Professional Documents

Culture Documents

National Internal Revenue Taxes: Based in The Case of Vincente Vs Raffierty G.R. No. L-12287

National Internal Revenue Taxes: Based in The Case of Vincente Vs Raffierty G.R. No. L-12287

Uploaded by

Warly PabloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

National Internal Revenue Taxes: Based in The Case of Vincente Vs Raffierty G.R. No. L-12287

National Internal Revenue Taxes: Based in The Case of Vincente Vs Raffierty G.R. No. L-12287

Uploaded by

Warly PabloCopyright:

Available Formats

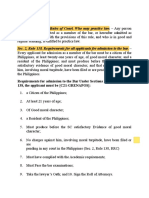

National internal revenue taxes

Sec 21 nirc

Income tax

Estate

Donor

Vat

Other percentage tase

Excise

Doc stamp

Imposed by the bir.

National internal revenue tax - lahat ng nasa list (exclusive list) taxes collected by the national govt. - Bir

(wc is part of the national govt. not all national tax are national internal revenue tax.

National tax - collected by BOC, BIR

Local tax - collected by the lgu

Income tax system - there will be only an income tax when there is an income, whether actual or

presumed. Privileged tax (excise tax)

1. Global tax system - all income are not classified or all grouped into one taxable income. Regardless

of the type, nature, source.

Tax rate - single or uniform. Applicable to a corporation. Subj to creditable withholding tax?

2. Schedular - kabaliktaran ng global. - classified income, categorised into diff taxable income.

Applicable to an individual tax payer. Subj to final withholding tax system.

3. Semi schedular or semi global -

Criteria in imposing IT

(comprehensive)

1. Citizenship principle - Citizen whether within or without - taxable in the ph. or alien

Resident citizen, domestic corp - are subj to income tax and if the question is what kind of income tax

will apply, within and without may apply.

4. Residence principle -

5. Source principle

Distinction between capital and income

Based in the case of Vincente vs raffierty g.r. no. L-12287

Capital - fund (not taxable) (return of capital )

Income - flow of fund

1m - not taxable - principal or capital

1,100,000 - 100k (taxable)

Association of non profit clubs vs BIR

Associations dues are subj to IT? SC - held no. it only constitute a contribution for the operation and

preservation of these association. It constitutes as an infusion of capital.

Sources of income whether from within or without the ph. Sec 42 A

1. Interest - nagkakaroon tayo ng interest income from bank deposits and loans.

- BP - governed by the law on loans

- Loans - titignan ang residence ng debtor and not his nationality. The place of payment or where the

contract was made is immaterial.

6. Dividend - kappa nag invest sa sang corp at sang stock holder. Kappa kumita and corp your are a

share holder and they declare dividends

Share holder is the income earner.

Kelan considered income from within or without ? - alamin muna Sino and corporation na nag decrlare if

it is foreign or domestic?

Domestic - within (absolute rule)

Foreign- titignan mo and gross income for the last 3 years preceding the declaration of the dividend.

Kapag at least 50% of the GI for the last 3 years is an income from within the ph is considered as within

the ph but up to the extent of the ratio of the income derived rom the ph over the world.

- if less than 50% ang galing sa ph? 100 % of the diviend income will be considered as income from

without the ph.

7. Services - look at the place of performance of the service. If performed in the ph - within

If outside - without. Place of execution of contract or payment is immaterial

8. Rentals and royalties - properties are located in the ph.

9. Sale of real property - look at the place where the property is located.

10. Sale of personal property - look at the place of sale.

Exception- sale of shares of stock a domestic corp regardless of the place - it is income from within the

ph. - intangible

Kinds of income taxes

a. Normal/net income tax - taxable income subj to schedular rate to 0 to 35 percent under the law.

Taxable income - sec 31

Gross income

- allowable deduction multiply by 0 to 35%

b. 8% percent income tax (TRAIN LAW)

c. Gross income tax - only two taxpayer Subjct to this, non resident alien not engaged in business - rate

25%

Non resident foreign corp - 30%

GI x 30% or 25% = GIT (no deductions allowed)

d. Final income

e. Regular corporate income tax - parehong taxable income basehan, tax rate -30% will be applied.

f. Minimum corpo -

g. Improperly accumulated earnings tax 10% and domestic corp lang ang subject to this.

h. Optional corporate income tax - not applicable at this time.

1 income can only be subjected to 1 income tax.

Kinds of taxpayers

Sec 22 A tax code

1. Individual - resident citizen - taxable both within or without.

non resident, - subj to gross income - definition- sec 22 E 1 to 4

note: non resident works abroad and derives income from abroad and whose employment thereat

required him to be physically present most of the time during the taxable year. (you have foreign

employment and time spent abroad)

BIR’s explanation - aggregate period of 183 days hence your are a non resident

resident alien - not a citizen but resident in the ph - look at their length of stay and purpose.

non resident alien not engaged - they have sources of income like dividends, interests etc.

and engaged in trade or business - 1. Only engaged in business 2. Non resident stayed an aggregate

180 days in a given calendar year. 3. Exercise of their profession

11. Corporation - domestic - taxable from within and without and foreign - without

Partnership - trade partnership. General profession partnership is not considered as a corporation it is for a

purpose of exercise of a common profession.

12. Estate

13. Trust

(tinamad na ko last part) hahah

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tax Bill 2022Document1 pageTax Bill 2022LOUNGE HOMENo ratings yet

- RMC No. 51-2018Document1 pageRMC No. 51-2018Atty. Jackelyn Joy Pernitez0% (1)

- In Worksheet On Word Problems On Percentage We Will Practice Some Real Life Problems On PercentDocument3 pagesIn Worksheet On Word Problems On Percentage We Will Practice Some Real Life Problems On PercentreenuNo ratings yet

- RR No. 18-2013 (Digest)Document3 pagesRR No. 18-2013 (Digest)Alisa FitzpatrickNo ratings yet

- Overview of Handling BIR Tax Audit in The PhilippinesDocument3 pagesOverview of Handling BIR Tax Audit in The PhilippinesMarietta Fragata Ramiterre100% (2)

- Inv 12360Document1 pageInv 12360Saket DhamiNo ratings yet

- CIR V Magsaysay LinesDocument2 pagesCIR V Magsaysay LinesReyna Remulta100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Praveen MishraNo ratings yet

- Commercial LawDocument183 pagesCommercial LawWarly PabloNo ratings yet

- Data Privacy ActDocument2 pagesData Privacy ActWarly PabloNo ratings yet

- Canon 8-12-Notes-PabloDocument56 pagesCanon 8-12-Notes-PabloWarly PabloNo ratings yet

- Nature of Real Property Tax (RPT)Document23 pagesNature of Real Property Tax (RPT)Warly PabloNo ratings yet

- DamagesDocument19 pagesDamagesWarly PabloNo ratings yet

- Con 21Document38 pagesCon 21Warly PabloNo ratings yet

- Fencing OverseasDocument17 pagesFencing OverseasWarly PabloNo ratings yet

- Evidence General Principles Up To DnaDocument87 pagesEvidence General Principles Up To DnaWarly PabloNo ratings yet

- Guardianship HCDocument7 pagesGuardianship HCWarly PabloNo ratings yet

- Corpo DoctrinesDocument8 pagesCorpo DoctrinesWarly PabloNo ratings yet

- BP22 CasesDocument71 pagesBP22 CasesWarly PabloNo ratings yet

- Corpo CasesDocument69 pagesCorpo CasesWarly PabloNo ratings yet

- Cases Vawc SADocument247 pagesCases Vawc SAWarly PabloNo ratings yet

- NotesDocument21 pagesNotesWarly PabloNo ratings yet

- CASESDocument8 pagesCASESWarly PabloNo ratings yet

- Parole EvidenceDocument5 pagesParole EvidenceWarly PabloNo ratings yet

- Wa HDDocument15 pagesWa HDWarly PabloNo ratings yet

- Morgan V. Commissioner of Internal Revenue (1940) No. 210Document19 pagesMorgan V. Commissioner of Internal Revenue (1940) No. 210Warly PabloNo ratings yet

- MANILA GAS CORPORATION, Plaintiff and Appellant, vs. THE COLLECTOR OF INTERNAL REVENUE, Defendant and AppelleeDocument77 pagesMANILA GAS CORPORATION, Plaintiff and Appellant, vs. THE COLLECTOR OF INTERNAL REVENUE, Defendant and AppelleeWarly PabloNo ratings yet

- Section 1, Rule 138, Rules of Court. Who May Practice Law. - Any PersonDocument51 pagesSection 1, Rule 138, Rules of Court. Who May Practice Law. - Any PersonWarly PabloNo ratings yet

- Testimonial EvidenceDocument10 pagesTestimonial EvidenceWarly PabloNo ratings yet

- Barredo V Garcia (Torts) : Torts and Damages Case Digests 2.23.22Document16 pagesBarredo V Garcia (Torts) : Torts and Damages Case Digests 2.23.22Warly PabloNo ratings yet

- Office of The Solicitor General For Plaintiff-Appellee. Felipe R. Hipolito For Defendants-AppellantsDocument86 pagesOffice of The Solicitor General For Plaintiff-Appellee. Felipe R. Hipolito For Defendants-AppellantsWarly PabloNo ratings yet

- Pale March29Document69 pagesPale March29Warly PabloNo ratings yet

- Who May Practice Law?Document18 pagesWho May Practice Law?Warly PabloNo ratings yet

- Estate Tax CasesDocument17 pagesEstate Tax CasesWarly PabloNo ratings yet

- PABLO LORENZO, As Trustee of The Estate of Thomas Hanley, vs. JUAN POSADAS, JR., Collector of Internal Revenue, G.R. No. L-43082 June 18, 1937 FactsDocument4 pagesPABLO LORENZO, As Trustee of The Estate of Thomas Hanley, vs. JUAN POSADAS, JR., Collector of Internal Revenue, G.R. No. L-43082 June 18, 1937 FactsWarly PabloNo ratings yet

- Income Tax CasesDocument143 pagesIncome Tax CasesWarly PabloNo ratings yet

- RAMON RALLOS, Administrator of The Estate of CONCEPCION RALLOSDocument109 pagesRAMON RALLOS, Administrator of The Estate of CONCEPCION RALLOSWarly PabloNo ratings yet

- Sections 119-125 Pablo, Palmera and PeedenDocument12 pagesSections 119-125 Pablo, Palmera and PeedenWarly PabloNo ratings yet

- Salary Slip (30681440 March, 2019) PDFDocument1 pageSalary Slip (30681440 March, 2019) PDFMuhammad Aoun RazaNo ratings yet

- Global Reciprocal College Inctax-1 Final Examination 1st Semester, SY 2020-2021 Problem 1Document4 pagesGlobal Reciprocal College Inctax-1 Final Examination 1st Semester, SY 2020-2021 Problem 1sharielles /No ratings yet

- EOCh 1 Self TestDocument9 pagesEOCh 1 Self TestHannah valdeNo ratings yet

- Roots Multiclean LTD Kovilpalayam, Pollachi: Pay Slip For The Month Of: LocationDocument1 pageRoots Multiclean LTD Kovilpalayam, Pollachi: Pay Slip For The Month Of: LocationMonishraj LakshmijanarthananNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismARJUNNo ratings yet

- Income Taxation - Tabag 2018Document33 pagesIncome Taxation - Tabag 2018Patrice De CastroNo ratings yet

- LBO Model - ValuationDocument6 pagesLBO Model - ValuationsashaathrgNo ratings yet

- Implications of Tax Evasion On The Economic Development of Third World CountriesDocument11 pagesImplications of Tax Evasion On The Economic Development of Third World CountriesTrisha GarciaNo ratings yet

- Bachelor's Degree Programme (BDP) : Assignment 2015-16Document4 pagesBachelor's Degree Programme (BDP) : Assignment 2015-16Paras JainNo ratings yet

- Cta Eb CV 02543 D 2023may11 AssDocument11 pagesCta Eb CV 02543 D 2023may11 AssErlinda SantiagoNo ratings yet

- Employee Share Ownership Plan: Your at A GlanceDocument5 pagesEmployee Share Ownership Plan: Your at A GlanceSami Shahid Al IslamNo ratings yet

- Patterns of Philippine ExpendituresDocument13 pagesPatterns of Philippine ExpendituresTrisha AlmonteNo ratings yet

- Far 6673Document4 pagesFar 6673Marinel Felipe0% (1)

- InvoiceDocument1 pageInvoiceSohib PawaiNo ratings yet

- Income Tax - MCQ InterDocument5 pagesIncome Tax - MCQ Interramaswamy dNo ratings yet

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- Taxation New Topics Cpa Borad Exam As of October 2017Document2 pagesTaxation New Topics Cpa Borad Exam As of October 2017Nath BongalonNo ratings yet

- Evolution of Taxation in The PhilippinesDocument16 pagesEvolution of Taxation in The Philippineshadji montanoNo ratings yet

- Income Tax Return Sat-Ita22: Official StampDocument6 pagesIncome Tax Return Sat-Ita22: Official Stamptsere butsere50% (2)

- MCQ in Ba Economics-Public EconomicsDocument18 pagesMCQ in Ba Economics-Public Economicsatif31350% (2)

- Tax Invoice: Patel Material Handling Equipment-2324Document1 pageTax Invoice: Patel Material Handling Equipment-2324IMARAN PATELNo ratings yet

- BillDocument6 pagesBillVelmani KananNo ratings yet