Professional Documents

Culture Documents

Stock of The Week: Robinsons Land Corporation

Uploaded by

Jade ClemenoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock of The Week: Robinsons Land Corporation

Uploaded by

Jade ClemenoCopyright:

Available Formats

Stock of the Week

16 August 2021

Robinsons Land Corporation What has changed?

RLC.PS RLC PM In our latest report, we adjusted our FY21F/22F EPS

estimates by +23%/-8% as we incorporated gains from the

JV land sales this year and moderated residential

Last Price construction ramp up next year. Our SOTP-based TP is

Rating Target Price Upside

13-Aug-2021 unchanged at PHP23.00 and we maintain our Buy rating as

Buy PHP15.94 PHP23.00 +44.0% the stock still trades at a wide 52% discount to NAV.

RLC’s 2Q21/1H21 earnings increased 394% y-y/48% y-y to

Minimum Free Float Mkt Cap P/E PHP2.6bn/PHP5.5bn, largely due to the recognition of gains

Lot Size Level (%) (USD mn) FY21F from JV land parcel sales (~PHP2.7bn revenues) in 2Q21.

100 38.80% 1,642 8.7x For the 1H21 period: 1) local residential revenues were still

down 40% y-y to PHP4.7bn as quarantine restrictions

EPS Growth Div Yield P/B ROE continued to restrain construction activity, while the high-

FY21F FY21F FY21F FY21F base effect of the accounting change last year also affected

revenue recognition trends; 2) mall revenues dropped 16% y-

75.9% 3.1% 0.8x 9.0% y to PHP4.2bn as mall footfall remained weak at ~40% of

pre-pandemic levels; and 3) office leasing revenues were

About the Company resilient at PHP3.1bn (+3% y-y) as 36.5k sqm of new office

Robinsons Land Corp (RLC) serves as the real estate arm of listed space (+6% q-q) was added in 2Q21 and occupancies

conglomerate JG Summit Holdings (JGS). The Company’s improved further to 94% (vs 93%/91% in 1Q21/4Q20) on

operations is divided into five business divisions: the commercial new signups from BPOs. As of end-2Q21, BPOs continued

centers, residential, office buildings, hotels and resorts, and to account for a bulk of RLC’s occupied GLA at 85%, while

traditional HQ tenants and POGOs accounted for the

industrial and integrated developments. As of end-2020, RLC has

balance at 13% and 2%, respectively.

52 commercial centers, 119 residential buildings and subdivisions,

25 office buildings, 5 flexible spaces, 20 hotels and resorts, 4 For the first half of the year, residential presales grew 19% y-

y to PHP5.5bn on improved take-up for its existing and new

industrial facilities, and 3 integrated developments distributed projects. Locals accounted for 92% of total presales, while

across 29 provinces in the Philippines. the remaining 8% was accounted for by foreign buyers.

Management notes that they are prepared for push-button

launches and hopes for a sustained revival in demand.

Absolute price performance (YTD):

RLC is down 25% YTD and has underperformed the PCOMP (-12%). We believe concerns over constrained construction

capacities in residentials and lingering weakness in mall revenues have largely been priced in by the market, while the

company’s strong financial position (PHP14bn in cash and a low net gearing of 0.39x) remains overlooked.

30% RLC price performance PCOMP price performance

20%

10%

0%

-10%

-20%

-30%

-40%

-50%

Jan-21 Feb-21 Mar-21 Apr-21 May-21 Jun-21 Jul-21 Aug-21

Disclaimer: The information, opinions and analysis contained herein are based on sources and data believed to be reliable but no representation,

expressed or implied, is made as to its accuracy, completeness or correctness. BDO Securities, Inc. is the distributors of this report in the Philippines.

This material is only for the general information of the authorized recipients by BDO Securities. In no event shall BDO Securities or its officers and

employees, including the author(s), be liable for any loss/damage resulting from reliance, directly or indirectly, or information found within this report.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Pile Caps Guidance PDFDocument7 pagesPile Caps Guidance PDFDeepak Jain100% (1)

- Flange Reference ChartDocument3 pagesFlange Reference ChartJade ClemenoNo ratings yet

- WINTER Catalogue Diamond DressersDocument200 pagesWINTER Catalogue Diamond DressersFarhaan MukadamNo ratings yet

- Speaking Templates For All 8 Parts of CELPIP. Structure & SamplesDocument11 pagesSpeaking Templates For All 8 Parts of CELPIP. Structure & SamplesPiyush Sharma100% (2)

- Economics 10th Edition Sloman Solutions ManualDocument25 pagesEconomics 10th Edition Sloman Solutions ManualCaseyDiazmbsx100% (55)

- Recommended Sashimi Restaurants:: 7. Shabutei Nishiumeda Branch (Nishi-Umeda / Shabu-Shabu, Sukiyaki)Document3 pagesRecommended Sashimi Restaurants:: 7. Shabutei Nishiumeda Branch (Nishi-Umeda / Shabu-Shabu, Sukiyaki)Jade ClemenoNo ratings yet

- S-BT Screw-In Stainless Steel and Carbon Steel Threaded StudsDocument10 pagesS-BT Screw-In Stainless Steel and Carbon Steel Threaded StudsJade ClemenoNo ratings yet

- Technically Speaking (PSEi) 16 Aug 2021-MinDocument1 pageTechnically Speaking (PSEi) 16 Aug 2021-MinJade ClemenoNo ratings yet

- Stairs Guide For Piping EngineersDocument2 pagesStairs Guide For Piping EngineersJade ClemenoNo ratings yet

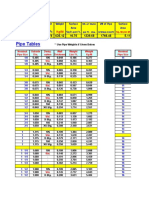

- Pipe Table For Smart EngineersDocument12 pagesPipe Table For Smart EngineersJade ClemenoNo ratings yet

- Greetings: English PronunciationDocument5 pagesGreetings: English PronunciationJade ClemenoNo ratings yet

- Conditionals Exercise 1: Choose The Word or Phrase That Best Complete The Sentence (A, B, C or D)Document5 pagesConditionals Exercise 1: Choose The Word or Phrase That Best Complete The Sentence (A, B, C or D)Nhật TânNo ratings yet

- CHAPTER 1 Basic Concepts in Audit Sampling PDFDocument10 pagesCHAPTER 1 Basic Concepts in Audit Sampling PDFJovelle LeonardoNo ratings yet

- Tech Support: Unscramble The QuestionsDocument16 pagesTech Support: Unscramble The QuestionsCarlos .LopezNo ratings yet

- 5.11 NC AG Letter To MissionDocument3 pages5.11 NC AG Letter To MissionMitchell BlackNo ratings yet

- Ac 518 Budget FormDocument1 pageAc 518 Budget FormJairus Adrian VilbarNo ratings yet

- Zebrafish Poster Portrait Eupfi Sep 2106 Final SubmittedDocument1 pageZebrafish Poster Portrait Eupfi Sep 2106 Final Submittedapi-266268510No ratings yet

- Shashank Sasane 02Document1 pageShashank Sasane 02Pratik BajiNo ratings yet

- Tablas H2O NISTIR5078-completaDocument39 pagesTablas H2O NISTIR5078-completaLeila Cheikh AliNo ratings yet

- DBP Vs COADocument20 pagesDBP Vs COAThea P PorrasNo ratings yet

- Modul Akuntansi Keuangan DasarDocument119 pagesModul Akuntansi Keuangan DasarLita NataliaNo ratings yet

- Fortuner UP16DP3495Document1 pageFortuner UP16DP3495BOC ClaimsNo ratings yet

- Gap Analysis: Dr. N. BhaskaranDocument4 pagesGap Analysis: Dr. N. BhaskaranNagarajan BhaskaranNo ratings yet

- Problems and Constraints in Banana Cultivation: A Case Study in Bhagalpur District of Bihar, IndiaDocument9 pagesProblems and Constraints in Banana Cultivation: A Case Study in Bhagalpur District of Bihar, IndiaVasan MohanNo ratings yet

- Pre Requisite Programs Main PresentationDocument19 pagesPre Requisite Programs Main PresentationASIF EJAZNo ratings yet

- Helzberg's Diamond Shops Inc V Valley West Des Moines Shopping Center Inc. 2012)Document10 pagesHelzberg's Diamond Shops Inc V Valley West Des Moines Shopping Center Inc. 2012)GenUp SportsNo ratings yet

- D 000 Rev0Document14 pagesD 000 Rev0wlater06No ratings yet

- Panera Bread Holiday MenuDocument8 pagesPanera Bread Holiday MenuAbby VanbrimmerNo ratings yet

- Hacienda Starke V CuencaDocument2 pagesHacienda Starke V CuencaGino Alejandro SisonNo ratings yet

- Gemba WalkDocument10 pagesGemba WalkAsmamaw FirewNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument15 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignaturemohitNo ratings yet

- Audit Project - Statutory AuditDocument2 pagesAudit Project - Statutory AuditWessa7No ratings yet

- Assignment On Garment Manufacturing - Store Room ManagementDocument8 pagesAssignment On Garment Manufacturing - Store Room ManagementAsm Towheed100% (4)

- Renault 12 SDocument17 pagesRenault 12 STadeusz Antoni ChudzikNo ratings yet

- VARIOline DS Brochure 2462-V1 en Original 44228Document16 pagesVARIOline DS Brochure 2462-V1 en Original 44228Kashif Xahir KhanNo ratings yet

- ARI - CAPEX FFE FormDocument2 pagesARI - CAPEX FFE FormWaleed AhmedNo ratings yet

- My Peace Plan FormDocument2 pagesMy Peace Plan FormStephen PhiriNo ratings yet