Professional Documents

Culture Documents

Income Taxes - Medix LTD Memo

Uploaded by

andiswa zuluOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Taxes - Medix LTD Memo

Uploaded by

andiswa zuluCopyright:

Available Formats

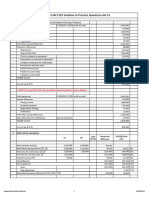

Question Medix Limited (30 marks)

REQUIRED 1:

Tax calculation

2022 2021

R R

Profit before taxation as stated 1 100 000½ 160 000½

Permanent differences (18 000) (6 000)

Dividends received (2 000) ½ (8 000) ½

Penalties paid to SARS 8 000 ½ 2 000 ½

Capital profit on disposal of manufacturing (60 000) √ -

equipment (R180 000 – R120 000)

Taxable capital gain ((R180 000 – R135 000) x 36 000√ -

80%)

1 082 000 154 000

Temporary differences 109 000 (223 250)

Depreciation 950 000 √ 830 000 √

Wear and tear (800 000) √ (900 000) √

Profit on disposal of equipment ((R180 000 –

R72 000) – R60 000) (48 000) √ -

Recoupment on machinery

(R120 000 – R60 000) 60 000 √ -

Income received in advance 1 000 √ 6 000 √

Prepaid expenses (70 000) √ (250 000) √

Allowance for credit losses expense 8 000 ½ 1 000 ½

Allowance for credit losses (2 000) ½ (250) ½

Provision for leave pay 10 000 ½ 90 000½

(Tax loss) / Taxable income for the year before 1 191 000 (69 250)

assessed loss

Assessed loss carried forward (69 250)

(Tax loss) / Taxable income for the year 1 121 750 (69 250)

Tax rate 27% 27%

Current tax

(1 121 750 x 27%) 302 873 ½P 0 ½P

Deferred tax (10 732) 41 580

(109 000 x 27% on temporary differences) (29 430) ½P

(223 250x 27% on temporary differences) 60 278 ½P

(69 250 x 27% on assessed loss) 18 698 ½P (18 698) ½P

Income tax expense 292 141 41 580

(21)

Deduct ½ mark for interest paid, interest received or rent received in tax calculation – max to deduct

– 1 mark

REQUIRED 2:

MEDIX LIMITED

EXTRACT NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2022 √Format

4. INCOME TAX EXPENSE

2022 2021

R R

Major components of tax expense

Current tax expense – current year 302 873 ½P - ½P

Deferred tax

- Current year (10 732) ½P 41 580½P

- Rate change (R250 000 x 1/28) (8 929) √

292 141 32 651

(4)

Tax rate reconciliation

2022 2021

R R

Accounting profit 1 100 000 160 000

Applicable tax rate 27% 27%

Tax at standard rate 297 000 43 200

Tax effect of:

Dividends received (540) ½ (2 160) ½

Penalties paid to SARS 2 160 ½ 540 ½

Capital profit on disposal of manufacturing (16 200) ½ -

equipment (R60 000 x 27%)

Taxable capital gain (R36 000 x 27%) 9 720 ½ -

Rate change (8 929) √P

Income tax expense 292 141 32 651

Effective tax rate 26.56% ½ 20.41.% ½

(5)

You might also like

- TAX3761 EXAM PACK JPJBLFDocument146 pagesTAX3761 EXAM PACK JPJBLFMonica Deetlefs0% (1)

- Ifrs PQDocument26 pagesIfrs PQpakhok3No ratings yet

- SBR June 2023 ANSWERS To Revision 4Document14 pagesSBR June 2023 ANSWERS To Revision 4Maria AgathocleousNo ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- FAC 3701 Exam PackDocument52 pagesFAC 3701 Exam Packartwell MagiyaNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- TEST 3 SolutionDocument3 pagesTEST 3 SolutionlusandasithembeloNo ratings yet

- Solution - Mock Exam - 240120 - 142640Document6 pagesSolution - Mock Exam - 240120 - 142640lebiyacNo ratings yet

- Accounting Worksheet 2 Answer SheetDocument31 pagesAccounting Worksheet 2 Answer Sheetzeldazitha87No ratings yet

- APT Tax AssignmentDocument11 pagesAPT Tax AssignmentMalik JavidNo ratings yet

- Chapter 9Document23 pagesChapter 9TouseefsabNo ratings yet

- 06 Taxation - Deferred s20 Final-1Document44 pages06 Taxation - Deferred s20 Final-150902849No ratings yet

- 06 Taxation - Deferred s22Document38 pages06 Taxation - Deferred s22Odzulaho DemanaNo ratings yet

- 2017 BGSS 4E5N Prelim P2 AnsDocument6 pages2017 BGSS 4E5N Prelim P2 AnsDamien SeowNo ratings yet

- FMA Assignment Sem1 2019HB58032Document7 pagesFMA Assignment Sem1 2019HB58032rageshNo ratings yet

- T8 Tutorial SolutionsDocument4 pagesT8 Tutorial SolutionsAnathi AnathiNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Solution Tax667 - Jun 2018Document9 pagesSolution Tax667 - Jun 2018Aiyani NabihahNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- AFS SolutionsDocument19 pagesAFS SolutionsRolivhuwaNo ratings yet

- GR 11 Accounting P1 (English) November 2022 Possible AnswersDocument9 pagesGR 11 Accounting P1 (English) November 2022 Possible Answersphafane2020No ratings yet

- Sampras SolutionDocument3 pagesSampras SolutionSiphesihleNo ratings yet

- Compilation Pyq - Far570Document109 pagesCompilation Pyq - Far570Nur SyafiqahNo ratings yet

- FAF Tutorial 7 Deferred TaxationDocument2 pagesFAF Tutorial 7 Deferred Taxation嘉慧No ratings yet

- Pricilla AssignmentDocument3 pagesPricilla AssignmentjasonnumahnalkelNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- 2018 Tax2A Test 2 Suggested Solution Question 3Document2 pages2018 Tax2A Test 2 Suggested Solution Question 3molemothekaNo ratings yet

- Basics LTD - MemoDocument3 pagesBasics LTD - Memoewriteandread.businessNo ratings yet

- Cash Flow EstimationDocument6 pagesCash Flow EstimationFazul RehmanNo ratings yet

- November 2019 Exam Solution Final PaperDocument7 pagesNovember 2019 Exam Solution Final Paper2603803No ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- Assign #03 FNNDocument11 pagesAssign #03 FNNUsman GhaniNo ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- ACG211E Test 1 Suggested SolutionDocument5 pagesACG211E Test 1 Suggested Solutionsphesihlemkhize1204No ratings yet

- Taller FinalDocument13 pagesTaller FinalJennifer Ramos PerezNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- Accounting PoliciesDocument10 pagesAccounting PoliciesHohohoNo ratings yet

- IAS 12 Ross LTD SolutionDocument2 pagesIAS 12 Ross LTD SolutionarronyeagarNo ratings yet

- Overall TemplateDocument5 pagesOverall TemplateUsman GhaniNo ratings yet

- Assignment 3 SolutionDocument2 pagesAssignment 3 SolutionThulani NdlovuNo ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- 2015 Jun Ans-8Document1 page2015 Jun Ans-8何健珩No ratings yet

- Financial Accounting N 6 Test MG 2nd Semester 2017Document8 pagesFinancial Accounting N 6 Test MG 2nd Semester 2017professional accountantsNo ratings yet

- Business Income Group Assignment...Document23 pagesBusiness Income Group Assignment...Brandon SibandaNo ratings yet

- August Q1Document3 pagesAugust Q1tengku rilNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- Sol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionDocument20 pagesSol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- INCOME TAX AssignmentDocument5 pagesINCOME TAX AssignmentShakib studentNo ratings yet

- Problem 12-10 SolutionDocument9 pagesProblem 12-10 SolutionKELLY DANGNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- Memorandum Question 12 Mandlacoal LTD 2021Document8 pagesMemorandum Question 12 Mandlacoal LTD 2021NOKUHLE ARTHELNo ratings yet

- Investment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Document7 pagesInvestment 80000 Cost Reduction 22000 Life 5 Salvage 20000 Tax 21% Discounting Rate 10%Sneha DasNo ratings yet

- Intermediate Accounting Volume 2 Canadian 12Th Edition Kieso Test Bank Full Chapter PDFDocument67 pagesIntermediate Accounting Volume 2 Canadian 12Th Edition Kieso Test Bank Full Chapter PDFDianeWhiteicyf100% (9)

- CF Chap002Document37 pagesCF Chap002Anissa Rianti NurinaNo ratings yet

- IncTax and PostEmpBenDocument42 pagesIncTax and PostEmpBenMarcus MonocayNo ratings yet

- Ia2 ReviewerDocument7 pagesIa2 ReviewerAiden MagnoNo ratings yet

- Multiples Choice Questions With AnswersDocument60 pagesMultiples Choice Questions With AnswersVaibhav Rusia100% (2)

- Intermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementDocument19 pagesIntermediate Accounting 3 Part 1: Cash Flows Objectives of Cash Flow StatementAG VenturesNo ratings yet

- Tax Faculty - Seminar On Tax Impl of IFRS - Taiwo OyedeleDocument58 pagesTax Faculty - Seminar On Tax Impl of IFRS - Taiwo OyedeleLegogie Moses AnoghenaNo ratings yet

- Annual Report 2012Document62 pagesAnnual Report 2012Devina DAJNo ratings yet

- The Effect of Book-Tax Diffferences, Cash Flow Volatility, and Corporate Governance On Earning QualityDocument10 pagesThe Effect of Book-Tax Diffferences, Cash Flow Volatility, and Corporate Governance On Earning QualityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Principles of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (8)

- Audit of Liabilities - Set ADocument5 pagesAudit of Liabilities - Set AZyrah Mae SaezNo ratings yet

- CFA Tai Lieu On TapDocument100 pagesCFA Tai Lieu On Tapkey4onNo ratings yet

- CFAS - Philippine Accounting StandardsDocument39 pagesCFAS - Philippine Accounting StandardsZerille Lynnelle Villamor Simbajon100% (1)

- Study Text PDFDocument658 pagesStudy Text PDFAli Sajid100% (1)

- Illustrative Example PDFDocument16 pagesIllustrative Example PDFTanvir AhmedNo ratings yet

- 03 Ia Auditing Mock Board Exam QuestionsDocument16 pages03 Ia Auditing Mock Board Exam QuestionsKial PachecoNo ratings yet

- ICAP TRsDocument45 pagesICAP TRsSyed Azhar Abbas0% (1)

- FS (3 Years) : A. Income StatementDocument10 pagesFS (3 Years) : A. Income StatementchiahwalousetteNo ratings yet

- Chapter 3 - Overview of Accounting AnalysisDocument21 pagesChapter 3 - Overview of Accounting AnalysisYong Ren100% (1)

- Taxation (Ia2)Document24 pagesTaxation (Ia2)Zhane KimNo ratings yet

- Financial Reporting and AnalysisDocument4 pagesFinancial Reporting and Analysisargie alccoberNo ratings yet

- FA2 Question BookDocument59 pagesFA2 Question BookNam LêNo ratings yet

- Intermediate Accounting 2Document23 pagesIntermediate Accounting 2hsjhsNo ratings yet

- Cash FlowsDocument51 pagesCash FlowsFabrienne Kate Eugenio Liberato100% (1)

- Cfas - FinalsDocument9 pagesCfas - FinalsawitakintoNo ratings yet

- Hand Out 1 Practice SetDocument6 pagesHand Out 1 Practice SetLayka ResorezNo ratings yet

- Accrev1 FINAL EXAM 19 20 NO ANSWERSDocument15 pagesAccrev1 FINAL EXAM 19 20 NO ANSWERSGray JavierNo ratings yet

- The Long Case For LKQ CorporationDocument38 pagesThe Long Case For LKQ CorporationAnonymous Ht0MIJNo ratings yet