Professional Documents

Culture Documents

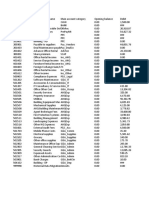

Code Name Type Tax Code Description

Uploaded by

miljane perdizo0 ratings0% found this document useful (0 votes)

6 views2 pagesThis document contains a chart listing accounting codes, descriptions, tax classifications for various assets, equity, expenses and income for a business. The codes are organized into current assets, fixed assets, equity, and expenses. The document provides an overview of the general ledger accounts for a company including classifications like cash, supplies, equipment, salaries, rent, and fees.

Original Description:

Original Title

CHART-OF-ACCOUNTS

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a chart listing accounting codes, descriptions, tax classifications for various assets, equity, expenses and income for a business. The codes are organized into current assets, fixed assets, equity, and expenses. The document provides an overview of the general ledger accounts for a company including classifications like cash, supplies, equipment, salaries, rent, and fees.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pagesCode Name Type Tax Code Description

Uploaded by

miljane perdizoThis document contains a chart listing accounting codes, descriptions, tax classifications for various assets, equity, expenses and income for a business. The codes are organized into current assets, fixed assets, equity, and expenses. The document provides an overview of the general ledger accounts for a company including classifications like cash, supplies, equipment, salaries, rent, and fees.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

*Code *Name *Type *Tax Code Description

1011 CASH Current Asset Tax exempt (0%)

1014 MAINTENANCE SUPPLIES Current Asset Input Vat (12%)

1015 OFFICE SUPPLIES Current Asset Input Vat (12%)

1016 OFFICE EQUIPMENT Current Asset Input Vat (12%)

1017 ACCUM. DEPR. OFFICE EQUIPMENT Fixed Asset Tax exempt (0%)

1018 VEHICLES Fixed Asset Input Vat (12%)

1019 ACCUM. DEPR. VEHICLES Fixed Asset Tax exempt (0%)

3031 PERDIZO, CAPITAL Equity Tax exempt (0%)

3032 HOLMES, DRAWING Equity Tax exempt (0%)

4041 FEES EARNED Expense Output Vat (12%)

5051 DRIVER SALARIES EXPENSE Expense Tax exempt (0%)

5052 MAINTENANCE SUPPLIES EXPENSE Expense Input Vat (12%)

5053 FUEL EXPENSE Expense Input Vat (12%)

5054 OFFICE SALARIES EXPENSE Expense Tax exempt (0%)

5055 RENT EXPENSE Expense Tax exempt (0%)

5056 ADVERTISING EXPENSE Expense Input Vat (12%)

5057 MISCELLANEOUS ADMINISTRATIVE Expense Input Vat (12%)

Dashboard Expense Claims Enable Payment Balance

65,200

17,300

-4,250

62,400

-17,800

-162,975

7,240

3,690

You might also like

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Sadguru Construction Cma 16-17 To 2020-21Document8 pagesSadguru Construction Cma 16-17 To 2020-21vdtaudit 1No ratings yet

- March PDFDocument1 pageMarch PDFajay jetavatNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- LembarDocument26 pagesLembarIbnu Kamajaya75% (4)

- Tax Answerrs and QuestionsDocument33 pagesTax Answerrs and QuestionsoluwafunmilolaabiolaNo ratings yet

- Fundamental Analyzis of WiproDocument15 pagesFundamental Analyzis of WiproAthira K. ANo ratings yet

- Declaration 3630294043517Document3 pagesDeclaration 3630294043517MuhammadWaqarNo ratings yet

- Electrify Financial StatementDocument60 pagesElectrify Financial StatementCosmin Tudor StefanNo ratings yet

- PROFITDocument3 pagesPROFITaditya malikNo ratings yet

- Bida-Tech Company Chart of Accounts Account Naccount NameDocument66 pagesBida-Tech Company Chart of Accounts Account Naccount NameTrisha Mae Mendoza MacalinoNo ratings yet

- StandarFeed Bank WCADocument91 pagesStandarFeed Bank WCAMd. Imam HossainNo ratings yet

- Kashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirDocument4 pagesKashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirKhalil ShakirNo ratings yet

- Shareholders' Funds Reserves and SurplusDocument10 pagesShareholders' Funds Reserves and SurplusBalaji GaneshNo ratings yet

- BASLinkDocument3 pagesBASLinkDilan HemachandraNo ratings yet

- Salaried Tax Calculator Ay 23-24Document2 pagesSalaried Tax Calculator Ay 23-24Proddut BasakNo ratings yet

- April Payment SleepDocument1 pageApril Payment Sleepizajahamed1No ratings yet

- Income StatementDocument4 pagesIncome Statementl201046No ratings yet

- Sampras SolutionDocument3 pagesSampras SolutionSiphesihleNo ratings yet

- Arus Kas: Margaria - Keziasulistio - 5150111005Document2 pagesArus Kas: Margaria - Keziasulistio - 5150111005Kezia SulistioNo ratings yet

- Balance Sheet of Reliance IndustriesDocument12 pagesBalance Sheet of Reliance IndustriesMohit Kumar SinghNo ratings yet

- Tax Return (2019-20) MR - AsadDocument3 pagesTax Return (2019-20) MR - AsadIkramNo ratings yet

- Shareholders' Funds Reserves and SurplusDocument3 pagesShareholders' Funds Reserves and SurplusBalaji GaneshNo ratings yet

- Chapters ExcelDocument121 pagesChapters ExcelRohan VermaNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- DynamicsExport 638249264853028518Document2 pagesDynamicsExport 638249264853028518Ahmad SohailNo ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- DRL Complete SolutionDocument3 pagesDRL Complete SolutionAnonymous aOj6NKBNo ratings yet

- Cpa Review Center Itatbus Final OutputDocument49 pagesCpa Review Center Itatbus Final Outputablay logeneNo ratings yet

- BOS Project YasminDocument11 pagesBOS Project YasminRushi MaidNo ratings yet

- Analisa Eva WaccDocument14 pagesAnalisa Eva WaccNur Maulidyah AzizahNo ratings yet

- Assessment For Working Capital Requirements: Actual Provisional Projected Projected ProjectedDocument11 pagesAssessment For Working Capital Requirements: Actual Provisional Projected Projected ProjectedVivek SharmaNo ratings yet

- Golden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Document10 pagesGolden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Sheilla BonsuNo ratings yet

- Sescom Info Solutions FzeDocument14 pagesSescom Info Solutions FzeSESCOM INFO SOLUTIONS FZENo ratings yet

- Project Income CalculatorDocument4 pagesProject Income CalculatorMahmoud ElmohamdyNo ratings yet

- Anya Forger CorporationDocument2 pagesAnya Forger CorporationMondays AndNo ratings yet

- Cash Flow Analysis: Anandam Manufacturing CompanyDocument13 pagesCash Flow Analysis: Anandam Manufacturing CompanyANANTHA BHAIRAVI MNo ratings yet

- Post-Closing Trial BalanceDocument8 pagesPost-Closing Trial BalanceNicole Andrea TuazonNo ratings yet

- Long Question WorkingDocument4 pagesLong Question WorkingAbishek GuptaNo ratings yet

- FAWCM - Cash Flow 2Document29 pagesFAWCM - Cash Flow 2Jake RoosenbloomNo ratings yet

- M K Resto and Cafe - Trial BalanceDocument1 pageM K Resto and Cafe - Trial BalanceMarieJoiaNo ratings yet

- Declaration 1726107Document4 pagesDeclaration 1726107Hanzala NasirNo ratings yet

- 2010 Draft Budget BP Rev 10-09Document1 page2010 Draft Budget BP Rev 10-09J.MeansNo ratings yet

- 02 Profits, Cash Flows and Taxes - StudentsDocument25 pages02 Profits, Cash Flows and Taxes - StudentslmsmNo ratings yet

- Houzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceDocument4 pagesHouzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceHamza Anees100% (1)

- MindtreeDocument18 pagesMindtreeAkash DidhariaNo ratings yet

- Menyusun Laporan KeuanganDocument18 pagesMenyusun Laporan KeuanganAngelaNo ratings yet

- Ratio ... Financial StatementsDocument17 pagesRatio ... Financial Statementsjinsha firozNo ratings yet

- Declaration 3710353141505Document5 pagesDeclaration 3710353141505Syed Bilal BukhariNo ratings yet

- Form 16 - 13-14Document4 pagesForm 16 - 13-14NITIN CHOUDHARYNo ratings yet

- Proknjižen Grupe Računa: Račun Naziv Saldo Potražuje DugujeDocument1 pageProknjižen Grupe Računa: Račun Naziv Saldo Potražuje DugujeSaša StankovićNo ratings yet

- House No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidDocument4 pagesHouse No. 333, Link Road, Narrian Abbottabad, Abbottabad Abbottabad Khawar ShahidIkramNo ratings yet

- Taxation Solution 2017 SeptemberDocument11 pagesTaxation Solution 2017 Septemberzezu zazaNo ratings yet

- Pawan Hans Helicopters Ltd. Balance SheetDocument3 pagesPawan Hans Helicopters Ltd. Balance SheetSonal ThukralNo ratings yet

- Adisoft - 2014Document22 pagesAdisoft - 2014Sridhar GandikotaNo ratings yet

- Accounting ProjectDocument7 pagesAccounting ProjectMuskan SeherNo ratings yet

- 2022 Budget TemplateDocument192 pages2022 Budget Templateojo bamideleNo ratings yet

- Intermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa IiiDocument3 pagesIntermediate Accounting 3-Activity 2: Perdizo, Miljane P. Bsa Iiimiljane perdizoNo ratings yet

- ESCOPETE Assignment CVPDocument6 pagesESCOPETE Assignment CVPmiljane perdizoNo ratings yet

- Multiple ChoiceDocument4 pagesMultiple Choicemiljane perdizoNo ratings yet

- Managerial AccountingDocument11 pagesManagerial Accountingmiljane perdizoNo ratings yet

- Module One Probing Our Christian Moral LifeDocument13 pagesModule One Probing Our Christian Moral Lifemiljane perdizoNo ratings yet

- Trend Analysis Chapter 123Document21 pagesTrend Analysis Chapter 123miljane perdizoNo ratings yet

- Miljane Perdizo - Inventory QuizDocument3 pagesMiljane Perdizo - Inventory Quizmiljane perdizoNo ratings yet

- PE - SportsDocument10 pagesPE - Sportsmiljane perdizoNo ratings yet

- The Influence of Inventory Control Management On Financial Organization PerformanceDocument19 pagesThe Influence of Inventory Control Management On Financial Organization Performancemiljane perdizoNo ratings yet

- Description What To Do : Practical ExamsDocument1 pageDescription What To Do : Practical Examsmiljane perdizoNo ratings yet

- Option MoneyDocument2 pagesOption Moneymiljane perdizoNo ratings yet

- VSM Current State MapDocument5 pagesVSM Current State Mapmiljane perdizoNo ratings yet

- Salvage Value Useful Life Accumulated YearsDocument10 pagesSalvage Value Useful Life Accumulated Yearsmiljane perdizoNo ratings yet

- Philippine Development Plan Framework and Headline TargetsDocument3 pagesPhilippine Development Plan Framework and Headline Targetsmiljane perdizoNo ratings yet

- VSM Current State MapDocument5 pagesVSM Current State Mapmiljane perdizoNo ratings yet

- Name Perdizo, Joemil Petallo COMPLETION DATE 2019-April-02 9:42 PMDocument1 pageName Perdizo, Joemil Petallo COMPLETION DATE 2019-April-02 9:42 PMmiljane perdizoNo ratings yet

- Purba Mukhlisin Aisyah Productivity 1 2018Document11 pagesPurba Mukhlisin Aisyah Productivity 1 2018miljane perdizoNo ratings yet