Professional Documents

Culture Documents

Chart of Accounts

Uploaded by

augusto silvaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

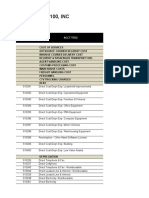

Chart of Accounts

Uploaded by

augusto silvaCopyright:

Available Formats

Chart of Accounts

(Categories of Income and Expenses)

Income (Revenues)

3010 Professional fees

3500 Refunds--typically deducted from gross income so that net income is used to calculate

percentage spent for each expense category.

4010 Interest income

4020 Other income

Expenses

7010 Accounting 9010 Marketing

7012 Advertising to find employees 5026 Meals - staff

9012 Advertising for marketing 7032 Meals - business

7013 Answering service 7034 Miscellaneous

9514 Auto expenses 7036 Office supplies

7014 Banking charges 7038 Petty cash replenishment

5018 Contract labor 7040 Postage

7015 Collection expense 7042 Printing

8015 Computer expense 9014 Prof. courtesy/gifts/entertainment

8016 Contingency fund 6010 Rent

7016 Continuing education 6012 Repair & maintenance - building

9518 Contributions 8018 Repair & maintenance - equipment

7020 Dues and subscriptions 5030 Retirement plan - staff

8011 Equipment and small tools purchase 9526 Retirement plan - dentist(s)

8012 Equipment lease 5010 Salaries - business staff

8510 Gases 5012 Salaries - dental assistant(s)

5022 Insurance - staff 5014 Salaries - dental hygienist(s)

6014 Insurance - building, equipment, etc. 9510 Salaries - dentist(s)

9522 Insurance - disability - dentist(s) 8514 Supplies - clinical

9524 Insurance - health - dentist(s) 8516 Supplies - sterilization

7024 Insurance - malpractice 9512 Taxes - dentist(s) payroll

6016 Interest on building loan 5016 Taxes - staff payroll

8013 Interest on equipment 7044 Taxes - property

6018 Janitorial service 7046 Telephone

8810 Lab work - outside 9528 Travel

7026 Laundry 5020 Uniforms - staff

7028 Legal 9530 Uniforms - dentist(s)

7030 Licenses & Permits 6020 Utilities

You might also like

- Money Master The GameDocument48 pagesMoney Master The GameSimon and Schuster72% (18)

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- Founder Share Purchase and Vesting Agreement SummaryDocument15 pagesFounder Share Purchase and Vesting Agreement SummaryIafrawNo ratings yet

- Case Study 1 - Strategic HR Integration at The Walt Disney CompanyDocument2 pagesCase Study 1 - Strategic HR Integration at The Walt Disney CompanyTrần Thanh HuyềnNo ratings yet

- Sage Nominal CodesDocument2 pagesSage Nominal Codesmalinkalon12No ratings yet

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountssnsdyurijjangNo ratings yet

- Schoolwide Budget Ead 510Document11 pagesSchoolwide Budget Ead 510api-515615857100% (1)

- Tugas 7: Akuntansi Sewa Guna UsahaDocument1 pageTugas 7: Akuntansi Sewa Guna UsahaZazan Zanuwar0% (1)

- Systems Analysis & Design 7th EditionDocument45 pagesSystems Analysis & Design 7th Editionapi-24535246100% (1)

- OM - J&G Distributors SolutionDocument8 pagesOM - J&G Distributors SolutionSiddharth JoshiNo ratings yet

- Chart of Accounts: (Categories of Income and Expenses) Income (Revenues)Document1 pageChart of Accounts: (Categories of Income and Expenses) Income (Revenues)augusto silvaNo ratings yet

- G Chart of AccountsDocument2 pagesG Chart of AccountsMubashar HussainNo ratings yet

- Airfreight 2100 Cost CodesDocument12 pagesAirfreight 2100 Cost Codes175pauNo ratings yet

- Details CertDocument7 pagesDetails CertChristine Joy CorpusNo ratings yet

- Default Chart of AccountsDocument4 pagesDefault Chart of Accountsjmanzungu2820No ratings yet

- Details of Expenditures: For The Month ofDocument4 pagesDetails of Expenditures: For The Month ofLily May AganaNo ratings yet

- Chart of AccountDocument4 pagesChart of AccountShang BugayongNo ratings yet

- Information Sheet 1Document2 pagesInformation Sheet 1cytnhia bulikdayNo ratings yet

- Chart of Accounts: Account NumberingDocument15 pagesChart of Accounts: Account NumberingrjrjrjNo ratings yet

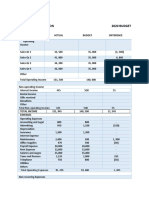

- Budget ProjectionsDocument4 pagesBudget Projectionssen0viaNo ratings yet

- Expenditure Statement - Xls12aDocument42 pagesExpenditure Statement - Xls12ayasirfazilNo ratings yet

- Region XI - FAR 1 & 1A - Current Revised Template - MARCH CY '2022 For ConsolidationDocument3,107 pagesRegion XI - FAR 1 & 1A - Current Revised Template - MARCH CY '2022 For ConsolidationLestle SocoNo ratings yet

- Opening Balance Sheet TotalsDocument22 pagesOpening Balance Sheet TotalsMuhammad MohsinNo ratings yet

- Charts of Accounts of Eagle Wheels Auto Solutions For QBDocument16 pagesCharts of Accounts of Eagle Wheels Auto Solutions For QBMuhammad UsmanNo ratings yet

- Accounting JournalDocument6 pagesAccounting JournaledwinjethromoliverosNo ratings yet

- IC Accounting Journal Template Updated 8552Document6 pagesIC Accounting Journal Template Updated 8552MochdeedatShonhajiNo ratings yet

- Code Name Type Tax Code DescriptionDocument2 pagesCode Name Type Tax Code Descriptionmiljane perdizoNo ratings yet

- ICLBP Form No - 071409Document1 pageICLBP Form No - 071409BenjaminJrMoroniaNo ratings yet

- Budget TemplateDocument42 pagesBudget Templatebabaeardy 18No ratings yet

- Frequently Used GL Accounts2Document2 pagesFrequently Used GL Accounts2Han TsuNo ratings yet

- SAP Finance Chart of Accounts OverviewDocument17 pagesSAP Finance Chart of Accounts OverviewailihengNo ratings yet

- WK1 - MTTI Budgets Pack ExcelDocument7 pagesWK1 - MTTI Budgets Pack ExcelBinay BhandariNo ratings yet

- Hospital budget breakdownDocument2 pagesHospital budget breakdownReslyn YanocNo ratings yet

- Hotel Chart of AccountsDocument2 pagesHotel Chart of AccountsVivek BhadviyaNo ratings yet

- Fy 2017 Budget FinalDocument23 pagesFy 2017 Budget FinalMichaelRomainNo ratings yet

- Annual Budget Plan SampleDocument3 pagesAnnual Budget Plan SampleRoland CamposNo ratings yet

- QuickBooks Online COA Sample FileDocument5 pagesQuickBooks Online COA Sample FileRAVITEJANo ratings yet

- FBN HFM Reporting Template MAY 2022 - First Pension Custodian Nig. Ltd. ADocument48 pagesFBN HFM Reporting Template MAY 2022 - First Pension Custodian Nig. Ltd. AIkechukwu ObiajuruNo ratings yet

- Uacs CodeDocument16 pagesUacs CodeJohn Angel ReyesNo ratings yet

- Chart of AccountsDocument7 pagesChart of AccountsJoseph EleazarNo ratings yet

- InfotypesDocument3 pagesInfotypesHitesh BalwaniNo ratings yet

- Annual School Budget: School Del Gallego Eight Hundred Ninety Four Thousand Pesos (894,000.00)Document3 pagesAnnual School Budget: School Del Gallego Eight Hundred Ninety Four Thousand Pesos (894,000.00)Roland CamposNo ratings yet

- Del Gallegos 2019 School BudgetDocument3 pagesDel Gallegos 2019 School BudgetRoland CamposNo ratings yet

- SBM FormDocument1 pageSBM FormNelsBelNo ratings yet

- Twinnies Corporation 2020 BudgetDocument2 pagesTwinnies Corporation 2020 BudgetMariya BhavesNo ratings yet

- List of InfotypeDocument6 pagesList of Infotypebushke getahunNo ratings yet

- Budget Template - Class Sheet (19th Batch)Document22 pagesBudget Template - Class Sheet (19th Batch)Shahanara AkterNo ratings yet

- Cabwad CF September 2019Document2 pagesCabwad CF September 2019EunicaNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsFarhana Yeasmin ShuchanaNo ratings yet

- RB - Budget Approved by Finance CommitteeDocument8 pagesRB - Budget Approved by Finance CommitteekobekahnNo ratings yet

- Bank Accounts, Assets, Liabilities, and Income Statement AccountsDocument5 pagesBank Accounts, Assets, Liabilities, and Income Statement AccountsGraceeyNo ratings yet

- VD - Operating Exp - PT Esco Utama 2022 - FINDocument64 pagesVD - Operating Exp - PT Esco Utama 2022 - FIN08Daniel Friandy PardedeNo ratings yet

- Tax return for individuals/AOPs with turnover up to Rs 50 millionDocument4 pagesTax return for individuals/AOPs with turnover up to Rs 50 millionSyed Faisal AhsanNo ratings yet

- 0Document2 pages0Hyuna KimNo ratings yet

- Name Type: NumberDocument8 pagesName Type: NumberRAVITEJANo ratings yet

- SLMPD 2018 Proposed BudgetDocument91 pagesSLMPD 2018 Proposed BudgetGRAMNo ratings yet

- AAHA/VMG CHART OF ACCOUNTSDocument8 pagesAAHA/VMG CHART OF ACCOUNTSShahidHussainBashovi100% (1)

- Expenses: Account Code Account Title Personal ServicesDocument5 pagesExpenses: Account Code Account Title Personal ServicesVina Ocho CadornaNo ratings yet

- RevRegion XI - FAR 1 & 1A - Continuing Revised Template - MARCH CY '2022 - For ConsolidationDocument3,005 pagesRevRegion XI - FAR 1 & 1A - Continuing Revised Template - MARCH CY '2022 - For ConsolidationLestle SocoNo ratings yet

- Sui Northern Gas Pipelines Limited Revenue Budget Proposals For Fy 2012-13Document11 pagesSui Northern Gas Pipelines Limited Revenue Budget Proposals For Fy 2012-13Arshad MalikNo ratings yet

- Caee 2023 BudgetDocument2 pagesCaee 2023 Budgetapi-201129963No ratings yet

- CFCFCFDocument5 pagesCFCFCFbabarshahNo ratings yet

- Pre-Closing TB As of Dec 2021Document2 pagesPre-Closing TB As of Dec 2021Angelic RecioNo ratings yet

- US BANK MCC GROUP LISTINGDocument10 pagesUS BANK MCC GROUP LISTINGenrique_jydNo ratings yet

- Sap Infor TypeDocument12 pagesSap Infor TypeDEEP KHATINo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Riva Star - Bottle - Sdi - Instructions - Es-SaDocument2 pagesRiva Star - Bottle - Sdi - Instructions - Es-Saaugusto silvaNo ratings yet

- Ep Cat 950 075 RevF SpreadsDocument41 pagesEp Cat 950 075 RevF Spreadsaugusto silvaNo ratings yet

- Differentiated and Simplified Pre-Exposure Prophylaxis For HIV PreventionDocument46 pagesDifferentiated and Simplified Pre-Exposure Prophylaxis For HIV Preventionaugusto silvaNo ratings yet

- Preferred Terminology For A Dental PracticeDocument1 pagePreferred Terminology For A Dental Practiceaugusto silvaNo ratings yet

- Reminova and EAER: Keeping Enamel Whole Through Caries RemineralizationDocument8 pagesReminova and EAER: Keeping Enamel Whole Through Caries Remineralizationaugusto silvaNo ratings yet

- Data You Must Know To Manage Your PracticeDocument2 pagesData You Must Know To Manage Your Practiceaugusto silvaNo ratings yet

- Practicon Online Application FormDocument3 pagesPracticon Online Application Formaugusto silvaNo ratings yet

- Tutorial 5: Automating Forms: Creating Online Forms With Form FieldsDocument5 pagesTutorial 5: Automating Forms: Creating Online Forms With Form Fieldsaugusto silvaNo ratings yet

- Calculating Annual and Daily GoalsDocument1 pageCalculating Annual and Daily Goalsaugusto silvaNo ratings yet

- OrtodonciaDocument14 pagesOrtodonciaaugusto silvaNo ratings yet

- Enhancement of Clinical EfficiencyDocument2 pagesEnhancement of Clinical Efficiencyaugusto silvaNo ratings yet

- Billing and Collection ProceduresDocument2 pagesBilling and Collection Proceduresaugusto silvaNo ratings yet

- Characteristics Successful Team Dentist Staff MembersDocument1 pageCharacteristics Successful Team Dentist Staff Membersaugusto silvaNo ratings yet

- Practice Systems Inventory: PersonnelDocument2 pagesPractice Systems Inventory: Personnelaugusto silvaNo ratings yet

- Monitor Daily Activities - A Key To Control Your PracticeDocument2 pagesMonitor Daily Activities - A Key To Control Your Practicemaximo santanaNo ratings yet

- Clinical Systems Inventory: PersonnelDocument1 pageClinical Systems Inventory: Personnelaugusto silvaNo ratings yet

- Block Scheduling For PracticesDocument2 pagesBlock Scheduling For Practicesaugusto silvaNo ratings yet

- Calculating Annual and Daily GoalsDocument1 pageCalculating Annual and Daily Goalsaugusto silvaNo ratings yet

- Block Scheduling in Pedo and Ortho OfficeDocument2 pagesBlock Scheduling in Pedo and Ortho Officeaugusto silvaNo ratings yet

- Business Systems InventoryDocument2 pagesBusiness Systems Inventoryaugusto silvaNo ratings yet

- Block Scheduling For PracticesDocument2 pagesBlock Scheduling For Practicesaugusto silvaNo ratings yet

- Block Scheduling in Pedo and Ortho OfficeDocument2 pagesBlock Scheduling in Pedo and Ortho Officeaugusto silvaNo ratings yet

- Original Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full ChapterDocument41 pagesOriginal Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full Chapterbetty.neverson777100% (26)

- PDF To WordDocument17 pagesPDF To WordMehulsonariaNo ratings yet

- Dsr April 2024Document10 pagesDsr April 2024vapatel767No ratings yet

- Ayeesha QuestionDocument2 pagesAyeesha QuestionMahesh KumarNo ratings yet

- IntroductionDocument13 pagesIntroductionNadiaaNo ratings yet

- Sahib Preet Prabhakar Profile SummaryDocument3 pagesSahib Preet Prabhakar Profile SummaryEclatNo ratings yet

- Pei201509 DLDocument46 pagesPei201509 DLanjangandak2932No ratings yet

- Tourism Policy of Malta 2007-2011: Francis Zammit Dimech Minister For Tourism and CultureDocument11 pagesTourism Policy of Malta 2007-2011: Francis Zammit Dimech Minister For Tourism and Cultureნინი მახარაძეNo ratings yet

- Acetic Acid (Europe) 2013-10-11Document2 pagesAcetic Acid (Europe) 2013-10-11Iván NavarroNo ratings yet

- Advanced Accounting RTP N21Document39 pagesAdvanced Accounting RTP N21Harshwardhan PatilNo ratings yet

- Profile of The Aerospace Industry in Greater MontrealDocument48 pagesProfile of The Aerospace Industry in Greater Montrealvigneshkumar rajanNo ratings yet

- IDENTIFIKASI PAD KABUPATEN KEPU LA UAN SANGIHEDocument8 pagesIDENTIFIKASI PAD KABUPATEN KEPU LA UAN SANGIHESentahanakeng Malahasa perkasaNo ratings yet

- Economic Scene in Pune Under The Rule of Peshwas - (18th Century)Document2 pagesEconomic Scene in Pune Under The Rule of Peshwas - (18th Century)Anamika Rai PandeyNo ratings yet

- Ust 2014 Bar Q Suggested Answers Civil LawDocument15 pagesUst 2014 Bar Q Suggested Answers Civil LawKevin AmanteNo ratings yet

- Gar 7Document2 pagesGar 7Surendra DevadigaNo ratings yet

- Understanding Transactions in The Controlling ModuleDocument31 pagesUnderstanding Transactions in The Controlling ModuleAbdelhamid HarakatNo ratings yet

- Chapter No. 1: Micro EconomicsDocument6 pagesChapter No. 1: Micro EconomicsRamesh AgarwalNo ratings yet

- Syllabus B7345-001 Entrepreneurial FinanceDocument7 pagesSyllabus B7345-001 Entrepreneurial FinanceTrang TranNo ratings yet

- Ch4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Document45 pagesCh4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Wenhui TuNo ratings yet

- African Tax Outlook 2019Document200 pagesAfrican Tax Outlook 2019The Independent Magazine100% (3)

- Republic of The PhilippinesDocument7 pagesRepublic of The Philippinesvita feliceNo ratings yet

- Quick Guide On Title TransfersDocument6 pagesQuick Guide On Title TransfersBam SantosNo ratings yet

- Level 1: New Century Mathematics (Second Edition) S3 Question Bank 3A Chapter 3 Percentages (II)Document27 pagesLevel 1: New Century Mathematics (Second Edition) S3 Question Bank 3A Chapter 3 Percentages (II)raydio 4No ratings yet

- Shobha DevelopersDocument212 pagesShobha DevelopersJames TownsendNo ratings yet