Professional Documents

Culture Documents

Stock Market Reports For The Week (16th - 20th May '11)

Uploaded by

Dasher_No_1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Market Reports For The Week (16th - 20th May '11)

Uploaded by

Dasher_No_1Copyright:

Available Formats

WEEKLY REPORT

16th May - 20th May 2011

Global Research Limited

STOCKS

R E P O R T

THE RAGING BULL vs THE FORMIDABLE BEAR !!

WEEK WRAP

All the sectoral indices were in the green, with the FMCG index rallying 2.3% to 3,803. BSE healthcare, auto and bankex were also in the green.

FMCG heavyweight, ITC, jumped 3.3% to Rs 190. Hindustan Unilever gained 2% to Rs 307. Among other FMCG gainers were Tata Global, Nestle, Marico and

Colgate Palmolive.

Metal indices gained 1.5% on bargain hunting. JSW Steel jumped 2.7% to Rs 935. Jindal Steel and Bhushan Steel added over 2% each. Sesa Goa, Tata Steel,

Hindalco and Sail advanced 1-2% each in trades today.

ASIAN & EMERGING MARKET

Asian shares were mixed Friday after China tightened monetary policy further in its battle to tame inflation, stoking regional concerns of a slowdown in the

world's number two economy.

Beijing late Thursday said it would raise the amount of money banks must hold in reserve for the fifth time this year, effectively limiting the amount they can

lend.

The move is the latest by China as it struggles with rising prices. It came a day after data showed inflation at 5.3 percent in April, slightly off March's 5.4 percent -

- which was a 32-month high -- but still well above the government's four percent target.

US MARKET

Stocks fell about 1 per cent on Friday as a strengthening in the dollar due to global uncertainty caused a drop in commodity-related and financial shares.

The euro fell against the dollar as investors refocused on euro zone debt before meetings by finance officials in Brussels and as the Federal Reserve moved

closer to ending a stimulus program. The dollar gained 0.9 per cent against a basket of currencies.

US crude futures lost 0.9 per cent and the S&P energy index lost 0.7 per cent. Financials were among the hardest hit on the fears the euro zone debt crisis could

worsen. The KBW Bank index dropped 1.7 per cent, weighed down by 2 per cent drop in JPMorgan Chase & Co to $43.06.

Yahoo Inc shares fell 4.3 per cent to $16.44 after it said the Alibaba Group restructured the ownership of Alipay, one of China's largest online payment

businesses, without the knowledge of Yahoo and Softbank, two of its stakeholders.

MICRO ECONOMIC FRONT

Food inflation eases to 7.7% on April 30 : India's food price index rose 7.70% and the fuel price index climbed 12.25% in the year to April 30, government data on

Thursday showed.

In the previous week, annual food and fuel inflation stood at 8.53% and 13.53%, respectively.

The primary articles price index was up 11.96%, compared with an annual rise of 12.11% a week earlier.

The RBI raised interest rates last week -- its ninth rate hike since March 2010 -- by a sharper-than-expected 50 basis points and said fighting inflation was its

priority, even at the expense of short-term growth.

1 | MAY 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

16th May - 20th May 2011

THE RAGING BULL vs THE FORMIDABLE BEAR !!

NIFTY WORLD INDICES

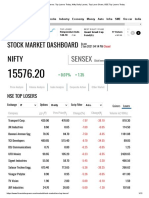

NIFTY Properties Values World Indices Close Weekly Chg Points % Chg

Weekly Open 5575.20 Sensex 18531.28 +13.47 +0.06%

Weekly High 5605.00 Nifty 5554.75 5544.75 -0.54%

Weekly Low 5472.15 DOW Jones 12595.75 -88.93 -0.70%

Weekly Close 5544.75 Shanghai Comp. 2871.87 -7.98 -0.27%

Weekly Chg Points -30.45 Nikkei 9648.77 -200 -2%

Weekly Chg% -0.54% CAC 40 4018.85 -39.16 -0.96%

FTSE 5925.87 -50.93 -0.85%

SECTORIAL INDICES

Indices Open High Low Close

BANK NIFTY 11194.45 11213.50 10838.15 11020.95

CNX NIFTY JUNIOR 11026.60 11244.20 10951.65 11185.40

S&P CNX 500 4473.35 4507.40 4416.90 4470.35

CNX IT 6645.15 6686.50 6554.85 6609.55

CNX MIDCAP 7966.35 8068.70 7921.90 8034.90

CNX 100 5474.95 5518.20 5395.00 5465.45

GAINERS LOSERS

Scrip GAINERS

Current Close Change Chg % Scrip Current Close Change Chg %

BHARAT RASYAN 195.00 150.15 29.87 KWALITY DAIRY 108.35 144.35 -24.93

APLAB 42.40 32.75 29.46 EMPEE SUGAR 41.25 54.85 -24.79

SHREE GAN.JEW 269.25 214.60 25.46 ALLIED DIGIT 58.60 77.85 -24.72

GENESYSINTL 197.60 161.70 22.20 ACROPET.TECH 29.30 38.05 -22.99

MAN INDS 111.30 92.85 19.87 SUMEET INDS 29.60 37.45 -20.96

DII’S INVESTMENTS FII’S INVESTMENTS

Indices Buy Value Sell Value Net Value Indices Buy Value Sell Value Net Value

11-May-2011 539.30 395.80 143.50 13-May-2011 1,602.50 2,479.10 -876.60

10-May-2011 456.80 321.30 135.50 12-May-2011 2,374.10 2,130.00 244.10

09-May-2011 273.70 376.80 -103.20 11-May-2011 1,474.90 1,374.00 100.80

10-May-2011 1,935.90 1,692.10 243.80

09-May-2011 2,613.60 2,964.90 -351.30

1 | DECEMBER 2010 | www.capitalvia.com

2 | MAY 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

16th May - 20th May 2011

THE RAGING BULL vs THE FORMIDABLE BEAR !!

WEEK AHEAD SPOT NIFTY

TECHNICALS

Properties Values

Support 1 5465

Support 2 5385

Resistance 1 5625

Resistance 2 5730

Figure: 1 Nifty Weekly

The Nifty futures closed and settled finally at 5558.90, up by 77.55 or 1.41 %. It is looking bullish in the coming trading session if it

manages to trade above the resistance level of 5625 else below support level of 5465 it would be in a downward trend.

WEEK AHEAD BANK NIFTY

TECHNICALS

Properties Values

Support 1 10780

Support 2 10690

Resistance 1 11240

Resistance 2 11726

Figure: Bank Nifty Weekly

Bank Nifty Futures shut stop at 11032.75 up by 157.45 points or 1.45 % It is looking bullish in the coming trading session if it

manages to trade above the resistance level of 11240 else below support level of 10780 it would be in a downward trend.

3 | MAY 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

16th May - 20th May 2011

THE RAGING BULL vs THE FORMIDABLE BEAR !!

STOCK OF THE WEEK - ROLTA INDIA LTD. BUY

TECHNICAL PICTURE

ROLTA INDIA IS IN CONSOLIDATION PHASE FROM LAST FEW TRADING SESSION. .IF IT MANAGES TO SUSTAIN ABOVE 138.10 IT WILL

TAKE UP MOVE .WE RECOMMEND TO BUY ROLTA IN CASH ABOVE 138.10TARGET 141.40 /143.90/146 WITH STOP LOSS OF 133.40.

ROLTA INDIA Indices ROLTA INDIA

Support 133.40

Resistance 138

Symbol ROLTA (NSE)

Company Name ROLTA INDIA LTD.

Price `136.60

Change `1.50

Volume 485691

52 Week High 188.70

% From High -27.60%

Day High 137.45

EPS 30.74

4 | MAY 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

16th May - 20th May 2011

THE RAGING BULL vs THE FORMIDABLE BEAR !!

KEY STATISTICS

C Current Quarter Earning per Share. The Higher The Better.

WHY CAN SLIM?

Primary Factors

Almost 48.27% decline in Q o Q Earnings.

A Annual Earnings Increases: Look for a significant growth.

Primary Factors

Annual Earnings showed a decline of 3.17% Y o Y.

N New Products, New Management, New Highs, Buying at

Right Time.

Primary Factors

ROLTA INDIA LTD. is set to have a breakout as it is being

consolidating with positive biasness from last a few trading

sessions.

“CAN SLIM is a formula created by

William J. O'Neil, who is the founder

of the Investor's Business Daily and

author of the book How to Make S Supply and Demand: Shares Outstanding Plus Big Volume

Demand.

Money in Stocks - A Winning System Primary Factors

in Good Times or Bad.

ROLTA INDIA LTD. is a mid cap stock consisting of Rs. 2161.09 crores

Shares Outstanding (Total Public Shareholding)

Each letter in CAN SLIM stands for

one of the seven chief

characteristics that are commonly

found in the greatest winning

stocks. The C-A-N-S-L-I-M.

L Leader or Laggard: Which is your stock?

Primary Factors

ROLTA INDIA LTD. is a leading stock with a relative strength above

41.19% in Weekly and 43% in Daily.

characteristics are often present

prior to a stock making a significant

rise in price, and making huge

profits for the shareholders! I Institutional Sponsorship: Follow the Leaders.

Primary Factors

Approximately 35.33% of Shares are held by the Institutional

O'Neil explains how he conducted Investors (FII”s, Mutual Funds etc.)

an intensive study of 500 of the

biggest winners in the stock market

from 1953 to 1990. A model of each

of these companies was built and

M Market Direction

Primary Factors

studied. Again and again, it was

noticed that almost all of the If Market continues to remain in a secular uptrend, hence overall

biggest stock market winners had conditions are appropriate to initiate long position in the stock: A Big

very similar characteristics just plus for the Stock

before they began their big moves.”

Sources: Sihl.in

5 | MAY 2011 | www.capitalvia.com

Global Research Limited

WEEKLY REPORT

16th May - 20th May 2011

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but we do not accept any responsibility (or

liability) for errors of fact or opinion. Users have the right to choose the product/s that suits them the most.

Investment in Stocks has its own risks. Sincere efforts have been made to present the right investment perspective. The information contained herein is

based on analysis and up on sources that we consider reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is

for personal information and we are not responsible for any loss incurred based upon it & take no responsibility whatsoever for any financial profits or

loss which may arise from the recommendations above.

The stock price projections shown are not necessarily indicative of future price performance. The information herein, together with all estimates and

forecasts, can change without notice.

CapitalVia does not purport to be an invitation or an offer to buy or sell any financial instrument.

Analyst or any person related to CapitalVia might be holding positions in the stocks recommended.

It is understood that anyone who is browsing through the site has done so at his free will and does not read any views expressed as a recommendation for

which either the site or its owners or anyone can be held responsible for.

Our Clients (Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or Any Information Provided by

us to/with anyone which is received directly or indirectly by them. If found so then Serious Legal Actions can be taken.

Any surfing and reading of the information is the acceptance of this disclaimer.

All Rights Reserved.

Contact Number:

Hotline: +91-91790-02828

Landline: +91-731-668000

Fax: +91-731-4238027

C O N TA C T U S

Corporate Office Address:

India: No. 99, 1st Floor, Surya Complex

CapitalVia Global Research Limited R. V. Road, Basavangudi

No. 506 West, Corporate House Opposite Lalbagh West Gate

169, R. N. T. Marg, Near D. A. V. V. Bangalore - 560004

Indore - 452001

Singapore:

CapitalVia Global Research Pvt. Ltd.

Block 2 Balestier Road

#04-665 Balestier Hill

Shopping Centre

Singapore - 320002

6 | MAY 2011 | www.capitalvia.com

You might also like

- Light Manufacturing in Vietnam: Creating Jobs and Prosperity in a Middle-Income EconomyFrom EverandLight Manufacturing in Vietnam: Creating Jobs and Prosperity in a Middle-Income EconomyNo ratings yet

- Equity Reports For The Week (2nd - 6th May '11)Document6 pagesEquity Reports For The Week (2nd - 6th May '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (9th - 13th May '11)Document6 pagesStock Market Reports For The Week (9th - 13th May '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (21st - 25th March - 2011)Document6 pagesStock Market Reports For The Week (21st - 25th March - 2011)Dasher_No_1No ratings yet

- Equity Market Reports For The Week (18th - 22nd April 11)Document6 pagesEquity Market Reports For The Week (18th - 22nd April 11)Dasher_No_1No ratings yet

- Equity Research Report 13 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 13 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Reports For The Week (11th - 15th April 11)Document6 pagesEquity Reports For The Week (11th - 15th April 11)Dasher_No_1No ratings yet

- Equity Research Report 27 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 27 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 06 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 06 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Equity Research Report 14 August 2018 Ways2CapitalDocument17 pagesEquity Research Report 14 August 2018 Ways2CapitalWays2CapitalNo ratings yet

- The Tea Times: Daily Updates On Financial MarketsDocument1 pageThe Tea Times: Daily Updates On Financial Marketsgurudev21No ratings yet

- Weekly Special Report of CapitalHeight 23 July 2018Document11 pagesWeekly Special Report of CapitalHeight 23 July 2018Damini CapitalNo ratings yet

- Money Maker Research Pvt. LTD.: Daily Equity ReportDocument6 pagesMoney Maker Research Pvt. LTD.: Daily Equity ReportMoney Maker ResearchNo ratings yet

- Equity Reports For The Week (25th - 29th April '11)Document6 pagesEquity Reports For The Week (25th - 29th April '11)Dasher_No_1No ratings yet

- Equity Research Report 20 November 2018 Ways2CapitalDocument17 pagesEquity Research Report 20 November 2018 Ways2CapitalWays2CapitalNo ratings yet

- Watch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Document11 pagesWatch Out CapitalHeight Weekly Performance Report From 23 To 27 July.Damini CapitalNo ratings yet

- High Brow Market Research Investment Advisor Private LimitedDocument16 pagesHigh Brow Market Research Investment Advisor Private LimitedWays2CapitalNo ratings yet

- January 29, 2010: Market OverviewDocument9 pagesJanuary 29, 2010: Market OverviewValuEngine.comNo ratings yet

- Report On Stock Trading Report by Mansukh Investment & Trading Solutions 6/07/2010Document5 pagesReport On Stock Trading Report by Mansukh Investment & Trading Solutions 6/07/2010MansukhNo ratings yet

- Equity DailyDocument4 pagesEquity DailyArvsrvNo ratings yet

- Derivative Report 6march2017Document6 pagesDerivative Report 6march2017ram sahuNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Stock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010Document5 pagesStock Trading Analysis by Mansukh Investment and Trading Solutions 10/5/2010MansukhNo ratings yet

- Weekly Report - Xxi - May 23 To 27, 2011Document3 pagesWeekly Report - Xxi - May 23 To 27, 2011JC CalaycayNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Daily Technicals (31-May-2023) - 230531 - 090018Document19 pagesDaily Technicals (31-May-2023) - 230531 - 090018ajayNo ratings yet

- Indian Stock Market Outlook by Mansukh Investment & Trading Solutions 28/7/2010Document5 pagesIndian Stock Market Outlook by Mansukh Investment & Trading Solutions 28/7/2010MansukhNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions5/07/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions5/07/2010MansukhNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Daily Technicals (08-Dec-2023)Document18 pagesDaily Technicals (08-Dec-2023)drtohogNo ratings yet

- Stock Market Analysis by Mansukh Investment & Trading Solutions 27/8/2010Document5 pagesStock Market Analysis by Mansukh Investment & Trading Solutions 27/8/2010MansukhNo ratings yet

- Kuntal Shah WatchlistDocument2 pagesKuntal Shah WatchlistDhrumil ShahNo ratings yet

- IFA Monthly Report FinalDocument24 pagesIFA Monthly Report FinalBushra ShaikhNo ratings yet

- Derivative Report 02 May UpdateDocument6 pagesDerivative Report 02 May UpdateDEEPAK MISHRANo ratings yet

- June 2Document5 pagesJune 2Pallavi M SNo ratings yet

- Daily Equity Report: A SEBI Registered CompanyDocument6 pagesDaily Equity Report: A SEBI Registered CompanyHighlight Investment ResearchNo ratings yet

- Analysis On Market Outlook by Mansukh Investment & Trading Solutions 11/08/2010Document5 pagesAnalysis On Market Outlook by Mansukh Investment & Trading Solutions 11/08/2010MansukhNo ratings yet

- Analysis On Stock Trading Report by Mansukh Investment & Trading Solutions 23/06/2010Document5 pagesAnalysis On Stock Trading Report by Mansukh Investment & Trading Solutions 23/06/2010MansukhNo ratings yet

- Morning Notes 12 AUG, 10: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 12 AUG, 10: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Market Outlook Review and StrategyDocument34 pagesMarket Outlook Review and StrategyVijay Kumar GabaNo ratings yet

- Stock Market Outlook by Mansukh Investment & Trading Solutions 06/08/2010Document5 pagesStock Market Outlook by Mansukh Investment & Trading Solutions 06/08/2010MansukhNo ratings yet

- ValuEngine Weekly Newsletter July 30, 2010Document16 pagesValuEngine Weekly Newsletter July 30, 2010ValuEngine.comNo ratings yet

- Market Snapshot ADocument5 pagesMarket Snapshot Abi11yNo ratings yet

- Analysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010Document5 pagesAnalysis On Stock Market Outlook by Mansukh Investment & Trading Solutions 23aug, 2010MansukhNo ratings yet

- Disenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Document5 pagesDisenchanted: .DJI 12,760.36 (+75.68) .SPX 1,357.16 (+10.87) .IXIC 2,871.89 (+28.64)Andre SetiawanNo ratings yet

- Report On Stock Trading Report by Mansukh Investment & Trading Solutions 22/06/2010Document5 pagesReport On Stock Trading Report by Mansukh Investment & Trading Solutions 22/06/2010MansukhNo ratings yet

- Daily Notes: Metropolitan Bank & Trust Com. (pse:MBT)Document2 pagesDaily Notes: Metropolitan Bank & Trust Com. (pse:MBT)junNo ratings yet

- Daily - April 15 - End of WeekDocument2 pagesDaily - April 15 - End of WeekJC CalaycayNo ratings yet

- Most Market Outlook Most Market Outlook Most Market Outlook: Morning UpdateDocument7 pagesMost Market Outlook Most Market Outlook Most Market Outlook: Morning Updatevikalp123123No ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument8 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- Daily Digest - 15 June, 2023Document2 pagesDaily Digest - 15 June, 2023Anant VishnoiNo ratings yet

- Pre Market Analysis: Important Price Levels for Today's TradingDocument12 pagesPre Market Analysis: Important Price Levels for Today's TradingVarun VasurendranNo ratings yet

- Daily Digest - 01 April, 2024Document2 pagesDaily Digest - 01 April, 2024saraonahembram3No ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 1/07/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 1/07/2010MansukhNo ratings yet

- Index Movement:: National Stock Exchange of India LimitedDocument36 pagesIndex Movement:: National Stock Exchange of India LimitedTrinadh Kumar GuthulaNo ratings yet

- Daily Market Sheet 1-5-10Document2 pagesDaily Market Sheet 1-5-10chainbridgeinvestingNo ratings yet

- Morning Notes 23 July: Mansukh Securities and Finance LTDDocument5 pagesMorning Notes 23 July: Mansukh Securities and Finance LTDMansukhNo ratings yet

- Stock Trading Report by Mansukh Investment & Trading Solutions 28/06/2010Document5 pagesStock Trading Report by Mansukh Investment & Trading Solutions 28/06/2010MansukhNo ratings yet

- Daily 07 March 2024Document5 pagesDaily 07 March 2024enockmartha01No ratings yet

- Nifty 50 Reports For The Week (16-20th August '11)Document52 pagesNifty 50 Reports For The Week (16-20th August '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (16-20th August '11)Document5 pagesStock Market Reports For The Week (16-20th August '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (8th - 12th August '11)Document8 pagesBullion Commodity Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (16-20th August '11)Document6 pagesAgri Commodity Reports For The Week (16-20th August '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (1st - 5th August '11)Document5 pagesStock Market Reports For The Week (1st - 5th August '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (8th - 12th August '11)Document52 pagesNifty 50 Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (16-20th August '11)Document8 pagesBullion Commodity Reports For The Week (16-20th August '11)Dasher_No_1No ratings yet

- Rollover Statistics (From July 2011 Series To September 2011 Series)Document10 pagesRollover Statistics (From July 2011 Series To September 2011 Series)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (8th - 12th August '11)Document5 pagesStock Market Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (8th - 12th August '11)Document6 pagesAgri Commodity Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (1st - 5th August '11)Document52 pagesNifty 50 Reports For The Week (1st - 5th August '11)Dasher_No_1No ratings yet

- Stock Futures and Options Reports For The Week (8th - 12th August '11)Document4 pagesStock Futures and Options Reports For The Week (8th - 12th August '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (1st - 5th August '11)Document6 pagesAgri Commodity Reports For The Week (1st - 5th August '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (25th - 29th July '11)Document5 pagesStock Market Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (1st - 5th August '11)Document8 pagesBullion Commodity Reports For The Week (1st - 5th August '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (11th - 15th July '11)Document5 pagesStock Market Reports For The Week (11th - 15th July '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (25th - 29th July '11)Document8 pagesBullion Commodity Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (25th - 29th July '11)Document52 pagesNifty 50 Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Rollover Statistics (From June 2011 Series To July 2011 Series)Document10 pagesRollover Statistics (From June 2011 Series To July 2011 Series)Dasher_No_1No ratings yet

- Bulion Commodity Reports For The Week (11th - 15th July '11)Document8 pagesBulion Commodity Reports For The Week (11th - 15th July '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (25th - 29th July '11)Document6 pagesAgri Commodity Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Stock Futures and Option Reports For The Week (25th - 29th July '11)Document4 pagesStock Futures and Option Reports For The Week (25th - 29th July '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (11th - 15th July '11)Document52 pagesNifty 50 Reports For The Week (11th - 15th July '11)Dasher_No_1No ratings yet

- Stock Market Reports For The Week (4th - 8th July '11)Document5 pagesStock Market Reports For The Week (4th - 8th July '11)Dasher_No_1No ratings yet

- Bullion Commodity Reports For The Week (4th - 8th July '11)Document8 pagesBullion Commodity Reports For The Week (4th - 8th July '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (4th - 8th July '11)Document6 pagesAgri Commodity Reports For The Week (4th - 8th July '11)Dasher_No_1No ratings yet

- Agri Commodity Reports For The Week (11th - 15th July '11)Document6 pagesAgri Commodity Reports For The Week (11th - 15th July '11)Dasher_No_1No ratings yet

- Nifty 50 Reports For The Week (4th - 8th July '11)Document52 pagesNifty 50 Reports For The Week (4th - 8th July '11)Dasher_No_1No ratings yet

- Summary of Benefits: Northeast RegionDocument16 pagesSummary of Benefits: Northeast RegionDavid NoreñaNo ratings yet

- LAMPE Harald Ignatius HubertusDocument100 pagesLAMPE Harald Ignatius HubertusSumaya NoorNo ratings yet

- Form: Contours and Areas V: Stefan ArteniDocument100 pagesForm: Contours and Areas V: Stefan Artenistefan arteniNo ratings yet

- Real Estate Appraisal Report PDFDocument55 pagesReal Estate Appraisal Report PDFSteven Bailey100% (4)

- Emcee King & QueenDocument8 pagesEmcee King & QueenMaryHazelClaveBeniga100% (10)

- Supreme Court Detailed Judgement On Asia Bibi's AppealDocument56 pagesSupreme Court Detailed Judgement On Asia Bibi's AppealDawndotcom94% (35)

- 2 Saliva PhysiologyDocument20 pages2 Saliva PhysiologyvelangniNo ratings yet

- Caste and Class An Interlinked ViewDocument12 pagesCaste and Class An Interlinked ViewghisaramNo ratings yet

- Progress Test 7 PDFDocument2 pagesProgress Test 7 PDFTatiana FainaNo ratings yet

- A Self-Biased Mixer in CMOS For An Ultra-Wideband ReceiverDocument9 pagesA Self-Biased Mixer in CMOS For An Ultra-Wideband ReceiverwwwNo ratings yet

- QSP 7.1-02. Control of Monitoring and Measuring Resources (Preview)Document4 pagesQSP 7.1-02. Control of Monitoring and Measuring Resources (Preview)Centauri Business Group Inc.100% (1)

- Pre Sequence Seq 1 2 3Document74 pagesPre Sequence Seq 1 2 3choaibirkiNo ratings yet

- Riopipeline2019 1120 Ibp1120 19 Transpetro S Worklo PDFDocument9 pagesRiopipeline2019 1120 Ibp1120 19 Transpetro S Worklo PDFMarcelo Varejão CasarinNo ratings yet

- Vegetarian and Vegan Diets in Type 2 Diabetes ManagementDocument3 pagesVegetarian and Vegan Diets in Type 2 Diabetes Managementapi-259343531No ratings yet

- MC Sampler Pack PDFDocument195 pagesMC Sampler Pack PDFVedaste Ndayishimiye100% (2)

- RRRDocument31 pagesRRRddNo ratings yet

- Cardiac Cath LabDocument2 pagesCardiac Cath Labapi-663643642No ratings yet

- Paragraph WritingDocument22 pagesParagraph WritingarvindranganathanNo ratings yet

- Communicate Formally and InformallyDocument13 pagesCommunicate Formally and Informallyankit161019893980100% (2)

- About Compression - Page 10 - RTM CommunityDocument31 pagesAbout Compression - Page 10 - RTM CommunityMohammed FarooqNo ratings yet

- CS602 Current Final Term Papers 2018 To 2020Document3 pagesCS602 Current Final Term Papers 2018 To 2020Jawad AliNo ratings yet

- Puppets in GreeceDocument6 pagesPuppets in GreeceStathis Markopoulos100% (1)

- PROM PPT UpdatedDocument26 pagesPROM PPT Updatedsaurabh chauhanNo ratings yet

- Just Say NO To Baby EinsteinDocument5 pagesJust Say NO To Baby Einsteinsmartypinto0% (1)

- Dolar Vs DiancinDocument2 pagesDolar Vs DiancinchrisNo ratings yet

- Gr.8 Ch.5 Chapter Review AnswerDocument10 pagesGr.8 Ch.5 Chapter Review Answerson GokuNo ratings yet

- Brown v. Board of EducationDocument1 pageBrown v. Board of EducationSam TaborNo ratings yet

- Partition SuitDocument2 pagesPartition SuitJyoti ChaudharyNo ratings yet

- ST Georges HallDocument15 pagesST Georges HallfeatherstarsNo ratings yet

- 8638 All SlidesDocument268 pages8638 All SlidesMariyum SanaNo ratings yet