Professional Documents

Culture Documents

Sampras Solution

Uploaded by

SiphesihleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sampras Solution

Uploaded by

SiphesihleCopyright:

Available Formats

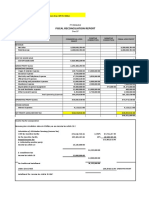

SAMPRAS LIMITED

EXTRACTS OF STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE

2012 2011 2010

R'000 R'000 R'000

Profit/(Loss) before Taxation (given) 35,200.00 (26,700.00) 25,000.00

Taxation 9,949.40 (6,538.00) 6,242.60

25,250.60 (20,162.00) 18,757.40

Profit/(Loss) is stated after taking into

account the following:-

- Dividend Received 600.00 500.00 800.00

- Depreciation (16,500.00) (18,200.00) (16,200.00)

- Profit on sale of land - - 3,000.00

- Profit on sale of plant 250.00

- Goodwill impaired - (5,000.00) -

- VAT penalty (800.00) - -

- Fair value adjustments to shares (150.00) 300.00 210.00

TAXATION

Current 10,470.60 3,963.40

Deferred iro temporary differences (3,658.20) (3,424.40) 2,279.20

Deferred iro assessed loss (created) reversed 3,113.60 (3,113.60)

Rate change on financial instruments 23.40 - -

9,949.40 (6,538.00) 6,242.60

TAX RECONCILIATION

28% 28% 28%

Statutory Charge/(Relief) 9,856.00 (7,476.00) 7,000.00

Exempt Income - Dividends (168.00) (140.00) (224.00)

Capital Gain - - (504.00)

Exempt portion of fair value gain/(loss) 14.00 (42.00) (29.40)

Goodwill written off - 1,120.00 -

VAT penalty 224.00 - -

Rate Change 23.40 -

Charge per Income Statement 9,949.40 (6,538.00) 6,242.60

Effective tax charge 28.26% (24.48%) 24.97%

SAMPRAS LIMITED

WORKINGS

TAX COMPUTATION

2012 2011 2010

Profit/(Loss) (given) 35,200 -26,700 25,000

Permanent Differences

Dividend receied (given) -600 -500 -800

Land profit -3,000

50% of land CGT 2400= [(3000+500)-1100] 1,200

Fair value gain portion perm difference **

33.4 or 50% fair value on shares 50 -150 -105

Goodwill 4,000

VAT penalty 800

Total Permanent 250 3,350 -2,705

Temporary differences

Depreciation 16,500 18,200 16,200

Wear and tear -3,625 -6,150 -24,250

Provision for doubtful debts (add back exp.) 120 40 20

Section 11(j) prior (add back prior yr) 90 80 75

Section 11(j) current -120 -90 -80

Fair value shares portion temp diff ** 100 -150 -105

Profit on sale of plant (given - remove) -250

Recoupment for tax purposes 550

Total Temporary 13,065 12,230 -8,140

TAXABLE INCOME 48,515 -11,120 14,155

Assessed Loss B/Fwd -11,120

37,395

At tax rate 0.28 0.28 0.28

10,470.6 3,963.4

** fair value gain taken out - not taxable but portion exempt because taxed at CGT rate

WORKING FINANCIAL INSTRUMENT C VALUE TAX BASE DIFFER TAX

2010 (950+210) 1160 950 210 29

2011 (1160+300) 1460 950 510 71

Rate change on opening value 18,6%-14% 23

510 95

-150 28

2012 (1460-150) 1310 950 360 67

SAMPRAS LIMITED

JOURNAL ENTRIES FOR DEFERRED TAX

2010

DR Deferred Tax Expense (P/L) 2,279.20

CR Deferred Tax BS 2,279.20

(8140 temporary differences at 28%)

DR Current Normal Tax (P/L) 3,963.40

CR SARS / Receiver of Revenue 3,963.40

(on taxable income of 14155 at 28%)

2011

DR Deferred Tax BS 3,424.40

CR Deferred tax expense (P/L) 3,424.40

(iro of temporary differences 12230)

DR Deferred tax BS 3,113.60

CR Deferred Tax Expense (P/L) 3,113.60

(iro of assessed loss 11120)

2012

DR Deferred Tax Expense (P/L) 3,113.60

CR Deferred Tax (BS) 3,113.60

(iro reversing assessed loss)

DR Deferred Tax BS 3,658.20

CR Deferred tax expense (P/L) 3,658.20

(iro of temporary differences 13065)

DR Deferred Tax Expense (PL) 23.40

CR Deferred Tax (BS) 23.40

(iro rate change for financial instruments)

DR Current Normal Tax 10,470.60

CR SARS / Receiver of Revenue 10,470.60

(on taxable income of 37 395 at 28%)

You might also like

- Eacc1614 Test 2 Memo 2021 AdjDocument10 pagesEacc1614 Test 2 Memo 2021 AdjshabanguntandoyenkosiNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- HendRes Financial First QTR 2010Document5 pagesHendRes Financial First QTR 2010sunshinedavidsonNo ratings yet

- Tax Assignment 4Document5 pagesTax Assignment 4pfungwaNo ratings yet

- DR Reddys Laboratories: PrintDocument5 pagesDR Reddys Laboratories: PrintSiddharth VermaNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- EPF Universal Account NumberDocument1 pageEPF Universal Account NumberetrshillongNo ratings yet

- Taller FinalDocument13 pagesTaller FinalJennifer Ramos PerezNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- Acct2015 - 2021 Paper Final SolutionDocument128 pagesAcct2015 - 2021 Paper Final SolutionTan TaylorNo ratings yet

- Income Taxes - Medix LTD MemoDocument3 pagesIncome Taxes - Medix LTD Memoandiswa zuluNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Golden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Document10 pagesGolden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Sheilla BonsuNo ratings yet

- ATX T1 Ans. To Q3 (CBAT)Document1 pageATX T1 Ans. To Q3 (CBAT)alvinmono.718No ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- Form 1Document1 pageForm 1Ganesh DasaraNo ratings yet

- FAC 3701 Exam PackDocument52 pagesFAC 3701 Exam Packartwell MagiyaNo ratings yet

- Solution For MFRS112 ExercisesDocument11 pagesSolution For MFRS112 Exercisesm-7039266No ratings yet

- DR Reddys Laboratories: PrintDocument2 pagesDR Reddys Laboratories: PrintSiddharth VermaNo ratings yet

- FormDocument1 pageFormPatel NiravNo ratings yet

- Income Tax Projection202206Document1 pageIncome Tax Projection202206Rakhi JadavNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Published Financial StatementsDocument13 pagesPublished Financial StatementsLoh Jin WenNo ratings yet

- Taxation 302Document5 pagesTaxation 302MGCININo ratings yet

- Confusion Plcs SolutionsDocument8 pagesConfusion Plcs SolutionsJen Hang WongNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- Answer Question 6.6Document3 pagesAnswer Question 6.6Lee Li HengNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- Tutorial 2 (3) 3 (E)Document2 pagesTutorial 2 (3) 3 (E)Shan JeefNo ratings yet

- FMA Assignment Sem1 2019HB58032Document7 pagesFMA Assignment Sem1 2019HB58032rageshNo ratings yet

- Tax Answerrs and QuestionsDocument33 pagesTax Answerrs and QuestionsoluwafunmilolaabiolaNo ratings yet

- Group B&D Case 19 FonderiaDocument12 pagesGroup B&D Case 19 FonderiaVinithi ThongkampalaNo ratings yet

- Kashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirDocument4 pagesKashana Hafiz Mir Colony Near Petrol PUMP LILYANI 0492450277 Khalil Ahmad ShakirKhalil ShakirNo ratings yet

- Answer Question 3Document27 pagesAnswer Question 3ummi sabrina100% (1)

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- July, 2008Document2 pagesJuly, 2008dujust_hudesNo ratings yet

- Windowlux - Case SolutionDocument2 pagesWindowlux - Case SolutionanisaNo ratings yet

- Idea Vs RelianceDocument1 pageIdea Vs RelianceMayank BhardwajNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- Investment Outlays at Time 0Document3 pagesInvestment Outlays at Time 0jualNo ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Salary SlipDocument1 pageSalary SlipAnkit SinghNo ratings yet

- Financial AnalysisDocument24 pagesFinancial AnalysisSwathi ShanmuganathanNo ratings yet

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.eNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- TSU - Public AdminDocument45 pagesTSU - Public AdminaileenrconcepcionNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Annual Financials For Tata Motors LTD: All Amounts in Millions Except Per Share AmountsDocument8 pagesAnnual Financials For Tata Motors LTD: All Amounts in Millions Except Per Share AmountsPawanLUMBANo ratings yet

- Tax Practice Assignmenment Edited 2 Ketty Dec 2022Document6 pagesTax Practice Assignmenment Edited 2 Ketty Dec 2022ketty sambaNo ratings yet

- Payslip Oct-2022 NareshDocument3 pagesPayslip Oct-2022 NareshDharshan Raj0% (1)

- Hindustanprofit LossDocument2 pagesHindustanprofit LossPradeep WaghNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsMehwish ArsalNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- (Lecture 8 & 9) - Cost of CapitalDocument22 pages(Lecture 8 & 9) - Cost of CapitalAjay Kumar TakiarNo ratings yet

- Ebook Corporate Finance A Focused Approach 5Th Edition Ehrhardt Solutions Manual Full Chapter PDFDocument43 pagesEbook Corporate Finance A Focused Approach 5Th Edition Ehrhardt Solutions Manual Full Chapter PDFquachhaitpit100% (9)

- MSQ-07 - Financial Statement AnalysisDocument13 pagesMSQ-07 - Financial Statement AnalysisMarilou Olaguir Saño0% (1)

- Lembar Jawaban 4-LAPORAN FixDocument7 pagesLembar Jawaban 4-LAPORAN FixClara Shinta OceeNo ratings yet

- Ch. 1 Advanced Acctg 12th Ed Hoyle SolutionsDocument73 pagesCh. 1 Advanced Acctg 12th Ed Hoyle Solutionsj loNo ratings yet

- Chapter 18 Outline 7eDocument23 pagesChapter 18 Outline 7eGelyn CruzNo ratings yet

- Project On Derivative MarketDocument101 pagesProject On Derivative MarketVishal Suthar100% (1)

- LAW Graduate Essay 2:1docxDocument5 pagesLAW Graduate Essay 2:1docxCarl MunnsNo ratings yet

- Introduction To Financial ManagementDocument6 pagesIntroduction To Financial ManagementDrveerapaneni SuryaprakasaraoNo ratings yet

- Avanti Feeds AshishChugh MultibaggerDocument7 pagesAvanti Feeds AshishChugh MultibaggerGurjeevAnandNo ratings yet

- Biwheels Excel SheetDocument18 pagesBiwheels Excel SheetSREEDIP GHOSHNo ratings yet

- Corpo Notes 2018 PrelimsDocument14 pagesCorpo Notes 2018 PrelimsCzara DyNo ratings yet

- MP Stocks 71-94Document5 pagesMP Stocks 71-94Rej PatnaanNo ratings yet

- Financial Statements Eastern Condiments PVT LTDDocument7 pagesFinancial Statements Eastern Condiments PVT LTDjjjajjaaaNo ratings yet

- Dell Computer Corporation: AssetsDocument20 pagesDell Computer Corporation: AssetsAniqa AshrafNo ratings yet

- Cma TemplateDocument25 pagesCma TemplateSavoir PenNo ratings yet

- 5191 - TAMBUN - AnnualReport - 2016-12-31 - TILB AR2016 - Final - 2017079731Document128 pages5191 - TAMBUN - AnnualReport - 2016-12-31 - TILB AR2016 - Final - 2017079731Ooi Wei ShengNo ratings yet

- Cae15 Chap16 TheoriesDocument21 pagesCae15 Chap16 TheoriesJomarNo ratings yet

- Accounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsDocument14 pagesAccounting 1A Exam 1 - Spring 2011 - Section 1 - SolutionsRex Tang100% (1)

- Annual Report 2011Document216 pagesAnnual Report 2011shaan_ahNo ratings yet

- SFM Final Upto Module 6 Apr 2016Document114 pagesSFM Final Upto Module 6 Apr 2016Sidharth ChoudharyNo ratings yet

- 2011 Commercial Law Bar Questions and AnswersDocument34 pages2011 Commercial Law Bar Questions and AnswersSam Fajardo0% (2)

- Group 5 Case 6.2Document18 pagesGroup 5 Case 6.2cathy evangelistaNo ratings yet

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document66 pagesKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINo ratings yet

- 2015 NIKL NIKL Annual Report 2015Document202 pages2015 NIKL NIKL Annual Report 2015Mochamad Khairudin50% (2)

- Through BSE Listing Centre - Through Neaps: All The Concerned Persons Have Been Informed That They Shall Not Deal in AnyDocument1 pageThrough BSE Listing Centre - Through Neaps: All The Concerned Persons Have Been Informed That They Shall Not Deal in AnyslohariNo ratings yet

- History of RanbaxyDocument50 pagesHistory of RanbaxyAnil VaidhNo ratings yet

- (Page 250 (2) ) : Section 72 (4) Para. (B) Act No. 3 of 2011Document15 pages(Page 250 (2) ) : Section 72 (4) Para. (B) Act No. 3 of 2011JohnistobarNo ratings yet

- Kohinoor 181 11 5851 FacDocument37 pagesKohinoor 181 11 5851 FacSharif KhanNo ratings yet

- A Study On Ratio Analysis at KSRTC, BangaloreDocument96 pagesA Study On Ratio Analysis at KSRTC, BangaloreVivek Tr100% (1)