Professional Documents

Culture Documents

GJ-1 Cash Account Summary

Uploaded by

Shane dela Cruz0 ratings0% found this document useful (0 votes)

8 views5 pagesFundamentals of Accountancy, Business and Management

Original Title

week2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFundamentals of Accountancy, Business and Management

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views5 pagesGJ-1 Cash Account Summary

Uploaded by

Shane dela CruzFundamentals of Accountancy, Business and Management

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

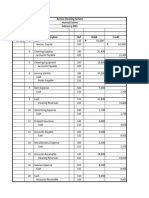

GJ-1

Date Account Title and Explanation PR Debit Credit

Jan 07 Cash 101 ₱ 180,000

Chui, Capital 301 ₱ 180,000

To record investment of capital

08 Office Equipment 151 20,000

Accounts Payable 201 20,000

To record purchase of equipments on account

10 Supplies 121 20,500

Cash 101 20,500

To record purchase of supplies

13 Prepaid Insurance 131 10,000

Cash 101 10,000

To record advance payment of insurance

15 Accounts Receivable 111 40,000

Service Revenue 401 40,000

To record services on account

16 Cash 101 30,000

Accounts Receivable 111 30,000

To record collection of services on account

Account 21 Accounts Payable 201 15,000

Name: Cash 101 15,000

CASH To record partial payment of equipment

Acc B

oun a

22 Accounts Receivable 111 17,000

t l

Nu a Service Revenue 401 17,000

mb n To record services rendered on account

er: c

101 e 23 Cash 101 12,000

DPa DC DC Loan Payable 211 12,000

rti Borrowed from the bank

cul

ar 31 Salaries Expense 501 14,000

s

Cash 101 14,000

J Inv ₱ ₱

To record payment of salaries to employees

est

m GJ-2

en 31 Chui, Drawing 311 8,000

t Cash 101 8,000

of To record withdrawals by the owner

Ca

pit Utilities Expense 512 1,500

al Cash 101 1,500

1Pu ₱₱

To record payment of telephone bill

rc

ha

Supplies Expense 511 11,000

Supplies 121 11,000

To record supplies expense

se of supplies

13 Payment for insurance GJ-1 10,000 ₱ 149,500

16 Collections for service rendered GJ-1 30,000 ₱ 179,500

21 Partial payment for equipment GJ-1 15,000 ₱ 164,500

23 Loans from a bank GJ-1 12,000 ₱ 176,500

31 Payment of employee's salaries GJ-1 14,000 ₱ 162,500

31 Withdrawal by the owner GJ-2 8,000 ₱ 154,500

31 Payment of telephone bill GJ-2 1,500 ₱ 153,000

Account Name: ACCOUNTS RECEIVABLE

Account Number: 111 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 15 Rendered services on account GJ-1 ₱ 40,000 ₱ 40,000

16 Collection of receivables GJ-1 ₱ 30,000 ₱ 10,000

22 Rendered services on account GJ-1 17,000 ₱ 27,000

Account Name: SUPPLIES

Account Number: 121 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 10 Purchase of supplies GJ-1 ₱ 20,500 ₱ 20,500

31 Supplies expense GJ-2 ₱ 11,000 ₱ 9,500

Account Name: PREPAID INSURANCE

Account Number: 131 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 13 Purchase of insurance GJ-1 ₱ 10,000 ₱ 10,000

31 Adjustment GJ-3 ₱ 1,000 ₱ 9,000

Account Name: OFFICE EQUIPMENT

Account Number: 151 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 08 Purchase of equipment GJ-1 ₱ 20,000 ₱ 20,000

Account Name: ACCUMULATED DEPRECATION - OFFICE EQUIPMENT

Account Number: 152 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 31 Depreciation of equipment GJ-3 ₱ 500 ₱ 500

Account Name: ACCOUNTS PAYABLE

Account Number: 201 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 08 Purchase of equipment on acc. GJ-1 ₱ 20,000 ₱ 20,000

21 Partial payment to supplier GJ-1 ₱ 15,000 ₱ 5,000

Account Name: LOANS PAYABLE

Account Number: 211 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 23 Loans from the bank GJ-1 ₱ 12,000 ₱ 12,000

Account Name: CHUI, CAPITAL

Account Number: 301 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 07 Investment GJ-1 ₱ 180,000 ₱ 180,000

Account Name: CHUI, DRAWING

Account Number: 311 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 31 Withdrawal GJ-2 ₱ 8,000 ₱ 8,000

Account Name: SERVICE REVENUE

Account Number: 401 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 15 Service rendered on account GJ-1 ₱ 40,000 ₱ 40,000

22 Service rendered on account GJ-1 17,000 ₱ 57,000

Account Name: SALARIES EXPENSE

Account Number: 501 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 31 Payment of salaries GJ-1 ₱ 14,000 ₱ 14,000

Account Name: SUPPLIES EXPENSE

Account Number: 511 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 31 Payment of supplies GJ-1 ₱ 11,000 ₱ 11,000

Account Name: UTILITIES EXPENSE

Account Number: 512 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 31 Payment of telephone bill GJ-2 ₱ 1,500 ₱ 1,500

Account Name: INSURANCE EXPENSE

Account Number: 513 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 31 Expired insurance GJ-3 ₱ 1,000 ₱ 1,000

Account Name: DEPRECIATION EXPENSE

Account Number: 514 Balance

Date Particulars Pos Debit Credit Debit Credit

t

Jan 31 Depreciation of asset GJ-3 ₱ 500 ₱ 500

Chui Taxes and Accounting Services

Unadjusted Trial Balance

As of January 31,2020

Account Title Debit Credit

Cash ₱ 153,000

Accounts Receivable 27,000

Supplies 9,500

Prepaid Insurance 10,000

Office Equipment 20,000

Accounts Payable ₱ 5,000

Loans Payable 12,000

Chui, Capital 180,000

Chui, Drawings 8,000

Service Revenue 57,000

Salaries Expense 14,000

Supplies Expense 11,000

Utilities Expense 1,500

Total ₱ 254,000 ₱ 254,000

GJ - 3

Date Account Title and Explanation PR Debit Credit

Jan 31 Depreciation Expense 514 ₱ 500

Accumulated Depreciation - Office Equipment 152 ₱ 500

To recognize the depreciated amount of office

equipment

31 Insurance Expense 513 1,000

Prepaid Expense 131 1,000

To record expired portion of prepaid

insurance

Chui Taxes and Accounting Services

Adjusted Trial Balance

As of January 31, 2020

Account Title Debit Credit

Cash ₱ 153,000

Accounts Receivable 27,000

Supplies 9,500

Prepaid Insurance 9,000

Office Equipment 20,000

Accumulated Depreciation - Office Equipment

Equipment ₱ 500

Accounts Payable 5,000

Loans Payable 12,000

Chui, Capital 180,000

Chui, Drawings 8,000

Service Revenue 57,000

Salaries Expense 14,000

Supplies Expense 11,000

Utilities Expense 1,500

Insurance Expense 1,000

Depreciation Expense 500

Total ₱ 254,500 ₱ 254,500

You might also like

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Notebook 2. Recording Transactions - Posting To The General LedgerDocument4 pagesNotebook 2. Recording Transactions - Posting To The General LedgerCherry RodriguezNo ratings yet

- Arrow Accounting ServicesDocument9 pagesArrow Accounting ServicesTrisha Mae CorpuzNo ratings yet

- Fabm 21Document6 pagesFabm 21kristelNo ratings yet

- General Journal: Date Particulars PR Debit CreditDocument5 pagesGeneral Journal: Date Particulars PR Debit CreditRicky Cordova SierraNo ratings yet

- ACCOUNTING CYCLE Leonor CreationsDocument6 pagesACCOUNTING CYCLE Leonor CreationsNadzma Pawaki HashimNo ratings yet

- Accounting Cycle SampleDocument7 pagesAccounting Cycle Samplejosedvega178No ratings yet

- Book 1Document11 pagesBook 1josedvega178No ratings yet

- Edgar DetoyaDocument16 pagesEdgar DetoyaAngelica EltagonNo ratings yet

- C Martin-JournalDocument2 pagesC Martin-JournalGenuine SmileNo ratings yet

- Journal EdaelDocument1 pageJournal Edaelelijah daelNo ratings yet

- Exercise JournalizingDocument2 pagesExercise JournalizingQueency RamirezNo ratings yet

- Trial Balance RecordsDocument2 pagesTrial Balance RecordsPearl Jade YecyecNo ratings yet

- LAURILLA Angela - FAR Sheet1 4Document1 pageLAURILLA Angela - FAR Sheet1 4Angela LaurillaNo ratings yet

- Journal EntryDocument5 pagesJournal EntryABM-AKRISTINE DELA CRUZNo ratings yet

- Particulars Ref. DR CR 1 CashDocument2 pagesParticulars Ref. DR CR 1 CashPearl Jade YecyecNo ratings yet

- Final Exam Part 2 Merch.Document7 pagesFinal Exam Part 2 Merch.Maribel Ticnang100% (1)

- Tutorial 2 - General Journal-2Document1 pageTutorial 2 - General Journal-2Thi Yen Nhi NguyenNo ratings yet

- 03_Handout_2(3)Document7 pages03_Handout_2(3)micah podadorNo ratings yet

- Book 2Document13 pagesBook 2josedvega178No ratings yet

- SEATWORK6Document6 pagesSEATWORK6dumpanonymouslyNo ratings yet

- GG Motorshop Financial RecordsDocument20 pagesGG Motorshop Financial RecordsSean LautaNo ratings yet

- CASE 1: PM Company: Total Current Asset 1,750,000Document3 pagesCASE 1: PM Company: Total Current Asset 1,750,000JanineD.MeranioNo ratings yet

- Sanchez General MerchandisingDocument3 pagesSanchez General MerchandisingRechelle Ramos100% (1)

- Homework Chapter 2: ExerciseDocument6 pagesHomework Chapter 2: ExerciseDiệu QuỳnhNo ratings yet

- FABM_PERFORMANCE_TASK.pdfDocument5 pagesFABM_PERFORMANCE_TASK.pdfKhiane Audrey GametNo ratings yet

- Sem Plang Merchandising Perpetual Problem With AnswersDocument21 pagesSem Plang Merchandising Perpetual Problem With AnswersJayson Miranda100% (1)

- Problem CAYNA No AnswerDocument6 pagesProblem CAYNA No AnswerMarian TorreonNo ratings yet

- Mam Karina Template Periodic 1Document21 pagesMam Karina Template Periodic 1Claudine bea NavarreteNo ratings yet

- Washy Wash Inc. Acctg For Already Existing BusinessDocument20 pagesWashy Wash Inc. Acctg For Already Existing BusinessmapapashishsasarapNo ratings yet

- General Journal Practice (Rey)Document8 pagesGeneral Journal Practice (Rey)Edz Adelyn HierasNo ratings yet

- Far-1 2Document6 pagesFar-1 2tygurNo ratings yet

- Journal entries for Whatzons business transactionsDocument7 pagesJournal entries for Whatzons business transactionsHalf BloodNo ratings yet

- Chan Accounting FirmDocument37 pagesChan Accounting FirmRishaan Dominic100% (3)

- Journalizing transactions and salesDocument11 pagesJournalizing transactions and salesSharlyne K. GuimbunganNo ratings yet

- Perpetual Inventory System: 1. Journalizing TransactionsDocument12 pagesPerpetual Inventory System: 1. Journalizing TransactionsCreate UsernaNo ratings yet

- L3: Posting and Preparation of Unadjusted Trial Balance: Accounting For Service and Merchandising Entities ACC11Document11 pagesL3: Posting and Preparation of Unadjusted Trial Balance: Accounting For Service and Merchandising Entities ACC11Rose LaureanoNo ratings yet

- Merchandising Perpetual Inv Sys Coco Computer StoreDocument18 pagesMerchandising Perpetual Inv Sys Coco Computer StoreMadelyn Espiritu100% (4)

- Prob 03-5aDocument16 pagesProb 03-5aapi-354329595No ratings yet

- Answer - Quiz No. 7 (B)Document9 pagesAnswer - Quiz No. 7 (B)CPA SangcapNo ratings yet

- CAE-1Document4 pagesCAE-1stonefiona6No ratings yet

- Edgar Detoya tax recordsDocument5 pagesEdgar Detoya tax recordsNeilan Jay FloresNo ratings yet

- General Journal: Date Account Titles and Explanation Ref Debit CreditDocument3 pagesGeneral Journal: Date Account Titles and Explanation Ref Debit CreditRezekiro IrmNo ratings yet

- MERELOS Accounting-Cycle FARDocument19 pagesMERELOS Accounting-Cycle FARRae Jeniña E.MerelosNo ratings yet

- Laban-Lang Washing Service Trial BalanceDocument9 pagesLaban-Lang Washing Service Trial BalanceBomon-as LebeaNo ratings yet

- Selam AssignmentDocument6 pagesSelam AssignmentDesalegn BezunehNo ratings yet

- Magnus ExerciseDocument13 pagesMagnus ExerciseLucas BantilingNo ratings yet

- 3Document1 page3Samuel HutchkinsNo ratings yet

- Mangapot Problem Set No. 3Document10 pagesMangapot Problem Set No. 3Lucky MeNo ratings yet

- Merchandising Problem "Periodic Inventory System (Sample Problem)Document17 pagesMerchandising Problem "Periodic Inventory System (Sample Problem)Vincent Madrid100% (1)

- 06 BTLE 30043 Santos Repair Shop Complete Cycle StudentDocument29 pages06 BTLE 30043 Santos Repair Shop Complete Cycle StudentnicoleshiNo ratings yet

- Far Module 1 ApolDocument7 pagesFar Module 1 ApolJeraldine DejanNo ratings yet

- General Journal Page 1 Date Description P/R Debit CreditDocument10 pagesGeneral Journal Page 1 Date Description P/R Debit CreditGonzalo FerrerNo ratings yet

- Businesses in PoblacionDocument29 pagesBusinesses in PoblacionnicoleshiNo ratings yet

- Journal Entries:: Special Topic On Financial ManagementDocument5 pagesJournal Entries:: Special Topic On Financial ManagementLisa PalermoNo ratings yet

- Admas ColledgeDocument20 pagesAdmas Colledgeyonas fitaNo ratings yet

- Repetitio Activity IIIDocument35 pagesRepetitio Activity IIIJesa TanNo ratings yet

- CSE FmgACC Mid CompreDocument3 pagesCSE FmgACC Mid CompreArif MannanNo ratings yet

- 2Document1 page2Samuel HutchkinsNo ratings yet

- Chapter 3 Accounting 1 26-12-2023Document7 pagesChapter 3 Accounting 1 26-12-2023maxamadaxmad365No ratings yet

- Equipment Lease Agreement & Guide: IncludedDocument10 pagesEquipment Lease Agreement & Guide: IncludedJohn Aaron100% (1)

- Lawn Master Manufactures Riding Lawn Mowers That It Sells ToDocument1 pageLawn Master Manufactures Riding Lawn Mowers That It Sells ToAmit PandeyNo ratings yet

- Pre Final Quiz 1Document2 pagesPre Final Quiz 1Xiu MinNo ratings yet

- Understanding the Buying Process for Kidswear at V-Mart RetailDocument109 pagesUnderstanding the Buying Process for Kidswear at V-Mart RetailKARISHMA RAJ100% (1)

- Understanding Asset Management Companies and Mutual FundsDocument16 pagesUnderstanding Asset Management Companies and Mutual Fundscourse shtsNo ratings yet

- Company status and contact detailsDocument5 pagesCompany status and contact detailsshriya shettiwarNo ratings yet

- 97530200000452Document75 pages97530200000452bagore nileshNo ratings yet

- What Is The Income Statement?Document3 pagesWhat Is The Income Statement?Mustaeen DarNo ratings yet

- LebronDocument5 pagesLebronRobert oumaNo ratings yet

- Mining Maintenance Management CourseDocument3 pagesMining Maintenance Management CourseRahmat FadhilahNo ratings yet

- Topic 1: Developing Operational Plans: Continuous Improvement in Business PracticeDocument32 pagesTopic 1: Developing Operational Plans: Continuous Improvement in Business PracticeMarlette TolentinoNo ratings yet

- ACFrOgAw0q9lIKvxcNk06fKcl-Ih3ndL8dKic4mqAZh CJzn-cAPHRuSJiFWVRH9BS8nL fOeQ-a5 X0tckM4cGFf04kNRjeXR40U79i9m46WlLgTAOEskpFqVQB7NgDocument6 pagesACFrOgAw0q9lIKvxcNk06fKcl-Ih3ndL8dKic4mqAZh CJzn-cAPHRuSJiFWVRH9BS8nL fOeQ-a5 X0tckM4cGFf04kNRjeXR40U79i9m46WlLgTAOEskpFqVQB7NgdelightplasticsNo ratings yet

- CS - Global Cycle NotesDocument20 pagesCS - Global Cycle NoteskunalwarwickNo ratings yet

- Competition and Class: A Reply To Foster and McnallyDocument11 pagesCompetition and Class: A Reply To Foster and McnallyMario CplazaNo ratings yet

- Human Resource BBPB2103 - English Module PDFDocument290 pagesHuman Resource BBPB2103 - English Module PDFVignash100% (1)

- PharmEasy Marketing 1Document9 pagesPharmEasy Marketing 1Pankaj MaryeNo ratings yet

- NMIMSDocument65 pagesNMIMSriteshbang1975No ratings yet

- Agile Vs. Lean: What's the DifferenceDocument2 pagesAgile Vs. Lean: What's the DifferenceEd Phénix le PrinceNo ratings yet

- SAPEWM01Document127 pagesSAPEWM01Mick LeeNo ratings yet

- Azq Erd Qa ResumeDocument8 pagesAzq Erd Qa ResumeApex HRNo ratings yet

- CHAPTER 1 Engineering Economic DecisionsDocument27 pagesCHAPTER 1 Engineering Economic DecisionsFh HNo ratings yet

- Management Information Systems Overview (17E00106Document68 pagesManagement Information Systems Overview (17E00106Cherry TejNo ratings yet

- Present Value, Annuity, and PerpetuityDocument42 pagesPresent Value, Annuity, and PerpetuityEdwin OctorizaNo ratings yet

- Coca Cola FinalDocument30 pagesCoca Cola Finalshadynader67% (3)

- OB AccentureDocument21 pagesOB AccentureBhadri100% (1)

- Customer Driven StrategyDocument15 pagesCustomer Driven StrategySonam ChawlaNo ratings yet

- Jeffrey A. Mello 4e - Chapter 5 - Strategic Workforce PlanningDocument23 pagesJeffrey A. Mello 4e - Chapter 5 - Strategic Workforce PlanningHuman Resource Management100% (3)

- Level II 2020 IFT Mock Exam SampleDocument12 pagesLevel II 2020 IFT Mock Exam SampleRuda Thales Lins MeirelesNo ratings yet

- Ms Archana. Wali MBA II Semester Exam No. MBA0702009Document78 pagesMs Archana. Wali MBA II Semester Exam No. MBA0702009vijayakooliNo ratings yet

- CRMModelsDocument10 pagesCRMModelsNgân ThùyNo ratings yet