Professional Documents

Culture Documents

Depreciation Methods Comparison1

Depreciation Methods Comparison1

Uploaded by

william oliveiraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Depreciation Methods Comparison1

Depreciation Methods Comparison1

Uploaded by

william oliveiraCopyright:

Available Formats

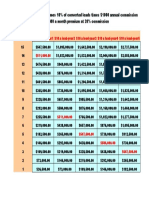

[Company Name]

Depreciation Methods Comparison

[Date]

Gray cells are calculated for you. You do not need to enter anything in them.

Cost of property $500,000

Recovery period (years) 5

Declining balance type 200%

Declining balance rate 0.40

Number of months in first year of service 6

Salvage value $50,000

[Company Name] CONFIDENTIAL

Year Straight Line Sum-of-Years' Digits Declining Balance

Depreciation Accumulated Depreciation Accumulated Depreciation Accumulated

per year depreciation per year depreciation per year depreciation

1 $45,000 $45,000 $75,000 $75,000 $90,000 $90,000

2 $90,000 $135,000 $135,000 $210,000 $144,000 $234,000

3 $90,000 $225,000 $105,000 $315,000 $86,400 $320,400

4 $90,000 $315,000 $75,000 $390,000 $51,840 $372,240

5 $90,000 $405,000 $45,000 $435,000 $51,840 $424,080

6 $45,000 $450,000 $15,000 $450,000 $25,920 $450,000

TOTAL $450,000 $450,000 $450,000

[Company Name]

Depreciation Methods Comparison

[Date]

Gray cells are calculated for you. You do not need to enter anything in them.

Cost of property $500,000

Recovery period (years) 7

Declining balance type 200%

Declining balance rate 0.29

Number of months in first year of service 6

Salvage value $50,000

[Company Name] CONFIDENTIAL

Year Straight Line Sum-of-Years' Digits Declining Balance

Depreciation Accumulated Depreciation Accumulated Depreciation Accumulated

per year depreciation per year depreciation per year depreciation

1 $32,143 $32,143 $56,250 $56,250 $64,286 $64,286

2 $64,286 $96,429 $104,464 $160,714 $110,204 $174,490

3 $64,286 $160,714 $88,393 $249,107 $78,717 $253,207

4 $64,286 $225,000 $72,321 $321,429 $56,227 $309,434

5 $64,286 $289,286 $56,250 $377,679 $40,162 $349,595

6 $64,286 $353,571 $40,179 $417,857 $40,162 $389,757

7 $64,286 $417,857 $24,107 $441,964 $40,162 $429,919

8 $32,143 $450,000 $8,036 $450,000 $20,081 $450,000

TOTAL $450,000 $450,000 $450,000

[Company Name]

Depreciation Methods Comparison

[Date]

Gray cells are calculated for you. You do not need to enter anything in them.

Cost of property $500,000

Recovery period (years) 10

Declining balance type 200%

Declining balance rate 0.20

Number of months in first year of service 6

Salvage value $50,000

[Company Name] CONFIDENTIAL

Year Straight Line Sum-of-Years' Digits Declining Balance

Depreciation Accumulated Depreciation Accumulated Depreciation Accumulated

per year depreciation per year depreciation per year depreciation

1 $22,500 $22,500 $40,909 $40,909 $45,000 $45,000

2 $45,000 $67,500 $77,727 $118,636 $81,000 $126,000

3 $45,000 $112,500 $69,545 $188,182 $64,800 $190,800

4 $45,000 $157,500 $61,364 $249,545 $51,840 $242,640

5 $45,000 $202,500 $53,182 $302,727 $41,472 $284,112

6 $45,000 $247,500 $45,000 $347,727 $33,178 $317,290

7 $45,000 $292,500 $36,818 $384,545 $29,491 $346,781

8 $45,000 $337,500 $28,636 $413,182 $29,491 $376,272

9 $45,000 $382,500 $20,455 $433,636 $29,491 $405,763

10 $45,000 $427,500 $12,273 $445,909 $29,491 $435,254

11 $22,500 $450,000 $4,091 $450,000 $14,746 $450,000

TOTAL $450,000 $450,000 $450,000

[Company Name]

Depreciation Methods Comparison

[Date]

Gray cells are calculated for you. You do not need to enter anything in them.

Cost of property $500,000

Recovery period (years) 15

Declining balance type 200%

Declining balance rate 0.13

Number of months in first year of service 6

Salvage value $50,000

[Company Name] CONFIDENTIAL

Year Straight Line Sum-of-Years' Digits Declining Balance

Depreciation Accumulated Depreciation Accumulated Depreciation Accumulated

per year depreciation per year depreciation per year depreciation

1 $15,000 $15,000 $28,125 $28,125 $30,000 $30,000

2 $30,000 $45,000 $54,375 $82,500 $56,000 $86,000

3 $30,000 $75,000 $50,625 $133,125 $48,533 $134,533

4 $30,000 $105,000 $46,875 $180,000 $42,062 $176,596

5 $30,000 $135,000 $43,125 $223,125 $36,454 $213,049

6 $30,000 $165,000 $39,375 $262,500 $31,593 $244,643

7 $30,000 $195,000 $35,625 $298,125 $27,381 $272,024

8 $30,000 $225,000 $31,875 $330,000 $23,730 $295,754

9 $30,000 $255,000 $28,125 $358,125 $20,566 $316,320

10 $30,000 $285,000 $24,375 $382,500 $20,566 $336,886

11 $30,000 $315,000 $20,625 $403,125 $20,566 $357,452

12 $30,000 $345,000 $16,875 $420,000 $20,566 $378,019

13 $30,000 $375,000 $13,125 $433,125 $20,566 $398,585

14 $30,000 $405,000 $9,375 $442,500 $20,566 $419,151

15 $30,000 $435,000 $5,625 $448,125 $20,566 $439,717

16 $15,000 $450,000 $1,875 $450,000 $10,283 $450,000

TOTAL $450,000 $450,000 $450,000

You might also like

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- ProformaDocument1 pageProformaapi-401204785No ratings yet

- Financial Reporting Analysis 2 EdgDocument315 pagesFinancial Reporting Analysis 2 EdgPeter Snell100% (1)

- NPV IRR CalculatorDocument3 pagesNPV IRR CalculatorAli TekinNo ratings yet

- Input: Excersise 10-1: Harley DavidsonDocument13 pagesInput: Excersise 10-1: Harley DavidsonMassahid Baedhowi100% (1)

- 5 Year Financial Plan ManufacturingDocument30 pages5 Year Financial Plan ManufacturingLiza GeorgeNo ratings yet

- Financial ModelDocument6 pagesFinancial ModelGarvit JainNo ratings yet

- Boutique Hotel Financial ModelDocument15 pagesBoutique Hotel Financial ModelNgọcThủy0% (1)

- Evolution Manual - Fixed Assets PDFDocument44 pagesEvolution Manual - Fixed Assets PDFshaharhr1No ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- Company Final Accounts PDFDocument31 pagesCompany Final Accounts PDFakshay64% (11)

- SAP FICO Introduction and BasicsDocument63 pagesSAP FICO Introduction and BasicsNikhil ShahNo ratings yet

- PPE AuditDocument3 pagesPPE AuditNel HipolitoNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- Pre BoardDocument16 pagesPre BoardPatrick WaltersNo ratings yet

- NP EX19 9a JinruiDong 2Document9 pagesNP EX19 9a JinruiDong 2Ike DongNo ratings yet

- Burger KioskDocument30 pagesBurger KiosksuneershinNo ratings yet

- Chapter 9 Case Question FinanceDocument3 pagesChapter 9 Case Question FinanceBhargavNo ratings yet

- Real Estate 1cqm9pdl6 - 232635Document68 pagesReal Estate 1cqm9pdl6 - 232635DGLNo ratings yet

- My Pro Forma Indv. AssignmentDocument36 pagesMy Pro Forma Indv. AssignmentGhieAliciaNo ratings yet

- 08 ENMA302 InflationExamplesDocument8 pages08 ENMA302 InflationExamplesMotazNo ratings yet

- Taller Funciones SolverDocument10 pagesTaller Funciones SolverLeidy Carolina MEDINA GOMEZNo ratings yet

- 2009 August Data Grwich UpdateDocument1 page2009 August Data Grwich UpdatecharlespaterninaNo ratings yet

- Mount Moreland Hospital: Perform Financial CalculationsDocument9 pagesMount Moreland Hospital: Perform Financial CalculationsJacob Sheridan0% (1)

- Retirement Planner1Document4 pagesRetirement Planner1happyenglishht.kgNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Financial StatDocument11 pagesFinancial StatYaqin YusufNo ratings yet

- Proforma Statement of Income of Walt Disney: RevenueDocument44 pagesProforma Statement of Income of Walt Disney: RevenueArif.hossen 30No ratings yet

- NPV (Discount Rate, Range of Values) +investmentDocument7 pagesNPV (Discount Rate, Range of Values) +investmentNgân NguyễnNo ratings yet

- E Street Development Waterfall - Fall 2020 Part 2 - MasterDocument38 pagesE Street Development Waterfall - Fall 2020 Part 2 - Masterapi-544095773No ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Omg I Need To Open A Roth IRADocument1 pageOmg I Need To Open A Roth IRAirina.issakova6516100% (1)

- Interes 1Document9 pagesInteres 1Milo GuevaraNo ratings yet

- Taller Calificable VPN-TIRDocument11 pagesTaller Calificable VPN-TIRMario MarinNo ratings yet

- County Steel Inc.Document20 pagesCounty Steel Inc.ingrid619No ratings yet

- Company Name: Profit and Loss StatementDocument3 pagesCompany Name: Profit and Loss Statementsaiful rajataNo ratings yet

- Retirement Planner: OOPS! This Plan Will Only Provide Income To Age 61. You'll Need To Makes Some ModificationsDocument4 pagesRetirement Planner: OOPS! This Plan Will Only Provide Income To Age 61. You'll Need To Makes Some ModificationsRaden Arif RifaiNo ratings yet

- Assignment 3 BookDocument14 pagesAssignment 3 Bookapi-604969350No ratings yet

- Stock Dads Compound Interest CalculatorDocument4 pagesStock Dads Compound Interest CalculatorMNo ratings yet

- FSDocument8 pagesFSjoseNo ratings yet

- Sales Price (Property Sold Under 45 Days) Net Proceeds From Sale Purchase Price (Equal or Less Than)Document1 pageSales Price (Property Sold Under 45 Days) Net Proceeds From Sale Purchase Price (Equal or Less Than)api-26010927No ratings yet

- Year 0 Year 1 Year 2 Year 3 Year 4Document14 pagesYear 0 Year 1 Year 2 Year 3 Year 4nina9121No ratings yet

- Act 6 MatematicasDocument13 pagesAct 6 MatematicasdanielaNo ratings yet

- Profit Tracker v3.1Document18 pagesProfit Tracker v3.1alishaNo ratings yet

- Four-Cormers - Grupo 3Document37 pagesFour-Cormers - Grupo 3elboomscrlNo ratings yet

- Meerut Adventure Company CV1Document9 pagesMeerut Adventure Company CV1Ayushi GuptaNo ratings yet

- Flujo de Caja Proyectado1Document8 pagesFlujo de Caja Proyectado1CHARLES WILLIAM SALAZAR SANCHEZNo ratings yet

- Budget Summary Template USDocument1 pageBudget Summary Template USSachin KulkarniNo ratings yet

- Loan Amount Closing Costs: 30 Year Amortization Per $1000 FinancedDocument1 pageLoan Amount Closing Costs: 30 Year Amortization Per $1000 Financedapi-26011493No ratings yet

- End of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)Document1 pageEnd of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)amanuel mindaNo ratings yet

- Insurance Schedule CalculationsDocument4 pagesInsurance Schedule CalculationsalfredanandNo ratings yet

- Actividad 7 Mat FinancieraDocument10 pagesActividad 7 Mat Financierajuguetes ymasNo ratings yet

- QSO 533 Week 4 Homework Starter FileDocument35 pagesQSO 533 Week 4 Homework Starter FileMellaniNo ratings yet

- Fuwang LTD.Document16 pagesFuwang LTD.MAHTAB KhandakerNo ratings yet

- Retirement PlannerDocument3 pagesRetirement PlannerAidaNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Republican Party Finances, 2007-2010Document1 pageRepublican Party Finances, 2007-2010coalitiontorebuildthepartyNo ratings yet

- Matemáticas Financieras: Evidencia de AprendizajeDocument5 pagesMatemáticas Financieras: Evidencia de AprendizajeMas JovNo ratings yet

- J SMytheDocument4 pagesJ SMytheSyed TabrezNo ratings yet

- Total RevenueDocument1 pageTotal RevenueethanselphNo ratings yet

- Savings CalculatorDocument3 pagesSavings Calculatoradamgross155No ratings yet

- 11.2 - Marketing Budget 2015 FinalDocument6 pages11.2 - Marketing Budget 2015 FinalCrivat CatalinNo ratings yet

- Budget Ch07 CompleteDocument8 pagesBudget Ch07 Completeクマー ヴィーンNo ratings yet

- Profit and Loss StatementDocument3 pagesProfit and Loss StatementharryNo ratings yet

- Financial History and RatiosDocument1 pageFinancial History and RatiosRosana Alves LaudelinoNo ratings yet

- Detailed Sales ForecastDocument3 pagesDetailed Sales ForecastRosana Alves LaudelinoNo ratings yet

- Controle de VisitasDocument42 pagesControle de VisitasRosana Alves LaudelinoNo ratings yet

- Curva ABC: Item Preço Médio VendasDocument6 pagesCurva ABC: Item Preço Médio VendasRosana Alves LaudelinoNo ratings yet

- Contas A Pagar e Receber DashboardDocument39 pagesContas A Pagar e Receber DashboardRosana Alves LaudelinoNo ratings yet

- Controle de ProduçãoDocument65 pagesControle de ProduçãoRosana Alves LaudelinoNo ratings yet

- Horngren Ima16 stppt16Document66 pagesHorngren Ima16 stppt16SumitasNo ratings yet

- BOAT Annual Report - Revenue - FinancialsDocument12 pagesBOAT Annual Report - Revenue - Financialsmaanyaagrawal65No ratings yet

- Mastek Jul-Sep 2021Document51 pagesMastek Jul-Sep 2021Aditya0% (1)

- AIS Chapter 6Document23 pagesAIS Chapter 6Hasan AbirNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- CHAPTER 6-FA Questions - BAsicDocument3 pagesCHAPTER 6-FA Questions - BAsicHussna Al-Habsi حُسنى الحبسيNo ratings yet

- 2018 AFR Local Govt Volume IIDocument528 pages2018 AFR Local Govt Volume IIJericho VillalonNo ratings yet

- Ias 41 PDFDocument33 pagesIas 41 PDFShekharKushJeetunNo ratings yet

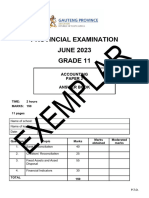

- Grade 11 ACC P2 (English) June 2023 AnswerbookDocument11 pagesGrade 11 ACC P2 (English) June 2023 AnswerbookzembenomazwiNo ratings yet

- Ias in Square PharmaDocument7 pagesIas in Square Pharmaarif9870% (1)

- Performance AppraisalDocument54 pagesPerformance AppraisalAbu BakrNo ratings yet

- Assignment - 8-Contemporary Engineering EconomicsDocument3 pagesAssignment - 8-Contemporary Engineering EconomicsDhiraj NayakNo ratings yet

- Startup ExpensesDocument4 pagesStartup ExpensesFajri RahmanNo ratings yet

- Informe Anual CECA Cuentas Consolidadas 2019 - EngDocument181 pagesInforme Anual CECA Cuentas Consolidadas 2019 - Engjosecente123321No ratings yet

- Acca P2 Corporate Reporting (INT) June 2015: Sample NoteDocument64 pagesAcca P2 Corporate Reporting (INT) June 2015: Sample NoteSovanna HangNo ratings yet

- Coal Stock Register: For The MonthDocument35 pagesCoal Stock Register: For The MonthRaja RamNo ratings yet

- Tally Group ListsDocument3 pagesTally Group ListsKabilan Kabil50% (2)

- Ys%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument28 pagesYs%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaSanaka LogesNo ratings yet

- Blessed Me LordDocument168 pagesBlessed Me LordBoa HancockNo ratings yet

- Lec 11 ControllingDocument10 pagesLec 11 ControllingThe Daily QuotesNo ratings yet

- Sandeep MaheshwariDocument56 pagesSandeep MaheshwarisandeephedaNo ratings yet

- Module 3 Problems On Income StatementDocument8 pagesModule 3 Problems On Income StatementShruthi PNo ratings yet

- Chap003 TestbankDocument90 pagesChap003 Testbankوائل مصطفىNo ratings yet