Professional Documents

Culture Documents

Ch. 35: Shareholder Value & Corporate Governance Problem 1: (Rs Crore)

Ch. 35: Shareholder Value & Corporate Governance Problem 1: (Rs Crore)

Uploaded by

Mukul KadyanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch. 35: Shareholder Value & Corporate Governance Problem 1: (Rs Crore)

Ch. 35: Shareholder Value & Corporate Governance Problem 1: (Rs Crore)

Uploaded by

Mukul KadyanCopyright:

Available Formats

Ch.

35: Shareholder Value & Corporate Governance

Problem 1

Net margin 57.8%

Leverage 1.68

Retention ratio 30%

Assets/sales 2.01

Sustainable growth 16.9%

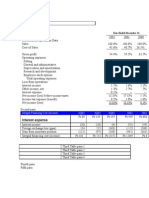

Problem 2

Growth 15%

ROI 16%

Interest rate 7%

Target growth 18%

Payout 60%

Retention 40%

Required D/E 3.22

Problem 3

(Rs crore)

PAT 123

Interest 24

Tax rate 35%

Invested capital (IC) 1340

WACC 15%

EBIT (1-T) = PAT + INT(1 - T) 139

Capital charges = WACC × IC 201

EVA -62

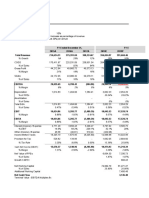

Problem 4

2003 2002 2001 2000

(A) Risk-free rate 6% 7.30% 10.30% 10.45%

(B) Risk premium 7% 7% 7% 8%

(C) Beta 1.57 1.41 1.54 1.48

(D) Cost of equity 17.0% 17.2% 21.1% 22.3%

(E) Capital employed (Rs crore) 2,470.48 1,734.97 1,111.47 703.87

(F) Enterprise value (Rs crore) 25,208.82 23,627.37 26,348.61 58,829.80

(G) MVA, (E - F) (Rs crore) 22,738.34 21,892.40 25,237.14 58,125.93

(H) PBT 1158.93 943.39 696.03 325.65

(I) Tax 201 135.43 72.71 39.7

(J) PAT, (H - I) 957.93 807.96 623.32 285.95

(K) Capital charges, (D ×E), (Rs crore) 419.73 297.89 234.30 156.89

(L) EVA, (J - K), (Rs crore) 538.20 510.07 389.02 129.06

(M) M/B, (F/E) 10.20 13.62 23.71 83.58

(N) ROE, %, (J/E) 38.8% 46.6% 56.1% 40.6%

(O) Economic return (L/E or N - D) 21.8% 29.4% 35.0% 18.3%

1999

12%

8%

1.48

23.8%

245.42

9,256.14

9,010.72

155.86

22.94

132.92

58.51

74.41

37.72

54.2%

30.3%

You might also like

- 2022.07.24 - DCF Tutorial Answer KeyDocument18 pages2022.07.24 - DCF Tutorial Answer KeySrikanth ReddyNo ratings yet

- Super Project AnalysisDocument6 pagesSuper Project AnalysisDHRUV SONAGARANo ratings yet

- 107 10 DCF Sanity Check AfterDocument6 pages107 10 DCF Sanity Check AfterDavid ChikhladzeNo ratings yet

- Challenger Sales - CEBDocument67 pagesChallenger Sales - CEBSpil_vv_IJmuiden100% (1)

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- PinkertonDocument10 pagesPinkertonAlok RajNo ratings yet

- Microsoft ValuationDocument4 pagesMicrosoft ValuationcorvettejrwNo ratings yet

- How Does Debt Affect CPKDocument14 pagesHow Does Debt Affect CPKLâm Thanh Huyền Nguyễn100% (1)

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- FM09-CH 15Document7 pagesFM09-CH 15Mukul Kadyan100% (1)

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art Euphoria100% (1)

- Module 1 ACCTG 1 A & B Partnership & Corporation (2021)Document24 pagesModule 1 ACCTG 1 A & B Partnership & Corporation (2021)Mary Lynn Dela PeñaNo ratings yet

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Test Labour Cost: Subject: MA1Document6 pagesTest Labour Cost: Subject: MA1Fatima KhaqanNo ratings yet

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Magic Quadrant For Data Masking TechnologyDocument11 pagesMagic Quadrant For Data Masking TechnologyGabriel SilerNo ratings yet

- Backus Valuation ExcelDocument28 pagesBackus Valuation ExcelAdrian MontoyaNo ratings yet

- Discrete Cosine Transform: Algorithms, Advantages, ApplicationsFrom EverandDiscrete Cosine Transform: Algorithms, Advantages, ApplicationsNo ratings yet

- Losch TheoryDocument19 pagesLosch TheoryAbhishek Venkitaraman Iyer91% (11)

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- FM09-CH 14Document12 pagesFM09-CH 14Mukul KadyanNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Net Income ($M) 8382 EBIT ($M) 13224 Income Tax Expense ($M) 5016 Return On EquityDocument21 pagesNet Income ($M) 8382 EBIT ($M) 13224 Income Tax Expense ($M) 5016 Return On EquityRahil VermaNo ratings yet

- Horizontal Analysis FinalDocument9 pagesHorizontal Analysis FinalJerry ManatadNo ratings yet

- MyfileDocument1 pageMyfilevdkvaibhav100% (1)

- Nestle India Dupont AnalysisDocument2 pagesNestle India Dupont AnalysisINDIAN REALITY SHOWSNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2animecommunity04No ratings yet

- Y-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesDocument45 pagesY-Y Growth (%) Y-Y Growth (%) Y-Y Growth (%) Utilization (%) Y-Y Growth (%) % of Sales % of Sales % of SalesSHIKHA CHAUHANNo ratings yet

- IIFL Finance Q1FY24 Data BookDocument11 pagesIIFL Finance Q1FY24 Data Bookvishwesheswaran1No ratings yet

- Nerolac - Solution PDFDocument5 pagesNerolac - Solution PDFricha krishnaNo ratings yet

- Group D - Case 32 California Pizza Kitchen-2Document91 pagesGroup D - Case 32 California Pizza Kitchen-2Vinithi ThongkampalaNo ratings yet

- Hero Motocorp EvaDocument1 pageHero Motocorp EvaproNo ratings yet

- 4.1.1 - Dự Báo Dòng TiềnDocument5 pages4.1.1 - Dự Báo Dòng TiềnLê TiếnNo ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- STRABAG - SE - Geschäftsbericht 2020 - E - ADocument264 pagesSTRABAG - SE - Geschäftsbericht 2020 - E - ASiddhartha ShekharNo ratings yet

- Goodyear Indonesia TBK.: Balance SheetDocument20 pagesGoodyear Indonesia TBK.: Balance SheetsariNo ratings yet

- Sarawak Plantation 100827 RN2Q10Document2 pagesSarawak Plantation 100827 RN2Q10limml63No ratings yet

- New Jersey Treasury Monthly Revenue Report With Snapshot-FY23MayDocument1 pageNew Jersey Treasury Monthly Revenue Report With Snapshot-FY23MayMichelle Rotuno-JohnsonNo ratings yet

- Is Excel Participant Samarth - Simplified v2Document9 pagesIs Excel Participant Samarth - Simplified v2samarth halliNo ratings yet

- Banco Santander Chile 2Q18 Earnings Report: July 26, 2018Document27 pagesBanco Santander Chile 2Q18 Earnings Report: July 26, 2018manuel querolNo ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- Contoh Simple FCFFDocument5 pagesContoh Simple FCFFFANNY KRISTIANTINo ratings yet

- Berger 1Document8 pagesBerger 1Nikesh PandeyNo ratings yet

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- FY23 April Revenue Report - NJ Department of The TreasuryDocument1 pageFY23 April Revenue Report - NJ Department of The TreasuryMichelle Rotuno-JohnsonNo ratings yet

- M1 14-AZ2 PENROSE Part 1 (Analysis) - BlankDocument5 pagesM1 14-AZ2 PENROSE Part 1 (Analysis) - BlankKhushi singhalNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- Fund Flow Statement - Feb-21Document128 pagesFund Flow Statement - Feb-21Suneet GaggarNo ratings yet

- CW 221025015738Document2 pagesCW 221025015738Nundu AntoneyNo ratings yet

- 1Q21 Core Operating Performance Beats Estimates: International Container Terminal Services IncDocument8 pages1Q21 Core Operating Performance Beats Estimates: International Container Terminal Services IncJajahinaNo ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- Excel 13132110016 Final Paper Individu Fin4BDocument22 pagesExcel 13132110016 Final Paper Individu Fin4BFerian PhungkyNo ratings yet

- Actual 2018 Per Club - OperationDocument59 pagesActual 2018 Per Club - OperationAnonymous 3QWXb5qxfNNo ratings yet

- Manaal - Commercial Banking W J.P MorganDocument9 pagesManaal - Commercial Banking W J.P Morganmanaal.murtaza1No ratings yet

- PrepzFy - LBO - VemptyDocument3 pagesPrepzFy - LBO - VemptykouakouNo ratings yet

- Peer Forest and Wood Working IndustriesDocument6 pagesPeer Forest and Wood Working Industriessetiawan etyNo ratings yet

- OverviewDocument45 pagesOverviewDr. Suman PaulNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Levered and Unlevered BetaDocument27 pagesLevered and Unlevered BetaJatin NandaNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- Union Bank - MP: Result TableDocument4 pagesUnion Bank - MP: Result TableManjunath ManjuNo ratings yet

- Samsung FY16 Q3 PresentationDocument8 pagesSamsung FY16 Q3 PresentationJeevan ParameswaranNo ratings yet

- 1Q21 Core Earnings Lag Forecasts: Metro Pacific Investments CorporationDocument8 pages1Q21 Core Earnings Lag Forecasts: Metro Pacific Investments CorporationJajahinaNo ratings yet

- FM09-CH 18Document5 pagesFM09-CH 18Mukul KadyanNo ratings yet

- FM09-CH 16Document12 pagesFM09-CH 16Mukul KadyanNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- FM09-CH 04Document4 pagesFM09-CH 04Mukul KadyanNo ratings yet

- CH 22: Lease, Hire Purchase and Project FinancingDocument7 pagesCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNo ratings yet

- FM09-CH 07Document9 pagesFM09-CH 07Mukul KadyanNo ratings yet

- FM09-CH 11Document5 pagesFM09-CH 11Mukul KadyanNo ratings yet

- FM09-CH 30Document4 pagesFM09-CH 30Mukul Kadyan100% (1)

- FM09-CH 05Document4 pagesFM09-CH 05Mukul KadyanNo ratings yet

- Chapter 16Document8 pagesChapter 16Mukul KadyanNo ratings yet

- FM09-CH 08Document9 pagesFM09-CH 08Mukul KadyanNo ratings yet

- Chapter 27Document10 pagesChapter 27Mukul KadyanNo ratings yet

- Chapter 12Document4 pagesChapter 12Mukul KadyanNo ratings yet

- Real Options, Investment Strategy and Process: Problem 1Document4 pagesReal Options, Investment Strategy and Process: Problem 1Mukul KadyanNo ratings yet

- FM09-CH 21Document4 pagesFM09-CH 21Mukul KadyanNo ratings yet

- FM09-CH 17Document5 pagesFM09-CH 17Mukul KadyanNo ratings yet

- CH 34: International Financial ManagementDocument2 pagesCH 34: International Financial ManagementMukul KadyanNo ratings yet

- FM09-CH 33Document3 pagesFM09-CH 33Mukul KadyanNo ratings yet

- Chapter 28Document7 pagesChapter 28Mukul KadyanNo ratings yet

- Download pdf A Roadmap To Industry 4 0 Smart Production Sharp Business And Sustainable Development Anand Nayyar ebook full chapterDocument54 pagesDownload pdf A Roadmap To Industry 4 0 Smart Production Sharp Business And Sustainable Development Anand Nayyar ebook full chapterdelora.plyler601100% (4)

- Bangladesh Post Office Waiting For A TurDocument20 pagesBangladesh Post Office Waiting For A Turgdewan364No ratings yet

- 2019 Quantitative - Finance SpletDocument4 pages2019 Quantitative - Finance SpletAlberto LoquendoNo ratings yet

- E-TicketDocument1 pageE-Ticketabigailfrancisco192002No ratings yet

- Risk & Adoption of Technology in Peasant AgricultureDocument4 pagesRisk & Adoption of Technology in Peasant AgricultureSlice LeNo ratings yet

- Effect of Work Life Balance On EmployeeDocument14 pagesEffect of Work Life Balance On Employeegarba shuaibuNo ratings yet

- Execution of Six Sigma Methodology Airlines IndustryDocument2 pagesExecution of Six Sigma Methodology Airlines IndustryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Ridwan2022 IMPLEMENTATION OF CASHLESS POLICY STRATEGIES TO MINIMIZE FRAUD IN THE GOVERNMENT SECTOR-SYSTEMIC REVIEWDocument8 pagesRidwan2022 IMPLEMENTATION OF CASHLESS POLICY STRATEGIES TO MINIMIZE FRAUD IN THE GOVERNMENT SECTOR-SYSTEMIC REVIEWDR. SYUKRIY ABDULLAH , S.E, M.SINo ratings yet

- MCQ Acct1000 Sem 1 2018Document3 pagesMCQ Acct1000 Sem 1 2018Yini ErNo ratings yet

- Subject Code:: Prepared byDocument6 pagesSubject Code:: Prepared byDarmmini MiniNo ratings yet

- Advertising Course Outline - 2020 - SIBADocument8 pagesAdvertising Course Outline - 2020 - SIBARahul DusejaNo ratings yet

- 97 Shrawani Jaywant Salunke LACF Case Study 4Document6 pages97 Shrawani Jaywant Salunke LACF Case Study 4Archit MangalNo ratings yet

- (2)Document42 pages(2)Saif JamalNo ratings yet

- Guaranteed Income GoalDocument6 pagesGuaranteed Income Goalsb RogerdatNo ratings yet

- Module 7 Handling Medical Equipment ParticipantDocument18 pagesModule 7 Handling Medical Equipment ParticipantAnanthShanmugamNo ratings yet

- Berkshire HathawayDocument12 pagesBerkshire HathawayyeskelNo ratings yet

- The 5 Levels of Relationship Marketing StrategiesDocument26 pagesThe 5 Levels of Relationship Marketing Strategiesdarshan jainNo ratings yet

- RBM6 05 062Document1 pageRBM6 05 062GIOVANNI CAPCHA RODRIGUEZNo ratings yet

- 02 CivProc Rule01 Hernandez Vs RuralBankOfLucenaInc 81SCRA75Document2 pages02 CivProc Rule01 Hernandez Vs RuralBankOfLucenaInc 81SCRA75Laurene Ashley S QuirosNo ratings yet

- Joint VentureDocument42 pagesJoint Ventureadityaupreti2003No ratings yet

- GAISANO CAGAYAN INC. v. INSURANCE COMPANY OF N.A.Document3 pagesGAISANO CAGAYAN INC. v. INSURANCE COMPANY OF N.A.Tricia CornelioNo ratings yet

- CH-01-An Introduction To RetailingDocument38 pagesCH-01-An Introduction To Retailingaruba anwarNo ratings yet

- Complete 1000+ Error DetectingDocument159 pagesComplete 1000+ Error DetectingVikashNo ratings yet

- AIS Packing Slip/ Bill of LadingDocument4 pagesAIS Packing Slip/ Bill of LadingLyka Liwanag NonogNo ratings yet

- Book of Program ICE-BEES 2020Document101 pagesBook of Program ICE-BEES 2020Tumbal PogoNo ratings yet