Professional Documents

Culture Documents

IAS 12 Ross LTD Solution

Uploaded by

arronyeagarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IAS 12 Ross LTD Solution

Uploaded by

arronyeagarCopyright:

Available Formats

FIAC7311 & FIAC7319 Solution to Practice Questions IAS 12

Ross Ltd Solution

1. Calculation of current tax expense (as calculated in 3rd year Taxation)

Profit before tax (1 406 000 + 25 000 profit on sale) 1,431,000

Exempt differences (76,000)

Foreign income (138,000)

Dividends received (25,000)

Depreciation building 75,000

Traffic fines 12,000

Profit after exempt differences 1,355,000

Temporary differences 19,500

Depreciation 357,000

Wear & Tear Plant (430,000)

Profit on disposal of equipment (25,000)

Recoupment on disposal of equipment 47,500

Increase in allowance for credit losses 60,000

Provision for warranty costs 180,000

Actual warranty costs (165,000)

Prepaid insurance 2022 (45,000)

Prepaid insurance 2021 40,000

Taxable income 1,374,500

Current tax @ 27% 371,115

In FIAC7311 and FIAC7319 the calculation above should be done as follows

Profit before tax (1 406 000 + 25 000 profit on sale) 1,431,000

Exempt differences (76,000)

Foreign income (138,000)

Dividends received (25,000)

Depreciation building 75,000

Traffic fines 12,000

Profit after exempt differences 1,355,000

Deductible temporary differences (per DT calculation) 19,500

Taxable income 1,374,500

Current tax @ 27% 371,115

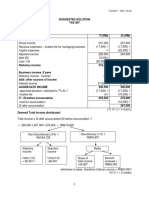

2. Deferred tax calculation

100% Temporary DTL/(DTA) @

CV TB

OR 80% difference 27%

Administration building 1,275,000 1,500,000 Exempt -

Manufacturing equipment ①;② 1,489,000 1,412,500 76,500 20,655 DTL

Allowance for credit losses ③;④ (200,000) (50,000) (150,000) (40,500) DTA

Provision for warranty costs ⑤ (215,000) - (215,000) (58,050) DTA

Prepaid insurance ⑥ 45,000 - 45,000 12,150 DTL

Closing Balance (243,500) (65,745) DTA

Opening Balance (224,000) (60,480) DTA

Given (224,000) (62,720) DTA

Rate adjustment 2,240 DTA

Deductible temporary difference (CR P/L, DR DT SFP) (19,500) (5,265)

Prepared by Shan Anderson 1 2023/01/10

FIAC7311 & FIAC7319 Solution to Practice Questions IAS 12

Ross Ltd Solution

① R1 549 000 – (R150 000 – 90 000) = R1 489 000

② R1 450 000 – (150 000 – 112 500) = R1 412 500

③ R120 000 + R80 000 = R200 000

④ R200 000 x 25% = R50 000

⑤ R43 000 000 x 0.5% = R215 000

⑥ R90 000 x 6/12 = R45 000

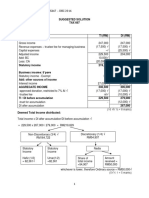

3. Income tax expense note

ROSS LIMITED

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 April 2023

Income tax expense

Major components of tax expense

SA Normal tax

Current 372,615

- Current year 371,115

- Underprovision prior year (17 500 - 16 000) 1,500

Deferred (3,025)

- Movement in temporary differences (5,265)

- Rate adjustment 2,240

Foreign tax 30,000

399,590

Tax reconciliation

Profit before tax 1,431,000

Standard tax @ 28% 386,370

Exempt differences

Dividends received (6,750)

Depreciation building 20,250

Traffic fines 3,240

Underprovision prior year 1,500

Rate adjustment 2,240

Difference in foreign tax ((138 000 x 27%) = 37 260 – 30 000) (7,260)

399,590

Prepared by Shan Anderson 2 2023/01/10

You might also like

- Company Profit and LossDocument6 pagesCompany Profit and LossFazal Rehman Mandokhail50% (2)

- Deed of Extra Judicial SettlementDocument3 pagesDeed of Extra Judicial SettlementEric CamposNo ratings yet

- QA Onboarding Basics - CentralDocument53 pagesQA Onboarding Basics - CentralRodrigo Hidalgo100% (1)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Babok Businessanalysis Poster Big SizeDocument1 pageBabok Businessanalysis Poster Big SizebensardiNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- 2002 Master Agreement Protocol: International Swaps and Derivatives Association, IncDocument34 pages2002 Master Agreement Protocol: International Swaps and Derivatives Association, Inckrishna TejaNo ratings yet

- The BIM Manager A Practical Guide For BIM Project ManagementDocument306 pagesThe BIM Manager A Practical Guide For BIM Project ManagementBelen RG100% (4)

- The Need of Improving Social Sustainability in Sri Lankan Construction ProjectsDocument28 pagesThe Need of Improving Social Sustainability in Sri Lankan Construction Projectslakshan mahanamaNo ratings yet

- IAS 12 Solutions PDFDocument74 pagesIAS 12 Solutions PDFrafid aliNo ratings yet

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- CFAS 16 and 18Document2 pagesCFAS 16 and 18Cath OquialdaNo ratings yet

- Accounting 2Document2 pagesAccounting 2reeisha7No ratings yet

- FAC 3701 Exam PackDocument52 pagesFAC 3701 Exam Packartwell MagiyaNo ratings yet

- Lap Laba RugiDocument1 pageLap Laba Rugisri riyantiNo ratings yet

- 2018 - Exam 1 - Q1 - Sug SolDocument4 pages2018 - Exam 1 - Q1 - Sug SolmamitjasNo ratings yet

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- Statement of Profit or Loss For The Year Ended 31 December 2016Document2 pagesStatement of Profit or Loss For The Year Ended 31 December 2016Plawan GhimireNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- Answer Sheet Mock Test 23-2Document5 pagesAnswer Sheet Mock Test 23-2Nam Nguyễn HoàngNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Prak. ALK Latihan Cash Flow - Assyva Naila Agustine - 023002001093Document2 pagesPrak. ALK Latihan Cash Flow - Assyva Naila Agustine - 023002001093nanaNo ratings yet

- Joyk-Excel 2 3 1Document4 pagesJoyk-Excel 2 3 1api-664350584No ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- ABC Chap 9 SolmanDocument11 pagesABC Chap 9 SolmanKimberly ToraldeNo ratings yet

- Quiz - Single Entry (Answer Key)Document2 pagesQuiz - Single Entry (Answer Key)Gloria BeltranNo ratings yet

- T11 Ans. 1Document1 pageT11 Ans. 1PUI TUNG CHONGNo ratings yet

- Apple Inc Com Economatica in Dollar US in Thousands: Profit Loss From Operating ActivitiesDocument3 pagesApple Inc Com Economatica in Dollar US in Thousands: Profit Loss From Operating ActivitiesJaime Alexander PENA VILLABONANo ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- TK4 AkuntasniDocument7 pagesTK4 AkuntasniSarah NurfadilahNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- CFAB Chapter12 Full GuidanceDocument74 pagesCFAB Chapter12 Full GuidanceNgân Lê Trần BảoNo ratings yet

- Solution Tax667 - Dec 2016Document7 pagesSolution Tax667 - Dec 2016Aiyani NabihahNo ratings yet

- Chapter 07 - Financial StatementsDocument40 pagesChapter 07 - Financial StatementsMkhonto XuluNo ratings yet

- Income Taxes - Medix LTD MemoDocument3 pagesIncome Taxes - Medix LTD Memoandiswa zuluNo ratings yet

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- Suggested Answers TAX667 - DEC 2016Document7 pagesSuggested Answers TAX667 - DEC 2016diysNo ratings yet

- Solution Tax667 - Jun 2018Document9 pagesSolution Tax667 - Jun 2018Aiyani NabihahNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- ACC106 Assignment AccountDocument5 pagesACC106 Assignment AccountsyafiqahNo ratings yet

- Cost Accounting System: TopicDocument2 pagesCost Accounting System: Topicsamartha umbareNo ratings yet

- IT Assessment of Individuals IllustrationDocument5 pagesIT Assessment of Individuals Illustrationsyedfareed596No ratings yet

- Tax 3702 Assignment 2Document3 pagesTax 3702 Assignment 2ngoloyintomboxoloNo ratings yet

- Acca Approved Content ProviderDocument1 pageAcca Approved Content ProviderbesterNo ratings yet

- Principles of Taxation Suggested Solution # 12 - (Mock Solution)Document9 pagesPrinciples of Taxation Suggested Solution # 12 - (Mock Solution)Ali OptimisticNo ratings yet

- Laporan Laba Rugi - CybertronDocument1 pageLaporan Laba Rugi - CybertronaghaarekbasNo ratings yet

- Laporan Laba Rugi - Cybertron - Agha Nur Sabri ADocument1 pageLaporan Laba Rugi - Cybertron - Agha Nur Sabri AaghaarekbasNo ratings yet

- Statement of Accounting Cash FlowsDocument1 pageStatement of Accounting Cash FlowsUtkarsh GurjarNo ratings yet

- Income Taxes - Crax LTD MemoDocument8 pagesIncome Taxes - Crax LTD Memoandiswa zuluNo ratings yet

- Exemplar Company - Fortunado PDFFDocument1 pageExemplar Company - Fortunado PDFFmitakumo uwuNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- Case 3.7Document7 pagesCase 3.7Thái SơnNo ratings yet

- Evi4 104957Document2 pagesEvi4 104957Al QadriNo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Pricilla AssignmentDocument3 pagesPricilla AssignmentjasonnumahnalkelNo ratings yet

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet

- PYQ June 2018Document4 pagesPYQ June 2018Nur Amira NadiaNo ratings yet

- Solution Tax667 - Dec 2016Document7 pagesSolution Tax667 - Dec 2016Zahiratul QamarinaNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- Midterm Problem - DocmDocument2 pagesMidterm Problem - Docmpippen venegasNo ratings yet

- Ice Task 2 Delta LTD QuestionDocument5 pagesIce Task 2 Delta LTD QuestionarronyeagarNo ratings yet

- MFAC6211 WorkbookDocument156 pagesMFAC6211 WorkbookarronyeagarNo ratings yet

- LU1 NotesdocxDocument2 pagesLU1 NotesdocxarronyeagarNo ratings yet

- ICE Task #1 - LU1 (Updated Question)Document1 pageICE Task #1 - LU1 (Updated Question)arronyeagarNo ratings yet

- Iie Pgac0801 Contact Full Time Ac 2024 v1Document1 pageIie Pgac0801 Contact Full Time Ac 2024 v1arronyeagarNo ratings yet

- Annexure 2ADocument12 pagesAnnexure 2AarronyeagarNo ratings yet

- Laes5111 MoDocument39 pagesLaes5111 MoarronyeagarNo ratings yet

- Laes5111 MoDocument39 pagesLaes5111 MoarronyeagarNo ratings yet

- Laes5111 Prescribed Material AddendumDocument3 pagesLaes5111 Prescribed Material AddendumarronyeagarNo ratings yet

- LAES 5111 Unit 1 Theme 4 QuestionsDocument2 pagesLAES 5111 Unit 1 Theme 4 QuestionsarronyeagarNo ratings yet

- Iins5211 MoDocument21 pagesIins5211 MoarronyeagarNo ratings yet

- BUET6212T1b THTDocument3 pagesBUET6212T1b THTarronyeagarNo ratings yet

- FIAC5112 WorkbookDocument138 pagesFIAC5112 WorkbookarronyeagarNo ratings yet

- APDRDocument2 pagesAPDRKyrene MartinezNo ratings yet

- Corporate StrategyDocument15 pagesCorporate StrategyAbhilasha BagariyaNo ratings yet

- Connor Sport Court International, Inc. v. Rhino Sports, Inc., Et Al - Document No. 9Document6 pagesConnor Sport Court International, Inc. v. Rhino Sports, Inc., Et Al - Document No. 9Justia.comNo ratings yet

- AMAZONDocument22 pagesAMAZONASHWINI PATILNo ratings yet

- Indo-Us Realtions in 21st CenturyDocument19 pagesIndo-Us Realtions in 21st CenturyRitesh Kumar PradhanNo ratings yet

- There Are A Number of Facts That Emphasise The Importance of Effective Salesforce SelectionDocument2 pagesThere Are A Number of Facts That Emphasise The Importance of Effective Salesforce SelectionIvan MendezNo ratings yet

- Week 2: How To Write A Concept Paper: at The End of The Lesson, You Should Be Able ToDocument8 pagesWeek 2: How To Write A Concept Paper: at The End of The Lesson, You Should Be Able ToDharyn KhaiNo ratings yet

- Our Products: Powercore Grain Oriented Electrical SteelDocument20 pagesOur Products: Powercore Grain Oriented Electrical SteelkoalaboiNo ratings yet

- ILO Guide To Myanmar Labour LawDocument62 pagesILO Guide To Myanmar Labour LawKaung Myat HtunNo ratings yet

- S4hana MorDocument24 pagesS4hana MorARYAN SINHANo ratings yet

- Communication Skills Past PapersDocument10 pagesCommunication Skills Past PapersEtiel MachingambiNo ratings yet

- 5.2 AnswersDocument1 page5.2 AnswersuwuNo ratings yet

- Industry AnalysisDocument22 pagesIndustry Analysispranita mundraNo ratings yet

- Template ABRG - Management Agency Agreement - FormDocument8 pagesTemplate ABRG - Management Agency Agreement - Formrayzaoliveira.ausNo ratings yet

- Nelba: Case StudyDocument7 pagesNelba: Case StudyVictor Sabrera ChiaNo ratings yet

- Cfa Level 1 Ethics-Code - Standard Class 6Document21 pagesCfa Level 1 Ethics-Code - Standard Class 6pamilNo ratings yet

- City Assessor of Cebu VSDocument6 pagesCity Assessor of Cebu VSLaw StudentNo ratings yet

- Fowler (1995) - Improving Survey Questions. Design and Evaluation.Document4 pagesFowler (1995) - Improving Survey Questions. Design and Evaluation.Katia AvilesNo ratings yet

- Onyxworks® Gateways: NFN Fire MonitoringDocument2 pagesOnyxworks® Gateways: NFN Fire MonitoringMinhthien NguyenNo ratings yet

- Minggu 2 I. Substitute Appropriate Terms For The Underlined Words or Phrases in The Sentence BelowDocument4 pagesMinggu 2 I. Substitute Appropriate Terms For The Underlined Words or Phrases in The Sentence BelowNabila ZainNo ratings yet

- Chapter 3 Marketing Concepts and TrendsDocument62 pagesChapter 3 Marketing Concepts and TrendsKirththi PriyaNo ratings yet

- The Future of Manufacturing - Canada: in This Report 2 6 10Document28 pagesThe Future of Manufacturing - Canada: in This Report 2 6 10catsdeadnowNo ratings yet

- Benefits of Online Core Tools TrainingDocument3 pagesBenefits of Online Core Tools TrainingVigneshNo ratings yet

- Research62 2015Document2 pagesResearch62 2015Ke LopezNo ratings yet