Professional Documents

Culture Documents

Role of Financial Derivatives in Risk Management: Imran Ramzan

Uploaded by

Sana UllahOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Role of Financial Derivatives in Risk Management: Imran Ramzan

Uploaded by

Sana UllahCopyright:

Available Formats

Role of Financial Derivatives in Risk Management

Imran Ramzan1

1. Introduction

The word risk is termed to different meanings to different people (Adams, 2014). There

is disagreement about the meaning of word risk among people. The word risk is used by the

people to address different terms (Rajic, 2015). Johansen and Rausand (2014) stated that you

would probably receive the various responses upon asking the people what they meant by the

word risk. Aven and Renn (2009) described the risk term as an event with uncertainty and

severity and outcomes of an activity that human value. Rajic (2015) defined the risk term as the

probability of injury to an employee. So, risk is a situation where actual outcome deviate from

expected outcome. Risk is categorized into two forms such as internal risk and external risk.

Internal risks are controllable while external risks are not in our control. Risk management

refers to the process of understanding, mitigation and sharing of risk.

Risk management plays a key role in the financial industry and an integral part of it.

Markets and risk management practices grow with the progress of business. The growth of the

business and market expansion pose challenges for managing the risk. As a result, financial

instruments evolved to manage the risks which are known as financial derivatives. Rao (2012)

stated that derivatives are contracts where the yields of contracts depend upon on underlying

value. The underlying can be an interest rate, commodity or currency. Emira Kozarevic et al.

(2014) defined the derivatives as securities whose values depend upon the underlying assets.

The assets can be a commodity, bond, foreign exchange rate, stock and weather disaseters

(Hanic, 2014). Malleswari (2013) stated that there are different forms of contract but most

common forms include futures, forwards, options and swaps.

Financial derivative is a tool used by the companies to manage the risk. In simple word,

it is used to hedge the risk which is being faced by the company. There are two important

functions which are played by the financial derivatives namely hedging and speculation. Hedge

instruments are used with an attempt to reduce the risk level attached with the underlying

transactions (Hausin et al., 2008). Hedgers protect their assets or liabilities from the adverse

change by entering into derivative contract. Speculation presumes the financial risk with the

prediction of gain from market fluctuations (Dunbar, 2016). Hedging and speculation are the

two sides of same coin (Chui, 2012). Therefore, financial derivative play key role for managing

risk. The efficient use of financial derivatives reduces risk level and increases rate of return.

Thus, it is improving the financial health of business and climate.

1

PhD Scholar Finance and Banking at Kadir Has University - Istanbul

Electronic copy available at: https://ssrn.com/abstract=3264962

It has been noted that almost all firms either operating domestically or globally, they

face some kind of risks. The risks facing by firms might be interest rate, foreign exchange,

commodity, credit, liquidity, operational and market risk etc. The risk could be controllable or

beyond the limits of firms. Similarly, it could be managed internally or through some external

channel. Whether the firms develop its own risk management procedures or outsource this

activity. The main concern of the firm is to manage the risks in such a way that foster its

operating activities and increase its return. Therefore, it deem necessary to introduce such

instruments in market that help to achieve the desired objectives. As a result, financial

instruments are introduced that help the firm to manage their risks in such a way that reduce

its costs and maximize the return. It has been witnessed that usage of derivatives instruments

increased in order to manage the risk domestically and globally. Financial derivatives are

categorized into two forms over the counter and exchange traded derivatives (Emira Kozarevic

et al. (2014).

Paul Embrechts et al. (2006) defined the market risk as the risk that will change the

investment value resulting from the movement of market risk factors. Market risk is a risk

which is faced by the Commerical banks, investment banks, financial institutions, insurance

companies, non-financial institutions and all the other firms which are operating domestically

and globally. Firms concern are to manage the market risk at such level that it increases the

firm values and save its costs. Market risk can be categorised into equity risk, interest rate risk,

commodity risk and exchange rate risk (Dowd, 2002; Paul Embrechts et al., 2006). However,

market risk can be easily differentiated from other types of risk esepecially from operational

risk and credit risk. The importance of market risk cannot be ignored due to increase in the

number of transactions across country borders.

The existence of market imperfection, financial distress situation, agency problems, and

taxes are costly for a firm which lead a firm to hedge their risk that increase the firm value

(Muller and Verschoor, 2005). Financial distress situation occur when a firm unable to pay its

financial obligations. But, using the derivative instruments reduces its costs. Thus, firm with low

liquidity and high leverage position can get the incentives through financial derivatives by

hedging its risky activities. Agency problem arises due to the conflict between manager and

shareholders which lead towards underinvestment problem. The issue can be resolved with the

help of hedging which redistribute the cash. Similarly, firms having convex tax liabilities have an

incentive for using the financial derivatives. Because, under convex functions, profitability of

firm is close to zero. So, it is in the interest of firm to use hedging activities to mitigate its risks.

The paper will primarily deal with the market risk and will attempt to answer the questions that

what is market risk? How to measure the market risk? What are the methods to measure the

market risk and how to manage it?

Electronic copy available at: https://ssrn.com/abstract=3264962

2. Literature Review

The role of financial derivatives in risk management has been extensively studied by

researchers. Chaudhury (2016) conducted a study on market risk and conservative VaR form

with the aim to find out its reason. It is argued in the study that stress VaR which is added in the

Basel II is overly conservative. The evidence is obtained by comparing the extended value at

risk, pre VaR and new VaR. Trenca et al. (2015) conducted the study on market risk assessment

from the perspective of financial crisis. They stated that managers require the information in

advance about the market volatility and its impact on portfolio losses. VaR has been used as

statistical tool for measuring the market risk as recommended by Basel Committee for

providing the required capital in order to cover the risk. Koksal and Orhan (2012) investigated

the study on emerging economies and market about market risk analysis by using the VaR

approach. The performance of the VaR method has been examined as a tool of market risk

measurement. The results reveled that performance of VaR is less pronounced in developed

economies relative to emerging economies. It is recommended by author to use the VaR

method as well as other methodology for measuring the market risk for correct risk

management.

Uylangco and Li (2015) examined a study on the evaluation of value at risk model and its

effectiveness by taking the evidence of Australian banks. The study focused to determine

whether the selection of parameters and methodology help the banks during crisis for holding

an adequate capital. Although, large criticisms had been made on the VaR over downside risk

but historical model and one year parameter of VaR give the better estimation as compare to

the long term. The finding revealed the high violation of VaR estimation under the simulation of

Monte Carlo.

Simone Varotto (2011) investigated the new capital criteria and its impact on trading

portfolio as directed by the Basel III committee. Stressed VaR and pre crisis VaR have been used

in order to estimate the requirements of capital for the portfolio of corporate bonds as traded.

The results are obtained by estimating the VaR under the condition of stress during the period

of crisis and it revealed that market risk is associated with the portfolio of corporate bond. In a

study of Acharya and Richardson (2009), expected short fall and VaR have been recommended

for the division of aggregate loses associated with different components. These approaches will

be useful and provide the estimation of marginal expected shortfall of banks under collective

shocks and its contribution in aggregate risk. Alexander and Sheedy (2008) formulated a

methodology in order to investigate the market risk under stress conditions which contain both

the fat tails and volatility. The increase in the relevance statistics and target probability can be

obtained with the help of these tests.

Electronic copy available at: https://ssrn.com/abstract=3264962

Li and Marnic (2014) examined the use of financial derivatives of US bank holding

companies. They find that systematic exposure of Bank holding companies is significantly and

positively associated with the usage of financial derivatives. There is an increase in the

systematic of credit, exchange rate and interest rate risk due to greater usage of credit,

exchange rate and interest rate derivatives. Moreover, there is persistence positive asssocation

between the derivatives for hedging and trading with risks. Vuillemey (2015) investigated that

how the commercial bank manage the interest rate risk through derivatives. He stated that

derivatives are used as a substitute in risk management in order to ensure the financial

stability. He also reported that derivatives users enjoy the lending opportunities and hold the

better position in good time. In addition to this, all the banks do not take the derivative position

despite the appealing features of derivative contracts.

Emira Kozarevic et al. (2014) conducted a study on derivatives usage for risk

management in emerging economies by taking the evidence of non-financial firms of

Herzegovina and Bosnia. They showed that banks play an important role in the Over the

counter market by offering the various kinds of derivative instruments. They explicit stated that

there is low demand for the use of derivatives due to the lack of knowledge about derivatives

benefits and less business opeations in global markets. Gibson (2007) analyzed the relationship

between credit derivatives and risk management from the perspective of commerical banks,

investment banks and investors. He described that market users use the credit derivative as an

important instrument for risk management. The risk on the offered loans is managed through

credit derivatives by the commerical banks. The investment banks manage the underwritting

securities risk with the help of credit derivatives. Similarly, the risk of credit exposure is aligned

with the credit risk profile thorugh the use of credit derivatives by investors. He also reproted

the challenges of model risk, counterparty risk, rating agency risk and settlement risk being

pose by the credit derivatives during risk management.

Malleswari (2013) studied the derivatives role in risk management practices. He stated

that change in the technology and growth of the international trade increase the volatility in

market. As a result, demand of derivative instruments increase for better risk management. He

also reported the three benefits of derivatives such as risk management, discovery of price and

improved liquidity position. He described that why the credit derivatives are viewed negatively.

It is not because of the instrument but due to the reason that how they are traded and used in

the market. Financial derivatives are used as a hedging method that helps the organization to

exchange the risk from one group to another group. The different strategies are used by

organization in order to manage the risks which face in business life.

Electronic copy available at: https://ssrn.com/abstract=3264962

Rao (2012) examined the derivatives and its role in risk management. He found that risk

management objectives can be fulfilled through the financial derivatives and risk raised from

the traditional instruments can be managed independently through derivatives. He stated that

derivatives can be used for hedging and speculation in volatile market. He also described that

derivatives improve the liquidity position and performed the vital role for market reform.

Organizations should be careful while selecting appropriate financial derivative for risk

management. Because, financial derivatives help to save cost and increase return, if used

correctly. Chui (2012) investigated the participants and products of derivatives markets. He

found that global financial system and change in it invented the derivatives. He stated that

using the financial derivatives improve the system and reward the incentives to users

economically, if managed properly.

Masry (2006) conducted the study on the usage of derivatives for UK non-financial firms

and its risk management practices. The study aimed to find out the reasons for using the

derivatives as well as not using it for risk management. The study results revealed that small

and medium firms did not use the derivatives as much as the large firms used. Similarly,

derivatives are largely used and practiced by public companies instead of private companies.

The results also indicated that most of firms did not use derivatives due to insignificant

exposure and its disclosure as required by FASB rules. The study reported that derivatives are

widely used to manage the foreign exchange and interest rate risk. He also found that cash

flows volatility is main reason for hedging. Afza and Alam (2011) analyzed the factors of FX

derivatives which affect on the non-financial firms decision marking. Logit model and non-

parametric tests applied in order to obtain results. They found that fx derivatives are used by

those firms having foreign sales in order to reduce the expsoure of foreign exchange rate. The

firms of large size with fiancial distressed positions and financial constraints are more potential

firms to use the foreign exchange rate.

Sprcic (2007) examined the derivatives roles in risk management practices by taking the

evidence from large non-financial firms of Slovenian and Croatian. The study concluded the

findings and disclosed that swaps and forwards are essential derivatives in Slovenian and

Croatian. He also uncovered that future contracts are important for the companies of Slovenian

as compared to the companies of Croatian, while over the counter options and exchange

traded instruments are not essential for both countries in order to manage the risk. The

comparative study also gave the evidence that companies of Slovenian use all kinds of

instruments in order manage their risks than Croatian companies. The decision to use

derivatives depends upon the company size in Slovenian companies whereas Croatian

companies make the decision of derivatives usage on the basis of investment expenditures to

asset ratio.

Electronic copy available at: https://ssrn.com/abstract=3264962

Selvi and Turel (2010) conducted the comparative study on turkish banks and non-

financial firms over the usage of derivatives for risk management. The study aimed to find out

that how non-financial firms and banks listed in Istanbul Stock exchange disclosed derivatives

information and its accounting treatment. The study reported that listed non-financial firms

(35%) and deposit banks (85%) use derivatives. The study also revealed that deposit banks

widely pratice the swaps to hedge their risks and thereafter exercise the forward contracts,

while, non-financial companies follow the forward contracts in order to mitigate their risks.

Derivatives contracts are mostly made between deposit banks. The results also indicated that

39 percent of deposit banks used the futures instruments whereas only 11 percent of non-

financial companies used it. The study reported that desposit banks and non-financial

companies use the derivatives in order to hedge their foreign exchange and interest rate risk.

Moreover, desposit banks play vital role as specualtors than non-financial companies.

Kapitsinas (2008) examined derivatives contracts usages of non-financial firms for risk

management by taking the evidence from Greece. A survey was sent to 110 non-financial firms

for the purpose of collecting data and informations about derivatives usage. The study results

reported that mostly interest rate is hedge through derivatives contacts and thereafter foreign

exchange risks by non-financial firms. Moreover, firms didn’t seem to control its risks pertaining

to equity. The large size of non-financial firms widely practice derivatives in their routine

transactions as compared to small size non-financial firms. The finding indicated that 33.9

percent of non-financial firm used financial derivatives to manage their interest rate risk. The

disclosure of informations and accounting treatments were major concerns for derivative users.

The non-financial firms followed the risk assessment process with sophisticated techinques and

used the derivatives under documented corporate policy. The other non-financial firms which

did not used derivatives due to inadequate risk exposure.

Fantini (2014) explored the comparative study of financial derivatives usage of non-

financial firms by taking the evidence from Italy and United Kingdom. The study focused to find

the hedging determinants and its types used for hedging purpose. The findings reported that

use of derivatives placed high costs which is unaffordable for businesses operating at small

scale. The fx rate is singinificant for UK sample and insignificant for italy due to their trade

withing european countries. However, interest rate is relevant for both countries. Both

countries manage the interest rate risk through financial instruments. The small and medium

firms exposed to long term debt which result high expsoure of interest rate. The high interest

rate exposure placed high cost of borrowing which could expose the financial distress situation.

As a result, firms operating at large scale move to hedge their risks. The study found that

interest rate is significant for both countries. It also reported that firm’s size is core variable

with respect to derivative adoption and its incentives.

Electronic copy available at: https://ssrn.com/abstract=3264962

3. Theories and Methods

3.1. Portfolio Theory

Before the development of the portfolio theory, investors make the investment decision

on the basis of return and ignore the risk factor. But, Markowitz (1952, 1959) originated the

portfolio theory for risk measurement which postulates that investors will make decision on the

basis of expected return between portfolios. Portfolio risk can be measured with the help of

standard deivation. Similarly, focus will be on the individual asset risks (Grant, 2001). So keeing

the other things constant, an investor will choose portfolio which give maximum return with

smallest standard deviation and such portfolio is called as an efficent portfolio. A rational

investor will always find a portfolio which meets that conditions and will choose the efficient

portfolio. Some efficient portfolios posses more risky elements that will give the expected

return higher as compare to least risky. Threrefore, a risk averse investor will choose a portfolio

which give small expected return and small standard deviation. On the other hand, an investor

with less risk averse nature will go for a portfolio having higher expected return.

3.2. Capital Market Theory

The theory developed by Sharpe and Lintner (1964, 1965) and refined by various scholar

such as Black and Merton. When the discussion of Markowitz theory ends then capital market

theory begins. The final output of the theory is Capital Asset Pricing Model. The model contains

market and individual stocks portfolio and finds out the required rate of return by pricing risky

assets. The assumptions of the capital market theory are same of portfolio theory with some

additional. However, ignoring those assumptions might have a minor effect on conclusion. Risk

free asset lead the portfolio theory into the introduction of capital market theory. Therefore,

risk free asset having zero variance is main factor for the development of capital market theory.

3.3. Arbitrage Pricing Theory

The arbitrage pricing theory was introduced by the Ross in 1976 as an alternative to

CAPM. The theory has less assumption as compare to CAPM and also overcome the weakness

of Capital Asset Pricing model as well. The arbitrage pricing model measures potential assets

ability to produce the profit or loss. The model attempts to relate the expected rate of return

with the sensitivities factor of the primitive securities. Therefore, factor model is the core

ingredient in APT, whereas multifactor models have an ability to measure the systematic risk of

an asset. It asserts that expected return of an asset has linear relationship with covariance of

random variables. The covariance is a risk that diversification does not allow an investor to

avoid it (Huberman and Wang, 2005).

Electronic copy available at: https://ssrn.com/abstract=3264962

3.4. Extreme Value Theory

Avdulaj (2011) stated that the extreme value theory take into the account of those

events which have high severity and low frequency. In simple word, it focuses on the event

whose probability for occurrence is very low but impact could be catastrophic. The threshold

exceedances and block maxima are the two main approaches for modeling the extreme value

theory.

Traditionally, the management of market risk was depending upon the nominal values

of individual positions. The risk exposure of financial instruments and its nominal values were

directly proportional to each other (Resti and Sironi, 2007). The modern approach to measure

the market risk is Value at Risk (VaR), Expected Shortfall and stress testing.

3.5. Value at Risk (VaR)

It attempts to determine the portfolio loss under distress situation. It is an approach which

measures the market risk on the basis of loss distribution (Avdulaj, 2011). The VaR does not

fulfill the purpose if it does not have probability and risk horizon specification. The time horizon

for the loss could be a day, month, quarter or year. The VaR helps to answers the question that

how much the things get bad. The importance of the VaR can be seen as that it becomes the

part of Basel Committee which bound the bank to test their VaR model on regular basis. There

are three approaches which are followed in order to calculate the VaR named as Historical,

Monte Carlo and Analytic.

3.6. Expected Shortfall

The expected shortfall helps to answer that if things get bad then how much a company

expect to lose it. It is also known as Conditional Value at Risk (CVaR). The expected shortfall has

two parameters confidence level and time horizon which is measured in term of days. So, it is

closely connected with Value at Risk but express better that what could be happened in worst

case. Therefore, it is more natural approach to measure the risk as compare to VaR by giving

the greater visibility over tail loss distribution.

3.7. Stress Testing

Stress testing is an approach which based on the stimulation technique of computer for

measuring the market risk for certain time period under the conditions of abnormal market.

Hughes and Macdonald (2002) stated that stress testing gives the summarized information of

firm’s extreme exposure under possible circumstances. Similarly, Resti and Sironi (2007)

described that stress testing helps to manage and indentify the exceptional losses under

simulated conditions by revaluating the portfolio.

Electronic copy available at: https://ssrn.com/abstract=3264962

4. Applications

Before the development of VaR, risk had been measured with the help of Gap Analysis,

Duration Analysis and Scenario Analysis (Dowd, 2002). Then, JP Morgan developed the risk

metrics which help for the awareness and establishment of the VaR. The VaR set up itself as a

core element for the view of financial risk and its management system (Jorion, 2007). The VaR

approach is suitable for businesses who are engaged in trading but also useful for the managers

of assets and financial institutions. Therefore, it is not only applied to the values of balance

sheet but also to cash flows. This resultant extension of the VaR is known as Cash flow at Risk. It

is used as passive application in order to present the risk number to stakeholders.

Institutions from all over the world try to learn and use the VaR methodology as a tool

of risk control as well as for measuring the overall risk exposure. The traders can complement

its position limits through the limits of VaR which is helpful for risk and leverage. The exposure

of the global risk can be monitored with the help of VaR by considering the diversification. The

evolution of the VaR application shifted to defensive nature. Now, the VaR evolved itself at

such level that helps to institutions for making decision about risk and return. Thus, VaR has

been evolved as an active risk management tool. With the help of VaR, competitive position can

be identified across sectors (Jorion, 2007). The allocation of the economic capital can be

decided by taking into account the risk level of business. The evolution of the VaR application

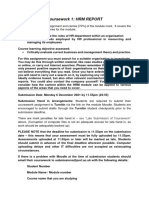

can be seen through the below diagram.

Evolution of Value at Risk Application

Passive: Risk Reporting Defensive: Risk Active: Risk Allocating

Controlling

▪ Revealing to ▪ Setting risk limits ▪ Evaluating

shareholder (Desk level and firm performance

▪ Repots management wide) ▪ Allocation of capital

▪ Requirements of ▪ Strategic decisions

Regulator of business

Electronic copy available at: https://ssrn.com/abstract=3264962

5. Numerical Examples

Example 1

An investor makes an average profit of $80,000 through trading desk on each day with a

standard deviation of $45000 and normally distributed. Calculate the relative and absolute VaR

for a confidence level of 95% and 99%.

It can be seen in the z-score table that 99% and 95% distribution for a random variable above

the mean is below than from a point of 2.326 and 1.645 standard deviations respectively.

Under losses situation, the mean value will be – 80000 and standard deviation 45000.

So, the absolute VaR0.99

VaR0.99 = - 80000 + 2.326 * 45000

VaR0.99 = $24,670

And the relative VaR0.99

VaR0.99 = $104,670

Similarly, the absolute VaR0.95

VaR0.95 = - 80000 + 1.645 * 45000

VaR0.95 = - $5,975

And the relative VaR0.95

VaR0.95 = $85,975

10

Electronic copy available at: https://ssrn.com/abstract=3264962

Example 2

The portfolio analyst is looking to compute the 5% VaR for a portfolio containing two categories

of assets. The first category includes stocks which are traded on Istanbul Stock exchange with

an expected return of 12% and standard deviation is 10% on annual basis. The second category

contains stocks which are traded on Pakistan stock exchange with an expected return of 15%

and standard deviation is 22% on annual basis. The annual correlation between the two

categories of assets is 0.80. The market value is $10 million of the portfolio. The proportion of

investment is 60% and 40% in the two categories of portfolio, respectively.

ISE µ1 = 12% σ1 = 10% W1 = 0.60

PSE µ2 = 15% σ2 = 22% W2 = 0.40

As, we know that expected return of the portfolio (ISE and PSE) is weighted average of the

expected return of its stocks. Similarly, variance of the portfolio is covariance and weighted

average variance of portfolio stocks.

So,

µP = W1*µ1 + W2*µ2

µP = 0.60*(0.12) + 0.40*(0.15) = 13.2%

σ2𝑝 = 𝑤12 σ12 + 𝑤22 σ22 + 2𝑤1 𝑤2 σ1 σ2 𝜌

σ2𝑝 = (0.60)2 *(0.10)2 + (0.40)2*(0.22)2 + 2(0.60)(0.40)(0.10)(0.22)(0.80)

σ2𝑝 = 0.0036 + 0.007744 + 0.008448

σ2𝑝 = 0.01979

σ𝑝 =14.07%

VaR has been calculated with the help of formula:

VaR0.95 Yearly = (µP – 1.645 σ) * Total Portfolio Value

VaR0.95 = [.132 – 1.645(.1407)] * 10,000,000

VaR0.95 = - $994,515

The above value means that portfolio analyst is 95% confident that total loss will not be greater

than from $994,515.

11

Electronic copy available at: https://ssrn.com/abstract=3264962

Conclusion

Risk is a situation where actual outcome may deviate from expected outcome. Risk is

categorized into two forms such as internal risk and external risk. Risk management refers to

the process of understanding, mitigation and sharing of risk. This is not about to see what will

happen in future, instead it deals to work out in advance what might happen. Therefore, it is

called as proactive management rather than reactive. Risk management plays a key role in the

financial industry and an integral part of it. Markets and risk management practices grow with

the progress of business. The growth of the business and market expansion pose challenges for

managing the risk. As a result, financial instruments evolved to manage the risks which are

known as financial derivatives. There are different forms of contract but most common forms

include futures, forwards, options and swaps.

Exchange traded derivatives are those which are traded through stock exchange. On the

other hand, over the counter derivatives are those financial instruments whose terms and

conditions are settled between two parties through negotiation. Although, the core purpose of

derivatives are to control the certain level of risks but they are also utilized for the purpose of

speculative activities by taking more risk in order to increase the return. Therefore, whether

activity is trade base or over the counter, firms are in position to mitigate their risk with the

help of financial derivatives. So, it is not hard to say that financial derivatives play a key role in

emerging markets. There are various approaches to estimate the risk but in this paper, VaR has

been used to measure the risk.

Financial derivative is a tool used by the companies to manage the risk. In simple word,

it is used to hedge the risk which is being faced by the company. There are two important

functions which are played by the financial derivatives namely hedging and speculation. Hedge

instruments are used with an attempt to reduce the risk level attached with the underlying

transactions. Hedgers protect their assets or liabilities from the adverse change by entering into

derivative contract. Speculation presumes the financial risk with the prediction of gain from

market fluctuations. Therefore, financial derivative play key role for managing risk. The efficient

use of financial derivatives reduces risk level and increases rate of return. Thus, it is improving

the financial health of business and climate.

12

Electronic copy available at: https://ssrn.com/abstract=3264962

References

Acharya, V,, Richardson, M,, (2009) “Restoring Financial Stability –How to Repair a Failed

System”, John Wiley & Sons, p, 1-418,

Adams, Ј., (2014). Managing Risk: framing your problems, BoeringerIngelheim Alumni Seminar,

SchlossGracht, Cologne 9-11

Alexander, C,, Sheedy, E,, (2008) “Developing a stress testing framework based on market risk

models”, Journal of Banking and Finance, 32, p,2220-2236

Avdulaj, K. (2011). “The Extreme Value Theory as a Tool to Measure Market Risk” IES Working

Paper 26/2011. IES FSV. Charles University

Aven, T., Renn, O., (2009).On risk defined as an event where the outcome is uncertain. Journal

of Risk Research, 12, 1 – 11.

Asli, S. Y. (2010). DERIVATIVES USAGE IN RISK MANAGEMENT BY TURKISH NON-FINANCIAL

FIRMS AND BANKS: A COMPARATIVE STUDY. Annales Universitatis Apulensis Series

Oeconomica, 12(2), 663-670.

Chaudhury, M. (2016). Why Basel II Market Risk VaR is Too Conservative. Journal of Trading,

11(1), 6-12.

Chui, M. (2012). Derivatives markets, products and participants: an Overview. Switzerland: Bank

for international Settlement.

Dowd, K. (2002). An introduction to Market Risk Measurement. England: John Wiley & Sons Ltd.

Dunbar, S. R. (2016). Speculation and Hedging. University of Nebraska-Lincoln, 1-10.

El‐Masry, A. A. (2006). Derivatives use and risk management practices by UK nonfinancial

companies. Managerial Finance, 32(2), 137-159.

Emira Kozarevic, M. K. (2014). The Use of Financial Derivatives in Emerging Market Economies:

An Empirical Evidence from Bosnia and Herzegovina's Non-Financial Firms. Research in World

Economy, 5(1), 39-47.

Fantini, G. (2014). Financial Derivatives usage by UK & Italian SMEs.Empirical evidence from UK

& Italian non-financial firms. EprintsUnife, 1-155.

Grant, J. L. (2001). Modern Portfolio Theory, Capital Market Theory, and Asset Pricing Models.

Research Gate, 11-41.

13

Electronic copy available at: https://ssrn.com/abstract=3264962

Gur Huberman, Z. W. (2005). Arbitrage Pricing Theory. New York: Columbia Business School.

Hanic, A. R. (2014). The use of Financial Derivatives in Risk Management Puroses of Non-

Financial firms in Bosnia and Herzegovina. Research in World Economy, 66-77.

Hausin M., Hemmingsson C., Johansson J., 2008. How to Hedge Disclosures? IFRS 7 and Hedge

Accounting, Master thesis within Business Administration, Handelshögskolan Vıd Göteborgs

Universitet, Spring.

Ioan Trencaa, A. M. (2015). The assessment of market risk in the context of the current financial

crisis. Procedia Economics and Finance, 32, 1391-1406.

Johansen, I.L., Rausand, M., (2014). Foundations and choice of risk metrics, Safety Science 62

386–399

Jorion, P. (2007). Value at Risk: The New Benchmark for Managing Financial Risk. United State

of America: The McGraw Hill Companies.

Kapitsinas, S. (2008). Derivatives Usage in Risk Management by Non-Financial Firms: Evidence

from Greece. Munich Personal RePEc Archive, 1-49.

Koksal, B,, Orhan, M,, (2012) “Market Risk of Developed and Developing Countries During the

Global Financial Crisis”, disponibil la

http://papers,ssrn,com/sol3/papers,cfm?abstract_id=2026781

Malleswari, D. B. (2013). Derivatives as a Tool of Risk Management. International Journal of

Humanities and Social Science Invention, 2(4), 12-15.

MichaelS.Gibson. (2007). CreditDerivativesandRiskManagement. Finance and Economics

Discussion Series. Washington, D.C.: Divisions of Research & Statistics and Monetary Affairs.

Paul Embrechts, H. F. (2006). Different Kinds of Risk. Department of Mathematics (pp. 1-22).

Switzerland: ETH Zurich.

Rajić, A. Š. (2015). The Review of the Definition of Risk. Online Journal of Applied Knowledge

Management, 3(3), 17-19.

Rao, D. G. (2012). Derivatives in Risk Management. International Journal of Advanced Research

in Management and Social Sciences, 1(4), 55-59.

Resti, A. S. (2007). Risk management and shareholders. London: Wiley.

Shaofang Li, M. M. (2014). The Use of Financial Derivatives and Risks U.S. Bank Holding

Companies. International Review of Financial Analysis, 35, 46-71.

14

Electronic copy available at: https://ssrn.com/abstract=3264962

Talat Afza, A. A. (2011). Corporate derivatives and foreign exchange risk management: A case

study of nonfinancial. The Journal of Risk Finance, 12(5), 409-420.

Varotto, S,, (2009) “Liquidity Risk, Credit Risk, Market Risk and Bank Capital”, ICMA Centre

Discussion Papers in Finance DP2011-02, University of Reading

Verschoor, A. M. (2005). The Impact of Corporate Derivative Usage on Foreign Exchange Risk

Exposure. Social Science Research Network, 1-49.

Vuillemey, G. (2014). Derivatives and Interest Rate Risk Management by Commercial Banks.

University of Lausanne, 1-46.

15

Electronic copy available at: https://ssrn.com/abstract=3264962

You might also like

- Experimental Verification of The Greenhouse Effect - Harde-Schnell-GHE-mDocument16 pagesExperimental Verification of The Greenhouse Effect - Harde-Schnell-GHE-mKarsten BrezinskyNo ratings yet

- The Investment Function in Banking and Financial-Services ManagementDocument18 pagesThe Investment Function in Banking and Financial-Services ManagementHaris FadžanNo ratings yet

- Economic Growth - The Loanable Funds DiagramDocument15 pagesEconomic Growth - The Loanable Funds DiagrammacromacronNo ratings yet

- Project ReportDocument59 pagesProject ReportAnuj YeleNo ratings yet

- RSKMGT Module II Credit Risk CH 2-Credit Scoring and Rating MethodsDocument12 pagesRSKMGT Module II Credit Risk CH 2-Credit Scoring and Rating MethodsAstha PandeyNo ratings yet

- 2022 LI MacroeconomicsDocument102 pages2022 LI MacroeconomicsAnshulNo ratings yet

- Madurai Kamaraj University: Capital Market Efficiency and Development of Capital Market in IndiaDocument11 pagesMadurai Kamaraj University: Capital Market Efficiency and Development of Capital Market in Indiachanus92No ratings yet

- Firm Attributes and Financial Reporting Timeliness of Consumer Goods Firms Listed in Nigeria Stock ExchangeDocument7 pagesFirm Attributes and Financial Reporting Timeliness of Consumer Goods Firms Listed in Nigeria Stock ExchangeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Case Study of Greenfield Bangalore InternationalDocument11 pagesA Case Study of Greenfield Bangalore InternationalPrajitha Jinachandran T KNo ratings yet

- Lanco Capital BudgetDocument78 pagesLanco Capital BudgetDeepak AroraNo ratings yet

- Investment Decision - IciciDocument8 pagesInvestment Decision - Icicimohammed khayyumNo ratings yet

- Msme FinanceDocument55 pagesMsme FinanceGauri MittalNo ratings yet

- Plant-based meat startup Blue Tribe launches in IndiaDocument16 pagesPlant-based meat startup Blue Tribe launches in Indiaideation12345No ratings yet

- Bosch LTDDocument50 pagesBosch LTDmanishsngh24No ratings yet

- New Approaches To SME Finance Using Bank Account Information (Big Data)Document19 pagesNew Approaches To SME Finance Using Bank Account Information (Big Data)ADBI EventsNo ratings yet

- (Routledge Research in Journalism) Arjen Van Dalen, Helle Svensson, Antonis Kalogeropoulos, Erik Albæk, Claes H. de Vreese - Economic News - Informing The Inattentive Audience-Routledge (2018)Document215 pages(Routledge Research in Journalism) Arjen Van Dalen, Helle Svensson, Antonis Kalogeropoulos, Erik Albæk, Claes H. de Vreese - Economic News - Informing The Inattentive Audience-Routledge (2018)Nicholas WoyshnerNo ratings yet

- Hamden Audit FY20Document131 pagesHamden Audit FY20Helen BennettNo ratings yet

- Group 3 ProjectDocument27 pagesGroup 3 ProjectAbhishek DhruvNo ratings yet

- MPX 9.100 Quarter 4 PDFDocument1 pageMPX 9.100 Quarter 4 PDFsrinuvoodiNo ratings yet

- The Impact of Rural Banking On Poverty and Employment in IndiaDocument64 pagesThe Impact of Rural Banking On Poverty and Employment in IndiaKunal BagdeNo ratings yet

- Chapter 14 Portfolio Analysis CbcsDocument17 pagesChapter 14 Portfolio Analysis CbcsShivanshNo ratings yet

- GST Study on Consumer Behavior in MumbaiDocument85 pagesGST Study on Consumer Behavior in MumbaiSalil SarvagodNo ratings yet

- Corporate Law Scam in Yes BankDocument14 pagesCorporate Law Scam in Yes BankGeetha Revathi p100% (1)

- Investment Banking Financial Services 14MBAFM302Document59 pagesInvestment Banking Financial Services 14MBAFM302khushbuNo ratings yet

- Customer Satisfaction and Awarness On Public Sector Bank Sectors in TiruchirappalliDocument8 pagesCustomer Satisfaction and Awarness On Public Sector Bank Sectors in TiruchirappalliIAEME PublicationNo ratings yet

- A Study On Working Capital Management at Berger Paints LTDDocument6 pagesA Study On Working Capital Management at Berger Paints LTDdanny kanniNo ratings yet

- LSA Group launches Children's Education FundDocument20 pagesLSA Group launches Children's Education Fundlinda zyongweNo ratings yet

- SBI CRA - Regular Non-Trade ModelDocument24 pagesSBI CRA - Regular Non-Trade Modelaruntce_kumar9286No ratings yet

- Role of Investment Bankers in Indian Stock Market: An Empirical StudyDocument28 pagesRole of Investment Bankers in Indian Stock Market: An Empirical StudyashishNo ratings yet

- CP Project FinalDocument102 pagesCP Project FinalPriyanka PandeyNo ratings yet

- Investors Perception Towards Investment in Derivative SecuritiesDocument8 pagesInvestors Perception Towards Investment in Derivative SecuritiesStella OktavianiNo ratings yet

- Icici 1Document36 pagesIcici 1Yash AnandNo ratings yet

- Talent management roadmap for SMB growth and expansionDocument10 pagesTalent management roadmap for SMB growth and expansionElio ZerpaNo ratings yet

- A Comparative Study On Debt Mutual Funds With Reference To SBI and HDFC BanksDocument5 pagesA Comparative Study On Debt Mutual Funds With Reference To SBI and HDFC BanksEditor IJTSRDNo ratings yet

- TiC CMS RecsDocument4 pagesTiC CMS RecsJakob EmersonNo ratings yet

- SEBI Draft Regulations Investment AdvisorsDocument51 pagesSEBI Draft Regulations Investment AdvisorspbdkpkNo ratings yet

- An Extraordinary Company-HDFCDocument35 pagesAn Extraordinary Company-HDFCPrachi JainNo ratings yet

- An Analysis of The Indian Stock Market With GDP, Interest Rates and InflationDocument15 pagesAn Analysis of The Indian Stock Market With GDP, Interest Rates and InflationAadyaNo ratings yet

- A Study On Risk and Return Analysis On Selected Equities With Reference To Shriram InsighDocument14 pagesA Study On Risk and Return Analysis On Selected Equities With Reference To Shriram InsighEditor IJTSRDNo ratings yet

- Effect of Investment Appraisal On The Profitability of Quoted Consumer Goods Companies in NigeriaDocument61 pagesEffect of Investment Appraisal On The Profitability of Quoted Consumer Goods Companies in NigeriaPrecious Chioma AgulukaNo ratings yet

- FM CG Final PaperDocument4 pagesFM CG Final PaperAndy ShamNo ratings yet

- As 13 Accounting of InvestmentsDocument6 pagesAs 13 Accounting of InvestmentsSamridhi SinghalNo ratings yet

- BSC CSIT Final Year Project Report On Sword of Warrior Game Project ReportDocument52 pagesBSC CSIT Final Year Project Report On Sword of Warrior Game Project ReportGrey OldNo ratings yet

- Gold ETFDocument22 pagesGold ETFSaroj KhadangaNo ratings yet

- NISM IX Merchant Banking Short NotesDocument39 pagesNISM IX Merchant Banking Short NotesMayank KhuranaNo ratings yet

- Managerial Approaches and Organizational Performance of Multinational Enterprises in NigeriaDocument13 pagesManagerial Approaches and Organizational Performance of Multinational Enterprises in NigeriaCentral Asian StudiesNo ratings yet

- INTL729 Mod 02 ActivityDocument6 pagesINTL729 Mod 02 ActivityIshtiak AmadNo ratings yet

- Lloyds - Choice of Law, Choice of Jurisdiction and Service of SuitDocument5 pagesLloyds - Choice of Law, Choice of Jurisdiction and Service of SuitJose MNo ratings yet

- MPA AssignmentDocument14 pagesMPA AssignmentShreya RajkumarNo ratings yet

- MM2 Final Report Group 05Document16 pagesMM2 Final Report Group 05Himanshu Goyal100% (1)

- Consolidation of BanksDocument20 pagesConsolidation of BanksParvinder vidanaNo ratings yet

- Project Topic:-Mutual Fund: Paper NameDocument18 pagesProject Topic:-Mutual Fund: Paper NameJYOTI VERMA100% (1)

- Impact of Financial Literacy On Investment Behavior and Consumption BehaviourDocument17 pagesImpact of Financial Literacy On Investment Behavior and Consumption BehaviourFadhil ChiwangaNo ratings yet

- SPL Risk Related To Trading Financial InstrumentsDocument18 pagesSPL Risk Related To Trading Financial InstrumentsDenis DenisNo ratings yet

- Financial Performance Analysis of RSPL LtdDocument108 pagesFinancial Performance Analysis of RSPL LtdAvneesh RajputNo ratings yet

- Junior Assistant NotificationDocument7 pagesJunior Assistant NotificationNDTVNo ratings yet

- InsuranceDocument19 pagesInsuranceVAR FINANCIAL SERVICESNo ratings yet

- Msme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Document67 pagesMsme Advances: Canara Bank Officers' Association Promotion Study Material - 2018Majhar HussainNo ratings yet

- GRI2009 EBrochureDocument27 pagesGRI2009 EBrochurenjaloualiNo ratings yet

- Role of Financial Derivatives in Financial Risk ManagementDocument16 pagesRole of Financial Derivatives in Financial Risk ManagementTYBMS-A 3001 Ansh AgarwalNo ratings yet

- Cross Cultural Management Portfolio GuidelineDocument4 pagesCross Cultural Management Portfolio GuidelineSana UllahNo ratings yet

- Its Organizational Culture and ND Jeff Bezos's Leadership Style?Document20 pagesIts Organizational Culture and ND Jeff Bezos's Leadership Style?Sana UllahNo ratings yet

- Coursework 1 HRM Report - Assignment BriefDocument7 pagesCoursework 1 HRM Report - Assignment BriefSana UllahNo ratings yet

- Coursework 1 HRM Report - Assignment BriefDocument7 pagesCoursework 1 HRM Report - Assignment BriefSana UllahNo ratings yet

- Milos Sprcic PDFDocument26 pagesMilos Sprcic PDFbaby0310No ratings yet

- Required Studies: Part Two: Continue Planning For The Project Started in Week 4, Using Project Planning PartDocument1 pageRequired Studies: Part Two: Continue Planning For The Project Started in Week 4, Using Project Planning PartSana UllahNo ratings yet

- Module Code Module Title Credit: KnowledgeDocument42 pagesModule Code Module Title Credit: KnowledgeSana UllahNo ratings yet

- Required Studies: Part Two: Continue Planning For The Project Started in Week 4, Using Project Planning PartDocument1 pageRequired Studies: Part Two: Continue Planning For The Project Started in Week 4, Using Project Planning PartSana UllahNo ratings yet

- Accounting Information Systems Chapter 7Document19 pagesAccounting Information Systems Chapter 7J PNo ratings yet

- Cendana - CITYZEN HILLS - 291123-1Document5 pagesCendana - CITYZEN HILLS - 291123-1Oky Arnol SunjayaNo ratings yet

- Principles of Managerial Finance Chapter 5 Time Value of MoneyDocument45 pagesPrinciples of Managerial Finance Chapter 5 Time Value of MoneyJoshNo ratings yet

- Faq On NeftDocument3 pagesFaq On Neftagpatil234No ratings yet

- The Impact of Mobile Bank On Economic Development (Case Study Telecommunication and Banks in Mogadashu-Somalia)Document47 pagesThe Impact of Mobile Bank On Economic Development (Case Study Telecommunication and Banks in Mogadashu-Somalia)NguyenTrung KienNo ratings yet

- Frequently Used Finacle Commands Finacle Commands Finacle Wiki Finacle Tutorial Amp Finacle Training For BankersDocument5 pagesFrequently Used Finacle Commands Finacle Commands Finacle Wiki Finacle Tutorial Amp Finacle Training For BankersGeraldine NkankumeNo ratings yet

- December 2022Document2 pagesDecember 2022Zolani100% (1)

- Appendices of Section B Bank Branch Audit Guidance NoteDocument151 pagesAppendices of Section B Bank Branch Audit Guidance Noteshyamsunder bajajNo ratings yet

- G.R. No. 217411 - PHILIPPINE BANK OF COMMUNICATIONS, PETITIONER, VS. RIA DE GUZMAN RIVERA, RESPONDENT.D E C I S I O N - Supreme Court E-LibraryDocument10 pagesG.R. No. 217411 - PHILIPPINE BANK OF COMMUNICATIONS, PETITIONER, VS. RIA DE GUZMAN RIVERA, RESPONDENT.D E C I S I O N - Supreme Court E-Librarymarvinnino888No ratings yet

- Snow Hill Wharf Phase 2&3Document11 pagesSnow Hill Wharf Phase 2&3cjchuaNo ratings yet

- Super Advantage SOCDocument3 pagesSuper Advantage SOCdip45150No ratings yet

- The Payment System and Financial InstrumentsDocument27 pagesThe Payment System and Financial InstrumentsAllen GonzagaNo ratings yet

- Receivables Factoring and Performance of Private Finance Companies in Kenya: A Case of Private Finance Companies in Nairobi City CountyDocument13 pagesReceivables Factoring and Performance of Private Finance Companies in Kenya: A Case of Private Finance Companies in Nairobi City CountyLong Ngọc GiangNo ratings yet

- Partnership Profits and LiabilitiesDocument7 pagesPartnership Profits and LiabilitiesHeavens MupedzisaNo ratings yet

- Fin 464 Final TSA PDF PDFDocument67 pagesFin 464 Final TSA PDF PDFArahf KashemiNo ratings yet

- Sources and Types of Short and Long Term Business FinancingDocument23 pagesSources and Types of Short and Long Term Business FinancingNishant TutejaNo ratings yet

- Canary - 2023-02-18 170231.l505964Document53 pagesCanary - 2023-02-18 170231.l505964SAID k sNo ratings yet

- (Studies in The Political Economy of Public Policy) Philip Mader-The Political Economy of Microfinance - Financializing Poverty-Palgrave Macmillan (2015)Document297 pages(Studies in The Political Economy of Public Policy) Philip Mader-The Political Economy of Microfinance - Financializing Poverty-Palgrave Macmillan (2015)VAY EntertainmentNo ratings yet

- Statement 28949Document4 pagesStatement 28949niyameddinagayev53No ratings yet

- StatementDocument1 pageStatementfert certNo ratings yet

- Financial Assets at Fair Value Through Profit or LossDocument13 pagesFinancial Assets at Fair Value Through Profit or LossALEJANDRE, Chris Shaira M.No ratings yet

- Fabm2 Q2 M3 - 4Document9 pagesFabm2 Q2 M3 - 4Zeus MalicdemNo ratings yet

- Account Opening Formalities at PBLDocument4 pagesAccount Opening Formalities at PBLMd Mohsin AliNo ratings yet

- Axis Bank Young Banker Programme Internship Diary: Suneet Kumar SinghDocument9 pagesAxis Bank Young Banker Programme Internship Diary: Suneet Kumar Singhsrinivas4949No ratings yet

- Varo Bank statement transaction detailsDocument2 pagesVaro Bank statement transaction detailsNatalie RichardsonNo ratings yet

- Wise Deposit Note 662136227 1003987913 enDocument2 pagesWise Deposit Note 662136227 1003987913 encavNo ratings yet

- Claim Process Rupay PMJDY Insurance Program 23-24Document21 pagesClaim Process Rupay PMJDY Insurance Program 23-24Chandan GuptaNo ratings yet

- Annual Report 2019Document306 pagesAnnual Report 2019Mohammad ShahjahanNo ratings yet

- BSP Receivership Authority Without Prior HearingDocument1 pageBSP Receivership Authority Without Prior HearingRoseller SasisNo ratings yet

- Rift Valley University Assela CampusDocument3 pagesRift Valley University Assela CampusTeshomeNo ratings yet