Professional Documents

Culture Documents

Existing Machine New Machine: Case 11.1: Ritesh Foundaries Limited

Uploaded by

Mukul KadyanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Existing Machine New Machine: Case 11.1: Ritesh Foundaries Limited

Uploaded by

Mukul KadyanCopyright:

Available Formats

Case 11.

1: Ritesh Foundaries Limited

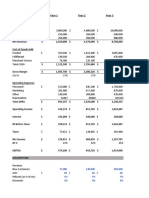

Existing New

machine machine

Book value 35,000 -

Cost - 1,800,000

Useful life 10 10

SL depreciation 3,500 180,000

Current salvage value 75,000 -

Salvage value after 10 years 125,000 180,000

Annual op. cost 600,000 250,000

Inflation rate 5%

Risk-free rate 6%

Risk premium 7%

Risk premium (replacement) 4%

Discount rate (replacement) 5% + 6% + 4% 15%

Tax rate 35%

New vs. Existing

0 1 2 3 4 5

Savings in op. cost 337,500 324,375 310,594 296,123 280,930

Less: depreciation 176,500 176,500 176,500 176,500 176,500

Taxable savings 161,000 147,875 134,094 119,623 104,430

Less: tax 56,350 51,756 46,933 41,868 36,550

Net savings 104,650 96,119 87,161 77,755 67,879

Plus: depreciation 176,500 176,500 176,500 176,500 176,500

Cash flow 281,150 272,619 263,661 254,255 244,379

Cash outlay:

Cost of new machine -1,800,000

Less: after-tax salvage value of existing 61,000

-1,739,000

Salvage value of new (after-tax)

Less: salvage value of existing (after-tax)

Net cash flows -1,739,000 281,150 272,619 263,661 254,255 244,379

NPV -482,058

IRR 6.8%

6 7 8 9 10

264,976 248,225 230,636 212,168 192,776

176,500 176,500 176,500 176,500 176,500

88,476 71,725 54,136 35,668 16,276

30,967 25,104 18,948 12,484 5,697

57,509 46,621 35,188 23,184 10,580

176,500 176,500 176,500 176,500 176,500

234,009 223,121 211,688 199,684 187,080

117,000

-81250

234,009 223,121 211,688 199,684 222,830

You might also like

- Cost of Capital Optimization ModelingDocument71 pagesCost of Capital Optimization ModelingAhmed Mostafa ElmowafyNo ratings yet

- Mandaluyong 2017 Zoning Ordinance Final With SignatureDocument59 pagesMandaluyong 2017 Zoning Ordinance Final With SignatureRochelle Ciudad Baylon43% (7)

- Tru EarthDocument5 pagesTru EarthSiddharthNo ratings yet

- Report On The Internal Audit of The Mayor's OfficeDocument13 pagesReport On The Internal Audit of The Mayor's OfficeJeremy Turnage100% (1)

- Calculating the Cost of CapitalDocument12 pagesCalculating the Cost of CapitalMukul KadyanNo ratings yet

- LBO TITLEDocument16 pagesLBO TITLEsingh0001No ratings yet

- FM09-CH 14Document12 pagesFM09-CH 14Mukul KadyanNo ratings yet

- FM09-CH 15Document7 pagesFM09-CH 15Mukul Kadyan100% (1)

- Project ManagementDocument18 pagesProject ManagementShashi Kumar100% (1)

- National Model Clinical Governance FrameworkDocument44 pagesNational Model Clinical Governance Frameworkwenhal100% (1)

- Burton SensorsDocument2 pagesBurton SensorsSankalp MishraNo ratings yet

- FM09-CH 27Document6 pagesFM09-CH 27Kritika SwaminathanNo ratings yet

- General Contractor Business PlanDocument50 pagesGeneral Contractor Business PlanJoseph QuillNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- United MetalDocument2 pagesUnited MetalshakilnaimaNo ratings yet

- BarclaysDocument1 pageBarclaysJordan kalib Samir100% (1)

- NPV & IrrDocument58 pagesNPV & IrrAira DacilloNo ratings yet

- Case Primus AutomationDocument26 pagesCase Primus AutomationHeniNo ratings yet

- 1-CAFM EbusinessDocument16 pages1-CAFM EbusinessDx MxNo ratings yet

- The 2011 Focus Experts' Guide To Enterprise Resource PlanningDocument24 pagesThe 2011 Focus Experts' Guide To Enterprise Resource PlanningRahul KapoorNo ratings yet

- FM09-CH 24Document16 pagesFM09-CH 24namitabijweNo ratings yet

- 9 PMP - ProcurementDocument14 pages9 PMP - Procurementdrsuresh26No ratings yet

- Assignment Capital BudgetingDocument29 pagesAssignment Capital BudgetingYasha Sahu0% (1)

- BRS3B Assessment Opportunity 1 2019Document11 pagesBRS3B Assessment Opportunity 1 2019221103909No ratings yet

- Example On Operating Lease and Finance LeaseDocument6 pagesExample On Operating Lease and Finance LeasekakshahNo ratings yet

- Enterprise ValuationDocument3 pagesEnterprise ValuationParth MalikNo ratings yet

- Current Year Data:: Calculating Enterprise ValueDocument3 pagesCurrent Year Data:: Calculating Enterprise ValueParth MalikNo ratings yet

- Carbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsDocument1 pageCarbide Chemical Company-Replacement of Old Machines-Discounting of CashflowsRajib Dahal50% (2)

- Advanced Corporate Finance Case 1Document2 pagesAdvanced Corporate Finance Case 1Adrien PortemontNo ratings yet

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDocument1 pageChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNo ratings yet

- Project PDA Conch Republic: Ebit 13,000,000 9,300,000Document4 pagesProject PDA Conch Republic: Ebit 13,000,000 9,300,000Harsya FitrioNo ratings yet

- Investment Analysis and Lockheed Tri StarDocument13 pagesInvestment Analysis and Lockheed Tri StarShivamNo ratings yet

- 60,000,000.00 CHF 12,000,000.00 CHF 10,000,000.00 CHF Units Price Revenue Cost Fixed Cost Total Cost Ebitda Dep Ebit Interest NopatDocument5 pages60,000,000.00 CHF 12,000,000.00 CHF 10,000,000.00 CHF Units Price Revenue Cost Fixed Cost Total Cost Ebitda Dep Ebit Interest NopatAkshay KothariNo ratings yet

- 60,000,000.00 CHF 12,000,000.00 CHF 10,000,000.00 CHF Units Price Revenue Cost Fixed Cost Total Cost Ebitda Dep Ebit Interest NopatDocument5 pages60,000,000.00 CHF 12,000,000.00 CHF 10,000,000.00 CHF Units Price Revenue Cost Fixed Cost Total Cost Ebitda Dep Ebit Interest NopatAkshay KothariNo ratings yet

- LeasingDocument14 pagesLeasingSana SarfarazNo ratings yet

- Capital Budgeting Class ExerciseDocument3 pagesCapital Budgeting Class ExerciseAryaman jaiswalNo ratings yet

- MockDocument5 pagesMockamna noorNo ratings yet

- Without Discount With DiscountDocument13 pagesWithout Discount With DiscountleylaNo ratings yet

- NPV ExcelDocument7 pagesNPV Excelkhanfaiz4144No ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- Investment Analysis and Depreciation CalculationsDocument9 pagesInvestment Analysis and Depreciation CalculationsdebojyotiNo ratings yet

- CapitalBudgeting HindPetrochemicalsDocument6 pagesCapitalBudgeting HindPetrochemicalsAryanSinghNo ratings yet

- Making Capital Investment DecisionsDocument48 pagesMaking Capital Investment DecisionsJerico ClarosNo ratings yet

- CF Assignment 1 Group 9Document51 pagesCF Assignment 1 Group 9rishabh tyagiNo ratings yet

- Assumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4Document2 pagesAssumptions - Assumptions - Financing: Year - 0 Year - 1 Year - 2 Year - 3 Year - 4PranshuNo ratings yet

- Case Study Making Capital Investment Decision.Document4 pagesCase Study Making Capital Investment Decision.Sarwanti PurwandariNo ratings yet

- Sinopec - Individual AssignmentDocument6 pagesSinopec - Individual AssignmentShaarang BeganiNo ratings yet

- ButlercaseDocument3 pagesButlercaseAn HuNo ratings yet

- Particulars Year 0 Year 1 To 10Document2 pagesParticulars Year 0 Year 1 To 10rajakosuri429No ratings yet

- Red Chilli WorkingsDocument10 pagesRed Chilli WorkingsImran UmarNo ratings yet

- Capital Budget MOPU Discounted After TaxDocument3 pagesCapital Budget MOPU Discounted After TaxBudi PrasetyoNo ratings yet

- Bus ModelDocument1 pageBus Modelshrish guptaNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Yulianita AdrimaNo ratings yet

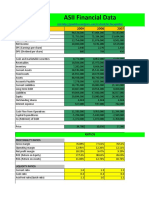

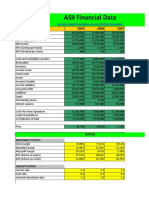

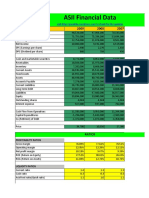

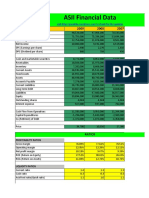

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007Aco AritonangNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007Booster HidroNo ratings yet

- PGP25394 Keshav Sureka G CFDocument13 pagesPGP25394 Keshav Sureka G CFKeshavSurekaNo ratings yet

- Comprehensive Case StudyDocument4 pagesComprehensive Case StudyAsmaa AlsabaaNo ratings yet

- Training Business Case Day 2Document13 pagesTraining Business Case Day 2amritakiranaaNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007Arif SupriyadiNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007AdrianNo ratings yet

- Rasio Sheet v1.0Document10 pagesRasio Sheet v1.0Akhi DanuNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007yrperdanaNo ratings yet

- ASII Financial Data: Items 2009 2008 2007Document10 pagesASII Financial Data: Items 2009 2008 2007Gilang AnggoroNo ratings yet

- Mississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisDocument1 pageMississippi River Shipyards Is Considering The Replacement of An - Appendix 11B-3 Replacement Project AnalysisRajib DahalNo ratings yet

- GYM Financial ModelingDocument12 pagesGYM Financial ModelingDivyanshu SharmaNo ratings yet

- DepreciationDocument2 pagesDepreciationhussain hasniNo ratings yet

- EstimationDocument5 pagesEstimationDivyam GargNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Intl Business Machines Corp ComDocument6 pagesIntl Business Machines Corp Comluisa Fernanda PeñaNo ratings yet

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliNo ratings yet

- Practice Q (Capital Budgeting)Document12 pagesPractice Q (Capital Budgeting)Divyam GargNo ratings yet

- p11 29Document5 pagesp11 29Saeful AzizNo ratings yet

- A&f - Group Assignment - Assignment 2Document8 pagesA&f - Group Assignment - Assignment 2lavaniaNo ratings yet

- Data Case 8Document31 pagesData Case 8milagrosNo ratings yet

- Analisa SahamDocument10 pagesAnalisa SahamGede AriantaNo ratings yet

- FM09-CH 16Document12 pagesFM09-CH 16Mukul KadyanNo ratings yet

- Dividend Policy AnalysisDocument5 pagesDividend Policy AnalysisMukul KadyanNo ratings yet

- FM09-CH 28Document8 pagesFM09-CH 28Nikhil ChitaliaNo ratings yet

- FM09-CH 25Document9 pagesFM09-CH 25Mukul KadyanNo ratings yet

- International Financial Management ExplainedDocument7 pagesInternational Financial Management ExplainedMukul KadyanNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- Mergers and Acquisitions Chapter: Key Concepts and Valuation TechniquesDocument3 pagesMergers and Acquisitions Chapter: Key Concepts and Valuation TechniquesNaveen RaiNo ratings yet

- FM09-CH 35Document4 pagesFM09-CH 35lefteris82No ratings yet

- CH 22: Lease, Hire Purchase and Project FinancingDocument7 pagesCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNo ratings yet

- Ch 4: Risk and Return ExplainedDocument4 pagesCh 4: Risk and Return ExplainedMukul KadyanNo ratings yet

- FM09-CH 03 PDFDocument14 pagesFM09-CH 03 PDFGregNo ratings yet

- Ch 7: Guide to Option Pricing ConceptsDocument9 pagesCh 7: Guide to Option Pricing ConceptsMukul KadyanNo ratings yet

- Chapter 05Document6 pagesChapter 05danbrowndaNo ratings yet

- Calculating Asset Beta, Levered Equity Beta, and WACCDocument8 pagesCalculating Asset Beta, Levered Equity Beta, and WACCMukul KadyanNo ratings yet

- FM09-CH 08Document9 pagesFM09-CH 08Mukul KadyanNo ratings yet

- FM09-CH 12Document7 pagesFM09-CH 12Mukul KadyanNo ratings yet

- FM09-CH 29 PDFDocument2 pagesFM09-CH 29 PDFNaveen RaiNo ratings yet

- Chapter 27Document10 pagesChapter 27Mukul KadyanNo ratings yet

- Cash Management Chapter SummaryDocument4 pagesCash Management Chapter SummaryMukul KadyanNo ratings yet

- Long-term Finance Options for Delite FurnitureDocument4 pagesLong-term Finance Options for Delite FurnitureNaveen RaiNo ratings yet

- Inventory Management Objectives and TechniquesDocument8 pagesInventory Management Objectives and TechniquesMukul KadyanNo ratings yet

- FM - Chapter 35Document4 pagesFM - Chapter 35Amit SukhaniNo ratings yet

- Ch 5: Risk Return Portfolio Theory Assets PricingDocument4 pagesCh 5: Risk Return Portfolio Theory Assets PricingMukul KadyanNo ratings yet

- Chapter 07Document8 pagesChapter 07Mukul KadyanNo ratings yet

- FM09-CH 11Document5 pagesFM09-CH 11Mukul KadyanNo ratings yet

- SGL Group to fully acquire BMW's stake in SGL ACF carbon fiber JVDocument4 pagesSGL Group to fully acquire BMW's stake in SGL ACF carbon fiber JVMiguel AngelNo ratings yet

- Performance Appraisal Methods - Human Resources ManagementDocument35 pagesPerformance Appraisal Methods - Human Resources ManagementSourabh MehraNo ratings yet

- COBIT 2019 FOUNDATION COURSE FfhgffkfhyuoliuDocument4 pagesCOBIT 2019 FOUNDATION COURSE FfhgffkfhyuoliuggcvbcNo ratings yet

- Magi Case StudyDocument6 pagesMagi Case StudylingzenpauliNo ratings yet

- A Study On Affiliate Marketing Towards Bizgurukul ProductsDocument11 pagesA Study On Affiliate Marketing Towards Bizgurukul ProductsEzhumalai.SNo ratings yet

- The Service Industry and The Moment of Truth The Quest For The Holy GrailDocument16 pagesThe Service Industry and The Moment of Truth The Quest For The Holy GrailtinalaurenaNo ratings yet

- Dr. Mohan Sawhney - Brillio Imagine 16Document43 pagesDr. Mohan Sawhney - Brillio Imagine 16thangave2000No ratings yet

- Sycip Salazar Hernandez GatmaitanDocument3 pagesSycip Salazar Hernandez GatmaitanLoren SanapoNo ratings yet

- Engineering Ethics CodesDocument18 pagesEngineering Ethics CodesdanishakimiNo ratings yet

- Project Management Question BankDocument2 pagesProject Management Question BankBramodh JayanthiNo ratings yet

- 7 8 Equivalence Rev 1Document32 pages7 8 Equivalence Rev 1Mateo, Elijah Jonathan C.No ratings yet

- Amazon Go: Venturing Into Traditional Retail: Report by - Epgp-Batch-14B - Group-2Document7 pagesAmazon Go: Venturing Into Traditional Retail: Report by - Epgp-Batch-14B - Group-2Virender SinghNo ratings yet

- MKUCHAJR_PROPOSAL[1]Document9 pagesMKUCHAJR_PROPOSAL[1]innocentmkuchajrNo ratings yet

- ABN AMRO Bank N.V. Is ADocument3 pagesABN AMRO Bank N.V. Is ASandip PatelNo ratings yet

- Self Service Laundry: Principles of MarketingDocument14 pagesSelf Service Laundry: Principles of MarketingMurgi kun :3No ratings yet

- Lesson 6 Pre-Engagement ActivitiesDocument5 pagesLesson 6 Pre-Engagement ActivitiesMark TaysonNo ratings yet

- Mallness Pitch Deck - JuneDocument19 pagesMallness Pitch Deck - JuneFrans HasiholanNo ratings yet

- SCM Lecture 3Document2 pagesSCM Lecture 3rishabh choudhryNo ratings yet

- Systematic Engineering Drives EPC Project SuccessDocument4 pagesSystematic Engineering Drives EPC Project SuccessMADHAVI BARIYANo ratings yet

![MKUCHAJR_PROPOSAL[1]](https://imgv2-2-f.scribdassets.com/img/document/722839407/149x198/8f31ac4be2/1713081319?v=1)