Professional Documents

Culture Documents

New Jersey Treasury Monthly Revenue Report With Snapshot-FY23May

Uploaded by

Michelle Rotuno-JohnsonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Jersey Treasury Monthly Revenue Report With Snapshot-FY23May

Uploaded by

Michelle Rotuno-JohnsonCopyright:

Available Formats

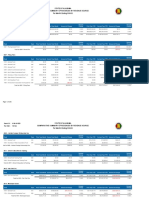

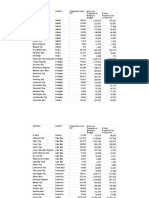

STATE OF NEW JERSEY

MONTH AND YEAR-TO-DATE CASH COLLECTIONS

Fiscal Year 2023 - May 2023 versus 2022

($ Thousands)

MAY % MAY YTD % FY 2023 Projected

2022 2023 Change 2022 2023 Change Growth Rate *

996,161 975,124 (2.1%) Sales 10,209,691 10,729,626 5.1% 5.2%

445,155 476,178 7.0% Sales tax - energy tax receipts 773,060 880,820 13.9% 12.6%

(80,076) (78,866) - Sales tax dedication (800,187) (845,597) -

1,361,240 1,372,436 0.8% Net Sales Tax 10,182,564 10,764,849 5.7%

301,580 166,138 (44.9%) Corporation Business 4,564,408 4,302,853 (5.7%) (3.0%)

4,588 5,247 14.4% CBT - energy tax receipts 12,659 8,916 (29.6%) (31.9%)

306,168 171,385 (44.0%) Net Corporation Business Tax 4,577,067 4,311,769 (5.8%)

29,301 39,324 34.2% Business Alternative Income Tax 3,085,892 3,450,234 11.8% (2.9%)

34,614 35,174 1.6% Motor Fuels 373,726 380,171 1.7% 0.3%

65,254 52,141 (20.1%) Motor Vehicle Fees (a) 376,791 330,928 (12.2%) (2.3%)

47,661 51,380 7.8% Transfer Inheritance Tax 539,107 525,129 (2.6%) (7.0%)

75 52 (30.7%) Estate Tax 2,499 2,240 (10.4%) (4.2%)

243,635 251,619 3.3% Insurance Premium 603,650 594,698 (1.5%) (14.9%)

3,864 38,756 903.0% Cigarette (b) 3,864 38,756 903.0% 72.8%

119,065 116,749 (1.9%) Petroleum Products Gross Receipts 1,298,625 1,159,990 (10.7%) 7.5%

(153,680) (151,923) - Capital Reserve (402,030) (219,595) -

168 17,164 10116.7% Corp. Banks & Financial Institutions 75,654 44,601 (41.0%) (57.8%)

20,837 21,747 4.4% Alcoholic Beverage Excise (c) 110,790 113,202 2.2% 2.7%

45,368 27,606 (39.2%) Realty Transfer 563,640 437,544 (22.4%) (22.1%)

3,837 5,090 32.7% Tobacco Products Wholesale Sales (b) 36,083 33,636 (6.8%) (11.5%)

4,718 5,144 9.0% Public Utility 6,196 7,325 18.2% 9.8%

$ 2,132,125 $ 2,053,844 (3.7%) Total General Fund Revenues $ 21,434,118 $ 21,975,477 2.5% 0.7%

1,030,513 460,824 (55.3%) Gross Income Tax (PTRF) 18,166,308 16,488,543 (9.2%) (7.0%)

82,560 81,339 - Sales tax dedication 822,418 870,061 -

1,113,073 542,163 (51.3%) Net Gross Income Tax (PTRF) 18,988,726 17,358,604 (8.6%)

36,906 44,289 20.0% Casino Revenue 392,764 416,050 5.9% 5.6%

$ 3,282,104 $ 2,640,296 (19.6%) Total Major Revenues $ 40,815,608 $ 39,750,131 (2.6%) (2.5%)

$ 86,685 $ 88,595 2.2% Lottery (d) $ 984,793 $ 1,041,053 5.7%

(a) Pursuant to P.L. 2003, C.13, $305.4 million of FY 2023 Motor Vehicle Fee collections are dedicated to the New Jersey Motor Vehicle Commission.

(b) Pursuant to P.L. 2006, C.37, revenue collections of $396.5 million from the Cigarette and Tobacco Products Wholesale Sales Tax are deposited

in the Health Care Subsidy Fund.

(c) Pursuant to P.L. 1990, C.41, and P.L 2009, C.71, $33.0 million of Alcoholic Beverage Excise Tax collections are deposited in the Alcohol Education,

Rehabilitation and Enforcement Fund and the Health Care Subsidy Fund, respectively.

(d) Pursuant to P.L. 2017, C.98, the State Lottery Enterprise was contributed to certain State pension systems and the Lottery proceeds are no longer included

in the State cash collections.

* Projected annual growth rate is the change from the FY 2022 ACFR to the FY 2023 revenue estimates per the Treasurer's May Testimony.

You might also like

- Green Clean Homes Projected Income Statement AnalysisDocument3 pagesGreen Clean Homes Projected Income Statement AnalysisRalph MorganNo ratings yet

- 11 Multiple Linear Regression WorkbookDocument12 pages11 Multiple Linear Regression WorkbookJohn SmithNo ratings yet

- FM Aaj KaDocument15 pagesFM Aaj Kakaranzen50% (2)

- 6 Polaroid Corporation 1996Document64 pages6 Polaroid Corporation 1996jk kumarNo ratings yet

- Bala TableDocument6 pagesBala TablefooNo ratings yet

- Mayes 8e CH05 SolutionsDocument36 pagesMayes 8e CH05 SolutionsRamez AhmedNo ratings yet

- Group valuation modelDocument3 pagesGroup valuation modelSoufiane EddianiNo ratings yet

- Eightcheck 32240821Document5 pagesEightcheck 32240821Andreas avellinus dwi noviyantoNo ratings yet

- Case 4-Stock - Returns - With - AnalysisDocument42 pagesCase 4-Stock - Returns - With - AnalysisReetika GuptaNo ratings yet

- International Marketing Project On NIODocument32 pagesInternational Marketing Project On NIOOsen GaoNo ratings yet

- DYS544 M1 WorkbookDocument5 pagesDYS544 M1 WorkbookChristine YuanNo ratings yet

- Ducati Case ExhibitsDocument10 pagesDucati Case Exhibitslucien_lu0% (1)

- 11 Simple Linear Regression WorkbookDocument23 pages11 Simple Linear Regression WorkbookJohn SmithNo ratings yet

- Group 7 Belle Air CharterDocument6 pagesGroup 7 Belle Air CharterCalvin WuNo ratings yet

- Statement of Cash Flows Final TermDocument20 pagesStatement of Cash Flows Final TermAG VenturesNo ratings yet

- Purchase of Property From Developer (Property With Title)Document7 pagesPurchase of Property From Developer (Property With Title)Lee Jun Zhe100% (1)

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- Polaroid Corporation ENGLISHDocument14 pagesPolaroid Corporation ENGLISHAtul AnandNo ratings yet

- NPS Calculator Free Download ExcelDocument7 pagesNPS Calculator Free Download Excelsambhavjoshi100% (1)

- Bacia de CamposDocument7 pagesBacia de CampospoisonboxNo ratings yet

- Balance Sheet PDFDocument1 pageBalance Sheet PDFMikhil Pranay SinghNo ratings yet

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFutkarsh varshneyNo ratings yet

- NWMLS September ReportDocument3 pagesNWMLS September ReportNeal McNamaraNo ratings yet

- SD7043 Airfoil CoordinatesDocument2 pagesSD7043 Airfoil CoordinatesBlocky999No ratings yet

- Stonecrest 2022 BudgetDocument29 pagesStonecrest 2022 BudgetZachary HansenNo ratings yet

- Case For Project FinanceDocument21 pagesCase For Project FinanceKARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Project On Pharmaceuticals DistributionDocument13 pagesProject On Pharmaceuticals Distributiongourav rameNo ratings yet

- Du Pont FlexDocument12 pagesDu Pont Flexhayagreevan vNo ratings yet

- 1958 CSO Table in An Excel SpreadsheetDocument11 pages1958 CSO Table in An Excel SpreadsheetHandoyoNo ratings yet

- 2021.06.02 PAGS 1Q21 Earnings ReleaseDocument23 pages2021.06.02 PAGS 1Q21 Earnings ReleaseRenan Dantas SantosNo ratings yet

- Assignment Day 8Document7 pagesAssignment Day 8Prem MakwanaNo ratings yet

- Bonds - April 22 2021Document3 pagesBonds - April 22 2021Lisle Daverin BlythNo ratings yet

- State of Connecticut Department of Revenue Services 450 COLUMBUS BLVD. HARTFORD, CT 06103-1837 Mark Boughton, CommissionerDocument1 pageState of Connecticut Department of Revenue Services 450 COLUMBUS BLVD. HARTFORD, CT 06103-1837 Mark Boughton, CommissionerHelen BennettNo ratings yet

- Balancesheet - Tata Motors LTDDocument9 pagesBalancesheet - Tata Motors LTDNaveen KumarNo ratings yet

- Capital Budgeting Methods and Cash Flow AnalysisDocument42 pagesCapital Budgeting Methods and Cash Flow AnalysiskornelusNo ratings yet

- Here's How The New Electoral Map Could Play Out ProvinciallyDocument12 pagesHere's How The New Electoral Map Could Play Out ProvinciallySabrina NanjiNo ratings yet

- Hindalco Industries Balance Sheet AnalysisDocument3 pagesHindalco Industries Balance Sheet AnalysisSharon T100% (1)

- Covid19 Data Latest 9-10-21Document9 pagesCovid19 Data Latest 9-10-21David SeligNo ratings yet

- Boston Creamery AnalysisDocument18 pagesBoston Creamery AnalysisBrad AndersonNo ratings yet

- Eightcheck 32240822Document5 pagesEightcheck 32240822Andreas avellinus dwi noviyanto100% (1)

- Broiler Performance & Nutrition Supplement: Europe, Middle East, Africa VersionDocument8 pagesBroiler Performance & Nutrition Supplement: Europe, Middle East, Africa VersioncikizdNo ratings yet

- Ceat, 11th January, 2013Document12 pagesCeat, 11th January, 2013Angel Broking100% (2)

- Maimonides Q2 2019Document7 pagesMaimonides Q2 2019Jonathan LaMantiaNo ratings yet

- Total 621 1749 2544 3300Document6 pagesTotal 621 1749 2544 3300Anupam ChaplotNo ratings yet

- Bonds - July 18 2022Document3 pagesBonds - July 18 2022Lisle Daverin BlythNo ratings yet

- Airthread Acquisition Operating AssumptionsDocument27 pagesAirthread Acquisition Operating AssumptionsnidhidNo ratings yet

- Bonds - July 19 2022Document3 pagesBonds - July 19 2022Lisle Daverin BlythNo ratings yet

- Company financial report with sales and profit data over 4 yearsDocument1 pageCompany financial report with sales and profit data over 4 yearsraju gunaNo ratings yet

- Air Thread ConnectionsDocument31 pagesAir Thread ConnectionsJasdeep SinghNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin Blyth100% (1)

- FY 2022 Revenue TotalsDocument296 pagesFY 2022 Revenue TotalsCaleb TaylorNo ratings yet

- Global Automotive Sales and Personnel Breakdown by RegionDocument4 pagesGlobal Automotive Sales and Personnel Breakdown by Regionniraj kumarNo ratings yet

- Overview of Budgetjuly2023-24Document31 pagesOverview of Budgetjuly2023-24Prajwal D'SouzaNo ratings yet

- MS Brothers Super Rice MillDocument9 pagesMS Brothers Super Rice MillMasud Ahmed khan100% (1)

- Atlas Power Plant Complex Output Correction Factors for Ambient TemperatureDocument247 pagesAtlas Power Plant Complex Output Correction Factors for Ambient TemperaturesitehabNo ratings yet

- FY23 April Revenue Report - NJ Department of The TreasuryDocument1 pageFY23 April Revenue Report - NJ Department of The TreasuryMichelle Rotuno-JohnsonNo ratings yet

- Cash FlowDocument6 pagesCash Flowahmedmostafaibrahim22No ratings yet

- Bear Stearns 4q2005 - TablesDocument4 pagesBear Stearns 4q2005 - Tablesjoeyn414No ratings yet

- News Release INDY Result 3M22Document7 pagesNews Release INDY Result 3M22M Rizky PermanaNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Contoh Simple FCFFDocument5 pagesContoh Simple FCFFFANNY KRISTIANTINo ratings yet

- 1Q23 Supporting SpreadsheetDocument22 pages1Q23 Supporting SpreadsheetJamilly PaivaNo ratings yet

- Judge Bumb's Court Order in Koons v. Platkin, May 16, 2023Document4 pagesJudge Bumb's Court Order in Koons v. Platkin, May 16, 2023Michelle Rotuno-JohnsonNo ratings yet

- U.S. V Menendez Et Al IndictmentDocument39 pagesU.S. V Menendez Et Al IndictmentMichelle Rotuno-Johnson0% (1)

- FY23 April Revenue Report - NJ Department of The TreasuryDocument1 pageFY23 April Revenue Report - NJ Department of The TreasuryMichelle Rotuno-JohnsonNo ratings yet

- Judge Bumb's Court Opinion On Koons v. Platkin, May 16, 2023Document235 pagesJudge Bumb's Court Opinion On Koons v. Platkin, May 16, 2023Michelle Rotuno-JohnsonNo ratings yet

- 2023 Introduced Budget - Wayne Township NJDocument74 pages2023 Introduced Budget - Wayne Township NJMichelle Rotuno-JohnsonNo ratings yet

- 2022 Rejected Vanity Plates From NJ Motor Vehicle CommissionDocument45 pages2022 Rejected Vanity Plates From NJ Motor Vehicle CommissionMichelle Rotuno-JohnsonNo ratings yet

- Proposed Rule Revisions To NJ Administrative Code Section On Communicable DiseasesDocument13 pagesProposed Rule Revisions To NJ Administrative Code Section On Communicable DiseasesMichelle Rotuno-JohnsonNo ratings yet

- Proposed Police Training Commission Rules in New JerseyDocument47 pagesProposed Police Training Commission Rules in New JerseyMichelle Rotuno-Johnson100% (1)

- $103M Additional Aid To NJ Schools - Full FiguresDocument6 pages$103M Additional Aid To NJ Schools - Full FiguresMichelle Rotuno-JohnsonNo ratings yet

- BPU Director Letter To Toms River Mayor 07.13.2022Document3 pagesBPU Director Letter To Toms River Mayor 07.13.2022Michelle Rotuno-JohnsonNo ratings yet

- Snap Factsheet Pennsylvania - From Center On Budget and Policy PrioritiesDocument2 pagesSnap Factsheet Pennsylvania - From Center On Budget and Policy PrioritiesMichelle Rotuno-JohnsonNo ratings yet

- SNAP Factsheet New Jersey - Center On Budget and Policy PrioritiesDocument2 pagesSNAP Factsheet New Jersey - Center On Budget and Policy PrioritiesMichelle Rotuno-JohnsonNo ratings yet

- XIDocument42 pagesXIareebsiddiqueNo ratings yet

- Singapore BudgetDocument35 pagesSingapore Budgetlengyianchua206No ratings yet

- Section 54F Deduction Available On Reinvestment in Twin Residential Units - Taxguru - inDocument18 pagesSection 54F Deduction Available On Reinvestment in Twin Residential Units - Taxguru - inRahul BhasmeNo ratings yet

- Princ ch06 PresentationDocument34 pagesPrinc ch06 Presentationhpl4jcNo ratings yet

- 03 Activity 1Document1 page03 Activity 1bea santiagoNo ratings yet

- ANALYZING LAND AND BUILDING TAX PERFORMANCEDocument11 pagesANALYZING LAND AND BUILDING TAX PERFORMANCEtaryonoNo ratings yet

- Macro Trade Pitch Individual Presentation: Steven Li Phi Gamma Nu New MemberDocument14 pagesMacro Trade Pitch Individual Presentation: Steven Li Phi Gamma Nu New MemberSteven LiNo ratings yet

- LIC's JEEVAN ANKUR 807 PDFDocument3 pagesLIC's JEEVAN ANKUR 807 PDFgvspavan0% (2)

- Collector vs. Yuseco (1961)Document2 pagesCollector vs. Yuseco (1961)8111 aaa 1118No ratings yet

- Gestopa Vs CADocument5 pagesGestopa Vs CAMyra Mae J. DuglasNo ratings yet

- Steps To Status Correction For Europe Not CompleteDocument8 pagesSteps To Status Correction For Europe Not CompleteBogna Córka Juliusza LS100% (1)

- FILING STATUS (Check One)Document3 pagesFILING STATUS (Check One)hypnotix-2000No ratings yet

- 4.1 (5) B.com SyllabusDocument23 pages4.1 (5) B.com SyllabusAshleshNo ratings yet

- 01 The Impact of Real Property Tax Knowledge and Awareness Towards Tax Compliance DraftDocument16 pages01 The Impact of Real Property Tax Knowledge and Awareness Towards Tax Compliance DraftMesina Joshua Ardie A.No ratings yet

- FINAL NABCEP PV Tech Sales Resource Guide 11-17-10Document28 pagesFINAL NABCEP PV Tech Sales Resource Guide 11-17-10soflavorfulNo ratings yet

- Economic Impact of Relief Package in PakistanDocument10 pagesEconomic Impact of Relief Package in PakistanNadia Farooq100% (1)

- A Review of "Transition Management" StrategiesDocument67 pagesA Review of "Transition Management" StrategiesSonia FilipettoNo ratings yet

- Haber - Rainfall and DemocracyDocument51 pagesHaber - Rainfall and DemocracyFedakynesNo ratings yet

- TRAIN Law Impacts on Low-Income GroupsDocument2 pagesTRAIN Law Impacts on Low-Income GroupsJireh Rivera0% (1)

- Steam Purchase and Supply Agreement SummaryDocument26 pagesSteam Purchase and Supply Agreement SummarySteamhouse InternNo ratings yet

- Question Bank Education Vi Semester Paper X Educational Planning & ManagementDocument52 pagesQuestion Bank Education Vi Semester Paper X Educational Planning & ManagementSunil MalviyaNo ratings yet

- Pigeon Brunet Glass Manual Gas Stove: Grand Total 1994.00Document1 pagePigeon Brunet Glass Manual Gas Stove: Grand Total 1994.00abhishekmohanty2No ratings yet

- NHIDCL Invoice Approval for Zojila Tunnel DPRDocument8 pagesNHIDCL Invoice Approval for Zojila Tunnel DPRMohd UmarNo ratings yet

- CONCLUSIONDocument6 pagesCONCLUSIONSandes GajbheNo ratings yet

- T11F CHP 03 1 Income Sources 2011Document140 pagesT11F CHP 03 1 Income Sources 2011jessie1614No ratings yet

- TLP-MCQ 100Document16 pagesTLP-MCQ 100PriyankaGuptaNo ratings yet

- Icse Class X Maths Practise Sheet 1 GST PDFDocument2 pagesIcse Class X Maths Practise Sheet 1 GST PDFHENA KHANNo ratings yet

- Cir Vs San Roque PowerDocument5 pagesCir Vs San Roque PowerMoon BeamsNo ratings yet