Professional Documents

Culture Documents

Tabnam Direct Idoctyp Mestyp Sndpor SNDPRT SNDPRN Rcvpor RCVPRT RCVPRN

Tabnam Direct Idoctyp Mestyp Sndpor SNDPRT SNDPRN Rcvpor RCVPRT RCVPRN

Uploaded by

Diana Carolina MartinezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tabnam Direct Idoctyp Mestyp Sndpor SNDPRT SNDPRN Rcvpor RCVPRT RCVPRN

Tabnam Direct Idoctyp Mestyp Sndpor SNDPRT SNDPRN Rcvpor RCVPRT RCVPRN

Uploaded by

Diana Carolina MartinezCopyright:

Available Formats

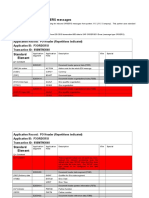

SAP IDOC XML INVOIC / INVOIC02

EGGER Version 1.2 09/2017

Segment designation Description Comments

EDI_DC40

TABNAM EDI_DC40

DIRECT 1

IDOCTYP INVOIC02

MESTYP INVOIC02

SNDPOR SAPEXP

SNDPRT LS

SNDPRN PARTNER

RCVPOR SAPPI

RCVPRT LS

RCVPRN TEST

E1EDK01

CURCY for example: EUR = Euro, GBP = British Pound

KUNDEUINR VAT registration number - invoice recipient

EIGENUINR VAT registration number - vendor

BSART Document type for example INVO = invoice, CRME = credit note

BELNR Invoice number

E1EDKA1

PARVW AG = Buyer

WE = Delivery party

BK = Supplier

RE = Invoice recipient

RS = Invoicing party

PARTN Partner number

LIFNR Supplier number

NAME1 Name of involved party

NAME2 Name of involved party

STRAS Street and number/p.o. box

ORT01 City name

PSTLZ Postcode identification

LAND1 Country, coded

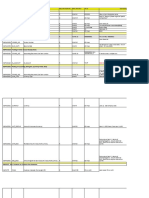

E1EDK02

QUALF 001 = Order number

002 = Supplier's document number

009 = Invoice number

012 = Supplier's delivery note number

BELNR Document number

DATUM Date

E1EDK03

IDDAT 001 = Delivery date

012 = Document date

DATUM Date

E1EDK04

MSATZ VAT rate

MWSBT Value added tax amount

E1EDK18 Terms of Payment

QUALF 001 = Payment term 1

002 = Payment term 2

TAGE Number of days

PRZNT Percentage

ZTERM_TXT Text

E1EDKT1

TDID Z003 = General text

TSSPRAS D

TSSPRAS_ISO DE

E1EDKT2

TDLINE Free Text

TDFORMAT *

E1EDP01

POSEX Line item number

MENGE Quantity, max. 3 decimals

MENEE for example PCE = piece, MTR = meter

NETWR Item value

NTGEW Net weight

GEWEI Weight unit for example KGM = Kilogram

SAP IDOC XML INVOIC customer Page 1 of 2

E1EDP02

QUALF 001 = Order number

002 = Supplier's document number

016 = Supplier's delivery note number

BELNR Document number

ZEILE Reference number

DATUM Date

E1EDP03

IDDAT 001 = Delivery date

DATUM Date

E1EDP19

QUALF 001 = Buyer's part number

002 = Supplier's article number

003 = EAN

IDTNR article number

E1EDP26

QUALF 006 = Net price

BETRG Amount

E1EDP04

MWSATZ VAT rate

MWSBT Value added tax amount

E1EDPT1

TDID 0001 = General text

TSSPRAS D

TSSPRAS_ISO DE

E1EDPT2

TDLINE Free text

TDFORMAT *

E1EDS01

SUMID 005 = Sales tax total

010 = Net invoice value

011 = Billed value

SUMME Amount, max. 2 decimals

WAERQ for example: EUR = Euro, GBP = British Pound

SAP IDOC XML INVOIC customer Page 2 of 2

You might also like

- O856v4010 TemplateDocument13 pagesO856v4010 TemplateSetiadji Sunarsan100% (2)

- The Vision of David MarrsDocument13 pagesThe Vision of David MarrsArunabh GhoshNo ratings yet

- 01 Edi Mapping TemplateDocument12 pages01 Edi Mapping TemplatesatishNo ratings yet

- C ProgrammingDocument1,670 pagesC ProgrammingValentin ValiNo ratings yet

- Retail Email Marketing Case Study: HalfordsDocument35 pagesRetail Email Marketing Case Study: HalfordsSmart Insights100% (1)

- IdocDocument39 pagesIdocRavi JosanNo ratings yet

- IdocDocument39 pagesIdocRaviNo ratings yet

- As 1289.6.7.1-2001 Methods of Testing Soils For Engineering Purposes Soil Strength and Consolidation TestsDocument2 pagesAs 1289.6.7.1-2001 Methods of Testing Soils For Engineering Purposes Soil Strength and Consolidation TestsSAI Global - APACNo ratings yet

- Assignment l3 D UpdatedDocument11 pagesAssignment l3 D Updatedapi-302641464No ratings yet

- Instructors Solution Manual For Introduction To Real Analysis PDFDocument4 pagesInstructors Solution Manual For Introduction To Real Analysis PDFAnika Sharma0% (2)

- Air Reservation SystemDocument50 pagesAir Reservation SystemVidya Niwas Mishra100% (2)

- 19.10.2005 SSVV-IN: Date SignDocument33 pages19.10.2005 SSVV-IN: Date SignNguyen binhNo ratings yet

- Scanning and Analysis Tools - Packets SniffersDocument22 pagesScanning and Analysis Tools - Packets Sniffersaurox3d100% (1)

- Splitting and Line Item PO Number Tracking in SAP SDDocument7 pagesSplitting and Line Item PO Number Tracking in SAP SDBalaji_SAPNo ratings yet

- InvoicouDocument16 pagesInvoicoustock18100% (1)

- SAP OSS Notes - Note 11162 - Invoice Split Criteria in Billing DocumentDocument3 pagesSAP OSS Notes - Note 11162 - Invoice Split Criteria in Billing DocumentrajkumaraeiNo ratings yet

- Howto UsedtwDocument21 pagesHowto Usedtwsyedasadanwer3290No ratings yet

- Reglas EspañolDocument21 pagesReglas EspañolNina Jeashel bahamon paezNo ratings yet

- SCM5 Ord Sol G 2011-03Document19 pagesSCM5 Ord Sol G 2011-03Ann WilsonNo ratings yet

- FI Document Number RangeDocument4 pagesFI Document Number RangeImtiaz KhanNo ratings yet

- RE FRICE Specification Consignment PO Release Strategy1Document5 pagesRE FRICE Specification Consignment PO Release Strategy1sudhakp100% (1)

- SAP Currency TransactionsDocument1 pageSAP Currency TransactionsYazeed_GhNo ratings yet

- Lista de Tablas de SAP Segun ModuloDocument2 pagesLista de Tablas de SAP Segun ModuloGino Spagnolo100% (1)

- Workflow Scenario For PO Change - ABAP Development - SCN WikiDocument11 pagesWorkflow Scenario For PO Change - ABAP Development - SCN WikiAnup SatishNo ratings yet

- Quiz No. 2 Quiz No. 2: Time: 20 MinutesDocument8 pagesQuiz No. 2 Quiz No. 2: Time: 20 MinuteslaxmanbethapudiNo ratings yet

- Resumen ABAP - CertificateDocument116 pagesResumen ABAP - Certificaterolo0o2013100% (4)

- It Edi Ordrsp-Sap-Idoc-Xml en PDFDocument2 pagesIt Edi Ordrsp-Sap-Idoc-Xml en PDFJohn SmithNo ratings yet

- EDI Mapping ExcelDocument40 pagesEDI Mapping ExcelRajesh PNo ratings yet

- 180 EDI Implementation Guide - ReturnsDocument6 pages180 EDI Implementation Guide - Returnsvenkateswarlu mandalapuNo ratings yet

- 850 DDFDocument38 pages850 DDFvenkateswarlu mandalapuNo ratings yet

- SAP Qulf ValueDocument58 pagesSAP Qulf ValueMakesh ElangovanNo ratings yet

- X12-810 4010 SpecsDocument24 pagesX12-810 4010 SpecsJavier BernabeuNo ratings yet

- Fisher Scientific Edi Specifications 810 Invoice Customer GuideDocument20 pagesFisher Scientific Edi Specifications 810 Invoice Customer Guidejeffa123No ratings yet

- Template O810v4010 SampleDocument8 pagesTemplate O810v4010 Samplesimhan_1983No ratings yet

- 01 Edi Mapping TemplateDocument11 pages01 Edi Mapping Templategawayne25% (4)

- Ansi Micron X12 Invoice MRSDocument65 pagesAnsi Micron X12 Invoice MRSMichael Angelo SantosNo ratings yet

- EDI Spec Guide Cust 855PDFDocument20 pagesEDI Spec Guide Cust 855PDFatungmuNo ratings yet

- Logicbroker 810 EDI SpecificationsDocument22 pagesLogicbroker 810 EDI SpecificationsMari SolanoNo ratings yet

- 820 PDFDocument19 pages820 PDFCharles JacobNo ratings yet

- Mapeo Campos Magento JDE B2H VNoc2023Document30 pagesMapeo Campos Magento JDE B2H VNoc2023julioNo ratings yet

- Reference Price Request (Budgetary) For PR 17519Document1 pageReference Price Request (Budgetary) For PR 17519Eliyanto E BudiartoNo ratings yet

- Edi810 File ExplanationDocument8 pagesEdi810 File ExplanationqqwtnqnoNo ratings yet

- Danfoss Xi Interface Description: Danfoss Subset Idoc Ordrsp - Orders05Document17 pagesDanfoss Xi Interface Description: Danfoss Subset Idoc Ordrsp - Orders05John SmithNo ratings yet

- Edi Modelo PDF PDFDocument60 pagesEdi Modelo PDF PDFJogador Dois SteamNo ratings yet

- Mediawebserver 850 4010 PDFDocument51 pagesMediawebserver 850 4010 PDFericlaw02No ratings yet

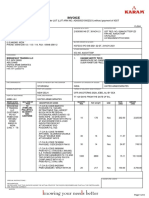

- Invoice P: YALE Europe Materials HandlingDocument2 pagesInvoice P: YALE Europe Materials HandlingNy Aritiana Miratia MahefasoaNo ratings yet

- 99-Incoming ACH - EDI 820 File Format Untranslated - Segment Breakdown (FIS)Document5 pages99-Incoming ACH - EDI 820 File Format Untranslated - Segment Breakdown (FIS)Venkatapavan SinagamNo ratings yet

- X12 850 SpecDocument16 pagesX12 850 SpecPhilip AlotayaNo ratings yet

- Xl0000008Document13 pagesXl0000008Makesh ElangovanNo ratings yet

- Revise 21830300149 InvDocument4 pagesRevise 21830300149 InvrajmayatraNo ratings yet

- Walgets 850 SpecDocument16 pagesWalgets 850 SpecPramodh Pramodh K NNo ratings yet

- Project For Peachtree Accounting: Iii. Trial Balance As of August 31, 2001 Acct. No Account Description Debit CreditDocument8 pagesProject For Peachtree Accounting: Iii. Trial Balance As of August 31, 2001 Acct. No Account Description Debit CreditBeka Asra100% (2)

- Receipt of Import Declaration 1 / 2Document2 pagesReceipt of Import Declaration 1 / 2Thant ZinNo ratings yet

- Table Access Diag ExampleDocument5 pagesTable Access Diag ExampleGovind kamtheNo ratings yet

- 856 - Supplier Advance Ship Notice Last Updated February 2017Document32 pages856 - Supplier Advance Ship Notice Last Updated February 2017Nimisha NigamNo ratings yet

- Putra Mubaraq Ihsan - Kertas Kerja Exc 11 BpmaDocument1 pagePutra Mubaraq Ihsan - Kertas Kerja Exc 11 BpmaPutra YachNo ratings yet

- Important FieldsDocument5 pagesImportant Fieldswirijo1740No ratings yet

- Functional Information For Inbound EDI Purchase Order (PO) Edifact - Orders ANSI X12 - 850Document44 pagesFunctional Information For Inbound EDI Purchase Order (PO) Edifact - Orders ANSI X12 - 850satishkr14No ratings yet

- Mis New FormatDocument5 pagesMis New Formatsalman_zahir20074521No ratings yet

- 1 - 200096071610 IV 0388HJ (Poland)Document2 pages1 - 200096071610 IV 0388HJ (Poland)ko paingNo ratings yet

- Work Order Form: ReconnectDocument2 pagesWork Order Form: ReconnectrickyNo ratings yet

- EDD0000000142Document3 pagesEDD0000000142Vu TuongNo ratings yet

- MM AppendixDocument22 pagesMM AppendixM'hamed ZhiouaNo ratings yet

- O855 ORDRSP FunctionalDocument61 pagesO855 ORDRSP FunctionalMohanish MurkuteNo ratings yet

- Esp Mig X12 Fin310 4010Document49 pagesEsp Mig X12 Fin310 4010Harsh ValandNo ratings yet

- 204 Motor Carrier Load TenderDocument41 pages204 Motor Carrier Load TenderIndu GowdaNo ratings yet

- Pre-Delivery InvoiceDocument15 pagesPre-Delivery Invoicegood hansNo ratings yet

- SAP SD CIN: Number Range MaintainceDocument6 pagesSAP SD CIN: Number Range MaintainceAshish KothariNo ratings yet

- SAP Best Practices: Development Master List: 184: Overhead Cost Accounting - ActualDocument2 pagesSAP Best Practices: Development Master List: 184: Overhead Cost Accounting - ActualNitinchandan KumarNo ratings yet

- Automation of CK40NDocument23 pagesAutomation of CK40NNitinchandan KumarNo ratings yet

- Informatica Powercenter Training: Srinivas PanchadarDocument81 pagesInformatica Powercenter Training: Srinivas PanchadarNitinchandan KumarNo ratings yet

- S4HANA Cloud Integration To SAP Cash ApplicationDocument15 pagesS4HANA Cloud Integration To SAP Cash ApplicationNitinchandan KumarNo ratings yet

- Informatica Hana Integrationjuly2013v4 VT 140408083908 Phpapp01 PDFDocument18 pagesInformatica Hana Integrationjuly2013v4 VT 140408083908 Phpapp01 PDFNitinchandan KumarNo ratings yet

- Secret of My Success Was To Have Ambition and Know Minds of MenDocument4 pagesSecret of My Success Was To Have Ambition and Know Minds of MenNitinchandan KumarNo ratings yet

- BI2017 EU BrochureDocument25 pagesBI2017 EU BrochureNitinchandan KumarNo ratings yet

- Pp3090 Causal AnalysisDocument5 pagesPp3090 Causal AnalysisNitinchandan KumarNo ratings yet

- Haier Group: OEC ManagementDocument10 pagesHaier Group: OEC ManagementNitinchandan KumarNo ratings yet

- Employee DetailsDocument2 pagesEmployee DetailsNitinchandan KumarNo ratings yet

- Tata DataDocument2 pagesTata DataNitinchandan KumarNo ratings yet

- 2009 India Presentation TimesDocument84 pages2009 India Presentation Timesrahulparmar99gmailNo ratings yet

- Leverage of The FirmDocument8 pagesLeverage of The FirmNitinchandan KumarNo ratings yet

- Apa Citation StyleDocument8 pagesApa Citation StyleNitinchandan KumarNo ratings yet

- Optimizing Your Music & SuDocument3 pagesOptimizing Your Music & SuShane CampbellNo ratings yet

- Project Green KartDocument36 pagesProject Green KartM R CreationsNo ratings yet

- Cyber 502x Unit 3Document19 pagesCyber 502x Unit 3Javier SonccoNo ratings yet

- CS302 MID Term GIGA FILE PDFDocument69 pagesCS302 MID Term GIGA FILE PDFattiqueNo ratings yet

- TopologyDocument6 pagesTopologySameen BaberNo ratings yet

- PDFDocument7 pagesPDFBalindo KhanaNo ratings yet

- Geographic Information System Development GuidesDocument151 pagesGeographic Information System Development GuidesFrederik Samuel PapilayaNo ratings yet

- dc390 6Document71 pagesdc390 6Adam CzarnyNo ratings yet

- 2 FF For SIF Patrick FlandersDocument12 pages2 FF For SIF Patrick FlandersSaahil KhanNo ratings yet

- Neles Valve GuardDocument12 pagesNeles Valve GuardhatakerobotNo ratings yet

- Beginners Guide To Accessing SQL Server Through CDocument8 pagesBeginners Guide To Accessing SQL Server Through CJuan Carlos CruzNo ratings yet

- Marten Van DijkDocument12 pagesMarten Van DijkkilopsNo ratings yet

- User Account Creation, Modification, and DeletionDocument3 pagesUser Account Creation, Modification, and DeletionstrokenfilledNo ratings yet

- LectureNotes Algorithmic PDFDocument199 pagesLectureNotes Algorithmic PDFq2842645No ratings yet

- Oci SecurityDocument34 pagesOci SecurityEugene simosNo ratings yet

- ChitraDocument8 pagesChitraJames SonNo ratings yet

- Scientific and Technical Translation ExplainedDocument6 pagesScientific and Technical Translation ExplainedJosefina PergolesiNo ratings yet

- Jee Mains 2020Document1 pageJee Mains 2020shashankNo ratings yet

- Purushottam Dangol 1801T3100081 CCT 102Document10 pagesPurushottam Dangol 1801T3100081 CCT 102Prabesh ShresthaNo ratings yet

- Gprs TricksDocument11 pagesGprs Trickssunil100% (5)

- Autoregressive Integrated Moving Average Models (Arima)Document2 pagesAutoregressive Integrated Moving Average Models (Arima)Ayush choudharyNo ratings yet

- Me 2309 Cad Lab Manual Part & Assemble DiagramsDocument23 pagesMe 2309 Cad Lab Manual Part & Assemble DiagramsShyam BharathiNo ratings yet