Professional Documents

Culture Documents

HW Module 9

Uploaded by

Lộc Nguyễn Như0 ratings0% found this document useful (0 votes)

7 views6 pagesThe document compares GAAP and IFRS accounting standards regarding cash and receivables. There are several similarities, such as cash and receivables being reported as current assets, and allowances recorded for uncollectible accounts. Differences include IFRS not mandating separate reporting of different receivable types and having different approaches for estimating uncollectible accounts depending on receivable financing components. IFRS also treats bank overdrafts as cash while GAAP treats them as liabilities.

Original Description:

Original Title

Hw module 9

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document compares GAAP and IFRS accounting standards regarding cash and receivables. There are several similarities, such as cash and receivables being reported as current assets, and allowances recorded for uncollectible accounts. Differences include IFRS not mandating separate reporting of different receivable types and having different approaches for estimating uncollectible accounts depending on receivable financing components. IFRS also treats bank overdrafts as cash while GAAP treats them as liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views6 pagesHW Module 9

Uploaded by

Lộc Nguyễn NhưThe document compares GAAP and IFRS accounting standards regarding cash and receivables. There are several similarities, such as cash and receivables being reported as current assets, and allowances recorded for uncollectible accounts. Differences include IFRS not mandating separate reporting of different receivable types and having different approaches for estimating uncollectible accounts depending on receivable financing components. IFRS also treats bank overdrafts as cash while GAAP treats them as liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

Nguyễn Như Lộc

Date of birth: Nov 10Th, 2001

Class: Advanced accounting Intake 61

Student ID: 11193127

IFRS7: S&D (7-63)

Following are the key similarities and differences between GAAP and IFRS related to cash and

receivables.

Similarities

• The accounting and reporting related to cash is essentially the same under both IFRS and

GAAP. In addition, the definition used for cash equivalents is the same.

• Like GAAP, cash and receivables are generally reported in the current assets section of the

statement of financial position under IFRS.

• Like GAAP, for trade and other accounts receivable without a significant financing component,

an allowance for uncollectible accounts should be recorded to result in receivables reported at the

net amount expected to be collected. The estimation approach used is like that under GAAP.

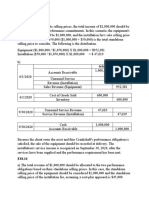

• Like GAAP, IFRS requires that loans and receivables be accounted for at amortized cost,

adjusted for allowances for doubtful accounts. IFRS sometimes refers to these allowances as

provisions. The entry to record the allowance would be as follows.

Bad Debt Expense xxxxxx

Provision for Doubtful Accounts xxxxxx

Differences

• Under IFRS, companies may report cash and receivables as the last items in current assets

under IFRS. Under GAAP, these items are reported in order of liquidity.

• While IFRS implies that receivables with different characteristics should be reported

separately, there is no standard that mandates this segregation. GAAP has explicit guidance in

the area.

• Unlike GAAP, IFRS has a different approach to estimating uncollectible accounts on

receivables with a significant financing component (e.g., notes receivable). For long-term

receivables that have not experienced a deterioration in credit quality after origination,

uncollectible accounts are estimated based on expected losses over the next 12 months. For long-

term receivables that experience a credit quality decline, uncollectible accounts are estimated

based on lifetime expected losses (which is the model used under GAAP for all receivables).

• The fair value option is similar under GAAP and IFRS but not identical. The international

standard related to the fair value option is subject to certain qualifying criteria not in the U.S.

standard. In addition, there are some differences in the financial instruments covered.

• Under IFRS, bank overdrafts are generally reported as cash. Under GAAP, such balances are

reported as liabilities.

• IFRS and GAAP diff er in the criteria used to account for transfers of receivables. IFRS is a

combination of an approach focused on risks and rewards and loss of control. GAAP uses loss of

control as the primary criterion. In addition, IFRS generally permits partial transfers; GAAP does

not.

You might also like

- GAAP General Accepted Accounting PrinciplesDocument10 pagesGAAP General Accepted Accounting PrinciplesAnonymous qbVaMYIIZNo ratings yet

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Lucid Dreaming Fast TrackDocument3 pagesLucid Dreaming Fast TrackWulan Funblogger50% (2)

- KPMG Financial Instruments - The Complete StandardDocument4 pagesKPMG Financial Instruments - The Complete Standardhui7411No ratings yet

- Effects of The Sugar RevolutionDocument9 pagesEffects of The Sugar RevolutionSusan BarriotNo ratings yet

- ANCHETAAADocument79 pagesANCHETAAAGUILAY, KEVIN MARK F.No ratings yet

- Investment Analysis ProjectDocument6 pagesInvestment Analysis Projectmuhammad ihtishamNo ratings yet

- Indian Banks - CLSADocument4 pagesIndian Banks - CLSAPranjayNo ratings yet

- Device Test ModeDocument14 pagesDevice Test ModeNay SoeNo ratings yet

- 100 transaction cycle in VisionPLUS banking systemDocument7 pages100 transaction cycle in VisionPLUS banking systemGoushik Balakrishnan100% (1)

- Analyzing Potential Audit Client LakesideDocument22 pagesAnalyzing Potential Audit Client LakesideLet it be100% (1)

- IFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsFrom EverandIFRS Simplified: A fast and easy-to-understand overview of the new International Financial Reporting StandardsRating: 4 out of 5 stars4/5 (11)

- Manual - Nokia - AirScale - System Module - Presentation NokiaDocument29 pagesManual - Nokia - AirScale - System Module - Presentation NokiaAndres Obando100% (1)

- The Treatment of Nonperforming Loans in Macroeconomic StatisticsDocument18 pagesThe Treatment of Nonperforming Loans in Macroeconomic StatisticsAnonymous A0jSvP1No ratings yet

- What Are Some of The Key Differences Between IFRS and U.S. GAAP?Document3 pagesWhat Are Some of The Key Differences Between IFRS and U.S. GAAP?Anupta PatiNo ratings yet

- DIFFDocument7 pagesDIFFEmaazNo ratings yet

- GAAP/IFRS Accounting DifferencesDocument7 pagesGAAP/IFRS Accounting DifferencesAlexander BoshraNo ratings yet

- Notes - IFRS vs. GAAPDocument3 pagesNotes - IFRS vs. GAAPbhavanaNo ratings yet

- Presented By:: Under The Kind Guidance ofDocument52 pagesPresented By:: Under The Kind Guidance ofArman UmarNo ratings yet

- GAAP, IFRS and Indian Accounting Standards ComparisonDocument52 pagesGAAP, IFRS and Indian Accounting Standards ComparisonAnkit JaniNo ratings yet

- IFRS vs GAAP: Top 10 Accounting DifferencesDocument3 pagesIFRS vs GAAP: Top 10 Accounting DifferencesRakesh GuptaNo ratings yet

- Analysis of Financial Statement: Indian Gaap V/s Us GaapDocument32 pagesAnalysis of Financial Statement: Indian Gaap V/s Us Gaapshyam123112007No ratings yet

- What Is Auditor IndependenceDocument6 pagesWhat Is Auditor IndependenceNeriza PonceNo ratings yet

- Diffarence Between US GAAP and Indian Accounting StandardsDocument18 pagesDiffarence Between US GAAP and Indian Accounting StandardsBluehacks100% (1)

- Gaap VS IfrsDocument4 pagesGaap VS IfrsPrasannaNo ratings yet

- Gaap VS IfrsDocument2 pagesGaap VS IfrsPrasannaNo ratings yet

- US GAAP vs Indian Accounting StandardsDocument18 pagesUS GAAP vs Indian Accounting StandardsKalidindi Vamsi Krishna VarmaNo ratings yet

- EnglishDocument5 pagesEnglishkoki222089No ratings yet

- Diffarence Between US GAAP and Indian Accounting StandardsDocument18 pagesDiffarence Between US GAAP and Indian Accounting StandardsPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (3)

- Irfs and Us GaapDocument7 pagesIrfs and Us Gaapabissi67No ratings yet

- US GAAP N FRA - IMPDocument17 pagesUS GAAP N FRA - IMPtanya1780No ratings yet

- Gaap - Stephen J BigelowDocument4 pagesGaap - Stephen J BigelowInnocent MundaNo ratings yet

- Long Term LiabilitiesDocument21 pagesLong Term Liabilitiesnioriatti8924No ratings yet

- IFRS Vs US GAAPDocument5 pagesIFRS Vs US GAAPtibebu5420No ratings yet

- MEASUREMENT APPLICATIONS IN ACCOUNTING THEORYDocument31 pagesMEASUREMENT APPLICATIONS IN ACCOUNTING THEORYFebNo ratings yet

- What Is IFRS and GAApDocument4 pagesWhat Is IFRS and GAApAsif UllahNo ratings yet

- Us Gaap Versus Ifrs: The BasicsDocument54 pagesUs Gaap Versus Ifrs: The BasicsAkhil ManglaNo ratings yet

- Interview Related QuestionsDocument8 pagesInterview Related QuestionsAnshita GargNo ratings yet

- Diff Betn Us Gaap - IfrsDocument9 pagesDiff Betn Us Gaap - IfrsVimal SoniNo ratings yet

- Summary Notes On Session 2 - Understanding Corporate Financial Statements IDocument10 pagesSummary Notes On Session 2 - Understanding Corporate Financial Statements Ilalith4uNo ratings yet

- Investor Perspective Financial Instruments July 2014Document6 pagesInvestor Perspective Financial Instruments July 2014Bheki TshimedziNo ratings yet

- Differences Between US GAAP, Indian GAAP and IFRSDocument7 pagesDifferences Between US GAAP, Indian GAAP and IFRSRendy MokogintaNo ratings yet

- Afm AssignmentDocument6 pagesAfm AssignmentShweta BhardwajNo ratings yet

- Cash and Receivables: Chapter ReviewDocument6 pagesCash and Receivables: Chapter ReviewOmar HosnyNo ratings yet

- GAAP Differences SummaryDocument7 pagesGAAP Differences SummaryAmitesh PandeyNo ratings yet

- Currency Gains Losses IfrsDocument8 pagesCurrency Gains Losses IfrsSatyendra KumarNo ratings yet

- GAAP vs IFRS: Key Accounting DifferencesDocument6 pagesGAAP vs IFRS: Key Accounting DifferencesShawn WeldieNo ratings yet

- US GAAP Vs IFRS 2Document4 pagesUS GAAP Vs IFRS 2BatuNo ratings yet

- IFRS Vs US GAAP 2020Document9 pagesIFRS Vs US GAAP 2020ERIN KRISTINo ratings yet

- Legislation, Standards & The Finance Services IndustryDocument42 pagesLegislation, Standards & The Finance Services IndustryStephen PommellsNo ratings yet

- Us Gaap and Indian GaapDocument22 pagesUs Gaap and Indian Gaapakram75zaaraNo ratings yet

- Diff Bet USGAAP IGAAP IFRSDocument7 pagesDiff Bet USGAAP IGAAP IFRSMichael HillNo ratings yet

- IFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMDocument9 pagesIFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMAnirudh DuttaNo ratings yet

- Basics of Accounting: By: Dr. Bhupendra Singh HadaDocument84 pagesBasics of Accounting: By: Dr. Bhupendra Singh HadaAryanSinghNo ratings yet

- Summary 1 60Document73 pagesSummary 1 60Karen Joy Jacinto Ello100% (1)

- CF ReformDocument40 pagesCF ReformJerry LoNo ratings yet

- Gaap Vs IfrsDocument12 pagesGaap Vs IfrsAnonymous Q3J7APoNo ratings yet

- Summary of Accounting ConceptsDocument21 pagesSummary of Accounting ConceptskimringineNo ratings yet

- Comparison of IFRS and U.S GAAP in Relation To Intangible AssetsDocument6 pagesComparison of IFRS and U.S GAAP in Relation To Intangible AssetsVimal SoniNo ratings yet

- Ifrs Vs NL GaapDocument19 pagesIfrs Vs NL GaapHTMoonNo ratings yet

- China Accounting StandardsDocument3 pagesChina Accounting StandardsAaron Joy Dominguez PutianNo ratings yet

- LEARNING OUTCOME STATEMENTSDocument3 pagesLEARNING OUTCOME STATEMENTSGUTIERREZ, Ronalyn Y.No ratings yet

- The Conceptual Framework: Accounting Policies and ConventionsDocument61 pagesThe Conceptual Framework: Accounting Policies and ConventionsZulfan LubisNo ratings yet

- Summary - Cash and Cash EquivalentDocument9 pagesSummary - Cash and Cash EquivalentDyenNo ratings yet

- 2016 Mock CommentaryDocument5 pages2016 Mock CommentaryNghia Tuan NghiaNo ratings yet

- Intermediate Accounting/Preparation of Financial StatementsDocument7 pagesIntermediate Accounting/Preparation of Financial StatementsHimashu TiwariNo ratings yet

- What Is Utilitarianism? 2. Do You Favor For Utilitarianism? Why or Why Not? 1Document2 pagesWhat Is Utilitarianism? 2. Do You Favor For Utilitarianism? Why or Why Not? 1Lộc Nguyễn NhưNo ratings yet

- Ethics-Ch1-Introduction-TS NgocDocument54 pagesEthics-Ch1-Introduction-TS Ngoctrung nguyenNo ratings yet

- P13 10Document1 pageP13 10Lộc Nguyễn NhưNo ratings yet

- U2 HWDocument1 pageU2 HWLộc Nguyễn NhưNo ratings yet

- Ethics-Ch3-Teleology-TS NgocDocument49 pagesEthics-Ch3-Teleology-TS Ngoctrung nguyenNo ratings yet

- Business Communication Group Project Proposal Members: Situation 1. The 19 Club Fashion BrandDocument5 pagesBusiness Communication Group Project Proposal Members: Situation 1. The 19 Club Fashion BrandLộc Nguyễn NhưNo ratings yet

- Business Communications Group 12 Proposal (KTTT 61) Team members: Nguyễn Như Lộc (Leader)Document2 pagesBusiness Communications Group 12 Proposal (KTTT 61) Team members: Nguyễn Như Lộc (Leader)Lộc Nguyễn NhưNo ratings yet

- HW Module 4Document4 pagesHW Module 4Lộc Nguyễn NhưNo ratings yet

- E18 13+14Document2 pagesE18 13+14Lộc Nguyễn NhưNo ratings yet

- HW Module 2Document5 pagesHW Module 2Lộc Nguyễn NhưNo ratings yet

- E21 18Document2 pagesE21 18Lộc Nguyễn NhưNo ratings yet

- E16.11 1/1/2021: No Entry 12/31/2021Document1 pageE16.11 1/1/2021: No Entry 12/31/2021Lộc Nguyễn NhưNo ratings yet

- HW Module 6Document6 pagesHW Module 6Lộc Nguyễn NhưNo ratings yet

- HW Module 5Document3 pagesHW Module 5Lộc Nguyễn NhưNo ratings yet

- E20.10 A) Webb Corp. Pension WorksheetDocument2 pagesE20.10 A) Webb Corp. Pension WorksheetLộc Nguyễn NhưNo ratings yet

- HW Module 3Document3 pagesHW Module 3Lộc Nguyễn NhưNo ratings yet

- E19 9Document1 pageE19 9Lộc Nguyễn NhưNo ratings yet

- HW Module 5Document3 pagesHW Module 5Lộc Nguyễn NhưNo ratings yet

- HW Module 9Document6 pagesHW Module 9Lộc Nguyễn NhưNo ratings yet

- Pension worksheet entriesDocument2 pagesPension worksheet entriesLộc Nguyễn NhưNo ratings yet

- Dr Deane's Savings Plan & House Down PaymentDocument5 pagesDr Deane's Savings Plan & House Down PaymentLộc Nguyễn NhưNo ratings yet

- E14 19Document1 pageE14 19Lộc Nguyễn NhưNo ratings yet

- Nguyễn Như Lộc Date of birth: Nov 10, 2001 Class: Advanced accounting Intake 61Document3 pagesNguyễn Như Lộc Date of birth: Nov 10, 2001 Class: Advanced accounting Intake 61Lộc Nguyễn NhưNo ratings yet

- E19 9Document1 pageE19 9Lộc Nguyễn NhưNo ratings yet

- HW Module 6Document6 pagesHW Module 6Lộc Nguyễn NhưNo ratings yet

- E15 23Document3 pagesE15 23Lộc Nguyễn NhưNo ratings yet

- E19 9Document1 pageE19 9Lộc Nguyễn NhưNo ratings yet

- E14 19Document1 pageE14 19Lộc Nguyễn NhưNo ratings yet

- E16.11 1/1/2021: No Entry 12/31/2021Document1 pageE16.11 1/1/2021: No Entry 12/31/2021Lộc Nguyễn NhưNo ratings yet

- MEM05 Header R8.1Document388 pagesMEM05 Header R8.1andysupaNo ratings yet

- Corporate Level Strategies ExplainedDocument30 pagesCorporate Level Strategies ExplainedNazir AnsariNo ratings yet

- The Residents of The British East India Company at Indian Royal Courts, C. 1798-1818Document224 pagesThe Residents of The British East India Company at Indian Royal Courts, C. 1798-1818Ajay_Ramesh_Dh_6124No ratings yet

- Alora Sealord History, How and Why They Were FormedDocument1 pageAlora Sealord History, How and Why They Were Formedgoddessjanefire003No ratings yet

- AUMUND Bucket Elevators 180801Document16 pagesAUMUND Bucket Elevators 180801Tino TorehNo ratings yet

- B.sc. Microbiology 1Document114 pagesB.sc. Microbiology 1nasitha princeNo ratings yet

- Inelastic Response SpectrumDocument10 pagesInelastic Response Spectrummathewsujith31No ratings yet

- Cat Behavior - Facts and MythsDocument3 pagesCat Behavior - Facts and MythsCharlie CajigalNo ratings yet

- International Organizations and RelationsDocument3 pagesInternational Organizations and RelationsPachie MoloNo ratings yet

- 5 Integumentary SystemDocument67 pages5 Integumentary SystemchelsealivesforeverNo ratings yet

- People Vs Sindiong & PastorDocument4 pagesPeople Vs Sindiong & PastorErby Jennifer Sotelo-GesellNo ratings yet

- 9th Science Mcqs PTB PDFDocument25 pages9th Science Mcqs PTB PDFUmar JuttNo ratings yet

- ADL Report "Attacking" Press TVDocument20 pagesADL Report "Attacking" Press TVGordon DuffNo ratings yet

- GJ ScriptDocument83 pagesGJ ScriptKim LawrenceNo ratings yet

- Lesson 7Document29 pagesLesson 7Khelly Joshua UyNo ratings yet

- Organizational Behavior: Eighteenth EditionDocument37 pagesOrganizational Behavior: Eighteenth EditionPrashant Kumar100% (1)

- pmwj93 May2020 Omar Fashina Fakunle Somaliland Construction IndustryDocument18 pagespmwj93 May2020 Omar Fashina Fakunle Somaliland Construction IndustryAdebayo FashinaNo ratings yet

- Trauma-Informed CounselingDocument1 pageTrauma-Informed Counselingapi-492010604No ratings yet

- Big Data Machine Learning Using Apache Spark Mllib: December 2017Document8 pagesBig Data Machine Learning Using Apache Spark Mllib: December 2017edgarNo ratings yet

- Introduction 130407092142 Phpapp01Document69 pagesIntroduction 130407092142 Phpapp01Pari Savla100% (1)

- Tourist Spot in Ilocos Norte PhilippinesDocument1 pageTourist Spot in Ilocos Norte Philippinescharlie besabellaNo ratings yet

- TRW WHP PDFDocument20 pagesTRW WHP PDFmonica_codNo ratings yet

- Summative Test 1Document3 pagesSummative Test 1Glenda AstodilloNo ratings yet