Efficiency High Ambient Amazon 20180726Document400 pagesService Manual For High Efficiency High Ambient Amazon 20180726Syedimam100% (1)

- How to Compost at Home: A Guide to the BasicsDocument10 pagesHow to Compost at Home: A Guide to the BasicsYeo Choon SengNo ratings yet

- Application Format For Child CustodyDocument2 pagesApplication Format For Child CustodyDHUP CHAND JAISWAL100% (3)

- Installation Manual - ClimateWell SolarChiller - v9 - 33 - 4 - ENDocument31 pagesInstallation Manual - ClimateWell SolarChiller - v9 - 33 - 4 - ENtxaelo100% (1)

- Exe Summ RajatCement Eng PDFDocument12 pagesExe Summ RajatCement Eng PDFflytorahulNo ratings yet

- 08 Ergonomics - 01Document35 pages08 Ergonomics - 01Cholan PillaiNo ratings yet

- Anatomy of The PeriodontiumDocument46 pagesAnatomy of The PeriodontiumYunita Nitnot50% (2)

- SGLGB Form 1 Barangay ProfileDocument3 pagesSGLGB Form 1 Barangay ProfileHELEN CASIANONo ratings yet

- ID 2019 CourseDescription MIKE21FlowModelFM HydrodynamicModellingUsingFlexibleMesh UKDocument2 pagesID 2019 CourseDescription MIKE21FlowModelFM HydrodynamicModellingUsingFlexibleMesh UKsaenuddinNo ratings yet

- SOP - APS - PUR - 02A - Flow Chart For PurchaseDocument2 pagesSOP - APS - PUR - 02A - Flow Chart For Purchaseprakash patelNo ratings yet

- Health Facilities and Services Regulatory Bureau: Republic of The Philippines Department of HealthDocument3 pagesHealth Facilities and Services Regulatory Bureau: Republic of The Philippines Department of Healthal gulNo ratings yet

- Standardized Recipes - Doc2Document130 pagesStandardized Recipes - Doc2epic failNo ratings yet

- Ecodial Advance Calculation 4.1Document33 pagesEcodial Advance Calculation 4.1Youwan LeeNo ratings yet

- DAYCENT Model Overview, Testing and Application To AgroecosystemsDocument28 pagesDAYCENT Model Overview, Testing and Application To AgroecosystemsJunoNo ratings yet

- Experiment # 04: Short-Circuit Test of Single Phase TransformerDocument5 pagesExperiment # 04: Short-Circuit Test of Single Phase TransformerNasir Ali / Lab Engineer, Electrical Engineering DepartmentNo ratings yet

- CAT 6040 Hydraulic Excavator Undercarriage Service TrainingDocument18 pagesCAT 6040 Hydraulic Excavator Undercarriage Service TrainingWillian Ticlia Ruiz100% (1)

- CaraKumpul - Soal PAS Bahasa Inggris Kls 12Document7 pagesCaraKumpul - Soal PAS Bahasa Inggris Kls 12akusayanklenaNo ratings yet

- HPLC Determination of Caffeine in Coffee BeverageDocument7 pagesHPLC Determination of Caffeine in Coffee Beveragemuhammad ihklasulNo ratings yet

- Alloy 5754 - Aimg3: Key FeaturesDocument1 pageAlloy 5754 - Aimg3: Key FeaturessatnamNo ratings yet

- Cultures and Beliefs NCM 120Document13 pagesCultures and Beliefs NCM 120Melanie AnanayoNo ratings yet

- Slide BP Texas City RefineryDocument20 pagesSlide BP Texas City Refineryamaleena_muniraNo ratings yet

- Case Study in Competency Appraisal II - ABC and EDNDocument5 pagesCase Study in Competency Appraisal II - ABC and EDNRogelio Saupan Jr100% (1)

- Spelling Bee WordsDocument3 pagesSpelling Bee WordsDana GomezNo ratings yet